MARKET OVERVIEW

The global warehouse automation market is part of the supply chain industry that is bound to keep changing the way products are stored, moved, and transferred across global networks. As corporations expand their product lines and grapple with reduced delivery times, calls for greater efficiency in warehouses will continue to become more apparent. This market will not only affect logistics providers but also manufacturers, retailers, and e-commerce sites that rely on efficient and fast-moving inventory. What will distinguish the world warehouse automation market is its potential to combine mechanical equipment with software intelligence.

Instead of depending solely on human labor for sorting, packing, or transporting goods, warehouses will begin to use more robotics, conveyor technology, and data-enabled management systems. The revolution will not render human jobs extinct, but rather reconfigure them. Workers will conduct supervisory and technical tasks, watching over groups of machines that are capable of performing repetitive processes with precision. The global warehouse automation market will also gain consideration as it will address one of the largest issues in logistics: precision. Hand-to-hand delivery has always been at risk of mistakes, whether it was stock counting or filling orders. Automated systems will do away with such differences by using standard procedures and imbuing machine-level uniformity. This development will be at the center of customer satisfaction when expedited shipping and accurate product matching will be the norm expectation. Another feature of this market will be its impact on space optimization.

The majority of traditional warehouses have inefficient layouts, where aisles and shelving units are optimized for human access, not system functionality. In the future, automation will allow buildings to make use of vertical and tight storage more effectively, utilizing all available square feet more efficiently. This capability will be particularly advantageous in markets where property costs are rising, compelling operators to seek out superior solutions rather than larger spaces. The global market for warehouse automation will not develop in isolation. It will be entwined with broader technology trends such as artificial intelligence, machine learning, and the Internet of Things. Warehouse equipment will no longer merely move packages between two points; it will be able to talk to other machines, learn the patterns of demand, and react to changing order volumes. Convergence like this will enable companies to forecast and alter their logistics approach with much greater agility and foresight. To complement efficiency, the market will also determine sustainability goals. The automated systems will eliminate wastage of energy by optimizing movement and eliminating idle time. The packaging operations will be optimized to eliminate material usage, and routing intelligence will limit unnecessary transportation in facilities. As organizations across the world grapple with growing pressure to comply with the environment, solutions offered in this market will be inimitable.

Overall, the global warehouse automation industry will shift as both a technological and operational column for sectors related to logistics. By transforming the manner in which products are managed, stored, and shipped out, it will provide the foundation for a quicker, more intelligent, and more dependable supply chain. The changes in the offing will reconfigure not only warehouses but also the standard of companies and individuals who depend on them.

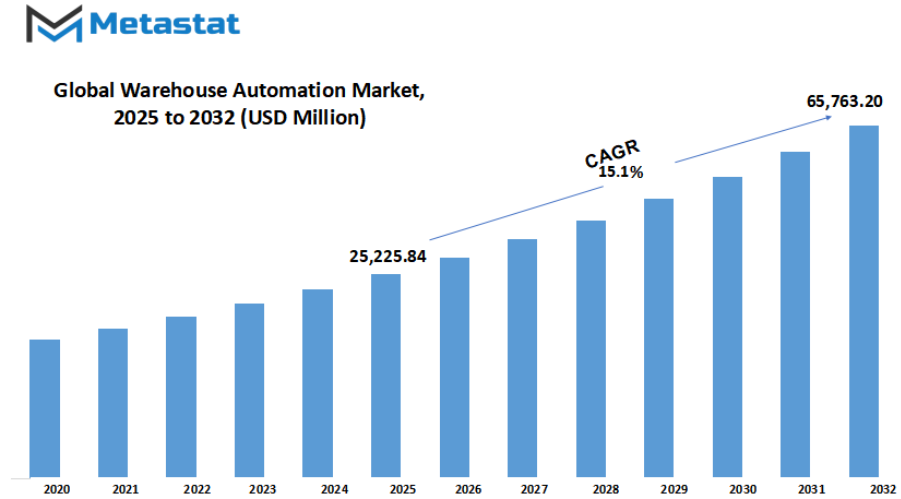

Global warehouse automation market is estimated to reach $65,763.20 Million by 2032; growing at a CAGR of 15.1% from 2025 to 2032.

GROWTH FACTORS

Chronic labor shortages and rising wage pressures in the logistics sector. and Explosive growth of e-commerce demanding faster fulfillment speeds and accuracy. are key driving factors of the market. However, Extremely high capital expenditure required for installation and integration. and Complex system integration and flexibility challenges with existing infrastructure. might hamper the market growth. Proliferation of AI and machine learning for predictive analytics and optimized workflows. would provide lucrative opportunities for the market in coming years.

