Global Diesel Exhaust Fluid (DEF) Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

Can the growing worldwide shift toward purifier transportation surely maintain the growing demand for diesel exhaust fluid, or will opportunity technologies quickly disrupt its dominance? As governments tighten emission guidelines, how will producers stability compliance expenses with profitability? And could improvements in electric powered mobility reshape the very foundation of the global diesel exhaust fluid (DEF) market within the coming years?

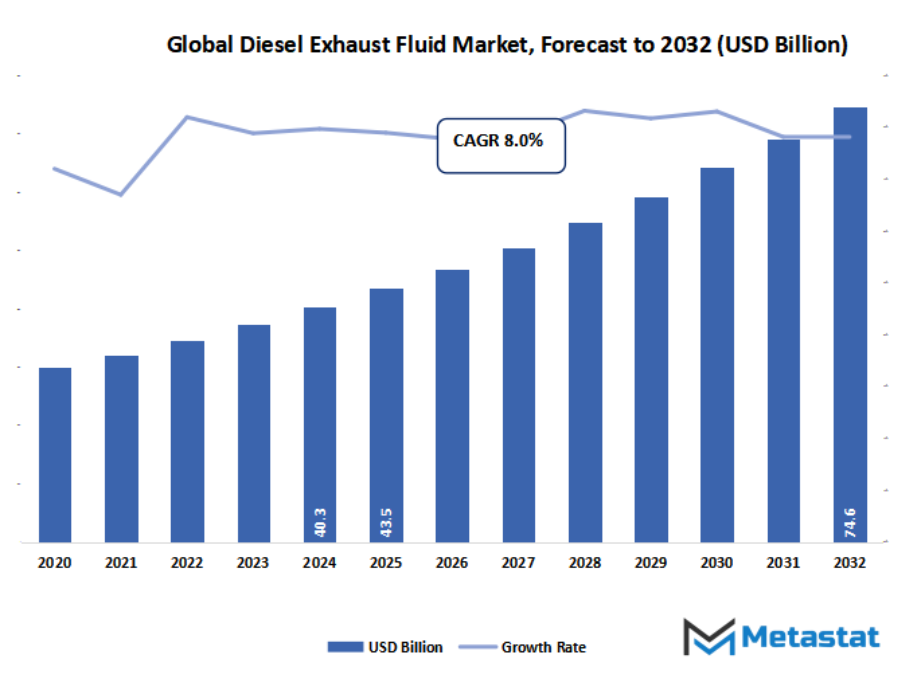

- The global diesel exhaust fluid (DEF) market valued at approximately USD 43.5 Billion in 2025, growing at a CAGR of around 8.0% through 2032, with potential to exceed USD 74.6 Billion.

