MARKET OVERVIEW

The Mexico courier, express and parcel (CEP) market is gradually structuring itself as one of the most important aspects of the logistics and transport sector, becoming a vibrant segment that will soon exert influence far beyond the boundaries of traditional expectations. As much as the existing infrastructure continues to cater to a wide range of consumer and business needs, its future will almost certainly evolve in directions that break conventions. Aside from door-to-door shipping and on-time deliveries, the market will become a critical facilitator of inter-sectoral efficiency, technology convergence, and economic reform.

The next few years will not only redefine parcel movement but also what role the entire delivery network will play in broader societal processes. With urban spread and growing e-commerce density reconfiguring distribution networks, the Mexico courier, express and parcel (CEP) market will be challenged to traverse splintered cityscapes while still addressing the increasing demand for speed, visibility, and eco-friendliness. As conventional supply chains fragment into shorter, more intricate cycles, this market will increasingly fill the gap with more intelligent, more lean solutions.

There will be an insistence on developing personalized logistic routes, where one-size-fits-all delivery mechanisms will no longer suffice. Companies will seek this segment not only for execution of shipments but for end-to-end experiences where live tracking, predictive insights, and communication with customers will become an integral part. At this stage, the Mexico courier, express and parcel (CEP) market will cease to exist on the periphery of commerce or retail but emerge as a core value creation partner, assisting brands in defining customer expectations and trust in brand.

Additionally, the changing consumer dynamics in Mexico will drive change in how the market is used and perceived. Rural connectivity, hitherto ignored, will be a frontier of opportunity. Expansion of infrastructure, especially in Tier 2 and Tier 3 cities, will promote fresh investment and logistical innovation. The market will witness the arrival of new hybrid delivery models that combine human labor with automated technology, striking a balance between human touch and digital efficacy to achieve greatest reach and reliability.

Technological advancements will also propel the Mexico courier, express and parcel (CEP) market into new unknowns. The future will introduce drone services, autonomous vehicle integrations, and blockchain-secured security processes that will revolutionize the way deliveries are booked, authenticated, and executed. These changes will be incremental but inescapable, establishing a system that is not merely reactive but proactive.

Essentially, the Mexico courier, express and parcel (CEP) market will come to outgrow its designation as mere delivery facilitator. It will be an economic hub of intertwined economies, cultural crossroads, and digital supply chain whispering but effectually changing the tempo of contemporary trade and daily life.

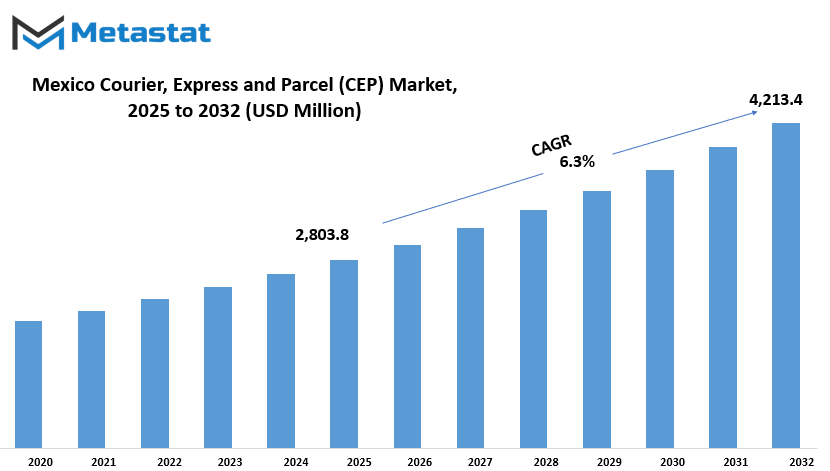

Mexico courier, express and parcel (CEP) market is estimated to reach $4,213.4 Million by 2032; growing at a CAGR of 6.3% from 2025 to 2032.

GROWTH FACTORS

The Mexico courier, express and parcel (CEP) market is slowly developing as it adjusts technological progress in emerging consumer habits, economic changes and logistics. The most important drivers of this change are the rapid expansion of e-commerce. With the increasing number of consumers adopting online shopping for convenience, the demand for effective final miles will increase dramatically. This change in buyer behavior is installing a new benchmark for speed and service, forcing courier operators to enhance their distribution network to keep pace with increasing expectations.

