MARKET OVERVIEW

The global banking & finance multifactor authentication (MFA) market is at the pinnacle of the finance sector, acting as a vital element in safeguarding the fragile harmony of customer convenience and protecting data. MFA, the strong and dynamic system of authentication, plays a crucial role in the protection of financial institutions, their customers, and the sensitive data being transferred in the digital world. In this essay, we explore the complex universe of Banking & Finance Multifactor Authentication (MFA), bringing to light its importance, critical elements, changing environment, and forces pushing its implementation. MFA, in quick, is a safety measure that demands a person to apply multiple identity elements with a purpose to access their financial institution account.

It entails quite a number authentication techniques, inclusive of something the consumer is aware of (PINs or passwords), something the consumer possesses (tokens or smart playing cards), and something the user is (biometrics which includes facial reputation or fingerprints). The multilayered technique strengthens protection by providing layers of protection in opposition to unauthorized use, with a effective barrier towards the ever-present specter of cybercrime. Banking and finance multifactor authentication (MFA) are protection structures used by banks to safeguard on-line transactions and get entry to touchy statistics. MFA is typically the usage of two or extra authentication techniques, for instance, something the person knows (e.G., a password), some thing the person possesses (e.G., a security token or a cellphone), and something the consumer is (e.G., a biometric characteristic like fingerprint or facial reputation) to authenticate the consumer.

The reason for MFA is to feature a 2nd layer of protection above one kind of authentication. The global banking & finance multifactor authentication (MFA) market is a defense against mounting threats to sensitive economic statistics. Its multi-pronged approach, inclusive of biometrics, smart playing cards, tokens, and other mechanisms, guarantees the integrity of economic transactions inside changing digital surroundings. MFA adoption is propelled by using increasing cognizance of the importance of facts protection, regulatory requirements, and the vital to maintain up with evolving technologies.

While economic establishments preserve to make big investments in MFA, they paintings to obtain the nice balance between securing transactions and making sure a smooth and handy user revel in. In doing so, they play a pivotal function in securing the monetary realm in brand new interconnected world.

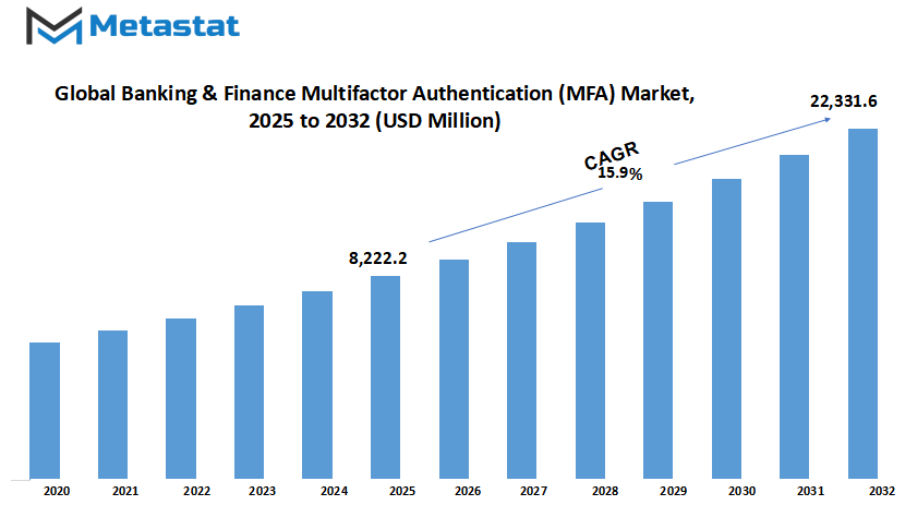

Global banking & finance multifactor authentication (MFA) market is estimated to reach $22,331.6 Million by 2032; growing at a CAGR of 15.9% from 2025 to 2032.

GROWTH FACTORS

The global banking & finance multifactor authentication (MFA) market is the increasing fear of online security. With more financial transactions taking place online, both institutions and customers have grown more concerned about the risks that go with it. MFA adds an additional layer of protection because it demands users to give several types of identification before access is granted, which makes it significantly more difficult for cybercriminals to establish unauthorized access.

Another strong motivator is the existence of strict regulatory needs and industry standards. Regulatory agencies have imposed high standards for banks and financial institutions to make their online channels secure. Meeting the standards requires compliance with regulations, which in turn requires the implementation of MFA solutions to ensure the standards are achieved and customers' financial data is secured.

