MARKET OVERVIEW

Part of the global industries that emphasize minimization of emissions and environmental sustainability, the Urea Quality Sensor market is a significant facet of increasing requirements as environmental regulations get tighter worldwide. The demand for urea quality sensors is characterized more in sectors like automotive and heavy machinery. SCRs or devices targeted at minimizing the release of harmful NOx cannot function effectively without sensors. These sensors measure the concentration of urea in diesel exhaust fluid, thus ensuring that the fluid concentration is at its best to neutralize pollutants. This means that boosting the overall efficiency of the system is achieved.

It's also one of the most regularly installed sensor types in the automobile world as the world demands reduced emissions. For buses and trucks, the sensors are fitted on commercial vehicles to monitor and keep the respective SCR system’s urea in the right amount. These sensors give efficiency and precision in meeting the various regulatory bodies’ standards set about emissions. Global Urea Quality Sensor Market Global Urea Quality Sensor Market.

The growth of the Global Urea Quality Sensor market will not only be within the automotive sector; other sectors like construction, agriculture, and marine industries will be showing increased use of urea quality sensors with stricter environmental regulations being brought into the global scene. Heavy machinery and equipment are used in these industries, which often require diesel engines, and the use of SCR will incorporate urea quality sensors, therefore, this market will expand further beyond its reach at the moment.

The Global Urea Quality Sensor Market will be driven by swift technology advancement in sensor fields. Manufacturer changes are continuing in terms of more innovation with the improvement in accuracy, as well as in durability and reliability, of urea quality sensors. The new advancements for the sensors will lead to newer models by increasing performance, which will require more of them. Additionally, vehicle electrification and hybrid technologies are becoming stronger, opening up new markets for these sensors because SCR systems are tied to electric drivetrains.

