MARKET OVERVIEW

The global automated mooring systems market is going to redefine the way maritime businesses function in future years. This industry will not just be limited to the role of mooring ships; rather, it will venture into a broad range of applications beyond its conventional purpose. With technological progress speeding up, automated mooring systems will be the future of offshore infrastructure, and they will become an integral part of the shipping and energy sectors. The sector will go through a period where automation is not just an additional benefit but also an integral component of safety, speed, and consistency in operations.

The impact of the global automated mooring systems market will reach far beyond ports and harbors. Advances in the future will enable automated mooring solutions to be interfaced with wider digital platforms, integrating them as a key component within smart shipping systems. With rising calls for real-time monitoring and predictive maintenance, automated systems will not just control mooring activities but will be active entities themselves in data-driven decision-making processes. This will translate into more connection between vessels and onshore control systems for synchronized seamless action towards improved safety and efficiency.

The usage of sustainable measures will also advance the limits of this sector. Automation of mooring will find more similarity with environmental goals by diminishing the amount of manual intervention, which means less chance of accidents and delay in operations. The future will probably witness these systems designed with energy-efficient technology and adaptive systems that respond to changing marine conditions, thereby ensuring economic and ecological benefits. In addition, as floating energy platforms and off-shore wind farms increase, automated mooring will play a more strategic part, enabling massive renewable energy schemes that require stability in turbulent sea conditions.

Another factor that will define this market is its contribution to remote and autonomous shipping. As shipping advances toward autonomy, automated mooring will be a key enabler for autonomous vessels with no human presence onboard. The ability of the system to operate under stressful conditions without human supervision will open opportunities for new shipping routes and offshore activities and redefine the boundaries of operations.

The impact of this market will also extend to areas outside traditional maritime sectors. Offshore oil and gas rigs, oceanographic research establishments, and next-generation floating city development will depend on these technologies to guarantee structural safety. This expansion will develop the importance of automated mooring way past its authentic application, making it a cornerstone of destiny marine era.

In the give up, the global automated mooring systems market will evolve from a gap way to an all-encompassing system that promotes automation, sustainability, and digitalization in maritime operations. By breaking the mildew of what is viable, this region will no longer only outline the destiny of vessel security but will remake the manner the sector perceives marine infrastructure.

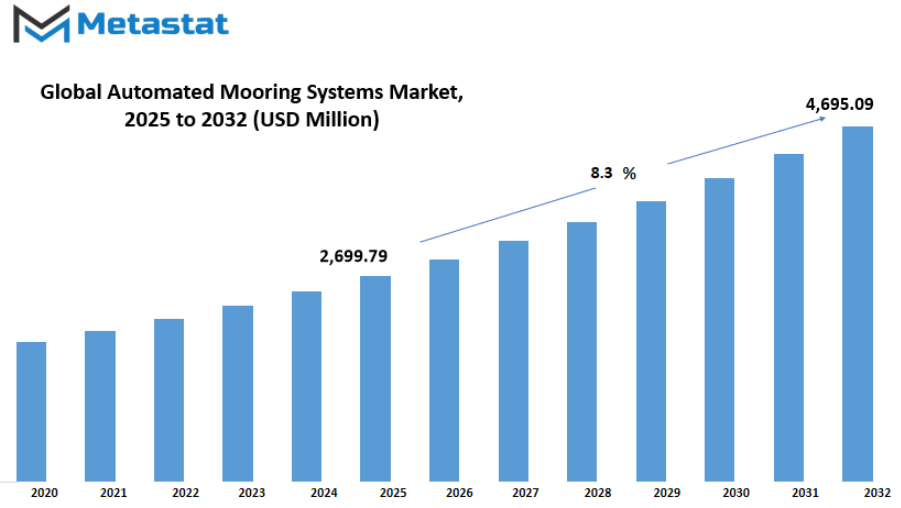

Global automated mooring systems market is estimated to reach $4,695.09 Million by 2032; growing at a CAGR of 8.3% from 2025 to 2032.