There are some restraints that the global banking & finance multifactor authentication (MFA) market encounters. High costs of implementation are likely to be a major hurdle for financial institutions. Implementation and maintenance of MFA systems may prove to be an expensive exercise, particularly for smaller organizations with tight budgets. The cost of implementing such security technologies may discourage some institutions from adopting MFA completely.

Complexity in setting up and managing MFA systems is also an issue. Implementing such measures in the existing banking and finance infrastructure can be a complicated affair. It usually demands advanced technical know-how and resources, which can be a deterrent for some institutions. The complexity of setting up and maintaining MFA systems can deter users.

On the positive side, there are growth opportunities in the Banking & Finance Multifactor Authentication industry. One opportunity is penetration into emerging markets. As technology moves to new areas of the world, there is a huge, untapped market for MFA solutions. Small and medium enterprises, especially, are an attractive segment. These companies do not have the same level of strong security in place as large institutions and would derive significant benefits from MFA systems to safeguard their financial information.

MARKET SEGMENTATION

By Component

Theglobal banking & finance multifactor authentication (MFA) market is expanding as economic institutions continue to be committed to extra protection for client bills and sensitive records. With accelerated difficulty over cyber threats and identification theft, banks and financial establishments are making an investment closely in systems that may authenticate users past the unmarried password. Multifactor authentication has emerged as a dependable manner to mitigate risks with the aid of merging diverse layers of safety including biometrics, one-time passcodes, and hardware tokens. This transition is not merely regulatory compliance, however, but also ensuring customer confidence in electronic transactions.

The market, by component, is segmented into hardware, software, and services with software being the largest segment. Hardware in this industry is worth $1,251.6 million, while software tops the list with $4,268.2 million, indicating the increasing need for scalable and elastic solutions. Services also come into the picture, as companies need regular support, system integration, and updates to maintain the effectiveness of security measures. The robust expansion of software brings forth the trend towards embracing cloud-based authentication and mobile-first solutions, enabling banks to access customers comfortably while adhering to tight levels of security.

The financial institutions are not only considering these tools to be protective shields but also means of enhancing customer experience. With biometric logins, token-based systems, and adaptive authentication, the account-access process is becoming easier without compromising its robustness against attacks. MFA adoption is also expanding. It is penetrating. Into mobile banking, investment websites, and digital wallets. So much so that it has become a fundamental piece of the financial technology puzzle. As online transactions become increasingly reliant on more users, the convenience-protection equation will still influence adoption.

In the future, the global banking & finance multifactor authentication (MFA) market will be aided by way of improvements in generation like synthetic intelligence and system getting to know, which can offer predictive elements to authentication structures. These technology will enable monetary institutions to become aware of uncommon styles early on and prevent threats from inflicting harm. With increasing investments in online banking and regulatory pressures driving the need for upgraded standards, the Global Banking & Finance MFA Market will keep growing, backed by the synergies of hardware, software, and services. The focus will be on developing systems to secure financial institutions without making the experience unduly cumbersome for users across the globe.

By Type

Theglobal banking & finance multifactor authentication (MFA) market is emerging as a key component of digital protection with financial institutions enduring increased threats of cybercrime. Password protection has been found wanting, prompting banks and financial institutions to implement more robust levels of authentication to protect customer accounts and confidential data. MFA provides another level of security through the process of requiring more than a single password to be provided, significantly making it less possible to have unauthorized access. With an increase in transactions being conducted online and mobile banking on the rise, this change will continue to intensify, bringing about an environment where MFA is not only desirable but also imperative.

The global banking & finance multifactor authentication (MFA) market is segmented based on type into Two-Factor Authentication, Three-Factor Authentication, and Others. Two-Factor Authentication is the most prevalent, usually using a password in conjunction with an arbitrarily generated code entered on a mobile device. It has become very popular due to simplicity and functionality. Three-Factor Authentication, though less widespread currently, involves a third component, usually biometric identification like fingerprints or facial scanning. This type of authentication is picking up speed as technology becomes less expensive and trustworthy. The "Others" segment involves sophisticated techniques such as behavioral analytics and voice recognition, which are increasingly being investigated by financial services in their search for means to remain ahead of ever cleverer cyberattacks.

Market growth is closely linked to growing digital transactions and the broader adoption of mobile banking apps. End-users demand quick and smooth banking experience but also want security and trust. MFA technology enables financial institutions to achieve this balance because it makes certain that convenience isn't being traded off against security. As regulatory agencies nudge financial institutions towards more robust security arrangements, banks and other financial service entities will continue to deepen their use of these authentication solutions.

