MARKET OVERVIEW

The global industrial insulation market is of key importance for the industrial sector in energy efficiency through the reduction of the operational costs. Advanced insulation materials will experience high demand due to the ongoing trend of energy-efficient and sustainable industrial operations. The market comprises insulation such as, among others, mineral wool, fiberglass, and foam; these contribute to less energy consumption and improved safety standards which benefit the chemical, power, and manufacturing industries at large.

In terms of insulation for future industry trends, those would further develop along the lines of sustainable energy solutions and increasing stringent environmental regulations. In the next few years, businesses would increasingly consider factors other than energy efficiency when selecting their insulation materials. With the deterioration of climate change implications, businesses are likely to incorporate insulation solutions that will minimize their carbon footprints. Innovations in advanced insulation materials above and beyond thermal and acoustic properties will be emphasized as recyclable and nontoxic.

The global industrial insulation market is dynamic towards advancements in insulation materials as driven by technological improvement. The high-performance insulation systems will be focusing on ensuring the very extreme requirements of industries, such as oil and gas demands, for example, thermally resistant. Innovations may also explore materials such as aerogels and nanomaterials or include bio-based solutions. This will help industries achieve insulation performance much better in high temperatures while improving safety and operational efficiency.

While maintaining market dynamics, demand will continue to the concern of industrial insulation. The more complex machines get automated and systemized, the more likely an accident is to happen, or a person is to be exposed to dangerously high temperatures or harmful chemicals. Safety remains a very integral component of industrial environments in terms of insulation to prevent accidents and failure of equipment. What remains to be seen is an increase in the type of insulation materials designed to be thermal resistant as well as fire- and corrosion-resistant, ensuring the longevity of industrial equipment.

As more and more industries in the world moderns require their infrastructure to be upgraded and modernized, the use of insulation in all-things industrial will soon skyrocket. From power generation plants right to petrochemical plants, the thermal insulation requirement is bound to expand in all respects, but primarily for the conservation of energy and minimizing operational costs. Insulation will aid much in industries where energy is mostly dictated by volatile temperatures-with effective insulation preventing heat losses and hence enhancing productivity, as well as improving the reliability of systems.

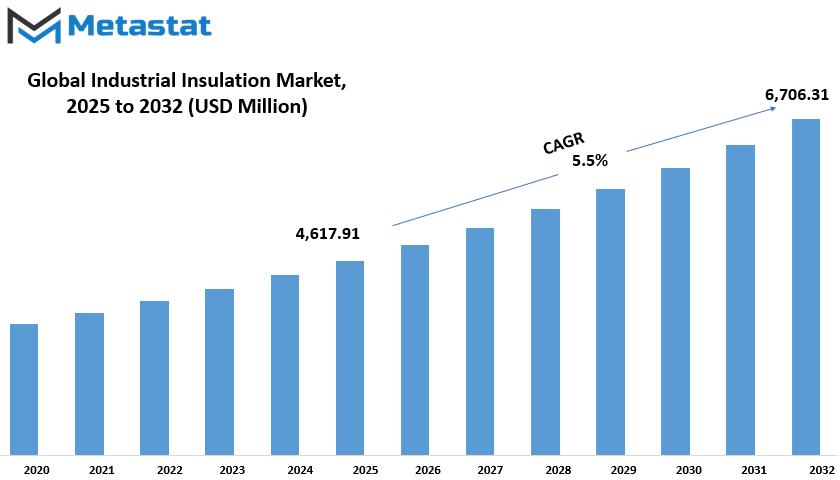

Global industrial insulation market is estimated to reach $6,706.31 Million by 2032; growing at a CAGR of 5.5% from 2025 to 2032.

GROWTH FACTORS

The global industrial insulation market is poised for substantial growth with energy efficiency gaining traction and the chemical and petrochemical process industries expanding. As these industries factor energy savings and efficiency into their operations, the importance of good insulating practice becomes pronounced.

The global industrial insulation market gives consideration to demand from the chemical and petrochemical industries. These industries need stringent temperature control within their operations; therefore, their growth, particularly in the developing markets, is expected to add to the demand for insulation materials.

