Global Serviced Apartment Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global serviced apartment market and sector will go much further than the conventional understanding of supplying transient accommodation. What has traditionally been appeared as a convenient choice for business tourists will rapidly evolve into an area where lengthy-time period life-style behaviour, cross-cultural interplay, and communities will emerge. Serviced residences will no longer just be short-live accommodation; they'll be hubs of connectivity, providing residents with an revel in that combines the intimacy of domestic and the ability of professional provider. With international mobility increasingly on the increase, the market will push its boundaries by meeting the broader needs of corporate and leisure visitors who will expect more than just accommodation.

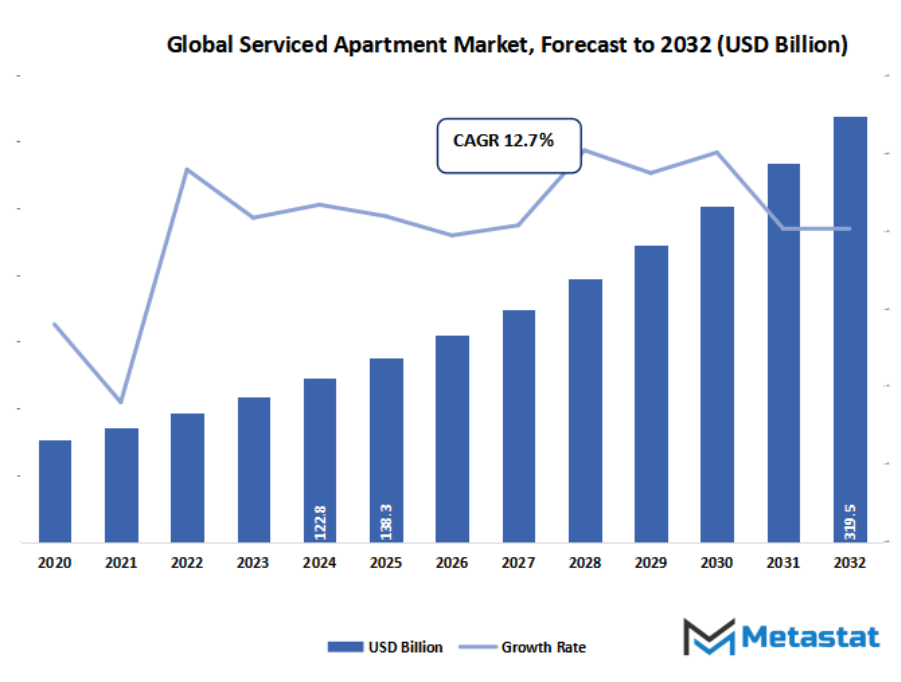

- Global serviced apartment market valued at approximately USD 138.3 Billion in 2025, growing at a CAGR of around 12.7% through 2032, with potential to exceed USD 319.5 Billion.

- Long-Term (>30 Nights) account for nearly 65.2% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand from business travelers for more space and amenities than standard hotels., Rising preference for flexible, home-like accommodations among remote workers and relocating families.

- Opportunities include Partnerships with corporations for extended-stay employee housing programs.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Could the developing desire for bendy dwelling preparations remodel serviced apartments into a mainstream alternative to conventional resorts and rentals? As generation and life-style shifts preserve, how may digital platforms, far flung work, and converting travel patterns disrupt the manner this market operates? With evolving patron expectations, will serviced residences strike the right balance between affordability, consolation, and lengthy-time period cost to stable their area in the worldwide hospitality landscape?

In the years to come, the global serviced apartment market will be expanding into territories that far surpass hospitality. It will have an influence on the way cities plan, on how cities are going to structure mixed-use development that incorporates residential, commercial, and recreational space. The business will also engage with technology and sustainability in manners that will be creating new benchmarks for the quality of living environment. Smart apartments, automated buildings, and sustainable design will become part of serviced apartments over time, making them a viable option not just for short stays but also for individuals looking for long-term options.

Market Segmentation Analysis

The global serviced apartment market is mainly classified based on Type, Booking Mode, End-user.

By Type is further segmented into:

- Long-Term (>30 Nights) - The global serviced apartment market will see consistent demand in the long-term stay segment as businesses expand globally, and employees are transferred for prolonged assignments. Longer stays will also increase with students, medical travelers, and project-based staff, and serviced apartments become a feasible and convenient option compared to conventional rental housing.

