Global Tax Advisory Services Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global tax advisory services market is an arena where the ever-changing financial reforms, the government’s demand for transparency, and businesses’ need to deal with the complexity of cross-border taxation coexist. The evolution of this service was slow at first. In the early 1900s, companies were very much relying on their own accountants who did the basic filings and prepared the annual financial reports. The growing trade among nations made tax laws more complex, especially after the 1970s when businesses started to distribute production, selling, and even patents over several countries. The traditional accountants in a firm could not cope with the international tax complexities anymore, thus, allowing consultancy firms to take over.

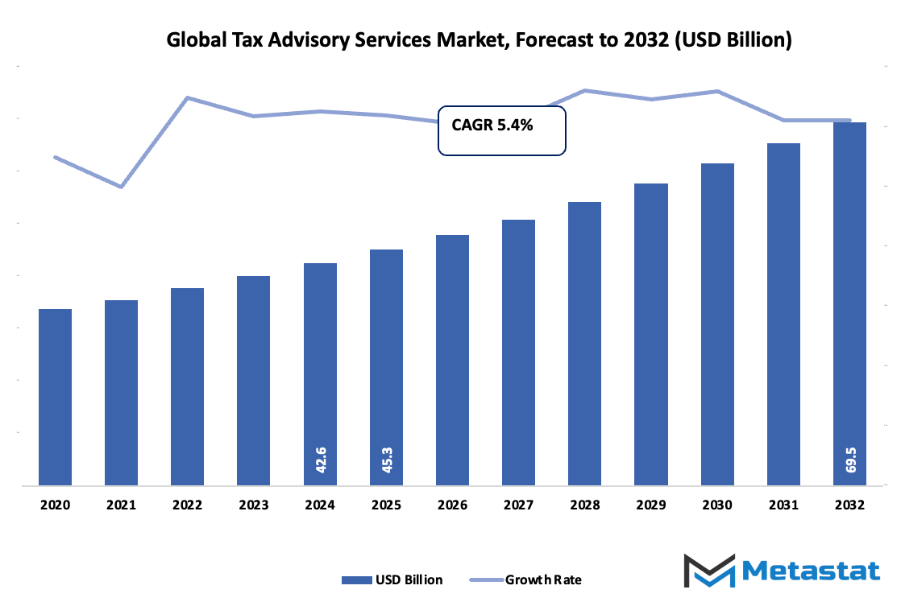

- The global tax advisory services market is estimated to be about USD 45.3 billion in 2025 with a gradual increase of about 6.3% CAGR till 2032, the market might turn to USD 69.5 billion plus.

- Corporate Tax Advisory takes a lion’s share of the market with nearly 37.6% and stimulates innovation along with the development of applications via the hardcore research.

- The foremost tax regulations in the world and domestic areas have become more and more complicated; therefore, the demand for efficient tax planning and optimization has increased.

- The opportunities are: The increased use of digital tax solutions and AI-driven advisory platforms.

- The market is predicted to experience an exponential increase in value in the next 10 years which means there will be great growth potential.

The 1990s marked a significant moment in history. International digital commerce began to unfold, and many nations were confronted with the complex issue of dividing the pie and assigning tax liability. The largest consulting companies began to form units specifically for international tax planning, and treaty analysis. The importance moved from pure compliance to that of strategic advisory. Corporations were looking for consultants who would not only clarify the tax payable for today but also indicate how tomorrow's obligations would be shaped by decisions taken today.

The twenty-first century witnessed rapid progression. The 2008 financial meltdown made the governments more tax-efficient and, consequently, more aggressive in their pursuit of revenue lost through loopholes. The consulting industry underwent major changes as it embraced the use of sophisticated data analysis and specialized planning that would enable the clients to predict the risks. Around the same time, the introduction of cloud computing and automation was revolutionizing the way services were delivered. Rather than being restricted to files and annual meetings, the consultants were providing live insights that could be accessed through secure online dashboards.

