MARKET OVERVIEW

The global organic flour market has progressed with such changes in consumers' choices and preferences for more of a health-oriented lifestyle wherein healthier food choices and items for eating are found more appealing, organic flour-free of synthetic pesticides, GMOs, or chemical fertilizers-gain great speed. This market can range from various flour types made of wheat, rice, corn, and special grains like quinoa and amaranth, which are specifically demanded to fulfill special diets and tastes in the market.

Organic flour generation adheres to standards that vary by region but, in general, require strict implementation of organizational bodies' standards for certification. These standards ensure the entire process of production-from soil preparation and planting to milling and packaging-meets the criteria of organic production. Today, the demand for organic alternatives forces manufacturers and suppliers to invest in sustainable sourcing, better milling techniques, and more innovative product formulations that enhance nutritional value without loss of taste or functionality.

The global organic flour market is no longer restricted to traditional retail, but also encompasses online platforms, specialty stores, supermarkets, and direct-to-consumer models. Moreover, with digital marketplaces offering easy access to organic flour, its reach across various demographics has increased further. Restaurants, bakeries, and food manufacturers have started offering organic flour in response to the growing demand of consumers for healthier and more transparent sourcing of ingredients.

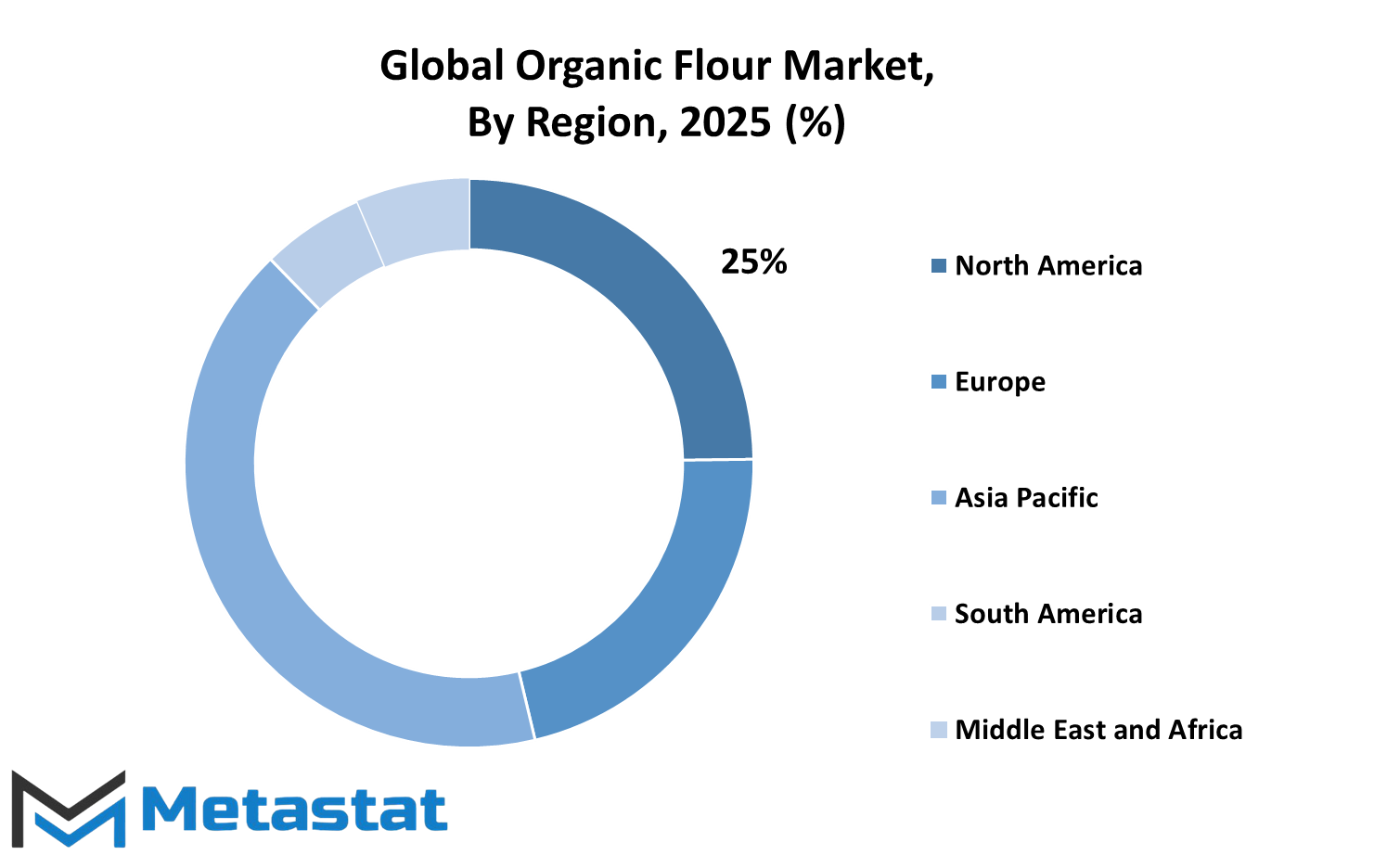

Organic flour consumption is higher in North America and Europe because it is a territory of strict rules for food security and an extensively developed culture to consume organic products. The high growth markets would be Asian-Pacific and Latin America, where uptake is gradual through increased disposable income, awareness over food quality issues, and even government support on organic farming techniques.

Although it is true that many issues surround the global organic flour market, some of them are a complex supply chain, erratic cost, and the need to educate consumers among a large market.

