MARKET OVERVIEW

The Global Automotive Structural Adhesives Market shows that it is very significant for the automotive industry, as the market allows manufacturers to produce vehicles that are safe, durable, and efficient. The bonding solutions are primarily being developed to replace or enhance the functions of traditional mechanized fasteners such as rivets and welding, used for structuring lighter and stronger vehicles. So the evolution of adhesive structural technology will further change the way the assembly and maintenance of the automobile are performed, accompanying the advancement in automotive design and engineering.

Modern high-strength adhesive bonding, impact resistance, and flexibility thus offer structural adhesives suitable tools for the assembly of new vehicle construction. Hence each and every application in the Global Automotive Structural Adhesives Market would have to develop its own unique blends designed for the different materials and substrates being bonded, such as aluminum, steel, composites, and engineered plastics. Already lightweight construction is contributing to better fuel efficiency while retaining structural integrity, and these adhesive technologies will do even better. Structural adhesive designs allow an even distribution of stress across the surface of the adhesive bond, thereby increasing durability by minimizing material fatigue and improving crash performance.

There are many applications that keep the Global Automotive Structural Adhesives Market alive: from assembly in body-in-white to chassis reinforcement, and panel bonding. In response to cutting-edge automotive manufacturing processes, the next level of enhancement would include optimizing these adhesive formulations with factors such as high-temperature resistance, vibration dampening, and corrosion protection. Structural adhesives, developed to create virtually undetectable seams as compared to traditional mechanical fasteners that typically introduce stress points or need secondary reinforcement, confer aerodynamic efficiencies while minimizing material distortion. Those proven adhesives will now be seamlessly integrated into state-of-the-art production lines, in concert with robotic automation and precision assembly methods.

Vehicle safety and performance regulatory scheme is the main driver of the Global Automotive Structural Adhesives Market, being constantly changed by the requirements of this particular industry. Formulation of adhesives with energy absorption and impact resistance properties, which would then be integrated into automotive designs with an emphasis on passenger protection and structural integrity in case of a collision, would be expedited by the introduction of strict crash safety regulations influencing market requirements. The formulation development of adhesives will keep pace with the uprising safety regulations that conform to global automotive standards.

Adhesive chemistry is one field that will usher in progressive times in the Global Automotive Structural Adhesives Market. Next-generation bonding solutions boasting improved curing mechanism, better adhesion to mixed materials, and superior resistance to environmental factors will be developed. Electric vehicle adhesives will be targeted at challenges such as sealing of the battery enclosure, thermal management, and shielding against electromagnetic interference.

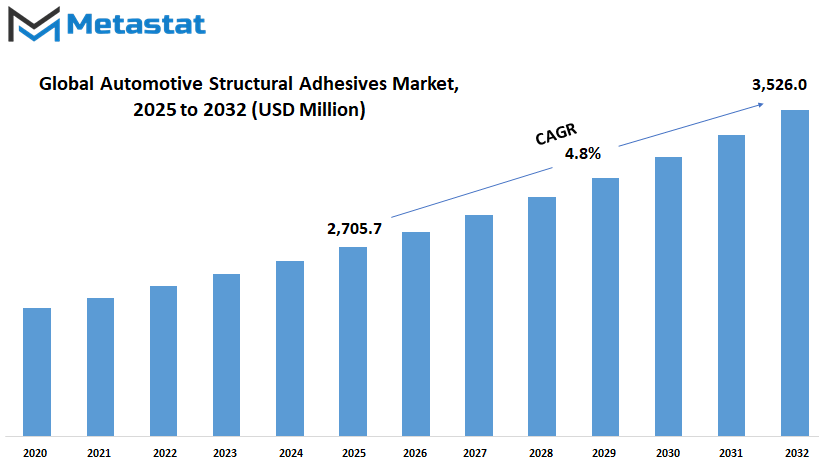

Global Automotive Structural Adhesives market is estimated to reach $3,526.0 Million by 2032; growing at a CAGR of 4.8% from 2025 to 2032.

GROWTH FACTORS

As a major driver of the global automotive structural adhesives market, lightweight designs have become more popular in increasing fuel economy and reducing emissions. Traditional welding and mechanical fastening methods are being replaced by structural adhesives because they will have the same performance as welding bonds but significantly reduce weight. The demand for structural adhesives is expected to grow as automakers continue to search for solutions to meet stringent environmental regulations and consumer expectations for fuel-efficient vehicles.

