MARKET OVERVIEW

The Global R134A Market is going to play an important role in the upcoming years for the refrigeration and automotive industries. Focusing on the production and distribution of R134A, which is one of the HFC-based refrigerants, this market should be one of the core constituents in cooling systems for appliances and vehicles. R134A is in wide use, mainly due to its higher efficiency and reduced environmental damage compared to the older variants of refrigerants such as R12. The strong environmental standards will, hence, require changes in R134A, as these regulatory requirements and technology variations continue.

The global market for R134A is going to be crucial to the auto industry due to increased requirements for air-conditioning units in cars. Air conditioners are now an add-on for most personal vehicles and all commercial vehicles on the planet, and more of this stuff called R134A will be required to cool all of these new vehicles. Manufacturers are likely to focus on more energy-efficient cooling options, which will push them to demand R134A because it provides an excellent balance between performance and considerations of the environment. Regulation in the future related to the reduction of greenhouse gas emissions will force manufacturers into innovation and optimization in how they use R134A to meet international agreements under the Kigali Amendment to the Montreal Protocol.

On the other hand, usage in commercial and residential refrigeration applications will continue to be major. The Global R134a Market is poised to continue as one of the primary players in the market of refrigeration, mainly for supermarkets, food storage, and air conditioning applications for residential and commercial purposes. R134a, in particular, is perfect for cold storage applications in view of its wide operation at a variety of temperature and pressure ranges. This versatility will make it a staple in many applications for cooling for years to come.

Technological advances will drive the future of the Global R134A Market. New refrigerants, and system design innovation and efficiency, will most likely present opportunities for the R134A market to adapt to emerging needs. However, the proven record of R134A on performance and reliability will assure it to be an important part of refrigeration and air conditioning systems for some time to come. As more attention is given to alternatives, R134A is likely to remain widely used as manufacturers continue improving its environmental footprint without diminishing its effectiveness.

In addition, the increased efforts of nations around the world to reduce climate change will create a demand for environmentally friendly and sustainable refrigerants, thereby changing the face of industry. The Global R134A Market will experience changes in formulations and recycling to reduce the impact of refrigerants on the environment. Governmental, manufacturing, and industry organizations will have to collaborate with each other to transition into this new era and make sure that R134A is still relevant in the environmentally conscious marketplace.

The Global R134A Market will, therefore, continue to play a key role in the refrigeration and air conditioning systems used by all sectors. In light of advancing technology and tighter environmental standards, it is likely to change with time. Still, due to the peculiar properties and vast application fields of R134A, in the automobile and refrigeration industries, its future would be sure. Innovation, sustainability, and a global approach of reducing environmental impact will fashion the future of this market.

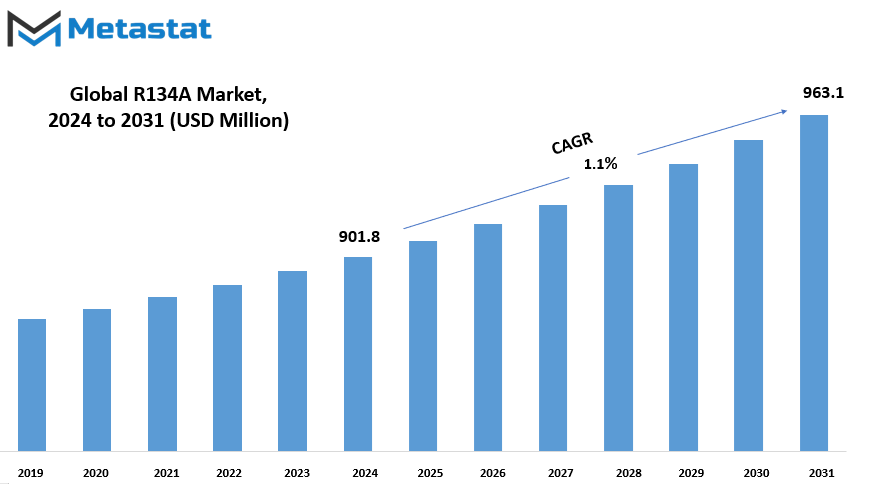

Global R134A market is estimated to reach $963.1 Million by 2031; growing at a CAGR of 1.1% from 2024 to 2031.