MARKET SEGMENTATION

By Component

The global warehouse automation market is set to witness remarkable growth in the coming years as businesses seek greater efficiency, accuracy, and speed in their logistics operations. Rapid advancements in technology will drive significant changes in warehouse management systems, leading to smarter and more interconnected storage solutions. Automation will no longer be limited to simple mechanical tasks but will expand to intelligent systems capable of predictive decision-making, real-time monitoring, and adaptive resource allocation. Companies operating in various industries will increasingly rely on these solutions to reduce operational costs, improve order fulfillment, and enhance overall productivity.

By component, the global warehouse automation market is further segmented into hardware, software, and services. Hardware will continue to form the backbone of automation systems, including robotic arms, automated guided vehicles, conveyor systems, and storage racks designed for optimized space utilization. The demand for durable and high-performance hardware will increase as warehouses handle larger volumes and more complex inventories. Future hardware innovations will focus on flexibility, energy efficiency, and integration with smart sensors to ensure seamless coordination across all processes.

Software will play a critical role in shaping the future of warehouse automation. Advanced warehouse management software, control systems, and analytics platforms will allow businesses to monitor operations in real time, forecast demand, and allocate resources efficiently. Cloud-based solutions will gain prominence, enabling remote monitoring and centralized control of multiple warehouses. Artificial intelligence and machine learning will enhance software capabilities, making systems self-learning and adaptive to changing market conditions, which will reduce errors and improve operational planning.

Services will support the adoption and maintenance of warehouse automation systems, ensuring smooth implementation and optimal performance. Consulting, integration, training, and maintenance services will help businesses maximize the potential of automation technologies. With rapid technological advancements, service providers will focus on predictive maintenance, remote troubleshooting, and continuous upgrades, allowing warehouses to maintain high efficiency with minimal downtime.

The future of the global warehouse automation market will be defined by the convergence of hardware, software, and services into a cohesive ecosystem that supports smarter, faster, and more sustainable logistics. Investment in technology and innovative solutions will transform warehouses into highly efficient operational hubs. Businesses that embrace these advancements will benefit from increased productivity, reduced operational risks, and a competitive edge in the evolving logistics landscape, making the global warehouse automation market an essential driver of modern supply chain efficiency.

By Technology

The global warehouse automation market is poised for significant growth as industries continue to seek efficiency, accuracy, and cost reduction in operations. The demand for faster order fulfillment, accurate inventory management, and streamlined logistics will drive adoption of advanced warehouse automation technologies across various sectors. Companies will increasingly implement automation to reduce human error, improve safety, and enhance overall productivity in warehouse operations.

By technology, the global warehouse automation market is divided into several key segments that will shape the future of logistics. Mobile robots, including Automated Guided Vehicles (AGV) and Autonomous Mobile Robots (AMR), will play a vital role in enabling flexible and intelligent material handling. These systems will support dynamic routing and real-time inventory movement, reducing dependency on manual labor and optimizing operational efficiency. Automated Storage and Retrieval Systems (AS/RS) will continue to be crucial in maximizing storage density and accelerating the picking process. The use of AS/RS will allow warehouses to manage higher volumes of products with minimal human intervention, ensuring faster and more precise inventory handling.

Conveyor and sortation systems will remain central to streamlining internal transportation of goods. These systems will enable continuous and organized flow of products, reducing bottlenecks and improving throughput. Palletizing and depalletizing robotics will handle repetitive tasks such as stacking, unstacking, and organizing products, ensuring consistent and safe operations while freeing human resources for more strategic activities. Piece-picking robots will further enhance accuracy and speed in handling individual items, which will be particularly valuable in e-commerce and high-mix warehouse environments. Automatic Identification and Data Collection (AIDC) technologies, including barcode scanners and RFID systems, will provide real-time tracking and monitoring of inventory. This will ensure accurate data capture, traceability, and seamless integration with warehouse management systems.

The future of the global warehouse automation market will be defined by the integration of these technologies with advanced software solutions and artificial intelligence. Predictive analytics, machine learning, and real-time monitoring will allow warehouses to adapt quickly to changing demands, optimize resource allocation, and reduce operational costs. The combination of robotics, automated systems, and intelligent data collection will create smarter and more responsive warehouses capable of meeting the evolving needs of global supply chains. The market will continue to grow as organizations invest in technologies that improve efficiency, reduce human dependency, and enhance overall performance, shaping the next generation of warehouse operations.

By Application Function

The global warehouse automation market is set to undergo substantial transformation as technology continues to advance and businesses focus on efficiency and cost reduction. Automation in warehouses will no longer be limited to simple mechanization but will increasingly integrate artificial intelligence, robotics, and advanced software systems. This integration will allow warehouses to handle larger volumes of goods while minimizing errors and operational delays. Companies will be able to respond to market demands more quickly, ensuring that products reach customers faster and more accurately.

