MARKET OVERVIEW

The global sexually transmitted diseases testing (STDs) market hence tends to remain an important part of healthcare and addresses the requirement of diagnostic methods that are accurate and efficient. In a nutshell, it identifies the sex-related contagious infection-testing market that plays an important role in the healthcare industry. It fulfills the increasing need for accurate and early detection of those kinds of infections. Awareness is increasing diagnostic technology advancements-and the creation of affordable and reliable testing options is dramatically raised. Governments, healthcare organizations, and private institutions work collaboratively to improve testing and treatment so that timely diagnosis can be made. More than that, a whole lot more emphasis would be on new ways of developing convenience, accuracy, and affordability.

The catchment area seems to have changed, as well, when it comes to SD testing in the past couple of years. Traditional lab methods require samples to be sent to central facilities; however, such methods are gradually being replaced by point-of-care testing. As a result, people can get tests done more quickly, bypassing the long waits incurred using typical methodologies, which delay treatment initiation. Adding self-testing kits helps widen access even further because an individual can take a test right in their home. With these developments, one expects the divide with health facilities having limited access to diagnostic services to be bridged.

As evident, digital health offers a growing array of solutions within the Global Sexually Transmitted Disease Testing (STDs) market. Digital telemedicine and mobile applications are crucial in linking patients to health professionals, rendering the testing and treating process smoother. Most of these platforms have entered into agreements with several health facilities in multiple locations to facilitate access to their consultations, result interpretation, and prescription services without traveling to visit health centers. Integration of artificial intelligence in diagnostic tools is also subject to exploration; algorithms guide in results analysis and reduce human error during interpretation.

Notwithstanding technological advances that eventually come with public health efforts, these particular two gatekeepers are said to be contributors of considerable change to current STD testing practices. Well-designed awareness campaigns, educational programs, and subsidized testing options are instituted by both governments and non-profit organizations, which aim at encouraging routine screening among high-risk groups and eroding the stigma associated with sexually transmitted infections. Engagement of health providers in partnership with advocacy groups presses a more proactive access to STD management, emphasizing prevention, rather than the usual modality involving early detection.

In conclusion, regulatory policies are expected to influence the global sexually transmitted diseases testing (STDs) market inwardly. When the countries are strengthening the guidelines for diagnostic accuracy and reliability, then the standards to be followed by the manufacturer will be strict, as they will require that their products satisfy high-quality benchmarks concerning such standards.

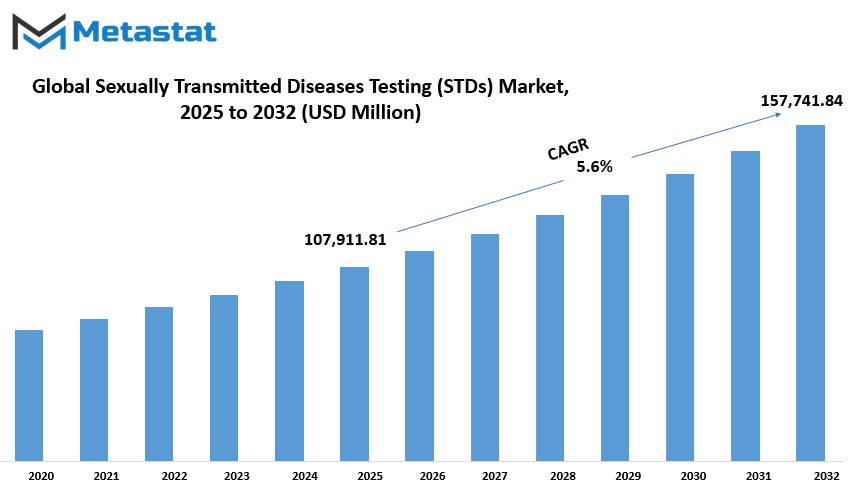

Global sexually transmitted diseases testing (STDs) market is estimated to reach $157,741.84 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The global sexually transmitted diseases testing (STDs) market provides a public health intervention with diagnostic answers in timely detection and management. Several growth drivers and challenges characterize the global sexually transmitted disease testing (STDs) environment. The disturbances in STIs are an exponential factor in demand for early and precise testing. With much recent awareness coming into play regarding the consequences of untreated infections, the demand for reliable diagnostic solutions has increased.

