MARKET OVERVIEW

The global para-menthane-3, 8-diol (PMD) market will continue to focus on the market as industries discover safe, plant-based options in individual care and domestic products. Derived from natural sources such as lemon eucalyptus oil, PMD has already shown significant value in the insect distinguished area. However, its capacity is far ahead of this traditional application. As regulatory bodies worldwide tighten restrictions on synthetic chemicals, manufacturers will rapidly detect PMD-based solutions that align with security and stability targets. This trend will gradually open the way for innovative yogas not only in individual safety products, but also in textiles, packaging and even veterinary applications.

Future development in the global para-menthane-3, 8-diol (PMD) market will benefit from increasing investment in green chemistry. Researchers are expected to refine extraction and production techniques to increase yield by reducing environmental impact. This progress will help in the position of PMD as a commercially viable option for rigid chemical agents in a wide array of consumer goods. Furthermore, because consumers preferences are shifted to naturally derived components, especially in markets such as North America and Europe, adopting PMD will expand skin care, pet care and even disaster for germs. This widening application will offer both the basis and challenge, as manufacturers will need to maintain stability, efficacy and regulatory compliance in diverse product formats.

The global para-menthane-3, 8-diol (PMD) market is also expected to establish a leg in the textile industry, especially in performing clothing that demands anti-intrigant or odor-defense properties. Fusion of PMD with advanced fabric technologies can result in long -lasting remedies suitable for outdoor gear, sports or military clothing. Such innovations will be likely to cooperate between chemical developers and textile manufacturers, which will encourage the birth of top product segments. Similarly, the potential role of PMD in packaging solutions-especially in food storage and agricultural applications-can be discovered as a natural preservative or anti-fungal agent, which reduces dependence on synthetic additives.

Regional markets that will gradually recognize the value of PMD beyond pests may include parts of Asia-Pacific, Latin America and Africa, where awareness of natural options has started increasing. The educational campaign and updated regulatory framework will shape on how these areas respond to new applications of PMD-based products. Furthermore, as international trade rules develop, manufacturers will need to standardize yoga and labels according to field-specific rules, possibly determining the phase for global partnership and supply chain changes.

Overall, the global para-menthane-3, 8-diol (PMD) market will gradually transition to a more dynamic and versatile industry than its current position. Its ability to integrate with environment, consumer safety and innovation agenda will allow it to gain importance in the manufacture of everyday products. The one who lies further is not only an extension of demand, but where and how PMD can be used, it suggests a redistribution, adaptability and future formed on natural.

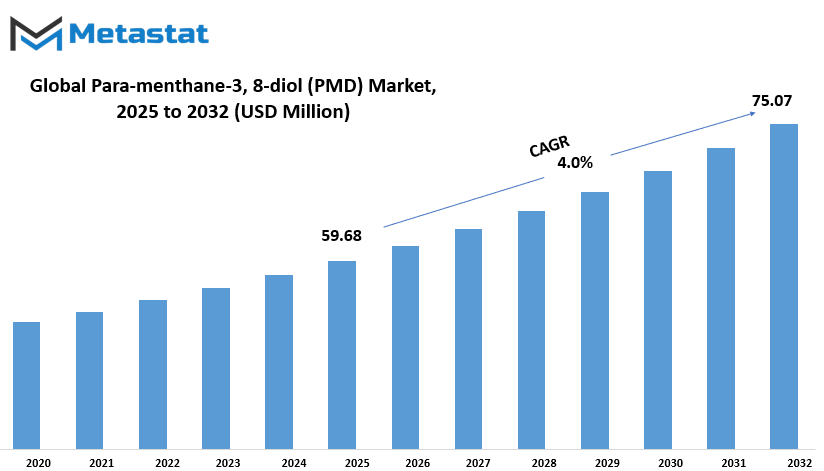

Global para-menthane-3, 8-diol (PMD) market is estimated to reach $75.07 Million by 2032; growing at a CAGR of 4.0% from 2025 to 2032.

GROWTH FACTORS

The global para-menthane-3, 8-diol (PMD) market is gradually attracting attention due to noticeable changes in consumer preference towards natural and DET-free pests. Many people are now more conscious of materials in personal care products and are actively looking for safe options, especially when it comes to the products applied directly to the skin. PMD obtained from lemon eucalyptus oil has emerged as a popular component in insectile products as it is seen as a more natural option than synthetic chemicals. This growing interest in cleaner and nature-based products is helping PMD achieve traction, especially designed to keep mosquitoes and other insects away.

