MARKET OVERVIEW

Silane-modified polyethers (SMPE) is the versatile group of hybrid polymers as they incorporate some properties from polyethers and are modified by incorporating silane groups in them. Owing to remarkable adhesion with different surface types, their importance increased in those areas of industries where usage of adhesives, sealants, and coatings is predominant. They have made their mark just because of possessing water-resistant features and longer durability which provide long-standing and dependable working for all applications.

The finest adhesive property of SMPE is its excellent adhesion capabilities. These polymers can bond through surfaces or environments that traditional adhesives find challenging. This makes them invaluable in the construction and automotive industries where the best possible structural integrity and performance demand firm and reliable adhesiveness. Furthermore, their ability to cure in the presence of moisture adds to their practicality because they can be used in any setting where other adhesives might fail.

Another importance of silane-modified polyethers is their resistance to water. Such polymers are usable in applications in which they inevitably contact moisture, for example, outdoor construction or marine environments. These polymers prevent deterioration over time and maintain the strength of the bond, thus keeping the materials they hold together securely attached.

Another characteristic of SMPE is its high durability. These polymers are formulated for harsh environments, including temperature cycles, UV exposure, and mechanical stress. Thus, these polymers would be excellent for demand applications where reliability over long periods of time is critical. This is especially relevant in industrialized settings where these polymers can maintain their properties under harsh conditions with less need for repair and replacement.

The silane-modified polyethers are also eco-friendly. Unlike some traditional materials, polymers often have lower levels of VOCs, making them safer and more environmentally responsible. It is an important factor in modern industries, where sustainability and health concerns increasingly play a role in material selection.

Silane-modified polyethers represent a unique and highly effective option in adhesives, sealants, and coatings. Their excellent adhesion, water resistance, and durability make them indispensable in a broad industrial spectrum with respected applications demanding both performance and longevity.

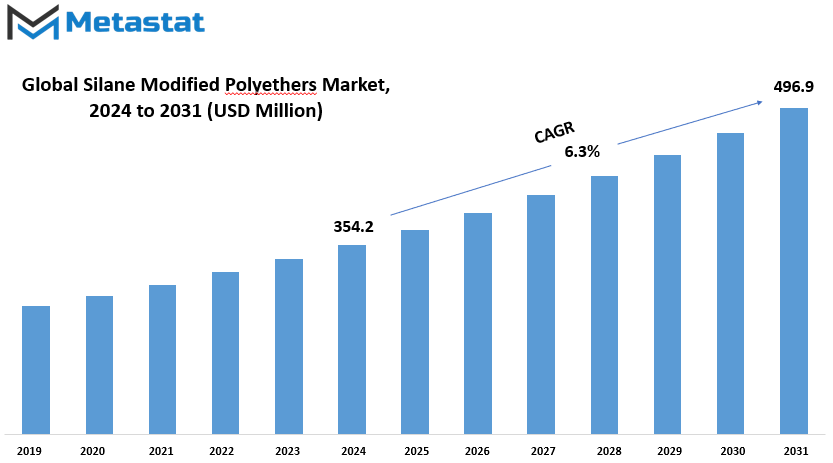

Global Silane Modified Polyethers market is estimated to reach $496.9 Million by 2031; growing at a CAGR of 6.3% from 2024 to 2031.

GROWTH FACTORS

Demand in the construction and automobile sectors is giving strong interest in high-performance adhesives and sealants. These product forms are in demand within industries that increasingly require items having durability, flexibility, and strong adhesion performance in order to meet contemporary demands for engineering and design applications. At the same time, there is a move towards the use of industrial application products that are eco-friendly and low-VOC products. This trend aligns with the global efforts of reducing environmental impact and meeting stringent regulations on emissions and sustainability, making these products a first choice for businesses seeking to improve their green credentials.

However, despite these encouraging trends, there are several factors that may impede the growth of the market. One of the major challenges is the relatively high production cost of SMPEs. The complexity of manufacturing, requiring advanced technical skills, makes these materials fairly expensive. Also, the understanding and adoption in certain parts of the world is negligible due to limited technical awareness or familiarity with these materials, which can cause delays for the market expansion in parts of the region dominated by these traditional materials.

Still, here are some considerable opportunities that appear on the SMPE's horizon. The increasing demand for sustainable, environmentally friendly, and long-lasting sealants in both the construction and automotive sectors clearly shows that there is an emerging need for advanced materials that are not only effective but also environmentally responsible. With industries increasingly focusing on durability and eco-friendliness, SMPEs are already geared to meet these demands. The companies that invest in development activities to make manufacturing processes better and cheaper will be best suited to lead this booming sector.

During the next couple of years, due to heightened interest in sustainability and improvement in technology, it may become a profitable opportunity for SMPEs. Improved understanding of their utility combined with the increasing demand of applications in construction and automobile sectors may lead to promising development. The cost and technical know-how issues may be tackled with education and innovation for better harnessing of this market with the assurance of steady growth.