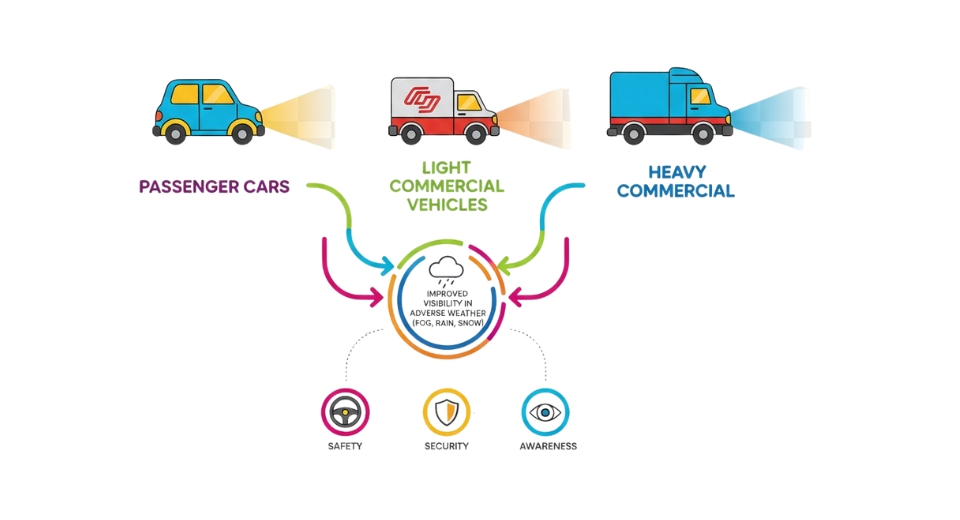

- Passenger Cars account for nearly 64.6% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Stringent emission regulations promoting SCR-equipped diesel vehicles., Rising demand for commercial vehicles and heavy-duty transportation.

- Opportunities include Expansion of DEF production and distribution networks in emerging markets.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global diesel exhaust fluid (DEF) market will hold to rise to prominence as stringent emission requirements and cleaner transportation dreams reshape both the car and commercial sectors. Diesel exhaust fluid is a unique aggregate of high-purity urea and deionized water that serves as a vital element within the discount of nitrogen oxide emissions through selective catalytic reduction era. According to the IEA, diesel automobiles will nonetheless dominate a huge proportion of heavy-duty shipping past 2030, depicting further demand in logistics, agriculture, and production industries. Use of the fluid will go further as government regulations-the Euro VI standards in Europe and the U.S. EPA’s emission rules-compel manufacturers to adopt more advanced emission control systems.

Apart from the transport sector, power generation units dependent on diesel gensets would be a secondary but regular consumer of DEF. Reports by the U.S. Department of Energy indicate that around 1.5 million diesel generators are in operation for backup power, and that number is expected to increase with expansion in urban infrastructure. This will indirectly fortify the supply chain of DEF, especially in emerging economies where power instability is common. Furthermore, it was stated by the International Fertilizer Association that the global production of urea, a key raw material for DEF, will increase due to better technology for natural gas reforming and wider adoption of carbon-efficient processes for its production, making its raw material supply stable.

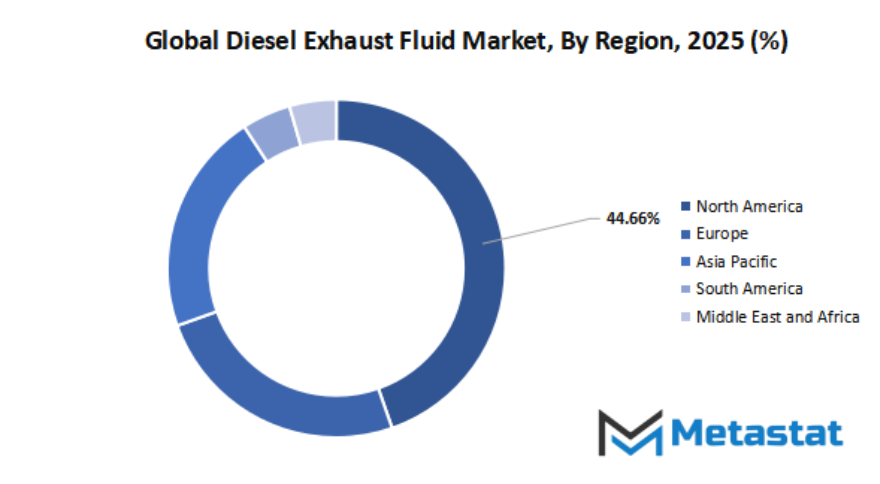

Geographic Dynamics

Based on geography, the global diesel exhaust fluid (DEF) market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global diesel exhaust fluid (DEF) market is mainly classified based on Vehicle Type, Packaging, Component, End-user.

By Vehicle Type is further segmented into:

- Passenger Cars

The global diesel exhaust fluid (DEF) market is witnessing growth across passenger cars due to rising emission regulations and the global focus on cleaner mobility solutions. Growing consumer awareness about sustainable transportation coupled with the integration of modern DEF technology in cars will be drivers for demand, especially as automakers move toward eco-friendly compliance.