The global para-menthane-3, 8-diol (PMD) market is growing another important reason is increasing public awareness about vector-related diseases like malaria, dengue and zika. These diseases can spread quickly and pose serious health risk in many areas, especially in tropical and subtropical regions. As a result, people are now more alert and are ready to invest in products that can provide reliable security. Governments and health organizations are also conducting educational campaigns to highlight the importance of using insect repellents, which have encouraged people to adopt protective measures.

Despite increasing popularity, there are some limitations that can affect global para-menthane-3, 8-diol (PMD) market growth. One of the challenges is that PMD may not be as effective against some insect species as some synthetic options such as DEET. This difference in performance may hesitate to some users, especially in high -risk areas where strong security is necessary. Additionally, the development of new PMD-based yogas often requires strict regulatory approval and comprehensive security testing. This process can delay product launch and increase costs for companies, making it a slow way for innovation.

However, there is obvious ability to grow, especially more people are interested in durable and environmentally friendly health products. Companies that can find ways to improve the effectiveness of PMD while living within the natural component guidelines will have a strong opportunity to attract consumers. External and individual care markets are open to new ideas, and such as consumers seek healthy, safe options, PMD market can see strong developments. This growing interest in greenery options presents a valuable opportunity for brands to expand its product lines and meet the changing audience needs.

MARKET SEGMENTATION

By Type

The global para-menthane-3, 8-diol (PMD) market is drawing attention due to its wide range and increasing demand in many industries. PMD, a natural compound that is often derived from essential oils such as lemon eucalyptus, has proved to be an effective and safe option for synthetic chemicals in many use cases. Its non-toxic nature makes it a preferred component in personal care products, pharmaceuticals and food-grade applications. The expansion of the market is not only inspired by its effectiveness as a model, but also by increasing consumer awareness about environmentally friendly and skin-safe materials.

In various types of PMD available in the market, the food grade segment is showing promising development. At a price of approximately $ 6.09 million, this section is seeing an increase in use due to the increasing requirement of food-safe guarders and additives that do not create health risks. The consumers are becoming more alert about what goes into their food, and it has made place to use as a safe and more natural option for PMD. Although this section still creates a small part of the total market, its steady growth suggests that manufacturers are responding to the changing priorities of health-conscious buyers.

Pharma grade PMD is also acquiring land, requiring high purity level due to possible use in large -scale topical applications and yogas. This grade of PMD is often used in the development of skin creams, lotions and other skin products, designed to treat or prevent skin irritation, insect bites, and other conditions. Its low toxicity and gentle action make it an attractive option for pharmaceutical companies that are looking to introduce non-hiratory content yet effective in their product lines. The pharmaceutical industry's move towards more natural solutions supports continuous interest in PMD for such applications.

Industrial grade PMD is usually used in agricultural and domestic products. This includes use in sprays, repelles and surface cleaner. Although this grade cannot meet the purity levels required for direct human application, it still provides an important purpose in maintaining cleanliness and safety in a non-individual environment. As governments and regulatory bodies push for strict standards around chemical use, especially in public and shared places, demand for less dangerous options such as PMD is likely to continue. With these increasing applications, the global para-menthane-3, 8-diol (PMD) market is slowly expanding, which is supported by the change in consumer's demand and industrial improvement towards safe, cleaner material.

By Application

The global para-menthane-3, 8-diol (PMD) market is shaped by a series of practical uses in various industries. PMD, which is a synthetic version of a natural substance found in lemon eucalyptus oil, is known for its role in canceling insects. This property has given rise to its growing presence in various applications. Among them, individual care and cosmetics lead the toilet passage, especially through products such as mosquito-twisting creams, lotions and sprays. People fast seek solutions that are soft on the skin but are effective against insects, which have attracted attention to PMD-based products. Unlike some chemical options, which can cause irritation, provides a safe experience without compromising PMD performance, making it a popular option in skin-related Yogas.

Pharmaceuticals also create a remarkable part of the PMD market. At this place, PMD is more useful towards public health protection, especially in areas of mosquito-borne diseases. It is often added to medicated creams or sprays distributed during health campaigns. The demand in this region increases in areas where diseases like malaria and dengue are more widespread. The fact is that PMD is supported by health agencies to its low toxicity, which further strengthens its acceptance in drug products. Although its use may not be widespread as cosmetics, its role in health-operated products is steadily increasing.

