MARKET OVERVIEW

The Global Polypropylene Catalyst market is a key part of the chemical and polymer industries, propelling progress in polypropylene manufacture. Catalysts work on the foundation of effective polymerization, taking propylene monomers and molding them into high-quality polypropylene. This is done with intent control over molecular structure and properties. Specialized catalyst technology in development is improved and used within the poly-application process to maximize efficacy, productivity, and product characteristics. As polymer science develops, the demand for innovated catalyst solutions will lead the course of the industry.

Polypropylene has huge thermoplastics applications, from packaging, automotive, and construction to medical care, as part of the Global Polypropylene Catalyst. The Global Polypropylene Catalyst market would be on technologies that manipulate polymer molecular weight distribution, stereoregularity, and overall performance. Much will involve catalyst systems (such as Ziegler-Natta, metallocene, and post-metallocene catalysts) to bolster and refine polymer properties for various industry demands. Each catalyst type has its own advantages, which makes it possible for manufacturers to come up with distinct grades of polypropylene for specific applications.

With the change of production techniques, the Global Polypropylene Catalyst market will get new formulations to improve yield efficiency probably and the quality of polymers. Catalyst performance directly affects some key properties such as impact resistance, clarity, and processability, which are indispensable elements in polypropylene synthesis. Industry players will invest in research and development to engineer catalysts with higher activity, better selectivity, and improved environmental sustainability. Also, customizing the solutions will align the manufacturer with regulatory provisions and provide differentiation of products in a highly competitive marketplace.

The traits that would define the Global Polypropylene Catalyst market will be feedstock availability and process advances. This projection would further advance continuingly refinements in catalyst developments. As manufacturers would be inclined to maximize propylene use and minimize by-product generation through innovative technologies, refinery and petrochemical integration would be a major motivation for development. Further improvement will produce good results as technological advancements in gas-phase, bulk, and slurry-phase polymerization benefit in facilitating efficiency towards the best possible catalyst to be chosen in every production environment.

Environmental aspects will also affect the Global Polypropylene Catalyst market and encourage manufacturers to develop catalyst solutions with low emissions, consumption of energy, and waste generation. Sustainability is also expected to drive the development of catalysts that are "phthalate-free" and "metallocene-based," as they tend to produce "cleaner" and "more recyclable" polypropylene.

The future development directions of the Global Polypropylene Catalyst market will rest upon the synergy in research between catalyst developers, polypropylene manufacturers, and end-user industries. As material performance requirements escalate for automotive applications and medical devices, specialized catalyst formulations will provide a means to manufacture lightweight, durable, and high-performance polypropylene grades. Moving forward, manufacturers will also put in maximum effort to enhance polymerization kinetics, catalyst particle morphology, and reactor productivity to address the emerging needs of the industry.

Regulatory standards will also have an impact on catalyst development strategies, warranting environmental and safety compliance. The strategy of polypropylene producers to meet rigorous quality and performance levels will channel interests within the Global Polypropylene Catalyst market further into solutions that comply with new regulations while remaining cost-effective. Also, the shift toward circular economy principles will generate further interest in catalysts that support newer advanced recycling technologies and sustainable polymer innovations.

The Global Polypropylene Catalyst Market will, therefore, remain a critical area in polymer manufacturing with continuous innovations in catalyst chemistry, process optimization, and their sustainability strategies. The further advancements of applications in polypropylene will still, however, create the demand for high-performance catalysts which enhance productivity and quality and improve the environmental footprint of modern polymer production.

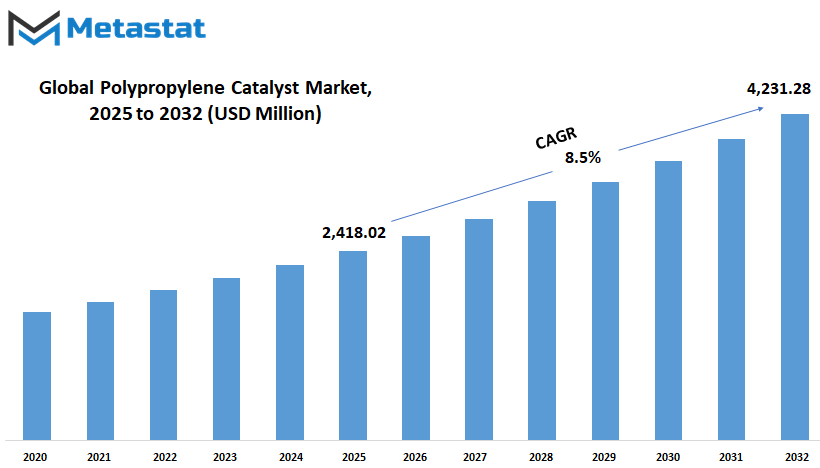

Global Polypropylene Catalyst market is estimated to reach $4,231.28 Million by 2032; growing at a CAGR of 8.5% from 2025 to 2032.

