MARKET OVERVIEW

The Global Edible Insects for Animal Feed market is expected to turn the animal nutrition industry on its head. With increasing levels of apprehension about sustainability, depletion of resources, and environmental consequences of conventional feed ingredients, alternative protein sources have earned their due attention. Historically seen as a natural food source by animals, insects find their place at the fore-front of offering feasible solution to commercial livestock and aquaculture industries today. The use of insects as protein-rich feed ingredient is fulfilling nutritional needs and customizing the dimensions of feed production and supply chains.

Most interest around insect-based feed is because it can serve high-quality protein and essential amino acids, as well as promoting beneficial fatty acids, while avoiding the emission impacts characteristic of the traditional feed sources. Livestock production and aquaculture are still relying disproportionately on soybean meal and fishmeal, and these two raw materials are subject to price fluctuations, not to mention deforestation and overfishing issues. The Global Edible Insects for Animal Feed market proposes sustainable alternatives that can really decrease reliance on traditional protein sources while improving digestibility and nutritional value for the animals. With high efficiency in conversion of feed and low land and water requirements, insect farming is expected to offer future benefits, both economic and environmental, to feed producers all over the world.

Less than feeding of livestock but nutritional value is constantly being improved in edible insects of feed processing applications. Advances in rearing, harvesting, and processing techniques have optimized the nutritional benefits and palatability of insect-based feed. Black soldier fly larvae, mealworms, crickets and other insect species are reared under controlled condition, ensuring that safety and quality consistency. These developments enable large scale production as per the requirements of the modern feed industry.

Regulatory landscapes that concern the Global Edible Insects for Animal Feed market continue evolving in such a way as to reflect on the adoption rate across the various regions. While several countries have already rolled out clear regulatory procedures and approval of insect-derived feed ingredients, some other nations are still looking into this option. Safety and quality standards will prove critical to the acceptance and mainstreaming of feeds based on insects. As research validates the nutrition benefits and safety further, regulations will definitely promote the growth of this market.

Integration of insect-based feed into commercial livestock, poultry, and aquaculture diets will redefine industry standards. Early adopters of insect-based nutrition have been able to report promising results in terms of growth rates, immune system support, and feed efficiency.

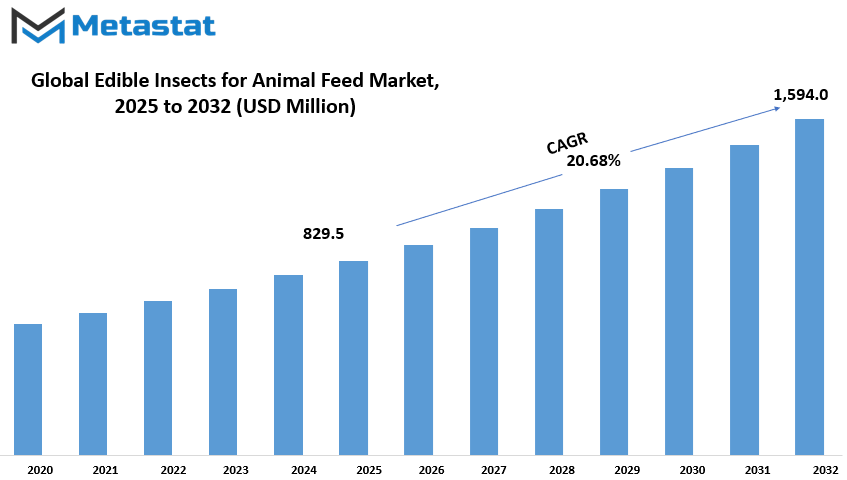

Global Edible Insects for Animal Feed market is estimated to reach $1,594.0 Million by 2032; growing at a CAGR of 20.68% from 2025 to 2032.

