MARKET OVERVIEW

The global data analytics market interweaving a sophisticated narrative based upon observed trends, regional balance, and prevailing industrial context. As information ever more frequently becomes the foundation for operational decision-making, this in-depth analysis invites readers into a world characterized by its sophistication, in which structured and unstructured data flows converge to drive strategic impetus. Instead of superficially skimming the surface themes, the report goes beneath and deeper into consequential changes and changing directions across industries that have started to reframe their paradigms to better leverage information.

The size of this market has not only expanded but also evolved with a more mature complexion in how it is applied across different spheres. The writing captures the manner in which industries that are both mature and emergent have come to utilize information not just as a resource but as a central nervous system within their customer-facing and operational models. What Metastat Insight research offers is something greater than a snapshot; it frames a steady redefinition in the nature of corporate infrastructure as companies migrate from legacy models toward models driven by smart inference, lightning-fast processing, and an agility not previously possible.

Of especial interest is how various geographies are tackling this shift. The institutional, regulatory, and cultural contexts of nations play their part in the unique paths through which companies take on and implement data-driven tools. Although there are some markets that are defined by large-scale deployments and centralized platforms, others are navigating through localized networks and customized use cases. These different paths are not only interesting from a geopolitical perspective but operationally, as they show the effect of localization on implementation. In this regard, the report sketches a differentiated picture that is not generic but rather one that captures true, location-based changes.

Corporate landscapes have also shown a more acute awareness of the consequences of velocity and volume in data flow. The shift from static databases to dynamic, responsive ecosystems has reordered enterprise priorities. Organizations now no longer care about simply warehousing information for occasional review, but are actively developing their capability to interact with streams of data in real-time. This shift in methodology marks a move away from previous practice and is a transformation of strategic intent where foresight, flexibility, and immediacy take precedence.

The report also addresses the shifting composition of workforce strategies. As demand grows for positions that marry technical competence with strategic vision, recruitment methods and in-house development initiatives are changing. The growth in demand for expertise represents not only a functional but also a cultural transformation. Information specialists no longer work in isolation in back rooms; they now sit at the table with executive teams to define long-term agendas and address potential risk. This realignment on organizational diagrams reinforces the increasing importance accorded to reading sophisticated data stories as part of a larger business agenda.

What is revealed through this report is a mosaic of industries that are not simply adapting to new instruments, but reforming themselves through their engagement with data. Some industries, long resistant to adopting digital approaches, are now showing quick adjustments, driven by increased competition and greater awareness of customer behavior. Others, digitally native, are adding additional insights to already sophisticated systems. In either scenario, the report is definite that adoption is not equal across the board but the underlying energy is unmistakable.

In following these diverse movements, Metastat Insight builds a perspective that is both earthed and stratified, providing readers with a nuanced sense of where this market is at now. Instead of depicting homogenized growth curves or tidy trajectories, the report encourages a more contemplative comprehension of how capability and culture converge in the use of analytical frameworks. This is an important distinction, particularly in an environment where the consequences of every choice can be exaggerated or diminished by the velocity and precision with which information is processed.

In addition, the research illustrates how organizational design is being quietly reengineered to more closely fit these changing systems of information. The transition is not necessarily dramatic or front-page but typically by subtle shifts in lines of reporting, tool choice, and partner ecosystems. These are less noticeable points but reflect a greater institutional positioning toward longer-term data strategies. The dynamic nature of these shifts means that no two organizations take the same route but the direction is the same toward greater integration and increased relevance of data in day-to-day decisions.

The report by Metastat Insight ends its investigation reaffirming that the global data analytics market is not a one-off trend or a fleeting phase. It is an underpinning revolution which keeps having an impact not only on how decisions are made, but what kinds of decisions are possible. With a close analysis of regional evolution, institutional response, and technological uptake, the report provides a reflective insight into a market that is reshaping global business structures in little ways but profound impact. It is only when viewed in this context that one starts to truly value not just the current configuration, but also the direction for this huge and strategically important realm.