GROWTH FACTORS

The global polypropylene catalyst market looks bright and is expected to grow by leaps and bounds with increasing demand from application areas. Packaging is becoming indispensable, and with the entry of consumer goods and automotive manufacturing, the range of advantages offered by polypropylene has increased tenfold, including durability, light weight, and cost effectiveness. Obviously, industries are looking for such materials that can perform excellently to meet efficiency levels, and dependence on polypropylene is only expected to grow in the future. Increasing demand calls for better catalysts that improve polymer properties and also streamline the production processes.

Ongoing improvements in catalyst technologies will play a major role in enhancing growth in the market. These improvements are important in making polypropylene more flexible for its application in specific industries. Hence, manufacturers are now concentrating on improving those properties equipped with an ability or efficiency to control molecular weight distribution, impact resistance, and production efficiency. Such developments not only improve the quality of the end product but also help in manufacturing it using lesser energy consumption and operational costs.

Even with such bright signs, there are a few problems that might inhibit the speed of development in the market. Price instability for raw materials is one of the most important issues that directly affect production costs. The cost of crude oil is very fluctuating as the petrochemical industry uses crude oil prices for its raw material for producing base materials for polypropylene catalysts. Higher production prices create stress on the manufacturers, leading to an overall decline in profitability and market stability. Further, there are very stringent environmental regulations on the manufacturing and disposal of catalysts. Governments globally are bringing strict guidelines on minimizing chemical footprint in processes and their emissions, which pushes investment into sustainable solutions by companies.

Eco-friendly and non-phthalate catalyst development will prove the most meaningful for market players going forward. It is evident that as awareness of environmental safety continues to rise, industries will shift away from harmful emission processes to greener alternatives that improve recyclability. Non-phthalate catalysts are more than compliant with regulations; they also promise less harm in meeting the ever-increasing demand for sustainable production of polypropylene. Therefore, this transformation will stimulate research and development to produce more efficient and environmentally friendly catalyst formulation.

With performance, cost efficiencies, and sustainability as the main thrusts, the global polypropylene catalyst market is projected to trend upwards in a straight line at a reasonable rate. Advancements in catalytic technology will continue to improve the quality and efficiency of products through production, while it may be possible that regulatory constraints and raw material costs may present challenges. The market will thus remain dynamic and responsive to the demands of future industries due to ongoing eco-friendly developments driving innovation.

MARKET SEGMENTATION

By Type

Polypropylene therefore occupies a significant niche in all sectors as construction materials, packaging, automotive components, and consumer goods. The catalysts employed in the physics become essential in determining the properties of the polymer as well as the efficiency of manufacturing. Future demands from industries for advanced polypropylene catalysts will thus bring further innovations as well as shifts in the dynamic competition in the market.

Of the available catalyst types, Ziegler-Natta types have been most instrumental in the course of developing polypropylene. They are flexible and economical, thus have been used for this purpose for several decades. Nevertheless, the industry is marching towards highly specialized performance features, but a shift is being observed toward highly developed catalyst systems.

Metallocenes are the emerging challenge, and they appear promising as they allow better control over the population of structures. Therefore, they allow the production of polypropylene with enhanced strength, clarity, and other desirable properties. Although the costs per unit are higher than the costs of traditional catalysts, the related benefits justify treating them as a tool for achieving the highest-quality products.

Post-metallocenes are the second level of catalyst development following metallocene technology. They make possible polymerization processes that allow even greater precision in the manufacturing of specialized grades of polypropylene destined for specific uses. The role of these catalysts in the market will increase with the advancement of research.

There are also special catalytic port lifecycles in the production process that directs into their own specific applications of polypropylene. Their special characteristics make them fit in particular types of production processes as they include other catalyst diversities for producers.

