Global Pension Fund Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global pension fund market have traveled a long way from modest origins to emerging as one of the most influential sectors of today's finance. Its genesis lies in the late nineteenth and early twentieth centuries when governments and corporate giants began setting aside funds for employees to provide for them after retirement. What had started as small pools of capital committed to public servants or plant workers would end up more and more assuming the form of organized funds that both carried social responsibility and economic weight. The post-World War II period was a constitutive period, in which welfare states became more widespread and pension funds evolved into an institutional safeguard for the protection of the financial security of elderly populations.

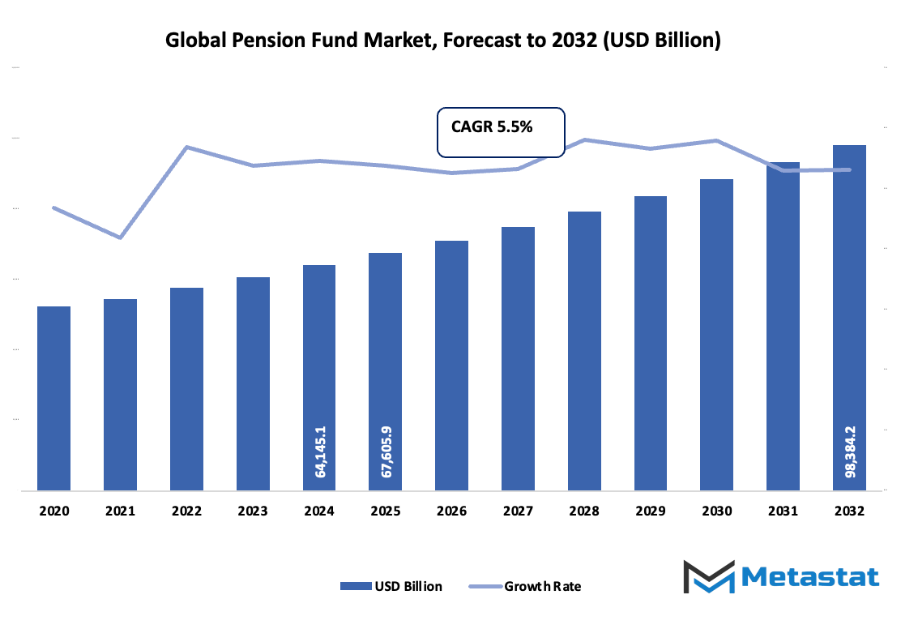

- Global pension fund market worth around USD 67605.9 Billion in 2025, with a CAGR of around 5.5% till 2032, with scope to reach over USD 98384.2 Billion.

- Defined Benefit Pension Funds contribute to around 32.4% market share, with potential for driving innovation and increasing applications via extensive research.

- Major trends fueling growth: Opportunities are: Growth of Sustainable and ESG-based Investments

- Key insight: The market will grow exponentially in value over the next decade with great growth prospects.

- The market transformed again by the 1970s and 1980s, through the drivers of globalization and private sector intervention.

Countries began experimenting with new designs, varying from defined benefit plans to defined contribution schemes, giving individuals greater ownership of future earnings. It was also a period when pension assets started moving across borders, and funds started investing in equities, bonds, and later in alternative asset classes. These changes coincided but were driven by a changing economic climate, demographic pressures, and reform which pushed more sustainable retirement systems. Technology added a new dimension to the global pension fund market as decades went by. The arrival of advanced portfolio management software, electronic reporting, and data-driven risk assessment transformed how these funds operated.

It was also a time when the expectations of consumers shifted; retirees and prospective beneficiaries did not only anticipate financial returns but also greater openness and ethics in investments. Regulation also shifted, with increasing controls after crises such as the financial crisis of 2008, which exposed weaknesses and compelled funds to adopt better governance practices. Today, the global market of pension funds stands at the crossroads: innovation and tradition. The sector will continue to develop in accordance with longer lifetimes, digitalization, and changing ideas of responsible investment. Its destiny will not merely be established by the overall volume of capital handled but also by how effectively it strikes a balance between security and flexibility to ensure that generations to come have been left a system that is based on resilience as well as trust.

Market Segments

The global pension fund market is mainly classified based on Fund Type, Investment Strategy, Sponsor Type, End User.

By Fund Type is further segmented into:

- Defined Benefit Pension Funds: The global pension fund market in the future will see Defined Benefit Pension Funds remaining relevant, though with gradual modifications. The funds guarantee a certain retirement income, which offers long-term stability. With life expectancy increasing and demographics evolving, sustainability will remain a concern, spurring reforms and adjustment in contributions structure.

