MARKET OVERVIEW

The US holiday plush market segment refers to a particular area within the greater toy and gift industry that not only captures the spirit but also festivity associated with different holidays in uniquely designed cuddly toys. It confines itself to the design of plush items reflecting themes or symbols for holidays like Christmas, Halloween, Easter, or even Valentine's Day. They are so much in demand because they are capable of evoking childhood memories and provide a touch of celebration to the interior decorations of a home, hence they are an instant hit as a gift item among children and adults alike. The holiday plush market in the US stays vibrant with creativity and seasonal trends, constantly evolving with consumer preference and cultural influences.

For example, during Christmas, plush toys depicting Santa Claus, reindeer, and snowmen become an instant hit. These are extremely popular with children, but they are also in demand among adults for use as seasonal decorations during these holidays or simply to give as mementos. Thereafter, Halloween sweeps in with a host of plush toys shaped like ghosts, witches, and pumpkins that appeal to people who celebrate the holiday with themed decorations and other fun accessories. Easter plush toys include bunnies, chicks, and lambs, which represent new life and the cheer of spring. These items are mainly purchased as Easter basket fillers and remain steady holiday plush items. Heart-shaped plush toys and teddy bears with loving messages take the holiday season by storm during Valentine's Day, specifically for those in search of heart-prodding gifts to share their love with loved ones.

The US Holiday Plush market designs its production and marketing strategies around the holiday seasons of the year. Most manufacturers design and start producing plush toys months in advance so that the products are stocked in stores way ahead of holidays. Online and brick-and-mortar retailers form a major channel market for the product by displaying these items at key locations to draw the eyes of holiday shoppers.

Holiday plush toy campaigns often work off emotion and a feeling of the holiday season. Ads usually include some type of scenario in which plush toys bring joy to families, enhance holiday traditions, or become irreplaceable gifts. Companies wanting to increase their reach and build interest in new holiday plush turn to social media, partner with influencers, and run targeted ads online.

The US Holiday Plush market in the future shall see a fusion of innovation and sustainability. Much as consumer awareness about the environment heightens, manufacturers might start looking into eco-friendly materials and ethical ways of production. Integration with technology through interactive features or augmented reality experiences could become a trend in plush toys.

Another fast-growing trend in the holiday plush market is customization. Most consumers are constantly in search of personalization—that makes the holidays special. This would be in the form of customizing plush toys with names, dates, or even special messages that make them extra special as gifts or as a personal keepsake.

The US holiday plush market has become an active, dynamic, and vibrant industry, showcasing the essence of various holidays in all cute, creative, cuddly toys. Continuously evolving to suit consumer preference, embracing new trends, and nudging emotional connections, holidays and all such celebrations are sure to enthrall and excite people of all ages for many years to come.

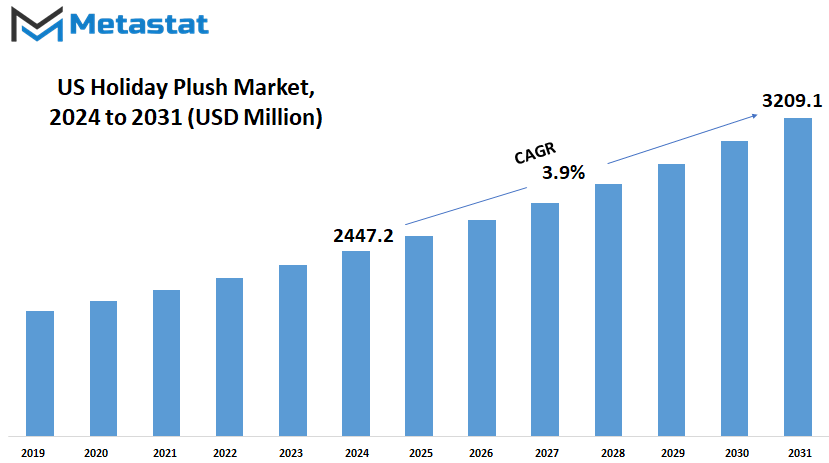

US Holiday Plush market is estimated to reach $3209.1 Million by 2031; growing at a CAGR of 3.9% from 2024 to 2031.

