MARKET OVERVIEW

The global feed premixes market, positioned within the broader animal nutrition and feed additives industry, will establish itself as a distinct segment shaped by innovation, strategic reformulation, and scientific precision. This market will not be a simple extension of traditional livestock feed production; rather, it will act as a critical layer of formulation in the commercial animal husbandry landscape. Feed premixes carefully measured blends of vitamins, minerals, amino acids, and other micro-ingredients will no longer serve as supplementary additions but will become the very foundation of consistent, quality-controlled feed solutions.

As production practices continue to shift toward performance optimization and disease mitigation, the global feed premixes market will begin to absorb a more technical, data-informed character. Formulators will no longer rely on broad-spectrum approaches. Instead, they will engineer blends with targeted precision adjusting trace minerals to match the physiological needs of different species and their developmental phases. Such customization will not be dictated by ingredient availability alone, but rather by insights derived from metabolic modeling, animal bioscience, and longitudinal health data.

Unlike the conventional feed manufacturing process, where bulk ingredients dominate formulation priorities, this market will draw attention to micro-level interventions. These premixes will be engineered not merely to meet nutritional baselines but to enhance digestibility, reduce feed conversion ratios, and support long-term animal resilience. As regulatory landscapes tighten around the use of antibiotics and growth promoters, feed premixes will step into that gap not as a substitute, but as a calculated response grounded in nutritional biochemistry and host-microbiome interaction.

The global feed premixes market will gradually outgrow its reputation as a commodity-driven business. It will become increasingly integrated with R&D pipelines, traceability protocols, and digital formulation tools. Nutrient density will no longer be seen as static; it will be responsive, adjusted in real time to account for factors such as regional ingredient quality, climate variation, and even pathogen resistance trends. These shifts will not be confined to high-output livestock operations. Smallholder producers and emerging economies will also begin to adopt modular premix strategies, enabled by scalable technologies and decentralized production models.

As the market continues to develop, competition will not be based solely on pricing or volume. Instead, differentiation will occur in terms of formulation agility, trace element bioavailability, and inclusion of novel functional ingredients. Companies will need to prove not just efficacy, but alignment with ethical sourcing, lifecycle carbon tracking, and animal welfare standards. The value of a premix will lie in its measurable outcomes improved calving intervals, reduced mortality, optimized egg shell integrity not just its cost per metric ton.

In this evolving context, the global feed premixes market will no longer be viewed as an auxiliary input. It will stand as a strategic enabler, poised to shape the future of how feed is developed, evaluated, and delivered. Its role will not be reactive. It will be proactive, foundational, and central to the transformation of animal nutrition systems worldwide.

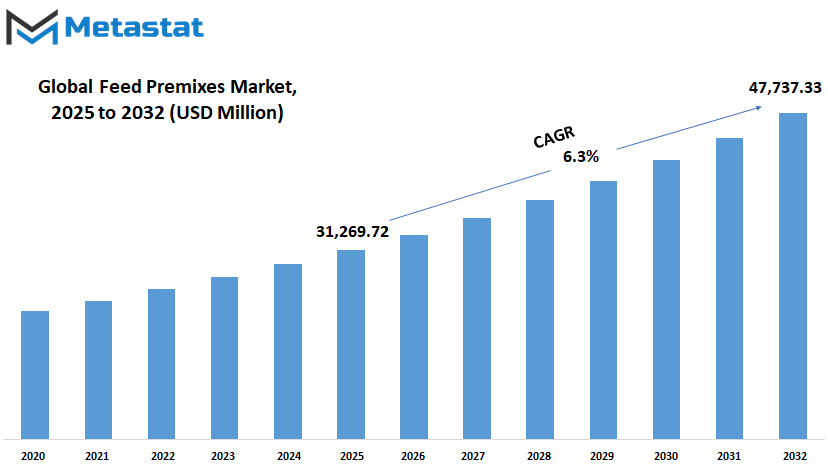

Global feed premixes market is estimated to reach $47,737.33 Million by 2032; growing at a CAGR of 6.3% from 2025 to 2032.

