MARKET OVERVIEW

The global transformers market is a key part of the electrical industry. It balances modern power transmission and distribution across different sectors. The industry is at a transformative juncture due to the ongoing development of technology, and this transformation will extend beyond conventional use. As industries grow and power consumption patterns shift, the ability of transformers to adapt to new situational demands with creative offerings that would augment performance and reliability will need to be observed.

One major factor in play here will be the incorporation of digital technologies into the global transformers market. Smart sensors and AI-driven monitoring systems embedded in transformers will be critical for future levels of real-time performance analysis and predictive maintenance. This will go a long way toward improving overall operational efficiency and extending equipment life by flagging probable defects before they develop into serious ones. The evolution toward intelligent transformers will further reduce downtime and facilitate grid stability, especially in fast urbanizing and industrializing territories.

Another major trend influencing the Global Transformers is the transition toward sustainable and environmentally friendly solutions. Conventional transformers usually use insulating oils that pose environmental hazards. This trend targets biodegradable alternatives and solid-state designs that eliminate conventional oil-based insulation from the industry. These innovations complement international efforts to reduce carbon footprint and energy efficiency. As regulations regarding emissions and energy conservation tighten, manufacturers are under obligation to opt for eco-friendly materials and technologies in transformer production.

Demand for high-voltage transformers is projected to increase as the sources of generation are becoming more dispersed. Renewable energy projects, including offshore wind farms and large-scale solar installations, require transformers that can withstand high loads of power while transmitting electricity effectively over long distances. The inherent need for transformer applications will be supported further by the ongoing growth of UHVDC transmission networks. Further, while countries are investing in upgrading their power grids, the concentration for the industry will be on developing solutions that promote effective energy transfer with minimum loss.

A similar feature with respect to decentralized power generation will play an important role in influencing the global transformers market. With concepts such as microgrids and distributed energy resources gaining in acceptance, these will call for transformers that can best manage fluctuations in the supply versus demand for power. Flexibility in transformer designs to handle bidirectional flow of power will be required for these systems to ensure stable distribution even in the face of complex grid structures.

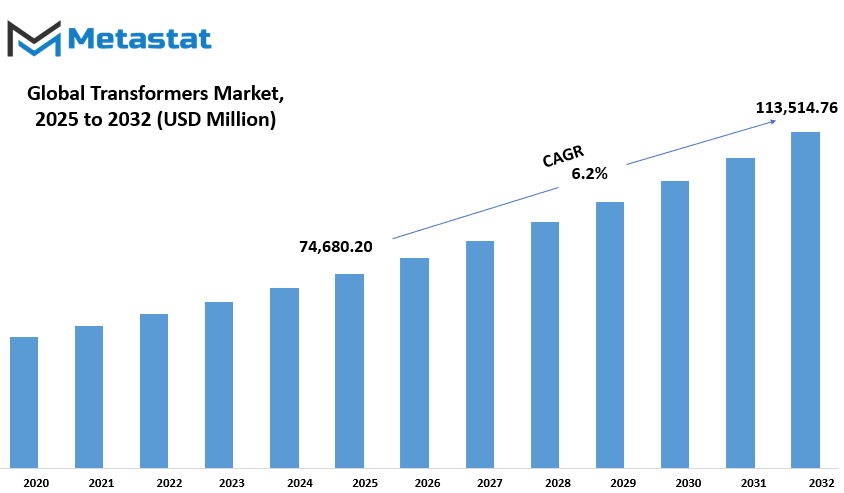

global transformers market is estimated to reach $113,514.76 Million by 2032; growing at a CAGR of 6.2% from 2025 to 2032.

GROWTH FACTORS

The global transformers market is fundamentally changing worldwide in developing countries due to growing electricity consumption. Industrialization and urbanization are rife, with demand for reliable transmission of electricity increasingly heightened among the nations investing heavily in their economies to build the infrastructure that will be able to house the power requirements.

Heavy investments in infrastructure for energy requirements are another significant factor driving transformer market growth, besides the demand for electricity in rapidly growing nations. Besides, the transition towards renewables is perking up market growth. The pressing need to embed solar, wind, and hydroelectric power into the existing grid has catalyzed the demand for efficient transformers capable of handling variable load patterns of energy.

Despite the above-mentioned growth factors, a number of challenges exist in the market. Fluctuating raw material costs are one of the major hurdles faced. Manufacturing claim transformers uses primary raw materials like copper, steel, and insulation materials that face a variable price regime depending upon market conditions. Such fluctuations directly affect manufacturing costs and, whose consequences are hence indirectly seen on product pricing and profit margins. Others are manufacturing constraints due to regulations regarding emissions and environmental standards. Various stringent policies being proposed to limit carbon footprints and ensure energy efficiency will require companies investing in eco-designs and eco-friendly transformer solutions, thereby raising their operational costs.