Another section where PMD promise shows that there are domestic products. From surface sprays to cleaning solutions and room fresheners, PMD is used for its insect-reilying capacity. Many homes prefer PMD-based products because they are seen as less rigid and safe for indoor use, especially around children and pets. This change towards more natural and less aggressive ingredients has worked in favor of PMD. Industrial application also takes a small but stable part. In these cases, PMD is sometimes used in protective gear or coatings in specific work environment where insect control is a concern. Although this section does not command the largest amount, it reflects the versatile nature of PMD in professional settings.

There are also uses that fall into the 'others' category, including areas such as pets or agriculture, although they are still being discovered and developed. As more people and industry seek solutions that are both effective and skin-safe, in these applications, there is a possibility of strengthening its place in the global market in demand for PMD.

By Distribution Channel

The global para-menthane-3, 8-diol (PMD) market has seen a noticeable change in the market in how products are reaching consumers. Distribution channels have played an important role in affecting purchasing decisions and brand access. Each distribution method has a unique effect on consumer behavior and availability of PMD-based products in areas. The growing demand for plant-based insect replants has made PMD into the limelight, and companies are adjusting their strategies to meet customers where they are the most active.

Online retail PMD has become one of the most dynamic segments in the distribution network for products. With ease of access and round-the-clock availability, consumers now prefer browsing and purchase facilities through digital platforms. The ability to compare prices, read reviews and reach a wide range of products has helped to give strengthening the online retail gain. Additionally, online platforms often allow direct interaction between manufacturers and consumers, removing the requirement of many intermediaries and often reduces overall costs.

On the other hand, supermarkets and hypermarkets continue to be popular among buyers who prefer an in-person shopping experience. These stores provide the benefit of product visibility and physical inspection before purchasing, which is important for customers looking for reliable, familiar brands. Many consumers still give importance to the option to see a product for the first time before talking or shopping to store employees, especially when it comes to personal care and domestic security related items.

Special stores also have a valuable position in the global para-menthane-3, 8-diol (PMD) market. These outlets typically focus on natural or environmentally friendly products, attracting buyers that are conscious of materials they use. Since PMD is often deployed as a natural alternative to chemical repellents, its presence in such stores creates confidence and a niche has yet to fulfill the loyal customer base. These stores offer individual service and knowledgeable employees who can educate consumers about the benefits and uses of PMD products.

Pharmacies remain a reliable source for health-related items, and PMD products sold through these channels often benefit from the perception of safety and reliability. Consumers that prefer the options that are medically supported, often turn to pharmacies when purchasing repellent or skin related products.

Direct sales, although not prominent like other channels, still play a role, especially in communities where relationship-based sales are more effective. Personal recommendations and performance can often affect the decision to buy decisions, giving PMD products a strong range in this segment.

Overall, these channels continue to shape on how PMD-based products are accessed worldwide, each consumer provides different advantages based on habits, beliefs and preferences.

By End-User

The global para-menthane-3, 8-diol (PMD) market is shaped how it completes a variety of end-users. Each category of end-user plays a unique role in increasing demand and shaping the use of the product. Of these, individual consumers create a large part of the market. These users look for plant-based and low disturbing insects, and PMD fits that preference well. As the awareness of synthetic repellents increases, more individuals are turning to PMD-based products. People use it directly in sprays, lotions and creams that protect them from mosquitoes and other insects, especially in tropical and sub-triangular regions where reliable repelles are required.

Cosmetic manufacturers are another important part of the market. For them, PMD provides a way to create safe and more skin -friendly personal care items. It can be added to skin creams, lotions and body mists to offer an additional layer of insect protection without compromising on comfort or fragrance. Companies of this place are constantly looking for materials that attack the correct balance between security, work and appeal, and PMD has proved to be a reliable option. Its plant-based original is a good match for brands promoting natural and durable beauty products.

Pharmaceutical companies also rely on PMD, although their approach is slightly different. Here, safety from insect-related diseases is focused on safety. Products made by pharmaceutical companies often follow strict rules, and PMD's ability to offer long -lasting safety without rigid side effects has made it a reliable component. These firms make ointments, patches and sprays, which can be recommended or determined in areas where the risk of the disease is high. Meditation often occurs on distributing solutions that are both preventive and safe for prolonged use.

Domestic product manufacturers have also started using PMD in items such as floor cleaner, room spray and fabric spray. These products not only help to maintain a clean living place, but also provide protection from insects. The ability to combine cleaning and repeat tasks in a product has added PMD appeal to this segment. As customers seek all-in-one solutions that reduce chemical risk in homes, PMD-based options are becoming more common.

