MARKET OVERVIEW

The global soy milk market is a niche of the big plant-based milk alternatives industry. The industry will continue to be attractive with its link to changing eating habits, health consciousness, and consumerism. Soy milk, which is produced by soaking, grinding, and boiling soybeans, has become more than an alternative to milk. It is a lifestyle choice for millions of individuals who prefer plant-based nutrition to animal-based foods.

Region-wise, the demand for soy milk will appear based on diverse cultural affinity and food habits. In some regions, particularly in Asia, soy milk has deep historical origins as a standard constituent of diets. In Western markets, it will be more accepted as a lifestyle option versus cow's milk. This difference in consumer behavior will continue to shape manufacturers' plans who are working in the global soy milk market. Manufacturers will no longer be marketing a beverage; they will be providing a product that is saturated with the perception of health, taste, and quality.

The market will also continue to be marked by the presence of established food and beverage brands as well as niche players focusing solely on plant-based products. These companies will fight it out on the grounds of flavor innovation, texture innovation, and nutritional fortification. Vitamin and mineral-fortified soy milk will appeal to segments of the population keen on closing dietary gaps. Furthermore, production technology improvement will result in improved shelf life and uniformity, which are those expectations implicit in modern consumers.

Distribution channels will determine how such a market fares across various territories. Online stores, health foods, and supermarkets will each contribute to delivering soy milk to final consumers. The convenience of online stores will assume a greater significance as urbanization increases and consumption habits migrate towards electronic stores. Health-oriented consumers will be drawn to specialty stores, however, where the quality of vegetable products seems to be more secure. The global soy milk market, therefore, will interlock itself within traditional retail frameworks and modern digital settings.

Beyond the retail environment, foodservice channels will dictate future opportunities. Restaurants, coffee houses, and bakeries will become increasingly familiar with carrying soy milk as part of their offerings to cater to the dairy-free consumer demand. This visibility within foodservice will make soy milk a mainstream option, not an alternative specialty diet choice. As plant-based consumption becomes the hospitality norm, soy milk availability and popularity will build naturally.

Cultural beliefs about health and wellness will quietly affect them. Soy milk will continue to carry associations of cardiovascular health, lactose intolerance solutions, and being a weight management drink. While marketing will avoid promising too much, consumers will move in with these broader stories at the forefront of their minds. This dynamic between perception and action will silently shape demand in ways that do not necessarily make it onto data sheets.

In the next couple of years, the global soy milk market will not be isolated from other trends in environmentalism, ethics, and sustainability. Soy milk's positioning as a greener alternative to dairy will quietly affect purchase choice for some consumer segments. As the debate about the environment reaches a deafening pitch, plant-based alternatives will sit comfortably with evolving values.

Lastly, the global soy milk market will remain a reflection of broader social change around food, health, and consumption. Its evolution will not just react to current demands but also predict the needs and desires of future consumers

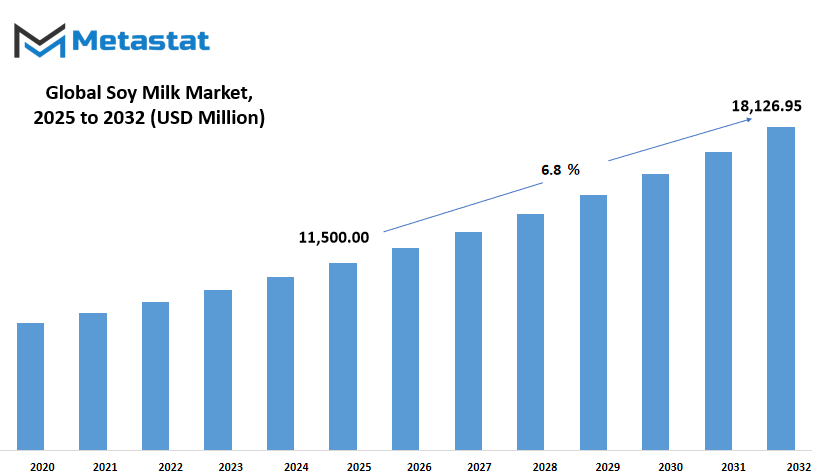

Global soy milk market is estimated to reach $18,126.95 Million by 2032; growing at a CAGR of 6.8% from 2025 to 2032.