- Short-Term (<30 Nights) - The Global Serviced Apartment Market short-term segment will increase as tourism grows, and business travel is on the rise. Such demand will be backed by travelers in need of flexibility, convenience, and fully equipped accommodation. Short-term rentals will also attract families while on holiday and professionals on short assignments.

By Booking Mode the market is divided into:

- Direct Booking - Direct booking in the global serviced apartment market will gain traction as property owners step up their online presence and loyalty schemes. This channel could be desired by means of repeat guests with aggressive pricing and custom designed services. Enhanced purchaser revel in will convince extra travelers to bypass third-birthday celebration web sites and e-book without delay from companies.

- Online Travel Agencies - Online travel agencies will continue to be key to influencing the global serviced apartment market by increasing visibility and access for operators. With reviews integrated, competitive pricing, and consumer-friendly platforms, this channel will still be appealing. Growing dependence on online ease of use will see OTAs as a go-to solution for many.

- Corporate Contracts - Corporate contracts will lead to high growth in the global serviced apartment market, especially since companies are searching for cost-effective long-term accommodations for visiting business travelers. Organizational associations with serviced apartment operators will provide guaranteed occupancy levels. The channel will continue to be robust as corporations focus on employees' comfort for extended stays overseas.

By End-user the market is further divided into:

- Corporate/Business Traveler - Corporate travelers will continue to be a leading segment of the global serviced apartment market due to worldwide business activities growing. Serviced apartments will provide flexibility, privateness, and value in comparison to inns. As far off paintings centers and long-term postings develop, businesspeople will hold turning to those flats for work-life stability.

- Leisure Traveler - Leisure quarter of the global serviced apartment market will flourish as purchasers look for roomy hotels as an opportunity to normal accommodations. Families, businesses, and excursion-makers will recognize domestic-like facilities, kitchens, and price-effectiveness. Cultural trips and seasonal holidays will pressure more leisure visitors to opt for serviced flats for comfort and comfort on excursion.

- Expats and Relocators - Expats and relocators will dominate the global serviced apartment market in the future. As global mobility increases, these travelers will opt for serviced apartments for prolonged adjustment periods. Flexible leases, furnished accommodations, and assistance services will provide stability for individuals and families relocating to new countries for work or personal relocation.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$138.3 Billion |

|

Market Size by 2032 |

$319.5 Billion |

|

Growth Rate from 2025 to 2032 |

12.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

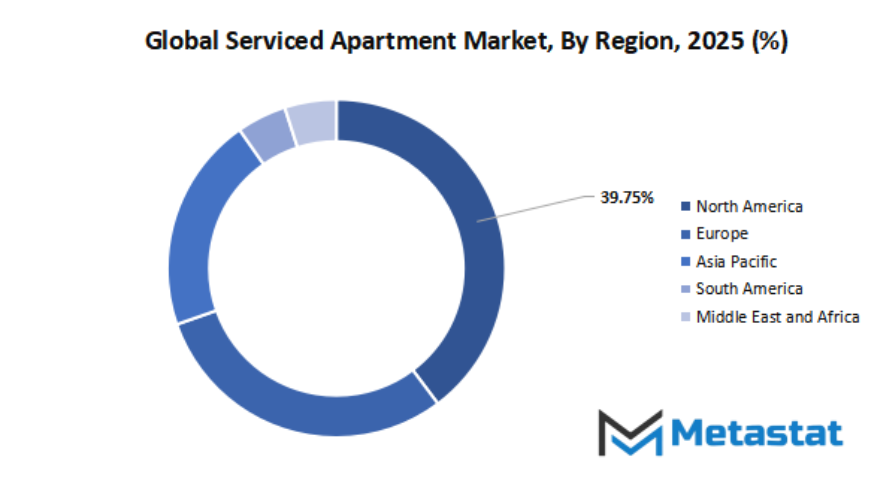

Geographic Dynamics

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global serviced apartment market has advanced into a colourful part of the hospitality industry, supplying a handy substitute for regular lodges. Serviced apartments serve commercial enterprise travelers, travelers, and long-stay citizens who searching for comfort, room, and cost in an unmarried region. The idea has won traction as travelers an increasing number of respects the mixture of domestic-stimulated residing with commercial enterprise services, inclusive of home tasks and concierge assistance. Unlike traditional lodge stays, serviced flats offer customers improved privacy and a sense of home, hence the enchantment they've for both brief and longer-term visits.