GROWTH FACTORS

Rising demand in automobiles as well as home appliances has increased due to growing people wanting comfort in their life. People are constantly finding coolness in daily living life. This trend will have further support through expanding the cold chain logistics because that would require proper and effective refrigeration system performance so that the goods delivered with them do not have spoilage or other type of deterioration. There's a rising demand for the systems, particularly in fields such as food distribution and pharmaceutical industries and others whose products have to be conserved at specific temperatures.

However, the market could face certain hindrances and challenges, mainly the fact that there are increased pressures on the environment through new regulations. Environmental regulations continue to shift attention toward low impact from refrigerants. These regulations are forcing the industry to accept low-global warming potential (GWP) refrigerants as a more environmental-friendly choice. Though changes like this are necessary in order to protect the environment, manufacturers face challenges of complying with these rules. Moreover, the high costs of changing to alternative refrigerants, and the requirement for new infrastructure and technology, may be a limiting factor in the short term.

However, the introduction of eco-friendly blends of refrigerants that can replace the traditional ones, such as R134A, without compromising performance, offers an exciting opportunity for the market. Such new refrigerants will enable businesses to meet environmental standards while providing efficient cooling solutions. This is also when demand for greener alternatives continues to increase. In these ways, it's only through new growth opportunities in refrigerant solutions that offer balance in efficiency with environmentally concerned production that manufacturers should look forward to having greater opportunities in the near future. Conclusion With certain challenges in place, this market will continue with growth for future years ahead. Further sustainability and improved advanced refrigerants will encourage growth into the future years. This is where some companies need to navigate certain challenges ahead while offering their solutions with maximum effectiveness will be leading this market near the future.

MARKET SEGMENTATION

By Type

The type is further subdivided into Virgin R134A and Recycled R134A. Virgin R134A refers to the refrigerant that is new and not used or recycled. It is directly manufactured and considered to be the purest form of the substance. Such a type of R134A is normally used in high purity and efficiency requiring industries such as in automotive air-conditioning systems and refrigeration units. It provides for optimum performance and reliability without contaminants affecting the functionality of the system.

The other way is recycled R134A, which is the one recovered from older systems that is cleaned and purified so it can be reused again. This would be much more environmentally friendly, as it would reduce the percentage of waste and also recycle the refrigerants that could eventually go to waste. The advantage of using recycled R134A is that it will certainly meet the industry's norms and can be applied on various levels. Nonetheless, the quality of recovered and purified refrigerant is supposed to vary.

The choice between virgin or recycled R134A will strictly depend on the system-specific requirements and the environmental expectations of the user. Even though virgin R134A is perfect for new installations where high purity is desired, recycled R134A comes in handy as a substitute for refrigerants in systems that have been around longer. Both play their important roles in ensuring efficiency and performance in cooling systems within vehicles, commercial refrigeration, and industrial use.

Using the right type of R134A will therefore help minimize the environmental footprint of most businesses and individuals while using their refrigeration systems more productively. Since sustainability awareness is increasing worldwide, people will opt for recycled solutions that can easily strike the balance between performance and eco-friendliness.

By Application

There are several key segments that can be divided in the market according to its applications. These include: automotive air conditioning, commercial refrigeration, residential refrigeration, industrial refrigeration, heat pumps, and pharmaceutical refrigeration. All of these play important roles within different sectors of the respective industries that have a lot of requirements and needs for such applications.

Automotive air conditioning is one of the most important applications, especially during hot seasons. The hot weather requires that the coolant systems in vehicles be powerful and efficient. These kinds of systems provide comfort especially to drivers and passengers undergoing long journeys in hot areas. In addition, since technology is improving, customers are demanding more energy-sufficient and environmentally friendly systems as well.

Commercial refrigeration is important to enterprises that handle perishable commodities and products, such as supermarket chains, restaurants, food storage facilities, etc., because these systems will increase the shelf life of a food item by preserving their freshness and quality. Systems in this sector are aimed at high business requirements due to efficiency and reliability issues.

The common place for residential refrigeration is the household, which employs refrigerators and freezers for food and beverages storage. This application is wide spread and has become part of daily life. With time, there have been efforts to have models that consume less electricity yet are still able to deliver enough cooling.

