Global Retail Banking Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global retail banking market is one of the most vibrant sectors that will keep influencing financial interaction between institutions and individuals. Outside the usual boundaries of providing deposit accounts, loans, and payment services, the sector will progressively evolve into a digital-first destination hub where customer engagement and personalization will be more significant than the mere availability of products. Banks will no longer be regarded as custodians of cash; rather, they will function as lifestyle facilitators, helping clients make financial choices based on personal aspirations, long-term security, and ease.

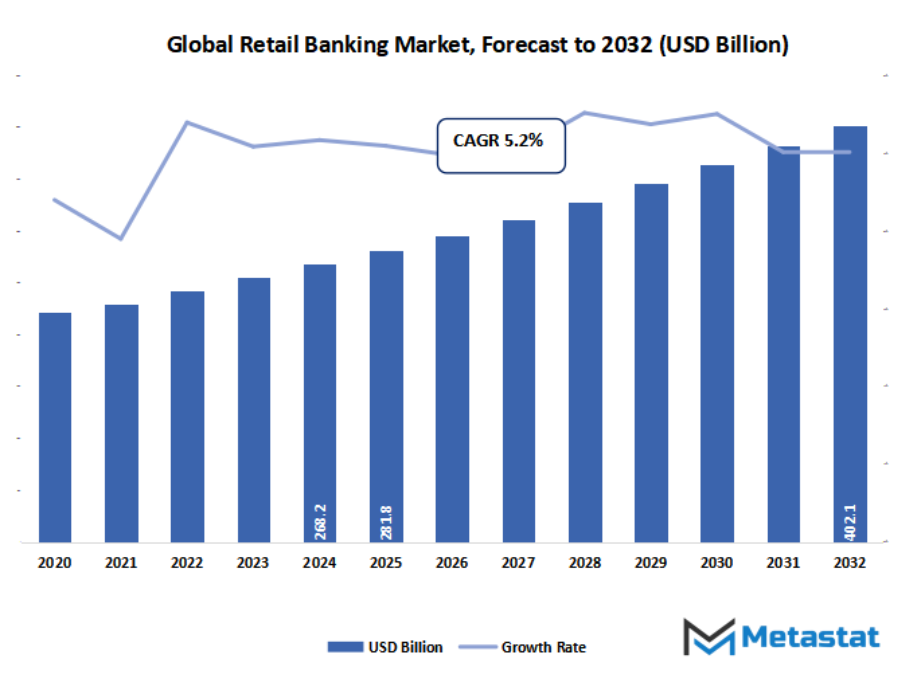

- Global retail banking market valued at approximately USD 281.8 Billion in 2025, growing at a CAGR of around 5.2% through 2032, with potential to exceed USD 402.1 Billion.

- Commercial Banks account for nearly 84.5% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing consumer demand for seamless digital banking experiences., Rising need for personalized financial products and advisory services.

- Opportunities include Leveraging AI and data analytics for hyper-personalization and risk assessment.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Could the speedy shift towards digital-only banking redefine the very foundation of conventional retail banking models, or will physical branches nevertheless maintain relevance within the destiny? How may rising technology inclusive of AI-driven personalization and blockchain-based transactions disrupt client agree with and reshape competitive dynamics inside the marketplace? Will regulatory changes and evolving consumer expectancies open up new boom possibilities, or create unforeseen demanding situations for global retail banks navigating this change?

As technology will gain greater influence, the global retail banking market will start to function more as a partner in daily life rather than merely a service provider. Artificial intelligence, blockchain technology, and predictive analytics will not only be back-office helpers but be part of the action when it comes to managing transactions, investments, and savings. This evolution will also change how consumers understand trust, as accountability and transparency will become the centerpieces of banking relationships. The distinction between financial service and financial guidance will blur, and the future of banking will be less transactional and more relational.

Market Segmentation Analysis

The global retail banking market is mainly classified based on Type, Function, End User.

By Type is further segmented into:

- Commercial Banks - Commercial banks will continue to be at the leading edge of the global retail banking market with developing virtual structures and customer support driven by way of AI. Growth can be fueled through customized financial merchandise, improved compliance tactics, and closer partnerships with fintech companies, leading to a powerful and on hand banking situation.