GROWTH FACTORS

Consumer demand and changing trends increase the market for Holiday Plush in the US. Holiday Plush toys, such as cuddly toys and seasonal characters, gain wide popularity in festive seasons like Christmas and Easter. This is so because consumers are reaching out to festive decorations and gifts that can put a smile on children's and adults' faces alike.

Disposable income is the major driving factor behind the growth of the US holiday plush market. As consumers' spending power increases, they are ready to spend money on holiday-themed plush toys for decoration purposes around the house or for gifting purposes. Another important reason is the product lineup expansion by manufacturers and retailers in order to cater to increasingly diversified consumer preferences, which further pushes the market growth momentum.

Moreover, the effect of social media and digital marketing is also playing a vital role in increasing market demand. Customers are exposed to various holiday plush products through social media platforms such as Instagram and Pinterest, which greatly influences them to buy. In turn, manufacturers are able to reach more customers with their newest designs and collections, hence driving sales during holiday seasons.

Challenges that could hamper the growth of the US Holiday Plush market do, however, exist. Economic uncertainties and fluctuations in consumer spending patterns can impact the market adversely. In times of recession, consumers are more likely to spend on essentials and less on discretionary items like holiday plush toys—some of which are big-ticket items—thereby affecting sales on the whole.

Advancements in technology and innovation in materials and processes of manufacturing will create opportunities for the Holiday Plush market. For example, the development of sustainable materials and eco-friendly plush toys could attract those consumers who are sensitive to the environment. Besides, with advanced technologies in manufacturing, production of customized or personalized plush toys will be enabled to answer the ever-increasing demand for unique and memorable holiday gifts.

The growth in disposable income, online marketing strategies, and product innovation are some of the major factors driving the US holiday plush market. Although a wide range of economic uncertainties poses a challenge to the market, technological changes and changing consumer behavior will turn out to be the drivers. Only those manufacturers or retailers who can adapt to such trends and exploit new opportunities will succeed in the dynamic holiday plush toy industry.

