Global Methyl Methacrylate (MMA) Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global methyl methacrylate (MMA) market has their beginnings during early twentieth century when chemists discovered means to produce acrylic glass as lighter alternative to traditional glass. Experimental tests in the 1930s soon became commercial production due to World War II-driven demand for tough and shatter-resistant materials. The first landmark achievement was the uses of transparent sheets of polymethyl methacrylate in military aircraft, an application that set the stage for wider acceptance in construction, auto, and signage industries in the post-war period.

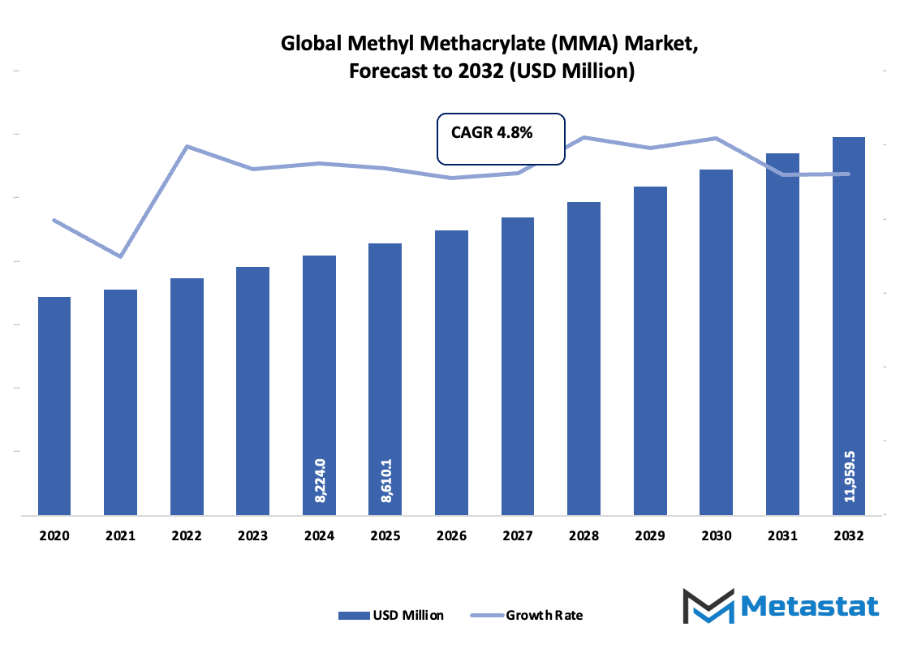

- Global methyl methacrylate (MMA) market value of approximately USD 8610.1 million in 2025 at a CAGR of approximately 4.8% during 2032, with possibility of a market size greater than USD 11959.5 million.

- Acetone Cyanohydrin (ACH) Process possess nearly 66.5% market share, driving innovation and expanding use through aggressive R&D.

- Key trends driving growth: Growing adoption of lightweight and yet tough materials in transportation and construction industries, Greater use of PMMA in electronics, medical devices, and signage industries

- Opportunities include: Increased use of bio-based and renewable MMA to reduce carbon footprint and comply with environmental regulations

- Critical comprehension: The industry is anticipated to grow exponentially in value over the coming ten years, which represents a radical growth prospect.

As manufacturing techniques matured through the 1950s and 1960s, producers moved from batch processes to continuous production methods, which significantly improved output and consistency. The latter twentieth century introduced additional facets as ecological consciousness compelled regulators to establish standards for emissions and sustainability. Manufacturers countered with cleaner production and recycling programs, maintaining the material in accord with changing expectations. At the same time, innovation in polymer chemistry provided openings for customized variations of MMA for advanced applications, ranging from medical devices to electronics. The era was one of movement away from basic bulk application towards more advanced, value-added uses.

Entering the twenty-first century, the international methyl methacrylate (MMA) industry would be influenced increasingly by shifting consumer needs. The demand for lighter, more fuel-efficient automobiles, the growth of renewable energy equipment, and computer technologies demanding resilient displays all started driving investment choices. Meanwhile, local players in Asia emerged as pivotal centers of manufacturing, redesigning the competitive landscape.

Market Segments

The global methyl methacrylate (MMA) market is mainly classified based on Production Process, Application, End-Use Industry.

