MARKET OVERVIEW

The global aviation test equipment market, within the aviation industry, encompasses a spectrum of specialized tools and apparatuses crucial for ensuring the safety, efficiency, and reliability of aircraft systems. These encompass a wide array of equipment, ranging from basic tools used for routine maintenance checks to sophisticated diagnostic systems employed for complex troubleshooting scenarios.

In the forthcoming years, the global aviation test equipment market is anticipated to witness significant advancements driven by technological innovations and the ever-growing demand for air travel. As air traffic continues to soar, particularly in emerging economies, the need for stringent quality assurance measures becomes increasingly paramount. This, in turn, propels the demand for cutting-edge test equipment capable of meeting the stringent regulatory standards imposed by aviation authorities across the globe.

The future trajectory of the global aviation test equipment market is poised to be shaped by several key trends. One such trend is the proliferation of advanced diagnostic tools leveraging artificial intelligence and machine learning algorithms. These tools are poised to revolutionize maintenance practices by enabling predictive maintenance, thereby reducing downtime and optimizing operational efficiency. Additionally, the integration of IoT (Internet of Things) technology is expected to facilitate real-time monitoring of aircraft systems, allowing for proactive identification of potential issues before they escalate into costly failures.

Furthermore, as aircraft systems become increasingly complex, there will be a growing need for versatile test equipment capable of accommodating diverse platforms and configurations. Manufacturers are thus focusing on developing modular and adaptable solutions that can cater to the evolving needs of modern aircraft fleets. Additionally, there is a burgeoning demand for portable test equipment, particularly in the context of field maintenance and remote operations. These compact and lightweight tools offer unparalleled flexibility, enabling technicians to conduct comprehensive diagnostic tests even in challenging environments.

Moreover, the global aviation test equipment market is witnessing a shift towards environmentally sustainable solutions in line with the broader aviation industry's efforts to reduce carbon emissions and minimize environmental impact. Manufacturers are investing in the development of eco-friendly testing technologies, such as battery-powered equipment and energy-efficient testing procedures, to align with sustainability goals while ensuring optimal performance and reliability.

The global aviation test equipment market is poised for significant growth and innovation in the coming years, driven by technological advancements, regulatory requirements, and evolving market dynamics. By embracing emerging trends and leveraging cutting-edge technologies, industry players can not only meet the escalating demands of the aviation sector but also contribute towards enhancing safety, efficiency, and sustainability in air transportation.

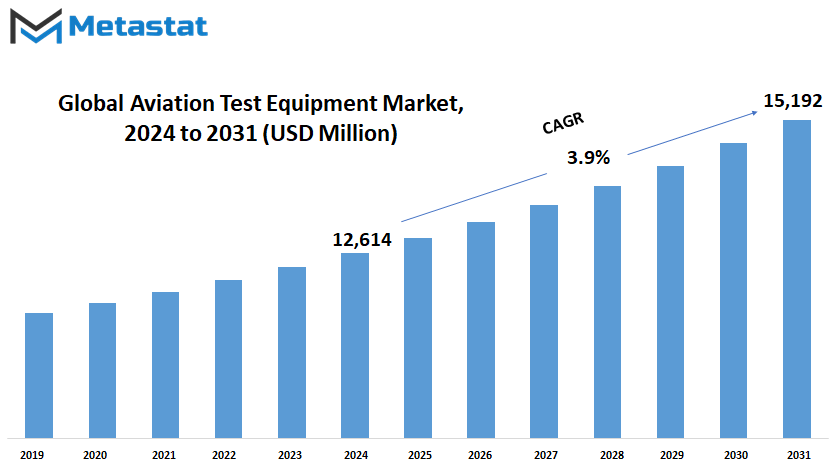

Global aviation test equipment market is estimated to reach $15192 Million by 2031; growing at a CAGR of 3.9% from 2024 to 2031.

GROWTH FACTORS

The global aviation test equipment market is poised for growth due to several key factors. One significant driver is the rising demand for aircraft maintenance, spurred by the continuous expansion of the aviation industry. As more aircraft take to the skies, there will be a corresponding need for regular testing and inspection to ensure their safe operation. This requirement is further emphasized by stringent safety regulations, which mandate thorough examination protocols.

However, alongside these growth factors, certain challenges may restrain market expansion. One notable obstacle is the high initial investment costs associated with purchasing aviation test equipment. The acquisition of such specialized tools can represent a significant financial burden for aviation companies, particularly smaller players in the industry. Additionally, the rapid evolution of aircraft systems introduces technological complexities and compatibility issues for test equipment. Keeping pace with these advancements requires continuous innovation and adaptation, which can pose challenges for market players.