Meanwhile, the border trade is increasing, which is contributing to the amount of international parcels. Since companies diversify their operations from domestic to foreign markets, especially small and medium businesses, courier services are becoming indispensable to deal with logistics across the country. It is pushing companies to consider better customs facility, efficient tracking functioning and optimized delivery mode to respond to increased demand. Such changes are facilitating the change of industry to be more responsible and Mexico integrated.

With this modification, but, come demanding situations. In some of regions in Mexico, especially in rural and isolated regions, the infrastructure is underdeveloped or volatile. Low street nice, loss of get admission to to sophisticated technology, and disparities in delivery networks tend to cause delays, which can effect satisfactory of carrier and consumer delight. Fast deliveries may be experienced in main cities, however this isn't the case for smaller towns due to these barriers. Second, excessive operation prices persist to place strain on logistics companies, in particular smaller ones. Fuel, warehousing, generation modernization, and employee education costs deplete income margins, forcing new or smaller businesses to warfare to compete meaningfully.

Notwithstanding these demanding situations, the marketplace holds fertile opportunities. Perhaps the maximum seen trend is increasing fascination with same-day delivery, especially in city centers. As customers appearance to get things introduced quicker and quicker, businesses that offer efficient and reliable options could be fine placed to win over patron loyalty. To meet this need, more businesses also are trying to automation and synthetic intelligence to streamline logistics. From using predictive facts for path planning to intelligent warehouses for faster handling, these technologies are streamlining operations and lowering the threat of mistakes.

In the future, the emphasis is expected to keep on finding the stability amongst speed, fee, and reliability. Businesses that reach achieving this balance and addressing troubles with deliveries as well as making the most of era will gain an facet in a fast-developing marketplace.

MARKET SEGMENTATION

By Business

The Mexico courier, express and parcel (CEP) market is embarking on a new era, driven by changing customer demands and increasing need for speed and reliability in delivery services. As the day-to-day life becomes increasingly reliant on digital convenience, the business will only evolve, not just in the ways of functioning but also in the manner of bringing people and enterprises together from afar.

An important segment of the market is trade-to-business services, currently $ 1,893.0 million. This section will remain a prominent driver, especially relying on quick logistics solutions such as regions such as manufacturing, retail and healthcare. Meanwhile, business-to-consumer (B2C) and consumer-to-consumer (C2C) markets. Online purchases, second-hand marketplaces, and Peer-to-Pier transactions have compulsorily presented to all that parcels travel quickly and efficiently, no matter where they come from or where they are going.

Firms will start to invest heavily in last-mile delivery effectiveness, a problem that's particularly acute in cities where traffic and infrastructure complicate processes. To meet this, most will resort to data-driven route optimization and local delivery nodes, seeking to reduce delivery windows and win customer satisfaction. Further, automation and digital tracking technologies will be the key to providing users with real-time visibility into their shipments, something that has graduated from a luxury item to a standard expectation.

The future of Mexico courier, express and parcel (CEP) market will also be shaped by growing awareness of environmental impact. Businesses will simply have to invest in electrical motors and eco-friendly packaging as consumers gravitate towards cleaner options. This change won't be solely branding-oriented policy and bottom-line expenses will force service companies to recast their strategy for transporting packages. It's a shift that will happen over time, but it will slowly redefine how parcels move from sender to consumer.

Rural delivery, another age-old problem, will require new infrastructure solutions. Companies will partner with local players or utilize smart lockers and drop-off locations to cover more distant areas without blowing costs out of the water. As technology becomes more affordable, even the smallest courier operators can take advantage of tools that enable them to handle and expand their services without large-scale investment.

Security will also be a focus, particularly for high-value cargo or sensitive materials. Improved verification procedures and tamper-evident packaging will become increasingly prevalent, further instilling confidence in the service. Customer service will also progress from reactive to proactive, utilizing analytics and AI to anticipate problems before they arise and remediate them with little friction.