By Production Process:

- Acetone Cyanohydrin (ACH) Process: The Acetone Cyanohydrin (ACH) process is likely to continue as the dominant production process due to current infrastructure and widespread use in factory environments. New developments will focus on making the process less wasteful, reducing toxic by-products, and lowering energy inputs. Improvements to this process will make large-scale production more safe and environmentally friendly, allowing higher demand in a broad array of applications around the world.

- Isobutylene Process: Isobutylene process will gain popularity as businesses seek environmentally friendly alternatives. Its lower environmental impact and the potential for compatibility with renewable feedstocks make it a better option for future manufacturing. Process improvement investments will increase output coupled with lower emissions, driving the global methyl methacrylate (MMA) market base of products from this process.

- Ethylene Oxide Process: The Ethylene Oxide process will increase in importance as the trend intensifies towards greener and more cost-effective alternatives. Improved catalysts and reaction conditions will make this process viable. The process will be anticipated to contribute towards high-quality production of MMA, especially for applications that require precise specifications in plastics and coatings.

- Others: Other developing production technologies will shape the global methyl methacrylate (MMA) market by providing competing routes with possible economic and environmental benefits. Ongoing research and pilot-scale investigations will create prospects for small-volume and niche production. Use of these technologies will increasingly support diversification and supply chain robustness.

By Application:

- Polymethyl Methacrylate (PMMA) Production: PMMA production will continue to be the largest application segment due to demand for clear and long-lasting materials across various industries. Future trends will concentrate on manufacturing PMMA with improved strength and resistance to the environment. Advances in technology will enable further application in high-performance and specialty applications, propelling overall global methyl methacrylate (MMA) market growth.

- Plastics: Plastic consumption will expand as MMA-based polymers more and more replace traditional materials. Better production processes will yield stronger, lighter, and recyclable plastics. Demand for environment-friendly packaging and industrial products will push this segment to become more environmentally friendly and more efficient in its production cycle.

- Coatings: MMA-based formulation innovations that increase durability, weatherability, and appearance will favour the coatings. Construction, automotive, and industrial use will be dealt with by new products. Environmental reduction and lifespan extension will be highlighted to make the coatings segment a major driver of MMA demand.

- Adhesives: Adhesive consumption will grow with the development of more robust and versatile MMA-based products. Future research will address performance in extreme conditions and compatibility with various materials. The segment of adhesives will continue to be crucial in the construction, automotive, and electronics industries, driving market expansion.

- Sealants: Sealant consumption will increasingly accept wider use with the increased flexibility and long-term stability of MMA-based products. Sealants will be made more resistant to temperature fluctuations and hostile environments through new advancements. Industry growth will be fueled by the increase in construction and infrastructure activity across the globe, indicating the necessity for successful sealing solutions.

- Others: Specialty chemicals and high-performance materials will further diversify the global methyl methacrylate (MMA) market. As firms seek new applications for MMA, these markets will offer opportunities for innovation and specialty products. Increasing interest will focus on products that combine performance with sustainability and cost-effectiveness.

By End-Use Industry:

- Construction: Construction will continue to be a prominent end-use sector, driven by needs for durable, transparent, and light-weight material. New projects will require energy-efficient and environmentally friendly products, leading to increased reliance on MMA-based materials. These materials will advance modern architecture and green infrastructure construction.

- Automotive: The automotive industry will increasingly look to MMA for lightweight components, clear windows, and coating. Cars of the future will need high-performance materials that optimize fuel economy and safeguard individuals. MMA-based technology will make electric vehicles possible and next-generation transportation, shaping the automotive manufacturing future.

- Electronics: The use of electronics will continue to grow as devices grow more compact, efficient, and tolerant of heat. Casings, display panels, and insulating components will be manufactured with materials based on MMA. Emerging technology will create new opportunities, and this industry will be a robust driver of demand for MMA.

- Consumer Goods: Consumer goods will increasingly use MMA-based products for performance, lifespan, and aesthetics. Future trends will be based on sustainable goods with long lifetime. MMA will provide innovative designs for home applications, personal care applications, and other consumer items.

- Health care: Medical use will grow with the need for medical devices, prosthetics, and lab equipment. MMA's strength and transparency make it a perfect choice for such applications. Future growth will focus on biocompatibility and sterilization efficiency, with increased reliance on MMA in health care treatments.

- Aerospace: Aerospace will apply MMA to light-weight parts, protection coatings, and transparent panels. New aircraft will need materials that address performance, safety, and weight reduction requirements. MMA will facilitate the development of upcoming aviation technologies and offer robustness in harsh conditions.