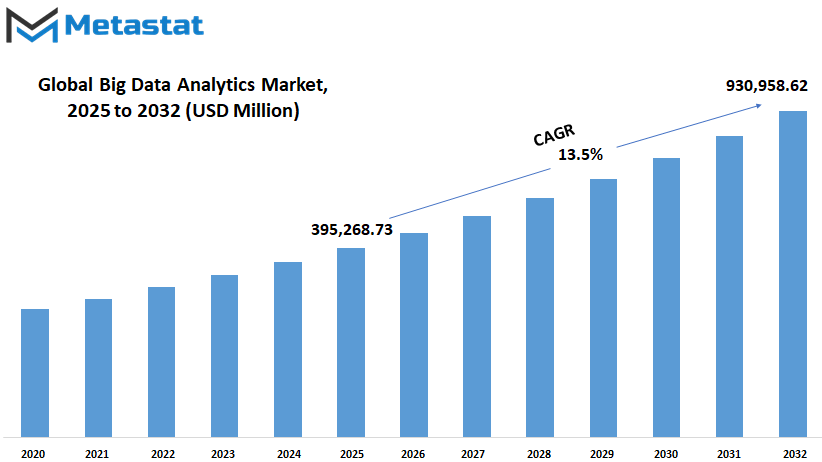

Global data analytics market is estimated to reach $930,958.62 Million by 2032; growing at a CAGR of 13.5% from 2025 to 2032.

GROWTH FACTORS

The global data analytics market is steadily gaining momentum as more businesses and industries shift towards digital operations. This trend is expected to continue, especially as the volume of data being generated increases at an extraordinary pace. From online transactions and social media activity to sensor data and connected devices, the world is producing more information than ever before. Organizations are starting to recognize the importance of using this data to make better decisions and understand their customers more clearly. As a result, the demand for data-driven insights is shaping how companies operate and compete.

Businesses across sectors now rely on Big Data Analytics to uncover trends, forecast outcomes, and tailor their strategies to meet changing demands. The ability to analyze vast amounts of data helps them respond faster, improve efficiency, and deliver personalized experiences. In the future, this approach will become even more vital as customer expectations grow and market dynamics shift rapidly. Companies that fail to adapt may fall behind, while those that invest in analytics will be better prepared to make smart choices.

Despite these advantages, several challenges could slow down the growth of the global data analytics market. The cost of setting up and maintaining the infrastructure required for advanced analytics remains high. Many organizations also face hurdles in managing the technical side of implementation. These include integrating data from different sources and ensuring smooth operations. In addition, concerns around data privacy and security continue to be significant. As governments enforce stricter compliance rules, companies must work harder to protect sensitive information while maintaining transparency.

Even with these obstacles, the future offers strong potential. The use of artificial intelligence and machine learning in analytics is opening up new possibilities. These technologies can quickly sort through large datasets and provide predictions in real-time, helping businesses react faster to changing conditions. This kind of automation will reduce manual effort and improve the accuracy of insights, making data analysis more accessible and efficient. Over time, it will help organizations tap into opportunities that were previously out of reach.

As industries continue to grow more connected and data becomes central to everyday decisions, the global data analytics market will likely play a major role in shaping business strategies. Although there are some concerns to address, the direction is clear: using data wisely will be a key factor in success going forward.

MARKET SEGMENTATION

By Component

The global data analytics market is steadily shaping the future of how businesses operate and make decisions. As data continues to grow at an immense rate, the need to make sense of it becomes more important. This is where Big Data Analytics steps in. Looking ahead, the industry is expected to expand, not just in size but also in the way it influences sectors such as healthcare, retail, manufacturing, and finance. At its core, Big Data Analytics helps organizations understand patterns, make predictions, and improve efficiency. It allows them to turn raw information into useful insights, supporting better strategies and quicker responses to change.

By component, the global data analytics market is divided into Software, Hardware, and Services. Each part plays a key role in supporting the growth and functionality of this market. Software tools are likely to remain essential as they help process and analyze large amounts of information in real time. These tools will continue to improve, becoming easier to use and more accurate in delivering insights. Hardware, which includes storage systems and servers, will keep evolving to handle the rising demand for speed and capacity. As data becomes more detailed and arrives faster, hardware will need to keep up without slowing down systems. Services will also grow in value, especially as companies seek expert help to set up, manage, and maintain their data projects. Consulting, system integration, and support services will be important in guiding businesses through new technologies and helping them make the most of their data.

Looking into the future, the global data analytics market will be driven by a stronger push toward automation and machine learning. These tools will make data analysis faster and more reliable, reducing the need for manual work and cutting down on errors. Businesses will also rely more on cloud platforms, which offer flexible storage and faster processing without the need for heavy infrastructure. As the market matures, privacy and security will become more important. Protecting sensitive information will not just be a legal issue but also a matter of trust.

In the years to come, the market will not only support large corporations but also open doors for smaller businesses to benefit from smart data use. The rise of user-friendly tools and affordable services will help level the playing field, making data-driven decision-making accessible to many.

By Enterprise Type

The global data analytics market will continue to grow steadily as businesses around the world become more dependent on data to make smart decisions. In the future, data will not only support operations but guide them. Every industry, from retail to healthcare, is beginning to see how important it is to understand and use large sets of information. This shift will lead to even more investment in tools and strategies that make data easier to understand and apply. Businesses are realizing that information, when properly handled, can improve customer service, cut costs, and predict future trends more accurately.

