MARKET OVERVIEW

The global logistics services market is fashioning an industry that will redefine the movement of goods across borders and through networks. This industry will no longer stay within the periphery of transportation and warehousing but rather head toward an arena where technology, sustainability, and strategic integration will become the drivers of operations. Companies will no longer view logistics as a background function but as a driver function for competitiveness. Future logistics solutions will go past conventional delivery fashions and provide answers which can be shrewd, automated, and resilient.

In the destiny, the arena will see a structural transformation pushed with the aid of heightened aspirations for velocity, transparency, and precision. Logistics providers will increasingly play the role of generation-pushed companions, leveraging synthetic intelligence, IoT, and predictive analytics to deliver accuracy and efficiency at every point of the deliver chain. These advances will now not best optimize movement but additionally maximize visibility, allowing corporations to are expecting interruptions and reply in actual-time. When markets grow and worldwide commerce becomes more and more incorporated, logistics offerings becomes the spine for industries that reach from retail and production to healthcare and e-commerce. Future logistics solutions will go past conventional delivery fashions and provide answers which can be shrewd, automated, and resilient.

In the destiny, the arena will see a structural transformation pushed with the aid of heightened aspirations for velocity, transparency, and precision. Logistics providers will increasingly play the role of generation-pushed companions, leveraging synthetic intelligence, IoT, and predictive analytics to deliver accuracy and efficiency at every point of the deliver chain. These advances will now not best optimize movement but additionally maximize visibility, allowing corporations to are expecting interruptions and reply in actual-time. When markets grow and worldwide commerce becomes more and more incorporated, logistics offerings becomes the spine for industries that reach from retail and production to healthcare and e-commerce.

Sustainability will be the hallmark of logistics strategies. The sector will be reducing carbon footprints, transitioning to renewable energy for transportation fleets, and streamlining routes for minimizing environmental footprint. Organizations will seek alternatives in the form of electric vehicles, autonomous delivery units, and green packaging. Such efforts will extend beyond legal compliance; they will be a differentiator for organizations looking to align with environmental objectives and win conscious consumers.

Yet another aspect that will influence the future of the global logistics services market will be the increasing significance of risk management and security. The quarter will counter cyber attacks, geopolitics, and economic turbulence by way of making investments in structures so as to defend records and guarantee supply chain continuity. Blockchain era will be a chief participant, making sure transparency and authenticity to all transactions, as a consequence fostering agree with among international stakeholders.

Personalization will pick up speed as companies require solutions that are specific to their operation models. From cold-chain networks for drugs to last-mile delivery at high speeds for e-commerce, logistics companies will develop offerings to suit special needs. Such personalized services will not only enhance customer relationships but also change service quality in the industry.

The global logistics services market will go far beyond mere traditional freight and storage activities. It will become an advanced system that combines technology, sustainability, and customer-first strategies. Logistics will be transformed into a driver of strategy rather than an ancillary activity for companies that want to thrive in a more dynamic global economy. The future will be for those who innovate, anticipate, and provide solutions that transport more than goods they will transport progress.