As the competition intensifies, it will be personalization that differentiates businesses. Others will provide variable delivery times, diversion options, or subscription services for regular users. It is no longer merely about transferring a package from point A to point B it's the complete experience.

Over the next few years, the Mexico courier, express and parcel (CEP) market will not only increase in volume but also in maturity. Each sector B2B, B2C, and C2C will pose its own challenges, and firms that remain vigilant, nimble, and consumer-centric will be the ones that take the lead.

By Destination

The Mexico courier, express and parcel (CEP) market gradually conforms to the needs of transfer of companies and individual consumers. With the increasing demand for rapid distribution, the service providers will continue to refine the local and across the border logistics. Timely dependence on transportation has inspired corporations to expand their network's reliability and coverage. Amidst all the methods in which this market is fragmented, one of the primary sections is destination. In this case, the market is cut into two separate sections: domestic and international.

Domestic services will remain a favorite option for domestic delivery within Mexico. These services usually handle short distances and deal with the delivery of the same day or the next day, especially in urban areas where consumers demand a quick turn time. With the increase of online shopping, especially in small cities and towns, local courier networks are bound to be strong, faster and more convenient. Companies that need to touch customers directly and instantly will keep depending on domestic shipping solutions to satisfy and preserve satisfaction.

Mexico services, however, cater to businesses and individuals who are shipping parcels internationally. As trade relations extend beyond North America, the need for quality international delivery solutions will increase. Such services also generally involve additional logistical challenges like customs clearance and foreign regulations, making them more complicated to operate. Providers are, however, making investments in superior technologies and alliances in order to make these processes smoother. With more of Mexico's small and mid-sized businesses accessing international markets via e-commerce, foreign courier services will be increasingly vital and competitive.

Going forward, the difference between domestic and foreign services will define how providers organize their operations. From the selection of warehouse facilities to the investment in speedier customs handling equipment, these segments will continue to influence decision-making along the supply chain. Knowing how each destination type operates in the market will enable firms to select the most appropriate choice, whether shipping locally in Mexico or moving products abroad.

By Service Type

The Mexico courier, express and parcel (CEP) market is continuing to evolve as shifting consumer behavior and business requirements impact the way services are provided. With increasing e-commerce demand and support from logistics across industries, the market will change its speed, focusing on more convenient, dependable service options. By type of service, the market is also segmented into Courier Services, Express Services, and Parcel Services. Each of these types has a unique function in the regional structure of deliveries. Courier companies will most likely continue to specialize in smaller, routine shipments, often staying within city limits or between adjacent regions. They will provide the backbone for day-to-day commercial deliveries and expeditious document handling, particularly for companies depending on quick correspondence.

Express services, however, will pick up further pace as the demand for timely delivery increases. This segment serves individual and commercial customers who value speed. It will see further traction from industries such as pharmaceuticals, electronics, and fashion, where any delay can result in greater losses. Since Mexico is geographically positioned close to key North American trade routes, express delivery networks will fortify their alliances with global logistics companies with a goal of shortening delivery times without cutting down on accuracy. The transition towards digital monitoring and real-time information will also accompany this expansion, since customers increasingly call for transparency throughout the delivery process.

Parcel business, which deals with bulk quantities and heavier loads, will grow due to more cross-border trade and retail distribution. With online shopping increasing its presence, the range of parcel shipments will boom. This will compel carrier providers to adapt with extra smart warehousing, more suitable packaging protocols, and higher coordination between ultimate-mile networks. Mexican parcel services will now not only facilitate trade in the domestic marketplace however additionally function a vital connection in nearby fee chains, in particular among small and medium-sized businesses that aspire to increase beyond home markets.

Technology integration will serve in a supporting role for all varieties of services. Ranging from cellular apps that make it easier to time table to synthetic intelligence-powered logistics systems that optimize routes, automation will increasingly more have an impact on how companies plan and execute. But human intervention will continue to be essential in making sure provider satisfactory, troubleshooting, and setting up consumer trust. The Mexico CEP Market isn't just growing it's morphing into a more responsive, customer-centric model whereby each type of service will have specific responsibilities, evolving to suit precise needs and creating the future of how individuals and companies connect.