There were alterations in the clientele expectations all the time. New technology startups and medium-sized establishments were asking for the same assistance as the large multinational corporations. Besides tax returns, the consultants began to offer services related to corporate decisions in areas such as the supply chain structure, M&A, digital assets transactions, and sustainability reporting. Machine learning will continue to drive the tax industry towards predictive analytics, where tax strategies are validated through modeling scenarios prior to any business decision being made.

Currently, the worldwide tax advisory market is combining together the skills of financial experts with the power of technology. The way the market moves will mainly depend on the digital tax systems of the future, the reporting requirements set by the governments, and the need for clearer financial footprints. The future belongs to the tax firms that are able to change their operations.

Market Segments

The global tax advisory services market is mainly classified based on Service Type, Organization Size, Organization Size.

By Service Type is further segmented into:

- Corporate Tax Advisory: Corporate tax advisory mainly deals with the provision of professional advice to corporations on tax planning, reporting, and compliance. The tax burden can be lawfully reduced and penalties avoided with expert assistance. This implies that the allocation of financial resources for the long term will be more stable if it is planned clearly. Corporate tax advisory, within the global tax advisory services market, is always a factor in the steady growth because it enables the proper handling of tax issues for business activities.

- International Tax Advisory: International tax advisory essentially provides the necessary advice for the transactions between different countries as well as the tax regulations applicable to different regions. Besides, the tax incentives offered in the various countries can be lawfully used with the help of strategic planning. Moreover, accurate guidance will assist in not getting taxed unnecessarily when expanding abroad. Therefore, reliable advisory support is important in reinforcing global operations and fostering trust in managing multiple tax systems through different national frameworks.

- Mergers and Acquisitions Tax Advisory: Mergers and acquisitions tax advisory mainly concentrates on the tax aspects involved during the acquisition, merger, or divestiture of businesses. The support consists of identifying the likely tax risks and working out the tax consequences after the deal. Proper tax direction will make it easier for one to integrate the finances and will also lower the risk of incurring tax costs that are unplanned during the course of major corporate transitions, thereby the decision-makers are always facilitated with the confidence to act at every stage of the transaction.

- Others: The other advisory services consist of indirect taxes, transfer pricing, audit preparedness, and specific-sector tax issues. The companies sometimes require help to determine and/or to stay compliant with unique tax requirements related to their products or operations. If companies are provided with sufficient tax advice, they will be able to introduce a better planning process, and at the same time, the probability of encountering unforeseen tax difficulties in the course of conducting complicated business activities will have been reduced.

By Organization Size the market is divided into:

- Large Enterprises: Large enterprises generally need very meticulous tax planning because of their large operational networks and extensive financial activities. The help of professional consultants not only promotes very accurate reporting but also helps quite a lot in the smooth operation of various departments. The organized tax planning approaches costs to be cut during the time of opening up new territories, making investment, and allocating resources for the long term.

- Small and Medium-Sized Enterprises: Small and medium-sized enterprises go for advisory support that is flexible and fits their limited resources and smaller scale of operations. The tax professional's help reduces risk of compliance errors and thus enables the correct selection of tax structures. The readily available advice not only gives the business confidence in its budgeting but also helps in sustainable growth through supporting during early and mid-stage business development.

By Industry Vertical the market is further divided into:

- IT and Telecom: The global tax advisory services market supports the IT and Telecom sector by guiding companies through cross-border tax rules, digital service taxes, and regulatory obligations. Expert planning encourages accurate reporting along with cost control. Fast innovation across digital networks demands careful tax planning to avoid financial risk and support steady expansion.

- Manufacturing: Manufacturing operations require strong planning for deductions, production credits, and investment incentives. Tax specialists help reduce unnecessary costs through organized reporting and clarity around regional regulations. Proper advisory guidance encourages long-term investment, reduces financial uncertainty, and supports efficient resource allocation across factories, supply networks, and distribution channels.

