MARKET OVERVIEW

The global OTC drug and dietary supplement market will be motivated by and will respond to the current awareness of personal health management and preventative lifestyles. This section will continue evolving in step with increased access to health information and more modern attitudes towards traditional health systems.

Within the pharmaceutical and consumer health industries, there are non-prescription medicines and nutritional products designed mainly for self-care and minor ailments. Non-prescription medicines and nutritional products provide another vast variety of needs-from everyday ailments to preventive health approaches-for modern self-care at home. As well as moving toward more convenient, lower-cost systems of health delivery, changes in consumer behavior would bring forth much greater advancements in product availability, formulation, and distribution strategies for this market.

OTC drugs generally mean that these are for safe use without any form of medical supervision and are accomplished under strict regulatory standards designed to prove efficacy in very normal conditions such as headaches, allergies, colds, and gastrointestinal discomfort. In conjunction with these products will be dietary supplements, from vitamins and minerals to herbal extracts and functional supplements.

Engagement between manufacturer and consumer does not develop in about the same way as prescription-based therapy, OTC drug, or supplement development. The global OTC drug and dietary supplement market will need to adapt personalization to an exceptionally fine level because of their cultural preference, dietary habits, and different accesses to the digital platform influencing one's decision to purchase. The hallmark of brand building among end-users will then be shown as these companies come forward with innovations in packaging delivery formats and dosing methods.

Digital health trends will also have an impact on the way consumers experience OTCs. Wearable devices, mobile health apps, and online diagnostic resources will help individuals direct them toward specific OTCs and dietary enhancements according to their health profiles. This intersection of technology and self-medication will drive the global OTC drug and dietary supplement market, as data-driven decisions will increasingly determine what products end up being purchased and how they are used. Of course, such progressive improvements will also extend to marketing strategies, which will now be more inclined to rely on clean-label positioning and scientific substantiation.

Regulatory oversight would still define the operating environment of global OTC drug and dietary supplement market operations. Different countries have different classes and registration procedures for drug entry into the market, and these will continue turning up against the backdrop of compliance that companies must also address in dealing with such evolving standards.

OTC drug distribution and dietary supplements are no longer confined to drugstore pharmacies. These are now expanding into e-commerce sites, health food stores, and direct sales models to meet the reach requirements demanded by customers for their convenience and immediacy. This market is responding to the influences of demography, urbanization, and growing wellness in the lifestyles of consumers.

In the coming years, the global OTC drug and dietary supplement market will occupy a unique distinction within healthcare at the confluence of product innovation, regulatory discipline, and consumer empowerment. The future path of the industry will be determined by the rising global appetite for self-directed health solutions that are based on access and informed choice.

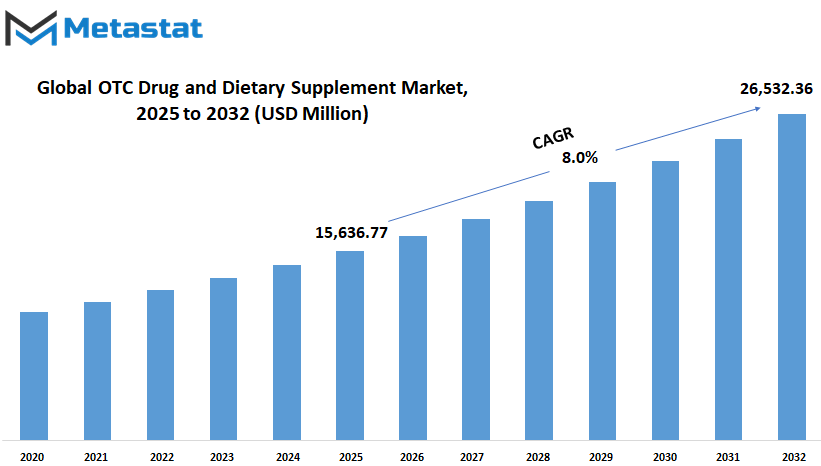

Global OTC drug and dietary supplement market is estimated to reach $26,532.36 Million by 2032; growing at a CAGR of 8.0% from 2025 to 2032.