By End User

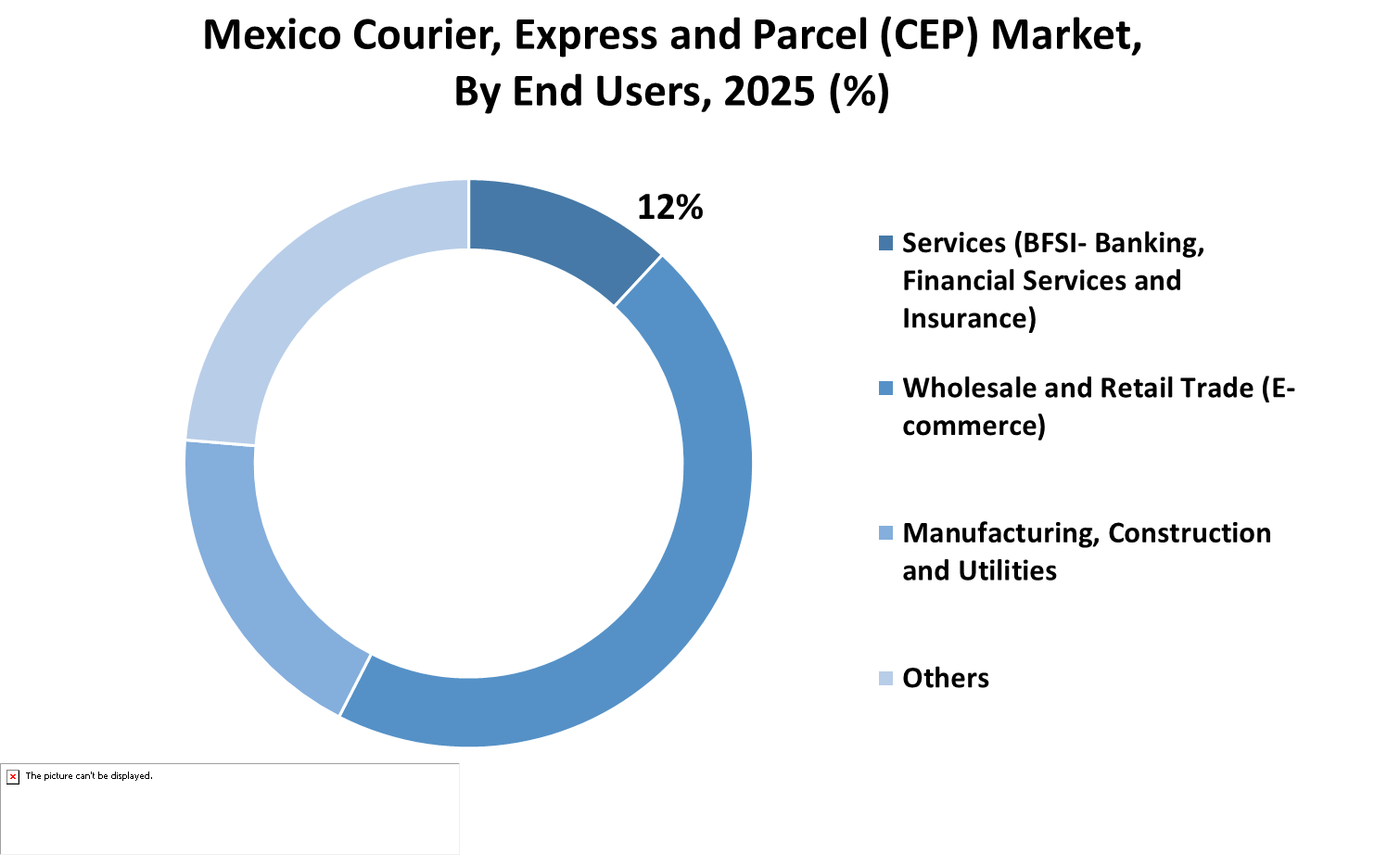

The Mexico courier, express and parcel (CEP) market, when viewed from the end user's perspective, indicates broad reach across a number of larger industry sectors. Among one of the primary areas of demand will be services of the likes of Banking, Financial Services, and Insurance (BFSI). These sectors are dependent on prompt and safe delivery of documents and parcels and therefore demand for trustworthy CEP solutions is required. With financial transactions ever more reliant on the physical exchange of documents in certain markets in spite of electronic substitutes, courier companies will remain a needed part of the equation.