Nonetheless, the smart grid technology is one such avenue that has given fertile ground for growth in the sector. These allow enhanced monitoring, automation, and efficient power distribution while reducing power losses and enabling reliability. With particular attention to modernization of aging power infrastructure as noted by utilities and governments, intelligent transformers are set to rise in demand. Smart transformers have digital monitoring systems and remote control to optimize distribution of energy and stabilization of the grid, thus being the life of future power networks as they can vary voltage levels in real-time depending on what consumption prescripts.

With technology advanced and investment in energy infrastructure on the rise, the global transformers market is bred for a steady growth process. Challenges such as raw material price fluctuations and regulatory constraints will always tell their story, while the transition to renewable energy and smart grid adoption will be its avenue of long-term growth. Companies that survive through innovation, with a clear sustainability agenda, will be in a much more favorable position to explore emerging opportunities and attend to the industry's evolving needs.

MARKET SEGMENTATION

By Type

A transformer is an essential component in the global market. This device serves as the backbone for the efficient transmission and distribution of electricity into almost every area or industry, thus proving to be integral in any portable electric generation system. Much demand calls for an increasing number of reliable and high-tech transformer solutions. The regulator keeps the required voltage levels so that power can be efficiently transmitted over greater distances and safely reaches every home, business, and industry. Keeping in mind that technology is advancing and more investments are in infrastructures to bear a shift toward renewable sources, much will happen in the overall development of the market, as more governments and private organizations are working to modernize power grids for efficiency and energy loss reductions.

The transformer industry is differentiated into different types according to their particular applications and functionalities. Power transformers account for a large proportion of the global transformers market, with a valuation of $29,476.78 million. These vital transformers have a purpose for controlling high-voltage transmission. These transformers are extensively used in substations for step-ups or step-down voltages and allow for a minimal loss in energy during transmission. Distribution transformers, on the other hand, deliver the power from substations to the end-user; hence, they are vital members of local power distribution networks. Another use is instrument transformers measure an electrical parameter such as voltage and current, providing a way to record either with a standard reading used in control or safety applications. Special transformers cater to industrials and com-mercials within their different needs, proving even more diverse.

There are many factors that will continue to add to the ongoing growth of the global transformers market. Increased demand for transformers characterized by uncertainty in power generation by wind and solar energy exists owing to the constantly changing needs for renewable energy integration. Greater urbanization and industrialization mean higher electricity consumption, which in turn creates the need for better and longer-lasting transformer systems. Investments in smart grid technology will also be vital to changing energy distribution networks to current requirements in a more resilient and flexible way.

While it has a huge potential for future development, it is hindered by challenges such as high initial costs, maintenance demands, and environmental pollution with conventional transformers. Innovations by researchers and manufacturers include eco-friendly insulating materials and energy-efficient designs. If developed and invested in strategically, the global transformers market will remain a cornerstone of the power sector while continuing to attend to the rapidly growing energy needs of industries and consumers in this world.

By Power Rating

Transformers constitute a very important part of the modern-day power distribution, providing reliable transmission of electricity across various industries. The voltage levels are adjusted to consumer, industrial, and power grid requirements by transformers. This sector therefore recorded rapid market growth with evolution of the energy infrastructure and need for reliable electricity. Classification of transformers with respect to power rating further helps in understanding their applications and suitability in various industries.

The small power transformers with a capacity that can reach as high as 10 MVA are used in residential neighborhoods, small commercial buildings, and rural electrification projects everywhere. They help stabilize voltage fluctuations and promote energy efficiency. All of this need has recently surged, given urbanization, especially in developing areas where expanded electrification still remains a focus. Medium power transformers, usually within the 10-100 MVA range, serve large commercial buildings, industrial plants, and regional power distribution networks.

These transformers are very much used for ensuring a fairly constant power supply and maintaining a stable energy transmission across medium distances. Medium power transformer demand is fueled by continued industrialization in developing markets where factories and commercial complexes are in need of consistent and unbroken power supply.

High power transformers, rated above 100 MVA, find applications in high-voltage power transmission systems, power generation plants, and large networks of grids. They step up or step down voltages for long-distance transmission, thus minimizing losses and improving efficiency. In the light of the renewable energy focus on wind and solar energy, large power transformers are being integrated into the new or existing grids for monitoring the transition towards sustainable energy. Their capability for heavy electrical load makes them a backbone for large-scale infrastructure development and inter-regional power chain distribution.