GROWTH FACTORS

The global feed premixes market is expected to grow steadily over the coming years due to several important factors. As the demand for animal protein continues to rise, especially in developing regions, livestock farming will keep expanding. This growth in livestock numbers directly increases the need for feed premixes, which are essential in boosting animal health and productivity. Farmers are becoming more aware of how important nutrition is for animal performance, and feed premixes offer a convenient and efficient way to meet these nutritional needs. This awareness will keep pushing the market forward.

Government support and the tightening of regulations around food safety will also play a strong role. Authorities in many countries are promoting better livestock management practices, including the use of feed premixes that meet quality and safety standards. As a result, feed manufacturers will likely continue improving their formulations to ensure compliance and maintain a competitive edge. In the future, innovations such as tailored premixes designed for specific breeds or growth stages could become more common, giving producers even better control over livestock health.

On the other hand, the market does face some challenges. Fluctuating prices of raw materials can affect production costs, making it difficult for small and medium-sized manufacturers to compete. The limited availability of high-quality ingredients can also be a barrier. In addition, there is still a gap in awareness among smaller farmers in rural areas, where traditional feeding practices are deeply rooted. These factors might slow down the spread of feed premixes in some regions.

However, technological advances and growing interest in precision farming could open up fresh opportunities for the global feed premixes market. Tools that allow for more accurate feeding and monitoring will make it easier to use premixes effectively, even in areas where they are not widely adopted today. Also, as climate change pushes for more sustainable farming practices, feed premixes designed to improve efficiency and reduce environmental impact could become more popular. Manufacturers that focus on developing eco-friendly and cost-effective products will be better positioned to succeed in the future.

Overall, while there are certain roadblocks, the global feed premixes market has strong potential for growth. With changing consumer habits, improved awareness, and the promise of future innovations, the market is likely to expand in both scale and reach. Companies that can adapt to shifting demands and offer high-quality, targeted solutions will stand out in the years ahead.

MARKET SEGMENTATION

By Ingredient Type

The global feed premixes market is expected to grow steadily in the coming years as the demand for efficient and balanced animal nutrition continues to rise. Farmers and producers are becoming more aware of the benefits that feed premixes bring to animal health, productivity, and overall farm profitability. As the focus on food quality and safety strengthens across different regions, the role of feed premixes is becoming more important than ever. These blends are carefully designed to improve the quality of animal feed, ensuring animals receive essential nutrients in precise amounts, which in turn supports their growth and overall well-being.

By ingredient type, the global feed premixes market is segmented into amino acids, vitamins, minerals, antibiotics, antioxidants, and others. Each of these ingredients plays a unique role in animal nutrition. Amino acids help in muscle development and improve feed efficiency, making them a key part of high-performance livestock diets. Vitamins are crucial for immunity and growth, and their balanced presence in feed can prevent several health issues. Minerals support bone development and metabolic functions, which are necessary for the proper growth of animals. Antibiotics, while used with caution, still serve an important role in disease prevention and maintaining herd health. Antioxidants help protect cells from damage, increasing the shelf life of feed and promoting animal longevity. Other ingredients often include enzymes and probiotics, which improve digestion and nutrient absorption.

Looking ahead, the market is expected to respond to changing consumer preferences, stricter regulations, and advances in feed technology. Countries are pushing for more sustainable farming practices, and feed premixes will play a role in helping farms lower their environmental footprint. Innovations in biotechnology may lead to more customized premixes tailored to specific animal needs or farming systems. As farming operations become more data-driven, feed solutions will likely be optimized using real-time information from smart systems. This shift will open doors to more precise feeding strategies, where every nutrient serves a targeted purpose.

The demand for quality meat, dairy, and other animal products is not slowing down, especially in growing economies. This increasing demand puts pressure on farmers to produce more with limited resources, and feed premixes offer an effective solution. In the future, it’s likely that the global feed premixes market will become even more essential in supporting safe, efficient, and responsible animal farming across the world.

