MARKET OVERVIEW

The global commercial real estate market is likely to witness steady growth in the coming years driven by growing geopolitics tension and the need for more security arrangements. Increasing defense expenditures in the leading economies highlight the need to upgrade and modernize existing military infrastructure. Nations are investing massive amounts of money in state-of-the-art defense technologies with a aim to enhance offensive as well as defensive capabilities in an effort to be strategically ahead. This heightened focus on security will propel demand for high-tech systems, placing the global defense system market at top speed.

Technological advancements play a central role in shaping the future of this market. Developments in artificial intelligence, autonomous platforms, and guided missiles are transforming the way defense missions are carried out. The integration of smart systems with data-driven decision tools facilitates faster response and improved operations. Ongoing research on cybersecurity, surveillance, and unmanned vehicles will continue to expand the global defense system market so that nations can prepare for radically evolving threats.

Despite potential growth, there are also some problems that are very likely to delay the pace of growth. Long acquisition cycles will generally delay the installation of critical systems, leaving gaps in national defense plans. The expense of research and development is also an obstacle to competition for smaller contractors, lowering the level of diverse suppliers and slowing the pace of innovation. All these problems underscore the need for effective procurement processes and collaborative partnerships to quicken things. Opportunities are also arriving as the demand for robust cyber-defense solutions picks up speed.

The increase in cyber attacks on defense networks and critical infrastructure is creating a new market segment that has vast growth potential. Implementing world-class digital defense systems as part of defense strategies will not only strengthen aggregate military preparedness but also guarantee investments from existing players as well as new players. Employing cyber capabilities along with conventional defense systems will be the way forward for the growth of the global defense system market. In the coming years, the international defense system market will evolve with a focus on flexibility, innovation, and speed.

The governments will focus on flexible systems capable of addressing conventional as well as virtual threats. Government-govt, defense agency, and technology company strategic alliances will define trends in shaping advancements and reducing deployment times. While cost and procurement issues may remain problems, stronger and more emphasis on integrated and advanced technology-focused solutions will ensure further progress, making the international defense system market a pivotal industry in future security landscapes.

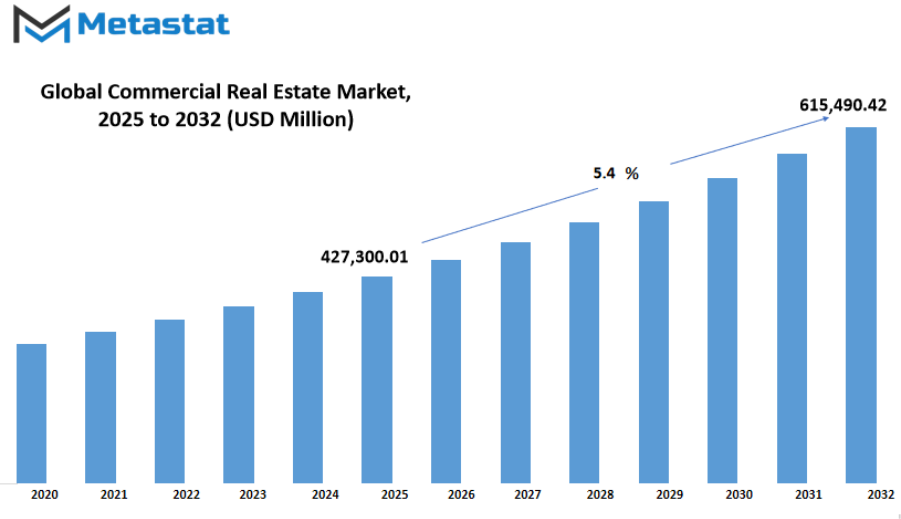

Global commercial real estate market is estimated to reach USD 615.4 billion by 2032; growing at a CAGR of 5.4% from 2025 to 2032.