The availability of sophisticated technologies, coupled with increased awareness among customers, will propel additional innovation in MFA systems. As the attackers get smarter, banks will continue to evolve their tactics to safeguard customer assets. What began with basic two-step verification is now taking shape as a more sophisticated and trustworthy system of layered protection. This evolution will be at the core of the future of global banking and finance, where trust, safety, and ease of access go hand in hand.

By Authentication Type

The global banking & finance multifactor authentication (MFA) market is turning into an increasing number of vast as banks and different monetary establishments hold to shore up their defenses in opposition to cybersecurity threats. In an international in which on-line transactions and online banking are not luxurious, however a daily dependency, security is of extreme priority. The customer needs convenience, however, additionally they want to understand that their debts and private statistics will live secure. Multifactor authentication takes center stage here, providing banks with a means of managing risks by incorporating additional layers of verification. Rather than depending on the use of conventional passwords, MFA incorporates additional steps in the form of biometrics, security tokens, or one-time passcodes to make it harder for others to access their accounts without authorization.

In this market, authentication is generally categorized under two categories: password-based and password less. Password-based systems still prevail, as they continue the well-known tradition of entering a password with additional verification steps like SMS codes or authentication apps. While still popularly used, this approach has its downsides as passwords can be stolen or guessed. This is where the transition towards passwordless systems kicks in. Passwordless authentication minimizes dependence on textual content-based totally codes and traits towards options together with fingerprint identification, facial recognition, and hardware tokens. They now not best growth security however additionally improve user enjoy by way of getting rid of the inconvenience of remembering or resetting complex passwords.

The finance and banking quarter is most of the maximum cybercrime-targeted industries, which is why investment in MFA is at the upward push. As online banking expands and cell gadgets grow to be mainstream, establishments will come beneath growing strain to decorate their safety. Passwordless technology will be selecting up steam because it gives stability of protection and simplicity of use, enabling clients to check in unexpectedly without sacrificing protection. Financial establishments additionally regard MFA as a method to meet guidelines and set up consider among clients who are cautious of posting sensitive data over the Internet.

In the future, the global banking & finance multifactor authentication (MFA) market will continue to change as technology progresses. Password-based systems will persist, particularly in areas where infrastructure is still evolving, but passwordless systems will increasingly become the norm. Banks and financial institutions will implement hybrid approaches with multiple authentication options to cater to various customers' requirements. As businesses test new biometric devices and secure digital identity products, the market will continue to grow, rendering multifactor authentication not only a security factor but an expectation in financial services.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8,222.2 million |

|

Market Size by 2032 |

$22,331.6 Million |

|

Growth Rate from 2025 to 2032 |

15.9% |

|

Base Year |

2024 |

|

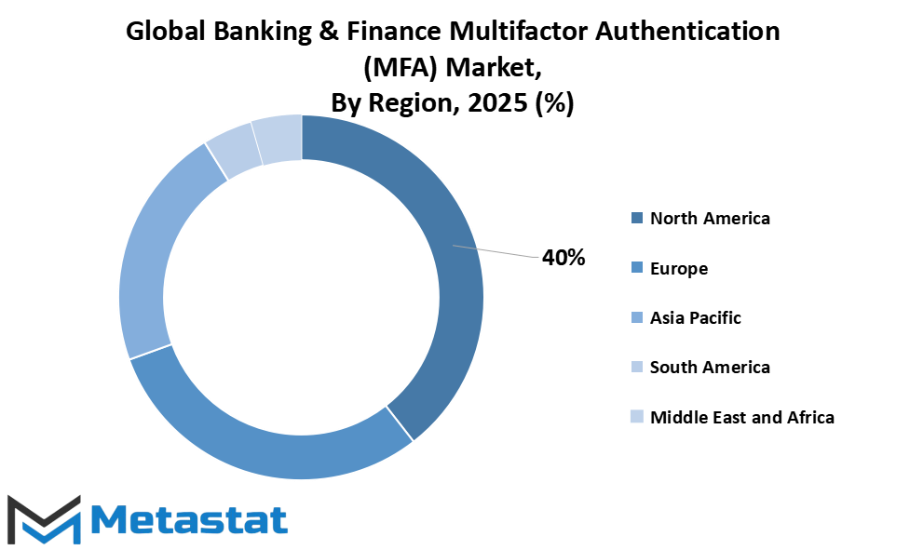

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The protection of financial transactions and sensitive information is an important issue for both institutions and individuals. In this regard, Multifactor Authentication (MFA) is a strong solution.