GROWTH FACTORS

The global soy milk market is expected to experience notable growth in the future, largely driven by changing consumer preferences and a stronger focus on health and sustainability. As more people become aware of the impact of their dietary choices on both their health and the environment, the demand for plant-based alternatives to dairy is rising. One of the main reasons behind this trend is the growing number of individuals who are lactose intolerant. These consumers actively seek alternatives that will not cause digestive issues, and soy milk presents itself as a reliable option. Additionally, the rise in vegan diets around the world is pushing more people to turn to soy milk as a staple in their daily routines.

There is also a growing awareness of the health benefits linked to plant-based products, which is encouraging people to consider soy milk as a healthier substitute for traditional dairy milk. People are becoming more careful about what they consume, paying attention to how their food choices affect their overall well-being. The environmental advantages of plant-based foods are another factor that cannot be ignored. Consumers are realizing that producing soy milk typically requires less water and creates a smaller carbon footprint compared to dairy farming. This growing environmental consciousness will continue to shape consumer behavior and encourage more people to choose soy milk over dairy options.

However, the global soy milk market does face certain challenges that might slow down its growth. One of the major issues is the price volatility of soybeans. Since soybeans are the key ingredient in soy milk, fluctuations in their price will directly affect production costs, making it harder for manufacturers to keep prices stable. Additionally, there are still some consumers who hesitate to switch from dairy to soy milk because of concerns related to taste and texture. These individuals often feel that soy milk does not match the flavor or mouthfeel of traditional dairy products, which can hold them back from making a permanent switch.

Looking ahead, there are many opportunities for growth within the global soy milk market. Companies are likely to focus on expanding their product offerings to meet a wider range of consumer tastes. Innovations such as new flavors, added nutrients, and enhanced formulations will help attract more people to try soy milk. These improvements will not only satisfy health-conscious consumers but will also appeal to those looking for better taste and variety. As a result, the future of the global soy milk market appears promising, with plenty of potential for further expansion.

MARKET SEGMENTATION

By Product Type

The global soy milk market is expected to witness steady growth in the future as consumer preferences continue to shift towards healthier and plant-based alternatives. People are becoming more aware of the benefits of plant-based diets, and soy milk has gained popularity as a nutritious option. The market by product type is further segmented into unflavored soy milk and flavored soy milk. Both of these categories will play an important role in the overall growth of this market. Currently, unflavored soy milk holds a significant share, with its market value reaching USD 3,374.66 million. Many health-conscious consumers prefer unflavored versions because they are seen as more natural and free from added sugars or artificial ingredients.

On the other hand, flavored soy milk is also becoming more popular, especially among younger consumers and those who are trying plant-based milk for the first time. The flavored segment allows companies to introduce a variety of tastes, making the product more attractive to a wider audience. As a result, this segment has contributed to the growth of the market, reaching a value of USD 8,125.34 million. Moving forward, companies will likely continue to invest in new flavors and packaging innovations to attract more customers.

Looking into the future, the global soy milk market will likely experience continued demand due to the rising focus on health and wellness. Governments and health organizations are encouraging people to reduce dairy consumption for both personal health and environmental reasons. Soy milk is seen as a good alternative because it is rich in protein and free from lactose. This positions it well in the broader plant-based market, where demand is expected to rise steadily. Companies in this market will likely focus on expanding their reach through both retail and online channels. They will also try to strengthen their brand identity by highlighting the health benefits and sustainability of their products.

Consumer behavior will shape how the market develops. More people are reading product labels, and transparency will become even more important. Companies that can show their commitment to quality and sustainability will gain customer trust. There will also be more partnerships between soy milk brands and other health-focused businesses to create new opportunities. As technology improves, manufacturing processes will become more efficient, helping companies offer better prices and improve their profit margins. Overall, the global soy milk market will continue to grow as it adapts to consumer needs, offering more choices and maintaining a focus on health and sustainability.