MARKET SEGMENTATION

By Types

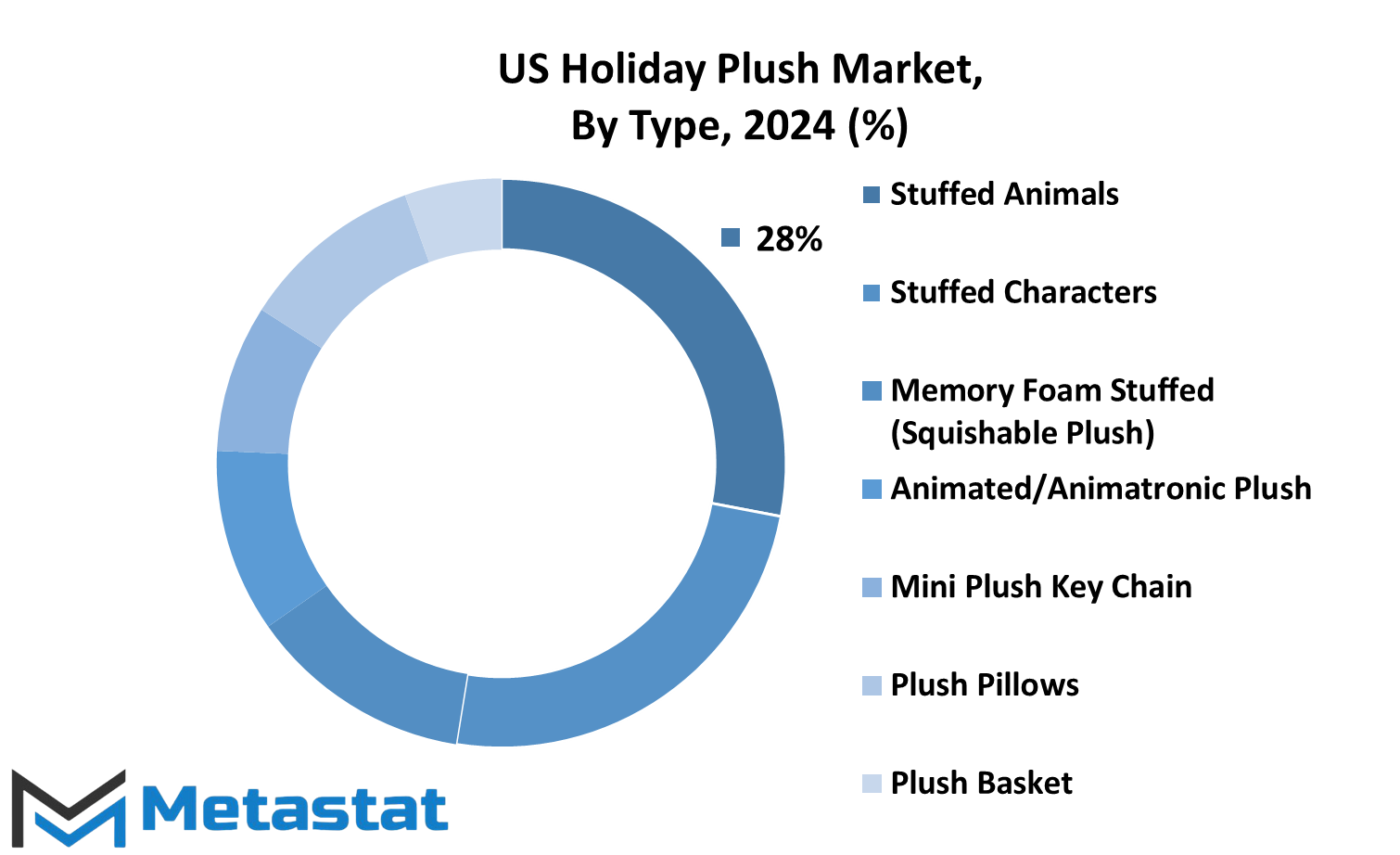

It is not left behind, with various products that seem to suit all tastes. Holiday plush toys—stuffed animals, character toys, memory foam squishables, animated/animatronic plush, mini plush keychain pillows, or plush baskets—are all making their way towards the top in demand. Joyful comfort providers are hugely in demand as festive season goodies.

They remain one of the most popular toys, not just with children but also with all types of collectors. Their shapes and sizes range from the classic teddy bear to highly exotic animals, thus fitting all tastes. Stuffed characters, that are usually created after popular cartoon or movie figures, bring much-loved personalities into life and therefore evoke a feeling of nostalgia in many consumers.

Toys stuffed with memory foam, such as squishable plush, provide a distinct feel. Being soft, they are manipulable toys that can be squeezed and hugged for sensory satisfaction. Animated plush or animatronic plush toys have an interactive element; their movement and sounds fascinate children and adults alike, adding further pleasure to the play experience.

These mini plush keychains could be small, portable companions attached to bags or keys so one may bring the comfort wherever one goes. The plush pillows also feature decoration and other functional purposes, such as to be used cosily for relaxation or as a nice touch of decoration during holidays.

Plush baskets, whether they are a variety of plush toys or sets with other festive holiday treats, make for great gifts or decorations. They can easily be tailored to a number of themes or occasions and become versatile choices for any holiday celebration.

By Sales Channel

In the present consumer market, the US holiday plush market is divided into two primary sales channels: online and offline. The segmentation shows that consumers have chosen to purchase their holiday plush items in different ways.

Over the past couple of years, this channel for online sales has grown at a fast rate. Because more and more consumers prefer to shop from home through the proliferation of portals of e-commerce, an increasing number buy their plush toys for holidays online. Websites and mobile applications provide a wide range of products at competitive prices with the added advantage of door-to-door delivery. This trend is likely to continue improving with the evolving technology and increasing numbers of people getting used to buying online all sorts of goods, including plush items during holidays.