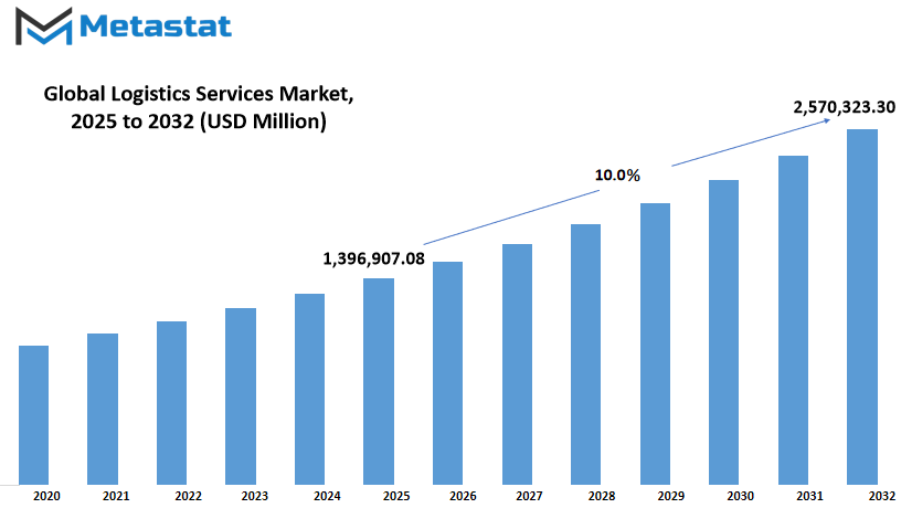

Global logistics services market is estimated to reach $2,570,323.30 Million by 2032; growing at a CAGR of 10.0% from 2025 to 2032.

GROWTH FACTORS

The global logistics services market has emerged as one of the most enormous industries backing worldwide trade and call for from customers. As businesses place focus on speed and efficiency, logistics is at the leading edge of making sure that merchandise arrive at their vacation spot in a timely manner. The regular upward thrust of e-trade has changed the expectancies of customers, driving companies to provide quicker shipping and efficient supply chains. This alternate has placed high-quality strain on logistics companies to modernize their systems and include strategies that may manner large volumes of shipments at excessive pace and reliability.

Expansion of global change is another key driving force of the global logistics services market. Companies are now operating across borders, and they need strong freight and cross-border logistics solutions. Organizations which operated in domestic markets before are now dealing with international customers, and this calls for more specific logistics solutions. From administering customs procedures to managing multi-modal transport, logistics providers have to do intricate things in order to keep products flowing effortlessly between regions. This is something that is bound to continue as world trade becomes more intertwined.

Nonetheless, the sector is challenged by large issues affecting profitability and operational efficiency. Low running margins, blended with volatile fuel fees, complicate logistics corporations' ability to preserve achievable margins. Moreover, infrastructure constraints in a few areas are bottlenecks that cause delays in transportation and delivery. Unfavorable road insurance, port congestion, and getting old centers have a tendency to abate streamlined operations, in particular among growing markets. These challenges need to be addressed due to the fact they'll prevent the overall boom potentialities of the industry.

In spite of these troubles, the destiny of the global logistics services market is shiny because of the growing use of digitalization and automation. Real-time tracking, computerized warehouses, and AI-facilitated direction optimization are revolutionizing logistics activities, making them green and comparatively cheap. Digital platforms also are improving the transparency and verbal exchange between clients and agencies, which will increase believe and pride. As companies keep to spend money on smart solutions, the sector will revel in excellent traits in terms of velocity, accuracy, and scalability, paving the way for brand spanking new avenues for expansion in the years ahead.

MARKET SEGMENTATION

By Logistics Providers

The global logistics services market will stay at the vanguard of facilitating alternate and supply chain operations in numerous industries. Companies depend on logistics companies for uninterrupted motion of products, timely delivery, and efficiency. With the boom of global commerce, the want for systematic and dependable logistics solutions is possibly to increase. Businesses today appearance no longer only for shipping but additionally comprehensive services encompassing storage, stock control, and stop-to-cease coordination, thereby making logistics an vital element of present day enterprise features.

Logistics providers fall into various categories, each rendering distinct services catering to different business requirements. First- and second-party logistics are core solutions, providing a bulk share of $353,025.58 million, as they consist mainly of direct management of goods from the suppliers to the customers. Apart from all these, third-party logistics has picked up significant speed due to the fact that firms prefer having their supply chain operations outsourced to experts for enhanced efficiency and scalability. These third-party logistics providers generally manage warehousing, transport, and distribution, lowering operational load on enterprises.

Fourth-party logistics extends this practice further by serving as an integrator, overseeing the whole supply chain process and synchronizing multiple service providers within one system. This type of carrier is acceptable for corporations that need pinnacle-degree strategic making plans and complete visibility into their deliver chain operations. Fifth-birthday celebration logistics makes a speciality of optimization through generation-based solutions and typically employs automation, AI, and statistics analytics to provide greater intelligent, sustainable logistics plans. These services are maximum applicable for corporations that opt to innovate and make their operations destiny-proof.

