Global Crypto Cold Storage Wallets Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global crypto cold storage wallets market experienced will be a defining place where security and technology will continue to cross paths in ways that determine the financial future. In contrast to traditional digital wallets, this market will increasingly become more significant as cryptocurrencies shift from being speculative assets to long-term value stores. Both institutions and retail investors will continue to prefer safety over convenience, and that will drive demand for solutions that protect assets offline, out of reach of cyber-attacks. To this end, the global crypto cold storage wallets market will evolve beyond mere hardware devices into a high-tech ecosystem of products and services that offer ease of use while sacrificing nothing in protection.

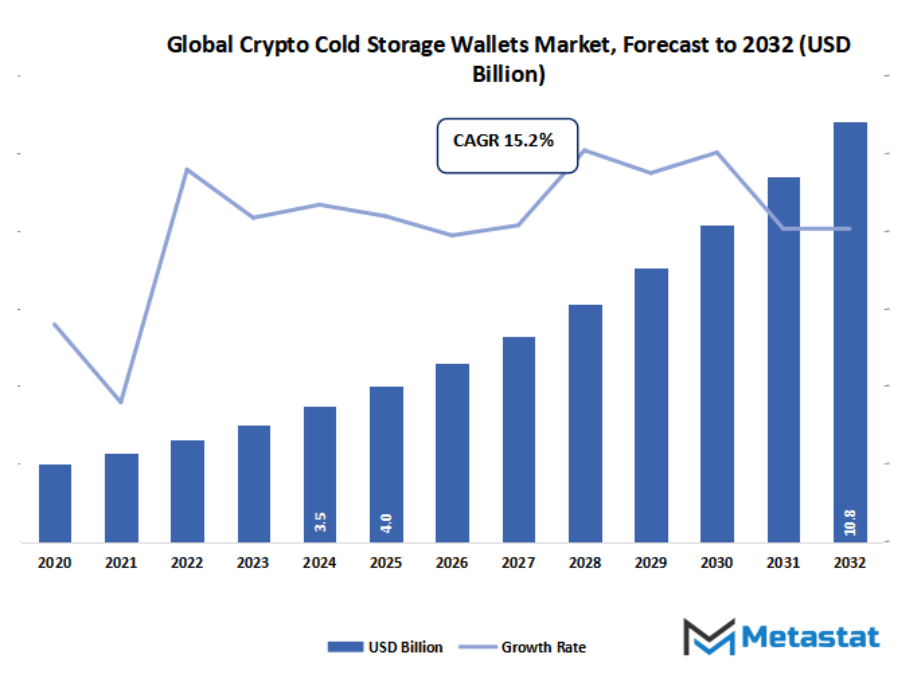

- Global crypto cold storage wallets market valued at approximately USD 4 Billion in 2025, growing at a CAGR of around 15.2% through 2032, with potential to exceed USD 10.8 Billion.

- Hardware Wallets account for nearly 59.7% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising cryptocurrency adoption and increasing value of digital assets., Growing frequency and sophistication of exchange hacks and online theft.

- Opportunities include Integration with decentralized finance (DeFi) protocols and multi-chain support.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

What role will crypto bloodless storage wallets play as traders increasingly demand more potent safeguards against cyber threats, and can these answers maintain pace with the fast enlargement of digital belongings international? Will improvements in pockets layout disrupt the dominance of conventional garage strategies, or will regulatory scrutiny sluggish down their sizable adoption in global economic systems? How would possibly moving person preferences between protection, convenience, and accessibility reshape the future trajectory of the global crypto cold storage wallets market?

In the future, innovation in the industry will not just be about more secure encryption or tamper-proofing but also about easy integration into wider financial platforms. Custodians, exchanges, and financial service providers will increasingly use cold storage technology to establish trust among users as well as adhere to compliance. Concurrently, new entrants will strive to reimagine the user experience, with the aim that security will not be traded for accessibility. As the environment of digital currencies expands, the global crypto cold storage wallets market will become the integral backbone for long-term adoption, where trust in asset security will frame participation.

Market Segmentation Analysis

The global crypto cold storage wallets market is mainly classified based on Type, Application, End-Users.

By Type is further segmented into:

- Hardware Wallets - Hardware wallets will be one of the most resilient areas in the global crypto cold storage wallets market. As cyber threats increase, investors will seek products that have better levels of encryption, biometric authentication, and intuitive connections with decentralized platforms. Future innovation will concentrate on blending ease of use and uncompromising security.

- Paper Wallets - While old school in essence, paper wallets will continue to have use in the global crypto cold storage wallets market. Future applications will be centered on very secure offline storage options for users requiring complete separation from electronic devices. Their use will be limited but very essential for the user demanding maximum security at minimal expense.

- Metal Seed Backups - Metal seed backups will become more significant in the global crypto cold storage wallets market as they are resistant to physical damage. Fire-resistant, waterproof, and tamper-resistant properties will ensure they become necessary for long-term investors. Next-generation innovation could bring sophisticated engraving methods or smart authentication layers to guarantee ultimate durability and traceability.