The future is bright for the polypropylene catalyst market. Increasingly lightweight, durable materials for the automotive and packaging industries are anticipated as sectors for growing expansion. In tandem with the development of catalyst design technologies aimed at more sustainable production processes, these issues will add more trends to the market.

From a geographical perspective, Asia-Pacific is likely to outshine all other areas of market growth. China and India will pay a lot of attention to this situation, as both countries are making rapid advances toward a growing industrial base with a corresponding demand for polypropylene products. The increasing opportunities created by major industry players and their investments in R&D further add to the trend.

This development of the market for polypropylene catalysts will be an exciting journey as innovations make their way into this fast-paced world, always focusing on the ever-changing needs of industries.

By Manufacturing Process

Polypropylene has emerged as an essential thermoplastic in many industries including packaging, automotive, and consumer goods. The properties of the polymer produced and the efficiency of the production process are heavily influenced by the catalyst used in producing the material. Various methods are known and widely practiced such as bulk, gas, and slurry phase processing.

Liquid phase polymerization or bulk phase polymerization is conducted in the presence of solvent. This solvent is typically a hydrocarbon devoid of olefins. The method is unique for application of control in reaction parameters that lead to consistent polymer characteristics.

In contrast, the gas phase operates by suspending gaseous monomers over a bed of solid catalysts. It boasts simplicity in operation as it does away with the need for solvent removal. Polypropylene is produced from the gas phase, with properties specifically designed to meet the intended application profile. Because of these advantages, the gas phase has been accepted well.

On the contrary, the slurry phase disperses the catalyst and monomer in a liquid diluent to form a slurry. Polymerization occurs in the resulting slurry and the polymer produced is separated from both the diluent and unreacted monomers. This process balances bulk and gas phase processes providing a certain level of flexibility in controlling polymer characteristics.

The manufacture of polypropylene is not only important for certain specific properties but even more so for process consideration among the industries nowadays. More energy-efficient green catalyst technologies have progressed in the making of much more possible efficient and green processes for production. Not only did the new green approach came into play but also the complete process improvement changed course towards less environmental impact and high product quality. Manufacturers seem to invest in research and development into better improved processes according to the changing needs of the different sectors.

Within the coming future, the global polypropylene catalyst market is going to witness growing leaps and bounds. Reason for such developments is the increasing consumption of polypropylene in emerging economies and continuing innovation in catalyst formulations. The trends of sustainability and efficiency may also encourage the industry into adopting processes complying with environmental standards and economic viability. Thus, the judicious choice of manufacturing processes and catalysts will remain a focus for producers wanting to satisfy the different needs of the market.

By Application

There will be developmental overhaul across the global polypropylene catalyst market with polymer technology and the application-oriented expansion of polypropylene in different domains. Polypropylene catalysts are required in the production protocols of a thermoplastic material characterized by durability, chemical resistance, and high adaptability. With industries advancing toward materials that bring on high performance but with sustainability, catalysts have become more important.

The lightweight and barrier-property characteristics of polypropylene make it suitable for application in the packaging industry, especially for various film and sheet applications. Demands for high-comfort packaging materials will increase, developing innovations in catalyst technology to give enhanced clarity, strength, and recyclability to polypropylene films. Manufacturers will focus on catalysts that direct the production of films with improved performance characteristics specific to the emerging needs of the packaging industry.

Injection molding is the primary application of polypropylene catalysts and is a well-established methodology for manufacturing parts for the automotive, consumer goods, and medical sectors. Here lies the impetus to develop catalysts for imparting superior mechanical properties to produce polypropylene so as to be able to manufacture complex and lightweight parts. A technological advancement will be in support of the automotive industry as it seeks to optimize fuel-efficient vehicles, while the medical industry would benefit from reliable, safe equipment.

Polypropylene catalysts have a huge impact on the fiber industry. Strength and wear resistance predetermine the use of polypropylene fibers in textiles, carpets, and geotextiles. As the textile industry strives for sustainability, eco-friendly polypropylene fibers will be increasingly produced through the use of those catalysts. The ensuing drive goes hand in hand with a worldwide campaign to minimize environmental footprints through the adoption of recyclable material.

