MARKET OVERVIEW

The global insurtech market is, hence, a vibrant space within the overall insurance market; there is a perfect point of convergence of modern technology and ancient risk management techniques. Such a young industry includes various digital solutions aimed at changing nearly every aspect of insurance-from customer engagement and underwriting to claims handling and risk analysis. Unlike traditional counterparts, Insurtech is founded on the most recent innovations of artificial intelligence, machine learning, blockchain, and big data analytics with an ambition to enable efficient work, higher productivity, and individualized experiences for policyholders.

The Insurtech industry offers a new paradigm in terms of the conception, delivery, and consumption of insurance products and services. New entrants and established players in the Insurtech sector look to solve long-standing problems in the insurance industry by capitalizing on the potential of digitalization, such as complex processes, legacy systems, and low customer engagement. Through innovative platforms and solutions, Insurtech firms will bring more transparency, flexibility, and accessibility to the insurance ecosystem and reshape industry norms while driving unprecedented levels of innovation.

One of the major growth drivers for the global insurtech market is the increasing demand from consumers for more seamless and user-centric experiences in insurance. Today's savvy consumer expects an insurer to offer convenient digital channels for policy management, claims filing, and communication. In response, Insurtech companies are creating intuitive mobile apps, online portals, and virtual assistants to accommodate these changing preferences, thereby reshaping the traditional insurance value chain and bringing customer engagement to unprecedented levels.

The emergence of Insurtech is also transforming the very concepts of risk assessment and underwriting. The application of advanced data analytics and predictive modeling techniques allows Insurtech companies to analyze massive amounts of structured and unstructured data for better risk assessment, customized coverage options, and optimized pricing strategies. This approach not only empowers insurers to understand their customers' needs and behaviors better but also helps develop innovative insurance products that are custom-made for certain market segments and emerging risks.

Furthermore, partnerships and collaborations are increasingly seen between ecosystem participants-the Insurtech startups, traditional insurers, and other-as the global insurtech market continues on a rise. This strategic alliance will allow incumbents to tap into the technological know-how and agility of Insurtech innovators while offering access to established distribution channels and regulatory expertise to the startups along with capital resources. Such synergistic collaboration, therefore, will add new dimensions to the insurance industry as a whole, allowing it to embrace fast innovation, enhanced competitiveness, and better customer value propositions.

Global Insurtech represents a tectonic shift in the landscape of the insurance industry. The reason behind this lies in the intersection of technological, shifting consumer preference, and strategic partnerships. Insurtech is an agent of change, transforming the way things have traditionally been done in the insurance business. In fact, the stakes for all concerned with this transformation have to shift gears, adopt digital transformation, and focus on innovation and customer-centricity as their primary guiding lights to create opportunities for growth, differentiation, and sustainable value creation in this digitized and connected world.

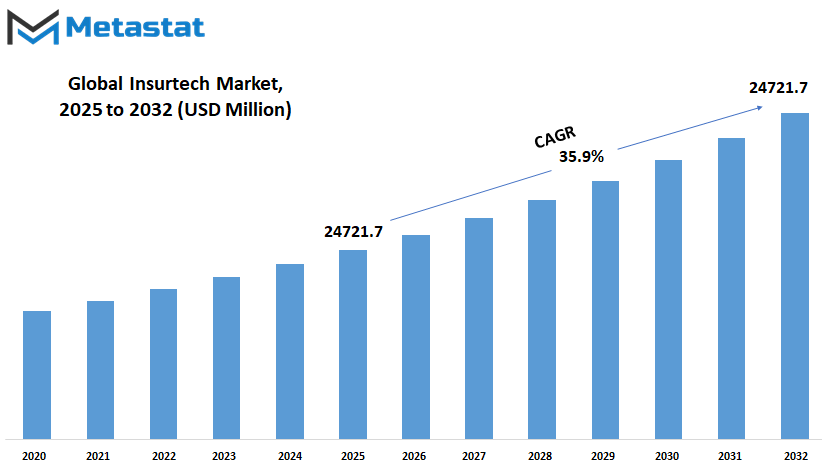

Global insurtech market is estimated to reach $239286.8 Million by 2032; growing at a CAGR of 35.9% from 2025 to 2032.

GROWTH FACTORS

Globally, a growing trend can be seen for the Insurtech market due to several drivers affecting it. However, digital transformation acts as the foremost driver because different forms of digital technology adopted by the various stages of insurance company's practices will help in effective integration of digital practices for various functions and improve issuance as well as settlement of policy claims and also service provision both from the point of view of an insurer as well as that of an insured.