- LCVs

Increasing logistics and e-commerce have made LCVs a major contributor to the market. Since these vehicles ply their trade almost entirely on city and regional routes, the employment of DEF systems would guarantee that fleet emissions are at their least, thus remaining compliant with regulations for the long term.

- HCVs

Heavy Commercial Vehicles form a strong share of the contribution in the global diesel exhaust fluid (DEF) market, with freight and construction sectors continuing to surge. The integration of DEF in these vehicles will improve engine performance and extend vehicle life. This segment's growth will be further strengthened by future advancements in the field of emission control systems.

By Packaging the market is divided into:

- Bulk

Bulk packaging may be very important within the global diesel exhaust fluid (DEF) market, considering that massive transportation fleets and commercial users locate it greater efficient and much less steeply-priced. With improved commercial operations and logistics hubs throughout the globe, bulk DEF garage and distribution will continue to be a critical aspect inside the infrastructural improvement of sustainable shipping.

- Cans and Bottles

The contribution of cans and bottles inside the market is principally via retail sale and person vehicle usage. Increasing availability thru carrier stations and car stores will make sure accessibility to small-scale customers. Demand for convenient packaging alternatives will keep to upward thrust with increasing car ownership.

- IBCs and Drums

In the global diesel exhaust fluid (DEF) market, IBCs and drums are gaining momentum for commercial and industrial makes use of. Their resilience and better garage capacity cause them to apt for fleet renovation and remote operations. With the upward push in international trade and transport, these packaging alternatives will see extra adoption.

By Component the market is further divided into:

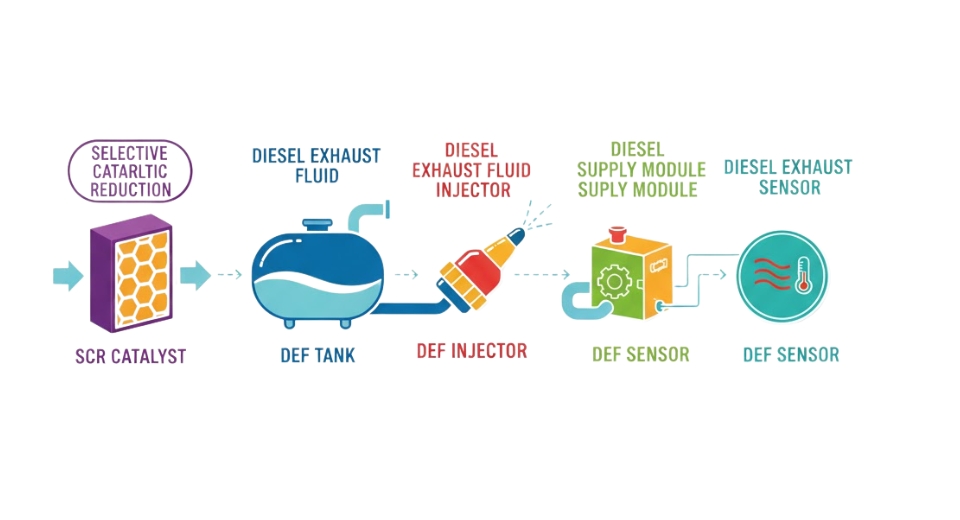

- Selective Catalytic Reduction (SCR) Catalyst

The SCR catalyst plays a vital role within the global diesel exhaust fluid (DEF) market because of its potential to selectively reduce harmful nitrogen oxides into harmless nitrogen and water vapor. Advancement within the SCR generation is supportive of the stringent emission requirements toward cleanser air and efficiency in numerous diesel engines.

- DIESEL EXHAUST FLUID (DEF) TANK

The DEF tank is considered a crucial part of the market as it homes the fluid that supplies the emission reduction machine. Future designs will increase the software of light-weight materials and temperature resistance in order to boost efficiency while meeting environmental and safety regulations.

