MARKET OVERVIEW

One of the defining features of the Global Plunger Pumps market is its adaptability to meet the demands of a wide array of industries. From oil and gas exploration to water treatment plants, plunger pumps find application in critical processes requiring accurate and efficient fluid transfer. This versatility underscores their significance in contributing to the seamless operation of numerous industrial processes.

In recent years, the Global Plunger Pumps market has witnessed a surge in demand driven by a growing emphasis on energy efficiency and sustainability. Industries are increasingly recognizing the need for advanced pumping solutions that not only meet performance requirements but also align with environmental goals. Plunger pumps, with their ability to provide high-pressure output with minimal energy consumption, are becoming instrumental in achieving these objectives.

The technological advancements in plunger pump design and manufacturing processes have further fueled the market’s expansion. Engineers and researchers are continuously exploring innovative materials and configurations to enhance pump efficiency, durability, and overall performance. This commitment to innovation is reshaping the Global Plunger Pumps market, offering solutions that go beyond traditional pumping technologies.

As industries continue to evolve, the demand for plunger pumps is expected to grow in tandem. The Global Plunger Pumps market, driven by the ever-changing landscape of industrial requirements, remains a dynamic and vital component of the global machinery sector. The interplay between technological innovation, environmental considerations, and industrial demands will undoubtedly shape the future trajectory of this market, solidifying its role as an essential player in the realm of fluid transfer solutions.

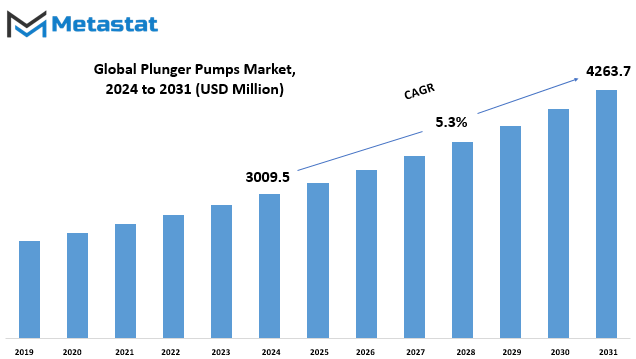

Global Plunger Pumps market is estimated to reach $4263.7 Million by 2031; growing at a CAGR of 5.3% from 2024 to 2031.

GROWTH FACTORS

The Global Plunger Pumps market experiences growth propelled by certain factors while facing challenges that might impede its progress. Understanding the dynamics of these elements is crucial for a comprehensive analysis.

One of the primary drivers is the increasing demand for these pumps across various industries. As businesses expand and diversify, the need for efficient fluid transfer mechanisms becomes more pronounced. Plunger pumps, with their reliability and versatility, address this demand effectively. Moreover, advancements in technology have led to the development of more efficient and cost effective plunger pump variants, further fueling market growth.

Another significant growth factor is the rising emphasis on sustainable practices. As industries worldwide strive to reduce their environmental footprint, plunger pumps gain prominence due to their efficiency in handling different fluids, including those necessary for eco-friendly processes. The ability of plunger pumps to operate with precision and minimize wastage aligns with the sustainability goals of many enterprises, driving the market forward.

However, the market is not without its challenges. Factors such as stringent regulations and compliance standards pose hurdles to the smooth progression of the plunger pump market. Meeting these standards often requires additional investments in research and development to enhance the pumps' performance and compliance. Economic uncertainties and fluctuations in raw material prices also present challenges, impacting the overall growth trajectory of the market.

Furthermore, the dependence on certain industries for significant revenue poses a vulnerability. If these industries face downturns or disruptions, the plunger pump market may experience a setback. Adapting to changing economic conditions becomes imperative to navigate through such challenges successfully.

Despite these impediments, there exist promising opportunities that could drive the market in the forthcoming years. One such opportunity lies in the continuous innovation within the plunger pump industry. Companies that invest in research and development to create more efficient, durable, and environmentally friendly pump solutions stand to gain a competitive edge. Additionally, the increasing focus on digitalization and automation across industries presents avenues for the integration of smart plunger pump technologies, opening up new markets and revenue streams.

The Global Plunger Pumps market exhibits a dynamic landscape shaped by both growth factors and challenges. While demand from expanding industries and a commitment to sustainability drive market growth, regulatory hurdles and economic uncertainties pose potential obstacles. Navigating this landscape requires a strategic approach, emphasizing innovation and adaptability to seize emerging opportunities and overcome challenges.