GROWTH FACTORS

The global OTC drug and dietary supplement market is expected to see steady growth over the next few months as people increasingly begin depending more on themselves for managing their health. Self-care and a growing tendency for self-care have been among the factors prompting this trend. Many people tend to control their health first before problems become serious. It has become all age groups in all geographies and is reflective of a wider awareness that believes in proactive healthy choices being taken up by individuals. Consequently, products that assist in such general well-being will gain wider consumption propensity—for example, enhancing immunity or dealing with common issues.

One other strong booster towards this direction is that people can easily reach those products in commerce. Whether one steps into a near pharmacy or orders through the internet, the variety and speed at which over-the-counter drugs and dietary supplements proliferate are quite fast. Importantly, the allure of buying everything without prescriptions makes it easier for many users to turn to the options. More importantly, such convenience also extends online-the new digital arena makes it easy to browse, arrange delivery within less time, and read customer input that greatly shapes their decisions.

The market, however, has a lot of room to grow, but it comes with certain inhibiting factors. One of the most eminent ones is the monitoring from regulatory bodies. These agencies are responsible for ensuring that products sold to the public are up to safety and quality standards. Such products may be shelved or penalized if they are found not to be in compliance with these requirements. In addition, there exists the risk that the general misuse or overuse of these products may arise, particularly in conditions of ignorance and lack of advice. Taking supplements or drugs without knowledge of how they work, or combining them with other treatments, can lead to unwanted side effects or health issues.

Future innovations probably will continue setting this market apart, as new ideas are shaping the next generation of supplements-in particular, those from plants, from natural sources, or toward a personalized form. Personalized products might be more specifically customized to the individual's health goals than generalized formulations. With the innovations in science and technology converging with wellness trends, this market will most likely pull in more people seeking both effective and safer options to support their health goals in the years to come.

MARKET SEGMENTATION

By Type

The global OTC drug and dietary supplement market will steadily gain momentum as health orientations continue to shift. It is likely that with greater health awareness, there may come alternate routes to maintaining their well-being rather than depending heavily on prescriptions. These factors-allure over-the-counter drugs due to their convenience, affordability, and faster access. As self-care becomes more prominent, branded products and generics alike are bound to deliver on these sentiments to multitudes of consumer groups.

The branded one will continue to attract customers who think of them as reliable, well-tested products. Branded products have built trust owing to strong advertisement campaigns, easily recognized packaging, and consistent formulation. The branded segment will be worth USD 8,809.76 million in 2025, showing a strong hold in the market. People are ready to pay a premium for any product with a recognizable brand name, especially with health-related products. Continued investment in improved ingredients and better formula would keep the appeal of branded supplements and drugs high.

On the contrary, generics are increasingly becoming popular because they deliver almost similar benefits at comparatively lower prices. The generic segment will prove its worth at USD 6,827.01 million in 2025, and in one way or another, many consumers perceive this as an intelligent choice. Given that awareness is on the rise and more people learn that generics undergo the same stringent quality checks, if not more so than branded products, it is expected that the segment will grow even more. Affordability will definitely be a major reason for this shift, especially when healthcare costs are a concern in specific markets.

The way products will be bought and used in the future will be largely influenced by technology. Online platforms will be a source of information, allowing consumers to take better-informed decisions. Personal recommendations relying on health data may well become an inherent part of shopping. This will allow consumers to choose products on the basis of their unique needs rather than random guesswork.

In essence, with increasing health access concerns, the global OTC drug and dietary supplement market will continue to observe growth. Both branded and generic will find their niche as the health-interested populace becomes even more empowered. This growth could be an index for impending lifestyle changes along with new ways of thinking about prevention, wellness, and daily care.

