MARKET OVERVIEW

The global site dumpers market comprises a rich texture of industry movement, competitive relocation, and nuanced changes in construction logistics. The in-depth publication continues to examine how this niche subsegment of the heavy machinery industry has evolved beyond its early days of providing support for on-site transportation and matured into a more advanced era of industry applicability. Though a lot of attention is frequently given to more sensational machinery, the development and function of site dumpers is a low-key yet recurring transformation in construction and material handling structures across the globe.

Fundamentally, the report does not so much map the travels of products or manufacturers, but rather considers the larger structural developments which have gradually transformed the way site dumpers are produced, supplied, and deployed in different regions. Regional behavior, however, demonstrates not just patterns of use but also the cultural and regulative influences that quietly impact equipment choice and operation methodology. In areas where accessibility is poor, the compact size of site dumpers is conducive to effective maneuverability and material handling, whereas in more developed environments, priorities shift toward performance metrics and compatibility with smart site procedures.

This thoughtful direction has allowed the global site dumpers market to expand past conventional assumptions. What had previously been relegated to fairly straightforward designs centered around mere load and dump functionality has become a varied industry characterized by innovative design ergonomics, control accuracy, and versatility across a wide range of terrains. This is not just a mechanical evolution it's a strategic conversation between users and manufacturers, a feedback cycle where experience in the field drives product refinement with more agility than ever.

Manufacturers themselves address their publics more directly, enabling customer demand to drive design language and user interface advancements. Customization and maintainability are no longer niceties but necessities driving product features. Incidentally, this also impacts the secondary market, where resale value and lifecycle performance increasingly determine purchasing decisions. In this manner, the usefulness of a site dumper is not only measured by its initial capabilities but by how it will be useful across a number of project cycles.

There has also been a distinct change in the manner in which companies approach resource allocation to training and operational safety. As machine designs become more advanced with hydraulic and digital components, operational dexterity has become as important as physical strength. The market today demonstrates an increasing demand for easy-to-use user environments, ones that minimize the learning curve for new users and make it possible for experienced staff to perform tasks with increased precision. These are subtle operational improvements with a great deal of impact on purchase decisions, particularly in those settings where employee rotation is great or where training budgets are constrained.

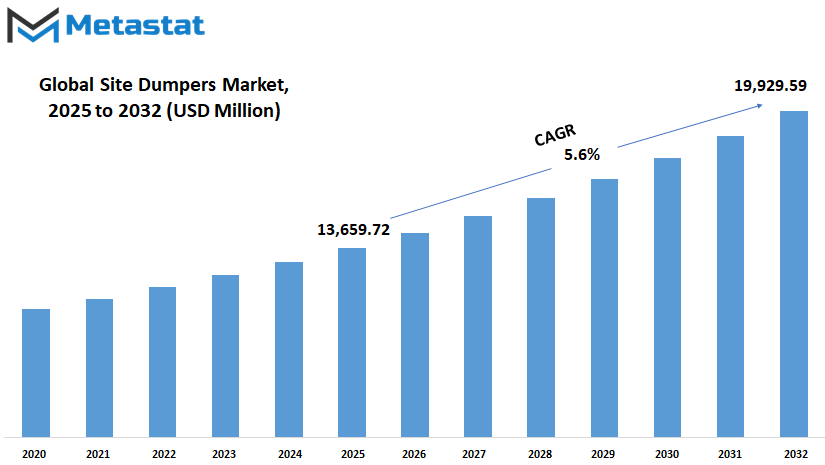

Global site dumpers market is estimated to reach $19,929.59 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The global site dumpers market is gradually gaining attention as construction needs grow in both urban and rural regions. As towns and cities expand and remote areas develop, the need for reliable tools to move materials on-site is becoming more important. Site dumpers are often the go-to machines for short-distance material transport, especially in areas that are hard to reach with larger equipment. Their ability to move quickly in tight spaces makes them a helpful solution on many job sites. What’s encouraging is how frequently they’re being chosen for their simplicity and usefulness, especially in projects that involve digging, groundwork, or road construction.

The growth in construction and infrastructure work is expected to push this market forward. From housing to roads and other public works, these projects will rely on machines that can get the job done efficiently without taking up too much space. There is also a noticeable rise in demand for equipment that is both compact and effective, which is exactly where site dumpers fit in. Their smaller size doesn’t take away from their strength and utility, and this balance is what many builders are looking for. As cities grow taller and rural spaces become more accessible, moving materials efficiently will stay a top concern.