In contrast, another stalwart holder of the offline selling channel is physical stores, boutiques, and department stores. Most consumers prefer the sensory experience of shopping in a physical store, where they can touch and feel the holiday plush toys. Store owners from this channel usually hold beautiful store displays and seasonal promotions to charm shoppers during busy holiday seasons.

The future of both sales channels will be one of accommodation to changing consumer behaviors and technological innovation. For example, innovations on online platforms may manifest in the form of augmented reality experiences or recommendations based on consumer preference. Offline retailers can continue to innovate with in-store experiences, from interactive displays to unique holiday-themed events that entice consumers into their stores.

By Business Model

The US holiday plush market encompasses a variety of business models at play, but there are a number of key segmentations—first, that between licensed and non-licensed brand and character decorations. Licensed products are those approved by the intellectual property owners featuring well-known characters from popular media or brands. A price premium is often associated with plush items carrying recognizable appeal and associability with a favorite story or franchise.

On the other hand, unlicensed holiday plushes are those without official approval or rights to specific characters or brands. In most cases, these will feature generic designs or perhaps some original characters which some manufacturers may have designed. They have a different kind of consumer appeal for people who are primarily interested in the budget-friendliness aspect or even the uniqueness of the holiday plush, as opposed to brand recognition.

In many ways, the two segments contribute differently to the holiday plush market. Licensed products cash in on pre-existing fan bases and consumer loyalty to certain brands or characters. For example, plush toys featuring characters from movies, cartoons, or video games appeal to fans who look to incorporate their favorite characters in holiday decorating. It is nostalgia-driven and even possibly emotional for some consumers when it comes to these figures.

In comparison, unlicensed holiday plush offers diversity in design and, quite often, more reasonable prices. Because manufacturers are not bound by licensing agreements, there is more leeway to innovate. This segment caters particularly to consumers who want something novel or seek differentiation in their decorations with designs that are not necessarily attached to the mainstream media.

The US holiday plush market will move on with changing consumer preference trends and developments in technology. Smart plush toys that have interactive elements could redefine the market by tapping into the demographic of the technologically savvy, who use more than just a décor appeal. Besides, sustainability and ethical sourcing are increasingly important and influencing purchasing decisions, therefore product development within the plush industry.

By Season

The US holiday Plush Market can be segmented by include Valentine's Day, Easter, Mother's Day, Father's Day, Graduation Season, Americana (including Memorial Day, Fourth of July, and Veterans Day), Harvest, Halloween, Christmas, and many others such as the Day of the Dead, Hanukkah, Kwanzaa, among others. Various seasons have different demands for plush toys with matching holiday themes to the spirits and cultural significance of such celebrations.

The Valentine's Day ushers in the holiday plush market for the year, and plush toys are supposed to express love and affection. Heart-studded, romantic motif-adorned plush is normally found in this category, sure to delight any gift-giver seeking a pressie full of feeling. Easter brings plush bunnies, chicks, and eggs as symbols of renewal and springtime joy. Parents and children alike love plush toys, adding flavor to Easter baskets.

As spring turns into summer, the market becomes flooded with merchandise for Mother's Day and Father's Day. Holiday plush items commonly reflect themes of appreciation and gratitude and boast about what it is to be a mom or dad.

Graduation time brings plush gifts in honor of academic milestones. This could be plush characters dressed in graduation regalia and carrying diplomas to immortalize these very special times in graduates' lives as they move forward into their next journey.

The Americana category includes holidays like Memorial Day, Fourth of July, and Veterans Day. Plush toys on a patriotic theme spell out a sense of national pride. Many have stars and stripes to reflect American heritage.

During the harvest season, many plush toys are designed with fall scenes like pumpkins, scarecrows, and leaves. These contribute to fall decor and displays for harvest festivals and Thanksgiving.

Ghosts, witches, black cats, and other such spooky but cute characters bring a playful eerie charm to Halloween celebrations, realizing a peak of demand in the case of plush toys.