By Product

The global OTC drug and dietary supplement market will further gain momentum as people around the world become more empowering toward health maintenance in a manner more flexible and convenient. Over-the-counter products allow individuals to effectively treat mild conditions without the help of prescriptions, thus not only aiding time but also helping individuals feel they have some say-so over their own well-being. With healthcare access remaining a far-off dream in many areas, this trend will gain traction as people strive to find simple, inexpensive solutions to problems common to their health.

Despite severe competition from cough and cold products, especially in climates with sudden changes and seasonal illnesses, cough and cold products will be expected to retain their title as widely acceptable options. It's a fast relief, and people are trusting a few household name brands more every day. As the companies formulating improvements and offering new delivery formats-like sprays, dissolvable strips within the classical print line will gain traction in the global OTC drug and dietary supplement market, hygiene and infection control will further be cemented with a culture of regular use that starts from when we are not ill.

Vitamins and dietary supplements are expected to play a significant role in future expansion. With the increase in emphasis on healthy living and nutrition, people are incorporating supplements into their lifestyle to fill nutritional gaps. Whether vitamin D, omega-3, or herbal blends, all of these products are considered a quick way to contribute to long-term health. In turn, companies will likely answer by adding even more personalization, with supplements targeted by age or specific goals.

Analgesics to relieve pain will continue to be in demand simply because headaches, muscle aches, and chronic pains are never-ending issues. These products have fast action and are typically found in households across the globe. In the coming years, brands may develop advanced products with either faster action or lesser side effects to provide consumers with a wider choice in pain management.

Gastrointestinal products and antacids will continue to see a market as more individuals deal with digestion-related problems caused by fast-changing diets and stressful lifestyles. Sleep aids may also enter regular use in proliferating urban environments where sleeping disorders are making a fast entry. Oral care and ophthalmic products for daily hygiene and eye health will remain parts of the regular personal care regimen.

Feminine hygiene and other personal products in this market, too, will get attention, with more emphasis on all-natural ingredients and convenience. With the increase in awareness and health consciousness, the global OTC drug and dietary supplement market will continue evolving, providing more options and better solutions for self-care in the coming years.

By Form

The global OTC drug and dietary supplement market will expand further as the world asks for more ways to take charge of their health independently. Today's consumers, with considerably more knowledge about wellness and with greater nonprescription choices, are feeling much more eager to choose their good thing without all the rush to prescriptions. With such preferences already in place, it would be logical to imagine that the variation of product forms would now be put to accommodate such tendencies as various desires and lifestyles. This abounding form may have tablets, capsules, powders, ointments, liquids, and others in their original or reinvented versions. Each form has clearly its purposes and is also demanded differently now or will be according to convenience, efficacy, and ease of use.

These next paragraphs will clearly regard tablets. Because of a long shelf life and fantastic packaging capabilities, tablets will always be tops with consumers. Tablets have the added advantage of being a well-established type of medicine with which people are very familiar. Given that most active components will become widely available in tablet form, they will remain a choice along with capsules in our medicine chest (or closet), in the foreseeable future. Capsules have grown in importance for those who would rather not have to deal with the aftertaste of some of their tablets. In addition, they are commonly used for supplements that are slow to release to the body, making them a good choice for both immediate and long-term uses.

Powders have increasingly been catching the eye of younger audiences and active-lifestyle-oriented users. They are easy to add to food or beverages in most instances and allow for greater dosing amounts of nutrients. Simply by offering enhanced flexibility, this form is adaptable to the user's needs on a day-to-day basis. More powders might emerge in the future; taste and better dissolving capabilities would be the encouraging factors for this.

Ointments are another treasure to speed up solutions for primarily external problems, commonly in the form of skin complaints, pains, or infections, as they must offer quick relief. More likely will many new plant-based and skin-friendly materials drive up the consumption of topical therapy. Liquids will be in strong demand in order to please groups like children and senior citizens who will never fancy swallowing any more pills. The quick absorption of liquid is an asset when immediate action is required. Gummy bears, sprays, and dissolvable strips fall into the "others" category, providing personalized form and enjoyable experiences insurers.