Blow molding is another important application, and polypropylene makes bottles, containers, and automotive parts. Lightweight and durable packaging solutions will fuel the development of catalysts for processing and performance of blow-molded products. New developments in this field shall allow for thinner and stronger containers, thus contributing to saving materials and more sustainable practice.

Advanced catalysts targeted at extrusion coating allow the deposition of thin layers of polypropylene onto paper or foil substrates. Improved adhesion properties will be achieved at lower processing temperatures, which leads to energy savings and increases product performance. Such developments shall find applications especially in the packaging industry, where high-performance coated materials are in demand.

By End-Use Industry

The global polypropylene catalyst market is poised for major transformation due to developments across industries that use polypropylene. This versatile polymer holds a major assignment in packaging, automotive, healthcare, buildings and constructions, electrical and electronics, and consumer goods. As these industries develop, it is likely that there will be an increase in the demand for efficient and specialized catalysts for the production of polypropylene, and thus the landscape of this market will begin to shape.

In packaging, the shift toward sustainable and recyclable materials is gaining momentum. Polypropylene packing is the favorite choice of environment-friendly packaging solutions for its lightweight and durable characteristics. Innovations in the development of catalysts are expected to enhance the production of high-quality polypropylene that meets the stringent environmental standards. The growing preference for sustainable packaging by consumers and regulators will thus see a prominent role for modern catalysts in facilitating the production of polypropylene in line with these preferences.

Revolution is being experienced in the automotive sector with the arrival of electric vehicles (EVs) and the continuous pursuit of fuel efficiency. Lightweight components made with polypropylene play a pivotal role in the overall reduction of weight in automobiles. The demand for polypropylene is, therefore, expected to grow increasingly as sustainability and performance begin to take higher ground in the automotive industry. As a consequence, advanced catalysts for producing polypropylene with improved properties, especially those needed for automotive applications, are expected to develop.

In healthcare, the demand for materials that are high-quality, sterilizable, and biocompatible is ever-increasing. Polypropylene is widely used in medical devices and packaging because of some of its useful properties. Future advancements in the field of catalyst technology are projected to focus on producing medical-grade polypropylene that meets the rigorous standards of the healthcare industry, thereby ensuring safety and efficacy in medical applications.

The building and construction industries are integrating polypropylene increasingly in applications such as piping systems, insulation, and roofing materials. Chemical resistance and moisture resistance are key features for those applications. With the construction game moving to the use of more sustainable and durable materials, demand for polypropylene is bound to increase. In turn, developments in their catalysts will allow polypropylene to be tailored to meet the demands of construction nowadays.

The miniaturization of devices and the search for heat resistant materials are supporting the growth of polypropylene in electrical and electronics. Polypropylene finds major applications in capacitors and cable insulation.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,418.02 million |