As technology advances, companies will have access to more sources of data than ever before. These include sensors, online activity, mobile devices, and many others. As this data grows in size and complexity, the need for faster and smarter analysis will also grow. The global data analytics market will respond by offering more advanced software that can handle high volumes of data in real time. This will help organizations make better choices much faster than they can today.

When looking at enterprise type, the global data analytics market is split between Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. Both groups are expected to play important roles in the future. SMEs are starting to understand that they too can benefit from data, not just large companies. In the past, high costs kept smaller firms away from using these tools. But newer, more affordable solutions are changing that. As these options become easier to use and cheaper to maintain, more SMEs will adopt them to stay competitive.

On the other hand, Large Enterprises have been leading the way and will keep doing so. They often manage complex systems and serve large customer bases, so they need powerful tools to process information quickly. These organizations will continue to invest in newer technologies that help them manage huge amounts of data across many platforms.

Looking ahead, both small and large businesses will use data in new and creative ways. The global data analytics market will adjust and grow to meet these needs. It will shape how businesses plan their goals, reach their customers, and stay ahead in a world that is becoming more driven by information. With new innovations and growing interest, this market is set to remain a central part of the business world for years to come.

By Deployment Model

The global data analytics market will continue to grow as the amount of data produced every day increases. Businesses across different sectors are realizing the value of using data to guide their decisions, understand customer behavior, and improve operations. With more data being generated, there’s a rising need for tools that can collect, process, and analyze it efficiently. As a result, the demand for big data analytics solutions is expected to expand steadily in the years to come.

One of the key ways these solutions are delivered is through deployment models. The two main types are On-Premises and Cloud. On-Premises deployment means the hardware and software are kept within the organization’s own infrastructure. Some companies prefer this model because it gives them more control over data security and system customization. It’s especially useful in sectors where strict data regulations are in place, such as banking or healthcare. Even with its advantages, maintaining an On-Premises setup requires regular updates, physical space, and a skilled IT team, which can make it costly over time.

On the other hand, the Cloud model is gaining more attention due to its flexibility and lower upfront costs. Cloud-based solutions allow businesses to access analytics tools over the internet, usually through subscription services. This means that smaller businesses can also use advanced analytics without having to invest heavily in physical infrastructure. Cloud models can also be scaled easily, which is important as companies grow or as their data needs increase. Many providers also offer automatic updates and strong data protection, which reduces the burden on in-house teams.

Looking into the future, the global data analytics market will likely see a strong move toward Cloud deployment. As remote work becomes more common and businesses become more digital, the ability to access data and tools from anywhere will become even more valuable. However, On-Premises solutions won’t disappear completely. Companies with highly sensitive data or unique needs will still rely on them to meet specific goals.

Over time, we may also see hybrid models become more common. These models combine both Cloud and On-Premises features, allowing organizations to get the best of both. As technology continues to improve, the gap between the two models may narrow, offering businesses more choice and better performance. The global data analytics market will keep adapting to changing needs, driven by innovation and the growing role of data in everyday decisions.

By Application

The global data analytics market is growing rapidly and is expected to continue doing so for years to come. As more industries shift towards digital operations and rely on large-scale information to make decisions, the need for tools that can sort, process, and make sense of vast amounts of data is only becoming more important. This shift is not just limited to large corporations; even small and medium-sized businesses are turning to data-based solutions to better understand customers, predict trends, and improve performance.

By application, the global data analytics market is mainly divided into Data Discovery and Visualization (DDV), Advanced Analytics (AA), and other related areas. Data Discovery and Visualization plays a key role in helping users understand patterns and trends through easy-to-read charts, graphs, and dashboards. These tools are designed to make information more accessible and allow decision-makers to spot important insights at a glance. In the future, DDV tools will likely become even more user-friendly and intelligent, able to highlight issues or opportunities without requiring deep technical knowledge.

Advanced Analytics, on the other hand, focuses more on prediction and deeper data interpretation. It uses methods like machine learning and statistical analysis to uncover patterns that aren’t immediately obvious. As technology continues to improve, these tools will become smarter, faster, and more accurate. Businesses will be able to test different outcomes, simulate future scenarios, and make confident decisions based on data rather than guesswork.

There are also other applications within the global data analytics market that support various needs, from improving customer experiences to strengthening cybersecurity. These tools help companies manage their operations better, keep their systems secure, and find new opportunities for growth. As businesses face more competition and changing customer expectations, the role of data in making smart, timely choices will only grow stronger.