MFA is a type of authentication that exceeds the normal username and password. It consists of extra levels of protection by prompting customers to enter a couple of forms of verification earlier than authorization. This can also involve something they recognize (together with a password), something they have got (consisting of a cellular telephone), and something they may be (including a fingerprint).

The global banking & finance multifactor authentication (MFA) market is geographically segmented into Europe and North America. Both areas own one-of-a-kind features and challenges with reference to monetary security. In North America, the economic environment is numerous, starting from big banks to credit score unions. The regulatory surroundings, which includes our bodies such as the Federal Reserve and the Consumer Financial Protection Bureau, places strict needs on defensive data. Adoption of MFA has improved due to the want to fulfill those policies and due to the growing stage of class in cybercrime. Europe, but, has multi-faceted monetary surroundings because it has numerous international locations with their very own banking guidelines.

Europe has had the Revised Payment Services Directive (PSD2) enacted through the European Union, which calls for Strong Customer Authentication (SCA) for electronic payments. This directive has accelerated the deployment of MFA within the region, with banks and carrier companies deploying it for you to meet SCA necessities. Both sides acknowledge the significance of MFA in bolstering security. Whereas North America is prompted by a mixture of regulatory imperatives and developing cyber threats, Europe is responding to an evolving regulatory landscape that needs more robust authentication strategies.

The global banking & finance multifactor authentication (MFA) market, centered in these markets, highlights the importance of security in the banking industry. MFA is not a choice but a requirement, considering the dynamic nature of cyber-attacks. It is an evident demonstration of how technology is being utilized to secure financial transactions and protect sensitive information, helping to create a more secure and safer financial environment.

COMPETITIVE PLAYERS

The global banking & finance multifactor authentication (MFA) market is expanding as banks, and other financial establishments keep building up their defense mechanisms against increasing digital threats. With increased online banking, mobile payments, and cloud services, the demand for effective authentication processes has become more so an urgent necessity than ever before. Multifactor authentication incorporates additional levels of security above and beyond passwords, rendering unauthorized access more difficult for attackers. This transformation is not just for protecting transactions but also for establishing trust with customers, as people are more inclined to employ financial services that guarantee they are keeping their information safe.

The use of MFA by banking and finance sectors is being pushed by the growing sophistication of cyberattacks, which have exposed the vulnerabilities of single-factor authentication. Banks and financial service institutions recognize that safeguarding sensitive data is essential to the preservation of their reputation and compliance. Multifactor authentication employs combinations of multifaceted factors including biometrics, tokens, or one-time codes, which significantly lower the risks of fraud. As digital services become increasingly used by more individuals, MFA will remain a critical part of the financial sector's effort to keep customers and organizations safe from data breaches and identity theft.

Numerous companies are contributing to the growth of the Banking and Finance MFA market. Some prominent names include Censornet, CyberArk Software Ltd., Deepnet Security, Duo Security, Entrust Corporation, ESET, spol. s r.o., ForgeRock, Inc., SaasPass, HID Global Corporation, IDEMIA, NEC Corporation, Okta, OneLogin, OneSpan, Ping Identity Corporation, RSA Security LLC, SecurEnvoy, Symantec Corporation, Thales, and Yubico. They're leading the way with advanced authentication technologies, from cloud-based MFA to biometrics, allowing financial institutions to address customer expectations and regulatory requirements alike. Their combined efforts are creating a safer digital banking environment globally.

The global banking & finance multifactor authentication (MFA) market will be characterized by increasing incorporation of technologies such as artificial intelligence, behavioral analytics, and biometric identification. As cyber threats continue to grow, MFA solutions will become more user-friendly without compromising on security. Customers want hassle-free digital experiences, and hence financial institutions will emphasize solutions that offer high security without inconvenience. The rivalry between the dominant players will promote ongoing innovation, such that the market evolves steadily and is able to respond to the increasing demands of international banking and finance.

Banking & Finance Multifactor Authentication (MFA) Market Key Segments:

By Component

- Hardware

- Software

- Services

By Type

- Two-Factor Authentication

- Three-Factor Authentication

- Others

By Authentication Type

- Password

- Passwordless

Key Global Banking & Finance Multifactor Authentication (MFA) Industry Players

- Censornet

- CyberArk Software Ltd.

- Deepnet Security

- Duo Security

- Entrust Corporation

- ESET, spol. s r.o.

- ForgeRock, Inc.

- SaasPass

- HID Global Corporation

- IDEMIA

- NEC Corporation

- Okta

- OneLogin

- OneSpan

- Ping Identity Corporation

- RSA Security LLC

- SecurEnvoy

- Symantec Corporation

- Thales

- Yubico

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252