GROWTH FACTORS

The global automated mooring systems market is becoming popular as ports across the globe seek more intelligent and efficient means to manage operations. One of the most compelling reasons for the move is increasing port automation. Automated mooring systems diminish time and labor required to moor ships, which ensures that ports process more traffic without any hindrance. This type of efficiency is becoming increasingly necessary as world trade keeps increasing, putting a strain on ports to modernize their operations. Ports that implement these systems can have quicker turnaround times, improved use of resources, and lower risks when they dock.

There is also the increased emphasis on operational safety. Mooring has in the past been a dangerous task that involves human effort and heavy ropes, causing accidents and injuries. Automated mooring eliminates the need for manual handling, which minimizes workplace risks. This safety benefit attracts operators and regulatory bodies that require safer port conditions. By reducing human presence in such risky jobs, ports not only safeguard their employees but also ensure uninterrupted functions, which is absolutely essential for their profitability.

In spite of these benefits, the market has challenges that cannot be neglected. The high installation and maintenance costs render it challenging for most ports, particularly those in the developing world, to invest. Automated systems involve considerable initial investment, and routine maintenance contributes to operating costs. Another constraint is non-compatibility with existing older port infrastructure. Most ports have old systems that do not easily interface with new automated systems, hindering uptake. These factors present a hindrance to smaller ports and those that are not ready to undertake the large capital projects.

Despite this, the future of this market continues to look optimistic due to opportunities arising from the increase in smart ports. With governments and private sector operators driving modernization, intelligent ports are fast becoming reality worldwide. Smart ports are supposed to leverage automation, data analysis, and networked systems to drive efficiency. Automated mooring is well within this vision and therefore a critical element of port infrastructure in the future. With increasing investments pouring in for the development of intelligent ports, the need for such systems will also expand, offering attractive growth opportunities to firms in this area over the next few years.

MARKET SEGMENTATION

By Product Type

The global automated mooring systems market is heading towards huge developments with ports and offshore terminals emphasizing efficiency and safety. Automated mooring systems are conceived to substitute conventional manual operations, with the process being quicker and with minimal labor. The systems minimize risks involved with human handling as they enhance vessel stability while mooring. As the ships are getting larger and more traffic is moving to ports, automation of mooring is becoming inevitable for smooth and secure docking operations. The growth of the market is driven by the increasing need for efficient equipment that reduces turnaround times and operations risks.

Automated systems introduce precision and reliability, which are paramount for operations of huge vessels in harsh conditions. Their capacity to operate across weather conditions is very pragmatic for both shipping lines and port operators. With international trade still rising, automated mooring systems will significantly contribute to cost reduction and overall productivity. With regard to product types, the market is segmented into Vacuum Mooring and Magnetic Mooring. Out of these, Vacuum Mooring has been highly popular, with an estimated value of $2,116.65 million, portraying its extensive uptake among major ports. Vacuum Mooring achieves this by forming a safe hold through vacuum pads, making for a rapid and secure attachment.

Alternatively, Magnetic Mooring accomplishes the same goal but in a different way using strong magnets, providing flexibility for particular operational requirements. Both options are designed to enhance efficiency and safety but the application is based on the individual needs of port facilities and ship types. The destiny of automated mooring systems will depend upon ongoing technological advancement and assimilation into smart port answers.

With ports embracing digital technology and automation, such systems becomes extra included and wise, facilitating actual-time tracking and predictive renovation. The trend will enhance operational performance but also facilitate sustainability targets through reduced fuel consumption and emissions upon docking. As more investments are made and awareness increases, the global automated mooring systems market will further grow, with automated solutions becoming an integral part of contemporary port operations.

By Anchor Type

The global automated mooring systems market is on the rise as offshore operations increase in industries such as oil and gas, renewable energy, and shipping. Automated mooring systems provide the efficient securing of vessels without human intervention, enhancing safety as well as operational speed. It is driven by growing vessel sizes and the requirement of stable anchoring in deeper water where conventional systems have difficulty. Automation minimizes the risk of accidents and human errors, thus making automation a high-recommended option for organizations that desire efficiency and sustainability in their operations.

