MARKET OVERVIEW

The global automotive aluminum trim coatings market is very vital for the automotive sector as innovative materials and coatings have gained traction in a need for higher-performance aluminum solutions for trim purposes. In the automotive industry, advanced material integration will be an area of attention, with more focus on aesthetics, durability, and sustainability in car designs. There is a high demand for aluminum trims, especially those that are finished with some special coatings, offering functional and aesthetic benefits to modern vehicles.

This market is due for change since car manufacturers now need to seek a balance between performance and the environment. Light weight will spur demand for aluminum, a metal known for strength, corrosion resistance, and lightness. Apart from its other attributes, the aluminum trim coatings are increasingly advanced, as companies are looking into innovative finishes that can stay the test of time and at the same time be attractive in the eyes of customers. The increasing popularity of eco-friendly coating technologies that reduce environmental impact will also be a factor in the Global Automotive Aluminum Trim Coatings market, compelling manufacturers to invest in greener alternatives that do not compromise on quality.

The need for coatings that can meet increasingly stringent standards will continue to shape the market landscape as vehicle designs become more sophisticated. Manufacturers will implement the more technologically advanced treatments like electroplating, powder coating, and chrome-like finishes, thereby ensuring the aesthetic appeal along with performance, to the aluminium trim components. Demand for aesthetic finishes of high quality will propel this market toward creating newer solutions that best meet the expectations of the modern trends in the automobile industry.

Advanced coatings techniques will open up aluminum trim to increased options for finish over the next few years such that it opens itself up to increase aesthetic qualities but also functionality. The coatings used will provide enough resistance to wear and tear, UV exposure, and weathering such as other critical factors where the trim remains intact. The Global Automotive Aluminum Trim Coatings market will start seeing an increased focus on products with aesthetics, durability, and environmental sustainability combined.

The use of aluminum trim coatings in the global automotive industry will grow as manufacturers are looking to differentiate their products in this very competitive marketplace. More variety of trim finishes will be made available to the consumer so that they can personalize their vehicle to their chosen finish. High demand for aluminum trim with finishes as manufacturers would opt for light-weight material to achieve efficiency and performance in emerging electric vehicles.

Manufacturers in the Global Automotive Aluminum Trim Coatings market will continue investing in research and development for coating properties enhancement and new solution developments. With changing consumer habits and environmental laws, the market will adapt to an evolving trend into more sustainable systems and innovative coating solutions. Looking ahead, expansion will continue within this market sector, with impressive technological development within demanding more effective, durable, and environmentally sound aluminum trim coatings for use in the auto industry.

Global Automotive Aluminum Trim Coatings market is estimated to reach $52,721.22 Million by 2031; growing at a CAGR of 10.5% from 2024 to 2031.

GROWTH FACTORS

The Global Automotive Aluminum Trim Coatings market is gaining growth due to the increasing demand for lightweight material. The need to improve fuel efficiency and reduce emission levels in vehicles primarily drives this demand. As the manufacturers are focusing on reducing the weight of the vehicle, there has been great demand for aluminum trim coatings since they can be used as a very ideal solution in this respect. In addition to this, consumers are becoming increasingly interested in aesthetic designs and premium finishes of the vehicles, thus propelling the usage of aluminum trim coatings. These coatings have matched the increased desire for fashionable, modern cars in terms of enhancing visual appeal and high-quality finishes.

Despite the market's potential, some challenges persist. Another great hindrance is that the advanced coatings, as well as raw materials needed to produce the aluminum trim coating, are extremely expensive. Costly procurement fees may limit some manufacturers, mainly in price-sensitive markets. Secondly, environmental awareness and regulations with respect to some chemicals used in coatings have raised the complexity involved in producing coatings. Regulations which focus on minimising the environmental impact often limit the use of materials and manufacturing processes, which may hinder market growth.

However, the transition of vehicles from conventional fuel to electric vehicles gives a good prospect to the aluminum trim coatings market. Electric cars require lightweight and environmentally friendly materials for the purpose of efficiency and sustainability. Aluminum, with excellent strength-to-weight ratio, has been a widely used material for the production of EVs; hence, it is crucial for aluminum trim coatings in these vehicles. As the market for EVs continues to grow, aluminum trim coatings are anticipated to be used more, hence providing an enormous opportunity for producers in the following years.