By Form

The global feed premixes market is gradually shaping the future of animal nutrition. As the demand for better quality meat, milk, and eggs continues to rise, producers are beginning to rely more on feed premixes to enhance the overall health and productivity of livestock. These premixes are carefully prepared blends of vitamins, minerals, amino acids, and other nutrients that animals need but may not get from basic feed alone. Their purpose is simple to make sure that animals grow healthier and faster, which in turn helps meet the rising food needs of a growing population.

When looking at the market by form, it is divided into dry and liquid premixes. Dry premixes are currently more common because they are easier to store, mix, and transport. They have a longer shelf life and are generally more stable under different conditions. Farmers prefer them for their convenience and consistent results. However, liquid premixes are gaining attention. Although they are less widely used at the moment, they have potential advantages. They allow for faster absorption in some cases and can be mixed directly into water or feed with precision. As technology develops and handling systems improve, more producers will likely explore liquid options, especially for large-scale operations where efficiency matters most.

Looking forward, the global feed premixes market will see growth driven by innovation and the push for more sustainable farming. With concerns about antibiotic resistance and animal welfare, more attention is being placed on the ingredients animals consume. Feed premixes will play a bigger role in addressing these issues. They will not only help in improving the health of animals without relying heavily on antibiotics but also in reducing the overall environmental footprint of animal farming. As countries set higher standards for animal products, feed manufacturers will focus on improving the quality and safety of their premixes.

Digital tools will also shape how feed premixes are used in the future. Smart farming technologies will allow farmers to monitor the health and nutritional needs of their animals in real-time, adjusting premix use accordingly. This means feed plans can be more tailored, reducing waste and improving output. Though dry forms are likely to stay in demand, liquid options may grow faster if they prove to be more effective in precision farming methods. In the years ahead, the global feed premixes market will remain a key part of how the world meets its food needs in a cleaner, more efficient way.

By Animal Type

The global feed premixes market will continue to grow steadily as the demand for efficient animal nutrition expands around the world. As the population grows, so does the need for more sustainable food production, especially protein sources such as meat, milk, and eggs. This rising demand places pressure on the livestock industry to improve productivity, which leads to an increased need for better quality animal feed. Premixes, which are a blend of essential nutrients like vitamins, minerals, amino acids, and other additives, play a crucial role in enhancing animal health and performance. Their use helps maintain consistent growth, immunity, and reproduction in animals.

Looking at the future, the market is expected to be shaped strongly by innovations in animal nutrition and advances in farming practices. The push for safer and more natural feed solutions will continue as people become more aware of food safety and the use of antibiotics in animal feed. This shift encourages feed manufacturers to explore new ways to boost animal health without relying heavily on chemicals. Premixes offer a balanced and controlled method of delivering nutrients, which will help reduce waste and improve feed efficiency.

By animal type, the global feed premixes market is divided into ruminant feed, poultry feed, swine feed, and others. Ruminant feed, which supports animals like cows and sheep, will likely see growth driven by the need to improve milk and meat yield. Poultry feed, on the other hand, remains a strong part of the market as chicken meat and eggs are some of the most widely consumed animal products worldwide. The poultry sector will benefit from targeted premix formulas that support faster growth and stronger immune systems. In the case of swine feed, changes in consumer eating habits and increasing pork demand in certain regions will push the need for improved feed quality. Other segments, which include pets and aquatic animals, will grow as well, thanks to a growing focus on pet nutrition and fish farming.

Looking ahead, the market will benefit from precision farming techniques, improved tracking of animal health, and rising digital solutions in agriculture. All of these developments will support better decision-making and the smarter use of premixes. As farmers and feed companies look for ways to reduce costs while improving results, the role of high-quality premixes will only become more important. These trends make it clear that the global feed premixes market will be a vital part of the future of animal farming.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$31,269.72 million |