Despite these potential constraints, the market remains ripe with opportunities, particularly through the integration of advanced technologies. Innovations such as the Internet of Things (IoT) and Artificial Intelligence (AI) hold the promise of revolutionizing maintenance practices. By harnessing IoT sensors and data analytics, aviation companies can implement predictive maintenance strategies, preemptively identifying potential issues before they escalate. This proactive approach not only enhances safety but also improves operational efficiency by minimizing downtime.

Furthermore, AI-driven solutions offer the potential for greater automation and precision in testing processes. Machine learning algorithms can analyze vast amounts of data to optimize testing protocols and identify patterns indicative of maintenance needs. This not only streamlines operations but also reduces human error, enhancing overall reliability.

Looking ahead, the integration of these advanced technologies is expected to unlock new avenues for market growth. As aviation companies increasingly recognize the benefits of predictive maintenance and efficiency improvements, the demand for innovative test equipment solutions will continue to rise. Market players that embrace these technological advancements and adapt their offerings accordingly will be well-positioned to capitalize on the evolving needs of the aviation industry.

While challenges such as high initial costs and technological complexities may pose temporary setbacks, the global aviation test equipment market is poised for growth. By leveraging advanced technologies and embracing innovation, market players can navigate these obstacles and seize the abundant opportunities that lie ahead.

MARKET SEGMENTATION

By Product Type

In the ever-changing landscape of aviation, the importance of reliable testing equipment cannot be overstated. As technology continues to advance, the demand for efficient and accurate aviation test equipment will only continue to grow.

