MARKET OVERVIEW

The Aerospace Fluoropolymers Market has emerged as a dynamic and transformative sector within the aerospace industry, fostering innovation and enhancing performance across a broad spectrum of applications. The aerospace industry is an arena where cutting-edge technology meets the boundless skies, with engineers and scientists continually pushing the envelope of human achievement. Central to this pursuit are materials engineered to withstand the harshest environments, and among them, Aerospace Fluoropolymers shine as stars of innovation. These high-performance polymer materials have been tailored exclusively for aerospace applications, where exceptional properties such as resistance to extreme temperatures, chemicals, and electrical conductivity are paramount. In this report, we delve into the world of Aerospace Fluoropolymers, exploring their unique characteristics and their invaluable role in various aerospace components.

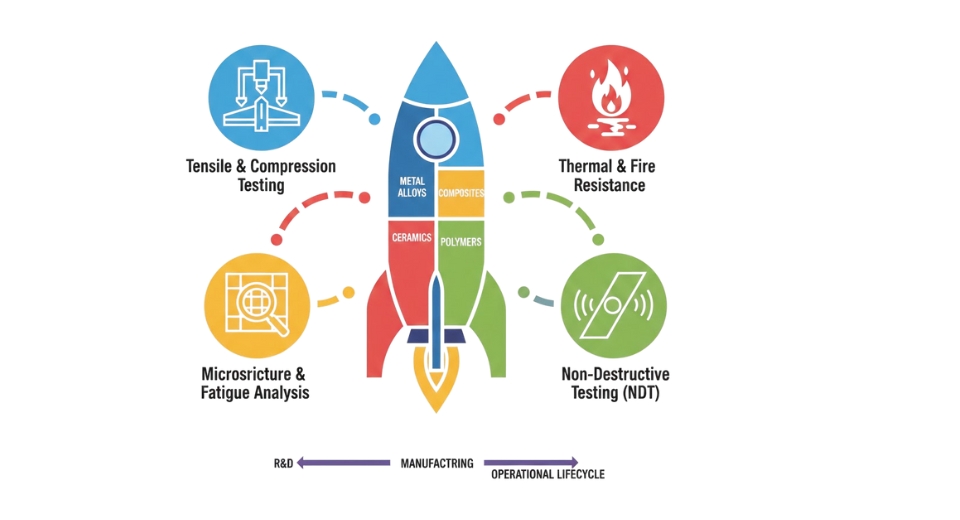

In Aerospace Fluoropolymers has the extraordinary ability to withstand extreme temperatures, making them indispensable in the aerospace industry. These materials exhibit a remarkable resistance to both low and high temperatures, thus ensuring that vital components remain functional under the most hostile conditions. Whether an aircraft is soaring through the frigid upper atmosphere or battling the searing heat of re-entry, Aerospace Fluoropolymers maintain their integrity. This is a critical feature, as the aerospace industry demands materials that can adapt to temperature variations without sacrificing performance.

The aerospace environment is fraught with exposure to a diverse range of chemicals, from hydraulic fluids to jet fuels. Aerospace Fluoropolymers are uniquely equipped to tackle this challenge. Their molecular structure includes fluorine atoms, which provide an exceptional shield against chemical degradation. This chemical resilience ensures the longevity and reliability of critical aerospace components, such as seals and gaskets. With Aerospace Fluoropolymers, the likelihood of chemical corrosion is dramatically reduced, contributing to the overall safety and longevity of aerospace systems.

These materials stand as a testament to human ingenuity and engineering excellence, offering a solution to the pivotal challenges posed by extreme temperatures, corrosive chemicals, and electrical conductivity. Their versatility and exceptional properties have earned them a well-deserved place as cornerstones of aerospace technology, contributing to the safety, reliability, and longevity of aircraft that traverse the skies and venture beyond. Aerospace Fluoropolymers, with their resilience and adaptability, continue to shape the future of aerospace innovation.

