MARKET OVERVIEW

The Global Grain Combine Harvester market is indeed one of the vital limbs on the front of modern agriculture and ensures orderly and timely harvest operations. Mechanization, having penetrated all aspects of farming, thus stands technologically advanced in crop-harvesting operations addressing efficiency and lesser human intervention. Agricultural automation and precision-farming methods, when introduced, will greatly enhance the performance, efficiency, and productivity of harvesting operations with minimal interference in farmwork. The industry is likely to witness other dynamic changes, dependent on climate patterns, sustainability regimes, and modern agricultural methods, all of which are drivers advancing the way harvesting equipment develops.

Farmers in different regions are destined to depend on harvester solutions to modern standards with regard to crop variety, soil conditions, and specific regional requirements. Hence, large-scale commercial farms are set to develop in a sustainable direction and manufacturers will, from now onwards, be inclined to produce machines that maximize yields and minimize grain losses. Advanced precision farming tools, such as GPS-guided navigation systems and real-time monitoring of resources, will become embedded in these machines, allowing farmers to optimize their resource-applications. AI in the harvesting machine is expected to further fine-tune operational efficiency, facilitating accurate yield estimation and subsequent data-driven decision-making.

Governments in several regions are likely to provide financial stimulant incentives and project initiatives making mechanization a theme for their agricultural policies in the interest of food production self-sufficiency. Manufacturers will focus on designing machines that can withstand harsh conditions and handling, keeping with the needs of farmers operating in different climatic setups. At the same time, the industry might look into electric and hybrid-powered harvesters to combat the challenges of fuel consumption and emissions while maximizing operational efficiency.

As time progresses, after-sales service and maintenance solutions, as well as remote diagnostics, will thus become more critical in the industry as they reduce the amount of time equipment remains offline while ensuring some continuity of operation. Digital connectivity introduced into harvesting equipment will ensure real-time tracking, performance evaluation, and predictive maintenance in order to curb unwanted halts and maximize field operations. In this way, these innovations will usher in a new dawn for farmers in their relations with and maintenance of their machinery to enhance profitability and efficiency.

International trade will continue affecting market dynamics; major exporting nations will send machinery to regions with developing models of mechanized farming. Manufacturers are likely expanding their international presence via strategic alliances, joint ventures, and localized production facilities to satisfy the demand for harvesting solutions. The supply chain will keep evolving based on improve manufacturing techniques, allowing farmers to access high-quality machines at competitive prices.

The Global Grain Combine Harvester market will maintain its position as a modernizer of agriculture, laying a foundation for sustainable farming activities, together with cutting-edge technologies. The industry will remain resilient to changing agricultural demands, ensuring farmers have the right tools at the right time to achieve food production goals effectively. The future vision is to redefine harvesting efficiency interlaced with precision, automation, and sustainability.

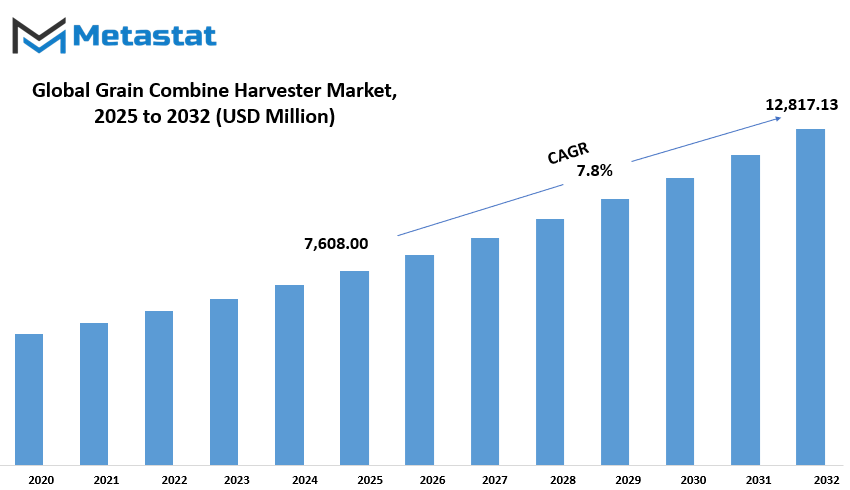

Global Grain Combine Harvester market is estimated to reach $12,817.13 Million by 2032; growing at a CAGR of 7.8% from 2025 to 2032.