The second driver for the growth of the Insurtech market is data analytics. Today, insurers are making extensive use of advanced analytics tools to analyze enormous amounts of data generated from different sources such as customer behavior, IoT devices, and social media. Gaining insights from such data enables the insurer to better understand the needs of customers, assess risks better, and customize insurance products and services accordingly.

However, despite the positive growth potential, there are still challenges in the global insurtech market. Regulation is one of the biggest constraints; due to complex regulatory scenarios across jurisdictions, business in this space needs to cut through red tape. Regulations about data privacy, consumer protection, and insurance licensing can be costly and time-consuming to follow, which somehow slows down innovation in the industry.

Another barrier to the growth of the global insurtech market is legacy systems in traditional insurance companies. Legacy systems are relatively inflexible and not compatible with currently used digital technologies, thereby preventing innovation and agility in response to the ever-changing needs of the market.

However, in those challenges there is excellent scope for growth and innovation in the global insurtech market. As technology continues to enhance and more significant changes take place in consumer preferences, different Insurtech firms have a chance to develop innovative solutions that tend to meet emerging market requirements and redefine the insurance landscape. Through digital transformation and data analytics capabilities, Insurtech companies can unlock new avenues for growth and differentiation within the competitive insurance market.

MARKET SEGMENTATION

By Deployment Model

The global insurtech market is growing continuously and is segmented based on various types. One of the segments of the deployment model is divided into two categories, namely on-premise and cloud-based solutions.

The on-premise deployment model hosts the software and infrastructure within the premises of the insurance company. This setup allows for a high degree of control and security since data and processes are managed internally. Companies opt for on-premise solutions when they require strict compliance with regulations or have specific security concerns that necessitate keeping data within their physical premises. While on-premise solutions offer advantages in terms of control and security, they can be more costly to implement and maintain due to the need for dedicated hardware and IT resources.

On the other hand, cloud-based deployment models offer greater flexibility and scalability. Cloud-based Insurtech solutions host software and infrastructure on remote servers and allow users to access them using the internet. This way, companies do not have to invest much in costly hardware. This avenue also allows easy scalability because a business can allocate its resources according to need. This is another plus in cloud-based solutions because users can access data and services anywhere with an internet connection. However, with cloud deployments, built-in security and updates become an integral part of the whole setup, making a heavy load on internal IT teams lighter.

Both these models have advantages. The final choice between on-premise or cloud-based is subjective and is influenced by considerations including budget, the requirement for higher security, or increased scalability needs. Insurance companies could prefer a combination of both-on-premise and cloud-based approach in order to reach the point where control meets flexibility.

There has indeed been a very strong trend within the Insurtech industry on the adoption of cloud over recent years, prompted by the need to be more agile, flexible, and cost-effective. What this does essentially is give companies an edge where they can always keep up-to-date with trends and customer behavior within a fluctuating market place.

The overall deployment model, therefore, forms a very crucial factor for insurance companies that wish to benefit from Insurtech solutions to gain efficiency, better customer experience, and staying one step ahead of the curve in this highly digital world. Whether opting for on-premise or cloud-based solutions, the businesses must weigh up their requirements carefully and then decide on the most suitable deployment model that will serve their purposes best.