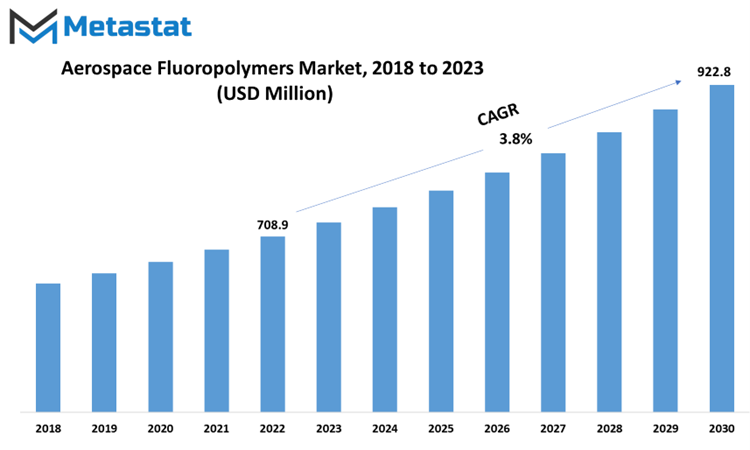

Global Aerospace Fluoropolymers market is estimated to reach $922.8 Million by 2030; growing at a CAGR of 3.8% from 2023 to 2030.

GROWTH FACTORS

The Aerospace Fluoropolymers market is experiencing significant growth due to several key driving factors. One of the primary drivers is the increasing demand for lightweight materials in the aerospace industry. As industry continues to seek ways to reduce the overall weight of aircraft and spacecraft, the use of lightweight materials has become crucial. Aerospace fluoropolymers, known for their low weight and high-performance characteristics, are well-suited to meet this demand. They provide the necessary structural integrity while keeping the weight at a minimum, contributing to improved fuel efficiency and overall performance.

Another driving factor is the stringent regulatory standards imposed on the aerospace industry. Regulatory bodies have set high safety and performance standards for aerospace components and materials. Aerospace fluoropolymers have proven to meet these standards, offering exceptional resistance to high temperatures, chemicals, and extreme conditions. As a result, they have gained preference in the industry for various critical applications, such as wiring, tubing, and sealing.

However, there are challenges that could potentially hamper the growth of the aerospace fluoropolymers market. One such challenge is the high production costs associated with these materials. Aerospace-grade fluoropolymers are known for their advanced properties but producing them to meet the exacting standards of the aerospace industry involves complex processes. These processes can be costly, impacting the overall affordability of these materials.

Limited material innovation is another obstacle to market growth. While aerospace fluoropolymers have proven their effectiveness, the industry is continuously seeking more advanced materials that can offer even better performance. The limited innovation in this field may restrict the market's ability to adapt to evolving industry needs and stay ahead of the competition.

Despite these challenges, there are opportunities on the horizon. Emerging markets, particularly in developing countries, present lucrative prospects for the aerospace fluoropolymers market in the coming years. These regions are witnessing a rise in aerospace activities and investments. As the aerospace industry expands globally, there will be an increasing need for high-performance materials, including fluoropolymers, to meet the growing demands.

In summary, the aerospace fluoropolymers market is driven by the need for lightweight materials and stringent regulatory standards in the aerospace industry. While high production costs and limited material innovation pose challenges, emerging markets hold promise for future growth in this sector. As the aerospace industry continues to evolve, aerospace fluoropolymers are likely to remain a vital component of advanced aerospace applications.

MARKET SEGMENTATION

By Type

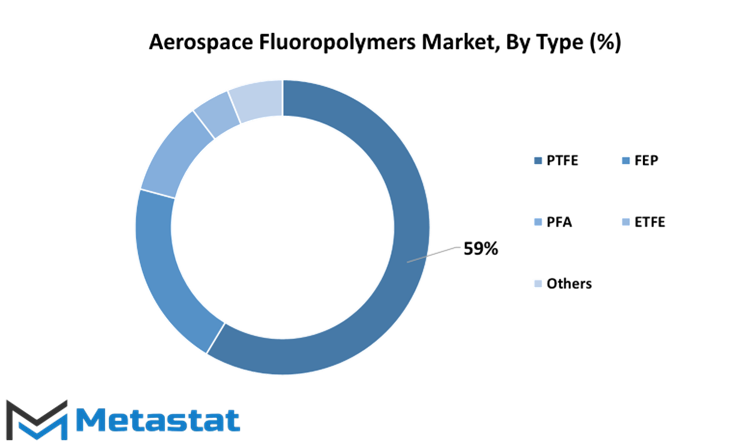

Among these types, PTFE, also known as Polytetrafluoroethylene, held a significant share in the market. In the year 2022, the PTFE segment was valued at 402.6 million USD. This high valuation reflects its extensive use in the aerospace industry due to its exceptional properties, including resistance to extreme temperatures and chemicals.