It reaches its climax at Christmas, which demands the largest volume of holiday plush toys. This includes Santa Claus, reindeer, snowmen, and elves—all kinds of motifs that symbolize the spirit of giving and the world's festive feeling.

Other holidays, such as Day of the Dead, Hanukkah, and Kwanzaa, could be represented by culturally relevant plush toys that respect traditions by donating meaningful gifts during respective celebrations.

The US holiday plush market does well on the diversity of seasonal celebrations by offering an array of themed plush toys that cater to varying tastes and cultural observances. Designs and offerings will incessantly change in this vibrant market segment as consumer preferences change, securing holiday plush toys their place as part of cherished tradition for years to come.

COMPETITIVE PLAYERS

The US holiday plush market shows a very vibrant landscape, as various key players steer innovation and competition. This industry contains a wide range of companies: Aurora, DanDee International, Jazwares, Hallmark Cards, Inc. (which includes Squishmallows), Disney Store, Ty Inc., Gund, Melissa & Doug, Ruz USA, Just Play, Gemmy Industries, Kurt S. Adler, Inc., and such leading retailers as Amazon Inc., Big Lots Stores, Inc., Five Below, CVS Pharmacy, Inc., Hobby Lobby, Home Depot, Inc., Lowe's, Walgreen Co., Walmart Inc., The Kroger Co., Dollar Tree, Inc., Michaels Stores, Inc., and Target Corporation.

These companies have helped shape a very dynamic market where creativeness and quality are the major differentiators. Aurora, for instance, and Ty Inc. list among these with stunning plush designs that are quite appealing and win the hearts of children and collectors. Jazwares, however, carves out its soft and huggable characters in the very famous line called Squishmallows, to which people can easily relate.

Companies like Hallmark Cards, Inc. thrive in this competitive playing field through brand recognition and large distribution networks, which get their products out to the largest number of eyes during the most significant holiday seasons. Their plush product takes many shapes in order to answer the needs of as many tastes and preferences as possible, featuring traditional holiday-themed designs and licensed characters from popular media.

Companies such as Walmart Inc. and Target Corporation, which have stores all over the country, each offering their unique types of holiday plush toys, greatly contribute to this market. They will, with their wide reach and clever pricing strategies, be formidable competitors in shaping the future of the market or customer choices.

In the future, the Holiday Plush market will continue to evolve as new materials and manufacturing technologies come to the forefront. As more people begin to make purchase decisions based on at least some ecological criteria, green material innovations and sustainable practices will likely engage. Digital integration and online retail platforms will be key elements in generating greater reach and enhancing consumer engagement.

The overall outlook of the US holiday plush market is one of solid competition, with a wide array of players competing to gain market share through innovation, quality, and strategic partnerships. Companies will have to strive further to adapt and innovate in view of changing consumer preferences and retail dynamics in order to remain competitive within the dynamic industry.

US Holiday Plush Market Key Segments:

By Types

- Stuffed Animals

- Stuffed Characters

- Memory Foam Stuffed (Squishable Plush)

- Animated/Animatronic Plush

- Mini Plush Key Chain

- Plush Pillows

- Plush Basket

By Sales Channel

- Online

- Offline

By Business Model

- Licensed Brand and Character Decorations

- Unlicensed Brand and Character Decorations

By Season

- Valentine's Day

- Easter

- Mother's Day

- Father's Day

- Graduation Season

- Americana (Memorial Day, Fourth of July and Veterans Day, Veterans Day)

- Harvest

- Halloween

- Christmas

- Others (Day of the Dead, Hannukah and Kwanzaa)

Key US Holiday Plush Industry Players

- Aurora

- DanDee International

- Jazwares (Squishmallows)

- Hallmark Cards, Inc.

- Disney Store

- Ty Inc.

- Gund

- Melissa & Doug

- Ruz USA

- Just Play

- Gemmy Industries

- Kurt S. Adler, Inc.

- Amazon Inc.

- Big Lots Stores, Inc.

- Five Below

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383