By Technology

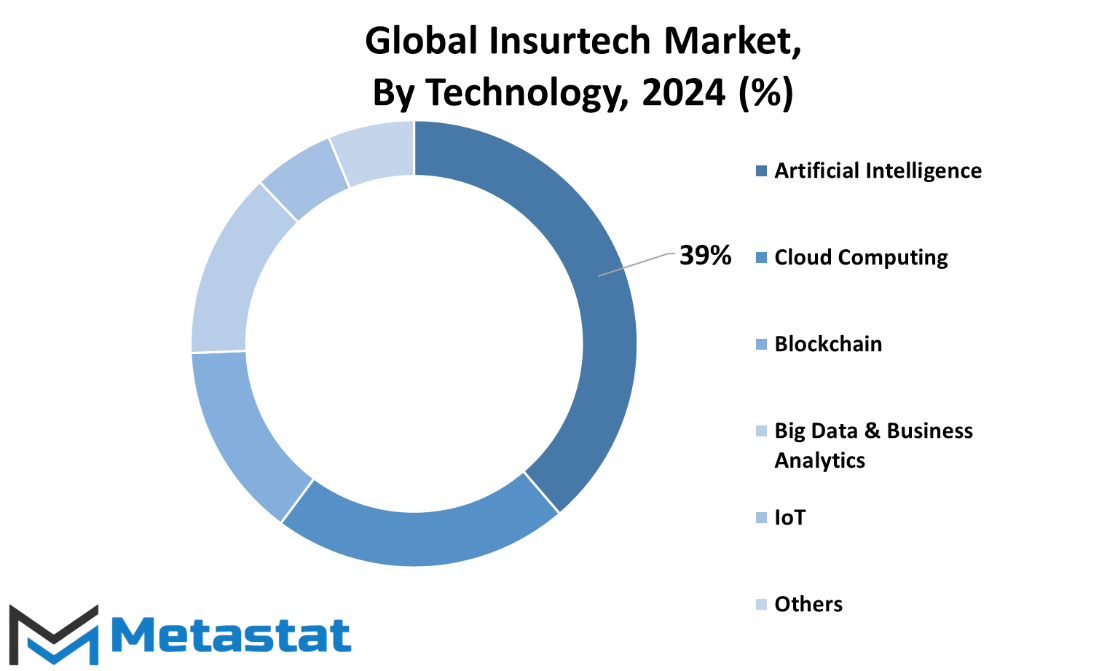

The global insurtech market is growing significantly globally, fueled by technological advancement. This market is segmented into various technologies such as Artificial Intelligence (AI), Cloud Computing, Blockchain, Big Data & Business Analytics, IoT (Internet of Things), and others.

AI is revolutionizing the insurance industry, as it can automate processes, improve risk assessment, and enhance customer experiences. It can analyze huge volumes of data, thereby making insurers better at making predictions and improving their operations.

Cloud Computing is another innovation enabler in the insurance sector. It allows for remote storage and access of data, thus fostering collaboration, scalability, and cost efficiency. Using cloud services helps insurance companies to enhance flexibility and agility in adapting to changing market demands.

Blockchain technology is gaining traction in the insurance industry due to its ability to provide secure, transparent, and tamper-proof record-keeping. It facilitates efficient claims processing, reduces fraudulent activities, and enhances trust among stakeholders.

Big Data & Business Analytics is important in helping insurers arrive at useful insights from large datasets. Insurance companies can, therefore, make important data-driven decisions and personalize services by analyzing customer behavior, market trends, and risk factors.

IoT is changing the insurance landscape by allowing real-time monitoring and data collection through connected devices. Insurers can use IoT devices such as telematics, wearables, and smart home sensors to assess risks accurately, prevent losses, and offer personalized insurance solutions.

Other emerging technologies such as robotic process automation, augmented reality, and machine learning are transforming the global insurtech market. All these have created new avenues for insurers in enhancing operational efficiency, improving customer engagement, and designing innovative products and services.

Hence, the global insurtech market finds itself in an evolutionary phase being triggered by innovative technology. Adoption of AI, Cloud Computing, Blockchain, Big Data & Business Analytics, Internet of Things and more such newly developed technologies ensures insurers are aligned to the increasing customer needs for services, ensure better operational productivity, and result in sustainable business growth. Applying these technologies responsibly keeps insurance providers in a constant battle to not only stay digitally but also make it in data-centricity landscape.

By End User

The global insurtech market covers numerous industries, which cater to the specific needs of the end users. Such end users are primarily Life & Health Insurance, Property and Casualty (P&C) Insurance, Auto Insurance, and others.

Life & Health Insurance is a significant segment of the global insurtech market. These are insurance policies dealing with the health and life of individuals, including the coverage of medical expenses, illnesses, accidents, and death. With technology advancement, Insurtech companies are revolutionizing this sector through innovative solutions in policy management and claims processing and customer engagement.

One of the other major components of the Insurtech industry is Property and Casualty, or P&C, insurance. This involves protection for physical property such as homes, buildings, and automobiles that may become damaged or otherwise lost in the occurrence of unexpected events such as natural disasters, theft, or accidents. Insurtech solutions for these markets help streamline underwriting processes through increased capabilities to assess risk, improved customer experience, and digital-based platforms and data analytics.