However, some challenges might slow down this progress. One key issue is the high cost of buying and maintaining site dumpers, especially for smaller contractors who might not have large budgets. These machines also don’t offer the wide range of uses that some other construction vehicles can handle, which might limit their use in certain types of projects. These concerns may hold back some builders from investing in them right away.

Even with these drawbacks, the future looks promising. More companies are starting to design electric and automated site dumpers, which could help reduce pollution and improve safety on job sites. This shift toward greener options will likely open new opportunities for growth. Builders are also looking for smarter ways to complete projects, and machines that use automation or run on clean energy will be in demand. As technology continues to shape construction work, site dumpers that meet both environmental and safety standards are likely to stand out.

In the coming years, the global site dumpers market will likely benefit from these changes. With rising construction needs and the push for cleaner and more efficient equipment, this market is set to move forward with steady progress.

MARKET SEGMENTATION

By Type

The global site dumpers market is expected to grow steadily in the coming years due to ongoing construction activities, urban development, and increasing demand for efficient material handling equipment. Site dumpers are simple but powerful machines used to transport heavy loads like soil, gravel, and debris across construction sites. They help save time and reduce manual labor. As cities expand and infrastructure projects increase, the need for compact and reliable site dumpers becomes more important. These machines are especially useful in tight spaces where larger vehicles can't operate easily. Because of this, their demand is likely to rise in both developed and developing countries.

Looking at the global site dumpers market by type, it can be divided into 4-Wheeler Site Dumpers, 2-Wheeler Site Dumpers, and Tracked Power Dumpers. Among these, 4-Wheeler Site Dumpers are widely used due to their balance, higher load capacity, and ability to move across uneven ground. Their stability makes them ideal for rough and sloped areas. On the other hand, 2-Wheeler Site Dumpers are more compact and better suited for smaller sites or jobs that don’t require heavy lifting. They offer better maneuverability and are easier to operate in narrow areas. Tracked Power Dumpers are expected to see growing interest because they can perform well in soft or muddy ground where wheeled vehicles might struggle. Their tracked system gives them better grip, making them more reliable in certain conditions.

Looking ahead, automation and electric power are expected to change how site dumpers are designed and used. Manufacturers are likely to introduce models that reduce emissions and improve fuel efficiency. This shift will help meet environmental regulations and lower operating costs. There’s also a rising focus on safety, which will push companies to develop smarter dumpers with sensors and better control systems. In the future, we may see site dumpers with semi-autonomous features that allow for remote operation or guided movement. These changes could make them more attractive for large projects where speed and safety are top priorities.

The global site dumpers market will likely expand as new technologies improve performance, and more companies see the benefits of using these machines. As construction needs grow, so will the demand for tools that make the job faster and easier. Site dumpers, with their practical design and potential for future upgrades, will continue to play a key role in shaping modern worksites.

By Capacity

The global site dumpers market is expected to grow steadily in the years ahead, shaped by changes in construction practices, technology, and the demand for efficient material handling. Site dumpers are used widely on building sites to transport heavy loads quickly and with less manual labor. As cities grow and infrastructure becomes a focus, the need for reliable and flexible dumping vehicles will continue to increase. These machines are designed to work well in rough conditions, which makes them essential for projects both big and small.

One of the most important ways to look at this market is by capacity. Site dumpers are grouped into categories like Under 2 Tons, 2 to 3 Tons, 3 to 5 Tons, and Above 5 Tons. Each group has a specific role, depending on the size of the job and the nature of the worksite. Smaller dumpers, such as those Under 2 Tons, are often chosen for work in tight areas or places where space is limited. These are easy to handle, especially on smaller construction projects like residential developments. As cities become more crowded, machines in this category will likely see more demand.

The 2 to 3 Ton and 3 to 5 Ton categories are the middle range and often serve as the most flexible tools. They offer a good balance between power and ease of use. Contractors appreciate this size for a variety of tasks, and because they’re not too large, they can still work well on sites with space restrictions. Over time, this segment may benefit from improvements in electric drive systems or hybrid models, which will help reduce fuel use and lower emissions.