This speed is partly fueled by public health campaigns and the initiatives of respective governments encouraging routine screening. Various organizations and health agencies continue to run campaigns aimed at creating awareness among the people about the advantages of timely testing, which aids in the early detection and treatment of infections and minimizes potential further transmission.

Aside from these increasing demands, there are some obstacles that remain on the way to the global sexually transmitted diseases testing (STDs) marketgrowth. Social stigma and doubts about privacy remain formidable obstacles in this regard, forcing many people to hideaway from testing service provision. Bias or being judged, even discriminated, often inhibit a person from facilitating their way into health facilities, thus witnessing a plethora of undiagnosed and untreated cases in the backdrop. Poor accessibility of testing in low-resource settings is another uphill task. The cost of testing in these regions is very high, there is little or no healthcare infrastructure to undertake such testing, and trained medical professionals are either unavailable or dissuaded from venturing into these remote areas.

Medical technology opens new horizons for the industrial sector. The very advent of home test kits and rapid point-of-care diagnostics has raised the bar for accessibility by allowing discreet and convenient alternatives to traditional forms. Such innovations allowed individuals to privately test themselves and receive fast results, which in turn reduces the necessity for them to visit health centers repetitively. With research and future investments in diagnostic solutions, the global sexually transmitted diseases testing (STDs) market shall witness increased growth for more effective and user-friendly options. Thus, the increased awareness, availability, and technological innovations to bring a paradigm shift in the healthcare system will largely decide the future of global STD testing.

MARKET SEGMENTATION

By Type of Testing

Sexually transmitted diseases still remain serious public health concerns, which is why demand for reliable testing solutions has further progressed over time. The global sexually transmitted diseases testing (STDs) market now takes into consideration the advancements in diagnostic technologies, ensuring that they detect the problem faster and more precisely in order to permit early treatment and management of infections.

There are different types of testing for sexually transmitted diseases, with each providing its own advantages and methods of application. One such segment under the ammunition of Nucleic Acid Amplification Tests (NAATs) stands tall among others valued at $45608.93 million because of its high sensitivity and specificity. It clearly defines the genetic material from the pathogens which will make the identification of infections very successful at early stages in the progress of the disease.

Enzyme-Linked Immunosorbent Assay (ELISA) plays a vital role in examining the antibodies or antigens aliases infections that these methods have successfully proved to be popular due to their routine screening. Rapid Diagnostic Tests (RDTs) provide quick results, quite often within minutes, and can be utilized at point-of-care where urgent decision-making is required. The serology test is used to detect the presence of antibodies in the blood, indicating that a past infection has occurred. This is beneficial especially in diagnosing those diseases that may present no immediate symptomatology.

Classical yet dependable methods to identify certain sexually transmitted infections include microscopy and culture testing. Here, samples are taken under a microscope for examination, or cultured into media that support the growth of the pathogens under controlled conditions for confirmation. Though these methods may take longer than newer ones for diagnosis, they still remain the gold standard in many clinical settings. Another major category is the Polymerase Chain Reaction (PCR) testing, which is used to make many copies of even minute amounts of DNA so that infection can be detected beyond every level of accuracy. PCR testing is used where bacterial and viral infections may be detected correctly when other tests fail.

Such diversity in the available testing methods allows health professionals to choose the most appropriate diagnostic method as per the specific patient's needs. Continued technology improvement, the global sexually transmitted diseases testing (STDs) market is likely to expand further in providing better solutions towards early diagnosis and timely treatment for improved public health outcomes. Public awareness and increased accessibility of testing would continue to sustain the world's efforts in controlling and minimizing the spread of sexually transmitted infections.