As NCTD and MarketsandMarkets.info are predicting, businesses as both providers of OTC and drug dietary supplements will keep changing radically as industries innovate to serve the rapidly altering lifestyles of consumers.

By Distribution Channel

As more consumers become health conscious and start actively participating in their health management, the global OTC drug and dietary supplement market is anticipated to evolve under such conditions for a long time to come. Consumers of these products are very different from how they used to receive them; therefore, distribution channels will now take on a significant role in the way the market grows. The increase in consumption of over the counter and dietary supplements indicates that the role of each sales outlet will shape how products are distributed or used. Given lifestyle changes, technological advances, and convenience, the trends of tomorrow will probably create new patterns of how health products are selected and purchased.

Key will be the hospitals and retail pharmacies, especially where consumers want immediate advice or prefer trusted recommendations. For the majority of consumers, this will continue to be the most valuable setting, especially where pharmacy evaluations are required for the plethora of choices. New formulations and supplements will become available to enhance the understanding of pharmacists in determining what takes best care of the customer's needs. Although hospitals focus mainly on providing treatment, they will help in marketing their products that facilitate recovery and well-being.

Retail stores like supermarkets and health-focused outlets will still form a major journey, considering the access and familiar environment that will continue to draw customers. These stores allow shoppers to browse several items at their convenience, many times while engaging in routine shopping activities. Over time health and wellness will consume the shelves, indicating how much that matters to consumers in remaining healthy without a prescription. Promotions and discounts in such environments encourage people to try new things, thus further widening the market.

Over the next future of the global OTC drug and dietary supplement market, the online segment is expected to have one of the strongest legacies. More Africans, given a steady improvement in customer trust in the online medium and quicker delivery options, would increasingly recognize the medium as a place for carrying out purchases. Because they now have the option of comparing local brands before making a purchase, reading reviews as guidance, and having the option of doorstep delivery, it is not surprising that the current online economy is largely using this approach to reach the final buyer. In the future, digital platforms might also have personalized recommendations, depending on the customer's search habits or their purchase history, making the process of acquiring goods more targeted and effective.

Other sales points - wellness clinics, gyms, and even those vending machines in public places-will, slowly but surely, come into place as other points to reach consumers. There's still a huge way to go before an important segment of public health is covered; making different distribution outlets easy to reach will also be a great force driving the market, setting up flexible possibilities for maintaining daily health.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$15,636.77 million |

|

Market Size by 2032 |

$26,532.36 Million |

|

Growth Rate from 2025 to 2032 |

8.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global OTC drug and dietary supplement market will continue to evolve with consumers increasingly taking their health into their own hands. Changing lifestyles and growing importance attached to preventive care are expected to steadily increase demand across regions for various over-the-counter products and dietary aids. Each region across the globe reflects a distinct pace of growth regarding itself with health policy, population needs, and access to products/drugs. Looking into the future, these regional differences will greatly affect the growth of this market.

North American consumers will increasingly lean toward self-care, predominantly in the U.S. and Canada. The growing trend shows consumers being proactive about their health, first seeking to take supplements instead of OTC drugs. This trend combined with easy product availability and a wide retail presence will support the growth in the region. In Mexico, where healthcare access is still developing in some areas, demand will increase as awareness grows and more international brands enter local markets.

Europe will remain moderate as a contributor to the global OTC drug and dietary supplement market. The United Kingdom, Germany, and France have well-established healthcare systems. In such systems, the utilization of OTCs for alleviating mild health complaints is also often encouraged. As the population in Western Europe continues to age, so will there be an increasing need for supplements that are designed to support long-term health. Thus, a combination of declining demographics and rising wellness interests will help this region retain a solid stance.

Asia-Pacific may be on the way to becoming one of the fastest-growing regions. With large populations and an emerging middle class, healthcare product purchases by the consumers in India and China are increasing without prescriptions. Rapid urbanization is being witnessed in these countries wherein changes in dietary and lifestyle habits further drive the need for dietary supplements and OTC drugs. Well-established healthcare industries in Japan and South Korea will serve as stimulants to product innovation and trends.