Industrial refrigeration serves large-scale operations that need cooling for products, including chemicals, pharmaceuticals, and other temperature-sensitive materials. These systems tend to be larger and much more complex, designed for factories and large production facilities.

Another important application of market is heat pumps, used as heating and cooling units, highly efficient devices to shift heat from one location to another. Heat pumps will keep homes and businesses within comfortable temperatures throughout the year, making them very useful for both residential and business use.

Pharmaceutical refrigeration is extremely important in the respect of drug and vaccine handling. Medical products need appropriate temperature to avoid losing strength. Hence, the market for this industry is raising day by day with consistent growth to meet the stricter standards demanded for medical applications.

In conclusion, each application that exists in the market, as outlined above, aims at performing a specific operation and collectively fulfills both the cooling, heating, and refrigeration requirements in many industries, thereby fostering both convenience and efficiency of everyday life.

By Distribution Channel

The market can further be divided based on the distribution channel into different categories, including direct sales, distributors and wholesalers, online retailers, and specialty stores. These channels all play a different role in getting products to the end customer, thus making sure that the right goods reach the right people with efficiency.

Direct selling involves the sales of products to consumers without a middleman by the companies. In this process, companies keep control over sales processes and customer relationships, which again benefits the direct sellers to know about their needs and preferences that help in the enhancement of brand loyalty further. Generally, direct sellers depend on self-made platforms or in-house teams for marketing and selling purposes.

The middlemen among the manufacturers and the customer are usually distributors and wholesalers. These persons purchase heavy volumes from manufacturers and make sales to multiple retail houses or small enterprises. Yet, it is also through this way that firms are able to get their large customers as many cannot make direct sales. Many other companies utilize the help of wholesaler and distributor so as to expand the tussled distribution to other markets across, hence finding places selling their products in other various locations.

It has become one of the biggest players in the market with the rise of online retailers, especially due to the increasing popularity of e-commerce. These retailers sell products from their websites or platforms and reach customers all over the world. Shopping from home, having products delivered directly to their doors, has made many consumers choose online retail as a preference. This channel provides businesses with a large customer base and a variety of products without the need for physical stores.

Specialty stores specialize in particular types of products catering to niche markets. The shops provide expertise and a focused selection of items, tailored to specific customer needs. Specializing in a given category often gives such shops a higher level of product knowledge and customer service. Physical and online sales help to attract customers seeking such specific products. With various channels of distribution, the businesses will be able to target the market effectively and reach customers through accessible avenues, meeting the preferences of consumers.

By End-User Industry

The global R134A market is segmented into various key industries that use the refrigerant differently. The automobile industry is one of the biggest consumers of R134A. The primary utilization of R134A by this industry is in automobile air-conditioning systems. The refrigerant cools the air inside the car cabin, and this allows people to comfortably travel in these vehicles, especially during scorching summer days. Given the rising climate regulations, this market will witness even higher demands for more ecologically friendly refrigerants.

The food and beverage industry is another critical consumer of R134A. Refrigeration and freezing systems require this refrigerant for preserving perishable goods. It is from supermarkets down to food production plants, that R134A maintains the temperature required in the storage and transport of food products. It has ensured that food is delivered to the consumers in a fresh state, as its ability to keep food fresh has made it a must-have in ensuring the product reaches the consumers without any loss in quality.

Another vital role that R134A also plays is in the HVAC industry, namely heating, ventilation, and air conditioning systems. Those are being applied in houses and other commercial buildings with the intent of keeping a comfortable temperature. The refrigerant is part of the cooling systems in air conditioners and heat pumps, ensuring that these systems are energy efficient and perform well in regulating indoor climates.

The health and pharmaceutical industries depend on R134A for cooling purposes as well. It is utilized in refrigeration systems of healthcare facilities where temperature-sensitive medicines, vaccines, and biological materials are stored. Maintaining such products within the correct temperature range helps them remain effective, while R134A ensures stability. At times, it is also employed in healthcare facility air conditioning systems for the comfort and safety of patients and personnel.

The electronics industry, too, uses R134A in various cooling applications. Electronic devices are made more advanced and generate even more heat, and they need cooling systems to operate properly. R134A is used in some cooling systems that prevent overheating and allow the devices to work efficiently.