By Type of STDs

In the practice of public health, the global sexually transmitted diseases testing (STDs) market provides the necessary diagnostics for those in need of infection identification and management. The demand for testing is rising with increased awareness about STDs in the public and slowly becoming accepted by health systems responsible for early detection and treatment measures. The upgrades in medical technology are providing the diagnostic methods with greater accuracy and speed in order to further enhance patient care.

Different test methods are applied to different STDs, some requiring blood or urine sampling or swabbing from involved areas. The global sexually transmitted diseases testing (STDs) market has been segregated into an STD type-test HIV-related Chlamydia, Gonorrhea, Syphilis, Herpes Simplex Virus (HSV), Human Papillomavirus (HPV), Hepatitis B and C, Trichomonas, and other relatives Mycoplasma genitalium, and Lymphogranuloma Venereum (LGV, wherein each of these infections differ from each other in terms of diagnosis and treatment and cater a more expansive testing solution.

Public health campaigns and government initiatives are becoming important features to push for routine screenings. Many clinicians and organizations educate the public about the importance of early detection in prevention of complications and limitation of transmission. Home testing kits also enable individuals to check their status by themselves and with ease, thus increasing the number of persons tested.

Increased transmission of sexually transmitted infections has equally increased the number of testing services offered at various hospitals, clinics, and diagnostic laboratories. The incorporation of point-of-care testing has aided in increasing its accessibility with rapid turn-around times for results and timely medical intervention. With the continuous upgrading of technology, testing instruments have improved in accuracy to eliminate the possibilities of false positives and false negatives. Healthcare practitioners and researchers are continuing to develop newer technologies that would satisfy the increased demand with higher efficiency and lower costs.

However, challenges still exist in the majority of these places in an attempt to achieve greater STD testing access. Stigma and ignorance, particularly in certain regions, inhibit a person from accessing timely diagnosis and treatment. Addressing these barriers will require education of the community and an improved healthcare system. Affordability and insurance coverage also play a role in determining the frequency of testing, making it an area for cooperation between health workers and policymakers to advance access to services.

With the further development of rapid diagnostics and home-testing solutions, the future for the global sexually transmitted diseases testing (STDs) market is made. Collaboration of the public and private sector will further add to the available affordable and efficient options for testing.

By Technology

With increases in STD cases all around the world, the demand for accurate and easily accessible testing has increased substantially. The integration of advanced diagnostic technologies into healthcare systems will help facilitate early detection and treatment so that transmission can be reduced. The division of the global sexually transmitted diseases testing (STDs) market is based on various testing technologies, differing in their pros for the efficient identification of infection.

Molecular diagnostics are considered highly useful due to their capability of accurately detecting infections at the very early stage. DNA and/or RNA from pathogens can be analyzed in a method for high-accuracy identification and, for this reason, it is increasingly the preferred method of diagnosis of sexually transmitted diseases such as HIV, chlamydia, and gonorrhea. Immunoassays generally detect antibodies or antigens in the blood of an infected person, thus enabling to check whether a particular person has at any particular moment been exposed to the infection or otherwise. These tests are extensively used in the detection of syphilis, hepatitis, and other STDs eliciting immune responses in the body.

Point-of-care testing, notably a key innovation, addresses constraints of space in medical care locations. Point-of-care tests confer immediate results that allow a patient to receive treatment at the same time when necessary. Their portability and simple application render them particularly useful for community health programs and rural and hard-to-reach areas of healthcare delivery. Home test kits are also gaining popularity for their privacy and convenience. Discretion is a reason most such kits are becoming widely accepted since many individuals prefer self-testing to avoid the stigma of visiting a clinic. With sample collection at home and results transferred on digital platforms, STDs have become more accessible.

DNA and RNA testing methods are witnessing further innovations and providing results with great sensitivity and specificity. The methods make a detection of genetic markers of their infectious agents; they are capable of detecting low pathogen concentration. The personalized healthcare trend is also stimulating greater demand for these molecular methods, which provide personalized treatment regimens based on the detected infection strain.

