MARKET OVERVIEW

The global insulin pumps market is the world of medical devices concerned with the design, manufacture, and distribution of implantable and wearable devices medically advantaging the precise and reliable infusion of insulin. It is available for diabetic patients requiring continuous subcutaneous insulin infusion as a part of their treatment plan. This very market stands at the crossroads of biotechnology, mechanical engineering, and digital health, joining disciplines that will perform the development of diabetes care through innovation, user experience, and the synthesis of data.

What differentiates the global insulin pumps market from more conventional diabetes care is that it focuses on miniaturized devices, algorithmic dosing, and closed-loop control considerations. These will set the product trends of the future, particularly when the divide between hardware and therapeutic software becomes increasingly blurred. In other words, companies would not just build hardware but would begin fostering ecosystems-deeply integrating insulin pumps with continuous glucose monitors and smartphones to offer cohesive therapeutic experiences to patients. In this process, the market will progress into digital territory beyond just devices.

The global insulin pumps market ecosystem will be characterized by heterogeneous players like medtech giants, start-ups with skilled engineering teams, healthcare providers, and digital health platforms. These players will compete and collaborate to design products addressing evolving user needs, regulatory demands, and device connectivity. Rather than sales per unit, market players will return to platform-based business models—offering end-to-end solutions that may include subscription-based offerings, AI-driven analytics, and real-time support systems. During this transformation process, device manufacturer and healthcare service provider lines will remain blurred.