- Retail and E-Commerce: Retail and E-Commerce face challenges linked to multiple sales regions, frequent transactions, and shifting tax rules. Advisory guidance assists with accurate filings, cross-border compliance, and control of unexpected penalties. Support from tax experts helps stores and online platforms maintain efficiency while managing seasonal sales volume and pricing strategies.

- Public Sector: Public Sector organizations require careful budgeting and accountability. Advisory input encourages transparent tax handling, reduces errors in financial planning, and improves decision-making for community programs. Guidance from specialists helps manage compliance responsibilities while supporting efficient allocation of public funds for economic and social development projects.

- BFSI: Banking, Financial Services, and Insurance entities face strict regulations, constant audits, and complex reporting standards. Tax advisors aid in planning, risk management, and interpretation of regulatory frameworks. Accurate tax handling helps maintain financial stability and supports responsible operations within financial institutions and insurance providers.

- Healthcare: Healthcare organizations manage sensitive funding structures, research credits, and grants. Tax advisors help ensure accurate reporting, guide organizations through deductions, and support long-term planning. Professional guidance reduces financial uncertainty and encourages resources to remain focused on patient services, research improvements, and facility development.

- Others: Other industries rely on advisory guidance to manage compliance and forecast tax expenses with confidence. Personalized planning supports efficient operations, encourages informed investment choices, and minimizes the risk of unexpected liabilities. Structured advisory direction benefits both established firms and growing enterprises across varied business environments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$45.3 Billion |

|

Market Size by 2032 |

$69.5 Billion |

|

Growth Rate from 2025 to 2032 |

6.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

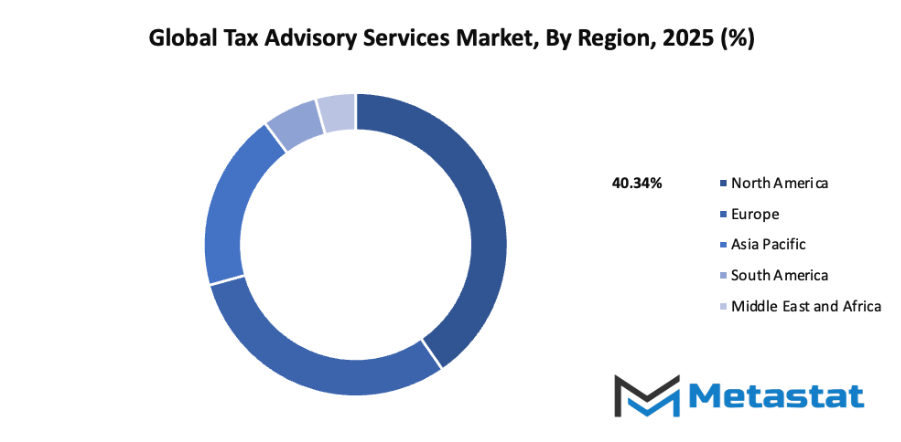

By Region:

- Based on geography, the global tax advisory services market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Increasing complexity of global and domestic tax regulations:

Rapid expansion of trade, cross-border transactions, and new compliance rules has increased the workload for companies in many regions. The global tax advisory services market gains stronger demand because firms seek clarity, accuracy, and reduced exposure to penalties. Constant updates in regulations require expert guidance to maintain financial stability and operational confidence.

Rising demand for strategic tax planning and optimization:

Organizations now focus on improving financial efficiency through careful planning and legally sound reduction of tax burdens. Strategic advisory support helps businesses identify savings, avoid unnecessary payments, and operate responsibly. Strong tax planning encourages growth, supports transparent financial reporting, and provides a dependable foundation for long-term business decisions.

Challenges and Opportunities

Frequent changes in tax laws creating compliance challenges:

Government authorities continue to update rules and filing requirements. Such changes lead to confusion, delays, and possible financial consequences for companies without strong internal tax knowledge. Advisory support becomes necessary for accurate filings, smoother audits, and continuous awareness of current regulations across local, national, and international frameworks.