However, the market is going to be pulled back by certain factors. The sporadic raw material prices, an area of concern, strike a decisive blow against growth. The price volatility of rare materials like fiberglass, mineral wool, and foam is determined mostly with rigid supply-demand dynamics, changes, and imbalances in global trade conditions. Such changes make it impossible for insulation manufacturers to determine stable production costs; hence, these companies might raise their selling prices to their respective end customers. Enforcement of strict regulations and standards by governments and organizations to ensure insulation material safety and environmental sustainability is a huge concern due to the cost of complying with those regulations, restricting market share of certain materials.

The very same market obstacles, however, also harbor many opportunities that could drive growth to the greater extent. The most promising opportunity is anticipated to emerge from expanding emerging markets. Such countries in regions of Asia-Pacific, the Middle East, and Africa are experiencing rapid industrialization and infrastructural developments. Such developments, in synergy with increasing energy efficiency awareness, will provide a conducive environment for industrial insulation products. The demand for advanced insulation solutions with energy-saving applications and optimized production processes will surge as the industries develop in these regions.

The global industrial insulation market is growing rapidly due to the demand for efficient energy usage on the one hand and the expansion and growth of the chemical and petrochemical industries on the other. With focus on improved energy savings and operational efficiency within industries worldwide, the need for good insulating practice is being greatly recognized.

Finally, the global industrial insulation market is set to carry on with growth, mostly as a result of energies for efficiency, and the furthering in industries of importance. However, challenging factors such as fluctuation in raw material pricing and rigorous restrictions will have some bearing in growth. On the other hand, opportunities present themselves in the form of emerging markets, giving an optimistic glance into the future.

MARKET SEGMENTATION

By Product

The global industrial insulation market around the world has been growing steadily in recent years, and now almost all industries need to be concerned about energy efficiency and safety. Industrial insulation provides temperature control, reduces energy losses, and increases efficiency in the complete system. Reliably growing demand continues for industrial insulation since industries take strides in controlling emissions and little energy costs. Oil and Gas, Power Generation, Chemicals and Manufacturing are highly demanding such that it needs the specific temperature regarding safety and performance issues.

The global Industrial insulation market by product type: Each type has been introduced to fulfill the demand of an application. These are pipe insulations which hold an outstanding value of $2,295.17 million and are used for heat loss protection of pipes, which will in certain circumstances assure the material being transported stays at the desired temperature. In both refineries and chemical plants, any insulated pipe must perform its function efficiently and safely.

After pipe insulation, board and blanket insulation make another contributing segment of the market. Boards are preferred mainly in high-temperature applications, especially in equipment or walls subjected to sustained heat exposure. They carry an impressive strength-to-weight ratio that will withstand pressure. Blanket insulation, on the other hand, is flexible and easy to work with and is therefore great for large areas or odd shapes. Installations within large industrial buildings or around equipment needing insulation where rigid materials are not accepted are common. Other things do get used in a low market share but to a set specific purpose depending on the need of a facility, such as fire-resistant insulation and soundproofing.

The global demand for industrial insulation products is being spurred by the imposition of mandatory environmental regulations on energy conservation. As the governments promote low carbon emissions, industries are forced to revamp their operations, including insulation. With soaring energy costs, it has become imperative for firms to minimize wastage. This, in turn, enhances profitability and protects the environment.

In brief, the global industrial insulation market highlights growth since industries measure efficiency and safety. With pipe insulation in front with a value of $2,295.17 million, followed by board, blanket, and other types of insulation, this market will witness further growth from the economic angle and environmental commitments that support it.

By Material

There is different insulating materials used in the world for the global industrial insulation market that directly relate to industries concerning temperature control, energy conservation, and safety. Glass wool is one of the most popular materials. It is lightweight and thermally resistant making its use common in industrial power plants, refineries, and chemical processing plants. Glass wool is created entirely from recycled glass and sand and is thus efficient and environmentally friendly. The fibers trap air and slow thus transferring heat, keeping systems efficient, energy savings, and delivering better outputs.

Mineral wool is another standard option. It usually comes with high-temperature resistance, hence a good material. This material is, in general, obtained from basalt or slag which is melted and spun into fibers. Mineral wool really possesses great soundproofing features apart from its thermal insulation capability, and it enjoys common usage in industries that lay great emphasis on noise control. It is highly fire- and moisture-resistant: hence safe application in heavy-duty demands.