- Others: Other industries like defense, energy, and specialty manufacturing will incorporate MMA-based materials into niche applications. Emerging future technologies will provide opportunities for new uses, enabling market diversification and support expansion into diversified sectors with high-performance needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8610.1 Million |

|

Market Size by 2032 |

$11959.5 Million |

|

Growth Rate from 2025 to 2032 |

4.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

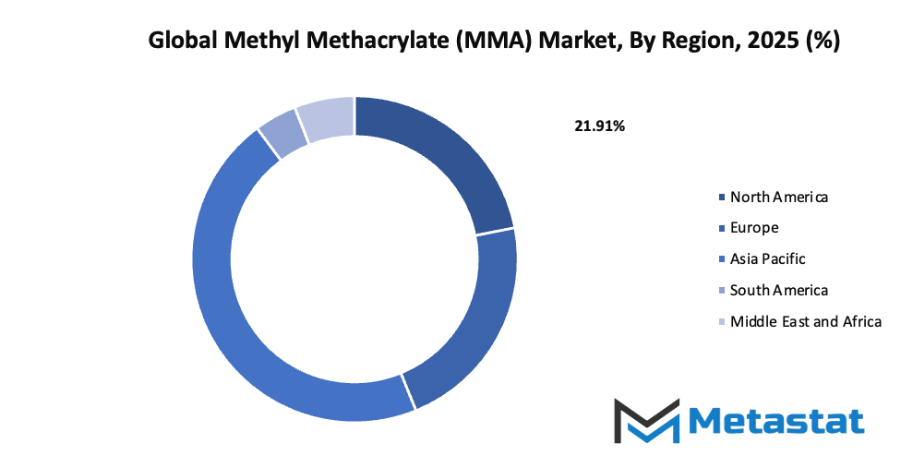

- Based on geography, the global methyl methacrylate (MMA) market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for lightweight and durable materials in automotive and construction industries: Lightweight and durable materials will become essential in automotive and construction sectors. They will help reduce fuel consumption, improve structural efficiency, and increase safety standards. Manufacturers will focus on using these materials to meet stricter regulations, which will boost the adoption of MMA in applications that require strength, transparency, and long-lasting performance.

- Growing adoption of PMMA in electronics, medical devices, and signage applications: PMMA will see wider use in electronics, medical devices, and signage. Its clarity, durability, and resistance to chemicals make it a preferred choice. In electronics, PMMA will be applied to displays and casings, while in medical devices it will ensure safety and reliability. Signage will benefit from its weather resistance and aesthetic appeal.

Challenges and Opportunities

- Fluctuating raw material (acetone, ammonia, methanol) prices affecting production costs: Production costs in the global methyl methacrylate (MMA) market will be influenced by changes in acetone, ammonia, and methanol prices. Price volatility may slow down expansion plans and affect supply chains. Companies will need to implement cost management strategies and long-term procurement plans to stabilize production and maintain competitive pricing in the market.

- Environmental and health concerns related to VOC emissions and toxicity: VOC emissions and toxicity will remain critical concerns in the global methyl methacrylate (MMA) market. Regulations on chemical safety and environmental protection will grow stricter. Companies will need to minimize harmful emissions and ensure worker safety. Addressing these concerns will be essential for sustainable growth and for avoiding penalties or reputational risks

Opportunities

Increasing use of bio-based and sustainable MMA to reduce carbon footprint and comply with environmental regulations: The adoption of bio-based MMA will increase as sustainability becomes a priority. Using renewable feedstocks will lower carbon emissions and ensure compliance with environmental laws. Manufacturers investing in green processes will gain a competitive advantage and appeal to industries seeking eco-friendly solutions. This shift will define future market strategies.

Competitive Landscape & Strategic Insights

The global methyl methacrylate (MMA) market is undergoing steady expansion, shaped by a combination of large multinational corporations and rising regional participants. This balance of well-established leaders and agile competitors is creating an industry that is not only resilient but also highly adaptable to new opportunities and challenges. With its wide range of applications in construction, automotive, electronics, healthcare, and packaging, the global methyl methacrylate (MMA) market has become central to industries that rely on durable, lightweight, and transparent materials. The role of MMA in producing acrylic sheets, coatings, adhesives, and resins has made it an essential chemical, and its demand continues to rise as industries look toward sustainable and advanced material solutions.

