Global Legal Insurance Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global legal insurance market will remain an emerging, unique segment of the insurance sector that addresses the needs of individuals and companies looking to shield themselves from increased legal costs. With increased frequency and complexity of legal disputes, the market will develop into an organized system providing access to cheap legal assistance. This sector will not only serve as a financial protection but also develop legal right consciousness and make professional legal services available to a greater part of society.

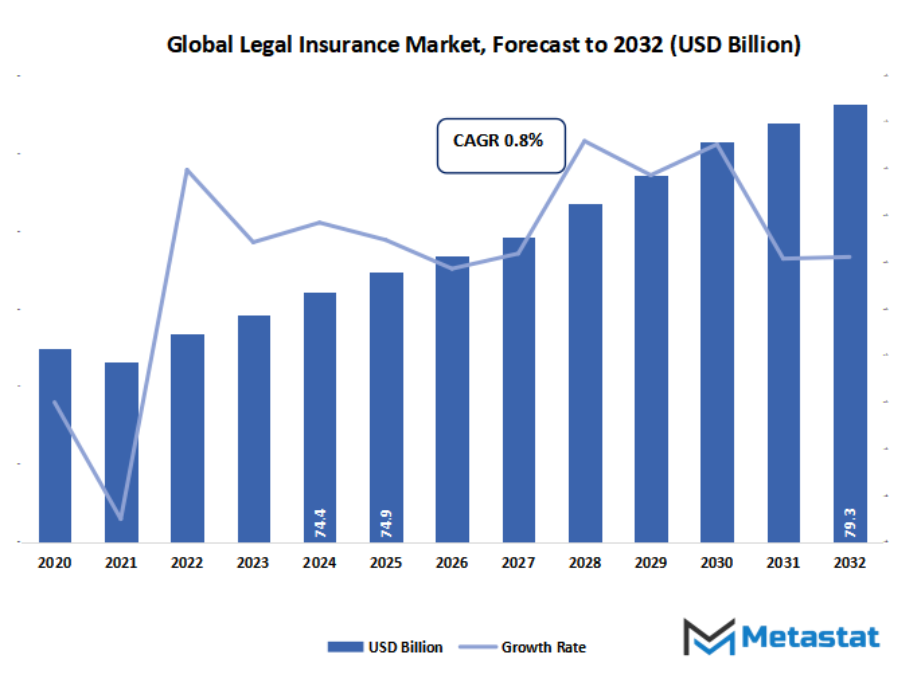

- Global legal insurance market valued at approximately USD 74.9 Billion in 2025, growing at a CAGR of around 0.8% through 2032, with potential to exceed USD 79.3 Billion.

- Before the Event (BTE) Insurance account for nearly 75.2% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising costs of legal services driving demand for affordable access., Growing consumer awareness of legal risks in personal and professional life.

- Opportunities include Partnerships with employers for group legal insurance as an employee benefit.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Will the developing focus of prison protection amongst individuals and organizations reshape the destiny of the worldwide legal insurance market? How would possibly technological innovations and virtual systems disrupt conventional legal coverage models? Could moving regulatory frameworks and evolving purchaser wishes create new uncertainties or possibilities for insurers international?

In the years to come, the global legal insurance market will become increasingly significant because it would be able to fill the gap between legal needs and the affordability of professional help. It will lead individuals to address legal issues positively rather than as cost issues. Law firms and insurers will work more closely together to develop packages for purposes varying from employment and family conflicts to business agreements and intellectual property issues. This enhanced cooperation will result in greater transparency and a better client–provider relationship founded on confidence and transparency.

In addition, the market will increase its spread across industries through digital interfaces so that consumers will be able to compare, subscribe, and redeem services more effectively. Technology integration will redefine access in that online consultations, document reviews, and virtual claim settlements will be the norm. Although regulatory differences between countries can be problematic, they also create new dimensions of innovation and adaptability.

Market Segmentation Analysis

The global legal insurance market is mainly classified based on Type, Distribution Channel, Application.

By Type is further segmented into:

- Before the Event (BTE) Insurance - The global legal insurance market will see tremendous increase by means of the developing requirement for less expensive prison cover. In the Before the Event (BTE) Insurance category, people and businesses will keep spending on policies that protect towards feasible future conflicts. This type of insurance will offer economic protection, with the warranty that unforeseen prison prices will now not be burdensome. With increasing awareness of rights and criminal troubles, this class will increase in demand as more individuals are aware of the want to defend themselves even earlier than any problem takes place.

