MARKET OVERVIEW

The global beverages market is a vast and diversified segment of the food and beverage market at large. It deals with an extensive array of products that persons all over the world consume throughout the day. From bottled spring water sitting on convenience store shelves to special brews of fine teas and expensive liquors, this market will continue being shaped by consumer preferences and the factors affecting society and culture. While beverages may seem to be simple products, the market that serves to the customers will begin evolving through lifestyle trends, branding strategies, and technology.

The global beverages market extends to a much farther distance than just a single beverage category or product type. In fact, it includes alcoholic or non-alcoholic beverages catering to a wide range of preferences-from health-conscious individuals seeking plant juices to heritage-driven whisky buyers. The global beverages market will be delivered to consumers through supermarkets, specialty stores, hospitality sites, and more so through online channels that bring in convenience with personalization options.

The key will be to seize the opportunity of change, as the ingredients matter more to the modern consumer, so do ethical sourcing and sustainability practices for this market. Changes in demand will need to be anticipated with resulting product and packaging innovation in companies that inhabit this space. The beverage market, by virtue of these changing lifestyles, would thus offer everything from sugar-free sodas to kombucha with probiotic benefits.

Segmentation-wise, this market would extend from soft drinks to dairy-based drinks to energy boosters and alcoholic choices such as wines, beers, and spirits. Each segment would carry its trends, challenges, and opportunities. Those brands that will continue being relevant are those that will listen to their consumers and will try new things with flavors, formulations, and presentations. The distribution networks would mold the future of this industry, as global logistics and supply chains would now adjust to environmental regulations and to consumer requirements of fast, reliable delivery methods.

Intersections between health, wellness, and technology will occur across product categories in the global beverage market. With an increase in prevalence, innovations will include smart packaging and ingredients traced by blockchain. Meanwhile, beverages and supplements will intermingle more, creating a category of functional drinks purportedly capable of doing more than just hydrate or refresh.

Cultural trends will contribute to shaping the market direction as well. Rituals surrounding coffee, tea, and alcohol vary widely from region to region, and brands will adapt their offerings to regional idiosyncrasies and emerging global taste profiles. As these liquid products make their way across borders, the stories behind them-either traditional, artisanal, or even modern health trends-will matter as much as the beverages themselves.

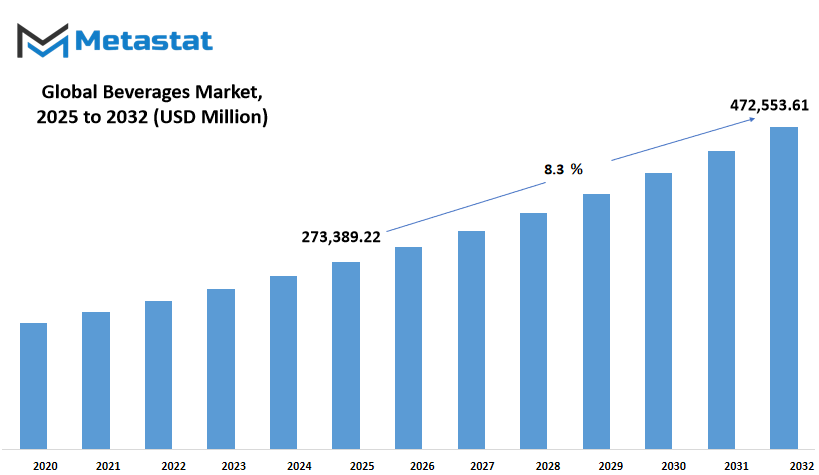

Global beverages market is estimated to reach $472,553.61 Million by 2032; growing at a CAGR of 8.3% from 2025 to 2032.

GROWTH FACTORS

The global beverages market will continue to expand in the future as people’s lifestyles and preferences keep changing. One of the biggest reasons for this growth is the rising demand for health-conscious and functional drinks. More people are becoming aware of the impact of what they consume on their overall health. This awareness pushes them to choose beverages that offer additional health benefits, such as those packed with vitamins, minerals, or probiotics. Consumers no longer want drinks that only quench their thirst; they are looking for options that support their well-being, boost immunity, and improve energy levels. This shift in mindset is expected to encourage more companies to develop and offer drinks that fit these preferences.

Another important factor driving this growth is the increase in disposable income in many parts of the world. As people earn more, they tend to spend on products that improve their lifestyle. Beverages are no exception to this trend. Consumers are more willing to try new, premium, or exotic drinks because they can now afford them. This behavior has already encouraged companies to expand their product ranges and explore new flavors and combinations. It also opens doors for brands to position their products as part of a healthy and modern lifestyle.