GROWTH FACTORS

One of the major thrusts driving the Global Grain Combine Harvester market is the mechanization of farming practices. The agricultural sector is advancing and thereby calls for harvesting equipment that improves productivity and cuts down on manual labor. Therefore, with a lack of farmworkers present in many areas, there is ever-increasing demand for combine harvesters since these machines would promote farmers to finish their process of harvesting much faster and more efficiently. The other is to overcome labor challenges and keep up with modern farming techniques that bring along advanced machinery designed to improve crop yield and reduce post-harvest losses.

However, despite all the advantages, the market faces several challenges, which might restrain growth. One main constraint is the high initial cost involved in purchasing and maintaining combine harvesters. Many small and medium-sized farmers are not capable of affording these machines because of their limited financing. Moreover, the market largely depends on seasonal harvest cycles, thus affecting the demand. In case the crop yield gets affected by erratic weather conditions or other changes outside farmers' control, there may be low enthusiasm among them to buy new harvesting equipment, which in turn affects growth in the market.

On the other hand, advancements in technology give birth to new opportunities for the industry. Automation and precision farming technology development is expected to completely change the way the harvesting is done. Today's combine harvesters come attached with GPS tracking, real-time monitoring systems, and AI-propelled analytics to ensure optimized operations and lower losses. These innovations witness advances in efficiency gains as they relate to greater sustainability by reducing waste and improving resource utilization.

With the promotion of mechanized farming by governments and agricultural organizations, the market for grain combine harvesters is expected to continue growing. Financial assistance programs and subsidies for farm machinery are biting into the barrier of high cost, opening the way for farmers to adopt advanced machinery. Improvements in design and functionality will continue and focus on cost-effective solutions to meet the various needs of the farmers in different regions. Smart technology and automation are here to shape the future of the industry by providing high productivity and sustainability in global agriculture.

MARKET SEGMENTATION

By Type

The Global Grain Combine Harvester market is vital for today's agricultural operations, enabling efficient and precise harvesting of grain crops. The food production demand will continue to rise, and technological advancements keep sweeping the combine harvester industry by storm. The machines improve farmers' productivity by minimizing securing manual effort and time in harvesting; therefore, combine harvesters are an indispensable asset in the large-scale farming sector.

The grain combine harvester market is classified into types: self-propelled combines, tractor-drawn ones, and PT0-powered ones. Out of the three, self-propelled combine harvesters have largely retained a significant market share estimated at $5,695.00 million. Their efficiency, operational agility on larger fields, and considerable automation give them a favorable market acceptance for commercial farming. On the other hand, mid-size farms appreciate tractor-drawn units because of their cost-effective nature, as they can be attached to the existing equipment. PTO-powered combines are favored in areas where farm operations are small-scale and require an affordable solution. Power take-off from the tractor is used for PTO-driven combine harvesters.

Some of the factors driving the growth of the grain combine harvester market are population growth, rising demand for food, and mechanization in agriculture. Farmers are now seeking machines for the higher yields but with the least post-harvest losses. Precision farming technologies, such as GPS tracking, real-time monitoring for adjustments, and computer-assisted automated adjustments, are aiding in maximized harvester performance. With optimized grain collection, reduced wastage, and improved efficiency, these harvesters are an asset that farmers must invest in.

Incidentally, high initial investments, upkeep costs, and the competent working of machinery are all factors that have limited their use. Most farmers cannot afford heavy machinery, particularly in underdeveloped areas, and rely on more traditional means of harvest. The intervention of these governments and other agricultural organizations through subsidies, loans, and training programs has been to inspire farmers to modernize their harvesting equipment.