By Form

The global soy milk market is expected to see gradual yet steady growth in the years to come. As people become more health-conscious and look for alternatives to dairy products, soy milk is gaining popularity across various regions. This shift is driven by an increasing number of consumers who are either lactose intolerant or looking to reduce their intake of animal-based products. Soy milk has found its place in daily routines as it offers both health benefits and versatility in usage. It can be used in drinks, cooking, and even baking, which makes it attractive to a wide range of consumers.

Looking ahead, the global soy milk market is likely to benefit from technological advancements in food production. Companies are focusing on improving both the taste and texture of soy milk to appeal to a broader audience. As demand grows, manufacturers will explore innovative methods to enhance shelf life without using harmful preservatives. In the future, consumers can expect to see more fortified soy milk products that include added vitamins, minerals, and other nutrients aimed at supporting better health.

By form, the global soy milk market is split into Ready-to-Drink (RTD) and powder. Ready-to-Drink options are gaining more attention because they offer convenience to busy consumers. People who are always on the go find these products easy to incorporate into their lifestyles since they require no preparation. This segment is expected to see steady demand, particularly in urban areas where fast-paced living leaves little time for preparing meals and beverages from scratch. On the other hand, powdered soy milk appeals to those looking for flexibility and longer shelf life. Consumers can adjust the concentration according to their taste and preference, making it a practical choice for many households.

The future of the global soy milk market will also be shaped by changing consumer habits. With more people adopting plant-based diets, the demand for soy milk in both forms is likely to rise. Environmental concerns are also playing a role, as soy milk production generally has a lower impact on natural resources compared to dairy farming. Companies that can offer sustainable packaging and ethical sourcing of soybeans will likely find greater success in attracting environmentally aware consumers.

In summary, the global soy milk market is positioned to grow through a mix of innovation, changing lifestyles, and a stronger focus on health and sustainability. Both Ready-to-Drink and powder forms will continue to play important roles in meeting consumer needs now and in the future.

By Packaging Type

The global soy milk market is expected to show steady growth in the future, shaped by changing lifestyles and rising awareness about health. People across different regions are now more concerned about what they consume daily, and soy milk fits well into this growing interest in healthier, plant-based options. As consumers continue to shift away from dairy products due to lactose intolerance, health reasons, or ethical concerns, soy milk is becoming a popular choice among all age groups. This shift will likely help the global soy milk market expand further in the years ahead.

Packaging plays an important role in attracting customers and ensuring the product’s safety and freshness. By packaging type, the market is further divided into aseptic cartons, PET and glass bottles, flexible pouches, and others. Aseptic cartons are often preferred because they keep the soy milk fresh for a longer time without the need for refrigeration before opening. These cartons are lightweight, easy to store, and considered more environmentally friendly, which makes them appealing to eco-conscious buyers. PET and glass bottles, on the other hand, offer a more premium feel. While glass bottles give a traditional look and are fully recyclable, PET bottles are lighter and less likely to break, which makes them practical for everyday use. Flexible pouches are becoming more noticeable in the market as well. These pouches use less material, which reduces waste and appeals to those who are focused on minimizing environmental impact.

As technology moves forward, it is likely that new forms of packaging will appear, designed to keep soy milk fresh for longer periods while being even more sustainable. In the future, packaging might also include smart features, such as indicators to show whether the product has been stored correctly. These kinds of advancements will help manufacturers stand out and offer extra value to their customers.

The global soy milk market is not only being shaped by packaging but also by ongoing innovations in flavors and fortification with vitamins and minerals. Companies are expected to focus more on providing soy milk that offers additional health benefits, helping people meet their nutritional needs more easily. Looking ahead, there is a good chance that demand will continue to rise as plant-based diets become even more accepted. People are paying closer attention to how their choices affect both their health and the environment, and soy milk fits well with these concerns. This makes the future of the global soy milk market appear positive and full of potential for further growth.

By Distribution Channel

The global soy milk market is expected to see steady growth in the future as more people become aware of health and dietary benefits linked with plant-based products. Consumers are turning to options that fit changing lifestyles and eating habits, and soy milk continues to stand out as a popular choice. This rise is not just because of health trends but also due to the push for sustainable and environmentally friendly food choices. As people seek alternatives to dairy, soy milk offers a reliable solution that aligns with both personal and environmental values.