GROWTH FACTORS

The global commercial real estate market is expected to experience significant changes in the years ahead as cities expand and economies grow. Rapid urbanization will continue to drive demand for office and retail spaces, particularly in regions where population growth and industrial development are on the rise. Economic growth fuels the need for modern workplaces and retail hubs, encouraging developers to build properties that meet evolving business needs. Rising foreign investments will further boost large-scale commercial property development, as international investors seek stable and profitable assets across diverse markets. This steady flow of capital will encourage the construction of advanced commercial spaces equipped with modern features that attract long-term tenants.

Despite this growth, several challenges will shape the pace of development. High interest rates and increased financing costs will likely reduce investment activity, as developers and investors become more cautious with their capital. Market volatility will also play a role in creating uncertainty, particularly in areas where economic conditions fluctuate rapidly. Changing tenant demands add another layer of complexity, as businesses seek flexible spaces that can adapt to hybrid work models or shifting consumer behaviors. These factors may lead to slower revenue growth for some sectors of the global commercial real estate market, pushing developers to reassess strategies and focus on stability.

However, future opportunities are expected to emerge as technology reshapes the market. The adoption of smart building technologies will transform commercial spaces by integrating advanced systems for energy efficiency, security, and tenant convenience. This shift will open new avenues for value-added services, allowing property owners to enhance building performance and improve overall tenant experience. Over time, such innovations will likely become standard features, giving early adopters a strong competitive advantage.

Sustainability efforts will also influence future trends, as governments and businesses emphasize green building standards and eco-friendly practices. Commercial properties designed with energy-efficient materials and systems will attract greater interest, particularly from organizations seeking to align with environmental goals. Additionally, regions experiencing rapid digital transformation will see increased demand for smart offices, data centers, and technology-driven retail environments.

In the long term, the global commercial real estate market will rely on adaptability to maintain growth. Balancing the pressures of rising costs and shifting tenant preferences with the potential offered by innovation and foreign investment will be key to sustaining momentum. The combination of urban expansion, advanced technologies, and strategic investments will shape a more dynamic and competitive landscape, setting the stage for steady development in the coming years.

MARKET SEGMENTATION

By Property Type

The global commercial real estate market will continue to grow as cities expand and businesses adapt to modern needs. With rapid urbanization and technological development, this market will keep shaping the way businesses operate and interact with communities. By property type, the market is further segmented into offices, retail, logistics, and others such as industrial parks, hospitality, and mixed-use developments. Each category will evolve based on demand, economic conditions, and advancements in digital tools that enhance building management and operational efficiency.

Offices will undergo significant transformation as flexible and hybrid work models become a standard practice. Modern workplaces will focus on collaborative spaces, smart infrastructure, and energy-efficient designs that attract companies aiming to balance productivity and sustainability. The demand for premium office spaces in metropolitan areas will remain strong, while secondary cities will also experience a steady rise in development due to cost advantages and improved connectivity.

Retail properties will adjust to a future driven by consumer preferences and technology integration. The growing popularity of online shopping will influence physical retail spaces to adopt experiential concepts, combining shopping, entertainment, and services in a single environment. Strategic locations with high foot traffic and strong local demographics will gain more attention as businesses seek to maximize visibility and customer engagement.

The logistics sector will continue to be one of the fastest-growing segments in the global commercial real estate market. E-commerce expansion, same-day delivery models, and advancements in automated storage systems will push developers to create larger, smarter, and more efficient facilities. Proximity to urban centers and transportation hubs will remain a priority to meet the rising demand for faster and more reliable distribution networks.

Other property types, including industrial parks, hospitality, and mixed-use developments, will diversify investment opportunities. Industrial parks will focus on supporting advanced manufacturing and high-tech industries, while hospitality properties will evolve with digital check-in systems and sustainable operations to meet the preferences of future travelers. Mixed-use spaces, combining residential, commercial, and recreational areas, will grow in popularity as communities look for convenient and connected environments that support modern lifestyles.

Technological innovation, sustainability efforts, and economic trends will shape the future growth of the global commercial real estate market. Smart buildings, powered by data analytics and automation, will enhance efficiency and reduce costs, while green certifications will become a key factor in investment decisions. As global markets adapt to changing needs, the demand for flexible, sustainable, and technology-driven spaces will define the path of growth and transformation in this sector.