Organic farming compared to ordinary farming is more time and resource-intensive in production and hence more expensive, which drives up the price. Quality control in various regions is not an easy task for the producers. Even though the current inefficiencies remain in place, improvements in agriculture and technologies will be able to resolve most of them in the next years.

Thus, future trends in the global organic flour market will continue diversification as more people become keenly interested in other grains as well as gluten-free products. Further research and developments in food technology would probably allow manufacturers to achieve new processing technologies that keep nutritionally intact, but have much better shelf stability and usability levels of organic flour. Sustainability concepts such as carbon-neutral production along with regenerative farming will hold high sway.

Consumer behavior will drive further market dynamics: transparency, ethical sourcing, and health benefits will be the key top-of-mind purchase drivers. Clear labeling, eco-friendly packaging, and sound sourcing practices will help successful brands have a competitive advantage.

Overall, the worldwide organic flour market is expected to continue transforming together with technological innovation, changing consumer expectations, and regulatory shifts. As there remains a continued consciousness of better quality food and sustainability, organic flour will continue through all categories in order to reaffirm the stronghold of its breadwinner ingredient within houses and industrial food production alike.

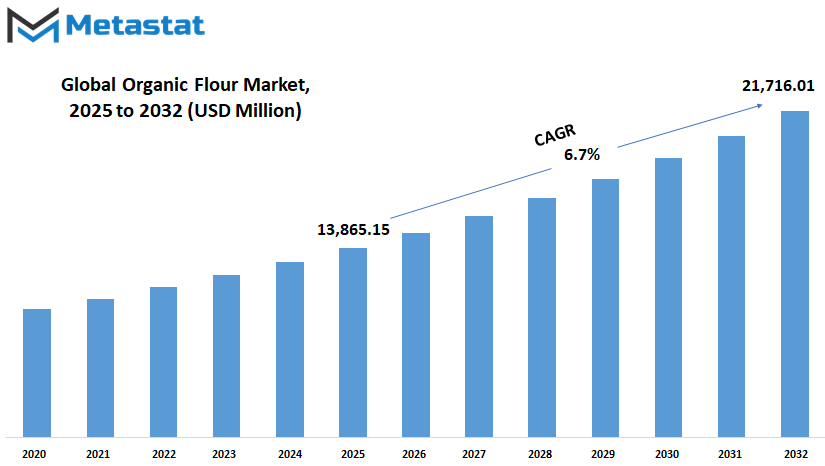

Global organic flour market is estimated to reach $21,716.01 Million by 2032; growing at a CAGR of 6.7% from 2025 to 2032.

GROWTH FACTORS

The global organic flour market has been increasing with an increase in health-conscious consumers. This change in consumer behavior is playing a vital role in the future of the global organic flour market. More and more people are getting conscious about their food, and thus, organic and natural food items are seeing an increasing demand. With the wide knowledge about the benefits of organic flour, people continue to add it in their daily use in households and businesses.

Organic flour is free from synthetic pesticides and chemicals compared with conventional flour, thus a healthier option for the consumers. One of the significant factors contributing to this market's growth is the growing awareness of the nutritional benefits of organic flour.

