MARKET OVERVIEW

The US Aerospace Material Testing Service market revolves around a commitment to quality assurance and compliance with stringent industry standards. This market is not merely a service provider; it is a guardian of the skies, a bastion of precision, meticulously scrutinizing the materials that form the backbone of aerospace engineering. These materials, ranging from alloys and composites to polymers, undergo rigorous testing protocols to guarantee their resilience in the face of extreme conditions and stringent operational requirements.

One of the primary facets of the US Aerospace Material Testing Service market is its proficiency in non-destructive testing (NDT) techniques. These cutting-edge methods allow for the evaluation of material properties without causing damage, ensuring that components retain their structural integrity. Ultrasonic testing, eddy current testing, and radiographic testing are just a few examples of the sophisticated techniques employed by experts in this market, showcasing a commitment to precision and safety.

Furthermore, the market is not confined to conventional materials but extends its expertise to advanced materials that push the boundaries of aerospace engineering. As the industry witnesses a surge in the use of composite materials and additive manufacturing, the US Aerospace Material Testing Service market adapts and evolves to meet the unique challenges posed by these innovations. The market's adaptability is a testament to its role as a cornerstone of aerospace technological advancement.

Collaboration and partnership are integral components of the US Aerospace Material Testing Service market. It operates in synergy with aerospace manufacturers, suppliers, and regulatory bodies to establish a comprehensive approach to material testing. This collaborative effort ensures that the market remains at the forefront of industry developments, contributing to the continuous improvement of aerospace materials and technologies.

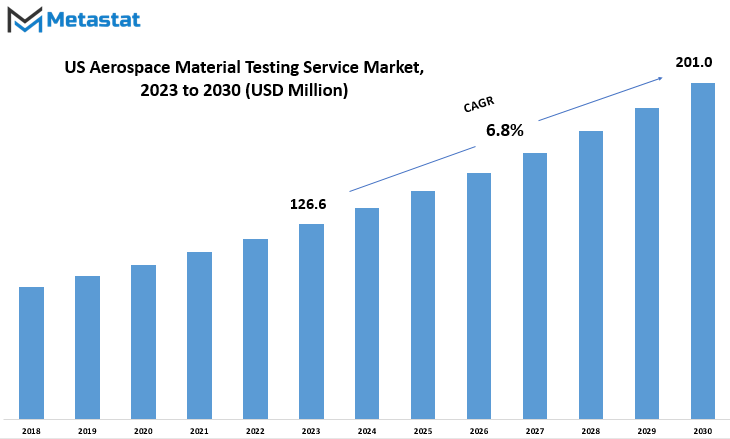

The US Aerospace Material Testing Service market transcends the conventional boundaries of service provision. It is a dynamic force shaping the trajectory of the aerospace industry, fostering innovation, and upholding the highest standards of quality and safety. As the aerospace sector continues to soar to new heights, the role of the US Aerospace Material Testing Service market becomes increasingly indispensable, solidifying its position as a cornerstone of excellence in aerospace material testing. The US Aerospace Material Testing Service market is estimated to reach $201.0 Million by 2030; growing at a CAGR of 6.8% from 2023 to 2030.

GROWTH FACTORS

The US Aerospace Material Testing Service market is on the move, driven by key factors shaping its trajectory. A significant driver is the escalating demand for lightweight materials. As the aerospace industry seeks to enhance fuel efficiency and overall performance, the call for materials that balance strength and weight becomes increasingly prominent. This demand underscores the pivotal role of material testing services in ensuring these materials meet the rigorous standards set by the industry.

In tandem with the pursuit of lightweight solutions, stringent regulatory standards act as another catalyst propelling the market forward. The aerospace sector operates in an environment where safety is paramount, and adherence to stringent regulations is non-negotiable. Material testing services have become instrumental in ensuring compliance with these standards, validating the integrity and reliability of materials used in aircraft manufacturing.

However, the journey forward is not without its challenges. High testing costs pose a potential hurdle, making companies weigh the economic feasibility of extensive material testing. The intricacies involved in testing procedures, coupled with technological complexities, contribute to the cost challenge. Navigating this terrain requires a delicate balance between ensuring safety and managing costs, a challenge that industry players must address for sustainable growth.

The field of aerospace material testing is set to benefit from advancements in composite materials. As technology progresses, composite materials offer a compelling alternative, presenting a harmonious blend of strength and reduced weight. This not only aligns with the industry's demand for lightweight solutions but also opens doors to more efficient and advanced materials that can withstand the rigors of aerospace applications.