- Defined Contribution Pension Funds: The global pension fund market will witness steady growth in Defined Contribution Pension Funds due to their adaptability. The funds are based on accumulated contributions and investment returns, hence making them unpredictable. Demand will be boosted in the future as individuals want personalized retirement planning with more investment control.

- Others: In the global pension fund market, other forms of funds will emerge to address various needs. Hybrid funds that mix elements of both defined benefit and contribution plans will become fashionable. New offerings will be created to accommodate changing financial circumstances, offering more flexible retirement choices for a wider population.

By Investment Strategy the market is divided into:

- Active: The global pension fund market will keep on dividing investment strategy into active ones, where managers make efforts to outperform the benchmarks. Active funds will be sought after when market volatility runs high, since professional expertise is worth it. But rising management charges will impact the way these strategies are used in the long run.

- Passive: global pension fund market will also increase through passive methods, where investment is alongside indexes. This method will become popular because of future expansion because of cheaper fees and clear structures. Passive investing will also remain a favorite among long-term retirement funds due to technology-based platforms that ease access.

By Sponsor Type the market is further divided into:

- Public-Sector Plans: In the global pension fund market, public-sector plans will lead because governments will remain with large pools of people with retirement money. The plans will increasingly be under pressure to stay financially sound despite aging populations. Future reforms will likely focus on sustainable funding arrangements and preserving timeliness of payments.

- Private-Sector Plans: Private-sector plans will also help to establish the global pension fund market and offer diverse choice to employees. As competition among companies increases, employers will design competitive retirement benefits in order to attract talent. The future expansion of these plans will be based on adaptable design, adopting technology, and inexpensive fund management.

By End User the global pension fund market is divided as:

- Government: The global pension fund market will see governments as significant end users, ensuring pensions for employees across public services. Governments will continue to adjust policies and regulations to secure long-term benefits. Investment in sustainable assets may also increase, aligning with broader economic and environmental goals.

- Corporate: Within the global pension fund market, corporations will play a crucial role as end users by providing structured retirement benefits to employees. Corporations will increasingly adapt retirement offerings to attract and retain skilled workers. Future developments will include digital management of funds and broader global investment opportunities.

- Individuals: The global pension fund market will see more individuals managing retirement savings independently. Rising awareness and financial literacy will drive personal participation. With growing access to digital platforms, individuals will explore different strategies, balancing security with growth potential. Personalized solutions will shape the future of individual pension planning.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$67605.9 Billion |

|

Market Size by 2032 |

$98384.2 Billion |

|

Growth Rate from 2025 to 2032 |

5.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

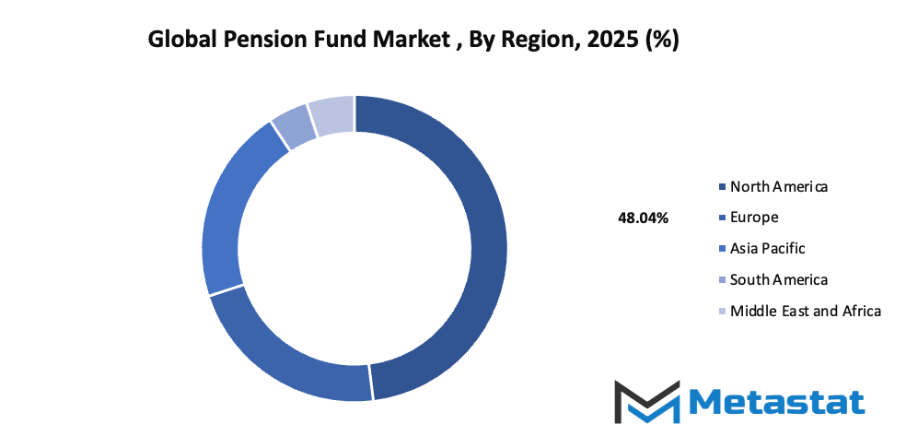

By Region:

- Based on geography, the global pension fund market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising Aging Population and Retirement Savings Demand: The global pension fund market will see growing demand as the population ages. Longer life expectancy will require stronger financial support systems to secure retirement years. With traditional family support systems changing, savings through pension funds will become essential, creating sustained opportunities for expansion across multiple regions.