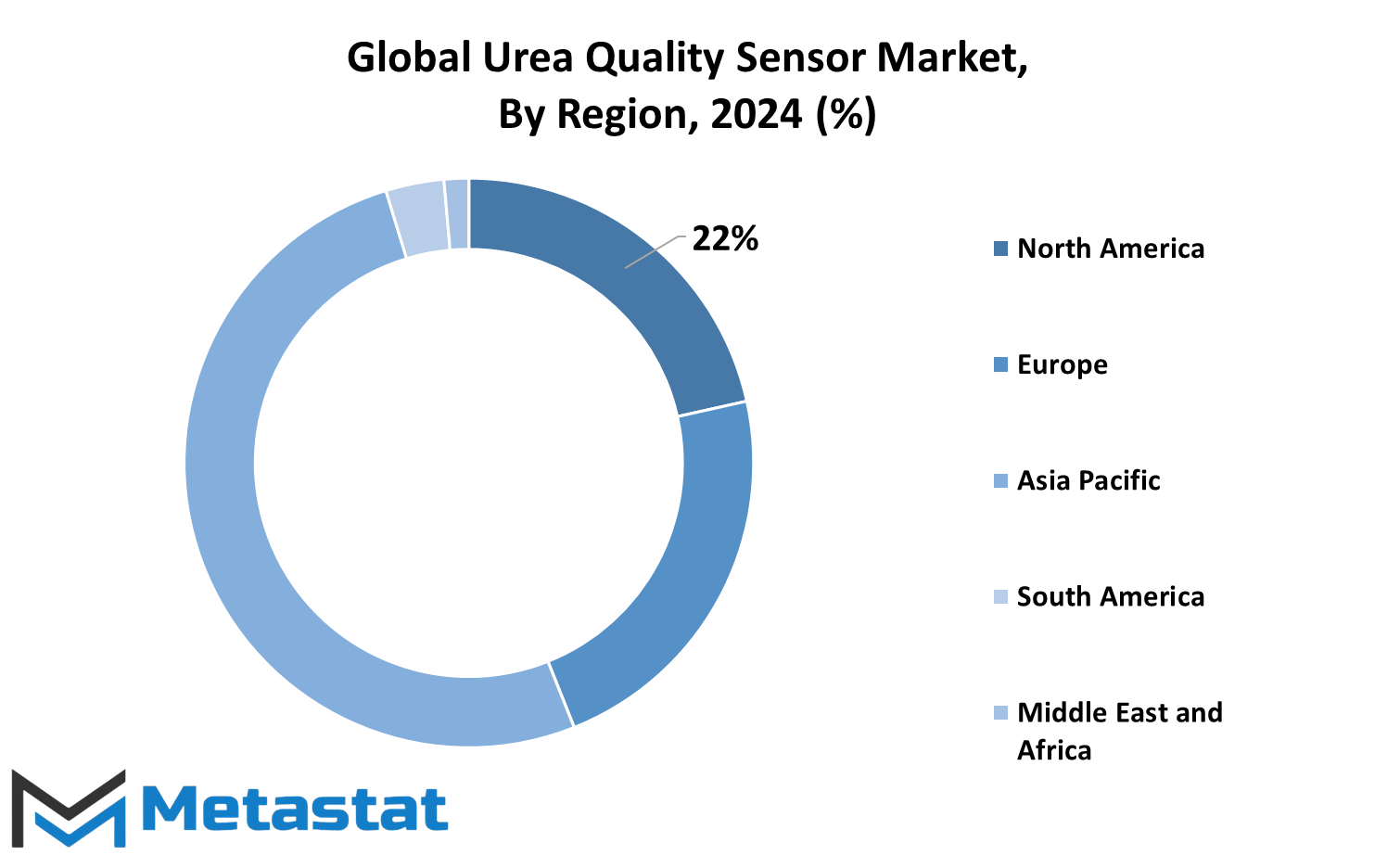

The geographic distribution of the Global Urea Quality Sensor market will also see significant shifts in the coming years. While Europe and North America are earlier adopters of urea quality sensors, geographies like Asia-Pacific and Latin America are likely to face a greater demand because of increased regulatory standards within these geographies catching up with developed countries. Industrialization and urbanization will expand their markets because the industries want solutions to their extra environmental impact.

The Global Urea Quality Sensor Market will be an integral part of the world’s efforts towards reduction and environmental sustainability. With the advancement of sensor technology and further extension of emissions regulations across the globe, the market is in for significant development in the next few years. As these sensors are integrated into almost every possible industry, their significance will be ensured in the global industrial scenario, creating great importance in the market amongst producers, regulation authorities, and industrial entities.

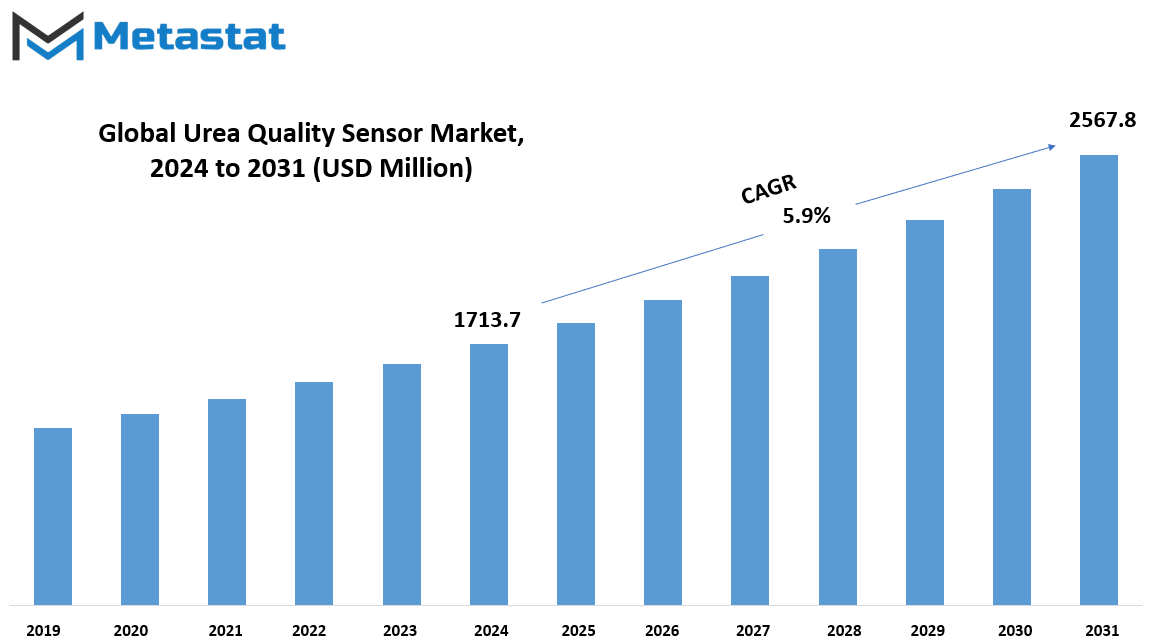

Global Urea Quality Sensor market is estimated to reach $2567.8 Million by 2031; growing at a CAGR of 5.9% from 2024 to 2031.