The competitive landscape reflects the presence of key companies such as Arkema SA, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Evonik Industries AG, BASF SE, Dow Chemical Company, Trinseo PLC, Chi Mei Corporation, Formosa Plastics Corporation, Kuraray Co., Ltd., Dhalop Chemicals, Nippon Shokubai Co., Ltd., Asahi Kasei Corporation, Huntsman Corporation, Saudi Basic Industries Corporation (SABIC), Thai MMA Co., Ltd., Plaskolite, Inc., and Altuglas International. These organizations are pushing boundaries through technological advancements, capacity expansions, and sustainable production methods. Alongside them, smaller regional companies are beginning to carve out a share by offering specialized solutions, flexible services, and competitive pricing, intensifying market dynamics.

Looking toward the future, the global methyl methacrylate (MMA) market is expected to experience continued demand driven by urbanization, population growth, and the rising need for eco-friendly materials. Construction activity, particularly in Asia-Pacific and the Middle East, will remain a key growth driver, as acrylic-based products find use in windows, panels, and coatings for both residential and commercial projects. At the same time, the automotive industry is anticipated to play a crucial role, with MMA-based polymers being adopted in lightweight vehicle designs, contributing to fuel efficiency and reduced emissions. This aligns with the broader trend of sustainability and regulatory pressure for greener materials, prompting producers to innovate in bio-based MMA production.

Healthcare applications are also projected to become increasingly important. MMA’s use in medical devices, dental products, and drug delivery systems is expected to grow as advances in healthcare technology demand more durable, safe, and adaptable materials. Electronics will likely remain another core sector, with MMA used in displays, panels, and other components that require high clarity and strength. With rapid technological growth, particularly in consumer electronics and renewable energy infrastructure, the global methyl methacrylate (MMA) market is poised to expand into newer avenues that demand reliability and performance.

Investments in research and development are strengthening the position of both international and regional players. Companies are exploring advanced catalysts, recycling processes, and sustainable feedstocks to reduce environmental impact and meet stricter regulations. This focus on green chemistry and closed-loop systems will likely define the next phase of growth, where market competitiveness is shaped not only by cost and capacity but also by the ability to meet global sustainability targets. Strategic partnerships, joint ventures, and acquisitions are expected to increase, allowing companies to expand market reach and secure resources in high-growth regions.

Overall, the global methyl methacrylate (MMA) market is on a trajectory that reflects both stability and transformation. Established leaders continue to drive innovation and scale, while new entrants bring flexibility and regional focus. With applications expanding and sustainability taking center stage, the industry is positioned to play an increasingly vital role across diverse sectors, ensuring that demand for MMA remains strong in the years ahead.

Market size is forecast to rise from USD 8610.1 million in 2025 to over USD 11959.5 million by 2032. Methyl Methacrylate (MMA) will maintain dominance but face growing competition from emerging formats.

Looking ahead, the industry will continue to balance innovation with sustainability. With stricter regulations and evolving consumer expectations, producers will develop smarter production methods while diversifying applications. The story of the global methyl methacrylate (MMA) market will remain one of adaptation—emerging from its wartime origins, navigating decades of technological and cultural change, and steadily redefining its role in global manufacturing.

Report Coverage

This research report categorizes the global methyl methacrylate (MMA) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global methyl methacrylate (MMA) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global methyl methacrylate (MMA) market.

Methyl Methacrylate (MMA) Market Key Segments:

By Production Process

- Acetone Cyanohydrin (ACH) Process

- Isobutylene Process

- Ethylene Oxide Process

- Others

By Application

- Polymethyl Methacrylate (PMMA) Production

- Plastics

- Coatings

- Adhesives

- Sealants

- Others

By End-Use Industry

- Construction

- Automotive

- Electronics

- Consumer Goods

- Healthcare

- Aerospace

- Others

Key Global Methyl Methacrylate (MMA) Industry Players

- Arkema SA

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Evonik Industries AG

- BASF SE

- Dow Chemical Company

- Trinseo PLC

- Chi Mei Corporation

- Formosa Plastics Corporation

- Kuraray Co., Ltd.

- Dhalop Chemicals

- Nippon Shokubai Co., Ltd.

- Asahi Kasei Corporation

- Huntsman Corporation

- Saudi Basic Industries Corporation (SABIC)

- Thai MMA Co., Ltd.

- Plaskolite, Inc.

- Altuglas International

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252