With rising electricity consumption all over the world, the global transformers market is adapting to face challenges and technological developments. Smart grid technologies, heavy investments in power infrastructure, and a shift toward greener energy sources are considered the prime future movers for the market. With old power systems highly focused on being upgraded by governments and energy providers, efficiency and reductions in energy losses remain another priority. This further underlines the importance of ongoing R&D to design transformers that are more energy efficient, robust, and capable of sustaining modern power demands.

By Cooling Type

Transformers play a significant role in the electric network infrastructure worldwide, supporting different industries to channelize power transmission and distribution more efficiently. Growing energy demand has increased the significance of reliable transformers today. These devices can regulate required voltage levels to supply electricity safely and efficiently from power plants to the end consumers, be it a household, business, or industry. As changes in technology develop, the use of modern transformers meets requirements that must now be efficiency, sustainability, and operational reliability.

One of the major issues involved in transformers is the effect of cooling on performance and longevity. The division of transformers on the basis of cooling type is further sub-divided into two: oil-cooled transformers and air-cooled transformers. Air-cooled transformers require the assistance of either natural or forced air to dissipate heat, making them inefficient for occupying any specification for indoor application because of space constraints. Oil-cooled transformers use oil-filled tank type construction to absorb and transfer heat away from the core and windings for thermal management. In addition, for thermal management as well as efficiency, oil-filled transformers perform much better for high-load applications. The choice of either of the cooling types, of course, depends on installation environment, load capacity, and maintenance requirements.

So factors influencing demand for transformers are urbanization and industrial growth and the migration toward renewable energy sources. All these factors increase the requirement for a reliable power supply into the cities or industries, and, hence, as a result, push the utility and government sectors toward investing in the latest technologies for advanced transformer solutions. Integration of renewable energy to power grids really emphasizes the importance of transformers with regards to grid stability and efficiency. In this aspect, turbines from the wind and photovoltatic sources have the most challenging points that require transformers for successful capturing and smooth distributions of power in generation.

Some challenges facing the global transformers market include the costs of raw materials, regulatory compliance, and the need for continuous innovation. Manufacturers have concentrated their efforts to design energy-efficient transformers with minimum loss to meet high environmental standards and save on their operational costs. Digital monitoring solutions are being included in transformers to give real-time performance analysis and predictive maintenance that are expected to help in downtime reduction and availability.

The overall global transformers market stands to constantly grow as the energy sector varies and continues to respond to an increased demand for power from the government and industries. Smart grids, renewable projects, and infrastructure investments will keep advancing this market.

By Insulation Type

In addition to that, the global transformers market is the pivot around which electrical distribution and transmission revolve. This is a critical component attached to electrical infrastructure. As demand for reliable connections increases globally, the global transformers market is adapting to technological advancements in energy efficiency. The transformer types are classified, with the insulation type having great influence over the performance, application, and operational efficiency of the transformer in question. Liquid-immersed, dry-type, and solid-insulated transformers are the main kinds whose design is based on an industry's need.

Liquid-immersed transformers are the most widely used nowadays, as they are efficient in cooling and can take on high power loads. It relies on insulating oils to dissipate heat, providing operational stability. Suitable for use in electricity-generating grids, industrial plants, and in most high-voltage applications, these transformers are made where cooling is very effective over long periods. New biodegradable and less flammable insulating fluids have been developed to address environmental and fire hazard issues. However, such materials comply with the modern safety regulations.

Dry-type transformers are not liquid insulated; therefore, they are used indoors, in commercial buildings, and in areas where the environment must be protected. These use air or resin insulation to prevent leakage and fire hazards. The compact design and maintenance-free features make them ideal for urban infrastructure as well as renewable energy projects. Apart from that, dry-type transformer systems are generally less efficient than liquid-immersed types with the amount of energy they can handle, indicating limited applications in high voltage situations.

Solid-insulated transformers utilize solid dielectric materials like epoxy resins to move to an advanced insulation approach. These transformers enhance safety while producing less environmental damage and a longer life span. Such applications are becoming widely used, especially in underground and compact power distribution systems, where space considerations pose serious constraints while reliability is of critical importance. The present trend shows that, with advancement in technology, solid insulation solutions will occupy much larger scenarios in future electrical networks.