Another crucial segment is FEP, or Fluorinated Ethylene Propylene, which was valued at 140.8 million USD in 2022. FEP is valued for its non-stick properties and resistance to chemicals, making it an important material for aerospace applications.

PFA, or Perfluoroalkoxy, is yet another noteworthy segment in this market, with a value of 71.2 million USD in 2022. PFA shares similar characteristics with PTFE and FEP but is preferred in situations where higher thermal stability is required.

ETFE, which stands for Ethylene Tetrafluoroethylene, is another significant player in this market. In 2022, the ETFE segment had a valuation of 29.5 million USD. This material is known for its excellent electrical properties and durability, making it an essential choice for aerospace applications.

The Others segment, valued at 42.2 million USD in 2022, includes various other types of fluoropolymers that are used in specialized aerospace applications. These materials may possess unique properties that cater to specific needs in the industry.

These different types of aerospace fluoropolymers serve diverse purposes within the aerospace sector. Their varying characteristics and properties make them suitable for different applications, from wiring and cabling to gaskets and seals, ensuring the efficient and safe operation of aerospace equipment. The market value of each segment is a reflection of the industry's reliance on these materials for their exceptional performance in challenging aerospace environments.

By Application

The Aerospace Fluoropolymers Market presents a dynamic landscape with its diverse applications. Understanding the segmentation of this market sheds light on its intricacies.

In the Aerospace Fluoropolymers Market, applications steer the direction of growth and influence market dynamics. The market encompasses various application segments, each with its unique significance.

One key segment is Electrical Insulation, which played a pivotal role, securing a value of 275.5 USD Million in 2022. The demand for Electrical Insulation in the aerospace sector arises from its capacity to insulate and protect electrical components, ensuring reliable and safe operation. It safeguards against electrical leaks and interference, making it indispensable in aerospace applications.

Seals & Gaskets represent another crucial segment, contributing significantly with a valuation of 198.9 USD Million in 2022. Seals and gaskets are essential components in the aerospace industry, serving as barriers to prevent the leakage of fluids and gases. They ensure airtight and watertight seals, a critical requirement in aerospace applications where the integrity of the components is paramount.

Coatings, valued at 135.6 USD Million in 2022, constitute a segment that cannot be overlooked. Coatings have a versatile role in aerospace. They provide protective layers against corrosion, wear and tear, and extreme environmental conditions. These coatings enhance the longevity and performance of aerospace components, making them an integral part of the industry.

The Others segment, valued at 76.3 USD Million in 2022, encompasses a range of applications that are not less important. These applications could include but are not limited to wiring, tubing, and various specialized components in the aerospace sector. Their significance lies in their specific functions that cater to the complex needs of the aerospace industry.

Understanding the distinct contributions of these application segments in the Aerospace Fluoropolymers Market is crucial for stakeholders. It allows for strategic decision-making and highlights the multifaceted nature of this ever-evolving market.

By End User

The Aerospace Fluoropolymers Market, segmented by end-users, exhibits a diverse landscape catering to various sectors of aviation. In 2022, this market showcased distinct valuations for different end-user categories.

Among these segments, Commercial Aviation emerged as the frontrunner, boasting a significant valuation of 401.2 USD Million. This substantial market value signifies the substantial use of aerospace fluoropolymers in commercial aviation, where they find applications in critical components, ensuring safety, efficiency, and durability.

In parallel, the Military Aviation segment secured a noteworthy valuation of 137.3 USD Million. The military aviation sector heavily relies on aerospace fluoropolymers due to their unique properties. These materials resist extreme conditions and contribute to the longevity and performance of military aircraft.

Additionally, the General Aviation segment carved out its niche in the market with a valuation of 70.3 USD Million. General aviation encompasses a broad spectrum of aircraft, from small private planes to business jets. The application of aerospace fluoropolymers in this segment reflects their versatility and adaptability to different aircraft types and sizes.