Based on anchor type, the global automated mooring systems market can be broadly classified into Vertical Loaded Anchors, Drag Embedment Anchors, Suction Anchors, and others. Vertical Loaded Anchors find extensive usage due to high holding power and stability in soft seabeds. These anchors are best for deep-water use, making them a necessity for offshore structures and floating production devices. As offshore ventures keep pushing to deeper zones, the demand for these anchors will stay excessive because of their potential to offer powerful resistance against vertical and lateral forces.

Drag Embedment Anchors are another popular option in the automated mooring systems industry. These anchors are economical and offer consistent performance in those regions where soil conditions permit effective penetration. They are widely used in offshore oil and gas operations and are likely to witness constant uptake as companies seek practical and proven alternatives. Although not as strong as vertical loaded anchors, their cost-effectiveness and ease of application across different seabed conditions make them a good choice for most operators.

Suction Anchors have also come into the limelight due to their high stability and the capacity to operate in deep water. Anchors operate by applying suction using a hollow apparatus that pierces the seafloor, providing adequate resistance even under difficult conditions. Their usage is also on the rise in wind farms afloat and other clean energy projects, wherein anchoring has to endure strong marine conditions. Alongside these primary types, the "Others" category comprises specialized anchors that are intended for specific seabed conditions and high-tech mooring demands. These products serve niche markets and are engineered specifically to address particular engineering issues.

In all, the global automated mooring systems market will expand further as businesses go increasingly offshore and as automation takes center stage. Anchor kinds are vital determinants of the stableness and reliability of these systems. As substances and technology evolve, every anchor kind is probably to become more efficient, allowing operators to gain safety and value-effectiveness in offshore undertakings inside the destiny.

By Mooring Type

The global automated mooring systems market is taking on increasing significance as ports and offshore terminals strive towards safer, faster, and more effective operations. Manual mooring approaches tend to involve a lot of manpower and time, posing greater risks of accidents and delays. Automated systems reverse this by employing cutting-edge technology to moor vessels rapidly and precisely, even in adverse conditions. This not only enhances operational efficacy but also raises the level of safety standards throughout maritime infrastructure, rendering automation the linchpin of the future for most port authorities as well as offshore platforms.

Based on mooring type, the global automated mooring systems market has a number of categories that address distinct operating requirements. Spread Mooring is quite common for stability, particularly in offshore platforms, since it spreads tension over many anchors to maintain a secure hold. Single Point Mooring, however, is used for transferring fluids from a tanker to a storage facility in most cases where waters are deeper. Catenary Mooring continues to be a depended on choice for its ability for heavy loads and its flexibility in unfavorable conditions, while Taut Leg Mooring gives better vertical anxiety to be used in deeper waters. Dynamic Positioning is specific in that it does not rely upon anchors however alternatively employs thrusters and complex management structures to maintain a deliver in position, which makes it ideal for conditions where it's miles impractical to anchor. There are different structures with specialized designs precise to precise offshore or port programs.

The requirement for such systems is prompted by various factors, including increasing vessel size, desire for rapid turnaround times in ports, and increased offshore exploration of oil and gas. These processes call for mooring solutions that are efficient as well as reliable in harsh environments. Automated mooring saves time and human mistakes, translating into cost savings for operators. As industries shift towards digitalization and automation, these systems will be a default option instead of an optional upgrade. Their incorporation with monitoring and control technologies also assists operators in monitoring performance and adhering to safety standards.

In the destiny, the global automated mooring systems market will keep developing as ports come to be upgraded and offshore tasks develop extra complicated. Energy operators, transport companies, and port authorities will want to put money into those structures to decorate safety, reduce operational expenses, and observe extra stringent environmental and safety rules. With several styles of moorings, the flexibility of these systems ensures that they could accommodate various operating wishes, and consequently they are a crucial part of the infrastructure of the contemporary maritime international. The combination of efficiency, protection, and automation will keep to gas adoption within the destiny.