Each of these end-user groups supports the development and direction of global para-menthane-3, 8-diol (PMD) market in its own way. Their different goals and needs help define how the component is used, and future demands may increase.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$59.68 million |

|

Market Size by 2032 |

$75.07 Million |

|

Growth Rate from 2025 to 2032 |

4.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

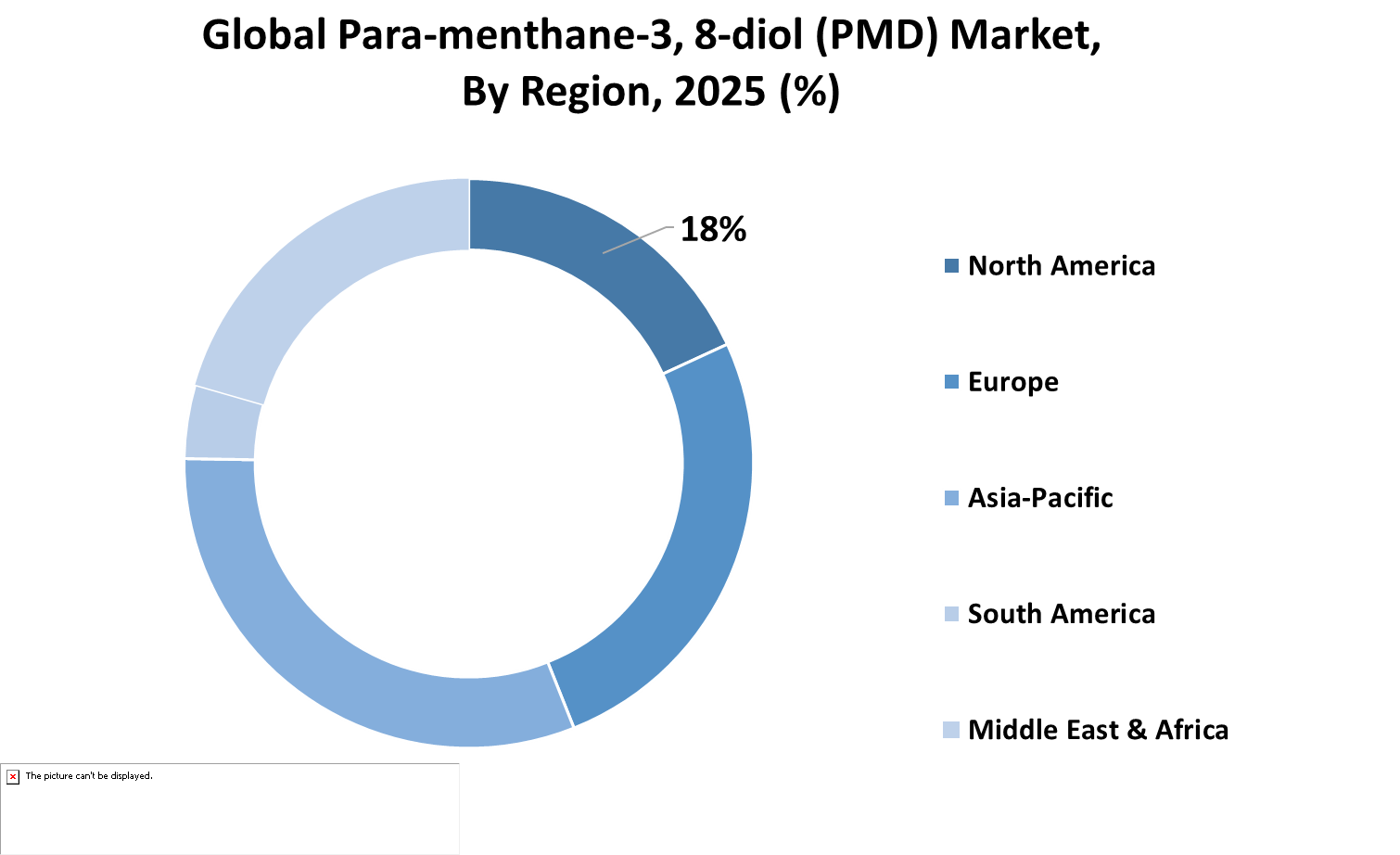

The global para-menthane-3, 8-diol (PMD) market is spread over several major areas, each with its own unique landscape and market behavior. North America plays a remarkable role in this market and is divided into the United States, Canada and Mexico. The United States continues to lead in the use of PMD due to increasing consumer preference for plant-based mosquito repelles. With awareness about a general change towards insect-related diseases and permanent options, PMD-based products have gained stable traction in many American homes. Canada follows a similar path, where environment-consciousness has shaped product options and further the demand for bio-based repelles. Mexico is also watching an increase in the use of PMD as the awareness program and the urban mosquito control initiative have started affecting purchasing behavior.