By application function, the global warehouse automation market is divided into several key segments. Inbound handling will see significant innovation as automated systems will manage the receipt, inspection, and movement of incoming goods with greater speed and accuracy. This will reduce manual labor requirements and enhance overall workflow. Storage and buffering functions will be optimized through smart shelving systems, automated guided vehicles, and AI-driven space management tools. These solutions will maximize warehouse space while ensuring that items are stored safely and can be accessed efficiently when needed.

Picking and packing processes will experience the most visible changes, as automation will allow precise selection and packaging of items according to customer orders. Robotics and automated picking systems will reduce errors and increase the speed of order fulfillment. Sorting and consolidation functions will also benefit from technology that can quickly organize products based on destination, size, or priority. This will allow for more accurate and timely delivery schedules. Outbound loading will be streamlined through automated systems capable of preparing shipments for transport without significant human intervention, ensuring that logistics operations remain smooth and efficient. Returns processing will also be enhanced, with automated systems capable of inspecting, sorting, and restocking returned goods, reducing turnaround time and operational costs.

The global warehouse automation market will continue to attract investment as companies recognize the benefits of reducing labor costs, increasing accuracy, and improving operational efficiency. Future warehouses will likely be designed around integrated automation systems that connect every stage of the supply chain. Data-driven insights from these systems will allow warehouse managers to predict demand, manage inventory more effectively, and optimize resource allocation. The adoption of such technologies will not only reshape the operational landscape but will also redefine the standards of speed, precision, and reliability in warehouse management. The market’s growth will signal a shift toward highly automated, intelligent warehouses capable of meeting the evolving demands of global trade.

By End-User

The global warehouse automation market is expected to transform the way industries handle storage, inventory, and distribution in the coming years. With the rapid growth of technology, warehouses are increasingly adopting automation solutions that improve efficiency, accuracy, and speed. Automated systems such as robotics, automated guided vehicles, conveyor systems, and warehouse management software are reshaping operations across multiple sectors. These systems will allow businesses to reduce human error, optimize space utilization, and handle larger volumes of goods with consistent precision. The impact of these technologies will be significant as industries adapt to the rising demand for faster delivery and seamless supply chain management.

By end-user industry, the global warehouse automation market will witness diverse adoption patterns. The Food and Beverage sector will benefit from automation through improved inventory management, better handling of perishable goods, and faster order fulfillment. Automation will ensure consistent quality and reduce waste, which is critical for meeting growing consumer expectations. In the Post and Parcel segment, automation will enable faster sorting, scanning, and dispatching of packages. This will be essential to cope with the increasing volume of e-commerce shipments, where speed and accuracy determine customer satisfaction. Retail and E-commerce warehouses will rely heavily on automated systems to handle high-volume order processing, returns management, and real-time inventory updates. The integration of robotics and software will make operations more flexible and responsive to fluctuating demand.

In the Apparel and Footwear sector, automation will streamline picking, packing, and inventory control, ensuring that seasonal trends and high-demand items are delivered efficiently. Manufacturing, both durable and non-durable, will gain from automated storage and retrieval systems, enabling smoother production schedules and reduced downtime. Pharmaceuticals and Healthcare will adopt automation to maintain strict standards for product handling, temperature control, and regulatory compliance. The 3PL and contract logistics industry will use automation to enhance service capabilities, reduce operational costs, and manage multiple clients with varying demands. Other industries will also find opportunities to improve workflow, reduce labor dependency, and enhance safety through automation solutions.

Overall, the global warehouse automation market will drive a future where operations are faster, safer, and more efficient. Investment in automation will not only optimize current processes but also support expansion to meet increasing global trade demands. As technology continues to advance, warehouses will become hubs of innovation, where intelligent systems handle complex tasks and provide valuable insights to maintain a competitive edge across industries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$25,225.84 million |