MARKET SEGMENTATION

By Type

Polyether-Modified Silane and Polyurethane-Modified Silane are two of the most significant types in their respective applications. The categories have different characteristics and uses, making them useful in various industrial processes. The difference between the two is that of composition and the particular properties that each offers, which satisfies different needs across fields.

Polyether-Modified Silane is flexible and has superior adhesion properties. It is especially valued due to its durability and resistance to weathering, which makes it a good choice in constructions and sealant applications. The versatility of bonding into many surfaces ensures that results can be achieved in specific projects requiring long-lasting work. Moreover, its chemical makeup makes it possible to get effective performance without compromising environmental requirements, which makes it relatively more sustainable in some applications.

On the contrary, Polyurethane-Modified Silane highlights strength and elasticity. This version is commonly used in applications where toughness and elasticity are required. Its composition allows it to resist dynamic stresses and movement and is, therefore, appropriate for applications where materials need to be of high performance and last long. The resistance to moisture further expands its application where otherwise moisture exposure would have damaged the integrity of the material.

Both types are highly used since they are compatible with the demands of modern needs in different sectors. Their efficiency does not only depend on their direct performance but also on how they can be used under changing conditions. In providing unique advantages, they give manufacturers and developers the choice of selecting the most appropriate option to suit their needs. There is always a reliable solution available to suit any challenge, which is consistent with the technical and practical demands.

In conclusion, Polyether-Modified Silane and Polyurethane-Modified Silane are two different products but share the same objective of providing quality performance. Their tailored properties make them indispensable in their respective roles, providing durability, flexibility, and strength where needed. As industries continue to evolve, the importance of these types will remain integral to achieving reliable and efficient outcomes. Their presence reflects a commitment to innovation and quality, ensuring that diverse needs are met with precision and effectiveness.

By Application

The application of materials and technologies largely contributes to different industries, reflecting in themselves the practical uses for such everyday life. The application segments the market into sectors Building & Construction, Transportation, Automotive, Industrial Assembly, among Others. Each sector has varying demands that drive innovation as materials evolve to meet performance criteria, leading to optimization efficiency.

Building & Construction products focus on durability, cost-effectiveness, and environmental sustainability through materials and technologies. Whether through adhesives used for bonding structural elements to sealants ensuring weather resistance, the segment thrives on the basis of products that enhance safety and functionality. Rapid urbanization and infrastructure growth have made these materials integral, ensuring buildings stand the test of time and environmental challenges.

Similarly, transportation heavily relies on advanced materials to improve fuel efficiency and safety. Lightweight composites are used in modern vehicles to reduce weight without weakening them. This approach not only helps improve energy efficiency but is also in line with global efforts to reduce emissions.

This reflects an automotive emphasis on performance and comfort enhancement innovations. Adhesives and sealants are especially significant here in bonding together the different parts and enhancing strength and durability, while the same processes that reduce the production complexity have to improve the smooth ride of a vehicle and longevity as well.

Industrial Assembly promotes the aspects of precision and reliability. Here, materials have been engineered to fulfill the standards required, such that equipment works with machines. The concentration is made on products to be resilient at aggressive conditions but maintain functionality. These sectors are a basis; solutions are produced to empower industrial manufacturing processes across industries.

The "Others" category has a wide variety of applications, which reflects the diversity in the needs of modern markets. From consumer electronics to customized equipment, this category, therefore, is a practical example of how materials can be shaped to meet specific challenges and possibilities.

Ultimately, that the market is divided into different sectors shows that industries shape their approach according to demand. Each application drives innovation, ensuring material is designed to enhance the functionality, sustainability, and efficiency of the final product. Focusing on specific needs could help industries deliver solutions better suited to improve quality of life, support economic growth, or contribute to a more sustainable future. This structured approach in using resources ensures that both companies and society at large win.

By End-User Industry

The market dynamics of different industries are determined by their specific requirements and applications. Among the most popular ways of categorizing markets is by end-user industries, which are critical for determining the direction of product development and service offerings. The sectors of construction and building, automotive, electronics and electrical, aerospace, among others, are some of the biggest influencers of trends and developments. This understanding serves to open insights into what fosters growth and innovation within each of these segments. The construction and building industry largely depends on materials and solutions that provide durability, cost-effectiveness, and environmental sustainability. The products in this sector need to meet the high standards of safety and respond to the increasing focus on green building practices. The contribution of this industry is not limited to physical structures, but it also supports economic development and urbanization efforts worldwide. Companies serving this sector are focused on developing innovative solutions for meeting the ever-growing demand for infrastructure, housing, and commercial spaces.