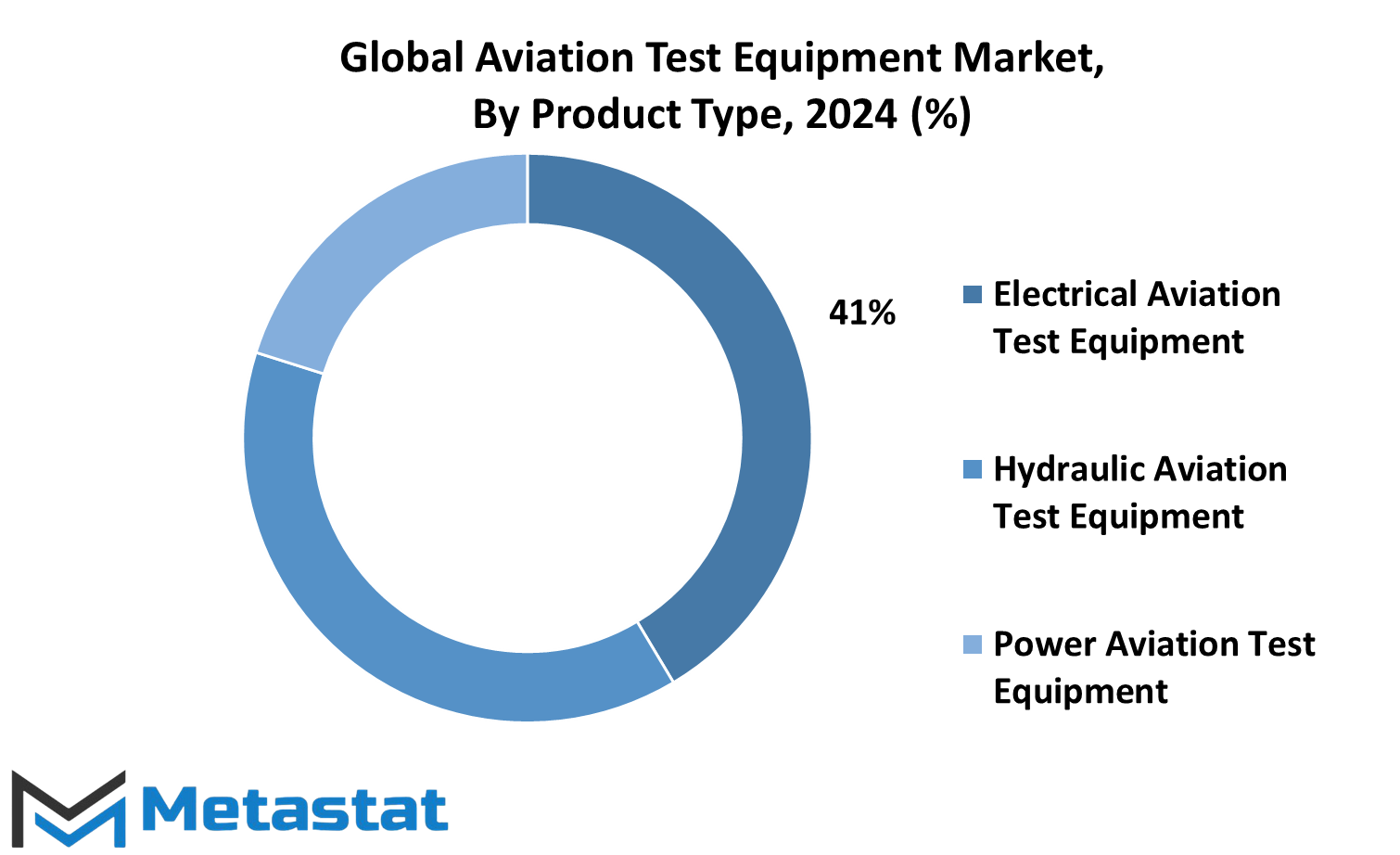

The global aviation test equipment market encompasses a wide array of products designed to ensure the safety and functionality of aircraft. These products can be categorized into various types, including Electrical Aviation Test Equipment, Hydraulic Aviation Test Equipment, and Power Aviation Test Equipment.

Electrical Aviation Test Equipment plays a crucial role in testing the electrical systems of aircraft. These systems are essential for ensuring that all electrical components function properly, from navigation lights to communication systems. Without reliable electrical test equipment, identifying and resolving issues with these systems would be significantly more challenging.

Similarly, Hydraulic Aviation Test Equipment is essential for testing the hydraulic systems that control various aspects of an aircraft, such as landing gear and flight controls. Proper maintenance and testing of these systems are vital for the safety of both passengers and crew.

Power Aviation Test Equipment focuses on testing the power systems of aircraft, including engines and generators. These systems must undergo rigorous testing to ensure they can perform optimally under various conditions, from takeoff to landing.

As the aviation industry continues to expand and evolve, the demand for reliable test equipment will only continue to increase. Factors such as technological advancements and regulatory requirements will drive growth in the global aviation test equipment market.

Advancements in technology, such as the development of more sophisticated aircraft systems, will require correspondingly advanced testing equipment to ensure their proper function. Additionally, stringent safety regulations imposed by aviation authorities will necessitate the use of high-quality test equipment to meet compliance standards.

However, despite the opportunities for growth, the global aviation test equipment market may also face challenges. Economic downturns or disruptions in the supply chain could potentially restrain market growth, as companies may prioritize cost-cutting measures over investments in new equipment.

The global aviation test equipment market plays a vital role in ensuring the safety and efficiency of aircraft operations. With technological advancements driving demand, the market is poised for significant growth, albeit with potential challenges on the horizon.

By Aircraft

The aviation industry has long been a symbol of human progress and technological advancement. With each passing year, new innovations and developments continue to shape the future of aviation. Among the key components driving this evolution is the global aviation test equipment market.

This market, segmented by aircraft types such as fixed-wing, rotary-wing, and unmanned aerial vehicles (UAVs), plays a crucial role in ensuring the safety, efficiency, and reliability of aircraft worldwide. As technology progresses, the demand for advanced testing equipment will only increase, driven by the need for more accurate and comprehensive testing procedures.

Fixed-wing aircraft, including commercial airliners and private jets, constitute a significant portion of the aviation industry. The testing equipment utilized for these aircraft must meet stringent standards to guarantee their airworthiness and operational integrity. As air travel continues to grow in popularity and accessibility, the demand for reliable testing equipment for fixed-wing aircraft will only continue to rise.

Similarly, rotary-wing aircraft, such as helicopters, serve vital roles in various sectors, including military, medical, and transportation. The unique design and operational characteristics of these aircraft necessitate specialized testing equipment tailored to their specific needs. As advancements in helicopter technology continue to push boundaries, the demand for innovative testing solutions will follow suit.

Unmanned aerial vehicles (UAVs), often referred to as drones, represent a rapidly expanding segment within the aviation industry. These versatile aircraft are utilized for a wide range of applications, including surveillance, reconnaissance, delivery services, and aerial photography. As the use of UAVs becomes more widespread across both commercial and military sectors, the demand for advanced testing equipment to ensure their safe and reliable operation will see a corresponding increase.

Several factors will drive the growth of the global aviation test equipment market in the coming years. Technological advancements, such as the integration of artificial intelligence (AI) and machine learning algorithms, will enhance the capabilities of testing equipment, enabling more precise and efficient testing procedures. Additionally, the increasing complexity of modern aircraft systems will necessitate the development of new testing methodologies and tools to address emerging challenges.