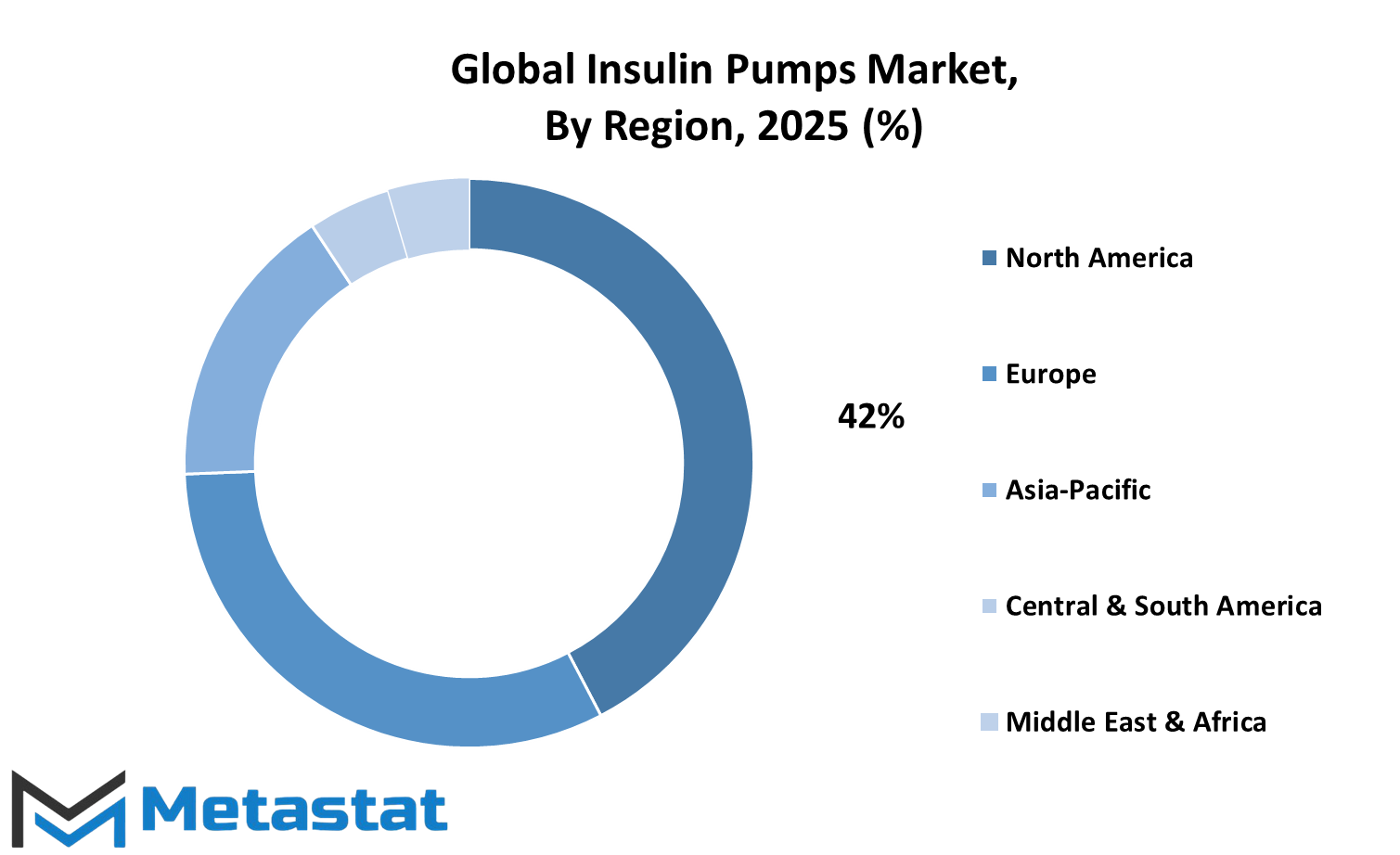

Regional forces will complicate the global insulin pumps market. While North America is currently served by a high rate of device adoption by structured reimbursement and broad clinical acceptance, the emerging economies will take their turn in the limelight more and more. As health policies at home mature to enable management of chronic disease with advanced technology, distribution channels and pricing mechanisms will adapt to accommodate those regional priorities. This expansion at the regional level will not be of a standard form but will require tailor-made solutions, calibrated based on demographic, regulatory, and infrastructural conditions that vary tremendously from country to country.

The global insulin pumps market will continue to redefine itself in the coming days through incremental innovations and paradigm-breaking new entrants. It will not only determine safety and effectiveness but also usability, wearability, and interoperability—drivers of long-term patient compliance. Data protection guidelines, cybersecurity requirements, and traceability of devices will center the stage, dictating design and monitoring of products into the future. Regulatory and technological advancements will drive the industry toward a more intelligent and responsible paradigm.

Success here will not be the relative newness of the hardware, but about how well and how consistently the system integrates into a patient's life. The global insulin pumps market will really be a change agent, not just in endocrinology, but in the health technology market at large.

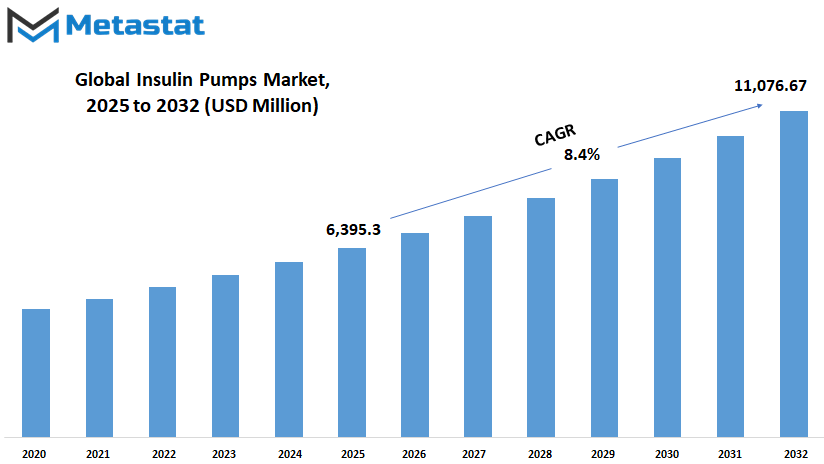

Global insulin pumps market is estimated to reach $11,076.67 Million by 2032; growing at a CAGR of 8.4% from 2025 to 2032.

GROWTH FACTORS

The global insulin pumps market is expected to grow steadily in the coming years, mainly because of the increasing number of people diagnosed with diabetes around the world. As more individuals face challenges related to blood sugar management, there is a stronger need for easier and more efficient ways to deliver insulin. Many patients are turning to insulin pumps because they offer a more consistent and convenient method of insulin delivery compared to traditional injections. This shift in preference, especially toward devices that are wearable and easy to use, continues to shape the direction of the market.