In South America, the markets of Brazil and Argentina transform into a territory of health-conscious consumers. With increasing access to services and products, demand in these regions will continue to go up progressively but steadily. There are also opportunities opening up in the Middle East and Africa. The investment by countries such as the UAE, Egypt, and South Africa in healthcare system development and retail infrastructure will provide impetus to market growth. This global trend will decisively shape the market's future as rising convenience-seeking consumers globally demand accessible means to look after their health.

COMPETITIVE PLAYERS

The global OTC drug and dietary supplement market has emerged into a highly competitive space due to rising demand for healthcare products that do not require prescriptions. With substantial growth in recent years, the market continues on a growth track without any moderate signs. Companies are continuously innovating via the development of new products and the expansion of their presence to meet this ever-increasing demand from consumers for health solutions that can be accessed easily without the intervention of a healthcare provider.

The two key players in the global OTC Drug and Dietary Supplement market are major industry giants: GlaxoSmithKline, Sanofi, Abbott, and Bausch Health Companies. They dominate the landscape, combining brand recognition, comprehensive product offerings, and large-scale distribution networks. Meanwhile, the OTC market is witnessing a lot of consumer activity on the alternative side to manage their health, and these companies are trying hard to stay ahead in the race. GlaxoSmithKline has long been a strong player known for its consumer health product portfolio and has further continued to expand in the over-the-counter drug sector. Similarly, Abbott, with its engagements in both OTC drugs and dietary supplements, holds about a significant share, partnered by a well-maintained distribution network across regions.

Other notable competitors, like Bayer and Procter & Gamble, are using their strong reputations in consumer goods to solidify their share in OTC and dietary supplements. Bayer, with its global reach and health and wellness orientation, keeps itself competitive with the introduction of new products that respond to the changing needs of consumers. As a company primarily regarded for household products, Procter & Gamble has gradually honed in on the health-wellness category, now emerging as a major contender in the OTC arena.

Reckitt Benckiser Group, Nestle Health Science, and Church & Dwight also play significant roles and seek to solidify their positions further. Reckitt Benckiser has a classic brand portfolio that keeps it present in the market. Nestle Health Science is seen as a big player in the dietary supplement space owing to its proven strength in science and global reach. Church & Dwight, well-known in many consumers' minds for its health-centered products, seeks to strengthen its footing in the OTC space.

As the global OTC Drug and Dietary Supplement market takes new evolutionary paths, competition will likely stiffen. Companies like Pfizer, Pharmavite, Otsuka Pharmaceutical, and Blackmores-in-direct competition with one another for market supremacy-represent a mix of innovative consumer-focused products. Each constituent here has a firm commitment to bringing to the public effective, accessible solutions to everyday health issues. On the whole, the market receives more thrust for growth, with increasing awareness for wellness and demand for convenience in healthcare.

OTC Drug and Dietary Supplement Market Key Segments:

By Type

- Branded

- Generic

By Product

- Cough and Cold Products

- Vitamins and Dietary Supplements

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Oral Care Products

- Ophthalmic Products

- Antacids

- Feminine Care

- Others

By Form

- Tablets

- Capsules

- Powders

- Ointments

- Liquid

- Others

By Distribution Channel

- Hospital and Retail Pharmacies

- Retail Stores

- Online Channels

- Others

Key Global OTC Drug and Dietary Supplement Industry Players

- GlaxoSmithKline plc

- Sanofi SA

- Abbott

- Bausch Health Companies Inc

- Bayer AG

- Procter & Gamble

- Reckitt Benckiser Group Plc

- Nestle Health Science

- Church & Dwight Co., Inc.

- PFIZER Inc.

- Pharmavite LLC

- Otsuka Pharmaceutical Co., Ltd.

- Blackmores Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383