By Business Model

The global commercial real estate market will continue to experience steady growth as businesses expand and economies adapt to new trends. Driven by factors such as urbanization, population growth, and advancements in technology, this market will shape the way companies and communities interact with physical spaces. Demand for flexible workspaces, sustainable buildings, and smart infrastructure will push developers and investors to rethink traditional approaches. By business model, the market is divided into sales and rental, each playing a critical role in shaping future developments.

The sales segment will witness growth as investors look for stable and long-term assets to secure wealth. Office spaces, retail properties, and industrial facilities will continue to be attractive investments, particularly in cities with strong economic performance. Investors will also pay closer attention to energy-efficient designs and technology-enabled buildings, as businesses seek locations that improve productivity and reduce operational costs. This focus on sustainability will make properties that meet green standards more valuable, influencing how developers design and market commercial spaces.

The rental segment will maintain a strong position due to increasing demand for flexibility. Startups, remote teams, and expanding companies will continue to favor rental spaces that allow easy scaling without heavy upfront costs. Co-working hubs and mixed-use properties will remain in high demand, especially in areas with growing populations and a need for collaborative environments. The shift toward digital platforms will also improve efficiency in finding and managing rental properties, offering faster transactions and better data insights for both landlords and tenants.

Looking ahead, the global commercial real estate market will adapt to rapid changes in technology and consumer behavior. Smart buildings equipped with automation and advanced security systems will attract higher demand, as businesses look for efficiency and safety. Virtual tours, AI-driven analytics, and blockchain transactions will streamline processes and create a more transparent market environment.

Sustainability will remain a key focus. Eco-friendly materials, renewable energy solutions, and efficient water systems will become standard in new developments. Investors and tenants will increasingly prefer properties that align with environmental and social goals, reshaping investment strategies. This shift will not only support a greener future but also enhance long-term returns.

Economic shifts, changing demographics, and technological innovation will continue to guide the direction of this market. As urban centers expand and businesses seek smarter, more adaptable spaces, the balance between sales and rental will remain vital to meeting diverse needs. With continuous innovation and strategic planning, the global commercial real estate market will build a foundation for sustained growth and future opportunities.

By End-User

The global commercial real estate market will continue to play a major role in shaping economic growth and urban development in the years ahead. As cities expand and technology advances, new opportunities and challenges will influence how properties are developed, managed, and utilized. Demand for flexible and sustainable spaces will rise, driven by changing preferences and rapid innovation across multiple industries. This market will remain a critical foundation for economic activity, supporting both emerging and established sectors worldwide.

By end-user, the market will experience distinct trends across different groups. Individuals and households will increasingly seek mixed-use properties that provide access to both residential and commercial amenities within the same environment. This shift will be fueled by the desire for convenience, connectivity, and work-life balance. Properties that integrate modern design with smart technology will gain popularity, offering a more efficient and adaptive experience for occupants.

Corporates and SMEs will continue to drive significant demand in the global commercial real estate market. The push for hybrid and flexible workplaces will lead to a surge in shared office spaces and adaptive building layouts. Businesses will seek properties that not only reduce operational costs but also support employee productivity and collaboration. In addition, advancements in automation, artificial intelligence, and digital management tools will transform how companies interact with and manage their spaces, making efficiency and sustainability key factors in decision-making.

For institutions, governments, and NGOs, investments will increasingly focus on community-driven and sustainable developments. Public and private partnerships will support projects that prioritize accessibility, energy efficiency, and environmental responsibility. Schools, hospitals, and government facilities will benefit from smart infrastructure that enhances safety and operational performance, meeting the growing demand for connected and resilient environments.

Looking forward, the global commercial real estate market will see technology playing an even greater role. Data-driven decision-making, digital platforms, and predictive analytics will allow investors and developers to better anticipate market trends and risks. Green construction materials and renewable energy systems will gain importance, as sustainability becomes a non-negotiable standard rather than an optional feature.