People are becoming more aware of how important it is to manage diabetes in a way that fits into their daily lives. Because of this, devices that allow for mobility, comfort, and simple operation are gaining popularity. Wearable pumps meet these expectations and are being widely accepted, especially among younger users who are more comfortable with technology. The move toward user-friendly devices is not just about comfort—it also helps improve health outcomes by making it easier for people to stick with their treatment plans.

However, not all areas are equally prepared to support this growth. In many regions, the high cost of insulin pumps is a major concern. Without proper insurance or financial assistance, many people simply cannot afford the devices, no matter how useful they may be. In addition, the lack of coverage or limited reimbursement policies in certain countries limits how many people have access to this technology. There are also risks tied to how these devices work. Malfunctions can lead to serious health problems, which makes proper training and education essential for safe use. Without this, even the best device can become a danger rather than a help.

Despite these issues, the future of the global insulin pumps market still holds promise. New technology is changing how these devices work. The latest smart pumps are being developed to work with continuous glucose monitoring systems, creating more responsive and personalized treatment options. These systems help users monitor their blood sugar in real-time and adjust insulin levels without the need for constant manual input. This kind of progress will likely make insulin pumps more effective and appealing. In the near future, these developments could help bring better health outcomes and a more manageable daily life for people living with diabetes.

MARKET SEGMENTATION

By Type

The global insulin pumps market is expected to grow steadily in the coming years, driven by a mix of technological progress and the rising number of people living with diabetes. As healthcare systems around the world continue to shift toward more personalized and efficient care, insulin pumps are becoming a preferred choice for many patients who require regular insulin delivery. These devices offer a reliable alternative to multiple daily injections, allowing users better control over their blood sugar levels while leading more flexible lives. With more awareness being raised about diabetes management and the advantages of using insulin pumps, the demand for these devices is likely to increase across various regions.

Looking at the global insulin pumps market by type, the main categories are patch pumps and tethered pumps. Patch pumps are gaining attention due to their compact size and ease of use. These pumps stick directly to the skin and deliver insulin through a small cannula, reducing the need for tubing and making them less noticeable. As people seek solutions that blend convenience with discretion, patch pumps are likely to become more popular, especially among younger users and those with active lifestyles. Their simple design also makes them appealing for first-time users who may find traditional methods intimidating.

On the other hand, tethered pumps, which are connected to the body through a thin tube, still hold a strong place in the market. These pumps allow more advanced programming and features, which appeal to users who prefer tight control over their insulin dosing. While they may be more visible and require more maintenance than patch pumps, their reliability and customizable settings give them lasting value. As new models come with better software and user interfaces, tethered pumps will likely remain a stable choice for many.

The future of the global insulin pumps market will likely be shaped by continued innovation. Companies are investing in smart technology, aiming to create pumps that can adjust insulin delivery based on real-time glucose readings. There is also growing interest in pumps that connect easily with mobile apps, giving users and doctors a better way to track data and make quick adjustments. With this kind of progress, insulin pumps will become even more accurate and user-friendly, helping people manage diabetes more effectively and with less effort. As a result, both patch and tethered pumps will continue to play an important role in shaping the future of diabetes care.

By Product Type

The global insulin pumps market is expected to see steady growth as diabetes becomes more common across the world. With an increasing number of people being diagnosed with both type 1 and type 2 diabetes, there is a clear need for more advanced and user-friendly insulin delivery systems. Insulin pumps offer an alternative to multiple daily injections and help users manage their blood sugar levels more effectively. As awareness about the benefits of using pumps continues to grow, more people are likely to consider them as a reliable option for everyday use.