Some feel that organic commodities contribute to wellbeing in general; this perception therefore influences the kinds of products chosen. Research seems to support consumers' shift in eating habits for healthier diets due to the assertion that organic foods contain fewer undesirable residues and possible higher nutritional worth. This tendency is not seen only in small households but now bakeries and restaurants, alongside food manufacturers and producers, consider using organic elements to meet and satisfy consumer wants. Although the global organic flour market prospects are good, there are, however a few variables that impact the growth. First, organic flour is more expensive than the standard flour.

Organic farming is not only labor and fertilizer-intensive, but stringent in terms of compliance with regulations that raise the costs of production. Moreover, it is also difficult for manufacturers to get raw organic grains as they have a limited supply, resulting in which the manufacturing becomes tough against the increasing demands. If these problems are not addressed properly by developing solutions, then it would slow down the expansion in the market. Strategic production, distribution, and pricing will be responsible for future development in the global organic flour market.

There is an opportunity to expand the distribution channel through online retailing. The advantages of e-commerce are that customers can get different organic flour brands even when physical stores are not available in the area. Companies that go for digital marketing and direct-to-consumer sales strategies will therefore have an edge. On top of that, the application of new farming techniques and enhancements in the supply chain might reduce costs over time.

The progressive advancement of agricultural technology may escalate efficiency in organic farming, which may result in increased production but at a lesser price. Governments and nongovernmental organizations that promote sustainable agriculture can also join by offering incentives to organic farmers, which aids the further growth in the global organic flour market. Preferences around the globe for consumers will change in the coming years; hence, it will be dynamic for the outlook of organic flour in the coming years as industries try to adjust. Although there is a presence of challenges, innovation and development in sales channels in the industry will likely hold steady growth in the sector.

MARKET SEGMENTATION

By Type

Wheat flour is still an organic staple in most homes since it can employ it to bake as well as cook foods. As more persons strive to be healthy, whole grain and unrefined wheat flours should climb at a higher rate. This is because such products contain high fiber content and nutrients to better digestion and well-being.

Organic rice flour is becoming more popular due to its gluten-free characteristics. It is the common starch in most Asian dishes and is used, for the first time, in Western states for baking and as a thickening agent. Rice flour can be found in various dishes due to its mild flavor and fine texture, which can cater for individuals who are sensitive to gluten and those who explore various culinary traditions.

Corn flour, or maize, is an important product within the organic market, especially where corn is the staple diet crop. Organic maize flour is utilized in making items such as tortillas, cornbread, and other snacks. With growing public concern over the issue of GMOs, more consumers are relying on organic maize flour to know that they will be consuming a non-GMO product, therefore supporting sustainable agriculture.

Derived from organic soybeans, soya flour is one of the richest sources of proteins. This adds nutrition to a number of bakery products, and as a result plays a leading role in any vegetarian and vegan recipes. Consequently, as demand continues rising for even more healthy eating and organic choices reducing reliance on non-renewable resources will have an ascending pattern for the organic soya flour.

Organic flour's future looks bright; it will be witnessing growth in the global organic flour market in the coming years. With time, farmers and processors' technological progress will heighten the quality of organic flours and make them more readily available. Increased awareness among consumers on the advantage of organic products will also further momentum in favor of these flours over traditional ones. These flours are likely to see online channels as their means of distribution, spreading even further the accessibility of organic flours to a widening audience.

The global market for organic flour appears to be bright in the future. With an emphasis on health, sustainability, and quality, organic flours are set to become part of diets globally, from hybrid to diverse culinary needs and preferences.

By Application

The global organic flour market This is an expanding market that experiences considerable growth with a rising number of health-conscious and environmentally conscious consumers, seeking more healthful and eco-friendly benefits of organic products. In its application areas, it encompasses bakery products, restaurants, household uses, dietary supplements, and more.

Organic flour is becoming the preferred choice for artisanal and commercial bakers in the bakery sector. Consumers are looking for baked goods made from ingredients free from synthetic pesticides and fertilizers, which has led to an increase in organic bread, pastries, and confectioneries. This shift is not only a response to health concerns but also a desire for more natural and authentic flavors in baked items.

