MARKET OVERVIEW

The global lubricants market, an important sector of the business of industrial chemicals and automotive fluids, will continue to be in an important position to reduce friction, wear, and heat formation within mechanical systems. The market will include a wide variety of fluid materials that are formulated to enhance operating efficiency and the life of machinery, engines, and components. Be it the engine of a car to heavy machinery used for industrial purposes, lubricants will assist in a range of functions including transmission, hydraulic movement, gear action, and general maintenance. The global lubricants market will be quite broad in terms of touching various industries that each necessitate product specifications and performance requirements. Automotive applications will require engine lubricating oils, transmission lubricants, and brake lubricants with stringent requirements for fuel economy, emissions management, and protection of components.

In contrast, the industrial market will employ gear lubricant, compressor lubricant, and hydraulic lubricant specifically for particular equipment and application purposes. Marine and aerospace will also draw upon high-performance lubricant, but with unique requirements such as oxidation resistance, extreme temperature conditions, and fluctuating pressure conditions. This market will contain a broad range of lubricant forms, broadly categorizing under mineral-based, synthetic, and bio-based. Both will be offering special advantages depending on the purpose of use. Refining mineral lubricants from crude oil will have extensive use for everyday demands, while synthetic will be utilized for high-stress applications with higher thermal stability and longer life.

Bio-based lubricants made from renewable raw materials will attract attention on the basis of future regulatory and environmental issues but will still face technical as well as economic limitations in large-scale applications. With respect to supply and distribution, the global lubricants market will co-exist with a multi-tiered structure of manufacturers, regional distributors, and retail distributors. Major oil companies will have the largest market share, but also specialized formulators and local suppliers with a high presence by offering customized solutions and local support. Private-label lubricant products will increase in cost-sensitive markets, while branded ones will remain more popular in markets where quality and technical competence are not subject to compromise. Standards and regulations will be instrumental in driving product formulations and labeling across regions. There will be a different set of regulations for base oil type, additive package, and environment labeling for each country, and therefore, companies will have to develop region-specific products.

The need to meet regulatory bodies such as American Petroleum Institute (API), European Automobile Manufacturers' Association (ACEA), and Japanese Automotive Standards Organization (JASO) will also shape the way in which products are tested, certified, and marketed. Global Lubricants will intersect with a number of the world's technological innovations, such as vehicle electrification, factory automation, and condition-monitoring systems. The technologies will alter the type of lubricant required and the pace at which they are dispensed or replaced. As technology redefines performance needs in engines and machinery, the industry will evolve by introducing formulas that can provide just what is needed. By cutting across technologies, industries, and geographies, the global lubricants market will remain in demand with its direct influence on mechanical efficiency and operational reliability.

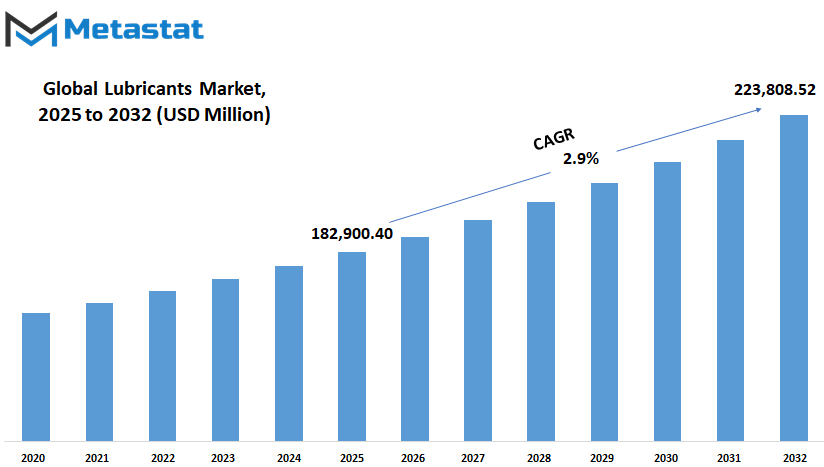

Global lubricants market is estimated to reach $223,808.52 Million by 2032; growing at a CAGR of 2.9% from 2025 to 2032.