By Application

The global automated mooring systems market is emerging with growing offshore oil and gas exploration and a demand for effective mooring technology. Automated mooring systems are poised to eliminate the complexity of mooring massive floating structures, providing stability and safety in harsh marine environments. In contrast to conventional approaches, the systems minimize human effort, reduce danger, and increase working efficacy. With offshore projects pushing into deeper seas and more adverse conditions, the demand for high-technology mooring solutions will increase.

Based on application, the global automated mooring systems market is classified as Floating Production Storage, Tension Leg Platform (TLP), Floating Liquefied Natural Gas (FLNG), Semi-Submersible, and Others. All applications perform distinct roles in offshore operations. Floating Production Storage units need robust and flexible mooring systems to be in position when dealing with heavy loads. TLPs, dependent on vertical tension to be stable, require accurate mooring for safety in deepwater operations. FLNG plants require sophisticated automated solutions to control complex storage and liquefaction processes within floating conditions, requiring reliability to be a primary concern. Semi-submersibles also gain benefits from these solutions, as their structure can provide stability in heavy seas when integrated with effective mooring technology.

Growing use of Floating Production Storage and FLNG facilities is likely to propel greater demand for automated mooring systems. These uses enable operators to maximize offshore oil and gas production at a lower cost of onshore facilities. With energy companies venturing into deeper waters and remote areas, automation proves to be a critical enabler of smooth operations. This transition to automated systems also aids in sustainability objectives since there are fewer manual interventions, which lowers the likelihood of accidents and environmental risks.

Besides these fundamental uses, other offshore developments are also driving market development. Some of these include specialized floating structures for renewable energy platforms and sophisticated offshore terminals. As the energy trend becomes more diversified towards traditional and renewable sources in a globalized context, automated mooring systems will continue to be a critical element of offshore infrastructure. Secure anchoring and operational safety in varied conditions offered by them make them an indispensable component for offshore developments in the future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,699.79 million |

|

Market Size by 2032 |

$4,695.09 Million |

|

Growth Rate from 2025 to 2032 |

8.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

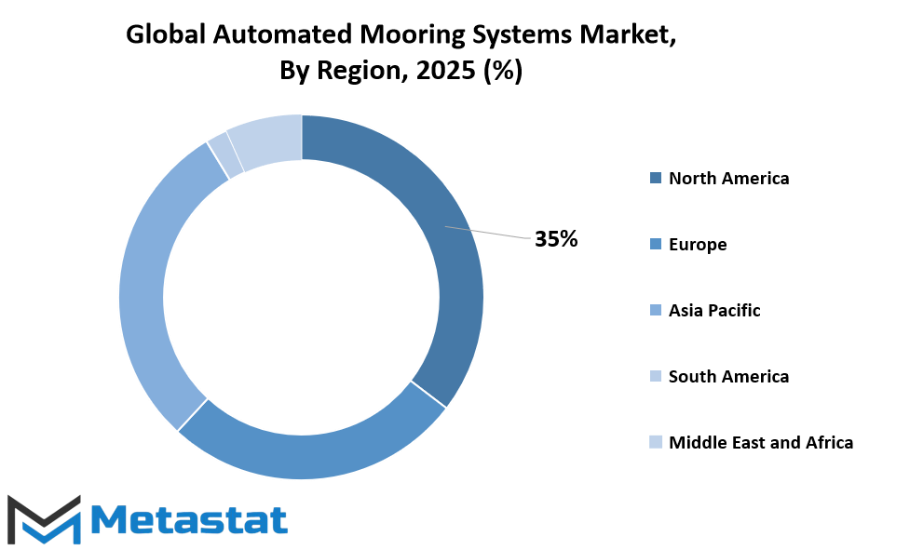

The global automated mooring systems market is influenced by different regions, which perform a distinct function in its development and uptake. North America is one of the major markets because of the robust presence of offshore activities as well as advancements in technology. The region encompasses the U.S., Canada, and Mexico, where the need for efficient and safer mooring systems has continuously grown. The U.S. has witnessed heavy investments in offshore exploration, leading to the implementation of automated systems that minimize operational risk and enhance performance. Canada and Mexico are also making their contributions by increasingly focusing on energy projects, increasing the momentum in the regional market.