Furthermore, the growing emphasis on safety and regulatory compliance within the aviation industry will drive investments in testing equipment and infrastructure. As aviation authorities around the world impose stricter regulations and standards, manufacturers and operators will need to invest in state-of-the-art testing equipment to ensure compliance and maintain safety standards.

The global aviation test equipment market plays a crucial role in ensuring the safety, reliability, and efficiency of aircraft across various sectors. With advancements in technology and increasing regulatory scrutiny, the demand for advanced testing solutions will continue to rise, driving growth in the market for years to come.

By Point of Sale

The dynamics of the market are influenced by various factors, shaping its trajectory in the future. One crucial element impacting market growth or restraint is the Point of Sale (POS) system. This system plays a pivotal role in the market landscape, delineating it into two key segments: Original Equipment Manufacturer (OEM) and Aftermarket.

The OEM segment represents products sold by manufacturers directly to consumers through authorized channels. These channels ensure quality control and brand reputation, fostering trust among consumers. In this segment, the sale of products is closely tied to the manufacturer's production capacity and distribution network. Therefore, advancements in manufacturing technology and efficient supply chain management will likely bolster growth in the OEM market.

On the other hand, the Aftermarket segment comprises products sold by third-party vendors or retailers after the initial sale by the OEM. This segment thrives on factors like consumer preferences, pricing strategies, and product availability. A significant advantage of the Aftermarket is its flexibility in catering to diverse consumer needs and preferences. However, it is also susceptible to fluctuations in consumer demand and competitive pricing pressures.

The evolution of POS systems will profoundly impact both segments of the market. Advancements in technology, such as cloud-based POS systems and integrated analytics, will enhance operational efficiency and customer engagement. These improvements will benefit both OEMs and Aftermarket vendors by streamlining transactions, optimizing inventory management, and providing valuable insights into consumer behavior.

Moreover, the integration of artificial intelligence (AI) and machine learning algorithms will revolutionize POS systems, enabling predictive analytics and personalized recommendations. AI-powered POS systems can analyze vast amounts of data in real-time, enabling businesses to anticipate market trends and adapt their strategies accordingly. This predictive capability will be invaluable for OEMs and Aftermarket vendors alike, enabling them to stay ahead of the competition and meet evolving consumer demands.

By End User

In analyzing the global aviation test equipment market, one cannot overlook the crucial segmentation based on end-users. This market is primarily divided into two key sectors: Commercial and Defense/Military. Such a division is essential for understanding the diverse needs and requirements within the aviation industry.

The Commercial sector encompasses various entities involved in civilian air transportation, including airlines, private aviation companies, and maintenance, repair, and overhaul (MRO) service providers. With the increasing demand for air travel worldwide, driven by factors such as economic growth, urbanization, and globalization, the Commercial segment is poised for significant expansion. The proliferation of low-cost carriers, the rise of emerging markets, and the advancement of air transport infrastructure will further fuel the growth of this sector.

On the other hand, the Defense/Military sector represents organizations and agencies responsible for national defense and security. This segment includes military forces, government defense departments, and defense contractors. The demand for aviation test equipment in this sector is driven by factors such as technological advancements, geopolitical tensions, and defense budget allocations. As countries continue to modernize their defense capabilities and invest in next-generation aircraft and aerospace systems, the demand for advanced test equipment will persist.

Furthermore, the increasing complexity of modern aircraft systems and components will necessitate advanced testing methodologies and equipment capable of handling diverse testing requirements. This includes testing for aircraft avionics, propulsion systems, structural integrity, and safety-critical components. As aircraft designs evolve and incorporate new materials and technologies, the demand for specialized test equipment tailored to these requirements will rise.

Moreover, the globalization of the aviation industry and the expansion of air transport networks will create new opportunities for market players. The emergence of new aviation hubs, the growth of regional connectivity, and the rising demand for air travel in emerging markets will drive the need for robust testing infrastructure and equipment.

The global aviation test equipment market is poised for growth, driven by factors such as technological innovation, geopolitical developments, and market expansion. The Commercial and Defense/Military sectors will continue to be key drivers of demand, with opportunities emerging from advancements in technology and changes in the global aviation landscape. As the industry evolves, stakeholders must adapt to meet the evolving needs and challenges of the aviation sector.

REGIONAL ANALYSIS

The global aviation test equipment market is geographically divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America comprises the U.S., Canada, and Mexico, while Europe encompasses the UK, Germany, France, Italy, and the rest of Europe. Similarly, Asia-Pacific is segmented into India, China, Japan, South Korea, and the rest of Asia-Pacific. South America includes Brazil, Argentina, and the rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the rest of Middle East & Africa. This extensive segmentation provides a comprehensive view of the market's regional distribution, enabling stakeholders to tailor their strategies according to specific geographical trends and opportunities.