|

Market Size by 2032 |

$4,231.28 Million |

|

Growth Rate from 2025 to 2032 |

8.5% |

|

Base Year |

2024 |

|

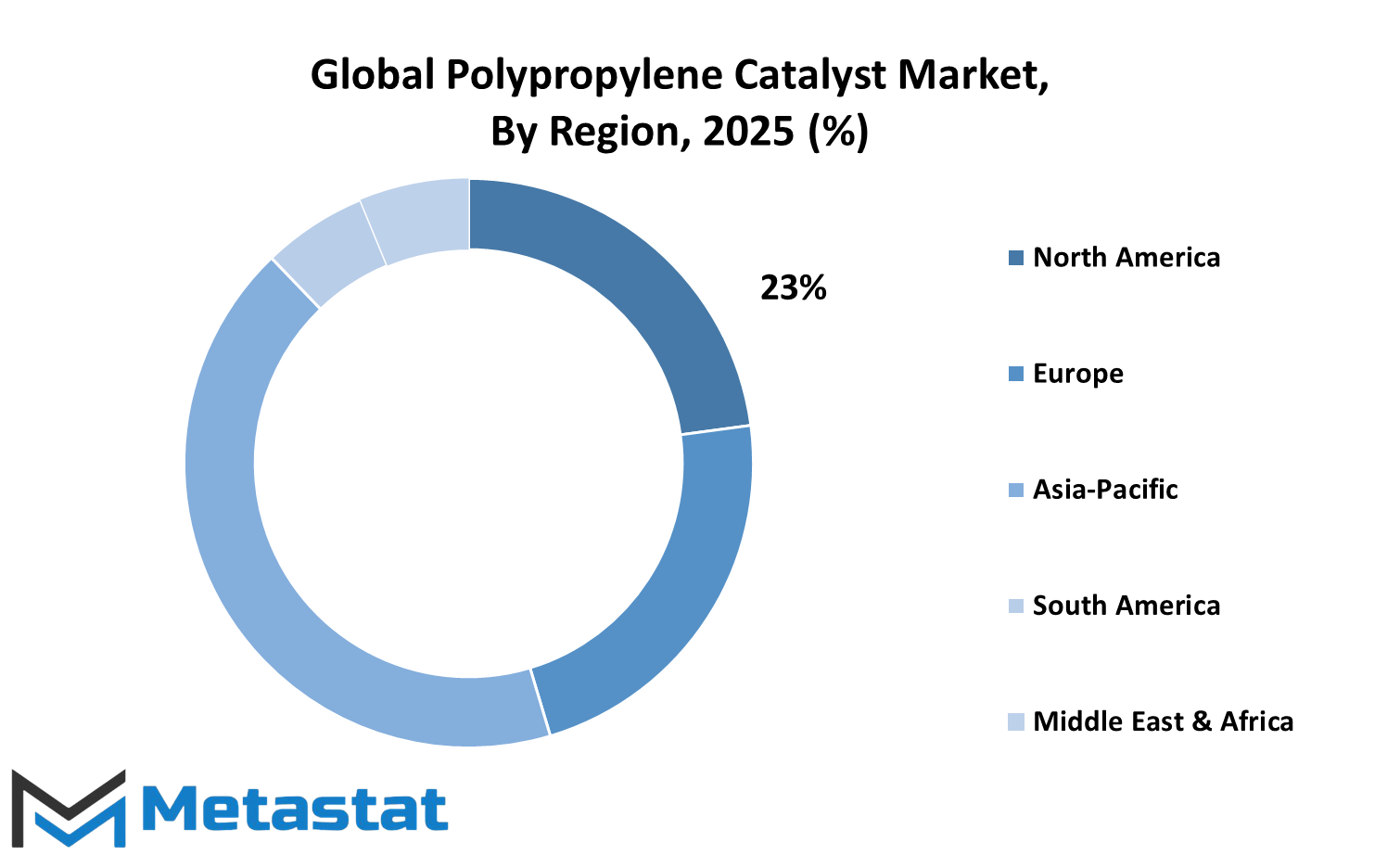

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Although the results of events surrounding regions are far from the same, the kind of opportunities for growth and challenges vary from one region to another. North America has the USA as a major player owing to its large consumer base and advanced manufacturing ability. It is becoming common for companies to modernize plants in accordance with environmental standards and market forces. The Canadian industrial sector is demonstrating excellent growth potential, as strong demand from end-users is acting as a catalyst for investment in niche segments of the market. Mexico is also strategically located and is undergoing reforms that represent opportunities for winning its share in the global market on the back of faster urbanization and expansion of the consumer base.

The market dynamics for Europe are transformed by industry's resilience and adaption towards changing economic circumstances. Sustainability and technological innovation in Germany work well for the growth of the market. France, recovering from the economic crisis, is given the infrastructure by government initiatives resting on promoting a good environment for market growth. In the positive outlook of the UK market, established brands hold strong positions, with companies ready to take increasing market shares. Spain and Italy are set to look for new growth avenues to better their presence in the market, backed by modern technology and a skilled workforce.

This Asia-Pacific region comes forward as one big base for the Polypropylene Catalyst market. In China, continuous investments in technology and strong supply chain infrastructures attract both domestic and international manufacturers. With the consumption-led economy supported by soaring disposable income and urbanization, a substantial demand for polypropylene catalysts is thus generated in India. Japan makes its plans strategically in order to adapt well to market changes, while South Korea is seemingly active in product launches and category expansion to cater for diverse consumer needs.

In South America, Brazil's ongoing urbanization and increasing income levels contribute to a growing market with consumers asking for a variety of products based on polypropylene. The Middle East and Africa have shown a steady increase, supported by economic diversification attempts and infrastructure developments. Countries such as Saudi Arabia and the UAE are increasing investments in petrochemical expansion to meet local and export demand. The growing population and urbanization trends in Africa create opportunities for market penetration, with local needs considered for manufacturing development.