Despite its challenges, the automotive aluminum trim coatings market is buoyed by drivers such as high demand for light material, aesthetic, and electric vehicle technologies. The change in the nature of vehicles, towards sustainable energy-efficient vehicles, could be one of the high growth areas of aluminum trim coatings, making it a market worth watching in the near future.

MARKET SEGMENTATION

By Type

The global automotive aluminum trim coatings market has been recording significant growth owing to the surging demand for high-quality coatings that enhance not only the durability but also aesthetics of aluminum components in vehicles. This market comes in various forms, each presenting different benefits, depending on individual needs in the automotive industry.

One of the major types of coatings used in the automotive aluminum trim is solvent-based coatings. These coatings have a very large preference among end-users, with high bonding ability and surface smoothening capability and toughness. At the same time, the solvent-based coating leads in the market and occupies $3,491.34 million share of this market segment due to the resistance against corrosion, scratching, and abrasion provided to aluminum trim parts that they have good looks and long-term retention in their fine conditions. These coatings also come in a range of finishes, from glossy to matte, which gives manufacturers flexibility in achieving the desired look for their vehicles.

Another important category in the automotive aluminum trim coatings market is water-based coatings. As environmental concerns grow, water-based coatings have gained traction due to their reduced environmental impact. These coatings have less VOC content in them, at times less compared to solvent-based ones. They can provide better durability and protection against all environmental factors. Water-based coatings are also being used increasingly by car manufacturers as they help meet sustainability targets and the rigid regulations related to emission.

Powder coatings also account for an important share of the automotive aluminum trim coatings market. In contrast, powder coatings are applied dry, and they undergo curing using heat. As a result, this process forms a tough, uniform finish with an excellent scratch and chip resistance along with an attractive fade-resistance. In general, it has been well preferred in automobile industries where more durable and long-term protection is a key requirement. Besides, these powder coatings emit lesser emissions and produce less waste as compared to other liquid-based coating applications. Their versatility in offering various textures and finishes has made powder coatings a preferred choice for manufacturers looking to enhance both the performance and appearance of aluminum trim.

In conclusion, solvent-based, water-based, and powder coatings, all play very important roles in the rapidly developing global automotive aluminum trim coatings market. Each offers unique benefits in its own class, with the solvent-based holding the largest portion of the market, followed closely by the increasing demands for environmentally friendly water-based and powder coatings. The growth in these segments speaks to the increasing efforts of the automotive industry in meeting both performance and sustainability standards.

By Application

The Global Automotive Aluminum Trim Coatings market is gaining steadily on the basis of demand for lighter, tougher, and aesthetically pleasing material usage in vehicles. The primary bifurcation in this market based on the application area occurs in two different forms: exterior aluminum trims and interior aluminum trims.

Exterior Aluminum trims in the vehicle body have always served functional and aesthetic purposes in automotive. They are mostly used for the exterior trim of vehicles. For example, around windows, doors, and bumpers. They are important in enhancing the vehicle's aesthetic value but also add to the durability of the vehicle by offering protection against elements. Aluminum is especially useful because it is a light metal and corrosion-resistant.

This material allows car manufacturers to achieve regulatory compliance with respect to fuel efficiency and safety without sacrificing the look of the vehicle. Since consumers remain focused on the aesthetics and performance of a car, the exterior aluminum trims will also continue to grow in demand. On the other hand, interior aluminum trims are applied to the vehicle's cabin, including features such as dashboard elements, door handles, and central consoles.

These trimmings are developed in order to enhance the interior's aesthetic appeal and add durability. As the coating technology improves, the sheets of aluminum that are currently applied on the inner walls of automobiles exhibit much lesser rust formation or corrosion. Aluminium sheet trims are also lightweight, which adds fuel efficiency to the total weight and friction reductions. The trend for high-end vehicle interior is likely to grow, and consumers are increasingly demanding high-quality materials that have both luxury appeal and functionality.

This is also likely to promote the growth of interior aluminum trims. Since vehicle manufacturers focus on enhancing aesthetics both inside and outside while ensuring practicality, the demand for aluminum trim coatings is likely to increase. Innovations in coatings technology, especially those that result in improved resistance to corrosion and wear and UV radiation, will play a crucial role in driving market growth.