|

Market Size by 2032 |

$65,763.20 Million |

|

Growth Rate from 2025 to 2032 |

15.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

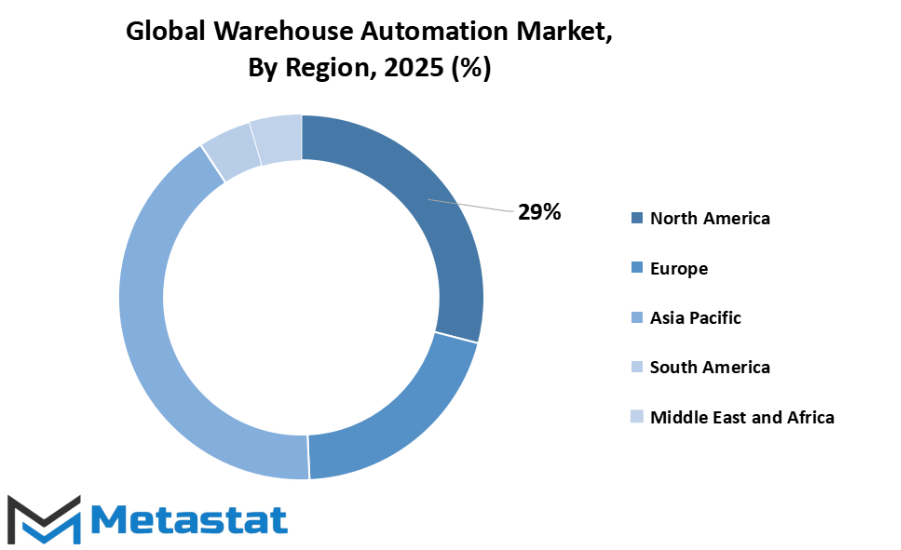

Based on geography, the global warehouse automation market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

COMPETITIVE PLAYERS

The global warehouse automation market is expected to witness significant growth in the coming years as industries increasingly adopt advanced technologies to improve efficiency and reduce operational costs. Automation in warehouses allows for streamlined processes, better inventory management, and faster order fulfillment, which are crucial in a highly competitive business environment. As technology continues to advance, the global warehouse automation market will become a central focus for companies seeking to maintain an edge in logistics and supply chain operations. The market will see widespread adoption of robotics, automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and advanced software systems designed to optimize warehouse management. These technologies will not only increase productivity but also reduce human errors, ensuring more accurate and timely operations.

Competitive players in the global warehouse automation market play a vital role in shaping the future of logistics. Key companies such as Dematic Group (KION AG), Daifuku Co Ltd, Swisslog Holding AG (KUKA), and Honeywell International Inc. have established a strong presence, driving innovation and setting benchmarks for performance and reliability. Other significant participants including Jungheinrich AG, KNAPP AG, TGW Logistics, Mecalux SA, SSI Schaefer AG, Vanderlande BV, and Boston Dynamics will continue to introduce cutting-edge solutions to meet the evolving needs of warehouses worldwide. Companies like Zebra Technologies, Exotec, Geek+, Symbotic, AutoStore, Locus Robotics, GreyOrange, Berkshire Grey, Element Logic, and Ocado Group will expand their influence by developing intelligent systems capable of handling complex warehouse operations with minimal human intervention.

The competitive landscape of the global warehouse automation market will also encourage collaboration and partnerships between technology providers and logistics companies, leading to the integration of smart sensors, artificial intelligence, and machine learning into warehouse operations. These advancements will enable real-time decision-making, predictive maintenance, and dynamic allocation of resources, ensuring that warehouses operate at peak efficiency. As industries continue to prioritize faster delivery and cost reduction, the global warehouse automation market will witness continuous innovation, with competitive players investing in research and development to introduce solutions that anticipate future needs. The combination of robotics, AI, and software-driven management systems will define the next phase of warehouse automation, positioning leading companies to shape the standards and expectations of the logistics industry in the years ahead.

Warehouse Automation Market Key Segments:

By Component

- Hardware

- Software

- Services

By Technology

- Mobile Robots (AGV, AMR)

- Automated Storage and Retrieval Systems (AS/RS)

- Conveyor and Sortation Systems

- Palletizing / Depalletizing Robotics

- Piece-Picking Robots

- Automatic Identification and Data Collection (AIDC)

By Application Function

- Inbound Handling

- Storage and Buffering

- Picking and Packing

- Sorting and Consolidation

- Outbound Loading

- Returns Processing

By End-User Industry

- Food and Beverage

- Post and Parcel

- Retail and E-commerce

- Apparel and Footwear

- Manufacturing (Durable and Non-Durable)

- Pharmaceuticals and Healthcare

- 3PL / Contract Logistics

- Others

Key Global Warehouse Automation Industry Players

- Dematic Group (KION AG)

- Daifuku Co Ltd

- Swisslog Holding AG (KUKA)

- Honeywell International Inc.

- Jungheinrich AG

- KNAPP AG

- TGW Logistics

- Mecalux SA

- SSI Schaefer AG

- Vanderlande BV

- Boston Dynamics

- Zebra Technologies

- Exotec

- Geek+

- Symbotic

- AutoStore

- Locus Robotics

- GreyOrange

- Berkshire Grey

- Element Logic

- Ocado Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252