GROWTH FACTORS

The Global Edible Insects for Animal Feed market is gaining more and more popularity as industries search for alternatives to feed sources that can be harvested sustainably. Environmental concerns over conventional livestock feed have added to the global protein demand, making it into a potentially viable insect-based feeding solution. Compared with soy or fishmeal, insects provide a nutrient- and resource-efficient protein source with relatively easy and eco-friendly production. With meat increasing, the need for sustainable feed options has become more urgent, thus establishing a sound business case for edible insect incorporation in animal nutrition.

The next trend boosting the market is knowledge of the nutritious value of insect-based feed. As nutrient-rich animals, insects constitute a source of protein, amino acids, and other essential nutrients that optimize health and growth in livestock. More farmers and feed manufacturers are slowly being convinced of the advantages of using insect ingredients in the diets of livestock, especially poultry, aquaculture, and pet food. Sustainable insect farming, whereby insects can even feed on organic waste streams, totally enhances their appeal as it also reduces the environmental footprint and creates a circular economy.

Nonetheless, these benefits could be counteracted by some hurdles to market advancement. Barriers with respect to the framework for the production and use of insect-based feeds differ significantly across regions. Some regions have well-established guidelines for insect use, while others are yet to approve any insect species/formulations as legal feed ingredients. The lack of standardized regulations causes uncertainty on the part of producers, which also limits international trade opportunities. Across the globe, another serious challenge is cultural and psychological resistances to insect-based articles. In many parts of the world, consumers still perceive insects as odd creatures, and it is an uphill task to promote the acceptance of these products, especially in those regions where insect consumption is not a custom.

We are witnessing a market that is evidently counterbalancing these barriers with advances in insect farming and processing technology that provide a way forward in creating opportunities for expansion. With increased demand, companies have invested in making insect production at scale facilities, improving processing methods, and ensuring product safety with a view to market acceptance. While research continues to speak favorably about insect feed, the players within the industry will run awareness programs to change the narrative and encourage uptake. Acceleration of growth will be also favored by measures from the government in terms of support and incentives for the insects conversion into a logo use ingredient flowing under the animal feed industry in the coming years.

MARKET SEGMENTATION

By Type

The Global Edible Insects for Animal Feed market is gaining popularity owing to the quest for sustainable and nutrient-rich alternatives to livestock and pet food. Insects are becoming increasingly accepted as sustainable alternatives to livestock feed because they are friendly to the environment and efficient resource users; due to the increasing concerns of society over the environment and skyrocketing costs of conventional feed sources, they become a feasible alternative. Owing to their richness in protein, essential amino acids, and healthy fats, they are one of the major ingredients in animal feeds. With a rising demand for high-quality nutrition, there is an emerging trend toward innovative formulations that increasingly adopt insect-based ingredients in the market.

There is immense interest in insects since it has a much lower environmental impact than conventional animal feed sources such as soybean and fishmeal. Also, it requires much less land, water, and food to raise, thus making it a much more environmentally friendly option. Organic waste can also be used to grow insects, thus closing the loop for the circular economy. Farmers and feed manufacturers are starting to pick up on those advantages, thus bringing about heavy investment in insect farming and processing technologies.

Covering a wide range of product types, the market is highly segmented according to nutritional requirements for targeted applications. Insect powder with a market value of $205.0 million has been in high demand due to its easy mixing with other feed components. Insects in meal form follow as another prominent segment with concentrated protein sources for poultry, aquaculture, and pet foods. Insect bars and pastes are new formats that lend themselves easily to mixing into very diverse feeding systems. Insect oil, which contains essential fatty acids, is gaining popularity for improving livestock health and growth. The whole dried insect forms are being considered for some of their natural and unprocessed advantages.

With the increase in consumer awareness, authorities are now having an influence on market scenario formation. A number of countries are actively working on developing their own guidelines on the safe and ethical production of insect-based feed. This secures standards while encouraging acceptance of insects as a mainstream feed ingredient. Major companies in the industry are very much interested in production scalability, processing optimization, and distribution channel enhancement in line with the demand surge.