Wholesale and retail trade, and in particular e-commerce, will be a significant driver of CEP demand as well. Online purchasing behaviors in Mexico will continue to grow, generating an increase in deliveries to both urban and rural zones. This trend will challenge service providers to optimize last-mile delivery efficiency while maintaining pace with customer demand for speed and reliability. With e-commerce platforms expanding and logistics technology advancing, the relationship between retailers and delivery networks will increasingly be integrated and responsive to real-time demands.

Manufacturing is another important end-user segment that will depend on courier and express services to deliver machinery components, samples, and custom orders. With more time-sensitive supply chains, the importance of timely delivery will grow. The construction and utility industries, however, might utilize CEP services to transport vital tools, papers, or break-down parts to work locations or operational areas. Those demands tend to have strict timing, compelling courier services to ensure precision and consistency.

The last segment consists of other diverse industries, each with specific delivery requirements. From law firms to schools, there are a number of niche sectors where document and package delivery is a routine imperative. Even while digital interaction increases, physical objects like certificates, agreements, or confidential packages will continue to need safe handling through reliable courier channels.

In the years to come, each of these end-user segments will impact the way the Mexico courier, express and parcel (CEP) market develops itself. Customization of services, quicker turnaround, and wider coverage will be normal expectations, and market players would need to invest in improved infrastructure, training, and technology. With various industries continuing to bank on reliable delivery services, the CEP sector will follow suit to cater to their speed and accuracy.

REGIONAL ANALYSIS

The Mexico courier, express and parcel (CEP) market is a crucial segment of the global logistics chain, facilitating companies and individuals through quicker and more efficient movement of goods. The market stretches across many major regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. All of these regions play a distinct role towards the overall structure and functions of the CEP industry.

In North America, the Mexico courier, express and parcel (CEP) market is segmented into the United States, Canada, and Mexico. The U.S. is exceptional for its highly developed infrastructure and reliable demand for quick deliveries, both from e-commerce sites and conventional business entities. According to number two, there is a stable network of logistics that caters to home country and cross-border delivery. Mexico has a rising presence in this group, serving as a bridge between the northern and southern markets because of its robust manufacturing sector and expanding digital commerce activities.

Europe comprises the UK, Germany, France, Italy, and the Rest of Europe countries. The region has a mature delivery network, and the closely knit cities of the region enable smooth parcel delivery. Both Germany and France have large volumes of domestic and international parcels. The UK, particularly with the boom in online shopping, has generated robust demand for next-day and express delivery services.

Asia-Pacific, which comprises India, China, Japan, South Korea, and other surrounding countries, is among the most vibrant markets in this arena. The growth of the middle class, mobile shopping, and enhanced supply chains have driven expansion. China and India, especially, are bases for some of the largest e-commerce businesses in the world, driving parcel volumes to record levels. South Korea and Japan, with their technologically advanced systems and customer-centric orientation, continue to raise the bar in terms of delivery time and service level.

South America breaks down to Brazil, Argentina, and the rest of the countries in the region. Brazil is the major contributor, with its growing digital retail market and rising investments in last-mile delivery. Argentina, though smaller in scope, is also improving its logistics infrastructure. The region as a whole will experience growth as online retail increasingly reaches more consumers.

The Middle East & Africa is classified as GCC Countries, Egypt, South Africa, and others under the Rest of Middle East & Africa. The GCC countries have emerged as robust hubs for trade, owing to their developed logistics centers and economic diversification efforts. Egypt and South Africa are gradually enhancing their courier networks, backed by road and warehouse infrastructure investments. Although the region continues to experience problems such as regulatory challenges and uneven rural connectivity, developments that continue indicate sustainable improvement.