The three depend on R134A to provide their unique properties; for example, its unique feature of acting as an efficient refrigerant in different temperature ranges. Moving into a future with more sustainability considerations in mind, the future for these three industries is likely to consist of more advanced, friendly solutions.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$901.8 million |

|

Market Size by 2031 |

$963.1 Million |

|

Growth Rate from 2024 to 2031 |

1.1% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

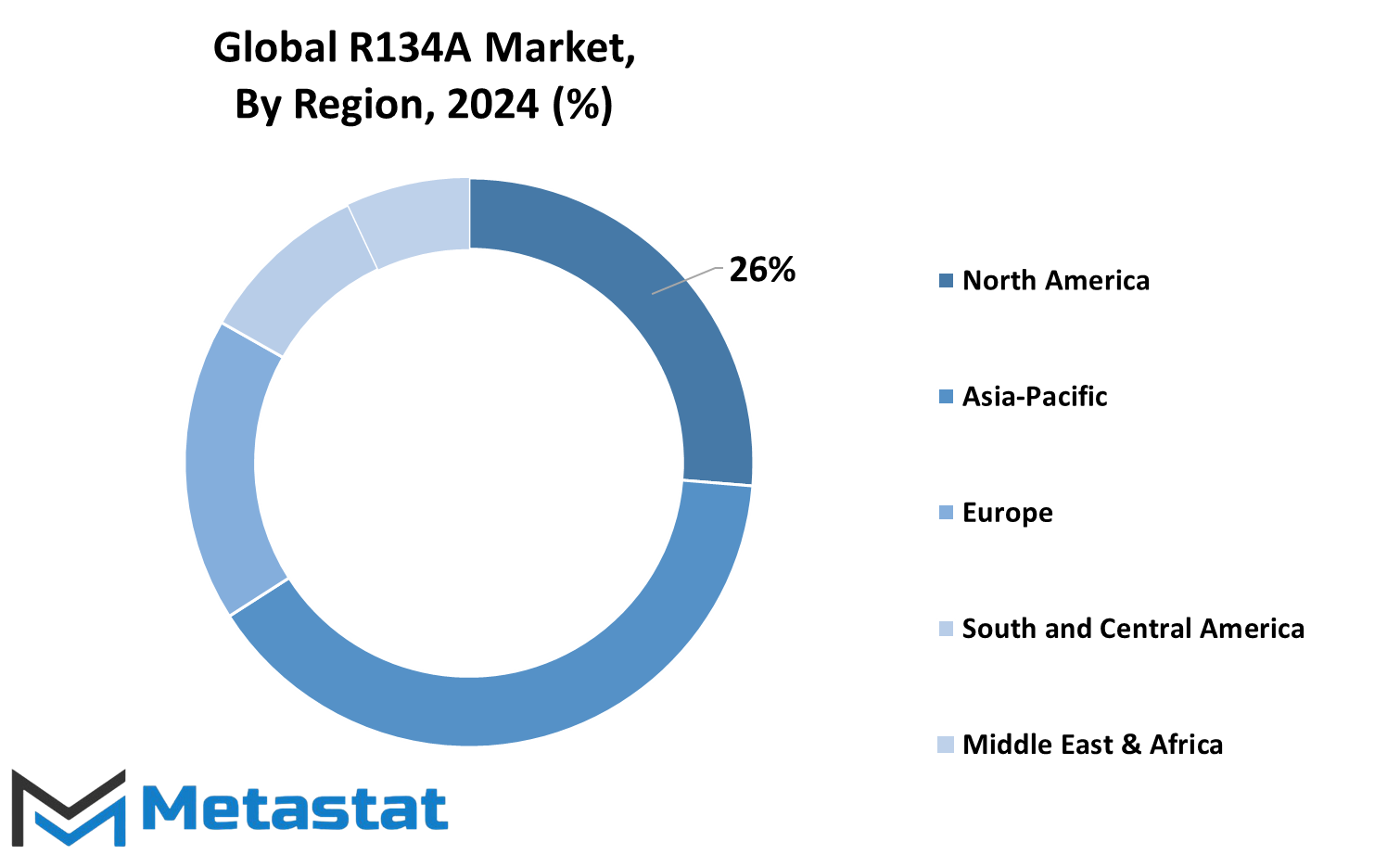

Global market for R134A, by geography is further segregated into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Under this, North America has further sub-segments that are the U.S., Canada, and Mexico. The same goes for Europe under further sub-segments as UK, Germany, France, Italy, and other countries. Asia-Pacific includes the countries India, China, Japan, South Korea, etc. Besides, the whole of Asia-Pacific region, it consists of. Similarly, the South America includes Brazil and Argentina, etc of South America. Finally, it has categorized the Middle East & Africa into a country-wise manner like GCCs, Egypt, South Africa, etc of the Middle East & Africa. Each of these regions has market characteristics and specific demand drivers and challenges.

The market in North America will, for example, be led by the regulations and advancement in technology; the European will be led by sustainability goals and environmental standards. Asia-Pacific is one of the major manufacturing regions, and because of increased demand from auto and refrigeration industries, among others, it is expected to increase significantly. South America and the Middle East & Africa, although smaller in comparison, will also have unique growth opportunities based on local industrialization and infrastructure developments. Understanding the distribution of the global R134A market will help business owners and investors identify emerging opportunities and make informed choices based on regional trends and demand. Each region will constantly grow depending on its economic status, the regulatory framework, and consumer preferences that can keep the market dynamic, hence full of potential to new entrants or expansion plans.

COMPETITIVE PLAYERS

Several key players have been identified in the R134A industry, and this impacts the growth and development of the industry. Such key companies include established ones such as Honeywell International Inc., Arkema S.A., and The Chemours Company. These firms are significant in the market and contribute to the production and distribution of R134A for a wide range of applications. Other leading companies such as Sinochem Group, Daikin Industries Ltd., and Mexichem Fluor (Orbia) also continue to drive innovation and supply in the industry.