Restaurateurs are also adding to the organic flour demand. Restaurants began to apply farm-to-table concepts and responsible sourcing and embraced organic ingredients as part of the menu. Serving pasta, bread, and a range of sweets made from organic flour, restaurants hope to attract health-aware consumers and environment-conscious consumers to their establishments.

The culture at the household level has emphasized more and more on homemade baked goods and home-cooked products. This has been more evident over the past years. Families use organic flour in making homemade foods and baked products primarily as a way to manage the ingredients they use and, in turn, their diet. Besides, the organic flour boom is supported by its availability at supermarkets and other online platforms, which allows easy access by the average consumer to organic flour.

Organic flour is yet another area through which it is gaining acceptance within the dietary supplement industry. Its manufacturers are now using organic grain flours as a base ingredient in health supplements to take advantage of their natural nutrient profiles. Consumers who seek clean-label products with minimal processing and no artificial additives are drawn to this approach.

The global organic flour market would continue to rise in the coming future. Improvements in quality and variety due to better farming practices for organics and advanced milling technologies will be witnessed in this market. The growing level of awareness amongst the population concerning the benefits associated with organic food products will increase demand in such applications. Sustainability and health would be the essence of growth within this market's product development as well as demand from consumers.

The global organic flour market is rapidly growing in all sectors and, in general, shows a significant trend toward shifting consumption to healthier and sustainable choices. Increasingly, in keeping with this trend, we believe that organic flour will become a part of several food industries for an increasingly mindful consumer.

By Distribution Channel

The global organic flour market is expected to grow in the coming years as consumers advance toward healthy and sustainable food cultures. Consumers are becoming more aware of the benefits of organic products and the growing demand for organic flour based on increasing pressure from awareness issues over pesticides and synthetic fertilizers and genetically modified organisms in conventional flour.

More conscious consumers will in the future seek more options where they can find more nutrients and environmental stewardship under one roof, and thus spreading awareness will push the global organic flour market ever forward. Supermarkets or hypermarkets were the most alternative choice for consumption since they represent the most reachable and wide-choice options. The big retails provide space for consumers in one location and easily get more varieties of a brand or brand type of organic flour.

These facts increase shelf space organic products and allow the demand and supply to eventually become more stabilized and readily supplied to consumers of organic flour products. Part of the broader reach are the convenience stores. Though they stock less organic produce than supermarkets, it is convenient in urban areas to stop there. Since the demand for organic flour continues to grow, stores can extend organic product lines so that more will have an opportunity to make healthier choices even in smaller retail settings.

Specialty stores will respond to health-conscious and organic consumers' needs wherein a customer will have a place to purchase quality and authentic products. Specialty stores offer a vast variety of organic flour-from the rare to the less common kinds-as per consumers' demands for specific nutritional benefits. As consumers continue demanding organic products, specialty stores will continue rising steadily, contributing to the growth of the global organic flour market.

Online retailing has become one of the crucial forms of distribution lately, mainly since the creation of e-commerce. Now there exists organic flour to be procured easily through homes with rich details about products along with feedbacks from consumers, and with very competitive pricing. The developing shopping culture over online will be in the midst of propelling its growth that this product could now be easily available to everyone worldwide.

Other forms of distribution include sales from organic farms and sales at farmers' markets, fresh direct to consumers, and supporting local agriculture. The more people build trust between the producers and the buyers, the more people are going to use organic flour.

The global organic flour market is going to grow consistently due to spreading awareness, advancement of distribution networks, and technological progressive enhancement. Consumers will continue to prioritize health and sustainability, and so will the demand for organic flour, creating the future of the industry.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$13,865.15 million |

|

Market Size by 2032 |

$21,716.01 Million |

|

Growth Rate from 2024 to 2031 |

6.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global organic flour market increases as more and more people opt for healthy and sustainable food options. North America is the major contributor in this market, followed by the U.S. primarily because there is a greater demand for organic and natural food products. Canada and Mexico are also growing steadily as consumers become more health-conscious and governments implement policies that encourage organic farming. In Europe, the UK, Germany, France, and Italy are the leading consumers of organic flour.

Strict regulations on food safety and a growing shift toward organic diets have driven the expansion of this market. Consumers in this region are highly qualified with respect to food quality and sustainability, and therefore, they always seek organic flour products. A strong network of organic food suppliers and retailers in Europe maintain its position in market growth. Asia-Pacific is a rapidly growing region for the global organic flour market. The major growth drivers of organic farming are the increased government incentives and changing consumer habits in countries like India and China.