Moreover, the automotive industry is increasingly moving toward new-value materials like composites and aluminum that provide excellent strength-to-weight ratios, thereby making them rather integral to future vehicle designs. Their integration into manufacturing processes will have to be developed using specific techniques, of which construction adhesives have become the primary tool. Structural adhesives will provide all the criteria required for seamless joining of mixed materials while guaranteeing structural integrity, durability, and environmental resistance.

These include various growth factors that can hamper the growth of structural adhesives in the automotive industry. The regulatory requirements related to the safety and performance of vehicles are gradually becoming more stringent; thus, manufacturers would need to ensure that adhesives have high durability and crashworthiness criteria. These regulatory standards require much research and testing for compliance, which are highly resource demanders for manufacturers. Moreover, the initial high cost that is required for implementing structural adhesive technologies forms a barrier, especially for the smaller manufacturers. Retooling facilities and training employees would incur large amounts of capital and might limit the adoption rate across the industry.

In turn, advances in adhesive compositions and application techniques promise positive opportunities for the sector. Next-gen structural adhesives are being developed through innovation aimed mainly toward improved effectiveness, efficiency, and cost. These advancements will also address broader industry concerns regarding the strength, flexibility, and curing times of adhesives. Increasing future use of adhesives for mass applications becomes more feasible as continued research fine-tunes adhesive properties towards industry needs in terms of performance and regulatory compliance.

Projection is undergoing very promising developments with regards to the market requirements for structural adhesives in automotive manufacturing. The development of smart materials will become automated in their applications to minimize adhesive use by production process costs and improve efficiency. Growing demand has also followed because the weight reduction created through structural adhesives is important to the production of more applications beyond modern vehicles, such as in electric vehicles. As the industry advances, manufacturers

MARKET SEGMENTATION

By Type

The Global Automotive Structural Adhesives market is changing dramatically due to the automotive sector's move toward lightweight and energy-efficient cars. Structural adhesives bond dissimilar materials, eliminating the need for many traditional mechanical fasteners, thereby contributing to the overall vehicle weight reduction. It is the weight reduction that improves fuel efficiency and aids in complying with strict emission regulations.

Polyurethane-based adhesives are very well becoming popular flexible and durable adhesives. These adhesives are known for their excellent bonding capacity with a variety of substrates, thus finding great use in high-performance automotive applications. The added stress-absorbing and impact-resistant characteristics are yet another reason these adhesives are ideal for components needing strength and flexibility.

The epoxy adhesives have classically held a large market share on account of high strength and environmental resistance. They are widely used in applications where strong adhesive bonds are primary, such as chassis and structural components. However, this is now undergoing a sea change with manufacturers shifting towards those adhesives that confer not only strength but performance and sustainability to the vehicle.

Acrylic adhesives are also making inroads in the automotive sector. Noted for fast curing times and strong adhesion properties, they are preferred in applications where speed and efficiency are critical. Their versatility is also enhanced by their ability to bond dissimilar materials to meet the changing design requisites placed on today's vehicles.

Silicone-based adhesives, aside from being used traditionally for applications requiring high-temperature resistance and flexibility, have begun to find new applications in the automotive industry. An excellent sealant with durability against extreme conditions, they fit well in engine components and regions undergoing serious thermal variations.

There are some adhesives of polysulfide, rubber, and polyamide types of adhesives under consideration as well. Each of these adhesives exhibits unique characteristics suitable for certain applications within the automotive sector and thus gives manufacturers a bigger palette of bonding solutions to meet different demands.

In the future, the demand for structural adhesives will certainly rise with the increase in electric vehicles (EVs). EV manufacturers are increasingly utilizing these adhesives to bond lightweight materials to prolong the battery life and enhance vehicle performance. The global trend towards sustainability and the adoption of green manufacturing processes are affecting the development of eco-friendly adhesive solutions, in alignment with stringent environmental regulations.

By Application

The big change taking place in the automotive industry is in fact the rewiring structurally of the adhesives to be used in the making of an automobile today. Those types of adhesives can provide bonds between materials for the production of vehicles that are lighter and fuel-efficient.

Structural Adhesives are used mainly in the Body-in-White (BIW) phase. It assembles the frame of the vehicle where adhesives attach the different components like aluminum and composites. Less welding results in reduced weight of the structures while maintaining strength and safety.

Adhesives offer a lot of freedom for the interior and exterior designers, allowing the integration of arbitrary structures of different materials with aesthetic and functional advantages. For example, they enable sleeker designs and better aerodynamics possibilities through strong attachment between different substrates.