Looking ahead, the US Aerospace Material Testing Service market stands at the intersection of challenges and opportunities. The industry's quest for lightweight materials and adherence to regulatory standards fuels its growth, while the specter of high testing costs and technological complexities looms. The key to sustained progress lies in overcoming these challenges through innovative approaches and cost-effective solutions. As advancements in composite materials come to the fore, the market is poised to leverage these opportunities, shaping a future where aerospace materials are not just compliant but at the forefront of technological innovation.

MARKET SEGMENTATION

By Type

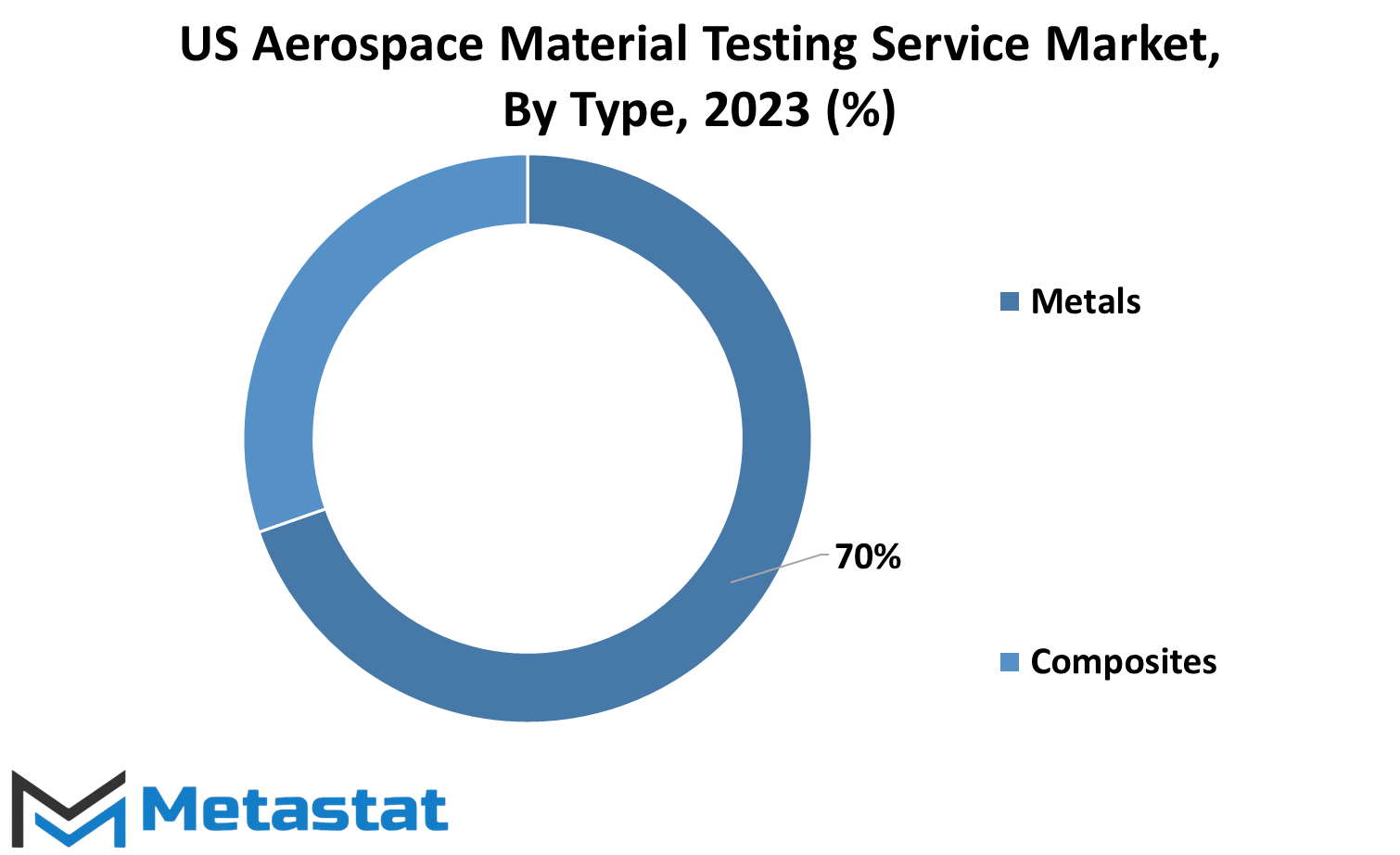

Within the expansive US Aerospace Material Testing Service market, the categorization by type brings clarity to the diverse materials under scrutiny. This segmentation distills the focus into two primary categories namely Metals and Composites.