Dumpers Above 5 Tons are meant for larger projects, such as road construction or commercial buildings. These machines are built for strength and endurance. As more investment goes into public infrastructure and large-scale developments around the world, this category will likely become more important. There may also be a move toward smarter machines that use sensors and automation to improve safety and productivity.

Looking ahead, the global site dumpers market will likely be shaped by advances in technology and environmental policies. Manufacturers are already exploring cleaner energy options and adding smarter features to make their machines more efficient. While the basic job of a site dumper hasn’t changed much, how that job is done will continue to evolve, driven by both global needs and local project demands.

By Application

The global site dumpers market is expected to grow steadily in the coming years due to the increasing demand across various sectors. These machines are widely used for transporting heavy loads in places where traditional trucks cannot operate efficiently. As industries look for more practical and time-saving ways to move materials, site dumpers offer a solution that fits well in rough terrains and tight construction zones. This growing need is shaping how companies view material handling and logistics, especially in areas with limited accessibility.

By application, the market is divided into construction, mining, agriculture, the utility industry, and others. Each of these fields has unique needs that site dumpers can fulfill. In construction, they are used to carry debris, sand, and concrete across uneven ground, reducing the need for manual labor and improving efficiency. The mining sector uses them to move soil and raw materials through narrow underground passages where larger vehicles can’t reach. In agriculture, farmers benefit from site dumpers when transporting harvests, soil, and tools, especially in hilly or muddy environments. The utility industry also relies on them during infrastructure repair and maintenance projects where space and terrain are not suitable for larger vehicles. Other industries that focus on remote site development or environmental work also find them useful for their ability to handle rough conditions with ease.

Looking ahead, technology will continue to play a key role in shaping this market. Newer models of site dumpers will likely include automated driving features and improved safety controls. These advancements will allow for more precise operation, lower the risk of accidents, and reduce the need for constant supervision. Companies are already investing in research to produce electric and hybrid site dumpers to reduce fuel costs and meet environmental regulations. This will help reduce emissions on job sites, which is a growing concern worldwide. As sustainability becomes more important, site dumpers that can operate with less environmental impact will be in higher demand.

In the future, industries that adopt these modern machines will see better productivity and lower operating costs. The use of smart sensors, GPS tracking, and real-time data monitoring will make it easier to manage fleets and plan work more efficiently. This will not only improve the way materials are moved but will also support larger projects that require accurate and timely deliveries. The global site dumpers market will continue to evolve, driven by practical needs, technical progress, and a shift toward cleaner, more efficient operations.

By Sales Channel

The global site dumpers market is expected to change significantly in the years to come as industries shift toward more efficient and cost-effective machinery. These machines, used for transporting and dumping bulk materials on construction and mining sites, will likely become more advanced, offering better performance, safety, and automation. As more companies look to complete tasks faster and with fewer resources, the demand for site dumpers is set to grow. This market will not only see improvements in technology but also in how the machines are bought and sold.

By sales channel, the global site dumpers market is mainly divided into distributors and direct sales. Each plays a key role in reaching customers. Distributors offer a broad network that helps reach smaller buyers who may not have direct access to manufacturers. They also provide service and support, which is important for businesses that want ongoing help after purchase. On the other hand, direct sales allow manufacturers to build stronger relationships with large buyers. This method gives manufacturers more control over pricing and customer feedback, which can help improve future products. Both channels will likely keep playing an important part in this market, though their roles may shift as online platforms become more common.

As industries continue to adopt smarter construction equipment, the demand for site dumpers that can work with digital systems and sensors will grow. Machines with tracking and remote operation features will be more popular, especially in places where labor is expensive or hard to find. This will also lead to better job site planning and reduced delays. With environmental concerns growing, many countries may soon require machines that produce fewer emissions. This could push manufacturers to create electric or hybrid site dumpers, offering a cleaner alternative to diesel-powered models.

Regions with large infrastructure projects, such as parts of Asia and the Middle East, will likely drive a big part of this market’s growth. Governments in these areas are spending more on roads, bridges, and housing, which will raise the need for site dumpers. Even in developed countries, replacing old machines with newer, more efficient models will keep demand steady.