Auto Insurance falls under a major chunk of the global insurtech market in terms of catering for car users. Telematics and Internet of Things devices are allowing Insurtech firms to access data that is provided by connected cars, thereby offering usage-based insurance (UBI) as well as personalized price. These types of technologies allow insurance companies to decide on behavior and determine risk profiles clearly, thereby charging premiums fairly that can result in a better customer satisfaction profile.

The global insurtech market also caters to other end users beyond the above categories. This comprises niche insurance segments such as travel insurance, pet insurance, and small business insurance among others. Insurtech startups specialize in these areas and use technology to tailor the insurance products for specific customer needs, providing convenience, flexibility, and affordability.

The evolution of the global insurtech market is triggered by the forces of technological progress, consumer behavior change, and industry regulation. It allows Insurtech firms to constantly innovate and break down traditional insurance models into a more efficient, customer-centric insurance ecosystem.

The global insurtech market can be segmented with various end-use customers, categorized into Life & Health Insurance, Property and Casualty Insurance, Auto Insurance, etc. Insurtech companies that have been engaging in technological innovation combined with data-based solutions are turning the insurance industries on their heels, improving experiences for customers in the digital sphere, and enabling growth.

By Application

In the last few years, the global insurtech market has grown and changed dramatically. The market, with its focus on leveraging technology to innovate and improve the insurance industry, has seen many applications emerge that each play a role in reshaping traditional insurance processes.

One of the main areas covered by the global insurtech market is in product development and underwriting. This covers the use of technology to rationalize the development of and assessment on insurance products. Data analytics, artificial intelligence, and machine learning algorithms can be harnessed in developing more tailor-made and personalized types of insurance from the companies' end. These allow not only the enhanced efficiency of the process of underwriting but also offer a better form of risk evaluation and competitive prices for customers of the insurance firm.

Another area for consideration is the selling and marketing front of the Insurtech industry. Insurtech firms are shifting the very model of selling insurance products and also its marketing strategies. Due to growth in digital media and digital technologies, these can reach customers beyond boundaries through more advanced digital media sources and digital distribution platforms and at the same time communicate more accurately with their respective target audience in different personalized ways and channels. This shift towards digital sales and marketing will improve customer experience but allow insurers to segment and target demographics better in order to grow and stay profitable.

Policy administration, collection, and disbursement form another significant segment of the global insurtech market. Traditionally, these processes are labor-intensive and error-prone. However, with the advent of Insurtech solutions, insurers can automate and streamline policy administration tasks such as premium collection, policy issuance, and claims processing. It reduces operational costs and enhances overall efficiency and accuracy in policy management, which leads to improved customer satisfaction and retention.

Claims management is another prominent area of emphasis in the global insurtech market. Technologies like blockchain, IoT devices, and predictive analytics can help speed up the process of claims handling, reduce fraud, and make claims assessments more accurate. With Insurtech solutions, insurers can provide more transparent and responsive claims services, increasing customer trust and loyalty.

In applications such as product development and underwriting, sales and marketing, policy administration, collection, and disbursement, claims management, rapid growth and innovation in the Insurtech global market are changing the insurance industry completely by improving its efficiency, offering a better experience for customers, and generating more value for both parties, insurers, and policyholders. The global insurtech market has an important place and will continue to do so because of the developing technology.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$33232.3 million |

|

Market Size by 2032 |

$239286.8 Million |

|

Growth Rate from 2024 to 2031 |

35.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

Based on geography, the global insurtech market is divided into North America, Europe, Asia-Pacific, The global insurtech market is analyzed based on geographical regions, namely North America, Europe, Asia-Pacific, and the rest of the world. These regions play significant roles in shaping the dynamics of the Insurtech industry.

North America stands out as a dominant player in the global insurtech market. With advanced technological infrastructure and a strong inclination towards innovation, countries like the United States and Canada have witnessed substantial growth in Insurtech initiatives. The region boasts a mature insurance market, coupled with a high adoption rate of digital solutions, making it a fertile ground for Insurtech startups and established players alike. Regulatory support and favorable investment climate further fuel the growth of Insurtech ventures in North America.

Europe emerges as another key region driving the Insurtech revolution. Countries within the European Union, such as the United Kingdom, Germany, and France, exhibit a similar trend of embracing digital transformation in the insurance sector. Regulatory reforms, such as the EU's General Data Protection Regulation (GDPR), have spurred innovation in data management and privacy protection, providing a conducive environment for Insurtech startups to thrive. Additionally, strategic partnerships between traditional insurers and technology firms have accelerated the adoption of Insurtech solutions across Europe.