GROWTH FACTORS

The global lubricants market is expected to undergo unprecedented changes driven by changing needs and evolving innovations. With industries expanding and emerging technologies taking center stage, the need for quality lubrication products increases. The biggest driver for this expansion is the unstoppable increase in the production of cars. As increasingly more cars are produced to meet global transportation needs, the need for quality lubricants will continue to escalate. Apart from the automotive industry, industrial machinery usage in the manufacturing and construction industries also fuels demand. The machinery used in such contexts requires periodic maintenance, such as periodic lubrication to avoid wear and ensure system performance. Another prime driver that will shape the future of the market is a growing demand for high-performance synthetic lubricants.

These high-end products offer such benefits as longer life in service, better endurance of rough temperatures, and increased fuel efficiency. Because of these advantages, a range of industries—going from the automotive industry to heavy manufacturing—are moving more and more towards synthetic alternatives. The trend does not appear to let up and will likely be a major factor in how the global lubricants market evolves over time. Even with these positive trends, there are several things that may hold up progress. One of them is the volatility of crude oil prices. Lubricants are usually made with petroleum products, and as oil prices tend to fluctuate, so do production expenses for such products.

In addition, tighter environmental laws exist in most parts of the world. The regulations attempt to limit hazardous emissions and promote sustainability but end up limiting utilization of certain chemical additives in traditional lubricants. The future, however, looks promising with new directions. More and more firms are investing in the manufacturing of bio-based and environmentally friendly lubricants. These are created with natural additives and are designed to break down more readily, so they are less damaging to the planet. As more companies seek to reduce their carbon footprint and be green compliant, there will be greater demand for these environmentally friendly solutions.

This shift not only benefits environmental goals but also brings new business opportunities. In the years to come, the global lubricants market will likely evolve through a combination of robust demand, innovation, and reaction. While there are challenges, these are met with growing awareness and development, which holds out a future full of potential for both producers and consumers.

MARKET SEGMENTATION

By Type

The global lubricants market will keep facing consistent changes in how it operates as a result of increasing need for machinery that works faster and lasts longer. With industries shifting towards improved technology and more environmentally friendly options, the demand for better lubrication products will also increase. Lubricants are important in the operation of equipment by decreasing friction, managing temperature, and increasing the lifespan of machinery. This will become increasingly significant as more industries move towards automation and effective systems. In the future, more industries will need specialty oils that can facilitate both high-performance and environmentally friendly operations. The global lubricants market by type is moving into more specialized categories, with each type having a distinct function in machines and engines.

Engine oil, for instance, will continue to be necessary for cars and generators as firms seek oils that assist in fuel efficiency and lower emissions. Hydraulic oil will also increase in demand as manufacturing equipment and construction equipment become more complex and need smoother motion and improved pressure control. Gear oil is important in allowing gear systems to manage heavy loads and prevent wear, a situation that will become more significant as machinery is becoming more compact but powerful. Compressor oil lubricates air systems, and its function will remain significant as air-based machines and tools increase in industry as well as home use. Greases will be effective where oils cannot be used easily, and they will increasingly become specialized to meet the requirements of various industries. Industrial oils will find a firm position in heavy usage in applications, particularly in factories with round-the-clock production lines.

Transformer oils support smooth operation of electrical systems, and their demand will increase with the expansion in renewable energy infrastructure and smart grids. Turbine oils will be the key to maintaining turbines operating in power plants and renewable energy facilities. Marine lubricants will also continue to have an important role as shipping and sea travel remain key to trade. In the future, the Global Lubricants industry will be defined by how well these products can adapt to new requirements. As equipment becomes smarter, lighter, and faster, the oils that help drive them need to become better too. Lubricants will be an unobtrusive but central component of the world's expanding technology.

By Application

The global lubricants market will keep on growing consistently as more demand is seen in a number of key regions, particularly where there are industries dependent on machines and engines. With industries striving to perform better, maintain high efficiency, and be more sustainable, the use of efficient lubrication becomes a necessity now more than ever. The future will see a continuation of newer kinds of lubricants that will be capable of withstanding more stress, more prolonged operation cycles, and increasingly stricter environmental regulations. This will require manufacturers to make products that not only extend the life of machines but also assist in curbing emissions and waste. In the automotive sector, the demand for lubricants will continue to be robust.