This also means that because sustainability is increasingly important to the automotive industry, lightweight and recyclable materials like aluminum will drive the market forward. The Global Automotive Aluminum Trim Coatings market will be continuously shaped by the evolving needs of consumers, advances in technology, and environmental considerations.

By Vehicle Type

The Global Automotive Aluminum Trim Coatings market is highly dynamic, where the sector constantly evolves in tandem with growing vehicle manufacturing requirements. It contributes largely to the automobile sector, especially towards aesthetic and functional aspects of the vehicles. Coatings of aluminum are used in improving the vehicle's appearance along with durability and resistance to natural phenomena and corrosion. This makes them a crucial aspect of the creation of different categories of vehicles.

There are mainly three categories, as far as automotive aluminum trim coatings are concerned. These classifications have been determined by the kinds of vehicles being categorized: Passenger Vehicles, Commercial Vehicles, and Electric Vehicles. These categories bear distinctive demands and traits that help define the varieties of aluminum trim coatings used, in addition to the application procedures followed.

The majority of passengers account for the number of passenger vehicles produced. These sedans, hatchbacks, and SUVs demand trim coatings that provide both aesthetic value and durability. The demand for aluminum trim coatings in passenger vehicles is increasing due to the consumer's preference for stylish designs and the increased demand for vehicle parts that can sustain harsh weather conditions. The primary purposes of these coatings are to provide aesthetic enhancement of the passenger vehicle through a smooth and modern look as well as the practical uses that involve protection against corrosion and UV protection.

Commercial vehicles that include trucks, vans, and buses are also important for the market of automotive aluminum trim coatings. Commercial vehicles generally undergo harsh usage, and thus the coatings used in these products should offer a much higher level of durability and abrasion resistance. Commercial vehicles have aluminium trim coatings to withstand heavy-duty conditions, such as dirt, debris, and high temperatures. Such coatings are not only aesthetically beneficial but also provide protection against environmental effects that cause corrosion and other kinds of damage.

Electric vehicles, or EVs, form a growing percentage in the automobile market based on the growing need for a sustainable and greener mode of transportation. Electric vehicles are gaining day-to-day acceptance; hence the electric vehicle sector also is raising demand for aluminum trim coatings. Light and corrosion-resistant materials are preferred in the manufacture of electric vehicles, as they seem to increase energy efficiency in the products and, at the same time, enhance the lifespan of their vehicle. Coatings applied on electric vehicles should have such properties with a highly polished, aesthetic finish according to the sleek modern designs of electric vehicles.

The Global Automotive Aluminum Trim Coatings market has needs that are developed for different types of vehicles. The passenger vehicle, commercial vehicle, and electric vehicle market has specific demands that call for different coatings. As the automotive market changes, so will the position of aluminum trim coatings, contributing to the best possible performance and external aesthetics of all vehicles.

By Distribution Channel

The Automotive Aluminum Trim Coatings market is an integral part of the automotive industry; it provides attractive appearance and longer life for the aluminum trim of the vehicles. It safeguards aluminum surfaces against corrosion, wear, and environmental destruction, and as such, are indispensable to preserving the quality and lifespan of the overall vehicle parts. In terms of market distribution channels, the two distinct types include OEM (Original Equipment Manufacturer) and Aftermarket.

OEM is one of the essential aspects of the automotive industry since it deals with the production of parts and coatings directly applied to new vehicles during the manufacturing process. In this area, automotive aluminum trim coatings are developed to meet the requirements of automobile manufacturers in such a way that automobiles start with high-quality trim components from the beginning. The demand is high for OEM coatings due to an increase in car productions globally with demands for toughness and aestheticness in components. Aftermarket encompasses coatings for any car that requires their aluminum trim part to be replaced, reinstalled, or to be reshaped.

This segment is fuelled by increasing numbers of automobiles on the roads and the vehicle owner's want to upgrade or maintain the car's appearance. Aftermarket coatings are necessary in restoring the looks of worn out trims from further damage while enhancing the looks of the overall vehicle. OEM and Aftermarket are channels of distribution; they are necessary for the dynamics to be formed by the global market of Automotive Aluminum Trim Coatings.