MARKET SEGMENTATION

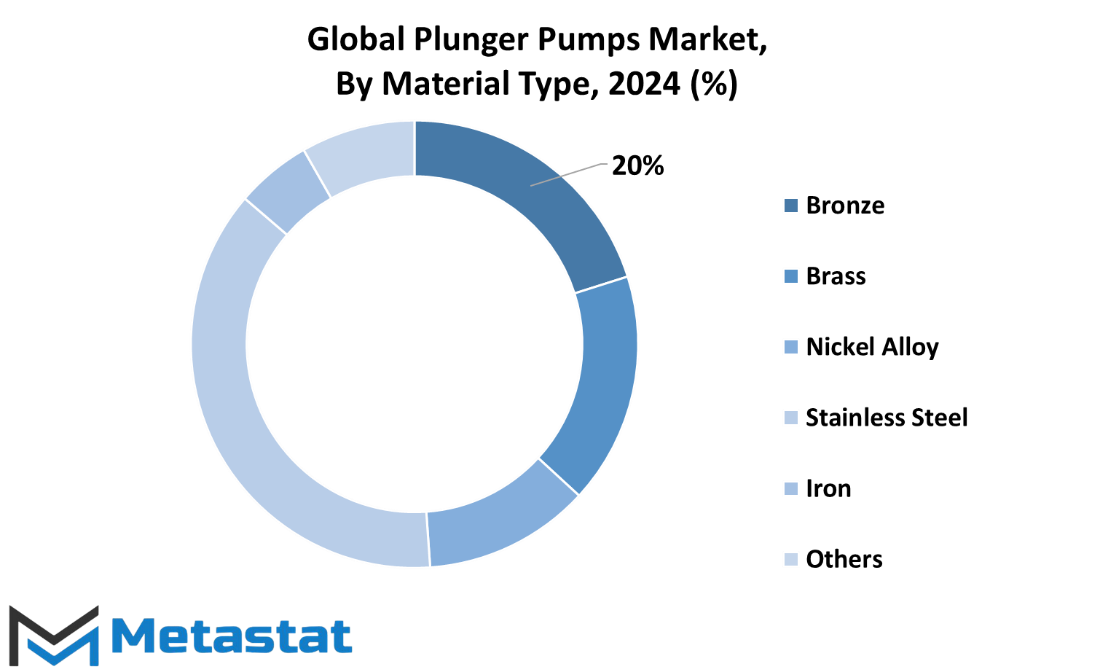

By Material Type

The Global Plunger Pumps market is a diverse landscape, showcasing a range of materials designed to cater to different needs and preferences. When we delve into the specifics of Material Types, the market reveals a nuanced segmentation. These materials play a crucial role in defining the functionality and durability of plunger pumps, influencing their performance in various applications.

One key aspect of this segmentation is based on the materials used in the construction of plunger pumps. We find that these materials can be broadly classified into categories such as Bronze, Brass, Nickel Alloy, Stainless Steel, Iron, and Other Materials like Duplex Stainless Steel and Aluminum.

Bronze, known for its corrosion resistance and malleability, is a popular choice in the plunger pump realm. Its ability to withstand harsh conditions makes it a reliable option for diverse industrial applications. Brass, another material in focus, offers a combination of strength and corrosion resistance, making it suitable for specific use cases within the market.

Nickel Alloy, recognized for its durability and resistance to high temperatures and corrosive environments, is a valuable player in the material spectrum. Stainless Steel, with its anti corrosive properties and robustness, stands out as a preferred material in plunger pump manufacturing, ensuring longevity and reliability.

Iron, a traditional yet sturdy choice, remains relevant in certain applications where its strength and affordability align with the requirements. The category of Other Materials, encompassing Duplex Stainless Steel and Aluminum, introduces additional options catering to specific needs within the market.

This segmentation based on material types reflects the industry's commitment to providing tailored solutions for a variety of scenarios. Manufacturers and consumers alike can navigate this diverse landscape, selecting the material that aligns best with their operational demands and environmental considerations. As the Global Plunger Pumps market continues to evolve, the significance of these material choices will undoubtedly play a pivotal role in shaping the industry's trajectory.

By End-User

The global Plunger Pumps market showcases a diverse landscape with various end-user segments steering its course. Among these, the market divides itself primarily into the Chemical and Petrochemical, Oil and Gas, Marine, Agriculture, Water and Wastewater, and Others (including Dairy, etc.) sectors. Each of these segments plays a pivotal role in shaping the market dynamics.

In the spectrum of the market, the Chemical and Petrochemical segment stands out, with a substantial valuation of 977 USD Million in 2024. This sector, driven by the demand for efficient pumping solutions, has established itself as a significant contributor to the overall market growth. Akin to this, the Oil and Gas segment has also made a noteworthy impact, being valued at 603.1 USD Million in 2024. The imperative need for specialized pumping equipment in the extraction and processing of oil and gas resources has propelled this segment to a prominent position within the market.