Due to subsequent technological development and farmer acceptance, the Global Edible Insects for Animal Feed market is set to experience significant growth. As the industry continues to develop, insects are expected to play a big role in the future of animal nutrition, balancing sustainability, affordability, and high nutritional value.

By Insect Type

The Global Edible Insects for Animal Feed market is making its way into the spotlight as the industries are on the lookout for sustainable appraisements for feeding protein-rich animal feed. Insect-based feed is aggressively being hailed from the fact that it poses a new alternative to the conventional so called soy and fishmeal. Concerns are growing with declining resources and pollution, and the efficiency of feed from insects as compared to traditional sources for feeding livestock will drive this which in turn will be supported by high nutritional values. Not only that, insects grow only on organic waste and to top it all off, they have a rapid growth cycle, making them a very easy and viable option for the feed industry.

The present edible insects market on animal feed includes many kinds of insects that offer unique advantages. Beetles are known to offer good quality protein and fats, which are very important for livestock growth. Crickets are very famous because of their high protein content and easy farming. There are also some caterpillars available in certain regions, which supplement the much required amino acids for animals. Less known Hymenoptera include ants and wasps, which have been shown to have promising potential in some feed formulations. Orthoptera includes grasshoppers and locusts and is especially known as high in protein density. Tree bugs are perhaps the least known but are under investigation for nutritional properties. Such a few types must be supplemented by many other insects to increase diversity in the available options and improve the overall nutritional profile of feed products.

Development of the market is being featured with new advancements in techniques of insect farming, their processing, and ensuring quality. Influence today is changing insect feed, so that the insect feed becomes more consistent and safer. Such investment by several more companies involves automating insect farming and creating conditions at the facility in order to scale production while still being nutritionally viable. The provision will also be made for ensuring very constant high-quality feed supply within regulatory standards and industry requirement. Furthermore, there is continuous research that focuses on the improvement of digestibility in insect protein for its modified use with respect to various livestock species.

With the growing awareness and decreasing prices making them much more economical compared to conventional feed, a lot of consideration is expected in the direction of insect-based feed across poultry, aquaculture, as well as livestock farming practices. Developing markets are also complemented by policies set by governments and regulatory authorities to ensure use of insect-derived ingredients in safe formulations in animal feeds. Such innovative continuing acceptance in the Global Edible Insects for Animal Feed market will only lead to further expansion of the market, which will offer even more sustainable and nutrient-rich alternatives that help support health in animals and the environment.

By Application

The global market for insect-derived animal feed is finally coming to light, as industries look into viable alternatives that promise sustainability and nutrition versus the very traditional feed sources. With the current call for protein-rich feeds, edible insects come as a viable option for meeting such needs. There are many possible applications for insect feeds, given their nutritional values, effective resource use, and minimal environmental impact. This segmented market will be based on the modes of application, such as livestock, pet food, and aquaculture. Each segment is beginning to appreciate the merits of including insect-based feeds in their respective feeding programs within the broader context of enhanced health and performance of the animals.

This is particularly apt for livestock, insect-based feeding would prove to be much more valuable. Farmers will thus be in dire search of cheap yet high-valued protein sources for boosting the growth of animals like poultry and swine. Commonly used source feeds-the soy and fishmeal on which these animals depend to grow-have various costs and serious environmental issues associated with their usage. Insects serve as a natural protein source and use much fewer land and water to produce. This does not only help the farmers but also ensures a far more sustainable agricultural system.

The pet food industry is also investigating insect-based feeds as an alternative protein source for pets. With an avid interest in nutrition and sustainability becoming increasingly part of the psyche of pet owners, there is heightened demand for new pet food ingredients. Insect-based pet foods are considered richer sources of essential nutrients like amino acids and fatty acids needed for better digestion and health in pets. Furthermore, farmed insects emit less greenhouse gas and are therefore seen as more environmentally responsible. Many pet food manufacturers are starting to include insects as part of their formulations so that pets get a balanced diet-reducing the reliance on so-called traditional protein sources.