Each part has a function, where the OEM coatings work as part of the production cycle of new automobiles, while after-market coatings bring flexibility and tailor-made products with existing automobiles. Both the Aftermarket and OEM channels drive up the market and are based on consumer demand. Consumers are requiring better performance of vehicles, look, and extended life. With an increased focus on vehicle customization and the need for high-quality coatings, the demand for automotive aluminum trim coatings in both OEM and Aftermarket segments will continue to drive the growth of the market over the next few years.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$26,198.93 million |

|

Market Size by 2031 |

$52,721.22 Million |

|

Growth Rate from 2024 to 2031 |

10.5% |

|

Base Year |

2022 |

|

Regions Covered |

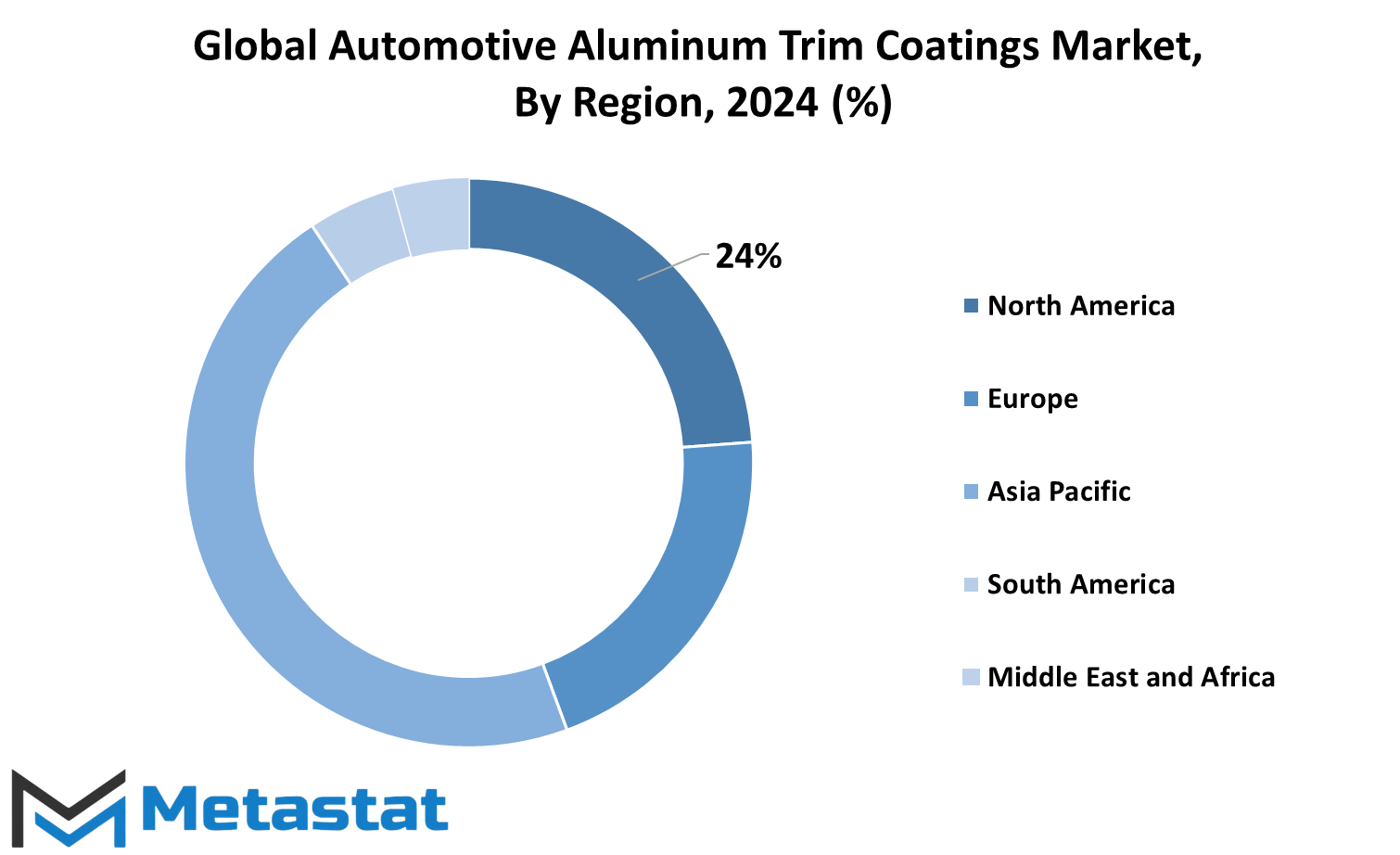

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Automotive Aluminum Trim Coatings market is divided into five major regions in terms of geography: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is further divided into three key countries: the United States, Canada, and Mexico. Europe consists of major markets such as the United Kingdom, Germany, France, and Italy, and also a segment that encompasses the rest of Europe. The Asia-Pacific market is further segmented into countries in the region: India, China, Japan, South Korea, and all the other countries included in the category of Asia-Pacific. South America is further categorized into Brazil, Argentina, and all other countries in the region, including Rest of South America. Lastly, the Middle East & Africa is segmented into the GCC countries, Egypt, South Africa, and the remaining countries in the region, that is, the rest of the Middle East & Africa.

These regions are quite important in contributing to the overall market dynamics for automotive aluminum trim coatings. As automotive production and consumer attitudes change, there is a varied demand for the coatings, but it is related to regional economies, technological advancements, and local regulations. The geographic split allows businesses as well as analysts to understand where maximum growth opportunities reside and how a strategy should be tailored to specific demands of various markets. Industry leaders can identify key trends and forecast future developments that will influence the global market for automotive aluminum trim coatings by examining these regions individually.

COMPETITIVE PLAYERS

The Global Automotive Aluminum Trim Coatings market is set to grow steadily with the rising demand in the automotive industry for aluminum trim coatings. Aluminum trim coatings are applied as a means of enhancing the look of automobiles while protecting them against corrosion, weather elements, and wear-off. These coatings enhance the beauty value of the automobile parts, such as grilles, mirrors, trims, and other exposed features. They add to the overall looks of the vehicle and contribute to making these parts more durable and long-lasting.