- Increasing Government Support and Regulatory Reforms: The global pension fund market will benefit from government actions aimed at strengthening retirement systems. Policies that encourage mandatory contributions and tax benefits will enhance fund participation. Regulatory changes focused on transparency and accountability will improve trust, attracting both individuals and institutions, and ensuring steady inflows into pension structures.

Challenges and Opportunities

- Market Volatility and Low-Interest Rate Environment: The global pension fund market will continue to struggle with unpredictable markets and prolonged low-interest conditions. Reduced returns from bonds and traditional investments will press fund managers to seek diversified strategies. Emphasis on global equities, alternative assets, and innovative financial tools will become necessary to maintain strong performance.

- High Administrative and Compliance Costs: The global pension fund market will encounter financial strain from rising operational and compliance costs. Regulations demand advanced reporting, technology adoption, and security systems, all of which increase expenses. These costs may affect smaller funds more heavily, pushing the industry toward consolidation while encouraging efficiency-driven reforms for long-term stability.

Opportunities

- Growth of Sustainable and ESG-focused Investments: The global pension fund market will grow significantly with rising interest in sustainable and ESG-focused investments. Environmental and social responsibility will guide allocation decisions, reflecting investor expectations. Strong demand for ethical and responsible portfolios will transform the way pension funds operate, aligning long-term financial returns with positive global impact.

Competitive Landscape & Strategic Insights

The global pension fund market is undergoing a phase of transformation that reflects both opportunities and challenges for established leaders and new participants. The industry is a mix of both international industry leaders and emerging regional competitors, creating a highly competitive environment where long-term strategies matter as much as short-term adaptability. Established institutions such as the Government Pension Investment Fund, Bavarian Pension Fund, Norges Bank Investment Management, National Pension Service, Ontario Municipal Employees Retirement System, California Public Employees’ Retirement System, California State Teachers’ Retirement System, APG Asset Management, PensionDanmark, ABP, Pensioenfonds Zorg en Welzijn (PFZW), AustralianSuper, and the New York City Comptroller have built a strong foundation of trust and financial stability. Their role in shaping global investment practices is central, and their actions often set the tone for how markets respond to future uncertainties.

A closer look at the direction of this market shows that the coming decades will place more emphasis on sustainability, technology integration, and resilience in the face of demographic shifts. With aging populations in many regions, the demand for secure and reliable pension systems will only increase. Large institutions are expected to invest heavily in areas such as green energy, digital infrastructure, and healthcare, as these sectors are projected to remain vital for long-term stability. Emerging regional funds, while smaller in scale, will continue to push innovation by adopting flexible models that allow quicker responses to new investment opportunities. This combination of scale from established players and agility from newer entrants will shape how the market develops in the years ahead.

Competition among these funds is no longer defined solely by financial returns but also by a commitment to social responsibility and sustainable growth. Pension funds are likely to expand investment portfolios beyond traditional assets and move toward projects that provide both economic and societal benefits. This shift will encourage further collaboration between international giants and regional competitors, as both groups recognize that global challenges such as climate change and economic inequality demand shared solutions. By adopting a forward-looking perspective, pension funds are not only protecting the interests of future retirees but also contributing to the broader stability of the global economy.

The global pension fund market, supported by both long-standing institutions and new players, is heading toward a future where resilience, adaptability, and responsibility define success. Those capable of balancing financial strength with an awareness of global challenges will maintain their leadership, while those willing to innovate and adapt quickly will secure an important role in shaping what comes next. This ongoing evolution reflects the growing importance of building systems that can withstand uncertainty and provide stability for generations to come.

Market size is forecast to rise from USD 67605.9 Billion in 2025 to over USD 98384.2 Billion by 2032. Pension Fund will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global pension fund market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global pension fund market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pension fund market.

Pension Fund Market Key Segments:

By Fund Type

- Defined Benefit Pension Funds

- Defined Contribution Pension Funds

- Others

By Investment Strategy

- Active

- Passive

By Sponsor Type

- Public-Sector Plans

- Private-Sector Plans

By End User

- Government

- Corporate

- Individuals

Key Global Pension Fund Industry Players

- Government Pension Investment Fund

- Bavarian Pension Fund

- Norges Bank Investment Management

- National Pension Service

- Ontario Municipal Employees Retirement System

- California Public Employees’ Retirement System

- California State Teachers’ Retirement System

- APG Asset Management

- PensionDanmark

- ABP

- Pensioenfonds Zorg en Welzijn (PFZW)

- AustralianSuper

- New York City Comptroller

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252