Example uses of adhesives also include fixed glass components like a windshield or windows. An adhesive bond is a strong bond, and thus, increases the structural integrity, while it also contributes to the safety of the vehicle by holding the glass in place during impacts.

Adhesives have a role beyond this because they are now part of all the electronics and powertrains. They protect the electronic components against corrosion and rescuing the heat for a reliable lifetime performance of these systems.

In the future, the use of structural adhesives would definitely show an upward inclination. The demands on design have changed especially because of the trend toward EVs; they require lighter materials to maintain maximum battery efficiency. Most adhesives cope with that. They enable lightweights without depriving structures of strength.

In the future, autonomous vehicles will become widely accepted; hence, demands will come pouring in for reliable bonds of sensors and other important components. This is where adhesives come in because their ruggedness and precision qualify them for use in these advanced systems.

To this end, structural adhesives are taking center stage in the transformation of designs and the manufacture of vehicles. Their applications across various vehicle components not only improve performance and safety but also provide solutions to move the industry toward more sustainable and innovative solutions.

By Vehicle Type

The global automotive structural adhesive market is growing rapidly due to the automotive industry's inclination toward light and fuel-efficient vehicles. Structural adhesives are being increasingly used for bonding diverse materials like aluminum, steel, and composites, making vehicles stronger and more durable while at the same time making them lighter.

Passenger cars are the largest segment in which adhesives are generally used for the bonding of body panels, windshields, trims, and interior components. While making the vehicles functional, safe, and attractive, application of adhesives enables lighter vehicles capable of fuel economy with better noise, vibration, and harshness (NVH) performance.

Structural adhesives are used in commercial vehicles like trucks and buses. In trucks, bonding cab components, chassis parts, and cargo systems improves load-carrying capacity and durability under harsh conditions. Adhesives are used in the buses in body panels, windows, and interior fittings which reduce weight and improves safety for passengers.

For light commercial vehicles (LCVs) such as vans and pickups, adhesives are used in the adhesion of interior panels, for sealing the cargo area, and as structural reinforcements. This enhances load-carrying capability, durability, and corrosion resistance, while improving the efficiency and overall performance of the vehicle.

All activities related to the repair, maintenance, and modification of vehicles after production come under the aftermarket segment. Automotive adhesives in this segment include body panel adhesives, trim component adhesives, glass replacement adhesives, and joint and seam sealants. These make repairs possible, restore the integrity of the vehicle, and sometimes even improve aesthetics.

Technological developments have led to the evolution of environmentally friendly water-borne adhesives, which are less volatile in terms of chemical emission into the indoors. These types of adhesives are mainly used in the interiors of automobiles for bonding headliners, door panels, and seat covers.

In conclusion, the global automotive structural adhesives market is growing in demand among all the various kinds of vehicles. This is due to the necessity to have lightweight, durable and efficient solutions for bonding. As the industry continues to innovate, structural adhesives will be critical to the future of manufacturing and performance in vehicle construction.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,705.7 million |