- After the Event (ATE) Insurance - The After the Event (ATE) Insurance market can even grow with extra customers and agencies searching for coverage after experiencing felony issues. This policy will prove useful to individuals already concerned in litigation requiring monetary help for persevering with legal prices. Rising costs of litigation and uncertainty of results in court will prompt the use of ATE insurance among small businesses and individuals looking to avoid financial loss if a court makes an unfavourable ruling.

By Distribution Channel the market is divided into:

- Direct Sales - In the global legal insurance market, Direct Sales will remain a vital section as insurers focus on establishing direct relationships with customers. Direct conversation will permit corporations to apprehend the needs of clients better, provide customized plans, and set up lengthy-time period consider without the want for intermediaries. This approach will growth transparency and broaden greater cost for each customers and insurers.

- Brokers and Agents - Agents and Brokers will be crucial to market expansion, particularly in areas where personal advice carries significant weight. Their role in explaining policy language and pointing customers toward appropriate legal coverage will sustain stable demand. Their knowledge will make the decision process for customers who are new to legal insurance easier, reinforcing trust in insurance companies.

- Bancassurance - The Bancassurance channel will gain strength as banks join hands with insurers to offer legal insurance in the form of packages of financial services. Given the large customer base and reputation of banks, this mode of distribution will make insurers reach a greater number of people. It will also allow customers to conveniently deal with both financial and legal cover under a single establishment.

- Online Platforms - The emergence of Online Platforms will revolutionize how customers obtain legal insurance. Comparative, buying, and claim processes will be made easier through digital tools, promoting increased adoption, particularly by younger and technology-friendly users. Increased utilization of digital channels will enhance ease of access, enabling customers to browse convenient plans with ease and faster processing.

By Application the market is further divided into:

- Enterprise - The Enterprise line of the global legal insurance market will increase aggressively as firms are seeking to manage risks related to contracts, exertions disputes, and compliance. Firms will increasingly include legal coverage to guard themselves in opposition to highly-priced litigation and surprise criminal troubles. This strategic making plans will permit corporations to concentrate on development even as maintaining prison uncertainties at a minimum and ensuring economic balance.

- Personal - The Personal category will remain on the rise as people want protection against everyday legal problems like property cases, employment disputes, and family matters. Low-cost legal coverage will become a necessary part of imparting financial security as well as professional legal guidance. Growing legal consciousness and the urge for personal protection will fuel the need for individual legal insurance policies, enhancing legal aid to be more widespread and widespread across the globe.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$74.9 Billion |

|

Market Size by 2032 |

$79.3 Billion |

|

Growth Rate from 2025 to 2032 |

0.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

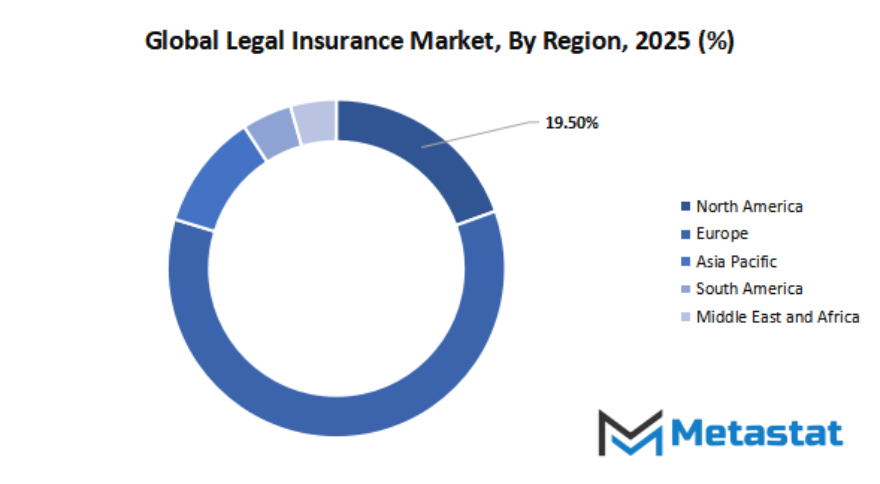

Based on geography, the global legal insurance market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global legal insurance market has been slowly but surely gaining popularity as more people and companies understand the importance of legal cover. With rising awareness of legal rights as well as the cost of legal services going up, legal insurance is no longer viewed as a luxury, but a necessity. This has led the established insurance giants as well as new regional players to increase their presence in the market. Legal insurance provides coverage for personal or business legal expenses and an assurance of financial stability in the event of unexpected disputes, claims, or legal consultations.