The growing emphasis on the energy efficiency, modernization of the grid, and incorporation of renewable energy sources are defining characters for the future of the global transformers market. More manufacturers are developing environmentally-friendlier insulation materials and transformer designs owing to regulatory frameworks emphasizing sustainable solutions. As electricity demand continues to increase, improvements in insulation technology will be a critical element to upgrade the performance and reliability of transformers worldwide.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$74,680.20 million |

|

Market Size by 2032 |

$113,514.76 Million |

|

Growth Rate from 2025 to 2032 |

6.2% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

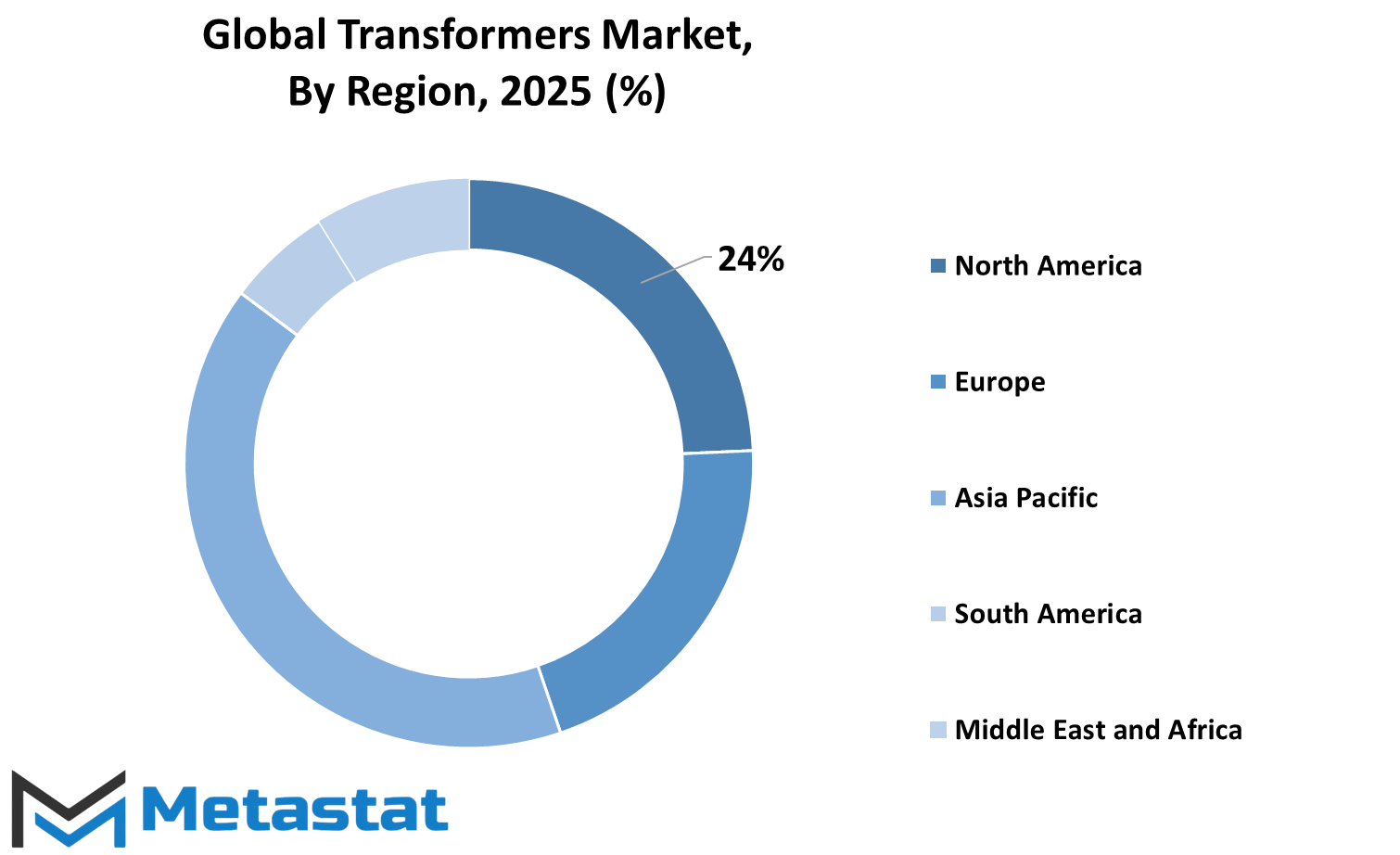

REGIONAL ANALYSIS

The global transformers market are affected by industrial development, urbanization, and the latest technologies in power distribution. Increasingly, the market recognizes the growing demand for high-efficiency large transformers for the industrial development and infrastructure projects with world scale investments. The market, in turn, can be geographically divided into regions that are key in affecting industrial trends and growth opportunities.

North America still remains a stronghold, especially the United States, Canada, and Mexico, making significant contributions to the demand for transformers. Aging power infrastructure and the assimilation of renewable energy sources have thus increased the need for advanced transformer solutions. In Europe, the countries that lead the market are the UK, Germany, France, and Italy, where sustainability and energy efficiency are priority sectors. Smart grids and environmentally friendly power solutions have emerged as the additional catalyst boosting transformer adoption across these regions.