It seems that the global sexually transmitted diseases testing (STDs) market will have a very high growth pattern as new technologies for diagnosis are being developed. To make a real impact in the overall reduction of STDs across the globe, it is important to consider issues related to affordability, accuracy, and accessibility of the diagnostics. Health care providers, researchers and policy makers are working together in creating innovative solutions to fill gaps within existing test availability necessary for early diagnosis and treatment improvement among affected individuals.

By End-User

The global sexually transmitted diseases testing (STDs) market, with its ability to provide early diagnosis, treatment, and prevention of infections, is an integral aspect of the public health system as infections affect millions worldwide. Increasing incidences of sexually-transmitted infections have made reliable and effective testing approaches highly sought after. Health and organization diagnostic testing service centers have been working on improvements to test access and accuracy to provide timely and appropriate patient care.

The greater sexual health awareness amongst individuals also translates onto higher participation in regular screening, which has greatly impelled the growth of the global sexually transmitted diseases testing (STDs) market. Governments and other public health authorities conduct campaigns aimed at early detection and prevention, consequently further boosting the uptake of testing services. The strengthening of the market has also been fueled by the availability of more advanced diagnostic technologies to allow rapid and precise diagnosis of infections. Popularization of home care and self-testing due to convenience and privacy has encouraged more public involvement in health maintenance without resorting to seeking medical facility services.

Hospitals continue to remain strong players in the global sexually transmitted diseases testing (STDs) market, as they provide all testing services and can render immediate medical intervention whenever needed. Diagnostic laboratories are also a large contributor to the share, with high accuracy and reliability in specialized tests. Physician offices and clinics are other accessible points of care for individuals seeking professional consultation together with testing. Ambulatory surgical centers add value to the market by dealing with cases requiring minor surgical procedures or further examination. Public health organizations have an important role in widening access to STD testing programs to previously inaccessible areas with proper health services.

Techniques have evolved, keeping pace with the needs of patients. Progress has been achieved in quick results. Techniques like nucleic acid amplification tests (NAATs) and point-of-care testing make early detection of infections easier by improving detection accuracy. Moreover, many funds and investments made toward healthcare infrastructure have contributed positively to the growth of such a market by providing better facilities and improved diagnostic capabilities.

As such, the global sexually transmitted diseases testing (STDs) market has changed owing to various trends in healthcare delivery and different patient preferences. It is vital for further market development to eliminate the stigma against getting tested for STDs and increase awareness of sexual health. Medicine will see its continuous rise due to accessibility to healthcare services and increased awareness amongst the population about their sexual health.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$107,911.81 million |