However, this market does not come without its challenges. Health concerns surrounding sugary drinks continue to grow, which has led to stricter regulations in many regions. Governments and health organizations are placing limits on sugar content and promoting transparency in labeling. These measures aim to protect public health but may create difficulties for companies that have relied on sugary beverages as a major part of their sales. Adapting to these regulations will require adjustments in recipes, marketing strategies, and even product placement.

Another obstacle the industry faces is the volatility in raw material prices. Ingredients such as fruits, dairy, and sweeteners often fluctuate in price due to factors like climate change, transportation issues, and geopolitical tensions. These price changes can make it hard for companies to maintain stable production costs, which in turn affects profit margins.

Looking ahead, innovation in plant-based and low-sugar beverages will offer valuable opportunities. Companies that invest in these areas will likely see positive results, as they align with consumer demand for healthier alternatives. New product lines focused on natural ingredients and sustainability will attract a growing base of customers who prioritize both personal health and environmental concerns. With the right strategies, the global beverages market will find plenty of room to grow and evolve in the years to come.

MARKET SEGMENTATION

By Alcoholic Beverages

The global beverages market is expected to experience significant growth in the future. This industry covers a wide range of products that people consume daily, and its development is linked to changing lifestyles, increasing disposable incomes, and shifting consumer preferences. The demand for both alcoholic and non-alcoholic beverages continues to expand, with businesses investing more in innovation, sustainability, and healthier options to attract a broader audience. These trends are likely to shape the future of the global beverages market, making it even more competitive and dynamic.

One of the main segments of this market is alcoholic beverages, which plays a crucial role in driving overall growth. Within this category, beer, wine, and spirits are the leading contributors. Based on recent values, beer accounts for USD 133,042.75 million, wine holds USD 48,767.61 million, and spirits bring in USD 91,578.86 million. These figures show how large and significant this segment already is, but there is still room for future growth. New markets are emerging, and companies are focusing on diversifying their product lines to meet different tastes and cultural trends. Consumers are becoming more adventurous with their choices, leading to a rise in demand for craft beers, premium wines, and unique spirits.

Looking ahead, the global beverages market will be shaped by several factors that focus on future possibilities. Health consciousness is influencing how products are made, with many people seeking drinks with lower sugar content, fewer calories, and natural ingredients. Technology will also play a bigger part, with smart packaging, digital marketing, and data-driven production helping brands connect more effectively with their customers. This focus on the future will help companies not only meet current demand but also anticipate what consumers will want next.

Sustainability is another area that will influence this market. More people are aware of environmental concerns and prefer brands that use eco-friendly packaging and ethical sourcing of ingredients. As a result, companies will continue to invest in sustainable solutions to keep up with these expectations. In addition, the rise of e-commerce will make beverages more accessible to people around the world, offering convenience and variety like never before.

In conclusion, the global beverages market holds strong potential for the future. With the alcoholic beverages segment showing impressive figures already, and with ongoing changes in consumer habits, technology, and sustainability, this industry will continue to grow and evolve. Businesses that stay focused on innovation and customer needs will be the ones that succeed in this competitive landscape.

By Non-Alcoholic Beverages

The global beverages market is expected to see steady growth in the future as people continue to seek a wider variety of drink options that fit into their changing lifestyles. One of the biggest drivers for this growth will be the rising demand for non-alcoholic beverages. As health awareness spreads across different age groups, more people are looking for drinks that offer both refreshment and added benefits such as hydration, energy, and even relaxation. This shift in consumer behavior is encouraging companies to come up with new and innovative products that can meet these evolving preferences.

When we talk about non-alcoholic beverages, the global beverages market can be broken down into several important categories. These include energy and sports drinks, soft drinks, bottled water, packaged juice, ready-to-drink tea and coffee, and other types of beverages. Each of these categories has its own path for growth. For example, energy and sports drinks are gaining more popularity among younger people and those who lead active lifestyles. This is because these drinks are often promoted as a quick way to boost performance and energy levels during workouts or busy schedules.

Soft drinks have been a mainstay in the global beverages market for decades, but companies are now adjusting their products to focus more on reduced sugar and natural ingredients. Consumers are becoming more selective and prefer options that they believe contribute to their overall well-being. Bottled water continues to lead the market in terms of growth because it is viewed as a healthier alternative to sugary drinks. Additionally, the demand for flavored and functional waters is rising, providing an extra push to this segment.

Packaged juices are also evolving. Instead of traditional sugary options, there is a noticeable trend toward juices that contain less sugar and more natural ingredients like superfruits and vegetables. Ready-to-drink tea and coffee are becoming more attractive to busy consumers who want convenience without sacrificing taste or quality. These drinks are now being crafted with unique flavors and health-focused ingredients, which will likely fuel future demand.