There's immense potential in the Asia-Pacific region with quick industrialization and urbanization in countries like India, China, Japan, and South Korea. With increased populations and higher energy consumption, there are investments made in networks for power transmission and distribution. China keeps on being one of the biggest centers that manufacture transformers for export. On the other hand, country-specific demands in India are further supported by government programs for rural electrification and overall infrastructure development.

Despite being in South America, the markets of Brazil and Argentina are still flourishing owing to infrastructure projects and economic developments within their fronts. Due to the need for secure distribution of power in both industrial and residential sectors, transformers have relatively seen increased installation. Besides, urbanization, economic diversification, and renewable energy projects are other factors stimulating the demand for transformers in the Middle East and Africa, particularly in the GCC countries, Egypt, and South Africa. Countries in this region are even investing further in the development of the power sector on meeting the emerging electricity demand.

There is an increasing need for novel transformer technologies as both industries and governments place priority on energy efficiency and sustainability. Apart from this, such a market is anticipated to witness new innovations regarding high-performance transformers meant for modern power grids. The global transformers market shall thus remain part of the energy sector. Technologies, improvements, and onward investments in infrastructure have ensured continuous evolution.

COMPETITIVE PLAYERS

According to the report, the global transformers market is one vital segment for the industrialized electrical industry. This segment plays a significant role in power transmission and electricity distribution. Transformers importance is mainly found in thermal conditions to level or regulate voltage levels to allow the proper and effective conduction of electric power within residential, commercial, and industrial applications. Based on increasing demand across the world for energy and the accompanying increase in advancements in transformer technology in terms of reliability, the requirement for transformers will continue to rise.

Due to increased urbanization and industrialization, the global transformers market has also enjoyed a decent growth trend, along with a gradual shift towards renewable energy sources. Governments and private entities are investing heavily in further upgrading the existing infrastructure of power generation and distribution, and all these measures drive the need for more efficient transformers.

The development of transformer technologies is greatly affected by the change in technology around the world. Nowadays, the focus of manufacturers is on the efficiency improvement, energy-wasting and longevity of transformers. Most relevant introduction of a concept in the field is smart transformers, which facilitate real-time monitoring and automatic alterations. All these innovations have a huge contribution towards enhancing the grid stability, reducing the maintenance costs, and providing an even more reliable power supply for future generations. The current trend of moving towards sustainable solutions has, therefore, influenced the manufacturers to develop more and more eco-friendly transformers that make use of biodegradable insulating fluids thus providing a more greener option for the end-users in green projects.

The industry has several big players, all working to build itself through investing in research and development as well as strategic alliances. Such global major companies in the global transformers market include ABB Ltd, Siemens AG, General Electric Company, Schneider Electric SE, Eaton Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd., Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd., Fuji Electric Co., Ltd., CG Power and Industrial Solutions Limited, Bharat Bijlee Ltd., SGB-SMIT Group, Miracle Electronics Devices Pvt. Ltd., Mehru Electricals & Engineers (I) Pvt. Ltd., Brush Electrical Machines Ltd., Virginia Transformer Corp., Wilson Power Solutions Ltd. and Alstom SA. All these research continuously for animal production targeting the customer at an efficacious value-adding product.

The market, even with its extensive growth, still faces challenges, including but not limited to high initial costs, maintenance costs, and the complex integration of modern transformers to older grids of power. Nonetheless, with increasing government initiatives that encourage energy efficiency, as well as gradual transition into renewable sources of power, the global transformers market still stands to overcome these obstacles. Future practice will continuously relate to transforming energy-efficient and technology-advanced transformers as part of engendering a reliable and sustainable world supply of power.

Transformers Market Key Segments:

By Type

- Power Transformers

- Distribution Transformers

- Instrument Transformers

- Others

By Power Rating

- Small Power Transformers (Up to 10 MVA)

- Medium Power Transformers (10 MVA to 100 MVA)

- Large Power Transformers (Above 100 MVA)

By Cooling Type

- Air Cooled

- Oil Cooled

By Insulation Type

- Liquid Immersed

- Dry Type

- Solid

Key Global Transformers Industry Players

- ABB Ltd.

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd.

- Fuji Electric Co., Ltd.

- CG Power and Industrial Solutions Limited

- Bharat Bijlee Ltd.

- SGB-SMIT Group

- Miracle Electronics Devices Pvt. Ltd.

- Mehru Electricals & Engineers (I) Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252