The market is dominated by a few major players. Prominent among them are 3M, PG Industries, Inc., American Trim, Sherwin-Williams Company, Alutrim, L.L.C, Norsk Hydro ASA, TIGER Coatings, and Stahl Holdings B.V. These companies specialize in delivering state-of-the-art solutions that adequately match the increasing demand for top-quality aluminum trim coatings. They offer multiple coatings designed specifically to enhance the appearance and functionality of aluminum components applied in the auto sector.

For example, 3M has dominated the market for years with diverse product lines that could make vehicle parts more attractive and performative. Likewise, Sherwin-Williams Company has enjoyed its reputation with more innovative coating solutions protecting automotive aluminum trim against environmental hazards yet providing aesthetic purposes. Their various products catered to the respective requirements of a different application, providing long-lasting protection.

Alutrim, L.L.C, and Norsk Hydro ASA are also market leaders. The company specializes in providing specialized coatings that respond to the need for sustainable and environmentally friendly solutions in the automotive sector. The coatings supplied by the company protect the aluminum trim while contributing to the overall reduction of vehicle weight, thereby contributing to better fuel efficiency.

TIGER Coatings and Stahl Holdings B.V. also played a crucial role in the market with high-quality coatings for aluminum trim, catering to the demands of the automotive industry regarding appearance and durability. The products they provided assist in the attainment of high surface finishes that give the appearance of enhanced looks on vehicles while being resistant to scratches, stains, and severe environmental conditions.

In conclusion, the Global Automotive Aluminum Trim Coatings market is supported by several leading players who provide high-quality products and solutions. As the demand for lightweight and durable automotive parts continues to grow, the role of aluminum trim coatings will become more significant in the automotive industry, with key companies continually innovating to meet market needs.

Automotive Aluminum Trim Coatings Market Key Segments:

By Type

- Solvent-based Coatings

- Water-based Coatings

- Powder Coatings

By Application

- Exterior Aluminum Trims

- Interior Aluminum Trims

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

By Distribution Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Key Global Automotive Aluminum Trim Coatings Industry Players

- 3M

- PPG Industries, Inc.

- American Trim

- Sherwin-Williams Company

- Alutrim, L.L.C

- Norsk Hydro ASA

- TIGER Coatings

- Stahl Holdings B.V.

- Norsk Hydro ASA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383