- Rural Banks - Rural banks will define the future of the global retail banking market by filling financial gaps in remote regions. With more digital inclusion, mobile banking penetration, and microfinance offering, rural banks will make access possible, allowing small communities to be more actively engaged in the global financial system and achieve sustainable economic growth.

- Others - Other forms of banking, like cooperative and online-only banks, will diversify the global retail banking market. They will emphasize flexibility, reduced operation expenses, and technology-powered solutions in drawing the younger populations. They will supplement conventional forms with new models that respond promptly to consumer demands and expectations.

By Function the market is divided into:

- Bank Account Opening - Opening of bank accounts will change in the global retail banking market with automated checks, biometric identification, and real-time digital onboarding. The future systems will focus on seamless customer experience and strong security, promoting higher coverage of financial services, while at the same time lowering unbanked populations' access barriers and increasing transparency in opening accounts.

- Deposits and Withdrawals - Deposits and withdrawals in the global retail banking market will be transformed by contactless payments, instant transfers, and blockchain-powered security. Conventional means will progressively lose significance as digital wallets and mobile platforms offer quicker, more secure, and more convenient options, making financial management smoother across varied economic and social strata.

- Debit and Credit Card Issuance - Debit and credit card issuance within the global retail banking market will go through swift revolution with contactless technology, digital playing cards, and superior fraud detection systems. Banks will attention on personalization, rewards integration, and mobility to make certain that charge answers are stable, easy to apply, and responsive to international trade tendencies and innovations.

- Investment and Insurance - Investment and insurance services will define the global retail banking market via the wedding of era with personalised monetary counseling. AI-based totally advisory, clean get admission to coverage bundles, and handy funding platforms will allow more participation, permitting person and corporate clients to obtain economic safety and decide for monetary unpredictability inside the future with guarantee.

- Others - Other operations like forex, remittances, and virtual advisory will develop in the global retail banking market. They could be augmented via automation, predictive analytics, and cross-border payments generation, if you want to allow institutions to deliver smoother stories and build more potent relationships among global economic ecosystems and foreign markets.

By End User the market is further divided into:

- Individuals - Customers will continue to be the central point of the global retail banking market, requiring convenience, speed, and individualization. With lifestyle transformation and familiarity with technology, future banking will be centered on money management tools, budgeting apps, and savings products, providing customers with services that are in tune with changing financial aspirations and goals.

- Companies - Companies will propel demand for the global retail banking market by demanding customized credit facilities, streamlined payment processing, and treasury solutions that integrate. Future expansion will include sophisticated digital platforms, risk management solutions, and financing models that facilitate expansion, eventually placing banks at the center of business sustainability and development.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$281.8 Billion |

|

Market Size by 2032 |

$402.1 Billion |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

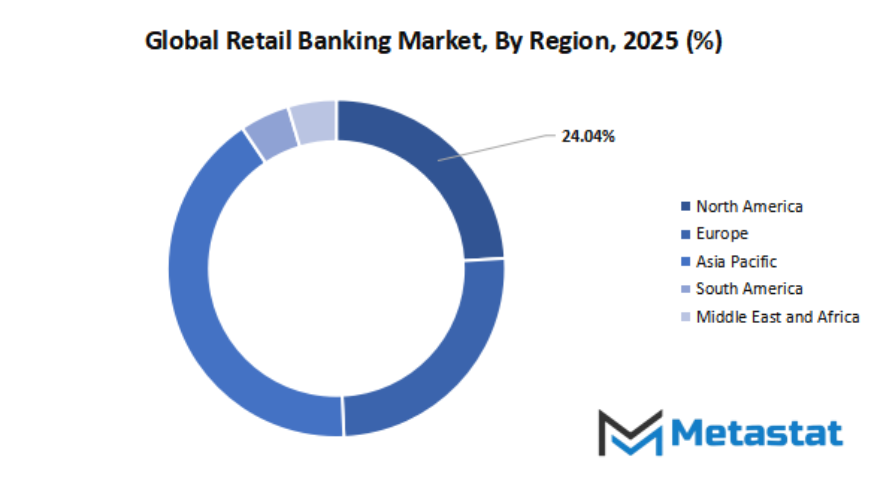

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global retail banking market is the arena's maximum visible and impactful phase of the monetary enterprise, influencing how people and groups spend, keep, and borrow money on a everyday foundation. Retail banking will remain the important thing area for satisfying the growing call for financial savings bills, private loans, credit facilities, mortgages, and e-money offerings. As the pass toward cashless bills profits tempo, banks ought to evolve to respond to changing patron behaviour without cutting off traditional services. Growth within the marketplace will no longer simply depend on digitalization but also on how harmoniously establishments reconcile accept as true with, protection, and ease of get admission to for customers globally.