Looking ahead, this market will likely be shaped by automation, real-time processing, and the integration of artificial intelligence. With constant updates and faster systems, users will be able to work with live data, respond to challenges quickly, and stay ahead of changes in the market. The global data analytics market will not just be about managing large sets of numbers it will be about turning those numbers into clear, useful actions that shape the future of businesses across the world.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$395,268.73 million |

|

Market Size by 2032 |

$930,958.62 Million |

|

Growth Rate from 2025 to 2032 |

13.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global data analytics market looks promising as more regions across the world adopt data-driven strategies to solve problems, improve efficiency, and drive economic growth. As data becomes increasingly central to decision-making, businesses and governments are turning to advanced analytics to gain insights and stay competitive. This growing interest will continue to expand the market in the coming years, especially as technology becomes more accessible and affordable.

North America remains one of the leading regions in this market. The United States, Canada, and Mexico have been early adopters of advanced analytics due to strong infrastructure, a focus on innovation, and support for digital transformation. The U.S. especially will continue to lead the way, driven by demand from industries such as healthcare, finance, and retail. Investments in machine learning and artificial intelligence will also help the region maintain its position at the forefront.

In Europe, countries like the UK, Germany, France, and Italy are showing steady progress in adopting big data solutions. While their growth may not be as rapid as in some other areas, strict data regulations are encouraging companies to use analytics responsibly and with greater precision. This approach, although cautious, helps ensure long-term success and builds trust with users. Over time, this will create a strong and sustainable market environment.

Asia-Pacific is expected to see the fastest growth. India, China, Japan, and South Korea are all making significant investments in technology, education, and digital infrastructure. These countries have large populations, fast-growing economies, and rising internet use, all of which contribute to a high demand for better data insights. As more startups and global tech companies enter these markets, Asia-Pacific will play a key role in shaping the future of big data analytics.

South America, led by Brazil and Argentina, is catching up as well. While the pace of adoption may be slower, the interest is growing as companies look for ways to manage large volumes of information. With the right support and training, this region will likely become a more active player in the global landscape.

The Middle East and Africa also show great potential. Countries such as the UAE, Saudi Arabia, Egypt, and South Africa are investing in digital innovation to strengthen their economies. As connectivity improves and more data becomes available, the global data analytics market will find new opportunities in these regions. In the years ahead, all parts of the world will contribute to the expansion of this powerful technology.

COMPETITIVE PLAYERS

The global data analytics market will continue to grow steadily as businesses and governments rely more on data to guide their decisions. With the spread of digital technology across all industries, the need to gather, sort, and understand vast amounts of information is only becoming more important. This growth is not just about collecting data but also about turning it into something useful. As more organizations realize the value of informed decision-making, the demand for strong data analytics tools will only increase.

Looking ahead, competition among the leading companies in this market will remain tight. Major players like IBM Corporation, Microsoft Corporation, Oracle Corporation, and SAP SE have been investing heavily in innovation to stay ahead. Their focus has shifted to more user-friendly tools that can be used by both technical and non-technical staff. These companies are also pushing towards cloud-based solutions, which allow faster access to information from anywhere. Amazon Web Services (AWS), known for its cloud strength, is another key force shaping the direction of this market. They continue to expand their analytics tools to serve both small businesses and large enterprises.

Fair Isaac Corporation and SAS Institute Inc. have also played significant roles in advancing data modeling and predictive analytics. These tools help businesses anticipate future outcomes and plan better strategies. Teradata Corporation and Dell Technologies Inc. are helping organizations handle large-scale information more efficiently, improving how data is stored and processed. Meanwhile, Tableau Software and QlikTech International AB have made data visualization more accessible, turning complex numbers into clear, easy-to-understand visuals. Informatica’s focus on data integration allows different systems to work together, which is essential in a world where data comes from many different sources.

The future of the global data analytics market will be shaped by the growing need to understand data quickly and accurately. Businesses will not just want answers but will expect them in real time. This will push developers to create tools that are both faster and smarter. Competitive players will need to balance performance with ease of use while staying aware of privacy concerns and regulations. As more industries look to analytics for guidance, the companies that can deliver reliable, quick, and user-friendly tools will lead the market. Those who adapt to these changes and invest in long-term solutions will be the ones who shape its future.

Big Data Analytics Market Key Segments:

By Component

- Software

- Hardware

- Services

By Enterprise Type

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Deployment Model

- On-Premises

- Cloud

By Application

- Data Discovery and Visualization (DDV)

- Advanced Analytics (AA)

- Others

Key Global Big Data Analytics Industry Players

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services (AWS)

- Fair Isaac Corporation

- SAS Institute Inc.

- Teradata Corporation

- Dell Technologies Inc.

- Tableau Software

- Informatica

- QlikTech International AB

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252