Europe is another important market for PMD and the United Kingdom, Germany, France, Italy and the rest in Europe. In this field, stringent rules around chemical ingredients in individual care products have encouraged the use of naturally derived solutions such as PMD. Countries such as Germany and France show high acceptance of vegetative options in both skincare and insect control products. The UK, also, is seeing an increase in demand, especially during the summer months when the insect population grows. Southern countries such as Italy, where warm climate attracts mosquitoes for a long time, shows frequent use of PMD-based repelles.

The Asia-Pacific region includes India, China, Japan, South Korea and the rest of the Asia-Pacific. The region provides the fastest growing opportunities for the global para-menthane-3, 8-diol (PMD) market. Combined population density with tropical and subtropical climate increases the risk of vector-related diseases. In countries such as India and China, the increase in middle class income, health awareness, increasing awareness, and government health campaigns are increasing the demand for safe repelles. Japan and South Korea, who already have mature consumers market, are focusing more on product innovation and convenience in delivery formats such as sprays and patch.

South America, including Brazil, Argentina and other neighboring countries, also plays an important role in the market due to exposure to diseases like dengue and zika. Meanwhile, the Middle East and Africa, with regions such as GCC countries, Egypt and South Africa, are gradually expanding their use of PMD. Here, health campaigns, climate challenges and rising tourism have contributed to increasing demand. Each of these areas adds different values to the global PMD market through local requirements, climate patterns and consumer preferences, shaping a complex but promising approach.

COMPETITIVE PLAYERS

The global para-menthane-3, 8-diol (PMD) market is showing signs of stable progress as consumer demand for safety and plant-based options for synthetic chemicals increases. PMD, mainly known for its use as a natural insect distinguished, has gained popularity due to its origin from lemon eucalyptus oil. Its ability to effectively shut down mosquitoes and insects without harmful side effects associated with DEET has made it a favorite option for health-conscious consumers. This increasing awareness among users, especially in areas affected by vector-borne diseases, is helping to achieve a strong presence in both developed and developing both developed and developing.

One of the driving forces behind this growth is the increasing acceptance of botanical solutions in everyday consumer products. Many buyers are actively looking for materials that they can trust, and PMD perfectly fits this demand. It has found its way into personal care items such as spray, lotion and wipes. Its application in these areas highlights its adaptability and increasing confidence in natural products. Governments and health organizations recommending PMD have also played a role in their growing visibility as a safe option, which helps the market to gain more interest from product developers.

The global para-menthane-3, 8-diol (PMD) market is supported by various major players working to improve the availability and purity of PMD. Some of the notable companies in the sector include Forewrest Resource Limited, The Good Sknts Company, Biotech Consortium India Limited, Sigma-Eldrich (Merc Group), Citrefine International Limited, Naining Venson Bio-Technology Co., Ltd., Ltd. These companies are not only supplying PMD, but are also contributing to research, innovation and better processing techniques to ensure better performance and comprehensive application.

Although the global para-menthane-3, 8-diol (PMD) market promises, there are some challenges that should address manufacturers and suppliers. The production of PMD largely depends on the availability of natural raw materials, which can sometimes be incompatible due to climate and farming conditions. This can affect pricing and supply. Nevertheless, ongoing research and investment in improving extraction and synthesis processes are expected to reduce these issues over time.

The expansion of the global para-menthane-3, 8-diol (PMD) market will continue, supported by the efforts of committed players who have increased awareness about natural repellers and focus on quality and safety. As long as consumer products are conscious of components and the rules support clean-labeled options, PMD will place its place as an important option in personal care and insect distinguished segments.

Para-menthane-3, 8-diol (PMD) Market Key Segments:

By Type

- Food Grade

- Pharma Grade

- Industrial Grade

By Application

- Personal Care and Cosmetics

- Pharmaceuticals

- Household Products

- Industrial Applications

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Direct Sales

By End-User

- Individual Consumers

- Cosmetic Manufacturers

- Pharmaceutical Companies

- Household Product Manufacturers

Key Global Para-menthane-3, 8-diol (PMD) Industry Players

- Foreverest Resources Ltd.

- The Good Scents Company

- BIOTECH CONSORTIUM INDIA LIMITED

- Sigma-Aldrich (Merck Group)

- Citrefine International Limited

- Nanning Venusson Bio-Technology Co., Ltd.

- Jiangxi Global Natural Spice Co., Ltd.

- BOC Sciences

- Hangzhou Fanda Chemical Co., Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252