Foamed plastics like polyurethane and polystyrene are key for this business segment of industrial insulation. These materials are light in weight and are renowned for their high insulating power; they are convenient for application and can be formed into almost any required shape for insulations of pipes, tanks, and equipment. They are common with relatively few limitations; however, as they are not fire and certain chemicals resistant, yet this weakness is compensating by their flexibility and low thermal conductivity.

Another name of significance is calcium silicate, pertinent, and applicable in those industries where the temperatures are severely high, like petrochemical industries and steam production plants. Strength, fire resistance, and durability are termed as the advantages of this material. The material does not shrink or crack when subjected to heat, which in turn retains its insulation effectiveness for a long time.

Many more materials belong to the list for certain applications while others can be chosen based on job specifications and environmental conditions. There could be aerogels, perlite, or even ceramics for special needs where standard insulation materials may not perform adequately.

The demand for insulation materials will increase considerably as industries concentrate on energy efficiency and safety, as well as compliance of infrastructural facilities to regulations. This is so because each one gravitates to this demand while presenting its unique offerings, thus ensuring continued growth of the global industrial insulation market at the global level.

By End-Use Industry

All over the world where industrial insulation is concerned, there has been a paradigm shift toward energy conservation and cost minimization for the past decade or so with the key focus being an energy-efficient insulation system. A very bright future of growth awaits the global industrial insulation market because energy-saving programs and environmental regulations are forces that regularly push industries for insulation solutions. These solutions hold the requisite temperature for industrial systems; help prevent the loss of energy through conduction and ensure a safe environment for the people involved. Hence, insulation is taking an increasingly pivotal role, especially with all these moving industries and energy demand.

Some markets under the industrial insulation category include Oil and Gas, Chemicals and Petrochemicals, Power Generation, Food and Beverage, and Automotive, among others. Oil and Gas cover the largest share of industrial insulation metal, mainly due to their temperature control of pipelines, storage tanks, and process units. Such insulation acts to save energy and provide a safe temperature for the workers against poor working conditions. In the chemical and petrochemical industries, insulation is used to ensure safety during high-temperature processing while preventing any chemical reactions due to temperature variations.

Insulation is also important for energy generation applications. Insulation helps to optimize boilers, turbines, and other high-temperature equipment in this sector by preventing energy losses that lead to cleaner and efficient power generation. In the Food and Beverage sector, insulation helps maintain good hygiene and regulates temperatures in processing and storage areas to avoid spoilage and guarantee product quality.

The automotive industry uses insulation for thermal and acoustic comfort in vehicles. Insulating parts such as the engine and exhaust system not only regulates heat but also heightens driving pleasure by alleviating noise. The category "Others" includes pharmaceutical and textile industries and construction, where insulation materials are utilized for related thermal and protective applications.

The demand for energy efficiency, safety, and compliance with standards is an active driver in pushing industries to invest in further insulation solutions. As technology matures and materials evolve, fully-fledged insulation remains in the fore across numerous industrial activities. Its role toward a good energy-management working environment, financially and from a modern-day performance stand, is the industry's heartbeat. The global industrial insulation market will continue to keep attaining growth because of several industries acknowledging the significance of effective insulation.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,617.91 million |