|

Market Size by 2032 |

$47,737.33 Million |

|

Growth Rate from 2025 to 2032 |

6.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

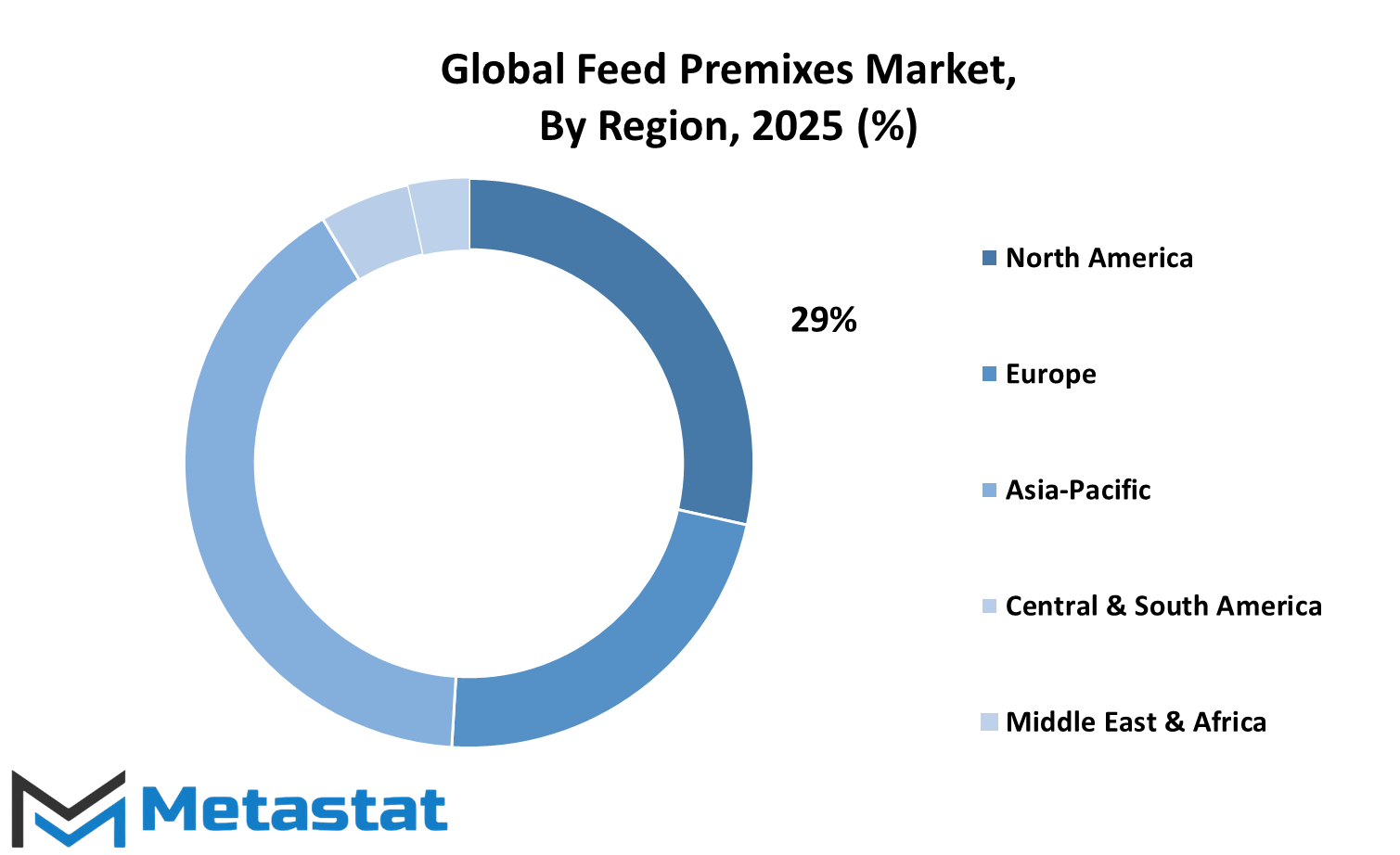

The global feed premixes market is shaped by a wide range of regional influences, each contributing uniquely to its future direction. Looking ahead, the role of geography in the development and expansion of this market cannot be underestimated. North America, led by the United States, Canada, and Mexico, will likely remain a key area due to its strong agricultural systems and the steady demand for high-quality livestock nutrition. As livestock farming practices continue to modernize, this region is expected to invest more in customized feed solutions, making feed premixes a growing priority.