Meanwhile, the Marine segment, valued at 394.5 USD Million in 2024, underscores the vital role plunger pumps play in maritime applications. Whether it’s for bilge pumping or hydraulic systems, the maritime industry’s reliance on these pumps is evident in its substantial market valuation.

Beyond these primary segments, the market extends its reach into Agriculture and Water and Wastewater sectors. The importance of plunger pumps in agricultural activities, such as irrigation, and their role in managing water resources and wastewater treatment, has led to a significant market presence in these domains.

Additionally, the market caters to various other sectors, including niche areas like Dairy, contributing to the Others category. This diversity in end-user segments reflects the adaptability and versatility of plunger pumps in meeting a spectrum of industrial needs.

The global Plunger Pumps market is characterized by its diverse and dynamic nature, driven by the unique demands of different industries. The Chemical and Petrochemical, Oil and Gas, Marine, Agriculture, Water and Wastewater, and Other segments collectively shape the market’s trajectory, highlighting the indispensability of plunger pumps across various sectors.

REGIONAL ANALYSIS

The Global Plunger Pumps market undergoes a detailed examination through regional analysis, dividing its scope into North America, Europe, and Asia-Pacific. This segmentation provides a comprehensive understanding of how the market operates in distinct geographical areas.

In North America, the Plunger Pumps market exhibits certain trends and dynamics unique to the region. Factors such as economic conditions, industrial infrastructure, and regulatory frameworks contribute to the market's behavior. Understanding these elements becomes crucial for businesses and stakeholders aiming to navigate the market successfully.

Moving on to Europe, the Plunger Pumps market takes on a different character shaped by the continent's specific conditions. Economic variations, technological advancements, and industry specific demands influence how the market functions in this region. Analyzing these factors aids in formulating strategies tailored to the European market landscape.

In the Asia-Pacific region, the Plunger Pumps market experiences yet another set of influences that mold its trajectory. Rapid industrialization, emerging markets, and cultural nuances play a vital role in determining the market dynamics. Navigating the nuances of the Asia-Pacific market is imperative for businesses seeking to establish a strong presence in this region.

By dissecting the global market into these distinct regions, stakeholders gain a more nuanced understanding of the Plunger Pumps market's intricacies. Each region presents its unique challenges and opportunities, requiring a tailored approach for market success. This regional analysis, therefore, serves as a valuable tool for businesses aiming to make informed decisions and strategic moves in the ever-changing landscape of the global Plunger Pumps market.

COMPETITIVE PLAYERS

The Global Plunger Pumps market is a dynamic arena with significant players shaping its landscape. Among the key contributors in the Plunger Pumps industry are renowned names such as Cat Pumps, Flowserve Corporation, GD Energy Products, LLC, LEWA GmbH, Pleuger Industries, PSG Dover, Ruhrpumpen Group, SPX Flow, Inc., Wepuko PAHNKE Engineering LP, USA., and WOMA GmbH.

Cat Pumps, a prominent player in the Plunger Pumps market, has demonstrated a commitment to quality and innovation. Their contributions have been pivotal in driving advancements within the industry. Similarly, Flowserve Corporation, with its strategic approach, has played a vital role in meeting the demands of a rapidly evolving market.

GD Energy Products, LLC, is another key participant, bringing a unique perspective to the Plunger Pumps sector. Their impact resonates through their dedication to providing efficient solutions. LEWA GmbH, Pleuger Industries, and PSG Dover contribute significantly, each adding its own expertise to the diverse tapestry of the market.

The Ruhrpumpen Group, with a history of reliability, stands as a testament to the resilience required in the competitive Plunger Pumps market. Meanwhile, SPX Flow, Inc. has demonstrated adaptability, showcasing an ability to navigate the dynamic industry landscape effectively.

Wepuko PAHNKE Engineering LP, USA., and WOMA GmbH round out the list of influential players. Their presence highlights the global nature of the Plunger Pumps market, with contributions extending beyond regional boundaries.

The collective efforts of these key players underscore the collaborative nature of the Plunger Pumps industry. As they continue to innovate and adapt to emerging trends, their influence on the market is set to persist, shaping the trajectory of this dynamic sector for the foreseeable future.

Plunger Pumps Market Key Segments:

By Material Type

- Bronze

- Brass

- Nickel Alloy

- Stainless Steel

- Iron

- Other Material (Duplex Stainless Steel, Aluminum, etc.)

By End-User

- Chemical and Petrochemical

- Oil and Gas

- Marine

- Agriculture

- Water and Wastewater

- Others (Dairy, etc.)

Key Global Plunger Pumps Industry Players

- Cat Pumps

- Flowserve Corporation

- GD Energy Products, LLC

- LEWA GmbH

- Pleuger Industries

- PSG Dover

- Ruhrpumpen Group

- SPX Flow, Inc.

- Wepuko PAHNKE Engineering LP, USA

- WOMA GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383