The region is characterised by using competitive competition between lengthy-standing international majors and local banks which are fast constructing up their services. Establishments along with Goldman Sachs Group, Citigroup, Inc, BNP Paribas, JP Morgan Chase & Co, and The Hongkong and Shanghai Banking Corporation Limited have cemented themselves as global leaders, because of the potential to offer a vast variety of products and huge client insurance. Meanwhile, others like Mitsubishi UFJ Financial Group, Inc, Barclays Bank Plc, Industrial and Commercial Bank of China (Asia) Limited, Deutsche Bank AG, and Wells Fargo & Company have their own set of strengths, be it technological innovation, patron loyalty, or local know-how.

Technology shall stay a riding pressure in retail banking inside the future. Mobile banking applications, online account maintenance, and AI-powered customer support are not extras however are simple tools to help banks stay aggressive. Customers need rapid, steady, and personalised services, and people banks that embody this trend will be poised for boom.

Having both global giants and regional players present guarantees that the market will not only be vibrant but also adapt to customer needs that vary from region to region. While international banks can offer size and resources, local players thrive by emphasizing cultural and local finance requirements. Collectively, they produce an environment where innovation, service excellence, and trust are the highest forms of currency. The worldwide retail bank market will continue to evolve, driven by competition, digitalization, and a desire to offer financial solutions that reflect how individuals live and work now.

Market Risks & Opportunities

Restraints & Challenges:

High operational costs from maintaining physical branches and legacy IT systems. - The global retail banking market will continue to be hindered by high operational costs associated with having physical branch networks and legacy IT infrastructure. With customer behaviour moving toward digital-first alternatives, excessive investment in contemporary technology will become inevitable, making it tough for banks to reconcile cost efficiency and customer experience.

Intense competition from fintechs and neobanks offering specialized solutions. - The global retail banking market will be under constant pressure from fintechs and neobanks that provide customized services with more agility. These new entrants have specialized products optimized for velocity and convenience, in an effort to enhance patron expectancies. It might be tough for conventional banks to preserve market proportion except they innovate to maintain up with the plug-and-play virtual reports presented by using these new entrants.

Opportunities:

Leveraging AI and data analytics for hyper-personalization and risk assessment. - The global retail banking market will comprehend huge possibilities by embracing synthetic intelligence and complicated information analytics. These technology will enable institutions to offer hyper-customized services, increase fraud detection, and decorate hazard assessment. With particular information of customer conduct, banks will deepen relationships and create modern answers reflecting converting financial needs.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 281.8 Billion in 2025 to over USD 402.1 Billion by 2032. Retail Banking will maintain dominance but face growing competition from emerging formats.

The market will also have a considerable cultural impact. Retail banking will increasingly find itself integrated into wider social ecosystems where financial literacy, accessibility, and inclusion will drive the nature of innovation. It will not only evolve according to digital expectations but also set new standards for the way people will perceive financial empowerment. The sector will go beyond the traditional brick-and-mortar offerings and emerge as a comprehensive network that will keep up with consumer dreams. In the end, the global retail banking market will be more than an industry—indeed, it will be a manifestation of how economic security and human development will advance together.

Report Coverage

This research report categorizes the global retail banking market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global retail banking market Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global retail banking market.

Retail Banking Market Key Segments:

By Type

- Commercial Banks

- Rural Banks

- Others

By Function

- Bank Account Opening

- Deposits and Withdrawals

- Debit and Credit Card Issuance

- Investment and Insurance

- Others

By End User

- Individuals

- Businesses

Key Global Retail Banking Industry Players

- Goldman Sachs Group

- Citigroup, Inc

- BNP Paribas

- JP Morgan Chase & Co

- The Hongkong and Shanghai Banking Corporation Limited

- Mitsubishi UFJ Financial Group, Inc

- Barclays Bank Plc

- Industrial and Commercial Bank of China (Asia ) Limited

- Deutsche Bank AG

- Wells Fargo & Company

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252