|

Market Size by 2032 |

$6,706.31 Million |

|

Growth Rate from 2025 to 2032 |

5.5% |

|

Base Year |

2024 |

|

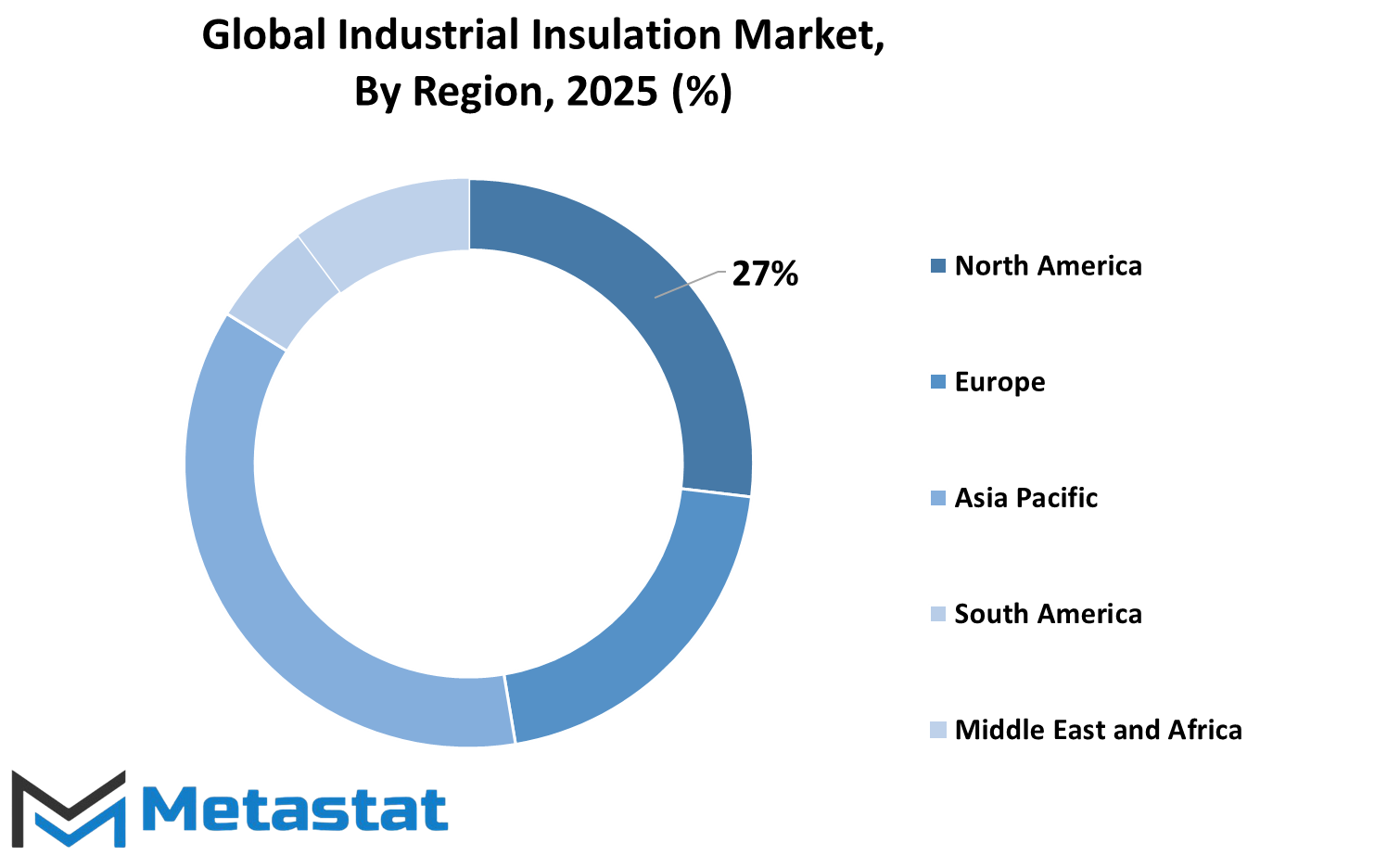

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global industrial insulation market has been divided into broad areas and various regions according to certain specific countries and fields of interest. North America extends to the three countries, i.e., the United States, Canada, and Mexico. The development of the highly industrialized countries coupled with the increased demand for energy efficiency makes them a three-way contribution to the market. Despite the high cost of operation, these countries have put into place safety measures through the use of insulated materials, making the industries highly encouraged to reduce energy loss at the industrial areas. The U.S. Government has continuously been investing in industrial development and has also put in place a strict regulatory system promoting energy-conserving technologies to be leaders in the market.

Russia, however, constitutes another vital region among the rest of the world, as far as the global industrial insulation market is concerned. This includes countries such as the UK, Germany, France, Italy, and the Rest of Europe. By being pioneer champions of sustainable practices, Europe has for many years continued to develop guidelines for its industrial processes. Insulation solutions in use in Europe are put in place for compliance with such environmental regulations, thus decreasing their carbon footprint. Two of the leading countries pushing for greenness in the industrial sector are Germany and France. One of the features of this region is the increase in the need for insulation as industries become more responsible for the environment.