The future developments in the Global Grain Combine Harvester market will highly depend on the advancement of agricultural technologies. Manufacturers are now inclined toward the production of machines that offer rather better fuel consumption, lower emission, and more automation in response to the ever-growing sustainable goals of farming. Integrating agricultural modernity guarantees that the combine harvester's role in food production and efficiency will always remain crucial for global food security.

By Power

The role of Global Grain Combine Harvesters is considerable in modern agriculture, which has taken on efficiency and productivity in harvesting crops. Advances have been due to the growing demand for food and technological improvements that have further diversified the markets to cater for farm sizes and operational sets. A combine harvester combines the reaping, threshing and winnowing processes into one vital part of farming equipment, meaning it is made to reduce personal labor while increasing yield efficiency. The further advancement of farm methods is demanding harvesting machines to be more powerful and efficient.

The market is segmented accordingly on the basis of power for use by different scales of farming operations. The power categories are below 150 HP for small farms or fields with low acreage. Such models are inexpensive and suitable for regions having no large-scale mechanization feasible. The 150-300 HP range serves medium-sized farms, with the capacity to provide good cost and productivity. Higher still is the 300-450 HP range, designed for larger farms requiring greater output and enhanced capabilities to manage vast agricultural lands efficiently.

That's where the 450-550 HP segment comes in, giving large-scale commercial farming operations high-capacity machines allowing optimal productivity and reduced operational costs. Finally, models above 550 HP represent the most advanced and powerful category, built for extensive farming needs, ensuring rapid harvesting while maintaining quality and reducing grain losses.

The need for advanced agricultural machinery find its roots in the increase in a population that has risen globally and also in food demands. Farmers have several approaches in mind during harvesting to improve on efficiency, cost reduction, and maximization yield. Technological improvements, such as precision farming, GPS guidance, and automation, have fortified through highly productive resource-saving farming. Government support and subsidy for different countries are also motivating farmers towards modernization equipment using mechanization in agriculture. However, small farmers have limitations as these machines require a high initial investment and maintenance costs.

As it is the Global Grain Combine Harvester market, so difficult to foresee new horizons. Manufacturers are focusing their attention on innovating, sustainability, and cost-effective solutions to meet the demands of farmers all over the globe. With advancements continuing to ramp up and increase adoption, those harvesting technologies will remain part and parcel of modern farming in food security and efficiency in crop production.

By Grain Tank Size

The world market for combine harvesters for grain makes a considerable impact in modern agriculture generally through its efficiency in harvesting large grain crops. New technologies coming in are improving machines, which are helping farmers increase their productivity and reduce their labor cost. A combine harvester tends to be designed so that reaping, threshing, and winnowing are all done simultaneously. This can be seen from the fact that it has become essential equipment employed by farmers in almost all countries depending on where high-scale grain production is done economically.

One of the most critical attributes affecting usage is how the header is classified according to tank size. It is classified into three sections: less than 250 bushels, 250 to 350 bushels, and 350 and above bushels. Every segment has its particular purpose intended for different scales of farming operations. Under 250 bushels is almost entirely a smaller farm use, as any grain storage above this level would usually prove excessive for the amount of ground farmed. Mostly, moderate farms prefer using machines extending between 250 and 350 bushels capacity. This size ranges between efficiency and low cost, making it viable for moderate fields. Very high-volume farms which require a machine to harvest vast amounts of grains per unit time usually make use of machines storing above 350 bushels since it considerably reduces the unloading frequency, hence making everything much more efficient.

Combine harvesters are in demand throughout the world because of many factors. The improvement in modernizing efficiency and obtaining more output with fewer labor requirements is because the increase in food consumption globally has increased needs for agricultural output. Government initiatives towards mechanization of farming and subsidies for agricultural machinery may encourage farmers to better harvest methods. Technology among many other determinants has completely shaped the market in terms of harvesting machines. Many of these machines nowadays are fitted with modern tools and systems like GPS technology and automated controls with precision farming tools for better efficiency and reduced operational costs.