- Diesel Exhaust Fluid (DEF) Injector

The DEF injector plays a center role inside the market for correctly turning in the fluid into the exhaust movement. Further, the innovation of injector generation has been making sure correct dosing and decreased wastages which have supported sustainable gas consumption and emission handling in cutting-edge diesel automobiles.

- Diesel Exhaust Fluid (DEF) Supply Module

The DEF supply module connects the tank to the injector inside the market. Due to its use for presenting constant pressure and drift, this module is critical to machine reliability. Future developments will increase sturdiness and tracking competencies to support performance dreams.

- Sensor de Diesel Exhaust Fluid (DEF)

The DEF sensor contributes to the global diesel exhaust fluid (DEF) market via tracking fluid first-rate and degree to ensure accurate performance. As digital tracking turns into standardized in vehicle technologies, destiny sensors could be able to combine with advanced diagnostics for predictive maintenance, ultimately decreasing operational downtime.

By End-user the global diesel exhaust fluid (DEF) market is divided as:

- OEM

OEMs constitute a main contribution to the global diesel exhaust fluid (DEF) market, with emission regulations promoting using manufacturing unit-mounted DEF systems. Growing diesel car production with emission manipulate technology will in addition improve the charge of adoption, in step with globally stated dreams of sustainable automotive production.

- Aftermarket

In the global diesel exhaust fluid (DEF) market, the aftermarket segment continues to show growth due to the growth in alternative needs and focus associated with emission control amongst clients. Increasing automobile age and maintenance demand will help preserve sales in the aftermarket, at the same time as stepped forward distribution networks make certain endured get right of entry to to first-rate DEF merchandise.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$43.5 Billion |

|

Market Size by 2032 |

$74.6 Billion |

|

Growth Rate from 2025 to 2032 |

8.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

The global diesel exhaust fluid (DEF) market is gaining momentum, which can be attributed to the industries and authorities of countries around the globe setting essential emphasis on reducing harmful emissions and increasing fuel performance. Diesel Exhaust Fluid, as utilized in selective catalytic discount structures, guarantees a discount in nitrogen oxide emissions from diesel engines. As environmental regulations keep becoming greater stringent and with growing consciousness approximately sustainable practices, DEF demand is probable to increase similarly. Companies and purchasers show more consciousness of the environmental footprint of delivery and heavy-duty vehicles, promoting expanded adoption throughout sectors.

The marketplace is fashioned via a mix of worldwide enterprise leaders and rising nearby players who carry innovation and opposition to the sphere. Important competition include Agrium Inc., Airgas, Inc., BASF SE, Blue Sky Diesel Exhaust Fluid, CF Industries Holdings, Inc., Chemours Company, China Petrochemical Corporation, Cummins Filtration, Dyno Nobel, Faurecia SE, GreenChem Solutions, Honeywell International Inc., Innoco Oil, KOST USA, McPherson Oil, Nissan Chemical Corporation, Old World Industries, Reladyne, Shell, Sinopec, Total Energies, Valvoline, and Yara International. These agencies retain to put money into manufacturing centers, studies, and partnerships to fulfill the growing worldwide call for and to strengthen their positions in each mounted and emerging markets.

The market will see constant increase with the implementation of stricter emission requirements by using governments, especially in North America, Europe, and components of Asia. Increasing heavy-obligation car production, agricultural machinery, and stale-avenue engines have also contributed to the increase in DEF intake. Companies are targeting product purity, supply chain efficiency, and improving packaging and distribution networks to cater to the economic and transport sectors. The improved utilization of digital tracking and garage solutions for DEF in addition enables operational performance by way of decreasing wastage and making sure adherence to emission norms.