Europe, which includes countries like the UK, Germany, France, Italy, and others, shows a growing interest in sustainable farming. With regulations favoring animal welfare and safe feed production, this region will likely focus on innovation and strict quality standards in feed premix use. As farmers aim to balance productivity with environmental responsibility, demand for efficient premix solutions will rise, especially in countries pushing for greener farming practices.

In Asia-Pacific, which includes India, China, Japan, South Korea, and other nearby countries, the market is set to grow rapidly. Rising population and growing meat consumption are creating strong demand for better livestock feed. Countries like China and India will likely become central to this market due to their large agricultural base and increasing efforts to improve animal health. As more producers in the region adopt new methods and technology, feed premixes will become an essential part of boosting animal nutrition and overall output.

South America, including Brazil, Argentina, and surrounding areas, holds great potential due to its large-scale farming and expanding meat exports. Brazil, in particular, will continue to drive growth as it strengthens its presence in the global meat industry. With the need to meet both domestic and international standards, producers in the region will rely more on feed premixes to ensure the health and performance of livestock.

In the Middle East and Africa, the market is developing steadily. Countries such as those in the GCC, along with Egypt and South Africa, are showing increased interest in improving animal farming methods. Although still growing, this region is expected to see higher adoption of feed premixes as demand for quality food products rises and investment in agriculture increases.

Overall, every region has a different starting point, but they all point toward a future where the global feed premixes market will become more vital to meeting food demands, supporting animal health, and adapting to changing environmental and consumer needs.

COMPETITIVE PLAYERS

The global feed premixes market is set to grow steadily in the years ahead, driven by rising awareness of animal health, better nutrition standards, and the need for sustainable livestock production. With growing demand for meat, dairy, and other animal-based products, there is a strong push toward improving the overall quality of animal feed. This market is expected to play a critical role in shaping how the agricultural and livestock industries adapt to the nutritional demands of animals, ensuring that producers meet both quantity and quality expectations.

The companies leading this shift include names like Cargill, DSM (dsm-firmenich), ADM (Archer Daniels Midland Company), BASF, and Nutreco. These companies are not only expanding their manufacturing capacity but also investing in research to create more efficient and tailored feed solutions. Many of them are focusing on ways to enhance digestion, improve immunity, and reduce the environmental impact of animal farming. For example, advancements made by Evonik Industries and Lallemand Animal Nutrition focus on targeted solutions that support gut health and promote growth, which may soon become the standard across the industry.

Other significant contributors such as Alltech, Kemin Industries, and Charoen Pokphand Foods are actively reshaping how nutrition is delivered to animals, using innovative blends of vitamins, minerals, amino acids, and enzymes. With growing global pressure to reduce antibiotic use in animal farming, these players are stepping in to fill the gap with alternatives that support health naturally. Companies like De Heus Animal Nutrition and Land O’Lakes are expected to expand into new regions, particularly in Asia and Africa, where growing populations are demanding more animal protein.

As the focus shifts toward sustainable practices, companies like Agrofeed Ltd., Novus International, and Zinpro Corporation are working on solutions that lower emissions and make better use of resources. These innovations are not just short-term adjustments but signals of what the future of animal nutrition will look like. There is a growing trend of using technology, such as data analysis and automation, to deliver precise feed premixes that adapt to the changing health needs of animals.

In the long run, the global feed premixes market will likely be shaped by how well these companies respond to environmental, economic, and ethical concerns. Their ability to balance innovation with affordability and accessibility will determine their success in this expanding market.

Feed Premixes Market Key Segments:

By Ingredient Type

- Amino Acids

- Vitamins

- Minerals

- Antibiotics

- Antioxidants

- Other

By Form

- Dry

- Liquid

By Animal Type

- Ruminant Feed

- Poultry Feed

- Swine Feed

- Other

Key Global Feed Premixes Industry Players

- Cargill

- DSM (dsm-firmenich)

- ADM (Archer Daniels Midland Company)

- BASF

- Nutreco

- Evonik Industries

- Lallemand Animal Nutrition

- Alltech

- Kemin Industries

- Charoen Pokphand Foods

- De Heus Animal Nutrition

- Land O’Lakes

- Agrofeed Ltd.

- Novus International

- Zinpro Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252