The global legal insurance market is characterized by a balance between global giants and regional players. Key gamers like Allianz, AXA, Zurich Insurance Group, Legal & General, Aviva, Generali, Liberty Mutual, and DAS Legal Expenses Insurance Company nevertheless dominate the market with extensive insurance capabilities and extensive patron base. In addition to those worldwide names, Tokio Marine, CIC (Credit Insurance Company), Detroit Insurance Company, Legal Shield, ARAG SE, and Covéa Group are some of the firms which have been expanding their nearby networks and launching new plans unique to local legal frameworks. This combination of global and nearby engagement has created diversity and competition, providing purchasers with extra flexible and affordable insurance options.

Technological innovation has been a significant factor in influencing the manner in which legal insurance services are provided. Numerous operators now make use of computer programs for policy administration, claim management, and customer care, which facilitates easier access to legal assistance for clients. Online legal advice, mobile apps, and online claim filing have accessible legal insurance to a wider number of people. Consequently, more consumers are using these services, especially where conventional legal aid was initially perceived as costly or complicated.

The growth of the market will continue to rise as societies increasingly realize their rights and companies want to deal with risks well. Governments across various nations are also backing insurance products that can render legal help more accessible to citizens. But legal insurance awareness and education must be improved, particularly in the developing world where individuals may not realize its advantages. Businesses that can fill this knowledge gap through good communication and more straightforward policy constructions will have a good chance to grow their customer base.

In the years ahead, the global legal insurance market will host a much wider institution of individuals engaged in a common mission legal protection made extra accessible and lower priced. With major players like Friends First Legal Protection, ERA Legal Protection, ARAG UK, and SBI Legal Insurance playing their component in this development, the marketplace will preserve maturing and adapting to the demands of present day society. The partnership between incumbent insurers and new marketplace entrants will make a contribution to defining a greater obvious and friendly felony coverage surroundings globally.

Market Risks & Opportunities

Restraints & Challenges:

- Complex regulatory environment and coverage limitations across regions. - The global legal insurance market will struggle with diverse legal structures and compliance regulations across countries. Every region has specific regulatory barriers that may impact product design, premium levels, and the claim process. Standardization will be absent, and insurers will struggle to deliver transparent and uniform coverage globally. This heterogeneity in legal systems will present operational complexities, hindering scalability and efficiency for insurance companies.

- Risk of adverse selection and high claims frequency impacting profitability. - One of the key hindrances for the global legal insurance market will be the increasing likelihood of adverse selection, where risky individuals opt for insurance. Such a discrepancy will result in an upsurge in claims, driving a wedge between profit margins of insurers. Moreover, increasing frequency of legal cases and costs of litigation will make it difficult to keep premiums low. In order to maintain profitability, insurers will have to embrace advanced analytics and prediction tools for improved risk assessment and pricing of policies.

Opportunities:

- Partnerships with employers for group legal insurance as an employee benefit. - The global legal insurance market will face vast growth prospects through partnership with corporations and organizations. Increasingly, employers will consider legal insurance as an attractive addition to employee benefit packages, enabling staff to receive accessible legal services. The partnerships will enhance staff loyalty while raising awareness of legal protection services. Through such a plan, insurers will be able to offer expanded coverage at a reduced acquisition cost and stabilize premium revenues through shared risk, making the long-term market sustainable.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 74.9 Billion in 2025 to over USD 79.3 Billion by 2032. Legal Insurance will maintain dominance but face growing competition from emerging formats.

In the end, the global legal insurance market will be the determining factor in redefining the way societies understand protection and justice. By lowering the economic hurdles of legal proceedings, it will cultivate a culture where people and businesses see legal coverage as a matter of necessity, not an individual choice, and forge an era of more just and legally empowered times.

Report Coverage

This research report categorizes the global legal insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global legal insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global legal insurance market.

Legal Insurance Market Key Segments:

By Type

- Before the Event (BTE) Insurance

- After the Event (ATE) Insurance

By Distribution Channel

- Direct Sales

- Brokers and Agents

- Bancassurance

- Online Platforms

By Application

- Enterprise

- Personal

Key Global Legal Insurance Industry Players

- Allianz

- AXA

- Zurich Insurance Group

- Legal & General

- Aviva

- Generali

- Liberty Mutual

- DAS Legal Expenses Insurance Company

- Tokio Marine

- CIC (Credit Insurance Company)

- Detroit Insurance Company

- Legal Shield

- ARAG SE

- Covéa Group

- Friends First Legal Protection

- ERA Legal Protection

- ARAG UK

- SBI Legal Insurance

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252