Among those are Zhejiang Juhua Co., Ltd. and Shandong Dongyue Group which is the global R134A market important contributors and companies that supply key material and services which support such a demand of this kind of refrigerant. Of more other influencing players is Gujarat Fluorochemicals Limited and Linde Group, a key provider of R134A in the markets of both the automotive and HVAC industry.

Other companies include Asahi Glass Co., Ltd. (AGC), Solvay S.A., Quimobásicos; their products are being applied in various applications where the necessity of R134A exists. Fluorochemicals, R134A production and distribution remain within the important players of SRF Limited and Navin Fluorine International Ltd. Tazzetti S.p.A., Harp International, and Arkool Refrigeration Co., Ltd are but a few of the significant players in the global supply chain that ensure businesses and industries have refrigerants to work with.

The fact is that these companies not only remain significant suppliers of R134A but also continue research and development in improving performance, safety, and environmental acceptability of the said refrigerant. The main players in the R134A market will, in fact continue to fill those needs and propel innovation within this industry as a result of an increase in the global need for sustainable and effective refrigerants. Competition in the industry will be maintained as the marketplace deals with new challenges and opportunities.

R134A Market Key Segments:

By Type

- Virgin R134A

- Recycled R134A

By Application

- Automotive Air Conditioning

- Commercial Refrigeration

- Residential Refrigeration

- Industrial Refrigeration

- Heat Pumps

- Pharmaceutical Refrigeration

By Distribution Channel

- Direct Sales

- Distributors and Wholesalers

- Online Retailers

- Specialty Stores

By End-User Industry

- Automotive Industry

- Food and Beverage Industry

- HVAC (Heating, Ventilation, and Air Conditioning)

- Healthcare and Pharmaceuticals

- Electronics Industry

Key Global R134A Industry Players

- Honeywell International Inc.

- Arkema S.A.

- The Chemours Company

- Sinochem Group

- Daikin Industries Ltd.

- Mexichem Fluor (Orbia)

- Zhejiang Juhua Co., Ltd.

- Shandong Dongyue Group

- Gujarat Fluorochemicals Limited (GFL)

- Linde Group

- Asahi Glass Co., Ltd. (AGC)

- Solvay S.A.

- Quimobásicos

- SRF Limited

- Navin Fluorine International Ltd.

- Tazzetti S.p.A.

- Harp International

- Arkool Refrigeration Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383