- Air-gapped Devices - Air-gapped devices will carry considerable importance in the global crypto cold storage wallets market. Their offline design will provide unparalleled security against online hacking attacks. Future versions might implement advanced air-gap bridges, providing selective transaction verification without breach of isolation, making them compelling for institutional and high-value cryptocurrency storage offerings.

- Custodial Cold Vault Services - Custodial cold vault solutions will grow exponentially in the global crypto cold storage wallets market as institutions need enterprise-level security. Better insurance coverage, adherence to global regulations, and multi-signature techniques will be the drivers of development. These solutions will find a home with large-scale investors that need convenience and completely auditable custodies.

- Other - Other types in the global crypto cold storage wallets market will be emerging technologies that combine physical and electronic security measures. These may be blockchain-based validation processes, hybrid wallets, or novel storage methodologies. The market will experience experimentation as coders work to fulfill unique investor needs that go beyond traditional processes.

By Application the market is divided into:

- Personal Long-Term Storage - Personal long-term storage will continue to be a fundamental use case in the global crypto cold storage wallets market. People who protect assets for retirement or estate planning will look for solutions that provide decades of resistance. Advanced biometric encryption, multi-layer redundancy, and inheritance protocols will dictate the future for this use case segment.

- Institutional Vaulting - Institutional vaulting will lead the global crypto cold storage wallets market as businesses require custom safekeeping services. The next generation of vaulting systems will focus on regulatory compliance, automated auditing, and financial reporting integration. The services will grow to meet increased institutional demand for secure, transparent, and scalable digital asset storage.

- Exchange Reserve Storage - Exchange reserve storage will continue to be important in the global crypto cold storage wallets market. In order to secure liquidity, exchanges will have to depend on sophisticated multi-signature wallets as well as real-time proof-of-reserve checks. Future adoption will focus on open systems that preserve investor confidence while allowing large-scale protection of assets from cybercrime and insider threats.

- OTC Desk Storage - OTC desk storage will become a niche application in the global crypto cold storage wallets market. With the high-value trades being executed off-exchange, storage solutions will be focused on speed and discretion as much as security. Next-generation models will bring seamless settlement procedures together with highly secure cold storage environments to create reliability.

- Treasury Management - Treasury management will be a powerful use case within the global crypto cold storage wallets market. Corporate treasuries that own digital assets will implement converged solutions providing liquidity optimization, governance procedures, and long-term security. Future models will combine conventional financial management systems with cutting-edge cold storage technologies to achieve optimal efficiency and security.

By End-Users the market is further divided into:

- Retail / Individual - Retail investor involvement will continue to influence the global crypto cold storage wallets market. Security-driven consumers will expect easy-to-use wallets that balance mobility with offline security. The future will more than likely feature easy backup arrangements, easy-to-use mobile interfaces, and robust recovery approaches, which will render cold storage available to a broader retail audience.

- Institutional Investors - Institutional investors will have a strong impact on the global crypto cold storage wallets market. Such players will look for robust solutions with compliance, audit trails, and multi-user authorization. Future uptake will be driven by financial regulations, developing systems to manage billions of assets without any compromise in security, transparency, or operational ease.

- Cryptocurrency Exchanges - Cryptocurrency exchanges will continue to be key end-users in the global crypto cold storage wallets market. With increasing trading platforms, storage will need ultra-secure vaulting with global compliance. Future adoption will concentrate on hybrid models that maintain minimal funds hot for liquidity while keeping most securely in cold storage.

- Custodial Service Providers - Custodial service providers will gain greater control over the global crypto cold storage wallets market. Providing professionally managed storage, they will highlight high-level insurance, regulatory compliance, and open access protocols. In the future, such providers will incorporate smart contracts and blockchain verification to ensure trust and scalability.

- Financial Institutions - Financial institutions moving into the global crypto cold storage wallets market will drive institutional-grade custodial solutions. Asset managers and banks will take up cold storage technologies that are integrated with conventional finance infrastructure. Growth in the future will emphasize technology company and financial institution partnerships, creating fully regulated, large-scale storage ecosystems.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4 Billion |