|

Market Size by 2032 |

$157,741.84 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2025 |

|

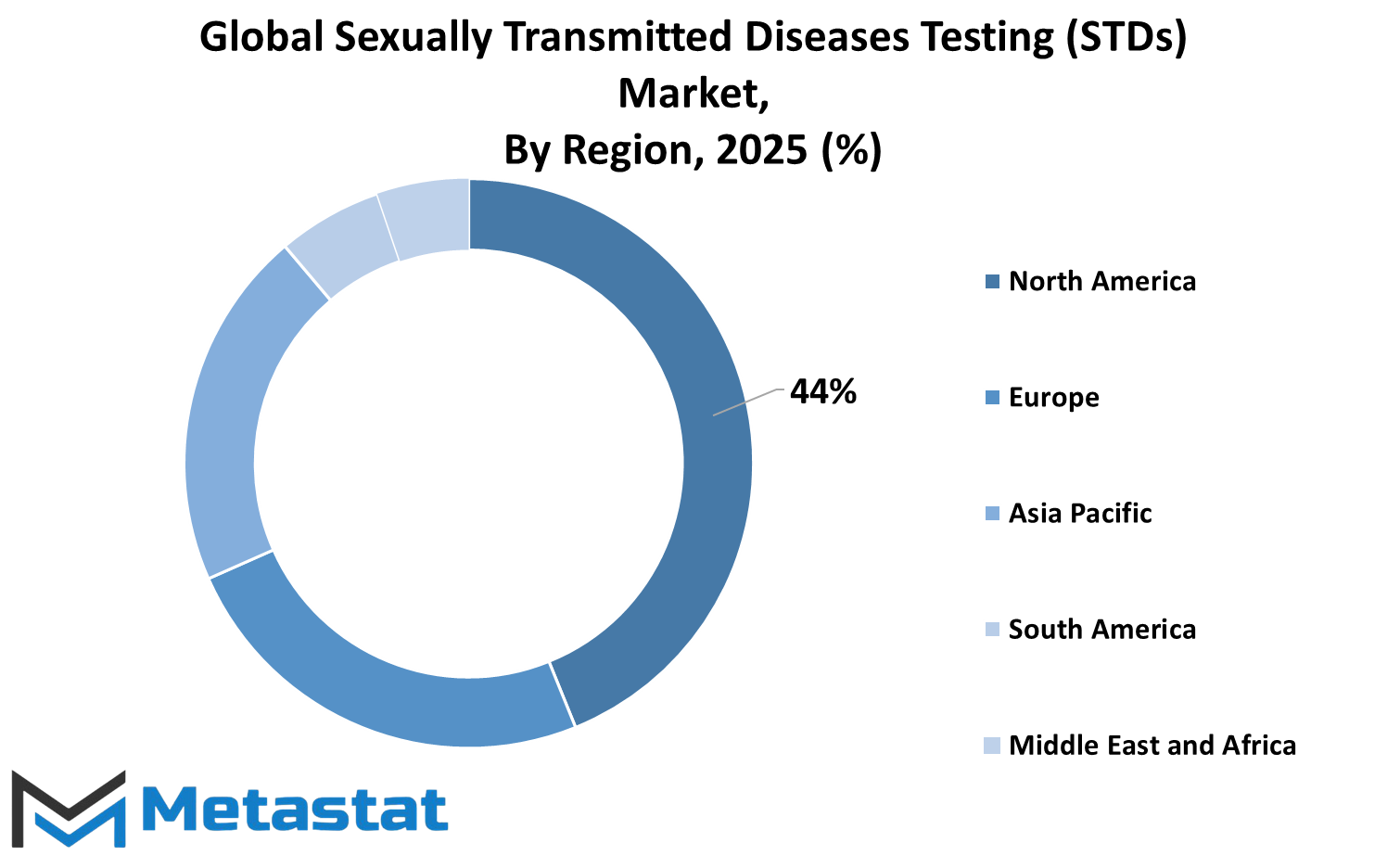

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global sexually transmitted diseases testing (STDs) market is used in public health for providing diagnostic solutions that assist controlling and prevents the spread of infection in humans. Awareness, government programs, and incidents of the disease across the globe have bolstered the demand for STD testing. Once identified, the infection can be diagnosed and treated early, thus reducing transmission.

The global sexually transmitted diseases testing (STDs) market is, therefore, segmented according to geography, with each region contributing in its own way to the industry. The North American market has become one stronghold with the activity of the U.S., Canada, and Mexico toward improving healthcare infrastructure and access to diagnostic services. The combination of advanced technologies with government initiatives has been a key strengthening factor for the testing regime in these countries.

Following closely, Europe carries a mantle where U.K., Germany, France, Italy, and other countries actively sponsor sexual health promotion. Stringent healthcare regulations and proactive management of such diseases within the region have greatly helped in expanding the availability of STD testing.

In the rapidly developing region of Asia-Pacific, the key factors driving STD testing service demand will rise in awareness, development in government programs, and increasingly more healthcare facilities. India, Japan, China, and South Korea are this vibrant region's major contributors, with constant developments in research and diagnostics.

Population growth has led to increasing demand for testing services, thereby increasing urbanization due to activities aiming at integrating sexual health education into health policies. The trajectory updating the status of STD testing can also be witnessed in South America within particular focus on Brazil and Argentina. Enhancing access to health care and awareness programs will significantly facilitate early diagnosis and intervention.

Building the healthcare infrastructure is gradually propelling the Middle East & Africa towards improvements in the diagnostic facilities of countries like Egypt, South Africa, and the Gulf Cooperation Council nations. Testing services are encouraged via government schemes, international agencies, and NGOs, making them accessible to people in remote areas. Solutions and investments into healthcare technology henceforward are expected to improve disease detection and management.