GROWTH FACTORS

The Global Urea Quality Sensor market is expected to grow at a wonderful pace for many years as the market is propelled by various key factors. Fuel efficiency coupled with emission control is primarily driving this market, as more and more governments today are implementing stricter environmental regulations on harming emissions. Thus, the need for vehicles to meet such standards has become more imperative. Therefore, urea quality sensors form a critical aspect of ensuring the urea solution delivered into selective catalytic reduction systems meets standards. This is the critical point that will serve to lower the emission of nitrogen oxides from diesel engines, thus making it an essential component in any new vehicle.

A key growth driver for the Global Urea Quality Sensor market is because of the rise of electric and hybrid vehicles. As far as electric vehicles are concerned, these don't consume the sensors directly, but in the case of hybrid vehicles, where internal combustion engines are still in place, these use urea sensors to ensure environmental compliance. As hybrid vehicle usage increases, the percentage of demand for urea quality sensors will increase, thereby driving this market more forward.

Although the prospects look optimistic, there are some challenges that could endanger the growth of the Global Urea Quality Sensor market. These include the relatively high price-tag on such sensors, which would discourage manufacturers from adopting these cost-cutting alternatives. Another challenge lies in the complexity of the systems where these sensors are designed to fit, because they might cause technical problems, which would sometimes require constant updates and maintenance. This may limit small-scale producers of these sensors from going large-scale in adopting them.

On the bright side, however, sensor technology has opportunities that market participants hope to exploit in the future. Sensors should become more efficient, cost-effective, and easier to integrate into vehicle systems as the years go by. There is also increasing environmental awareness and the pressure to make technologies cleaner. This will further drive demand for quality sensors for urea. The resulting need for more innovative solutions from manufacturers should increase market opportunity.

The more strict environmental regulations shall support steady growth for the Global Urea Quality Sensor market as more and more people push for cleaner and more efficient vehicles. However, fewer challenges may slow down such an adoption rate and technology development is still held as an ongoing process. Sustainability focus shall help open up new avenues for growth in the near future years.

MARKET SEGMENTATION

By Type

Due to the widening of innovation in sensor technology and various industries focusing on emissions, the Global Urea Quality Sensor market is ready to see a broad growth in years to come. The global market for Urea Quality Sensors, an important part of all vehicles, especially those systems providing emission reduction, is expected to grow strongly in the coming years. These sensors will measure the quality of urea used in diesel engines. Therefore, the fluid will break down nitrogen oxides, which is a harmful pollutant. With governments across the world imposing stricter emission standards, it is quite possible that the demand for these sensors will increase.

By type, the global market for Urea Quality Sensor has been classified into: Single-Tube and Multiple Tubes. Each type serves different purposes, depending on how complex and large the system is that it will be installed in. Single-Tube sensors are generally pretty straightforward and are primarily used in smaller systems where elementary monitoring will suffice. Multiple Tubes sensors provide more nuanced and accurate readings and are best suited for bigger or more complex systems, which need constant and precise monitoring of urea quality.

As emission control is even more crucial to society, both Single-Tube and Multiple Tubes sensors might see even more improvements. Manufacturers of these sensors are likely to commit more in terms of research with durable accuracy to meet the increasing demands. That trend is relatively evident in transportation and agricultural sectors that are going strict in terms of emission control measures.

Further, since electrical and hybrid cars still have a growing market share, the application of urea quality sensors in traditional I/C engines would still trend upward in the near to medium term. However, since heavy-duty diesel engines are still dominated by heavy trucks, buses, as well as construction equipment, demand from this segment will still be substantial. Control emission systems, which require the adoption of such sensors, is unlikely to drop in the near future.

The Global Urea Quality Sensor market is slated for steady growth as the emission regulations will remain stiff. Both Single-Tube and Multiple Tubes sensors will do their part to ensure that these requirements are met by the industries. As technology improves in the future, the sensors will be smart enough, so better monitoring and control of urea quality in many applications will happen. This future-oriented development also opens up exciting prospects for the industry as a whole, keeping it relevant and vital in the years ahead.