Technological progress, sustainability initiatives, and changing trends among consumers will keep the wheels of evolution turning for the Global Polypropylene Catalyst market, as different regions continue to navigate through their economic and industrial landscapes.

COMPETITIVE PLAYERS

The Global Polypropylene Catalyst Market is on the verge of remarkable changes as top companies engage in innovative changes to align with progressive emerging demands in the industry. These companies have been focusing on research and development activities to offer advanced catalyst technologies to enhance polypropylene production efficiency and quality. These developments are quite necessary for addressing burgeoning demands from industries, such as those involved in packaging, automotive, and construction.

Clariant AG, the leading Swiss multinational, announced the PolyMax 600 Series-a phthalate-free catalyst that is going to optimize production while also cutting energy and cost. This action really testifies to Clariant's dedication to sustainability in the making of polypropylene.

Its domicile Netherlands remains a powerhouse in the global market offered by LyondellBasell Industries Holdings B.V. It is present in almost all countries in the world and develops innovative catalyst solutions for more efficient polymerization processes of high-quality products produced for various applications.

United States-based W. R. Grace & Co.-Conn. has developed its product portfolio by acquiring the polypropylene catalysts business of Albemarle Corporation. The strategic move is intended to increase the company's ability to meet the market with an even broader line of catalysts with superior customer performance.

As such, China Petrochemical Corporation has become one of the most critical players it puts into market influence with its vast resources and technological prowess. An active participant in the Asia-Pacific region and a dominant force globally, this organization is determinant for the supply chain in response to the rising demand for polypropylene products.

INEOS AG is a renowned global chemical player, famed for optimizing polymerization processes through innovations in catalyst technologies. INEOS is about transforming all that into what the end users want and staying ahead of the trend in the marketplace.

Mitsui Chemicals, Inc., on the other hand, is developing state-of-the-art catalysts that enhance the quality and environmental sustainability of these products being made out of polypropylene. The Japanese company's ongoing research and investment show how serious it is to be ready for the next challenges thrown by the industry.

Süd-Chemie India Pvt. Ltd.-the subsidiary of Clariant AG in India-would add value in the developing market through specialized catalyst solutions relevant to the region. The efforts to focus on quality and innovation relate to the larger goals of the parent company in the global perspective.

Sumitomo Chemical Co Limited in Japan is yet another conglomerate that has been investing heavily into the development of catalysts that optimize and lower the environmental impacts of polypropylene production. These steps are in line with the successful transition that has started in the industry to make the process more sustainable.

Toho Titanium Co., Ltd., also a member of Japan, specializes in catalysts meant to speed up the polymerization and improve the polypropylene product's quality. Their technology is transforming how the market is understood or perceived.

Evonik Industries AG, a German company, is one whose work aims for environmentally sustainable practices. Evonik develops catalysts reducing rather than expanding the ecological footprint to achieve the wider industry aim of sustainably manufacturing processes.

Borealis AG is headquartered in Austria and emphasizes value creation through innovation in catalyst technologies. Keeping up with the changes in various industries, their agendas target improving the performance and sustainability of polypropylene production.

The strategic initiatives and technology advancements of these companies will define the Global Polypropylene Catalyst Market as it evolves over time. They endeavor to be innovative and sustainable to be able to respond to the increasing demands of different industries while addressing the issue of the environment.

Polypropylene Catalyst Market Key Segments:

By Type

- Ziegler-Natta Catalysts

- Metallocene Catalysts

- Post-Metallocene Catalysts

- Chromium Catalysts

By Manufacturing Process

- Bulk Phase Process

- Gas Phase Process

- Slurry Phase Process

By Application

- Film & Sheet

- Injection Molding

- Fibers

- Blow Molding

- Extrusion Coating

By End-Use Industry

- Packaging

- Automotive

- Healthcare

- Building & Construction

- Electrical & Electronics

- Consumer Goods

Key Global Polypropylene Catalyst Industry Players

- Clariant AG

- LyondellBasell Industries Holdings B.V.W. R. Grace & Co.-Conn.

- China Petrochemical Corporation (Sinopec Group)

- INEOS AG

- Mitsui Chemicals, Inc.

- Süd-Chemie India Pvt. Ltd.

- Sumitomo Chemical Co., Ltd.

- Toho Titanium Co., Ltd.

- Evonik Industries AG

- Borealis AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383