By product type, the market includes devices such as MiniMed, Accu-Chek, Tandem, Omnipod, My Life Omnipod, and others. Each type has its own features that appeal to different user needs. For example, MiniMed pumps are well-known for their continuous glucose monitoring compatibility. Accu-Chek pumps are appreciated for their simplicity and user-focused design. Tandem pumps offer touchscreens and software updates, which may attract younger users who prefer smart technology. The Omnipod and My Life Omnipod are tubeless options that provide more freedom of movement, which is important for people with active lifestyles. The demand for variety shows that no single design works for everyone, and companies are trying to meet different needs.

In the coming years, the global insulin pumps market will likely shift toward more personalized technology. This means pumps that adjust insulin delivery automatically based on real-time glucose data. With improvements in artificial intelligence and smart sensors, these devices may soon be able to learn from a user’s habits and make better predictions. This will reduce the need for manual input and lower the risk of error. People will likely feel more confident in managing their condition, especially younger patients and caregivers.

Price and accessibility will also play a role in shaping the market’s future. As technology gets better, companies may find ways to reduce costs, making these devices more available to a wider group of people. Insurance coverage and government health programs could also expand their support. Education and awareness campaigns might help people understand how insulin pumps work and why they could be the right choice for long-term diabetes care.

In short, the future of the global insulin pumps market looks promising. With constant innovation and a growing focus on personal comfort, safety, and convenience, these devices are likely to become a regular part of diabetes treatment around the world.

By End-user

The global insulin pumps market is showing signs of steady growth, and this trend will likely continue in the years ahead. With diabetes becoming more common, the demand for efficient, user-friendly insulin delivery systems is on the rise. Insulin pumps are becoming an important tool for better diabetes management. They help people regulate blood sugar levels more precisely and with less effort than traditional methods. This shift in preference will play a major role in shaping the market in the future.

By end-user, the global insulin pumps market is divided into hospitals and clinics, homecare, and laboratories. Each of these sectors contributes in a unique way. Hospitals and clinics are at the front line, using insulin pumps as part of their routine diabetes treatment programs. These settings often deal with newly diagnosed patients or those with serious conditions, and healthcare workers need reliable tools to manage insulin therapy. As awareness and education improve, more hospitals and clinics are choosing insulin pumps for both short-term and long-term care.

The homecare segment is becoming more important as patients look for ways to manage their condition in a more private and convenient setting. Many users now prefer devices that are easy to operate at home, and technology is making this possible. In the future, more advanced pumps will likely connect to apps or cloud-based platforms, letting users and doctors monitor blood sugar levels remotely. This will reduce hospital visits and allow for quicker adjustments in treatment, leading to better control and improved quality of life. Homecare use will continue to grow as older adults and busy patients seek simpler ways to manage their daily insulin needs.

Laboratories may not be the first place one thinks of for insulin pumps, but they play a part in testing and research. As innovation moves forward, laboratories help test new designs, software improvements, and safety features. Their role in pushing technology forward is key to future market developments. With continued research, future insulin pumps may become smaller, smarter, and more personalized, which will appeal to both healthcare providers and patients.

Overall, the global insulin pumps market will expand as new technology meets growing medical needs. All three end-user groups—hospitals and clinics, homecare, and laboratories—will keep influencing how these devices are made and used. In the coming years, more people will likely turn to insulin pumps, making them a standard part of diabetes care around the world.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6,395.34 million |

|

Market Size by 2032 |

$11,076.67 Million |

|

Growth Rate from 2025 to 2032 |

8.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global insulin pumps market is shaped by geographical differences in healthcare infrastructure, awareness, and access to advanced medical technology. As we look at this market across regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, it's clear that each region plays a unique role in how the industry is expanding and changing. North America, with the United States, Canada, and Mexico, has remained a leader due to its widespread adoption of new technology, better insurance support, and strong investment in healthcare research. The U.S. in particular continues to push innovation in medical devices, including insulin pumps, creating a model that many other countries aim to follow.

Europe, which includes countries like the UK, Germany, France, Italy, and others, is another major player. With high awareness of diabetes and good access to public healthcare, insulin pump usage has steadily grown. These countries are focusing on early diagnosis and patient education, making it easier for individuals to manage their condition effectively. As technology improves and smaller, smarter pumps become available, their use is expected to increase even more. The push for personalized care across Europe also supports the broader adoption of these devices.