By Application

This market of global urea quality sensor is expected to grow much in the coming future. The sensors are widely going to be used for passenger and commercial vehicles besides other applications as well. These are important for tracking the quality of urea that meets the limiting emissions standards in a vehicle. As more intensity seems to arise with environmental issues around the world, more stringent and eco-friendly automobiles would push the desire for urea quality sensors upward.

Urea quality sensors are increasingly being used in passenger cars with governments starting to put stricter emission norms. The role of these sensors is to monitor the levels of urea in SCR systems provided in diesel engines so that the performance can be excellent and harmful emissions can be kept at its minimum level. As people become more conscious about the environment, they will require more of such monitoring systems for the vehicles used. This will directly impact the growth of the global urea quality sensor market in the passenger vehicle segment.

Commercial vehicles, which include trucks and buses, are major consumers of diesel engines. And for reducing such harmful nitrogen oxides, SCR technology is highly used in these engines. With increasing control in various parts of the world, commercial vehicle manufacturers would be compelled to raise their dependence on urea quality sensors. The demand in this industry will be not only because of regulatory requirements but also for efficiency and for the cost of maintenance. Accurate sensors prevent the damage to engines caused by poor-quality urea, ensuring that vehicles stay on the roads for a longer time while contributing toward overall reductions in emissions. Hence, it would always remain a prominent sector for enhancing the growth of the global market for urea quality sensor.

Other industries aside from vehicle manufacturers are also exploring the market potential for urea quality sensors, mainly in scenarios where their emissions are more strictly monitored-for instance, power production and heavy equipment. Growing interest in companies’ sustainability and environmental footprints will likely generate opportunities for greater market growth.

The trend is expected to continue smoothly worldwide in the near term for urea quality sensors, driven by improvements in sensor technology, making them more efficient and cost-effective. Emphasis on continually developed emission standards worldwide will ensure cleaner modes of transportation and industry, ensuring that urea quality sensors remain a part of the application landscape into the future.

By Sales Channel

The Global Urea Quality Sensor market is expected to grow further in the coming years due to greater attentiveness towards environmental regulations and of efficient vehicle emissions control. With countries and companies putting their best efforts to minimize the harmful emissions, advance sensors, like the urea quality sensors, are going to have a broader market. These sensors are a key part of meeting strict exhaust emission standards by vehicles, especially when their systems such as SCR rely on good-quality urea. More countries will be forced to implement strict environmental policies to fight pollution. The prospect of this market is promising.

From a sales channel perspective, the market can be segmented into two major segments: OEMs and the Aftermarket. Generally speaking, OEMs are considered stable and primary sources of demand for urea quality sensors. As the vehicle manufacturers incorporate them in new models in areas with strict requirements for emissions, dependence on OEMs for such technology will increase. Therefore, the long-term contract to be set between the manufacturers and the OEMs will ensure that there are no hindrances in demand for the products market. The new vehicles will meet all environmental standards.

Conversely, after-sales distribution is the most important channel that will be fueled by even more vehicle manufacturers fitting their vehicles with good-quality urea sensors. Eventually, those sensors would have to be replaced or upgraded for continuous sales to owners of vehicles and fleet managers. As the global fleet of vehicles continues to grow and especially in developing regions, after-sales distribution will remain increasingly strong, as older vehicle units are steadily kept in service or are brought up to date to meet new standards.

In the future, the direction in which sensor technology advances would be one of the several factors that would shape the Global Urea Quality Sensor market. Improvement of sensors in respect of accuracy, durability, and efficiency would be a critical area, as the demand is increasing because the sensors have to keep pace with the demand of the global market. In fact, with the rise in automobile industries, specially electric and hybrid system automobiles, the status of the emission control technology may change, but the need for urea quality sensors shall be glaring as ever in the traditional combustion engine cars.

Overall, environmental concerns and growing drives for cleaner, more efficient vehicles will keep the Global Urea Quality Sensor market going. Both OEM and Aftermarket sales channels will help mold a future for their respective vehicles, ensuring continued compliance with global emission standards.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$1713.7 Million |

|

Market Size by 2031 |

$2567.8 Million |

|

Growth Rate from 2024 to 2031 |

5.9% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Urea Quality Sensor market is expanding significantly across different geographic regions, each with a distinct contribution to its overall growth patterns. Geographically, the market can be classified into the major regions of North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, wherein each of the regions presents isolated trends and prospects for growth. To elaborate further, the North America region is quite an important market driven mainly by countries such as the U.S., Canada, and Mexico. The U.S. is one of the most significant markets because it possesses very high-quality automotive and agriculture sectors, and which are further adopting urea quality sensors in accordance with strong pollution regulations. Canada and Mexico also offer considerable opportunities as the two countries are quite advanced in terms of environmental technologies.