Metals, a stalwart in aerospace construction, undergo rigorous testing to ensure their structural integrity and performance in varying conditions. This category encompasses a spectrum of alloys and metals, each subjected to meticulous examination to meet the stringent standards demanded by the aerospace industry. From tensile strength to fatigue resistance, the testing of metals is comprehensive, aiming to guarantee their reliability in the aerospace applications they serve.

On the other hand, Composites represent a more contemporary facet of aerospace materials. Combining different materials to achieve specific properties, composites offer a lightweight alternative without compromising strength. In the realm of aerospace material testing services, composites undergo scrutiny for factors like delamination resistance and impact strength. The goal is to ascertain their suitability for use in critical components, fostering innovation and efficiency in aerospace design.

This segmentation is not just a structural division; it mirrors the evolving landscape of materials used in the aerospace industry. While metals continue to be the backbone, composites exemplify the industry’s pursuit of advanced materials to enhance performance and fuel efficiency. The meticulous testing of both metals and composites underscores the commitment to maintaining the highest standards of safety and reliability in aerospace applications.

The categorization of the US Aerospace Material Testing Service market into Metals and Composites reflects the industry’s conscientious approach to materials that are the building blocks of aviation technology. The scrutiny these materials undergo is not merely a procedural formality but a crucial step in ensuring the safety and efficiency of aerospace components, embodying the industry’s commitment to excellence in every flight.

By Application

In the US Aerospace Material Testing Service market, applications serve as crucial delineators, specifying the diverse uses of these testing services. Two prominent segments, namely Military Aviation and Civilian Aviation, stand out, each contributing significantly to the market’s dynamics.

The Military Aviation segment, valued at 47 USD Million in 2022, represents a vital component of the aerospace industry. Here, material testing services play a critical role in ensuring the integrity and reliability of materials used in military aviation applications. The rigorous demands and specialized requirements of military aircraft necessitate thorough testing to meet stringent safety and performance standards.

On the other hand, the Civilian Aviation segment, valued at 77.9 USD Million in 2022, addresses the needs of commercial and private aviation. This segment encompasses a broad spectrum, including commercial airlines, private aircraft, and emerging technologies in the aviation sector. Material testing services in civilian aviation focus on adhering to industry regulations and standards, ensuring the safety and efficiency of materials in various aircraft.

Both segments highlight the importance of material testing in guaranteeing the safety, reliability, and performance of aerospace materials. While Military Aviation prioritizes the stringent demands of defense applications, Civilian Aviation caters to the diverse and expanding needs of the broader aviation industry. Together, they underscore the indispensable role of material testing services in ensuring the robustness and compliance of materials used in the aerospace sector.

The US Aerospace Material Testing Service market is intricately linked to the distinct applications within military and civilian aviation. The testing services offered cater to the unique requirements of each segment, collectively contributing to the overall safety and reliability of materials in the expansive aerospace industry.

COMPETITIVE PLAYERS

In the US Aerospace Material Testing Service market, key players are instrumental in steering the industry forward. Among these players, prominent names include Element Materials Technology, Applus+ Laboratories, and Eurofins Scientific (EAG Laboratories). These entities play a pivotal role in providing crucial material testing services to the aerospace sector.

Element Materials Technology stands out as a significant player, contributing expertise and resources to ensure the integrity and quality of materials used in aerospace applications. Applus+ Laboratories is another notable player, bringing its testing capabilities to the forefront, aligning with the industry's stringent standards. Eurofins Scientific, operating through EAG Laboratories, adds to the competitive landscape with its proficiency in delivering precise material analyses.

These key players underscore the importance of specialized testing services in the aerospace domain. Their contributions extend beyond mere testing; they form integral components of the aerospace material supply chain, ensuring that materials meet the rigorous demands and safety standards set by the industry.

In a sector where precision and reliability are paramount, these players take center stage, offering services that go beyond conventional testing. Their role is pivotal in ensuring the safety, efficiency, and compliance of materials used in the aerospace industry. As the industry advances, these key players continue to be vital cogs in the machinery, contributing to the overall growth and sustainability of the US Aerospace Material Testing Service market.

US Aerospace Material Testing Service Market Key Segments:

By Type

- Metals

- Composites

By Application

- Military Aviation

- Civilian Aviation

Key US Aerospace Material Testing Service Industry Players

- Element Materials Technology

- Applus+ Laboratories

- Eurofins Scientific (EAG Laboratories)

- Laboratory Testing Inc.

- Applied Technical Services, LLC

- Collins Aerospace

- NSL Analytical Services, Inc.

- Composites Testing Lab

- IMR Test Labs

- ITA Labs, International Tin Association Ltd

- Innovative Test Solutions, Inc.

- Aeroblaze Laboratory Inc

- Clark Testing

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383