Asia-Pacific thus occupies a valuable portion of the market and will grow the fastest over the years to come. India, China, Japan, South Korea, and the rest of Asia-Pacific are characterized in this region. The rapid growth experienced in the region results from industrialization, urbanization, and growing consciousness of energy-saving technologies. In particular, China and India lead far faster growth rates in the construction and manufacturing sectors, resulting in heavy demand for insulation materials. Furthermore, the governments of both countries are giving support to energy efficiency practices, and this is a great contributory factor to the market development.

South American countries include Brazil, Argentina, and the Rest of South America. The region is yet to develop like others, although industrial insulation is slowly making its way in here, particularly in oil, gas, and energy industries. Brazil has indeed modernized the industries, being the largest south American contributor to reduce energy consumption.

Last but not least are the countries of the Middle East and Africa, which include GCC Countries, Egypt, South Africa, and the Rest of Middle East and Africa. This region is continuously increasing in the requirement of insulation as increased growth in industries is focused on reducing extreme temperatures as well as improving energy efficiency. The oil and gas sector of the GCC countries has been particularly interested in high-end insulation system implementations, while South Africa is busy adjusting its industrial activities to meet international standards.

COMPETITIVE PLAYERS

The main principle behind energy insulation is the consideration of energy efficiency, reduced emission, and safety mechanisms in various fields of the global industrial insulation market, manufacturing, oil and gas, power generation, and chemical processing. Industrial insulation serves as a temperature controller and minimizes energy losses and process instabilities. At present, industries are striving to find ways to comply with compulsory regulations while seeking improved performance and minimizing non-energy uses. With increasing awareness, this need is rapidly becoming troublesome for industries bound by regulations.

Several key players are actively involved in shaping the global industrial insulation market by developing and supplying good-quality products that meet various needs. The leading players-Rockwool Group, Owens Corning, Saint-Gobain S.A., Knauf Insulation, Johns Manville, Kingspan Group PLC, and Huntsman Corporation-have dedicated considerable resources towards research and development to provide materials that are durable, reliable, and environment-friendly. Advances in thermal and acoustic insulation have improved industrial performance especially in those areas where energy regulations are stringent or energy usage is very high.

In addition to that, Armacell International S.A., BASF SE, L'Isolante K-Flex S.p.A., Promat International NV, and Paroc Group Oy that have built their names by providing insulation solutions for demanding industrial environments. The insulation solution is resistant to high-temperature extremes, moisture intrusion, and reduces chances of fire-associated risks to keep operations safe and sound. As energy requirements continue to grow and increase in complexity, it remains paramount that any insulation employed in application must be reliable.

Key companies that stimulate further growth include Aspen Aerogels, Inc., Cabot Corporation, Thermaxx Jackets, Anco Products, Inc., General Insulation Company, Solvay, Insulcon B.V., Etex Group, Nichias Corporation, and NMC SA. There are a range of products and solutions endorsed by these companies for both traditional industries and newer sectors in search of sustainable alternatives. Their undeterred focus on quality, performance, and customer satisfaction shall continue to tilt the market's scale in their favour. Industrial insulation will see a wider market with increasing global consciousness towards energy conservation and industrial safety.

Industrial Insulation Market Key Segments:

By Product

- Pipe

- Board

- Blanket

- Others

By Material

- Glass Wool

- Mineral Wool

- Foamed Plastics

- Calcium Silicate

- Others

By End-Use Industry

- Oil & Gas

- Chemical & Petrochemical

- Power Generation

- Food & Beverage

- Automotive

- Others

Key Global Industrial Insulation Industry Players

- Rockwool Group

- Owens Corning

- Saint-Gobain S.A.

- Knauf Insulation

- Johns Manville

- Kingspan Group PLC

- Huntsman Corporation

- Armacell International S.A.

- BASF SE

- L’Isolante K-Flex S.p.A.

- Promat International NV

- Paroc Group Oy

- Aspen Aerogels, Inc.

- Cabot Corporation

- Thermaxx Jackets

- Anco Products, Inc.

- General Insulation Company

- Solvay

- Insulcon B.V.

- Etex Group

- Nichias Corporation

- NMC SA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252