Each of the global regions in the Mexico courier, express and parcel (CEP) market has its own development pace, influenced by the needs of consumers, the state of the economy, and digitalization. With further growth of cross-border trade and e-commerce, the need for robust, agile, and effective parcel delivery networks will grow ever stronger. The regional analysis influences global companies' overall strategies and emphasizes the different, yet interrelated, nature of the Mexico courier, express and parcel (CEP) market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,803.8 million |

|

Market Size by 2032 |

$4,213.4 Million |

|

Growth Rate from 2025 to 2032 |

6.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

COMPETITIVE PLAYERS

The Mexico courier, express and parcel (CEP) market will remain a highly dynamic industry as a result of evolving consumer expectations and increasing reliance on quick, trusted delivery networks. As e-commerce permeates every aspect of life, from big cities to towns, logistics services providers are no longer merely processing packages they are enabling daily convenience and business continuity. What was once used for limited commercial purposes has now become a foundational piece of how products are being circulated throughout Mexico and abroad. With consumers demanding more same-day or next-day delivery, the sector will be forced to react with quicker, smarter, and more intelligent solutions.

The Mexico courier, express and parcel (CEP) market will also witness greater adoption of digital tools, not only for monitoring packages, but to manage fleets, plan routes, and streamline each touchpoint from dispatch through doorstep. Mobile apps and real-time delivery status are already on the expectation list for customers, and businesses will keep evolving to respond to these needs. What distinguishes a delivery service these days is not only speed but also reliability and transparency, with logistics firms putting more emphasis on the customer experience. Companies that know how to provide smooth, hassle-free delivery will gain long-term trust and get ahead of the competition.

Major players in the Mexico courier, express and parcel (CEP) market are DHL Group, Estafeta Soluciones Logisticas S.A de C.V., FedEx Corporation, United Parcel Service of America, Inc. (UPS), 99minutos, iVoy Mensajería Express, Paquetexpress Services Operator, SA de CV, SkyPostal Networks, Inc., Grupo Traxion SAB de CV, Grupo Senda, and Transportes Castores De Baja California S.A. DE C.V. All of these players have taken strategic steps to enhance their reach and service quality. While international players such as DHL, FedEx, and UPS enjoy the advantage of mature networks and global presence, local players are adapting to the needs of the country with variable and location-specific models for delivery.

The contribution of regional logistics hubs will become more significant. Businesses will continue to expand warehousing and last-mile infrastructure investments in order to increase speed of delivery and lower operational expenses. Additionally, innovation will not only appear in technology it will also manifest in service models. For instance, a few providers might test pickup points or locker systems for places in which home delivery isn't as feasible. Others could implement electric vehicles or different transport to reduce their environmental impact and improve sustainability targets.

With so many opportunities available, the market won't advance without a fight. The issue of managing delivery logistics in regions with poor infrastructure or variable traffic patterns is still one of concern. Increasing fuel prices, labor shortages, and environmental policies will also have an impact on the operations of these companies. But those companies that are prepared to adjust, re-think their approaches, and implement pragmatic change will have a better chance of overcoming these obstacles.

Over the coming years, Mexico courier, express and parcel (CEP) market will not only meet demand it will drive how goods are delivered and how companies remain engaged with customers. The above-named companies are not merely players in a burgeoning industry they are defining its future, meeting real-time challenges with pragmatic innovation and customer-centric solutions. Their prosperity will be a function of how effectively they can reconcile speed and sustainability, reliability and flexibility, and technology and humanity.

Mexico Courier, Express and Parcel (CEP) Market Key Segments:

By Business

- B2B

- B2C

- C2C

By Destination

- Domestic

- International

By Service Type

- Courier Services

- Express Services

- Parcel Services

By End User

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

Key Mexico Courier, Express and Parcel (CEP) Industry Players

- DHL Group

- Estafeta Soluciones Logisticas S.a de C.V

- FedEx Corporation

- United Parcel Service of America, Inc. (UPS)

- 99minutos

- iVoy Mensajería Express

- Paquetexpress Services Operator, SA de CV

- SkyPostal Networks, Inc.

- Grupo Traxion SAB de CV

- Grupo Senda

- Transportes Castores De Baja California S.A. DE C.V.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252