Looking ahead, the global beverages market will likely continue to focus on health, sustainability, and innovation. Companies are expected to invest more in eco-friendly packaging, new flavors, and functional benefits that meet the changing expectations of consumers. This push for healthier and more responsible choices will shape the future of the market and create more opportunities for growth across different regions.

By Distribution Channel

The global beverages market is expected to see noticeable changes in the years ahead, mostly driven by how people choose to buy their drinks. As lifestyles continue to shift, consumer preferences will shape how this market grows and develops. In the future, shopping habits will likely become even more diverse, and businesses will need to adjust their strategies to meet these changes. One of the key ways this market is divided is by distribution channels, which will keep evolving based on technology, convenience, and consumer expectations.

Traditional stores, such as supermarkets and hypermarkets, have always been strong players in this market. They offer a wide variety of beverages and make it easy for customers to pick up products while doing their routine shopping. However, these stores will need to adapt by providing more personalized shopping experiences and better loyalty programs if they want to keep their position strong. Convenience stores and small grocery shops will also continue to attract busy consumers who are looking for quick and easy access to drinks. Although these stores may have smaller selections, they are favored for their speed and proximity, and this will likely keep them relevant in the future.

On-trade channels, which include places like restaurants, bars, and cafes, have been key parts of the global beverages market for a long time. These spaces offer not just products but also experiences, and this is something that will probably grow in importance. Consumers increasingly look for unique, memorable experiences, and these venues are well-positioned to meet that demand by offering exclusive products or creative beverage menus. This channel will likely continue to adapt, with trends like health-conscious options and sustainable packaging gaining attention.

Online retail stores are set to play an even bigger role. As technology becomes more advanced and people look for easier shopping solutions, ordering beverages online will become more common. Fast delivery services and subscription models will shape how people access their favorite drinks. Online platforms also allow brands to connect directly with consumers, offering tailored suggestions and promotions that traditional stores may struggle to match.

Other off-trade channels, though less talked about, still serve a purpose. These include vending machines and specialty stores, which might not hold the largest share but offer niche benefits. In the future, these channels may use technology like AI to offer smarter, more interactive buying experiences. Altogether, the global beverages market will continue to grow through these different channels, each adapting to future consumer needs and preferences.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$273,389.22 million |

|

Market Size by 2032 |

$472,553.61 Million |

|

Growth Rate from 2025 to 2032 |

8.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

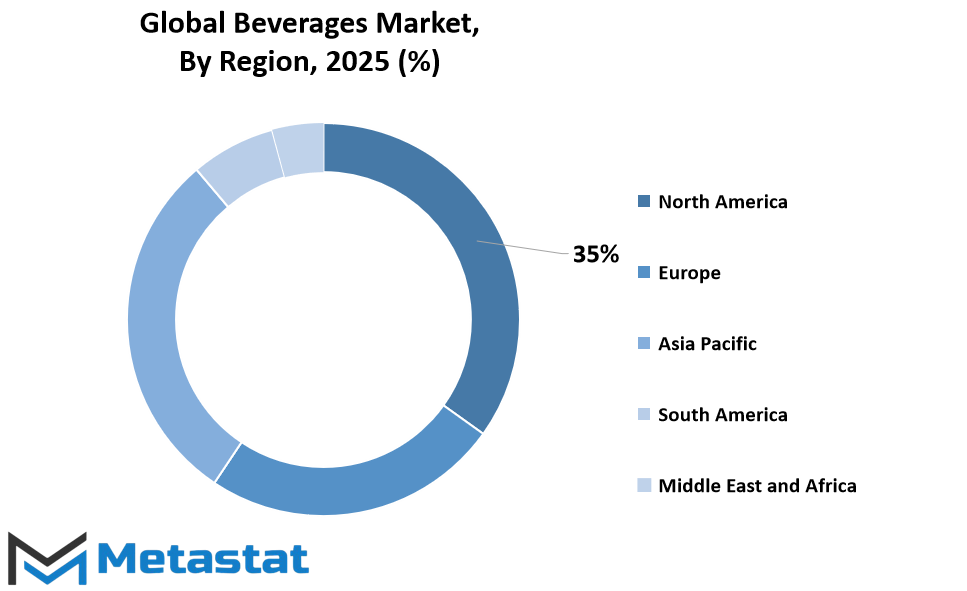

The global beverages market is expected to experience significant changes in the coming years as different regions continue to shape its progress. This market is influenced by changing consumer preferences, technological advancements, and efforts from companies to adapt to local tastes and health trends. Based on geography, the global beverages market is divided into key regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region plays a unique role in shaping the future of this industry through its population trends, cultural habits, and economic conditions.