Europe, too, has seen strong interest in advanced mooring technologies from nations like the UK, Germany, France, and Italy. Offshore energy ventures, particularly off the coast of the North Sea, have increased demand for automated systems that provide stability and safety under adverse conditions. The region continues to venture into renewable energy sources such as offshore wind farms, further propelling the demand for such systems. The Rest of Europe is also experiencing slow uptake, spurred by the necessity of efficient operation in both the energy and industrial sectors.

Asia-Pacific is also an important market, dominated by China, Japan, India, and South Korea. Sustained industrialization, increased energy demand, and vast offshore operations have converted this region into a growth center. China and Japan are establishing giant marine infrastructure, and India and South Korea are targeting their growth in the energy sector. These advances have provided a solid foundation for the Asia-Pacific automated mooring systems market to grow with increased technological integration and cost-efficient solution demand.

South America and the Middle East & Africa regions also contribute significantly to the market dynamics worldwide. In South America, Brazil and Argentina continue to lead the way with significant offshore oil and gas reserves of their own, which need sophisticated mooring solutions for effective operations. While in the Middle East & Africa region, covering the GCC nations, Egypt, and South Africa, the growth of energy and offshore projects continues to rise. The increasing focus on enhancing safety, minimising manual operations, and augmenting massive energy exploration in these areas will make the demand for automated mooring systems continue to be high in the near future.

COMPETITIVE PLAYERS

The global automated mooring systems market is attracting interest as companies seek safer, faster, and more efficient mooring options at ports, terminals, and offshore platforms. Conventional mooring practices tend to require extensive manpower and time, which raises the risk of accidents and delays. Automated alternatives are transforming this process by bringing in technology-based systems with minimal human intervention and enhanced operational safety. These systems not only reduce the docking time but also reduce man-made errors, a serious issue with maritime operations.

Multiple companies are leading the pace of innovation and development in this area. Well-known players like Cavotec SA, Trelleborg Marine & Infrastructure, Mampaey Offshore Industries, MacGregor, Seaflex AB, ABC Moorings, MODEC, Inc. (Sofec), and Offspring International Limited are developing cutting-edge solutions that ensure reliability and performance. Their technologies combine automation and digital surveillance to offer real-time information, enabling vessel operators to manage ships well in varying weather and tides. These are likely to promote greater use across ports and offshore structures.

The global automated mooring systems market will keep expanding as international trade and energy initiatives continue to grow. Floating production units and large ships need robust and resilient mooring solutions capable of withstanding complex scenarios without compromising safety. Automated systems are found to be cost-efficient in the long term since they cut downtime and maintenance, and enhance turnaround times in ports. This trend follows the enhanced emphasis on digitalization and automation in the maritime industry.

In the future, the market is expected to invest more in research and development to ensure that these systems become smarter and more sustainable. The players discussed above are already developing solutions that can be integrated into future port infrastructure such as smart ports and green operations. With shipping and offshore projects becoming more sophisticated, automated mooring systems are expected to become important in enhancing efficiency and safety standards globally.

Automated Mooring Systems Market Key Segments:

By Product Type

- Vaccum Mooring

- Magnetic Mooring

By Anchor Type

- Vertical Loaded Anchors

- Drag Embedment Anchors

- Suction Anchors

- Others

By Mooring Type

- Spread Mooring

- Single Point Mooring

- Catenary Mooring

- Dynamic Positioning

- Taut Leg

- Others

By Application

- Floating Production Storage

- Tension Leg Platform (TLP)

- Floating Liquefied Natural Gas (FLNG)

- Semi-Submersible

- Others

Key Global Automated Mooring Systems Industry Players

- Cavotec SA

- Trelleborg Marine & Infrastructure

- Mampaey Offshore Industries

- MacGregor

- Seaflex AB

- ABC Moorings

- MODEC, Inc. (Sofec)

- Offspring International Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383