Consumption of insects for feed will similarly influence aquaculture. Fishmeal has traditionally been the prime protein source for the farmed fish in the fishing industry. However, overfishing and fluctuating costs cause near-constant changes in the situation. Nature has insects, which provide such an option for fish farmers as a sustainable and nutrient-rich feed solution. It has been shown that insect-based feed can improve fish growth and defense against diseases making it quite of a viable substitute for conventional feed. Furthermore, its ability to be produced at a large scale with very little resources improves its status in aquaculture.

The Global Edible Insects for Animal Feed market will continue to grow along the demand for more sustainable solutions. As the insect farming technologies progress and the environmental benefits of insects become more known, the technology will get further acceptance from diverse industries.

By Livestock Type

The Global Edible Insects in Animal Feed markets are leaping past attention as the search continues for sustainable nutrient-rich sources for livestock nutrition. With rising demand for protein source and increasing awareness towards environmental impact, edible insects are emerging as a feasible option. These insects are going to be accompanied by high protein content, essential amino acids, and good fats that allow them to be termed fit for animal consumption. Farmers and feed manufacturers are now keen on developing insect-based feed for livestock nutrition by capitalizing on its efficiency, affordability, and eco-sustainability.

The market is segmented on the basis of livestock type including poultry, swine, and other animals. Among them, poultry farming is now being increasingly fed insect-based feed for optimally growing and producing eggs. Chickens are meant to feed on insects in their natural habitat and therefore this shift should be more feasible and effective. Swine farming also benefits as insect meals could provide an alternative to conventional sources of feed like soybean and fish-meal, thus reducing the dependency on traditional protein sources. Other livestock needs for edible insects namely aquaculture species and pet animals are also becoming an attractive option for consideration because of high nutrition and digestibility of this feed.

The shift towards edible insects in animal feed will be encouraged by sustainability issues and advances in policy frameworks. While conventional feed production strains land, water, and energy resources, insect farming has minimal resource requirements and emits less greenhouse gases in the production phase. Therefore, it represents a potential opportunity for easing the environmental burden posed by livestock farming. Ongoing research and investment focused on relevant processing technologies also aim to guarantee safety and nutritional uniformity of insect-based feed.

Some hindrances include consumer acceptance of insects in feed, regulatory frameworks, and large-scale implementation challenges. Regardless, as the awareness of insect-based feed expands and industries adapt, the market will grow. Leaders in agricultural innovation explore policies to enable further integration of insect farming into mainstream feed production. Therefore, edible insect-based animal feed is well poised in the future of livestock nutrition to intentionally contribute to food security and the resolution of environmental problems.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$829.5 million |

|

Market Size by 2032 |

$1,594.0 Million |

|

Growth Rate from 2025 to 2032 |

20.68% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Edible Insects for Animal Feed industry may assume such relevance as a separate domain in itself because industries are increasingly engaged in searching for environmentally sustainable newer forms of nutritious alternatives to conventional animal feeds. This raises questions with respect to the disruptive environmental impacts, resource needings, and protein feed requirements related to the edible insects that may fast develop as a solution for them. They meet nutritional needs, improve feed efficiency, and help reduce the carbon footprint created by conventional feed sources. The market is gradually broadening across regions as awareness of the productive benefits of edible insects rises with various companies and farmers.