Looking ahead, the global soy milk market will likely expand further through various distribution channels. On-Trade channels, which include cafes, restaurants, and other food service outlets, play a key role in introducing soy milk to new consumers. These establishments offer soy milk in coffee, smoothies, and other beverages, allowing customers to experience the product without having to commit to purchasing it in large quantities. This first-hand experience helps build trust in the product, encouraging repeat purchases.

Supermarkets and hypermarkets also continue to hold a strong position in this market. These stores provide wide visibility for soy milk brands, offering consumers a chance to compare different options and choose according to their preference and budget. The presence of soy milk in these stores assures customers of its growing popularity and availability. Convenience stores add another layer to the distribution network, serving customers who prefer quick and easy access to such products. These smaller stores are especially useful in urban settings where busy schedules demand efficiency in shopping habits.

Online retailers are predicted to have a bigger impact on the global soy milk market moving forward. With more people shopping from home, the convenience of browsing and ordering soy milk online cannot be overlooked. E-commerce platforms allow customers to read reviews, compare prices, and even access products that may not be available locally. This channel offers brands a chance to reach customers directly, without the limitations of shelf space or store hours.

Other distribution channels, including specialty health stores and direct-to-consumer sales, will also play a part in shaping the future of this market. As awareness grows and demand increases, these channels provide opportunities for brands to offer unique product variations or bundles that cater to specific customer needs.

In the future, the global soy milk market will likely become more innovative, with new flavors, packaging, and fortified options emerging to meet the expectations of a wider audience.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$11,500.00 million |

|

Market Size by 2032 |

$18,126.95 Million |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

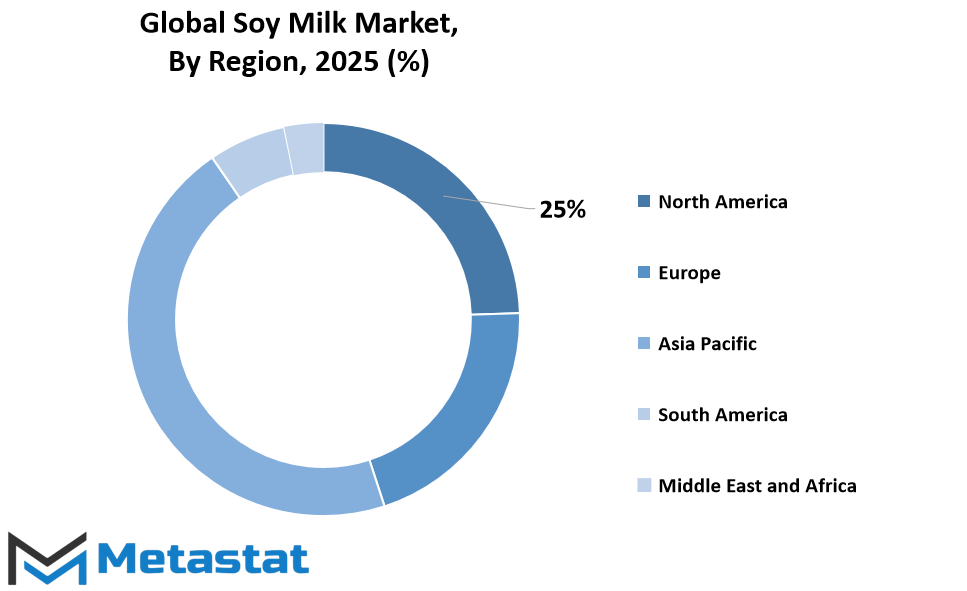

The global soy milk market is expected to show steady growth in the coming years as more people become aware of the benefits of plant-based diets. With changing lifestyles and a growing focus on health and sustainability, soy milk is gaining popularity as an alternative to traditional dairy products. This shift is not just limited to one area; it is spreading across many parts of the world. Based on geography, the global soy milk market is divided into regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. These divisions help businesses and researchers understand how the market behaves differently in each part of the world.