The automotive industry focuses on efficiency, safety, and sustainability. This industry is always demanding materials and technologies that can meet the requirements of electric vehicles, lightweight construction, and advanced safety systems. It's a fast-moving and extremely competitive market, and only manufacturers and suppliers who offer cutting-edge technologies can get ahead. As consumer preferences shift to eco-friendly and connected vehicles, the automotive industry has emerged as a catalyst for technological breakthroughs.

Electronics and electrical industries, however, are based on precision and reliability. Innovations in consumer electronics, industrial applications, and power generation systems are led by this industry. Miniaturization, energy efficiency, and connectivity are critical factors guiding this market. The demand for smarter devices and efficient energy solutions makes this sector an indispensable part of modern living and industrial progress.

The aerospace industry is highly focused upon safety performance with a reduction in environmental impact. Its demands good quality material that can withstand extreme conditions while ensuring reliability. Such a sector contributes heavily towards global connectivity and defense systems demanding non-stop advancement toward greater technological and regulatory standards.

The other industries include healthcare, packaging, and textiles. Each has specific needs and challenges that require unique products and solutions to achieve growth and meet market demands effectively.

Through the analysis of these industries, it becomes clear how diverse needs open up opportunities for innovation and development. Each sector pushes boundaries to cater to its unique requirements, ultimately driving progress across markets.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$ 354.2 million |