Overall, the global site dumpers market will continue to grow as industries and governments seek better tools for construction and mining. New technologies, better sales methods, and the push for cleaner machines will shape the market’s future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$13,659.72 million |

|

Market Size by 2032 |

$19,929.59 Million |

|

Growth Rate from 2025 to 2032 |

5.6 % |

|

Base Year |

2025 |

|

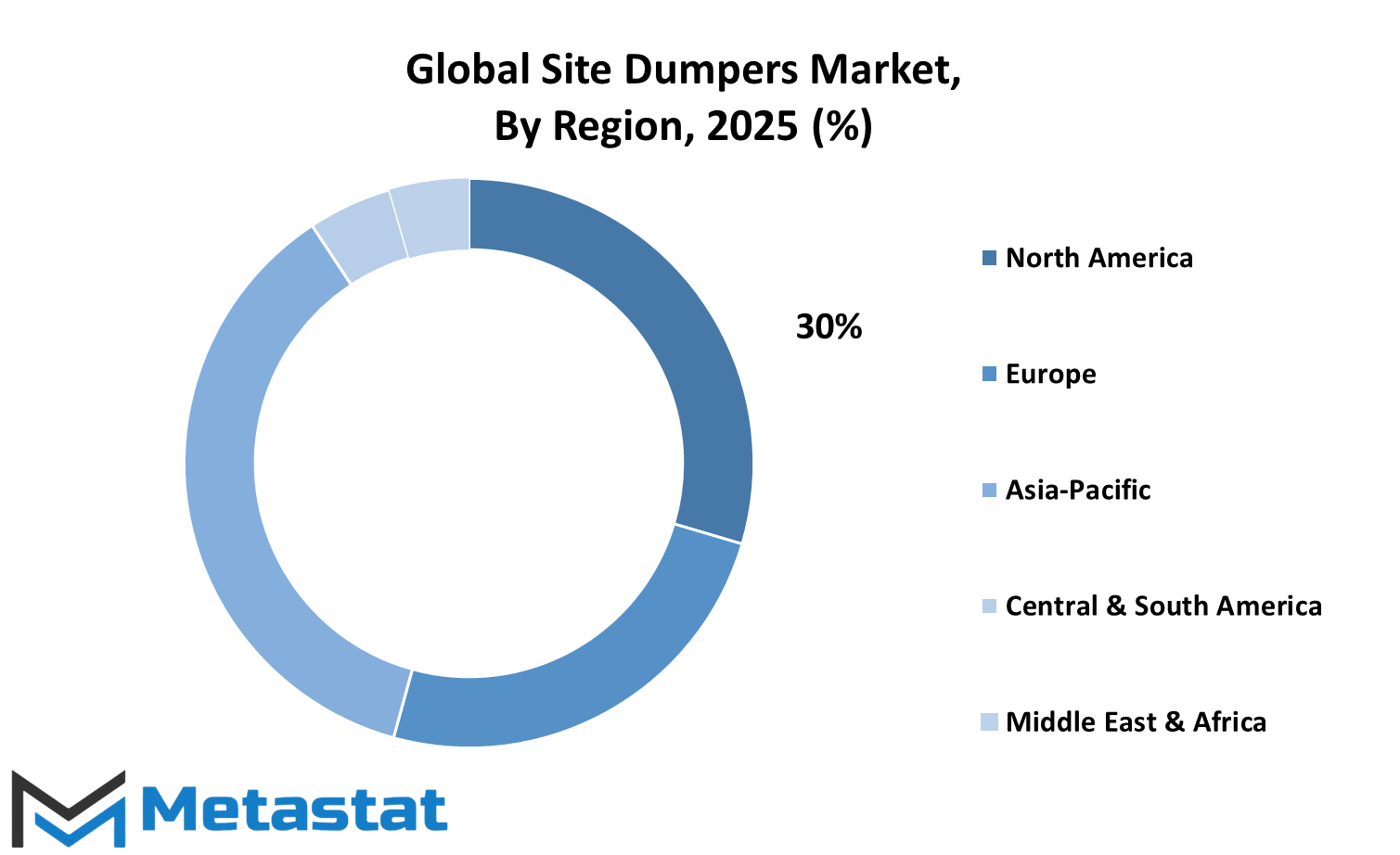

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global site dumpers market is expected to experience steady growth in the coming years due to increasing demand for efficient construction equipment across different regions. As infrastructure projects continue to expand, especially in urban and semi-urban areas, site dumpers will play an essential role in managing material transport on construction sites. These machines, known for their ability to move large quantities of soil, sand, and debris, are becoming more valuable as project timelines tighten and labor costs rise. Manufacturers are already beginning to focus on creating more compact, fuel-efficient, and automated dumpers to meet changing industry needs. This shift is expected to influence market trends and encourage faster adoption.