In the Asia-Pacific region, which includes India, China, Japan, South Korea, and other nearby countries, growth is becoming more noticeable. Although some areas still face challenges in access and affordability, there is growing demand for better diabetes care. Rising income levels, an increase in diabetes cases, and a younger population that is more open to using wearable devices are all helping drive future growth in this region. Local companies are also entering the space, offering more cost-effective products tailored to regional needs.

South America, with Brazil, Argentina, and neighboring countries, is beginning to see a shift. Though the market is not as mature, government efforts to improve healthcare services and growing awareness of diabetes are starting to create new opportunities. As systems improve, more people will likely turn to insulin pumps for better control of their condition.

In the Middle East & Africa, including the GCC countries, Egypt, South Africa, and others, the outlook is also shifting. There is a clear effort to invest in healthcare and technology, especially in wealthier nations within the region. As public health campaigns and education increase, so will interest in more advanced treatment options. Over time, this will support a broader adoption of insulin pumps. Overall, the global insulin pumps market is expected to grow steadily, shaped by regional differences but united by a common need for better diabetes care.

COMPETITIVE PLAYERS

The global insulin pumps market has been growing steadily, with a future that points toward even greater innovation and wider accessibility. As diabetes continues to affect millions across the globe, the demand for better treatment options is rising. Insulin pumps are becoming a more preferred choice for many patients, offering better blood sugar management and increased convenience compared to traditional injection methods. This shift is creating strong competition among several companies working to develop advanced and reliable devices.

Companies like Medtronic, Hoffmann-La Roche AG, and Tandem Diabetes Care, Inc. are pushing boundaries by investing in smarter pump technologies. These include features such as automated insulin delivery, Bluetooth connectivity, and seamless integration with continuous glucose monitors. Tandem Diabetes Care, for example, continues to gain attention for its user-friendly designs and software upgrades that enhance patient experience. Meanwhile, Medtronic remains one of the leading forces with its hybrid closed-loop systems that work in sync with glucose sensors to adjust insulin levels automatically.

Other players such as Ypsomed and Beta Bionics are exploring newer designs that will focus on more personalized insulin delivery. Beta Bionics is known for developing the iLet Bionic Pancreas, which mimics the body's natural ability to regulate blood sugar, something that might become a standard in the near future. Sanofi S.A. and Sooil Development are also looking to strengthen their positions by offering competitive pricing and simplified usability, making their devices more accessible to people in emerging markets.

In addition to these established names, companies like EOFlow Co., Ltd., Cellnovo Ltd, and Bigfoot Biomedical are shaping the next generation of insulin delivery systems. These firms are focused on compact, wearable devices that allow users to manage their condition without disrupting their daily lives. EOFlow’s wearable patch pumps and Bigfoot Biomedical’s AI-based insulin dosing technology could become game changers, especially for younger users or those new to pump therapy.

The global insulin pumps market will likely see more cooperation between hardware manufacturers and digital health platforms. Nipro Corporation and Dexcom Inc. are good examples of companies involved in supporting technology like continuous glucose monitoring, which complements insulin pump systems and helps improve health outcomes. As more companies join this space and existing ones evolve, the future of insulin pump technology promises better safety, smarter automation, and broader reach to those who need it most.

Insulin Pumps Market Key Segments:

By Type

- Patch Pumps

- Tethered Pumps

By Product Type

- MiniMed

- Accu-Chek

- Tandem

- Omnipod

- My Life Omnipod

- Others

By End-user

- Hospitals & clinics

- Homecare

- Laboratories

Key Global Insulin Pumps Industry Players

- Medtronic

- Hoffmann-La Roche AG

- Tandem Diabetes Care, Inc.

- Ypsomed

- Sanofi S.A.

- Sooil development

- Jiangsu Delfu Co., Ltd.

- Cellnovo Ltd

- Beta Bionics

- EOFlow Co., Ltd.

- Debiotech SA

- Bigfoot Biomedical

- Nipro Corporation

- Dexcom Inc. (indirect, through CGM + closed-loop systems)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383