The boom of the global logistics services market will hinge upon the extent to which these segments efficaciously address troubles like risky gas charges, inexperienced rules, and shifting trade rules. In building integration with technology might be a key component in improving precision, velocity, and fee-effectiveness. Companies will increasingly more are trying to find companies that offer no longer most effective transportation but cost-delivered services and innovative solutions that release competitiveness. As trade networks keep growing and digitalization affects operations, logistics offerings will continue to be crucial to hold items in a hastily evolving global economic system.

By Mode of Transport

The global logistics services market is a critical section of world change and trade, facilitating the clean transportation of products from one region to every other. Companies of all industries depend on logistics to make sure timely delivery of products, limit operational expenses, and satisfy customers. The market has been developing as groups an increasing number of seek quicker and extra efficient strategies to attain providers and customers. Urbanization, globalization, and the increasing need for e-trade have also improved the importance of logistics offerings to an all-time high, which influences the way groups address supply chains and distribution.

Transportation is one of the key segments of this market that has a tremendous position to play in figuring out logistics performance and price. On the basis of the mode of shipping, the global logistics services market is segmented into railways, air, roads, and oceans. All of these modes have their respective benefits and are decided on relying on pace, cost, sort of cargo, and distance. Companies have a tendency to depend upon a mixture of those options with the intention to develop bendy and sturdy logistics strategies that may be changed according with numerous needs and issues.

Rail delivery is generally applied for sporting bulk products over massive distances at comparatively modest fees. They offer an low cost solution for heavy hundreds, as a result appropriate for sectors such as production, mining, and agriculture. Road shipping, on the contrary, has the highest connectivity and performs a vital function in last-mile shipping. Road shipping helps door-to-door offerings and is essential for e-commerce businesses that prefer rapid delivery. The adaptability of street shipping earns it a sturdy role in domestic logistics and short-distance transportation.

Airways are the fastest manner of transport and are most regularly utilized for products of high value or with urgent shipping requirements like prescribed drugs, electronics, and perishable commodities. Although air freight is extra steeply-priced than others, it guarantees velocity and reliability, which is important to organizations managing urgent deliveries. Waterways are nonetheless an economical choice for handing over excessive-tonnage shipment globally. Seaborne shipping of goods takes longer than air shipping however allows organizations to transport bulk cargo at reduced quotes, for this reason becoming a favorable method of worldwide commodity exchange of merchandise together with coal, oil, and produce.

As organizations amplify and customer needs circulate toward faster deliveries, the global logistics services market will keep to pay attention on enhancing delivery performance. Businesses will want to embody state-of-the-art technology, streamline course planning, and formulate interconnected answers that contain various modes of delivery to gain most benefit. The combination of dependability, affordability, and swiftness will outline the destiny of logistics and cement its function as a spine of worldwide exchange.

By End Use

The global logistics services market will continue to be a vital link in bringing businesses from different industries together. With groups prioritizing faster deliveries and powerful supply chains, logistics services will stay on the heart of operations. The want for dependable transportation, warehousing, and distribution offerings will boom as trade volumes increase round the arena. Digitalization, automation, and most advantageous direction planning will make sure smoother operations and facilitate organizations to reply to purchaser demands. As industries combine increasingly more, logistics offerings will serve as a connector to make certain velocity and efficiency in the transportation of products.

One of the prime regions of call for might be from the healthcare quarter. The health industry demands on-time shipping of medicines, vaccines, and scientific gadget, so precision and reliability emerge as high worries. Proper temperature management and dealing with are essential for sensitive products together with biologics and existence-saving medicines. The expanded emphasis on healthcare infrastructure and emergency preparedness will increasingly more pressure the call for for specialised logistics offerings. The companies supplying such offerings could be required to live compliant with safety policies even as making sure seamless deliver.

Manufacturing and aerospace will also rely appreciably on logistics to make sure the smooth movement of raw materials and finished items. Production factories require continuous components of components to keep up with manufacturing cycles, whereas the aerospace enterprise relies on on-time shipping of high-priority additives to save you postpone in operations. Telecommunications and technology firms will also need effective logistics to transport high-value electronics and equipment. The increasing use of 5G connections and digital equipment will also generate more prospects for logistics companies to coordinate bulk shipping and international deliveries.