|

Market Size by 2032 |

$3,526.0 Million |

|

Growth Rate from 2025 to 2032 |

4.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

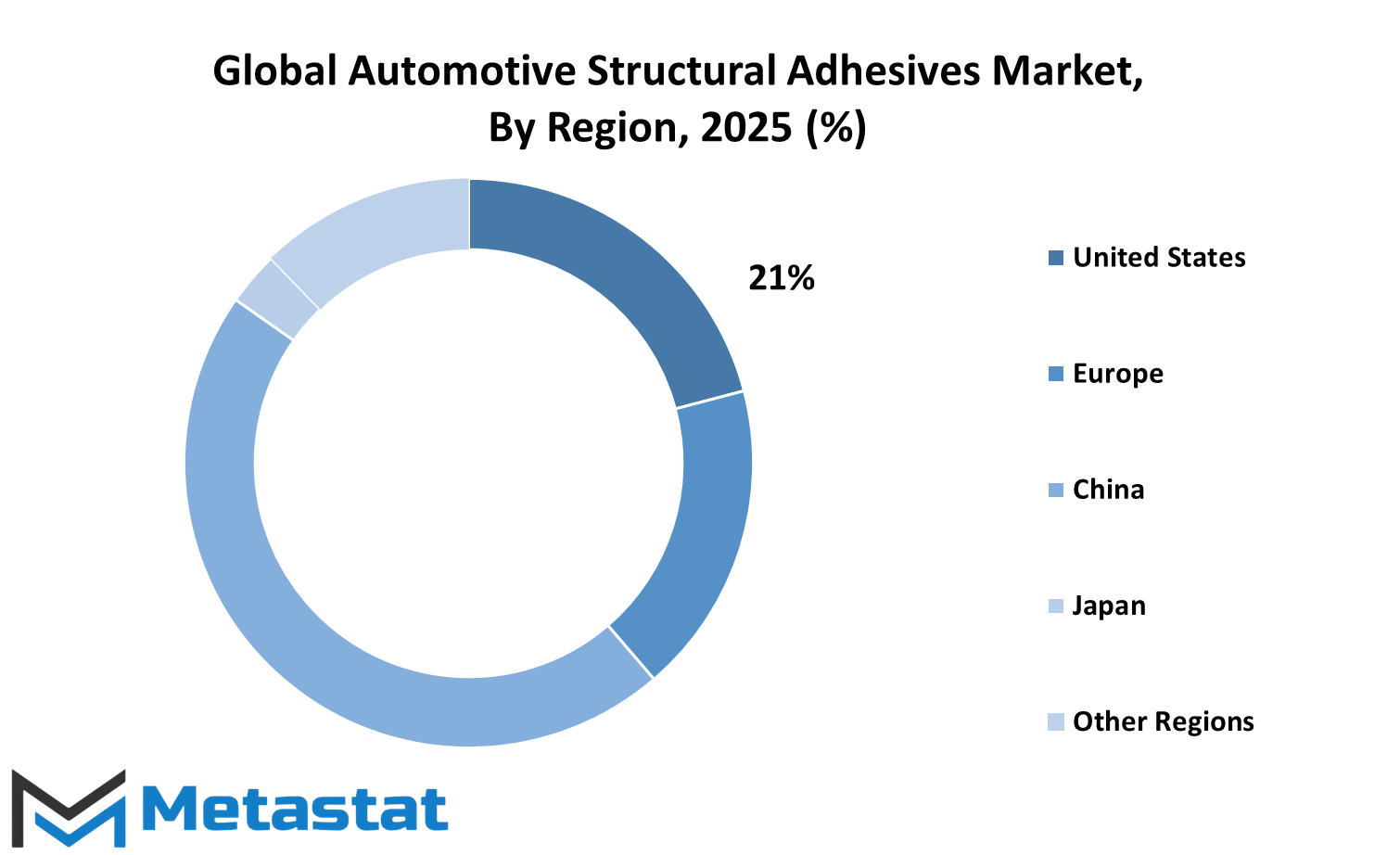

Geographical congregation of demand, innovation, and growth, along with their peculiarities, gives shape to the Global Automotive Structural Adhesives market. North America remains pivotal, with the U.S., Canada, and Mexico pushing advancements. The nearby presence of huge automotive manufacturers and a focus on sustainable materials and lightweight constructions influence the adhesives' usage. Companies here are pouring immense amounts into research and development to improve adhesion properties and thus obtain improved performance and longevity in assembly applications.

Next is Europe, making contributions through the UK, Germany, France, and Italy. This region has historically been the cradle of automotive innovation, with manufacturers espousing energy efficiency and emissions reduction. Structural adhesives are an integral part of these solutions, enabling the production of lightweight, fuel-efficient automotive vehicles. Further, the stringent criteria on emissions and vehicle safety create a pull for these adhesives; thus, manufacturers are looking for even more advanced solutions.

The Asia-Pacific is among the most diversifying areas for the growing automotive industry, led prominently by Indian, Chinese, Japanese, and South Korean markets. Increasing vehicular demand, increasing production capacities, and technological developments all contribute to market growth. China occupies a more dominant position with its wide automotive industry and increasing investments in electric vehicle. The trend now is for manufacturers to reduce production costs while keeping quality at par; structural adhesives are emerging as vehicles used for production.

In South America, too, automotive markets are undergoing change, with Brazil and Argentina being key contributors. Growth of the market is influenced by various factors, including economic conditions and government policy, gradually increasing the cogs of vehicle production. Such dynamics undergo an influence by various obstructions, for instance, market fluctuations; the need still remains from the manufacturers' perspective for durable and high-performance adhesives whereby vehicle life and efficiency can still be improved.

The growth and challenges associated with the Global Automotive Structural Adhesives market converge in the Middle East and Africa. In the GCC countries, coupled with Egypt and South Africa, a budding demand for vehicles arises as a result of infrastructure development and urbanization. The automotive sector within the region is gradually warming up to embrace new technologies like structural adhesives as a source of vehicle enhancement. The chances are the zone shall enhance market gains in the near future thanks to the continuing industrial development and sustainability measures.