The demand for organic flour is picking up in Japan and South Korea, driven by concerns regarding health and preference for additive-free foods. Urbanization and disposable incomes are also on the rise in these countries, and the global organic flour market is likely to continue its growth trajectory in the future years. There is a gradual growth in demand for organic flour in South America, mainly in Brazil and Argentina.

Compared to North America and Europe, the rate of adoption is still lower; however, this awareness about organic food benefits should grow the market further. Farming techniques among the farmers of this region have begun adopting organic methods, and expansion of health-focused retail chains increases access to organic flour. The Middle East & Africa region represents a developing market that is set for future growth.

Apart from some of the GCC nations and Egypt, South Africa has become yet another organic food trend embracing a nation. Despite high prices and limited availability, growing awareness in the minds of consumers coupled with government initiatives to promote organic agriculture augur well for the markets in the near future.

The global organic flour market is bound to grow, looking ahead. Sustainability and health concerns continue to shape consumer choices, and this market will expand accordingly. In different regions, contributions are not alike, but there is one common factor: the growing tendency toward organic products as part of a healthier lifestyle.

COMPETITIVE PLAYERS

The global organic flour market is expected to exhibit steady growth, as consumer demand has shifted toward healthier and sustainable food choices. Increased awareness about the value of organic products is also driving companies within this industry to concentrate on innovation and sustainability, as well as expanding their markets. Major players such as Ardent Mills, Bay State Milling Company, Bob's Red Mill Natural Foods, and General Mills, Inc. are investing in advanced production techniques to meet the growing demand.

With more consumers seeking chemical-free and environmentally friendly food, the global organic flour market will continue to evolve with competition for better quality and diversity of products. Looking ahead, companies will likely integrate technology to improve efficiency and enhance product offerings. Digital platforms and e-commerce will play a crucial role in reaching a broader audience, making organic flour more accessible. Automation and smart farming techniques are also expected to contribute to higher yield and quality while reducing production costs.

Additionally, businesses will focus on transparency, ensuring that consumers can trace the origins of their flour. This shift toward greater accountability will increase customer trust and brand loyalty. Sustainability will continue to be a leading driver in shaping the global organic flour market. The companies will search for more sustainable packaging solutions and reduce carbon footprinting in the supply chain. Farmers and millers will shift towards regenerative agriculture, enhancing soil health but also the nutrition content of the flour.

Such efforts will match consumer expectations as well as comply with regulatory standards that emphasize sustainability. Product diversification will be another big trend. With changing dietary preferences, companies will introduce new organic flour varieties in gluten-free, high-protein, and ancient grain segments. Companies like King Arthur Baking Company, Inc., Lindley Mills, Inc., and Montana Flour & Grains are already expanding their offerings to include specialty flours that appeal to a broader range of consumers.

This trend is likely to continue, with emphasis on meeting the requirements of organic and dietary-constrained consumers. The competition will shape further the strategies for marketing and engaging customers. Companies are likely to use a social-media mix, influencer marketing, and direct-to-consumer sales channels as ways of deepening their offering. This might also be the time personalized recommendations and subscription-based models are initiated to ensure customer convenience and a stable demand supply chain from the organic flour producers.

With increasing demand, innovation, and commitment toward sustainability, the global organic flour market will definitely continue to thrive. Companies are poised to continue with their technological progress and take a step towards innovation in products catering to emerging needs of changing consumer preferences in this growing business line.

Organic Flour Market Key Segments:

By Type

- Wheat

- Rice

- Maize

- Soya

- Others

By Application

- Bakery Products

- Restaurants

- Household

- Dietary Supplements

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Key Global Organic Flour Industry Players

- Ardent Mills

- Bay State Milling Company

- Bob’s Red Mill Natural Foods

- Doves Farm Foods Ltd

- EHL Ingredients

- General Mills, Inc.

- Great River Organic Milling, Inc.

- Heartland Mill Inc.

- King Arthur Baking Company, Inc.

- Lindley Mills, Inc.

- Montana Flour & Grains

- Central Milling

- Shipton Mill Ltd

- Sunrise Flour Mill

- The Birkett Mills

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252