Although very many advantages accrue towards the possibility of having combine harvesters, some challenges continue to rear up around the same. Cost of initial investments and upkeep can be prohibitive to small and medium category farmers. Another concern regards the availability of skilled operators as use of modern combine harvesters entails a lot of technical expertise during operation to enhance optimal performance. However, with the emphasis on manufacturing economically viable solutions and training , these challenges are gradually coming to a close.

Thus, the market for grain combine harvesters is at the threshold of enhancing further profitability increases bringing the need ongoing for increased agricultural productivity. With ongoing research and innovations, it is anticipated several new models will prove energy-efficient, environmentally friendlier with easier operation, guaranteeing that farmers will keep up with the demand for food while maximizing efficiency and profitability.

By Application

The Global Grain Combine Harvester market forms a backbone of modern agriculture to enhance efficiency during the harvesting and decrease the labor required. These machines can harvest more than one crop so that farmers could maximize their yield with as little manual work as possible. With technological advancement, these harvesters have become more advanced, with better speed, precision, and energy efficiency. These multifunctional machines have completely changed the global harvesting practice by being able to reap, thresh, and winnow all in one pass.

In application, the market is subdivided according to the type of crop being harvested. Wheat harvesting is one of the most-used applications due to the great global demand for wheat as staple food. The fruitful harvesting of wheat is particularly essential in reducing grain losses and retaining high quality of produce. Similar to the wheat harvesting, rice harvesting would also need types of machinery that could handle the specific features of rice crops that could include water-logging culture and delicate structure of rice grain.

The introduction of combine harvesters for rice has greatly enhanced productivity in rice-growing areas considered the staple food. Soybean harvesting constitutes another important segment in the market. Soybeans are the most important in the agricultural trade and are utilized for oil production, animal feed, and varieties of food products. Soybean harvesters come with advanced technology to enable clean separation of grains and minimize losses. Apart from these major crops, combine harvesters are also used for other grains and, thereby, adapted to very many local field conditions and types of crops.

Increasing adoption of new agricultural implements is occasioned by demand for greater productivity and efficiency in modern agriculture. High unemployment rates in many regions necessitate mechanized harvesting almost by compulsion. The government incentives and policies to encourage the use of advanced farm machinery have helped to spur this expanding market. Additionally, technology has improved the GPS guiding system and automation, enhancing accuracy and easing operation, thus making accessibility to farmers all over the world.

However, high initial costs and high maintenance costs are some disadvantages hampering small and medium farmers. Nevertheless, the rental services and cooperative farming models have provided options that have benefited many farmers accessing these machines without an unbearable financial burden. With advancing technology, we expect improved grain combine harvester efficiency and affordability, thus enhancing adoption in more agricultural landscapes.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$7,608.00 million |

