Sep 15, 2025

The new report on the warehouse automation market done by Metastat Insight provides an in-depth view of an industry that has evolved from being a peripheral function within supply chains to a key component of operational strategy. The report details not just technological advancements but also changing patterns of demand which are driving the warehousing practices of today. Instead of seeing automation as something sci-fi, the market is now an active arena of adjustment where machinery, software, and organizational processes are combined into synergistic solutions. This shift is an indicator of the general drive by industries to redefine efficiency, safety, and flexibility within storage and distribution chains.

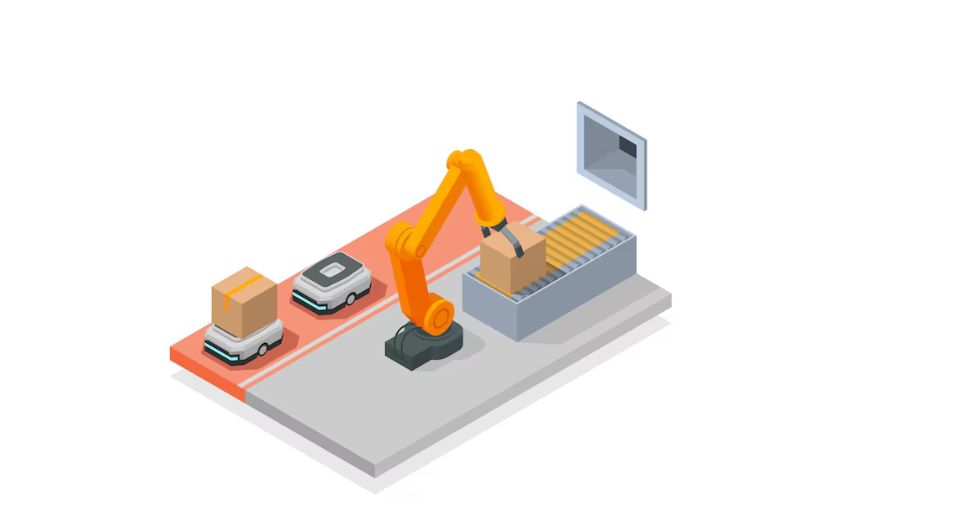

The warehouse automation market has evolved to be a high-end ecosystem where robotics, data systems, and mechanical handling solutions get along in harmony. Warehouses that were once structured around human-intensive cycles are now more focused on automated flows, coaxing products through receiving, storage, and outbound phases with minimal pause. This integration makes possible consistent performance over different scales of operation, whether regional depots or large global hubs. The industry illustrates how physical infrastructure and digital intelligence are no longer considered in isolation but as interdependent layers within the logistics architecture.

In studying the warehouse automation space, it's evident that automation is no longer a discretionary investment but a structural change. Most facilities today incorporate automated pallets, robotic arms, and machine vision to take over repetitive manual procedures, not only augmenting productivity but also consistency in processing. Software platforms are tied to physical equipment in order to develop an adaptive environment that can handle changing volumes, seasonal spikes, and nuanced product variety. The effect is not limited to the internal design of a warehouse; it carries over to transport coordination and customer service, making the supply chain experience more open and regulated.

The larger landscape of the warehouse automation market is one of regional disparities that represent varying degrees of adoption. Mature economies prioritize replacement of legacy systems with next-generation networks, whereas emerging markets see automation as a way of skipping over development stages and aligning with global standards. This dual trend indicates that the market works on multiple timelines, reconciling the requirements of modernization with the possibilities of new deployment. Even with these differences, there is a common theme running through all areas: an acceptance that automated systems redefine the standards of reliability and scalability in warehousing.

Technology suppliers in the warehouse automation industry are also changing their role. No longer confined to selling individual products, many are becoming long-term collaborators in design, installation, and lifecycle management. This model of partnership mirrors the sophistication of automation projects, which require customized solutions more than standard equipment. Ongoing service, software maintenance, and integration assistance are now as essential as the original provision of machinery. As a result, competition is less about hardware superiority only and more about ongoing partnership with end users.

Another characteristic feature of the warehouse automation market is the increasing intersection between automation and sustainability objectives. Energy efficiency, reducing wastage, and optimal space usage are now being viewed as inherent consequences of automated solutions. Smart routing of products decreases unnecessary travel, and leading-edge control mechanisms decrease power usage during idling. Such aspects confirm that automation is not sought after only for cost savings but also for compliance with larger environmental goals, leading it to become part of the long-term responsibility framework that organizations widely adopt.

The evolution of workforce compositions further demonstrates the influence of the warehouse automation marketplace. Automation does not remove human intervention but shifts labour towards supervisory, maintenance, and analytical functions. The availability of capable technicians and data experts is as critical as mechanical systems, forming a hybrid workforce paradigm. The change necessitates additional training programs and career tracks, reframing the perception of warehousing from manual labour to a high-tech profession. These shifts have social as well as economic impacts that go beyond the walls of the facilities themselves.

Customer expectations affect the warehouse automation market as well. Greater demand for quicker delivery and greater order accuracy has led to the investment in automated storage and retrieval systems that provide quick response without sacrificing precision. Automation successfully bridged the distance between physical warehousing of goods and virtual promise of e-commerce and supply chain transparency. Ensuring consistent performance, automation systems facilitate the trust needed among companies and clients, transforming warehousing into a strategic customer satisfaction enabler.

As industries come to terms with global disruptions and changing consumption patterns, the market for warehouse automation shows a high degree of resilience. To adapt is not merely about the integration of machines but about building resilient networks that can absorb uncertainty without deviating from consistent performance. This resilience is a key feature of the contribution of automation to today's supply structure.

The warehouse automation industry report published by Metastat Insight ends up presenting this shift as an inter-layered evolution affecting technology, personnel, sustainability, and customer interaction all at once. Quite the contraition of a single technical improvement, automation in warehouses has evolved into a central part of international logistics planning. With ongoing innovation and increasing integration, the industry is poised to shape the way industries plan, run, and see the future of distribution systems.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479