What makes this market interesting is the combination of mature international players and regional suppliers who offer their own unique strengths to the market. Giant brands like The Ascott Limited, Frasers Hospitality, and Marriott International, Inc. have achieved international fame by joining faith with quality services. Meanwhile, new players like Staycity Ltd, Viridian Apartments, and THE SQUA.RE SERVICED APARTMENTS are marking their presence by providing customized services and contemporary designs that mirror the evolving demands of visitors. This equilibrium of veteran leaders and new aspiring entrants has provided richness and diversity to the market, and customers now have greater opportunities to select from based on requirements and prices.

Technology and changing patterns of travel have influenced the way forward for this industry as well. With booking becoming easier and more convenient due to online portals such as adiahotels.com, customers can compare services more quickly and identify appropriate accommodations for themselves. This digital transformation has motivated providers to emphasize not just quality spaces but also customer experience, from checkout to booking. Companies like Adagio and Habicus Group have noticed this trend, combining easy-to-use platforms with dedicated service delivery. Serviced apartments are projected to serve an even bigger role in fulfilling housing demands in various regions as remote work and international mobility keep on increasing.

In the future, the global serviced apartment market will be impacted by both regional players and established giants. Each of the competitors has something to offer, ranging from global presence, powerful brand value, or local knowledge that resonates with communities. This combination of operators will influence the improvement of the industry, making the serviced apartments a green and ideal alternative for contemporary travelers. In this way, the marketplace demonstrates how diversity in competition can lead to higher services, extra innovation, and greater pride for people round the sector.

Market Risks & Opportunities

Restraints & Challenges:

Higher nightly rates compared to standard hotels or unfurnished rentals. - The global serviced apartment market will be challenged because premium nightly rates might deter price-sensitive tourists from opting for this choice. Most travelers who often travel or travel for extended periods will go for budget rentals or hotels, particularly when searching for affordability. Growth might be restricted unless value-added services offset the cost difference.

Inconsistent regulatory landscape and zoning restrictions in some cities. - The global serviced apartment market will be impacted by evolving regulations and zoning regulations in various areas. Municipal authorities are likely to introduce restrictions limiting property usage, which could cause operational issues for providers. This inconsistency will provide challenges to easy expansion, calling for strategic preparation and flexibility to ensure stability and regulatory conformity.

Opportunities:

Partnerships with corporations for extended-stay employee housing programs. - The global serviced apartment market will create new opportunities by establishing alliances with companies looking for long-term housing for employees. Companies are increasingly worrying flexible dwelling options for personnel moving or traveling for assignments. Establishing such alliances will make certain regular demand, enhance occupancy tiers, and set up serviced apartments as a reliable company housing solution.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 138.3 Billion in 2025 to over USD 319.5 Billion by 2032. Serviced Apartment will maintain dominance but face growing competition from emerging formats.

In the future, the global serviced apartment market will reflect larger trends in lifestyle choice. People will appreciate flexibility and customization, and serviced apartments will react by designing spaces that are flexible to varied professional, cultural, and personal requirements. By breaking the limits of accommodation, the business will become a strong driver of international mobility, city growth, and lifestyle change, creating a strong legacy on how individuals will live in modern urban areas of the future.

Report Coverage

This research report categorizes the Serviced Apartment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Serviced Apartment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Serviced Apartment market.

Serviced Apartment Market Key Segments:

By Type

- Long-Term (>30 Nights)

- Short-Term (

By Booking Mode

- Direct Booking

- Online Travel Agencies

- Corporate Contracts

By End-user

- Corporate/Business Traveler

- Leisure Traveler

- Expats and Relocators

Key Global Serviced Apartment Industry Players

- The Ascott Limited

- Frasers Hospitality

- The Serviced Apartment Company

- Staycity Ltd

- Habicus Group

- THE SQUA.RE SERVICED APARTMENTS

- adiahotels.com

- Viridian Apartments

- Adagio

- Marriott International, Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252