In the European region, the market for Urea Quality Sensor continues its stable rise, where leaders on the growth list include the UK, Germany, France, and Italy. Especially, Germany is one major market of this sensor, as it has a considerable automotive business and is seriously working to reduce pollution. The rest of the European countries, such as France and the UK, are also giving emphasis on the cause of environmental sustainability and, therefore increase the demand for these sensors. Therefore, Europe itself will occupy an important position in the global market.

Asia-Pacific is a very promising region to grow in the Urea Quality Sensor market. India, China, Japan, and South Korea are hugely investing in this segment of industrialization and technology. China will be such a big driver in this market as it has huge manufacturing industries. India is concentrated on agriculture and also requires high efficiency in this field, thereby increasing the use of urea quality sensors. Advanced technologies are not limited to Japan and South Korea alone, and in them, the use of these sensors is likely to develop in coming years.

In South America, Brazil and Argentina show interest in the use of urea quality sensors, especially related to the agriculture field. Middle East & Africa: The market is increasing with the adoption of urea quality sensors in the GCC countries. Countries like Saudi Arabia and the UAE show an increased focus on sustainability and technological innovation, especially in Egypt and South Africa. All these regions present unique opportunities for the future of the market, ensuring its continued growth globally.

COMPETITIVE PLAYERS

Amongst the fast-growing markets is a Global Urea Quality Sensor, primarily in the automobile sector, due to the fast-growing requirements of quality-sensing urea. With the presently in-setting environmental laws worldwide, it has been the focus to reduce harmful emissions. A urea quality sensor, therefore, is critical to prevent such vehicles, mainly the ones that make use of the SCR system, from non-compliance with the emission standards. The sensors measure the concentration of urea in diesel exhaust fluid (DEF), and thus, are very crucial in what may be the next step in NOx emissions reduction.

Competitive landscape: Several major participants dominate the market as they are making great strides in development in sensor technology. Vitesco Technologies GmbH and SSI Technologies, LLC are leading companies with high performance and reliable urea quality sensors. Constant research and development are required to keep up with new designs and accuracies of sensors as well as their durability. Here, TE Connectivity and KYOCERA AVX Components (Werne) GmbH, to name a few of the main competitors, present creative solutions and cater to various sectors, including car manufacturing.

Their roles in the market are likely to increase in the future as the market continues to evolve. Increasing environmental concerns would lead to stricter regulations on emissions from several regions. SUN-A Co., Ltd. And Anhui ActBlue Environmental Protection Co., Ltd. Will thus be poised to capture a bigger portion of the market, especially as they focus on catering to regional demand for cleaner technologies.

Absolute Watchers KUS Technology Corporation and Kailong High Technology Co., Ltd. Are Companies that are yet to revolutionise sensor technology, answering increasing global demand. This increasingly trendy utilization of advanced materials and smarter sensors allows Continental AG and VOSS Automotive, Inc. to continue competitive within the highly dynamic market.

In the future, with this market expanding, cooperation is very likely among key stakeholders. Partnership and mergers will be found with the ability of companies to pool their resources and technology in an effort to preserve the environment. For the years to come, this market’s future appears bright with key industry players working continuously to further advance their relevance in this market. Demand drive will also fuel the cleaner, more efficient technologies and then competition and innovation will sprout in this space. And that is how the market will stay vibrant and responsive to the needs of the world.

Urea Quality Sensor Market Key Segments:

By Type

- Single-Tube

- Multiple Tubes

By Application

- Passenger Vehicles

- Commercial Vehicles

- Others

By Sales Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket

Key Global Urea Quality Sensor Industry Players

- Vitesco Technologies GmbH

- SSI Technologies, LLC

- TE Connectivity

- SUN-A Co., Ltd.

- Anhui ActBlue Environmental Protection Co., Ltd.

- KUS Technology Corporation

- Kailong High Technology Co., Ltd.

- Continental AG

- VOSS Automotive, Inc

- KYOCERA AVX Components (Werne) GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383