In North America, the market is broken down further into the U.S., Canada, and Mexico. The U.S. will likely continue to lead in this region due to the high demand for plant-based products. Consumers in Canada and Mexico are also showing increasing interest, though on a smaller scale. Europe is another important area, including the UK, Germany, France, Italy, and the Rest of Europe. Countries like Germany and the UK are seeing growing demand for dairy alternatives because people there are becoming more health-conscious and environmentally aware. France and Italy also contribute to the market's growth, although cultural habits tied to traditional dairy can slow progress in some areas.

Asia-Pacific is considered a key player in the future of the global soy milk market. This region is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific. China and Japan already have a strong tradition of soy-based foods, so the acceptance of soy milk comes naturally. India and South Korea are showing signs of growth as well, driven by younger generations and urban populations who are open to new food trends. These countries are expected to shape much of the market’s direction in the future.

South America, which includes Brazil, Argentina, and the Rest of South America, is also embracing soy milk. Brazil leads the way as consumers there become more interested in plant-based nutrition. Argentina is following a similar path, although the shift is a bit slower. Lastly, the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. These areas show potential, especially as health trends spread and awareness grows. In the future, the global soy milk market will likely continue to expand as people everywhere look for healthier, more sustainable choices.

COMPETITIVE PLAYERS

The global soy milk market is expected to witness steady growth in the future as people across the world continue to look for healthier alternatives to dairy milk. The increasing awareness about lactose intolerance, health benefits associated with plant-based diets, and the environmental impact of dairy farming are encouraging more consumers to turn towards soy milk. This shift in consumer behavior will likely create more opportunities for companies already operating in this space. Some of the key players contributing to this market include Pacific Natural Foods, Sunopta Inc, Pureharvest, Vitasoy International Holdings, American Soy Products, Hain Celestial Group Inc (Natumi), Sanitarium, Danone SA, Kikkoman Corporation, Fraser and Neave, Limited, Earth’s Own Food Company Inc, Dr Chung’s Food Co Ltd, Maeil Dairy Ind Co Ltd, and Yeo Hiap Seng Ltd. These companies are not only competing through product quality but are also focusing on innovation to cater to the evolving needs of health-conscious customers.

The future of the global soy milk market looks promising as technological advancements in food processing will help improve both the taste and texture of soy milk, making it more appealing to a wider range of consumers. In addition, companies are expected to focus on enhancing nutritional content, offering more fortified options with added vitamins and minerals. This will attract more people who seek products that support their health and wellness goals. With the growing influence of social media and digital marketing, these companies will also likely strengthen their brand presence by promoting the benefits of soy milk to a broader audience.

As demand rises, it is expected that the supply chain will also evolve to become more sustainable. Companies might invest in eco-friendly packaging and greener production methods to align with the increasing consumer preference for environmentally responsible brands. The global soy milk market will also benefit from expanding distribution networks, making soy milk more available in emerging markets where awareness about plant-based options is still developing.

Looking ahead, the global soy milk market will continue to be shaped by innovation, sustainability, and changing consumer habits. Companies will need to stay flexible and responsive to these trends to maintain their competitive edge. Health trends, dietary preferences, and environmental concerns will remain the main factors influencing this industry. With more people recognizing the benefits of soy milk, this market is expected to become a vital part of the global food and beverage industry in the years to come.

Soy Milk Market Key Segments:

By Product Type

- Unflavored Soy Milk

- Flavored Soy Milk

By Form

- Ready-to-Drink (RTD)

- Powder

By Packaging Type

- Aseptic Cartons

- PET and Glass Bottles

- Flexible Pouches

- Others

By Distribution Channel

- On-Trade

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Others

Key Global Soy Milk Industry Players

- Pacific Natural Foods

- Sunopta Inc

- Pureharvest

- Vitasoy International Holdings

- American Soy Products

- Hain Celestial Group Inc (Natumi)

- Sanitarium

- Danone SA

- Kikkoman Corporation

- Fraser and Neave, Limited

- Earth’s Own Food Company Inc

- Dr Chung’s Food Co Ltd

- Maeil Dairy Ind Co Ltd

- Yeo Hiap Seng Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252