North America, which includes the U.S., Canada, and Mexico, is likely to continue leading innovation in the market through the introduction of healthier drink options and environmentally friendly packaging solutions. The demand for low-calorie, sugar-free, and plant-based beverages is expected to increase as health awareness grows. In addition, the influence of technology, such as AI-driven production and supply chain methods, will support the growth and efficiency of this market across the region.

Europe, covering the UK, Germany, France, Italy, and the Rest of Europe, will remain a strong player through its focus on sustainability and tradition. European consumers have shown consistent interest in natural and organic beverage options. Governments in this region are also expected to introduce more regulations concerning packaging and sugar content, which will push companies to rethink their strategies. Innovations in flavor and sustainable sourcing will likely become standard expectations in the years ahead.

The Asia-Pacific region, which includes India, China, Japan, South Korea, and the Rest of Asia-Pacific, is projected to witness the fastest growth due to its large population, rising incomes, and changing lifestyles. Consumers here are increasingly drawn to functional beverages that promise health benefits beyond hydration. The rise of e-commerce and urbanization will also support the expansion of the global beverages market in this area, with companies adjusting their products to suit local preferences.

South America, with countries like Brazil, Argentina, and the Rest of South America, is gradually adopting trends seen in North America and Europe. However, the region’s strong traditions in beverages like coffee and fruit juices will continue to shape its future market. Companies will likely focus on blending these traditions with modern health-conscious trends.

In the Middle East & Africa, including GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, the market will grow as consumers look for premium and health-focused options. Economic development and tourism will further influence consumption patterns, offering fresh opportunities for global and local players.

COMPETITIVE PLAYERS

The global beverages market is expected to see consistent growth in the future as consumer preferences continue to shift alongside advancements in production and marketing strategies. People are becoming more aware of what they consume, and this awareness is shaping how beverage companies design, market, and distribute their products. There is a noticeable rise in demand for beverages that align with healthier lifestyles, offer functional benefits, or cater to specific dietary needs. This change is pushing companies to rethink their product lines and bring innovation to the forefront. The competition in the global beverages market will likely become more intense as companies seek to meet these evolving demands while also maintaining brand loyalty.

Key competitive players are focusing on more than just expanding their product range. They are also making efforts to enhance sustainability, reduce environmental impact, and improve supply chains to stay ahead. Nestle SA, PepsiCo, Inc, and The Coca-Cola Company are already recognized for their global influence and strong product portfolios. Their continued investments in research and development, along with strategic partnerships, show their commitment to staying competitive. Companies like Anheuser-Busch InBev and Heineken NV are also adapting to changing consumer trends by exploring non-alcoholic options and beverages with lower sugar content. This shift suggests a future where the global beverages market will offer even more diverse choices to consumers.

Other key players such as Diageo plc, Suntory Holdings Limited, and Constellation Brands, Inc are focusing on premium segments and unique flavors to appeal to consumers looking for new experiences. The strategy of targeting niche markets may help them capture attention in a space that is becoming increasingly crowded. Meanwhile, Red Bull GmbH and Monster Beverage Corporation remain strong in the energy drinks segment, continuously refining their marketing efforts to attract younger demographics. Companies like Danone and Unilever are looking towards health-focused innovations, pushing forward with products that support hydration and wellness.

Moving forward, the global beverages market will likely see more collaboration between competitors, technology providers, and health experts. These partnerships could lead to breakthrough products that better align with future consumer expectations. This competitive environment benefits consumers through more variety and better-quality options. As technology continues to influence production, packaging, and distribution, companies that adapt quickly will be better positioned to lead. The global beverages market is shaping into a space where innovation and adaptability will define long-term success, and the competitive players mentioned will likely play a key role in shaping this future.

Beverages Market Key Segments:

By Alcoholic Beverages

- Beer

- Wine

- Spirits

By Non-Alcoholic Beverages

- Energy & Sports Drink

- Soft Drinks

- Bottled Water

- Packaged Juice

- RTD Tea and Coffee

- Others

By Distribution Channel

- On-trade

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Other Off Trade Channels

Key Global Beverages Industry Players

- Nestle SA

- PepsiCo, Inc

- The Coca-Cola Company

- Anheuser-Busch InBev

- Heineken NV

- Diageo plc

- Suntory Holdings Limited

- Constellation Brands, Inc

- Red Bull GmbH

- Keurig Dr Pepper

- Monster Beverage Corporation

- Danone

- Unilever

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252