|

Market Size by 2032 |

$12,817.13 Million |

|

Growth Rate from 2025 to 2032 |

7.8% |

|

Base Year |

2025 |

|

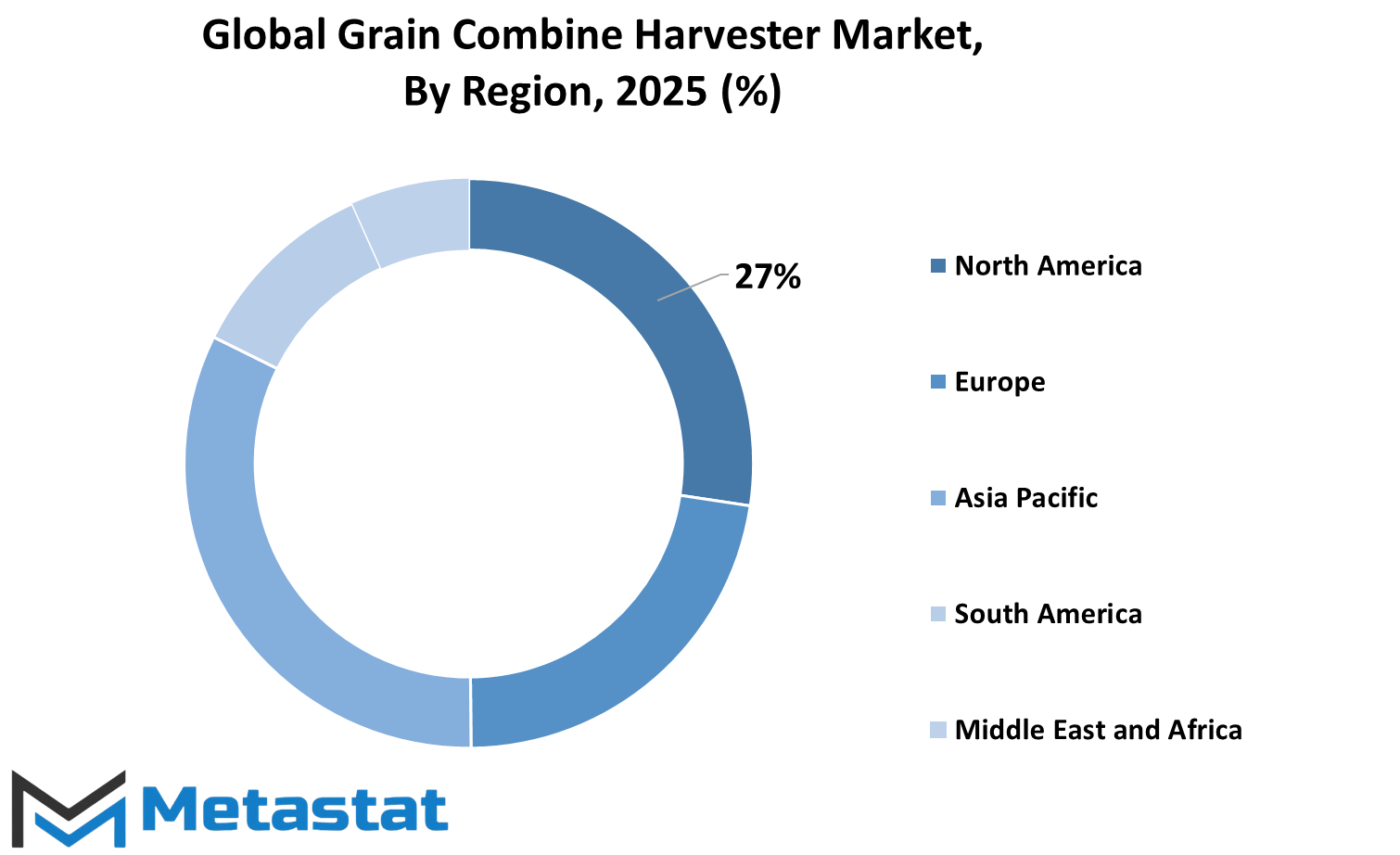

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Grain Combine Harvester market is an essential segment of the agricultural machinery industry, driven by efficient needs for harvesting solutions. These machines essentially improve productivity, reduce human dependence, and ensure harvests are done at the right time. Modernizing technologies have influenced manufacturers with an effort to improve the efficiency, durability, and automation of these machines for the increasing demand of farmers from different regions across the globe.

Geographically, the different segments of the market correspond to major regions, each with specific agricultural landscape and demand types. North America, which comprises the United States, Canada, and Mexico, has a significant portion of the market, thanks to advanced farming methods and mechanization. The U.S. dominates the region because it has large farms that use specialize in harvesting equipment with a high capacity. Europe, which has several countries such as the UK, Germany, France, and Italy, also disposes of considerable use of grain combine harvesters due to government laws that support new agricultural practices and the need to produce high yields in crops.

Countries like India, China, Japan, and South Korea in the Asia Pacific region have growing markets for grain combine harvesters. The rise of mechanized farming has been partly fostered by initiatives from the government promoting modern agricultural equipment, which has also contributed to market expansion. This is particularly evident for China and India, as the world's largest agricultural producers have great potential for market growth as demand for efficient harvesters gradually increases.