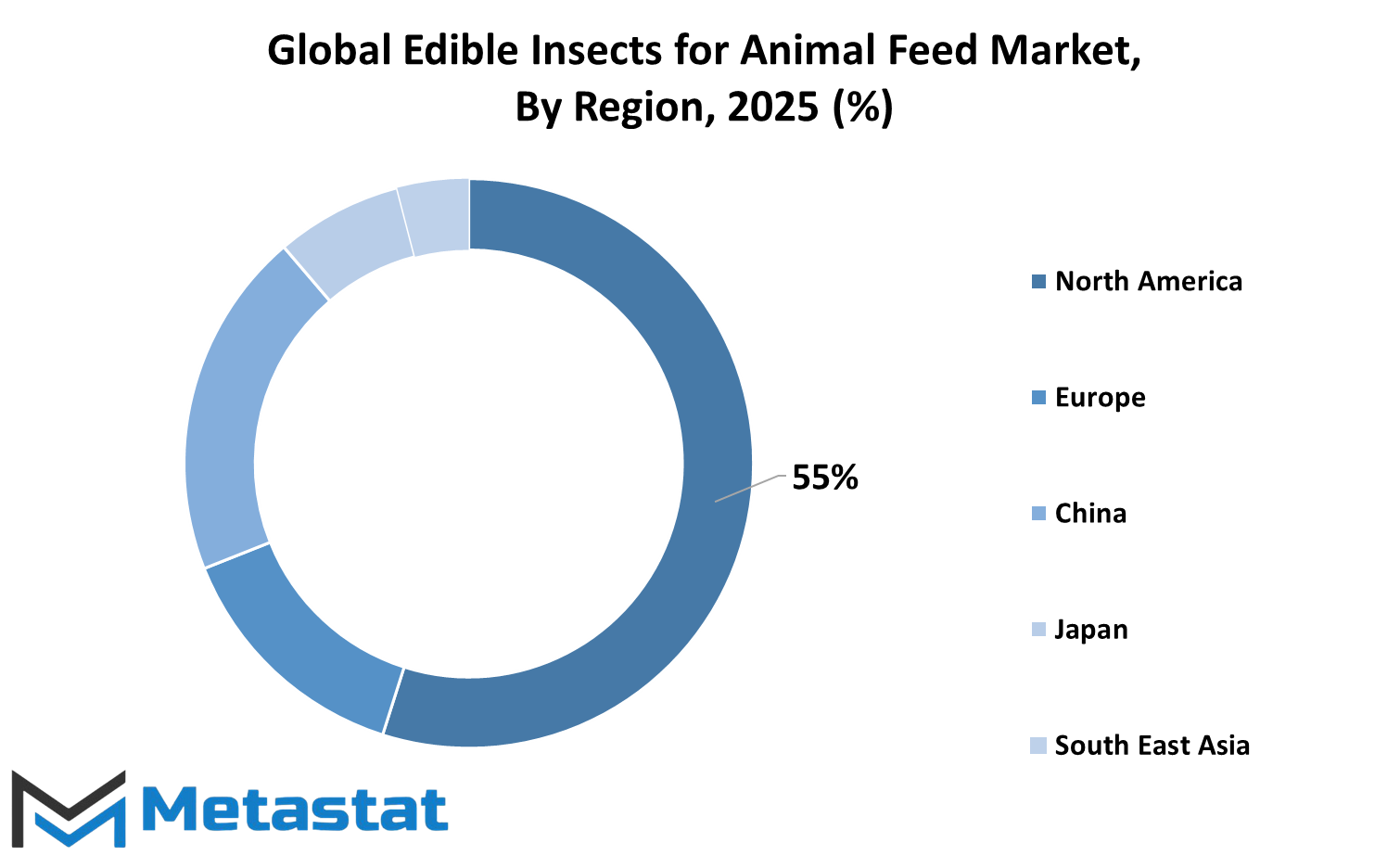

The market is segmented in regions such as North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America, with important countries such as the U.S., Canada, and Mexico, would be crucial in this rise of demand since agriculture is moving more towards sustainable agricultural practices. Germany, France, and Italy would be characterized in Europe as those countries embracing a more eco-centric trend toward animal feed products.