The Asia-Pacific region presents immense opportunities for Insurtech growth, fueled by rapid digitization and burgeoning insurance markets. Countries like China, India, and Singapore are at the forefront of this transformation, driven by factors such as expanding middle-class populations, rising insurance awareness, and increasing internet penetration. Insurtech startups in the region leverage technologies like artificial intelligence, blockchain, and telematics to cater to the evolving needs of consumers and insurers. Government initiatives aimed at promoting financial inclusion and technological innovation further catalyze the growth of Insurtech in Asia-Pacific.

The rest of the world comprises regions with emerging Insurtech landscapes, albeit at varying stages of development. Latin America, the Middle East, and Africa are witnessing a gradual shift towards digital insurance solutions, propelled by factors like rising smartphone penetration and changing consumer preferences. Although these regions face unique challenges such as regulatory hurdles and infrastructure limitations, they present untapped opportunities for Insurtech players willing to navigate the diverse market landscapes.

The global insurtech market exhibits a diverse regional landscape, with North America, Europe, and Asia-Pacific leading the charge towards digital transformation in the insurance industry. As technology continues to reshape the way insurance products and services are delivered, regional dynamics will play a crucial role in shaping the future trajectory of the Insurtech ecosystem worldwide.

COMPETITIVE PLAYERS

The global insurtech market is characterized by a diverse array of competitive players vying for prominence. These companies operate in various segments of the Insurtech industry, each bringing its own unique strengths and innovations to the table.

Among the key players in the Insurtech sector are Damco Group, DXC Technology Company, Majesco Holdings Inc., Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Trov Insurance Solutions, LLC, Wipro Limited, Lemonade Insurance Agency, LLC, Hippo Enterprises Inc., Policygenius, Root Insurance Inc., Next Insurance, Inc., CoverHound, Corvus Insurance Holdings Inc., Zego (Extracover Limited), Wefox Insurance AG, Kin Insurance Technology Hub, LLC., and ZhongAn Online P & C Insurance Co., Ltd.

These companies operate in various niches within the Insurtech landscape, ranging from technology solutions for insurance underwriting and claims processing to innovative insurance product offerings and distribution channels. They leverage advanced technologies such as artificial intelligence, data analytics, blockchain, and machine learning to enhance operational efficiency, improve customer experience, and develop tailored insurance solutions.

Damco Group, for instance, specializes in providing technology consulting and solutions to insurance companies, helping them streamline their operations and adapt to digital transformation trends. Similarly, DXC Technology Company offers a wide range of digital insurance solutions, including software platforms for policy administration, claims management, and customer engagement.

Majesco Holdings Inc. focuses on developing cloud-based software solutions for the insurance industry, enabling insurers to launch new products quickly, scale their operations efficiently, and deliver personalized customer experiences. On the other hand, Oscar Insurance is known for its consumer-centric approach to health insurance, leveraging technology to simplify the insurance buying process and enhance member engagement.

OutSystems provides low-code development platforms that empower insurance companies to build and deploy custom applications rapidly, accelerating their digital transformation journey. Shift Technology specializes in fraud detection and claims automation solutions, helping insurers detect and prevent fraudulent activities while streamlining claims processing workflows.

Overall, the competitive landscape of the global insurtech market is characterized by intense competition and rapid innovation, with key players continuously striving to differentiate themselves through technological advancements, customer-centric approaches, and strategic partnerships. As the Insurtech industry continues to evolve, these players are expected to play a pivotal role in shaping the future of insurance.

Insurtech Market Key Segments:

By Deployment Model

- On-premise

- Cloud

By Technology

- Artificial Intelligence

- Cloud Computing

- Blockchain

- Big Data & Business Analytics

- IoT

- Others

By End User

- Life & Health Insurance

- Property and Casualty (P&C) Insurance

- Auto Insurance

- Others

By Application

- Product Development & Underwriting

- Sales & Marketing

- Policy Admin Collection & Disbursement

- Claims Management

Key Global Insurtech Industry Players

- Damco Group

- DXC Technology Company

- Majesco Holdings Inc.

- Oscar Insurance

- OutSystems

- Quantemplate

- Shift Technology

- Trov Insurance Solutions, LLC

- Wipro Limited

- Lemonade Insurance Agency, LLC

- Hippo Enterprises Inc.

- Policygenius

- Root Insurance Inc.

- Next Insurance, Inc.

- CoverHound

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252