Other industries, including government and public utilities, banking and finance, and media and entertainment, will also play a role in the expansion of the global logistics services market. Government and utilities need massive distribution of resources, whereas the financial industry relies on secure processing of confidential documents and data systems. The media and entertainment sector needs fast movement of production equipment and marketing material. In the equal way, delivery and trade will nonetheless remain the mainstay of global commercial enterprise, necessitating sturdy logistics infrastructure. These varied cease-use programs exhibit how the offerings of logistics will stay a center enterprise characteristic all over the world, conforming to the specs of various industries while making sure performance and dependability.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,396,907.08 million |

|

Market Size by 2032 |

$2,570,323.30 Million |

|

Growth Rate from 2025 to 2032 |

10.0% |

|

Base Year |

2024 |

|

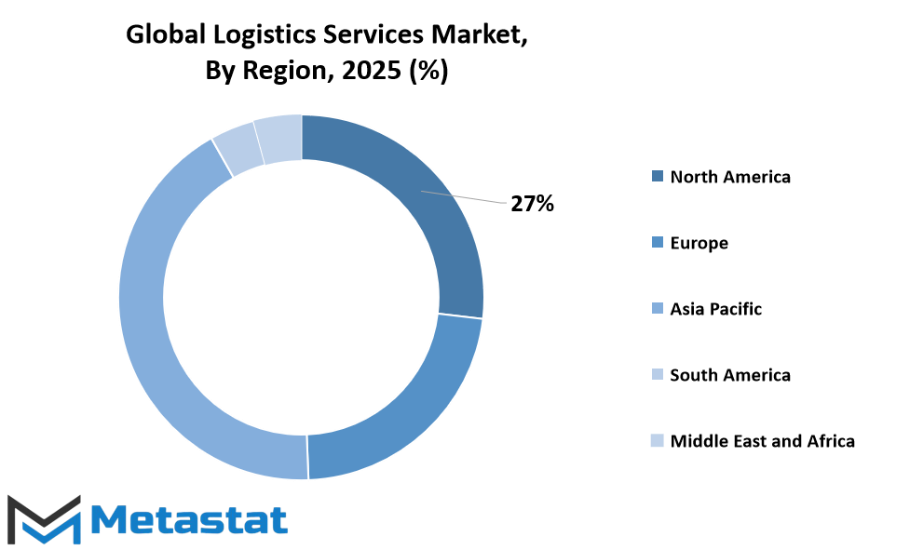

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global logistics services market has made itself an indispensable pillar for commerce and trade, influencing how products travel between continents. The industry functions on a sophisticated web of providers, facilitating companies to reach customers all over the world. With global trade expanding by the day, logistics services have become vital in controlling transportation, warehousing, distribution, and supply chain effectiveness. One of the most impactful determinants of this market is geography, since areas vary in regards to trade corridors, infrastructure, and demand trends. Every area presents distinct opportunity and obstacle, dictating how service providers plan and provide solutions.

North America is a bastion in the logistics services market, largely owing to its sophisticated infrastructure and high-density trade activity. The United States, Canada, and Mexico are at the forefront of this growth, backed by highly advanced transport infrastructure and cross-border trading agreements like the USMCA. The presence of big e-commerce firms and manufacturers further intensified the demand for good logistics solutions here. High-tech solutions like automation and real-time monitoring are heavily implemented here, resulting in faster and more reliable logistics.

The logistics services market in Europe is helped by a streamlined trade framework facilitated by the European Union, making cross-border transport within member countries easy. The UK, Germany, France, and Italy are major contributors, each providing a robust industrial platform and streamlined transportation infrastructure. Demand for sustainable logistics has been on the rise in the region steadily, with operators looking to minimize carbon footprints and streamline supply chains. Such initiatives confirm increasing environmental consciousness coupled with prompt deliveries over varied landscapes.