Opportunities will expand in emerging markets where urbanization is accelerating and infrastructure development is gaining momentum. Strategic planning and innovation will guide investments, ensuring long-term returns while adapting to changing consumer and business needs. The market will also be influenced by global economic conditions, regulatory changes, and environmental considerations, all of which will shape future growth patterns.

As demand continues to evolve, adaptability and foresight will determine success in the global commercial real estate market, positioning forward-thinking investors and developers at the center of growth and transformation.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

USD 427.3 billion |

|

Market Size by 2032 |

USD 615.4 billion |

|

Growth Rate from 2025 to 2032 |

5.4% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

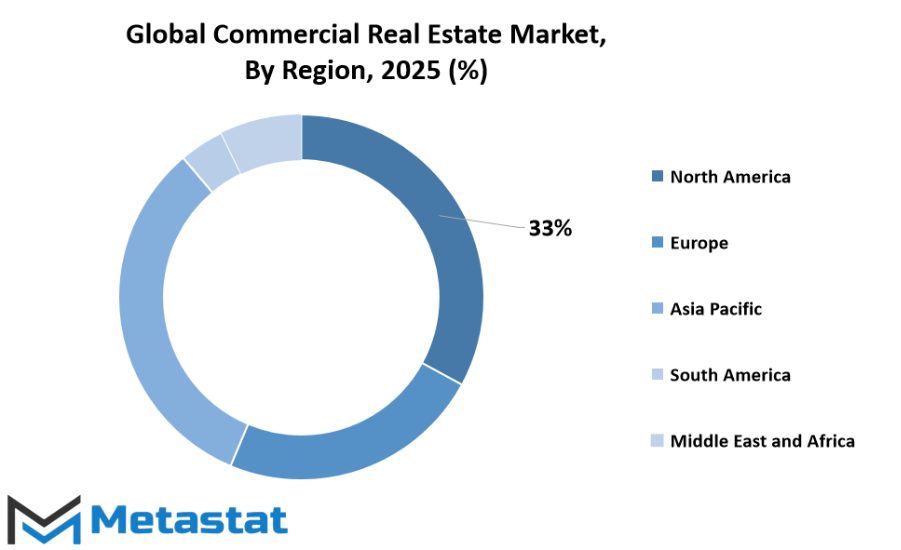

The global commercial real estate market is shaping the future of business spaces, driven by rapid urban development, technological advancements, and growing demand for sustainable infrastructure. This market is projected to expand steadily, supported by increasing investments, strategic partnerships, and a shift toward innovative property solutions. Based on geography, the global commercial real estate market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, each region contributing to growth in unique ways.

In North America, steady demand in the U.S., Canada, and Mexico will continue to shape modern urban landscapes. The U.S. will lead with high investment in mixed-use developments and advanced smart building technologies, while Canada will witness growing interest in energy-efficient office spaces. Mexico will focus on industrial hubs catering to global trade and logistics, ensuring strong regional competitiveness.

Across Europe, growth will be driven by the UK, Germany, France, Italy, and the Rest of Europe, where modernization of aging infrastructure and a rising focus on green building initiatives will be key factors. Germany and the UK will remain leaders in sustainable commercial properties, while Italy and France will prioritize adaptive reuse of older buildings to meet new market needs.

The Asia-Pacific region will experience the fastest growth, led by India, China, Japan, South Korea, and the Rest of Asia-Pacific. China will see an expansion of high-tech industrial parks and commercial zones to support its manufacturing and technology industries. India will focus on large-scale urbanization projects and smart cities, attracting significant global investments. Japan and South Korea will continue to integrate advanced automation and digital solutions into commercial spaces, enhancing efficiency and long-term value.

In South America, Brazil, Argentina, and the Rest of South America will concentrate on urban redevelopment and expanding logistics networks to keep pace with rising e-commerce demand. Brazil will remain the largest contributor, with industrial and retail developments supporting economic growth.