COMPETITIVE PLAYERS

The automotive industry is all set to witness a major revolution in the near future with structural adhesives being the key components that enhance the performance of and sustainability in a vehicle. All these components need to be bonded together, and that's the process that makes a vehicle lighter and more fuel-efficient, as well as safer. The future contours of the automotive industry promise to usher in an era of new developments in the use of sophisticated adhesive solutions as the advent of electric vehicles and creative manufacturing concepts gains ground.

These leading companies set trends in product innovations specific to changing circumstances under which automobile manufacturers find themselves. Henkel, for instance, sells a complete range of adhesives, sealants, and coatings that improve corrosion resistance and make vehicles more robust and efficient. Sika supplies high-performance adhesives and sealants for the bonding of body panels, glass, and interior components, thus increasing the structural integrity of vehicles while reducing noise and shivering due to vibrations. 3M: For the improved performance of vehicles, we have created innovative bonding, sealing, and damping application products.

Huntsman has specialized adhesives and sealants for assembly, repair, and maintenance, contributing to the longevity and reliability of vehicles. Wacker Chemie offers solutions for improving the durability of automotive components through silicones and polymers. Arkema Group specializes in specialty chemicals and adhesives for various applications within the automotive realm, promoting their usage in various automotive niches with promises of sustainability. From protective coatings to paints and specialty materials, PPG Industries provides for the assembly processes, as well. H.B. Fuller is the house name for manufacturers of adhesives worldwide, producing more than thousands of products that cater to many applications, including automotive. Illinois Tool Works (ITW) facilitates many adhesive solutions designed to meet the specific needs of the automotive sector for enhancement in manufacturing efficiency and product performance.

Hubei Huitian is an enterprise that manufactures adhesives and sealants, and one of the areas it focuses on is automotive applications that enhance safety and durability for products. ThreeBond specialises in adhesives, sealants, and coatings to deliver solutions that will further optimise the performance level and reliability of automotive components. Among others, DuPont offers advanced materials and adhesives, contributing towards lightweighting improved fuel efficiency of vehicles. Sunstar produces a wide array of adhesive solutions to improve safety and performance of vehicles. That includes adhesives where BASF, which is the biggest chemicals producer in the world, comes in, as one of the many strides towards innovation and sustainability in the automotive industry. Bostik specializes in adhesive solutions that help improve assembly and performance for automotive components. Hernon Manufacturing produces high-performance adhesives and sealants for critical automotive applications.

They are important for the development of new adhesives to meet the changing demands of the industry, taking into consideration improved bonding strength, durability, and resistance to environmental factors while providing a way towards sustainability for the industry. The changes that the automotive industry and vehicles are going through in their evolution will go a long way in the future and are on the verge of becoming an important area where structural adhesives will find applications, thus enhancing performance, safety, and environmental responsibility.

L&L Products specializes in finding solutions to improve lightweighting as well as noise reduction and structural integrity for vehicles. Master Bond has a number of adhesives-sealants that can meet the rigorous standards of the automotive industry. Parson Adhesives manufacture good adhesive solutions for automotive manufacturing and repair. Permabond designs engineering adhesives that rub shoulders with other proceedings to give bond guarantee solution reliability for different automotive applications. Riëd B.V is a supplier of adhesive products for automotive manufacturers according to their requirements.

SCIGRIP offers the best adhesive solutions for enhancing his structurally effective performance in vehicles. UniSeal is home to highly innovative adhesives and sealant technologies, which improve vehicle assembly processes. WEICON brings in adhesives and sealants bringing hardworking efficiency to automotive components.

Automotive Structural Adhesives Market Key Segments:

By Type

- Polyurethane

- Epoxy

- Acrylics

- Silicone

- Others (Polysulfide, Rubber, Polyamide, etc.)

By Application

- Body-in-White

- Interior & Exterior

- Fixed Glass

- Others (Electronics, Powertrain)

By Vehicle Type

- Passenger cars

- LCVs

- Trucks

- Buses

- Others

Key Global Automotive Structural Adhesives Industry Players

- Henkel

- Sika

- 3M

- Huntsman

- Wacker-Chemie

- Arkema Group

- PPG Industries

- H.B. Fuller

- ITW

- Hubei Huitian

- ThreeBond

- Dupont

- Sunstar

- BASF

- Bostik

- Hernon Manufacturing

- L&L Products

- Master Bond

- Parson Adhesives

- Permabond

- Riëd B.V

- SCIGRIP

- UniSeal

- WEICON

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383