The enterprise, even as nevertheless growing, additionally has to deal with raw fabric charge fluctuations and other logistical challenges that have to be overcome to make certain secure transportation and garage of DEF. The non-stop innovations and dedication of main producers to sustainable manner will probably mark the destiny of the marketplace. Investments in cleaner technologies and worldwide collaborations are using a course for greater effective production and deliver of Diesel Exhaust Fluid. According to the latest record supplied by means of Metastat Insight, the global diesel exhaust fluid (DEF) market represents a large soar towards a purifier and greener industrial atmosphere. The contribution of leading global players, along side rising innovators, could open many possibilities inside the market that would further develop as industries pass collectively, balancing financial increase and environmental obligation.

Market Risks & Opportunities

Restraints & Challenges:

Fluctuating urea prices impacting overall DEF production costs:

Unstable urea prices will continue to put pressure on the global diesel exhaust fluid (DEF) market, given the fact that urea is a key raw material in the formulation of DEF. With supply costs increasing due to increased urea costs, this ultimately leads to fluctuating regional prices. Such price fluctuations pose uncertainties for producers to have a regular supply and margin of profit, particularly when global trade or agricultural demand shift the supply of urea. Over time, this unpredictability will affect manufacturing strategy and pricing policy in the market.

Limited availability of DEF refilling infrastructure in developing regions:

In developing regions, the global diesel exhaust fluid (DEF) market will continue to struggle due to a lack of refilling stations and limited logistics networks. Most transport fleets in such areas operate without readily available DEF supply points, making compliance with emission standards very problematic. It is this underdeveloped infrastructure that impedes growth, as fleet operators will be very skeptical about adapting to the DEF systems without adequate refilling support. It will take a buildup of such a network for easier adoptions and smoother operations to be considered in the future market.

Opportunities

Expansion of the production and distribution networks of DEF in emerging markets:

The growth of production and distribution networks in emerging economies will significantly boost potential in the global diesel exhaust fluid (DEF) market. The growing industrial and transportation sectors in these regions will need cleaner fuel solutions to meet global emission standards. Localized manufacturing units and effective distribution channels will reduce the cost and enhance accessibility. It will not only meet the growing domestic requirements but also place the emerging markets in a better position to contribute to the global trade of DEF, thereby improving the overall sustainability and competitiveness of the market.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 43.5 Billion in 2025 to over USD 74.6 Billion by 2032. Diesel Exhaust Fluid (DEF) will maintain dominance but face growing competition from emerging formats.

Looking ahead, the industry will continue to innovate in storage, dispensing, and fluid monitoring systems that will uphold the standards of purity. Partnership between chemical producers and fuel distributors is bound to increase accessibility along highways and industrial hubs. As countries move toward cleaner mobility objectives, the market will not only help meet the goals of reducing emissions but also contribute to the industrial world shifting towards sustainable operations.

Report Coverage

This research report categorizes the global diesel exhaust fluid (DEF) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global diesel exhaust fluid (DEF) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global diesel exhaust fluid (DEF) market.

Diesel Exhaust Fluid (DEF) Market Key Segments:

By Vehicle Type

- Passenger Cars

- LCVs

- HCVs

By Packaging

- Bulk

- Cans and Bottles

- IBCs and Drums

By Component

- Selective Catalytic Reduction (Scr) Catalyst

- Diesel Exhaust Fluid (Def) Tank

- Diesel Exhaust Fluid (Def) Injector

- Diesel Exhaust Fluid (Def) Supply Module

- Diesel Exhaust Fluid (Def) Sensor

By End-user

- OEM

- Aftermarket

Key Global Diesel Exhaust Fluid (DEF) Industry Players

- Agrium Inc.

- Airgas, Inc.

- BASF SE

- Blue Sky Diesel Exhaust Fluid

- CF Industries Holdings, Inc.

- Chemours Company

- China Petrochemical Corporation

- Cummins Filtration

- Dyno Nobel

- Faurecia SE

- GreenChem Solutions

- Honeywell International Inc.

- Innoco Oil

- KOST USA

- McPherson Oil

- Nissan Chemical Corporation

- Old World Industries

- Reladyne

- Shell

- Sinopec

- Total Energies

- Valvoline

- Yara International

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252