High cost of professional tax advisory services for small businesses:

Large advisory firms often charge premium fees, creating financial pressure for smaller companies with limited budgets. Smaller firms struggle to access specialized guidance, which may reduce compliance quality and long-term growth prospects. Limited resources can result in missed financial benefits and reduced confidence during filing or audit cycles.

Opportunities

Growing adoption of digital tax solutions and AI-driven advisory platforms:

Automation, data analysis tools, and cloud-based tax platforms offer faster reporting and improved accuracy. Digital solutions reduce manual errors, shorten preparation time, and lower overall service expenses. AI tools support predictive analysis and scenario planning, giving businesses the benefit of reliable tax decisions supported by real-time data.

Competitive Landscape & Strategic Insights

The industry attracts significant attention because demand for guidance in tax law, reporting standards, and cross-border compliance continues to rise. A growing number of organizations seek support that reduces financial risk and improves planning. The sector features a wide range of firms with different strengths. Large international networks hold strong reputations based on scale, long-term client relationships, and broad service menus. PricewaterhouseCoopers (PwC), Deloitte Touche Tohmatsu Limited, Ernst & Young (EY), and KPMG International Limited represent the group often labeled as major global leaders. These networks provide extensive knowledge, large professional talent pools, and advanced technology for analysis.

The sector also includes influential mid-tier networks. BDO International Limited, DLA Piper, RSM International, Baker Tilly International, Crowe Global, Mazars Group, Nexia International, and Grant Thornton International Ltd. frequently compete for projects that require close attention and flexibility. Each network builds value through regional familiarity, faster response time, and direct access to decision makers. Specialized operations such as HLB International, Andersen Global, PKF International Limited, UHY International, Plante Moran, CliftonLarsonAllen LLP (CLA), EisnerAmper LLP, Alvarez & Marsal Taxand, LLC, CohnReznick LLP, Armanino LLP, WithumSmith+Brown, PC, Ryan, LLC, and Moore Global Network Limited strengthen competition by focusing on specific segments.

Competition encourages constant improvement. Faster regulatory changes create pressure for accuracy and strong advisory judgment. Firms invest in digital tools that speed up research, automate calculations, and support transparency. New software reduces errors and provides clearer projections, enabling more confident business planning for clients. Growth in cross-border trade amplifies demand for advisory knowledge. More organizations need guidance that connects accounting rules, local tax codes, and international requirements.

Market size is forecast to rise from USD 45.3 billion in 2025 to over USD 69.5 billion by 2032. Tax Advisory Services will maintain dominance but face growing competition from emerging formats.

Future growth of the sector depends on trust. Clear communication and reliable guidance motivate clients to form long partnerships. Firms that demonstrate consistent performance, ethical behavior, and strong client support will gain an advantage. Continuous learning, investment in new tools, and strong cooperation among different departments will shape success. As competition expands, the sector will keep moving toward better quality, sharper analysis, and stronger client confidence.

Report Coverage

This research report categorizes the global tax advisory services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global tax advisory services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global tax advisory services market.

Tax Advisory Services Market Key Segments:

By Service Type

- Corporate Tax Advisory

- International Tax Advisory

- Mergers and Acquisitions Tax Advisory

- Others

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Organization Size

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Public Sector

- BFSI

- Healthcare

- Others

Key Global Tax Advisory Services Industry Players

- PricewaterhouseCoopers (PwC)

- Deloitte Touche Tohmatsu Limited

- Ernst & Young (EY)

- KPMG International Limited

- BDO International Limited

- DLA Piper

- RSM International

- Baker Tilly International

- Crowe Global

- Mazars Group

- Nexia International

- Grant Thornton International Ltd.

- HLB International

- Andersen Global

- PKF International Limited

- UHY International

- Plante Moran

- CliftonLarsonAllen LLP (CLA)

- EisnerAmper LLP

- Alvarez & Marsal Taxand, LLC

- CohnReznick LLP

- Armanino LLP

- WithumSmith+Brown, PC

- Ryan, LLC

- Moore Global Network Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252