South America, including Brazil, Argentina, and countries in the region, is mainly dependent on the use of grain combine harvesters for large scale farming operations for soybeans and wheat. With increasing productivity and loss reduction at harvest, this market is pushing forward. In the Middle East & Africa, comprising countries from the GCC, Egypt, and South Africa, demand comes from improving food security and the efficiency of agriculture in arid parts where mechanization could significantly impact yield and profitability.

Several factors shape the future of this market: technology advancement, government policies, and increasing adoption of precision farming techniques. These shifts toward automation and smart farming solutions may, too, result in increased demand for grain combine harvesters. The emerging markets are also bound to face challenges stemming from high initial investment cum maintenance costs of grain combine harvesters, resulting in low adoption of the technologies in the former regions. The reforms in harvester technology and the emerging population need sustainable farming solutions that will keep shaping the market expansion growth.

COMPETITIVE PLAYERS

The Global Grain Combine Harvester market occupies a major share in the modern production of agriculture, rather than increasing efficiency and productivity for grain harvesting. As the food production continues to grow, agricultural machinery work towards the timely and effective harvesting of crops production. Grain Combine HARVESTERS serve different purposes including reaping, threshing, and winnowing, all in one single operation. Thus, it has considerably lowered the manual work and speeded up the harvesting of crops, benefiting farmers all over the world. With the expansion of farming operations, the demand for progressive machinery which increases output productivity and reduces losses will remain robust.

Technological advancement in the Grain Combine Harvester market has led to it giving rise to highly efficient automated machines. Some innovations include precision farming tools and GPS guidance, sensor-based monitoring systems and these make the user-friendliness and productivity of the machine higher. Farmers can now monitor the performance of the equipment in real-time, thus making it easier to decide on future action and resources optimization. Such harvesters with fuel efficiency and friendly emissions are the objective for manufacturers because these will be high in performance, yet low in operation emissions. This is what continues to spur innovation in the industry since most companies invest in research and development to have smarter, agile machinery that caters closely to the needs of specific farm sizes and varieties of crops.

Major players in the Grain Combine Harvester industry are well-established names like Deere & Company, Kubota Corporation, Mahindra & Mahindra Limited, CLAAS KGaA mbH, KS Agrotech PVT. LTD., YANMAR Co., Ltd., Preet Group, Deutz-Fahr, Hind Agro Industries, Kartar Agro Industries Private Limited, Massey Ferguson, Weichai Lovol Intelligent Agricultural Technology CO., LTD, and New Holland Agriculture. All these companies continue to dominate the market by offering diversified ranges of models which suit different farming conditions and geographic regions. Their focus remains on integrating advanced technologies that help improve yield quality and minimize crop losses during the harvesting process.

Government intervention, subsidization, and leasing options help to close the affordability and access gap since the latest harvesting equipment is within reach for large-scale farmers, while small and medium-scale farmers cannot afford it. They maintain a gap between the two mostly due to high initial investment costs in the market and maintenance requirements, as well as the need for skilled operators. With changing times and modification in agricultural practices, the Grain Combine Harvester market is expected to grow continuously with improvements in growing methods into more efficient and sustainable ways.

Grain Combine Harvester Market Key Segments:

By Type

- Self-propelled

- Tractor-pulled Combine

- PTO-powered Combine

By Power

- Below 150 HP

- 150-300 HP

- 300-450 HP

- 450-550 HP

- Above 550 HP

By Grain Tank Size

- Less Than 250 bu

- 250 to 350 bu

- More Than 350 bu

By Application

- Wheat Harvesting

- Rice Harvesting

- Soyabeans Harvesting

- Others

Key Global Grain Combine Harvester Industry Players

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Limited

- CLAAS KGaA mbH

- KS Agrotech PVT. LTD.

- YANMAR Co., Ltd.

- Preet Group

- Deutz-Fahr

- Hind Agro Industries

- Kartar Agro Industries Private Limited

- Massey Ferguson

- Weichai Lovol Intelligent Agricultural Technology CO., LTD

- New Holland Agriculture

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383