|

Market Size by 2032 |

$10.8 Billion |

|

Growth Rate from 2025 to 2032 |

15.2% |

|

Base Year |

2024 |

|

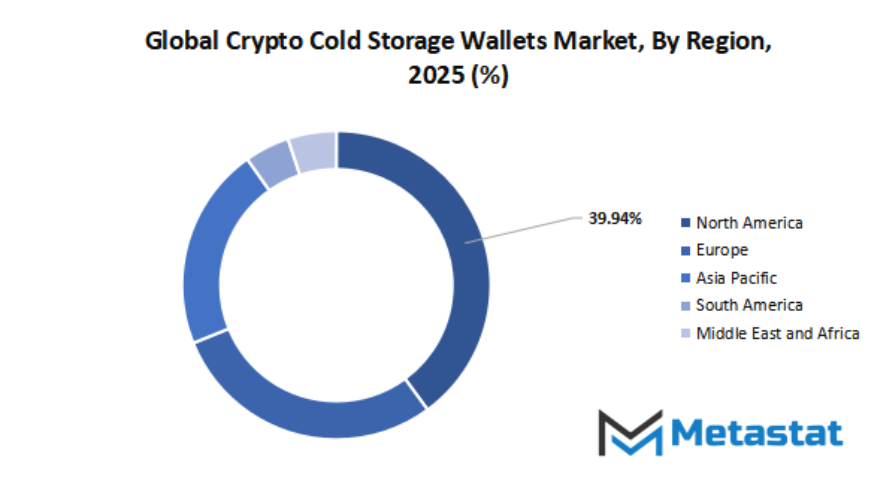

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global crypto cold storage wallets market has been picking up pace as digital assets continue to find their way into mainstream usage. Investors, each institutional and individual, are now increasingly trying to shop their property in a more secure way, and cold garage wallets are one of the most depended on answers available. In assessment to online garage, those wallets keep private keys offline, imparting immunity in opposition to hacking and cyber assaults. This increasing call for security has provided opportunities for corporations to layout devices and structures that are not simplest secure but additionally convenient for customers who paintings with cryptocurrencies on an each day foundation.

The enterprise is inspired by the presence of established international players in addition to smaller local ones that are looking for their area of interest. Firms like Ledger, Trezor, and Ellipal have already got precise reputations for supplying secure and easy-to-use wallets. Meanwhile, others like D'Cent, BC Vault, and Tangem introduce new ideas and novel designs that cater to other segments of investors. This blend of hooked up leaders and new entrants makes the market extraordinarily dynamic, with regular upgrades being made in phrases of design, protection capability, and compatibility with numerous cryptocurrencies.

As crypto popularity increases, demand for cold storage wallets will keep on growing. Investors are now no longer considering these products as add-ons but as integral components of their digital investment process. Companies such as Ngrave, SafePal, CoolWallet, and KeepKey have been developing small and mobile devices that are integrated into contemporary lifestyles without sacrificing security. Others like BitBox, SecuX, Coldcard, and CryptoTrust are developing very specialized solutions that serve users who have very advanced needs, such as additional layers of security and support for complex trading platforms.

The competition further includes brands like Ellipal Titan, Authereum, and Opendime, which are going after niche audiences with special features like mobile integration, touch screens, or disposable wallets for one-time usage. With so much variety, the market will only grow and evolve further as new technology and regulatory developments influence how digital assets are stored. The global crypto cold storage wallets market is a demonstration of how technology and security will come together to establish trust in future financial systems, and the breadth of players guarantees that customers will have alternatives tailored to various skills and tastes.

Market Risks & Opportunities

Restraints & Challenges:

- User friction and technical complexity for non-technical investors - The global crypto cold storage wallets market will struggle with the learning barrier that continues to be a challenge for most new investors. Non-technical users tend to view the setup process as complex, and so they are reluctant to use such wallets. Future innovations need to eliminate friction via user-friendly interfaces and simple onboarding processes.

- Risk of physical loss, damage, or forgetting credentials with no recovery option - Another limitation of the global crypto cold storage wallets market will be the risk associated with human mistakes or accidents. Hardware wallets can get lost, stolen, or destroyed, and with no recovery solutions, access to digital assets will be lost forever. This will drive innovation towards redundant safe solutions.

Opportunities:

- Integration with decentralized finance (DeFi) protocols and multi-chain support - A robust play in the global crypto cold storage wallets market will be in integrating with decentralized finance systems and spreading multi-chain support. With the diversification of investors among networks, wallets which facilitate seamless interaction with DeFi platforms will be extremely valuable. Advanced developments will enable secure participation without undermining asset security.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 4 Billion in 2025 to over USD 10.8 Billion by 2032. Crypto Cold Storage Wallets will maintain dominance but face growing competition from emerging formats.

This sector will also cross borders, synchronizing itself with the regulatory paradigms and conforming to local differences in policies regarding digital currency. In doing this, it will solidify its position as a vital infrastructure layer for international finance. The global crypto cold storage wallets market, aside from its current purview, will not just protect wealth but will facilitate a culture of trust that will support the development of digital assets for decades to come.

Report Coverage

This research report categorizes the global crypto cold storage wallets market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global crypto cold storage wallets market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global crypto cold storage wallets market.

Crypto Cold Storage Wallets Market Key Segments:

By Type

- Hardware Wallets

- Paper Wallets

- Metal Seed Backups

- Air-gapped Devices

- Custodial Cold Vault Services

- Others

By Application

- Personal Long-Term Storage

- Institutional Vaulting

- Exchange Reserve Storage

- OTC Desk Storage

- Treasury Management

By End-Users

- Retail / Individual

- Institutional Investors

- Cryptocurrency Exchanges

- Custodial Service Providers

- Financial Institutions

Key Global Crypto Cold Storage Wallets Industry Players

- Ledger

- Trezor

- Ellipal

- D’Cent

- BC Vault

- Tangem

- Ngrave

- SafePal

- CoolWallet

- KeepKey

- BitBox

- SecuX

- Coldcard

- CryptoTrust

- Ellipal Titan

- Authereum

- Opendime

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252