The Middle East & Africa region, covering GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa, will see rising opportunities driven by infrastructure expansion and economic diversification. GCC Countries will lead with ambitious projects blending luxury commercial developments with innovative technologies, while South Africa and Egypt will attract investors through strategic property developments in key urban centers.

Looking ahead, the global commercial real estate market will continue to evolve as cities adopt smarter, greener, and more adaptable spaces. Growing demand for sustainable, tech-driven properties and well-connected urban hubs will shape the next phase of growth, fostering opportunities across every region.

COMPETITIVE PLAYERS

The global commercial real estate market is moving toward a future shaped by technology, sustainability, and a growing demand for adaptive spaces. Rapid urbanization and shifting economic priorities will keep driving growth, creating opportunities for investors, developers, and service providers. With digital solutions becoming central to operations, from data-driven asset management to virtual property tours, efficiency and transparency will continue to improve. Sustainability will also remain a priority, with green building practices and energy-efficient infrastructure becoming key factors in property valuation and investment decisions.

Key players such as Brookfield Asset Management, Prologis Inc, Blackstone Real Estate (BREIT & BPP), Simon Property Group, Link REIT, Segro Plc, Mitsubishi Estate Co, Unibail-Rodamco-Westfield, Vonovia SE, Gecina SA, Boston Properties Inc, Alexandria Real Estate Equities, Dexus, Goodman Group, China Vanke Co, Wanda Group, CapitaLand Investment, Mapletree Investments, CapitaLand Ascendas REIT, CBRE Group, JLL, Cushman & Wakefield, Colliers International, and Knight Frank will continue to shape industry standards. These companies are expected to lead the way in integrating smart technologies and optimizing portfolio performance to meet changing client demands.

The market will likely see stronger investment in mixed-use developments that combine commercial, residential, and recreational spaces. As global businesses adapt to hybrid work models, demand for flexible office environments and co-working spaces will remain steady. Warehousing and logistics properties will also grow in importance due to the steady rise of e-commerce, prompting developers to focus on modern, well-located facilities to meet delivery speed requirements.

Capital flow into the global commercial real estate market will stay resilient, driven by investors seeking stable returns in an unpredictable economic environment. Institutional investors and private equity firms will keep diversifying their portfolios, with an emphasis on high-growth regions in Asia-Pacific, North America, and parts of Europe. Technology will enhance predictive analytics, helping stakeholders make informed decisions about market cycles, risk management, and asset optimization.

In the coming years, innovation will continue to redefine the industry. Smart buildings equipped with automated systems, real-time monitoring, and energy-efficient designs will attract both tenants and investors. Environmental, social, and governance (ESG) principles will gain even greater influence, making sustainable assets more desirable and valuable. Digital platforms will simplify transactions, enabling faster and more secure processes that align with the growing need for efficiency in global markets.

With strong leadership from established players and ongoing adoption of advanced solutions, the global commercial real estate market will remain dynamic. The industry will keep adapting to meet future economic, technological, and environmental demands while creating opportunities for sustainable and profitable growth.

Commercial Real Estate Market Key Segments:

By Property Type

- Offices

- Retail

- Logistics

- Others (Industrial Parks, Hospitality, Mixed-Use)

By Business Model

- Sales

- Rental

By End-User

- Individuals / Households

- Corporates & SMEs

- Others (Institutions, Government, NGOs)

Key Global Commercial Real Estate Industry Players

- Brookfield Asset Management

- Prologis Inc

- Blackstone Real Estate (BREIT & BPP)

- Simon Property Group

- Link REIT

- Segro Plc

- Mitsubishi Estate Co

- Unibail-Rodamco-Westfield

- Vonovia SE

- Gecina SA

- Boston Properties Inc

- Alexandria Real Estate Equities

- Dexus

- Goodman Group

- China Vanke Co

- Wanda Group

- CapitaLand Investment

- Mapletree Investments

- CapitaLand Ascendas REIT

- CBRE Group

- JLL

- Cushman & Wakefield

- Colliers International

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383