The Others segment achieved a substantial valuation of 77.4 USD Million in 2022. This category encompasses a range of applications beyond the primary divisions of commercial, military, and general aviation. It speaks to the diverse applications of aerospace fluoropolymers in areas such as space exploration, unmanned aerial vehicles, and more.

These valuations underscore the significance of aerospace fluoropolymers across various aviation sectors. Their unique properties, including resistance to extreme conditions, electrical insulation, and low friction, make them indispensable in ensuring the safety, reliability, and performance of aircraft, whether in the commercial, military, general, or other aviation segments. As the aviation industry continues to evolve and demand advanced materials, the aerospace fluoropolymers market is poised for continued growth and innovation, driven by the specific needs and challenges of each aviation sector.

REGIONAL ANALYSIS

The global Aerospace Fluoropolymers market is influenced by geographical factors, particularly in North America and Europe. In 2018, the North American market for Aerospace Fluoropolymers was estimated to have a value of 188.4 million USD, while the European market held an estimated value of 160.5 million USD. These geographical divisions have a significant impact on the dynamics and growth of the Aerospace Fluoropolymers market.

North America, with its substantial market value, is a key player in the Aerospace Fluoropolymers market. The region's aerospace industry is well-established and technologically advanced, driving the demand for Aerospace Fluoropolymers. Factors such as the presence of major aerospace companies and a robust defense sector contribute to the market's growth. Moreover, the region's focus on research and development in aerospace technologies further bolsters the demand for these specialized materials.

On the other hand, Europe is also a noteworthy market for Aerospace Fluoropolymers. With an estimated value of 160.5 million USD in 2018, it plays a crucial role in the global market. European aerospace companies have a strong reputation for innovation and quality, leading to a continuous need for advanced materials like Aerospace Fluoropolymers. The region's commitment to sustainability and stringent regulations regarding aerospace materials also drive the market's growth.

These geographical distinctions highlight the significance of local aerospace industries in shaping the demand for Aerospace Fluoropolymers. Factors like technological advancements, industry regulations, and the presence of key players contribute to the variations in market value between North America and Europe. Understanding these geographical influences is crucial for stakeholders in the Aerospace Fluoropolymers market to make informed decisions and effectively address the specific needs of each region

COMPETITIVE PLAYERS

The Aerospace Fluoropolymers market is a dynamic and competitive industry that finds applications in various aerospace components, from wiring and cabling to seals and gaskets. Key players operating in the Aerospace Fluoropolymers industry include Daikin Industries, Ltd. and The Chemours Company.

Daikin Industries Ltd., a leading company in the aerospace fluoropolymers sector, has a track record of producing high-performance polymer products. Their expertise in developing and manufacturing advanced fluoropolymers makes them a prominent player in the market. These fluoropolymers are known for their excellent resistance to chemicals, extreme temperatures, and electrical conductivity, making them indispensable in aerospace applications.

The Chemours Company is another significant contributor to the aerospace fluoropolymers market. They have a strong focus on innovation and sustainability. Their products are integral in the aerospace industry, especially in critical areas where materials must withstand extreme conditions. The Chemours Company is known for its commitment to environmental responsibility and the development of high-quality, reliable fluoropolymer solutions.

Both Daikin Industries, Ltd. and The Chemours Company play vital roles in advancing the aerospace fluoropolymers sector. Their contributions in terms of research, development, and manufacturing of high-performance fluoropolymers are instrumental in meeting the demands of the aerospace industry, where reliability, durability, and high-performance materials are paramount. These key players continue to push the boundaries of what is achievable with fluoropolymers, ensuring that the aerospace sector benefits from the latest advancements in materials technology.

Aerospace Fluoropolymers Market Key Segments:

By Type

- PTFE

- FEP

- PFA

- ETFE

- Others

By Application

- Electrical Insulation

- Seals & Gaskets

- Coatings

- Others

By End User

- Commercial Aviation

- Military Aviation

- General Aviation

- Others

Key Global Aerospace Fluoropolymers Industry Players

- Daikin Industries, Ltd.

- The Chemours Company

- AGC Inc.

- Arkema S.A.

- Solvay SA

- 3M Company

- Saint-Gobain S.A.

- HaloPolymer Holding

- Polyflon Technology Limited

- Parker Hannifin Corp

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252