The geographical distribution of the global aviation test equipment market holds significant implications for its growth trajectory. North America, with its established aviation industry and technological prowess, is poised to maintain a prominent position in the market. The presence of major players, coupled with ongoing advancements in aviation technology, will continue to drive market growth in this region. Additionally, the robust regulatory framework and emphasis on safety standards further bolster market expansion.

Europe, home to some of the world's leading aviation manufacturers and suppliers, will also play a crucial role in shaping the market landscape. The region's focus on research and development, coupled with increasing investments in aviation infrastructure, will fuel demand for test equipment. Moreover, strategic collaborations between industry players and government initiatives aimed at promoting innovation will foster market growth in Europe.

Asia-Pacific, characterized by rapid industrialization and urbanization, presents lucrative opportunities for market players. The burgeoning aviation sector in countries like China and India, driven by rising disposable incomes and air travel demand, will drive the adoption of test equipment. Furthermore, initiatives to modernize existing fleets and expand aviation infrastructure will contribute to market expansion in the region.

South America and the Middle East & Africa, although relatively smaller markets compared to North America and Europe, will witness steady growth driven by increasing investments in aviation infrastructure and rising air passenger traffic. Government initiatives aimed at enhancing aviation safety and efficiency will further drive market demand in these regions.

The geographical distribution of the global aviation test equipment market will play a pivotal role in shaping its growth trajectory. While North America and Europe will continue to dominate the market, Asia-Pacific, South America, and the Middle East & Africa will emerge as key growth regions, driven by technological advancements and infrastructure development initiatives.

COMPETITIVE PLAYERS

The global aviation test equipment market is critical, ensuring safety, efficiency, and reliability in aircraft operations. Among the myriad players in this sector, prominent names emerge, each contributing to the advancement and innovation within the field.

Boeing, Rockwell Collins, Honeywell International Inc., Moog, SPHEREA Test & Services, General Electric Aviation, Teradyne Inc., DMA-Aero Ideal Aerosmith, Lockheed Martin Corporation, Testek, 3M, Airbus, Astronics Corporation, BAE Systems, Bauer Inc., DAC International, ECA Group, Hydraulics International Inc., Ideal Aerosmith Inc., and Rolls Royce Holdings Plc represent a formidable array of companies shaping the trajectory of aviation test equipment.

The presence of these key players injects a competitive edge into the market, fostering an environment ripe for innovation and technological advancement. As they vie for market share and dominance, their efforts spur the development of cutting-edge solutions tailored to meet the evolving needs of the aviation sector. This competition serves as a driving force propelling the industry forward, pushing the boundaries of what is possible and setting new standards for performance and reliability.

With the increasing demand for air travel projected in the coming years, fueled by a growing global population and expanding economies, the role of aviation test equipment becomes even more pivotal. As airlines seek to enhance safety measures and operational efficiency, they will rely heavily on the latest advancements in testing technology offered by these key players.

However, alongside the potential for growth, certain factors may also pose constraints on the market. Economic fluctuations, regulatory changes, and geopolitical tensions can all exert influence, shaping the landscape in which these companies operate. Navigating these challenges requires agility and adaptability, traits that will determine which players emerge as leaders in the industry.

Furthermore, the emergence of disruptive technologies such as artificial intelligence and automation presents both opportunities and challenges for aviation test equipment providers. While these innovations hold the promise of streamlining operations and improving accuracy, they also necessitate significant investment in research and development to stay ahead of the curve.

The global aviation test equipment market is characterized by a diverse array of competitive players, each contributing to the advancement of safety and efficiency in air travel. Through innovation, collaboration, and strategic foresight, these key players will continue to shape the future of the industry, driving growth and innovation while navigating the challenges that lie ahead.

Aviation Test Equipment Market Key Segments:

By Product Type

- Electrical Aviation Test Equipment

- Hydraulic Aviation Test Equipment

- Power Aviation Test Equipment

By Aircraft

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicle (UAV)

By Point of Sale

- OEM

- Aftermarket

By End User

- Commercial

- Defense/Military Sector

Key Global Aviation Test Equipment Industry Players

- Boeing

- Rockwell Collins

- Honeywell International Inc.

- Moog

- SPHEREA Test & services

- General Electric Aviation

- Teradyne Inc.

- DMA-Aero Ideal Aerosmith

- Lockheed Martin Corporation

- Testek

- 3M

- Airbus

- Astronics Corporation

- BAE Systems

- Bauer Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383