The rising prominence of early diagnosis along with continued advancements in the medical industry will define the new dimensions of expansion in the global sexually transmitted diseases testing (STDs) market. Superlative awareness campaigns, increasing accessibility to healthcare services, and technological advancements will combine together to define the future of this industry, thereby securing better disease control and prevention across all the countries in the world.

COMPETITIVE PLAYERS

The global sexually transmitted diseases testing (STDs) market is thus fundamentally important to public health since it gave necessary diagnostic tools for early diagnosis and management of infections. One of the most pressing health issues being faced by humanity is the sexually transmitted disease, numbering thousands of new infections each year. With the growing desire for effective and reliable testing solutions, the companies from government to health organizations and private sectors are pitching in their effort to control infection spread. Accurate testing methods allow for infections to be identified early, treated promptly, and with minimum complications.

Tests for sexually transmitted diseases utilize a variety of diagnostic methods like nucleic acid amplification tests (NAATs), enzyme-linked immunosorbent assay (ELISA), and rapid test kits. The methods perform accurate detection of infections such as HIV, syphilis, gonorrhea, chlamydia, and human papillomavirus (HPV) by a health care worker. Technology has advanced in the direction of faster and more efficient tools for user convenience in accessing testing services. Home testing kits are becoming popularized; these allow people to engage in testing on their own and can then seek medical intervention if necessary.

Several companies are involved in the innovation and distribution of sexually transmitted diseases testing solutions. Some of the hallowed names in this industry are Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, Hologic, Inc., Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., OraSure Technologies, Inc., and so on; Laboratory Corporation of America (LabCorp), Quest Diagnostics Incorporated, BioMerieux S.A., MedMira Inc., and Cepheid, Inc. These companies consider R&D to provide advanced methods of testing to the global sexually transmitted diseases testing (STDs) market that are more accurate and thus improve early detection and treatment.

Awareness campaigns initiated by governments have been critical in increasing the uptake of sexually transmitted disease testing. Several nations instituted routine testing under screening programs with an emphasis on high-risk populations. In addition, several non-governmental organizations and health agencies are working toward the de-stigmatization of sexually transmitted disease testing and facilitating regular checkups for sexually active individuals. Such attitude-shift initiatives are now yielding results, with many more persons coming forward to access testing services, which then translates into better disease management and control.

There may, however, still remain gaps in some areas of sexually transmitted disease testing. Limited access to health care facilities, especially in developing nations, is a barrier to universal testing. Also, huge sums of money have posed a major barrier to other very advanced testing procedures, which in return escape the treatment of large reasonably-sized populations.

Sexually Transmitted Diseases Testing (STDs) Market Key Segments:

By Type of Testing

- Nucleic Acid Amplification Tests (NAATs)

- Enzyme-Linked Immunosorbent Assays (ELISA)

- Rapid Diagnostic Tests (RDTs)

- Serology Tests

- Microscopy & Culture Testing

- Polymerase Chain Reaction (PCR) Testing

By Type of STDs Tested

- Chlamydia

- Gonorrhea

- Syphilis

- HIV/AIDS

- Herpes Simplex Virus (HSV)

- Human Papillomavirus (HPV)

- Hepatitis B & C

- Trichomoniasis

- Other STDs (e.g., Mycoplasma genitalium, LGV)

By Technology

- Molecular Diagnostics

- Immunoassays

- Point-of-Care Testing

- Home Test Kits

- DNA & RNA-Based Testing

By End-User

- Hospitals

- Diagnostic Laboratories

- Home Care & Self-testing

- Physician Offices & Clinics

- Ambulatory Surgical Centers

- Public Health Organizations

Key Global Sexually Transmitted Diseases Testing (STDs) Industry Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific

- Hologic, Inc.

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories, Inc.

- OraSure Technologies, Inc.

- Laboratory Corporation of America (LabCorp)

- Quest Diagnostics Incorporated

- BioMerieux S.A.

- MedMira Inc.

- Cepheid, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383