Geographically, the global site dumpers market is divided into five major regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, the U.S. leads with large-scale infrastructure and residential projects, while Canada and Mexico are also seeing moderate growth driven by commercial development. Europe includes key markets such as the UK, Germany, France, and Italy. These countries are making significant investments in public works, and construction activities are being boosted by both private and government funding. In Asia-Pacific, countries like India and China are witnessing an increase in urban expansion, industrial zones, and smart city developments. Japan and South Korea continue to advance in machinery innovation, which helps fuel the adoption of upgraded site dumpers. South America, led by Brazil and Argentina, is seeing growth due to efforts to modernize construction practices and improve infrastructure. In the Middle East & Africa, countries in the GCC, along with Egypt and South Africa, are investing in long-term development plans, which include major construction efforts where site dumpers are necessary.

Looking ahead, the market is likely to shift toward electric-powered and semi-autonomous dumpers. As more regulations focus on reducing emissions and improving worksite safety, manufacturers will respond with models that not only comply with environmental standards but also make operations smoother and more cost-effective. Remote-controlled features and integration with digital project management tools may also become more common. Overall, while regional dynamics will influence the pace of growth, the global site dumpers market will likely benefit from a universal push for faster, safer, and smarter construction solutions.

COMPETITIVE PLAYERS

The global site dumpers market is expected to grow steadily as the demand for efficient material handling equipment continues to rise across different industries. This growth will likely be driven by the growing need for compact yet powerful machinery that can move heavy loads in limited spaces, such as construction sites and mining operations. As urban development expands and infrastructure projects increase, site dumpers will become even more important for managing materials safely and efficiently.

In the coming years, technology will play a major role in shaping how site dumpers are designed and operated. Manufacturers are likely to focus on developing electric and hybrid models that reduce emissions while maintaining performance. This shift will help meet stricter environmental standards and appeal to companies aiming to reduce their carbon footprint. Along with that, automation and smart control features may become more common, allowing operators to handle equipment more precisely and safely. These changes will not only improve productivity but also reduce maintenance needs and operating costs.

Some of the key players operating in the global site dumpers market are already pushing forward with innovation and expansion. Companies like J C Bamford Excavators Ltd., Thwaites Ltd., and Wacker Neuson SE have a long history of developing durable and efficient dumpers. Others, including Mecalac, Terex Corporation, and Bell Equipment Company SA, are also investing in modern designs to meet changing customer demands. The entry of companies like SANY Group, XCMG Group, and Zoomlion Heavy Industry Science and Technology Co., Ltd. shows how global competition is increasing, especially from regions like Asia where construction growth is rapid.

More established names such as Volvo Construction Equipment, Caterpillar Inc., and Hitachi Construction Machinery Co. Ltd. will likely continue to lead with their strong global presence and focus on performance, reliability, and innovation. Firms like Kubota Corporation and Cormidi S.r.l. are also carving out space in specific segments by offering specialized models that suit niche markets.

Looking ahead, the global site dumpers market will likely experience a shift not only in design and power sources but also in how manufacturers support and service their equipment. Digital tools for remote monitoring, predictive maintenance, and fleet management could become standard. As technology advances, the market will continue to evolve in response to industry demands, tighter regulations, and the growing need for efficient and sustainable solutions.

Site Dumpers Market Key Segments:

By Type

- 4-Wheeler Site Dumper

- 2-Wheeler Site Dumper

- Tracked Power Dumpers

By Capacity

- Above 5 Tons

- 3 to 5 Tons

- 2 to 3 Tons

- Under 2 Tons

By Application

- Construction

- Mining

- Agriculture

- Utility Industry

- Others

By Sales Channel

- Distributor

- Direct Sales

Key Global Site Dumpers Industry Players

- J C Bamford Excavators Ltd.

- Thwaites Ltd.

- Wacker Neuson SE

- Ausa

- Mecalac

- Terex Corporation

- Bell Equipment Company SA

- SANY Group

- XCMG Group

- Shantui Construction Machinery Co., Ltd.

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Volvo Construction Equipment

- Caterpillar Inc.

- Cormidi S.r.l.

- Kubota Corporation

- Hitachi Construction Machinery Co. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252