|

Market Size by 2031 |

$496.9 Million |

|

Growth Rate from 2024 to 2031 |

6.3% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL SEGEMENTATION

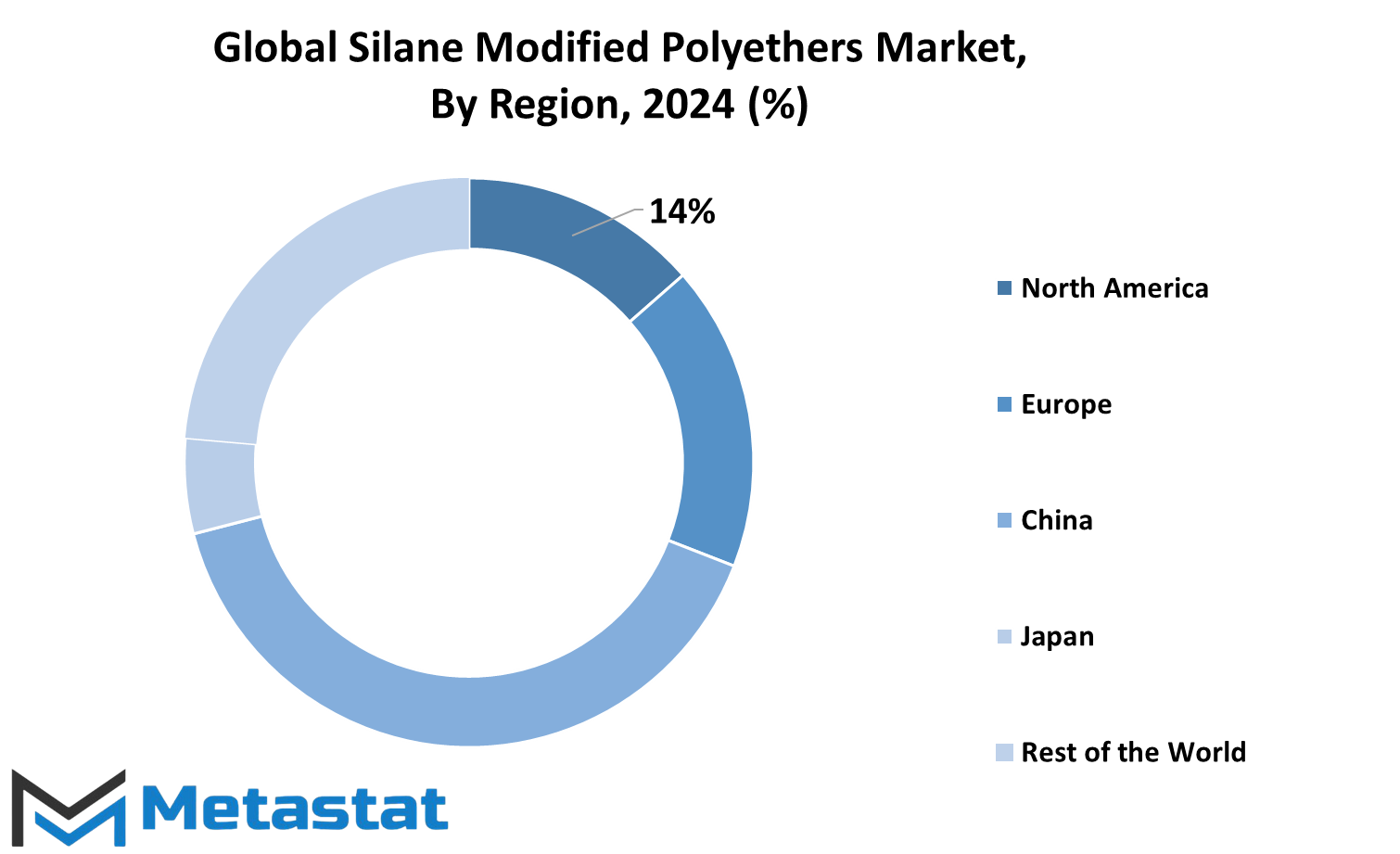

The Silane Modified Polyethers market can be divided into regions, all of which have contributed uniquely to the global industry landscape. North America covers the United States, Canada, and Mexico, where advances in construction and automotive industries have been driving demand for high-performance sealants and adhesives. These products, generally formulated with Silane Modified Polyethers, are increasingly used because of their durability and versatility in a variety of applications. Europe is roughly synonymous with the UK, Germany, France, Italy, and Rest of Europe-all important contributors to the overall move toward more innovative and productive materials in the building and manufacturing sectors.

The Asia-Pacific region is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. Industrialization and urbanization are on a very high growth curve in this region, which contributes to increased development of infrastructures and consumer goods. Since the economies are increasing, there will be an increase in demand for advanced materials like Silane Modified Polyethers, with superior properties that are well-suited to different climatic conditions.

Inclusions in South America include the expansion in construction and industrial applications in countries such as Brazil and Argentina and other parts of South America. These contain segments of Silane Modified Polyethers for waterproofing and bonding applications, answering the burgeoning requirement for resilient infrastructure solutions in that region. Other good prospects reside in Middle East & Africa, which once more can be broken down into segments: GCC Countries, Egypt, South Africa, and then the Rest of Middle East & Africa. The construction and investments in industrial projects boom required the need for efficient as well as flexible materials including Silane Modified Polyethers. Every region has its market dynamics influenced by economic conditions, industrial growth, and regulatory frameworks.

All these factors shape the adoption and application of Silane Modified Polyethers, which are necessary to overcome regional challenges and opportunities. It thus not only reflects the geographical influence of this market but also its adapted strategies to cater to varied local needs. As industries look for the need to create sustainable and innovative materials, further growth in the Silane Modified Polyethers market has scope across these varied geographies.

COMPETITIVE PLAYERS

The Silane Modified Polyethers industry is characterized by its huge contributions to different sectors, which are driven by the innovations of key players in terms of meeting market demands. Wacker Chemie AG, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., and Sika AG are some of the major companies in this field. Each of these organizations brings its expertise to the table, ensuring the development of versatile materials that cater to a wide range of applications. Their advances play a very important role in enhancing the performance, durability, and environmental compatibility of products.

Dow Inc. is one of the leaders in the industry, especially in terms of innovation, where it develops solutions that answer both immediate needs and future problems. The same goes for Evonik Industries AG and 3M Company, where their distinct approaches to material science continually expand the applications of silane-modified polyethers. Their dedication to research and development is what keeps the products relevant in a competitive market.

Companies such as Asahi Kasei Corporation and Arkema Group have also achieved great success in terms of the improvement of the production processes and applications of these materials. They integrate advanced technologies to provide solutions in accordance with the growing demand for efficiency and sustainability. Daikin Industries Ltd. and Mitsubishi Chemical Corporation enhance the industry landscape further through the delivery of high-quality products tailored to specific needs, ensuring that customer requirements are met with precision.

Covestro AG and Elkem ASA are contributing to the industry's growth through their comprehensive understanding of material applications and innovative practices. The efforts of these companies lay a focus on solutions that work effectively but also concern environmental issues, showing their commitment to sustainability. They further support the development by investing in cutting-edge research and strong industry ties, keeping on the path to creating new advancements for manufacturers and end-users alike.

Together, these industry leaders keep the Silane Modified Polyethers sector vibrant and responsive to global needs. Through continuous quality, innovation, and customer satisfaction, they create a future in which these materials are vital parts of various applications. Their combined efforts demonstrate the role of collaboration and innovation in the growth of the sector and the challenge of keeping up with an ever-changing market.

Silane Modified Polyethers Market Key Segments:

By Type

- Polyether-Modified Silane

- Polyurethane-Modified Silane

By Application

- Building & Construction

- Transportation

- Automotive

- Industrial Assembly

- Others

By End-User Industry

- Construction & Building

- Automotive

- Electronics & Electrical

- Aerospace

- Other Industries

Key Global Silane Modified Polyethers Industry Players

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Dow Inc.

- Evonik Industries AG

- 3M Company

- Asahi Kasei Corporation

- Arkema Group

- Daikin Industries Ltd.

- Mitsubishi Chemical Corporation

- Covestro AG

- Elkem ASA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252