Asia-Pacific is one of the most rapidly expanding logistics services market, propelled by explosive manufacturing centers and increasing e-commerce penetration. Dominating the scene are China, India, Japan, and South Korea, backed by massive industrial-scale production and an expanding consumer market. Rapid digitalization and urbanization have urged businesses to make investments in sophisticated supply chain solutions. Moreover, regional trade policies and government efforts to strengthen infrastructure are likely to drive the market ahead in this region.

South America and the Middle East & Africa are also among the other regions that play an important role in the global logistics network. Brazil and Argentina are prominent contributors in South America, with a focus on agricultural export and intra-regional trade expansion. In contrast, the Middle East & Africa gains from being a regional hub of trade linking Asia, Europe, and Africa. Countries such as in the GCC, Egypt, and South Africa are heavily investing in transport infrastructure and logistics parks to entice international businesses. Collectively, the regions point to the mosaic character of the logistics services market, a function of its global significance in facilitating world trade and economic growth.

COMPETITIVE PLAYERS

The global logistics services market plays a key role in the world economy, facilitating trade, manufacturing, and distribution networks globally. With businesses going international, the demand for effective logistics solutions increases day by day. This sector is all about transporting goods swiftly and securely from one location to another, either by air, sea, or land. Logistics providers are also responsible for warehousing, customs clearance, and supply chain management, which makes them a critical connection between consumers and producers. As globalization compels companies to link up with global markets, the need for efficient logistics services will keep on increasing.

A number of companies have established strong footholds in this sector by providing end-to-end services and cutting-edge technology to enhance efficiency. FedEx and United Parcel Service of America, Inc. (UPS) are strongly recognized globally for their express delivery networks and speed of delivery. DHL Group has also been positioned as one of the largest, famous for its supply chain solutions and global express services. Likewise, Kuehne+Nagel and DB Schenker Logistics are strongly established for their freight forwarding and integrated logistics services. These firms continue to invest in digital channels and automation to address the growing demand for prompt and precise deliveries.

In addition to these, other key players have consolidated the global logistics services market by specialized offerings and regional experience. A.P. Moller - Maersk has expanded from ocean shipping to provide end-to-end logistics services, including warehousing and inland haulage. Nippon Express Co., Ltd., and Yusen Logistics are well established in Asia with efficient and cost-effective services to meet the increasing trade between the region. Geodis Logistics and DSV have developed their business worldwide by concentrating on supply chain optimization as well as tailored solutions to various industries.

Expeditors International and CEVA Logistics also play their role to a great extent in this market by offering versatile services to various industries like healthcare, automotive, and retail. Their customer-specific focus has ensured that they have long-term relationships with companies. As competition here continues to be intense, businesses are embracing sophisticated technologies like real-time tracking, automated storage facilities, and AI-powered route planning to optimize performance. These enhancements not only save expenses but also enhance customer satisfaction, a continued priority for the sector.

In the future, the global logistics services market will develop further as companies look for quicker, more dependable, and cleaner modes of transportation. The growth of e-commerce and international trade will pressure logistics providers to increase capacity and enhance innovation. With major players such as FedEx, DHL Group, UPS, and others heavily investing in infrastructure and technology, the sector is set to remain competitive and vibrant, with goods transported smoothly around the globe and satisfying the needs of an interconnected world economy.

Logistics Services Market Key Segments:

By Logistics Providers

- First- & Second-Party Logistics

- Third Party Logistics

- Fourth Party Logistics

- Fifth Party Logistics

By Mode of Transport

- Railways

- Airways

- Roadways

- Waterways

By End Use

- Healthcare

- Manufacturing

- Aerospace

- Telecommunication

- Government and Public Utilities

- Banking and Financial Services

- Media and Entertainment

- Technology

- Trade and Transportation

- Others

Key Global Logistics Services Industry Players

- FedEx

- Kuehne+Nagel

- DHL Group

- Geodis logistic

- United Parcel Service of America, Inc.

- A.P. Moller - Maersk

- Nippon Express Co., Ltd.

- C.H. Robinson Worldwide Inc.

- DB Schenker Logistics

- DSV

- Expeditors International

- CEVA Logistics

- Yusen Logistics

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383