Economically important countries in the Asia-Pacific region are India, China, Japan, and South Korea, where insect-based feeds for aquaculture and livestock are garnering momentum. Brazil and Argentina are the two leader countries within South America. Argentina is helping the market with the agricultural advances that have been made. For example, South Africa, Egypt, and the GCC nations within the Middle East and Africa are conducting active research on the insect protein alternative in an attempt to deal with questions of food security.

Continued investment in R&D, in technology, and in industrial production is directed into this industry in steady growth continuance. Growing recognition, with backing of renewed regulatory support, very probably treats edible insects as one of the more viable feed alternatives to sustainable farming practices. During the development of this market, it will become more instrumental in driving the future of animal nutrition.

COMPETITIVE PLAYERS

The growing Global Edible Insects for Animal Feed market implies that the industries are on the lookout for sustainable and efficient protein sources. Insect protein is increasingly being considered seriously as a protein option for livestock, aquaculture, and pet food industries. Furthermore, these insects are rich in nutrients, providing high protein and essential amino acids along with desirable lipids, all replacement materials instead of traditional feed materials such as fishmeal and soybean meal. Given environmental sustainability reasons, edible insects seem an alternative. Their ecological footprint can be mainly regarded as lower due to lesser land, water, and resource requirements for rearing than conventional livestock feed production.

An array of companies promotes the advancement and subsequent adoption of edible insect-based feed solutions. These critical players are the ones who capture the whole industry such as Enviroflight, Ynsect, Protix, Protenga, Bioflytech, Entomotech, Entomo Farms, Haocheng Mealworms Inc., Beta Hatch, DeliBugs, Entobel, Hexafly Biotech, HiProMine S.A., Innova Feed, Kreca Ento-Feed BV, Mutatec, nextProtein, Nusect, and Nutrition Technologies Group. This group of companies operates large-scale insect farming, innovating processing technologies, and novel product formulations for high quality and better applicability of insect-based feeds. With prolific scientific research and approval regulations becoming increasingly favorable in the commercial application of animal feed, edible insects are showing promise in addressing economic and environmental demands of their feed industry.

The major driving factors for the growth of this market are consumer awareness and policy support in addition to developments in technology. The advantage of this new insect-based feed is being slowly realized by farmers and feed manufacturers for animal growth promotion, improved digestive health, and disease resistance. Organizations are investigating a variety of insect species such as the black soldier fly, mealworm, and cricket, as demand grows-accruing their individual biodegradable nutritional attributes pertinent to the needs of various livestock and aquaculture. Research continues to improve farm productivity, breeding conditions, and processing methods to ensure uniformity in quality and safety.

Production scaling and competitiveness with traditional feed ingredients still face some hurdles. Regulations, supply chain infrastructure, and perception management are vital for the wider acceptance of insect-based feed. Nevertheless, sustainable protein from insects is poised to play a transformative role in animal nutrition if investment and innovation are channelled into it. The Global Edible Insects for Animal Feed market will have open roads to expansion, as industries ask for far-sighted solutions toward food security and environmental conservation. This certainly provides a promising alternative for modern feed production.

Edible Insects for Animal Feed Market Key Segments:

By Type

- Insect Powder

- Insect Meal

- Insect Bar

- Insect Paste

- Insect Oil

- Others

By Insect Type

- Beetles

- Cricket

- Caterpillar

- Hymenoptera

- Orthoptera

- Tree Bugs

- Others

By Application

- Livestock

- Pet Food

- Aquaculture

By Livestock Type

- Poultry

- Swine

- Others

Key Global Edible Insects for Animal Feed Industry Players

- Enviroflight

- Ynsect

- Protix

- Protenga

- Bioflytech

- Entomotech

- Entomo Farms

- Haocheng Mealworms Inc.

- Beta Hatch

- DeliBugs

- Entobel

- Hexafly Biotech

- HiProMine S.A

- Innova Feed

- Kreca Ento-Feed BV

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252