With the ongoing innovation in commercial vehicles and passenger cars, new engines and mobile parts will require lubricants to withstand high heat and long operating hours. While electric cars are becoming popular, conventional engines are still dominantly used, particularly where full electric conversion is not yet achieved. Commercial trucks, specifically, will continue to rely on sophisticated lubricants to keep heavy loads and long distances moving. In this arena, the global lubricants market will predominantly move toward products that lengthen oil change intervals and help ensure fuel economy. The industrial aspect of things also will come into play. Equipment applied in manufacturing, construction, and power generation rely on consistent lubrication to avoid harm and minimize downtime.

As these sectors become more modernized, there is pressure to create lubricants with improved service life and which can withstand more challenging conditions. Automation and incorporation of smart technology into equipment will also have an impact on how lubricants are created and tracked. Sensors might even monitor how well the lubricant is operating in real-time in the future, warning consumers before something goes wrong. Outside of terrestrial industries, other sectors such as marine, aviation, and agriculture will also continue to require specialized lubricants. Ships and aircraft work under harsh conditions, typically without access to regular maintenance. Lubricants in such settings have to withstand high pressure, temperature fluctuations, and extended operating hours. Agriculture, which tends to employ heavy equipment over large fields, will appreciate products that can survive dust, heat, and prolonged use. Overall, the global lubricants market will evolve with the changing needs of the world. From smoother engines to longer machines, this market will evolve to overcome the challenges of the future while also concentrating on cleaner and smarter solutions.

By End User

The global lubricants market will also expand and evolve as businesses from around the globe require smoother and more efficient operations. Lubricants are critical in minimizing wear and tear, keeping equipment cool, and maximizing the lifespan of engines and other mechanical equipment. With more industries realizing the value of effective maintenance, the demand for state-of-the-art lubricant solutions will increase consistently. There will be a definite drift in the years to come towards more sustainable and cleaner lubricant solutions prompted by environmental factors and increasing regulations across a wide range of nations. Consumer retail customers will remain an essential component in global lubricants market. With more people buying personal vehicles and becoming more involved in their upkeep, use of transmission fluids and engine oils will grow. Such customers tend to opt for easy-to-use products that last longer and need less maintenance. This group will remain loyal to firms in the industry that emphasize convenience packaging, instructions, and reliability.

Industrial consumers, however, will fuel demand for high-performance lubricants that will resist heavy-duty applications and harsh temperatures. Factory floors, mining equipment, and power plants all rely on equipment that cannot be allowed unplanned downtime. For such consumers, consistent lubrication will be viewed not only as an ancillary product but as an integral component of operations. With industries converging to automation and precision, their expectation from lubricants also will increase.

Commercial transport fleets will require lubricants extending the engine's service life and decreasing maintenance costs overall. Transport companies will, with increasingly tight delivery schedules and increasing fuel costs, rely on lubricants that improve fuel efficiency and lower emissions. Fleet managers will probable seek lubricants with real-time monitoring and predictive maintenance.

Marine and aviation businesses, though smaller markets, will keep calling for extremely specialized lubricants that meet the most demanding conditions. Saltwater contamination and pressures at high altitudes will necessitate advanced products that perform consistently in those applications. These industries tend to have stringent safety regulations in place, so lubricant performance will be monitored closely.

The farming industry is also going to expand, particularly as modern agriculture relies on more sophisticated machinery. From tractors to harvesters, smooth functioning becomes critical in narrow planting and harvesting windows. Lubricants that are specifically made to endure heavy outdoor usage, with dust and moisture resistance, will be in great demand. In the future, the global lubricants market will not only be about guarding engines but about enabling smarter, cleaner, and more efficient operations in all end-use segments.

|

Report Coverage |

Details |

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$182,900.40 million |

|

Market Size by 2032 |

$223,808.52 Million |

|

Growth Rate from 2025 to 2032 |

2.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

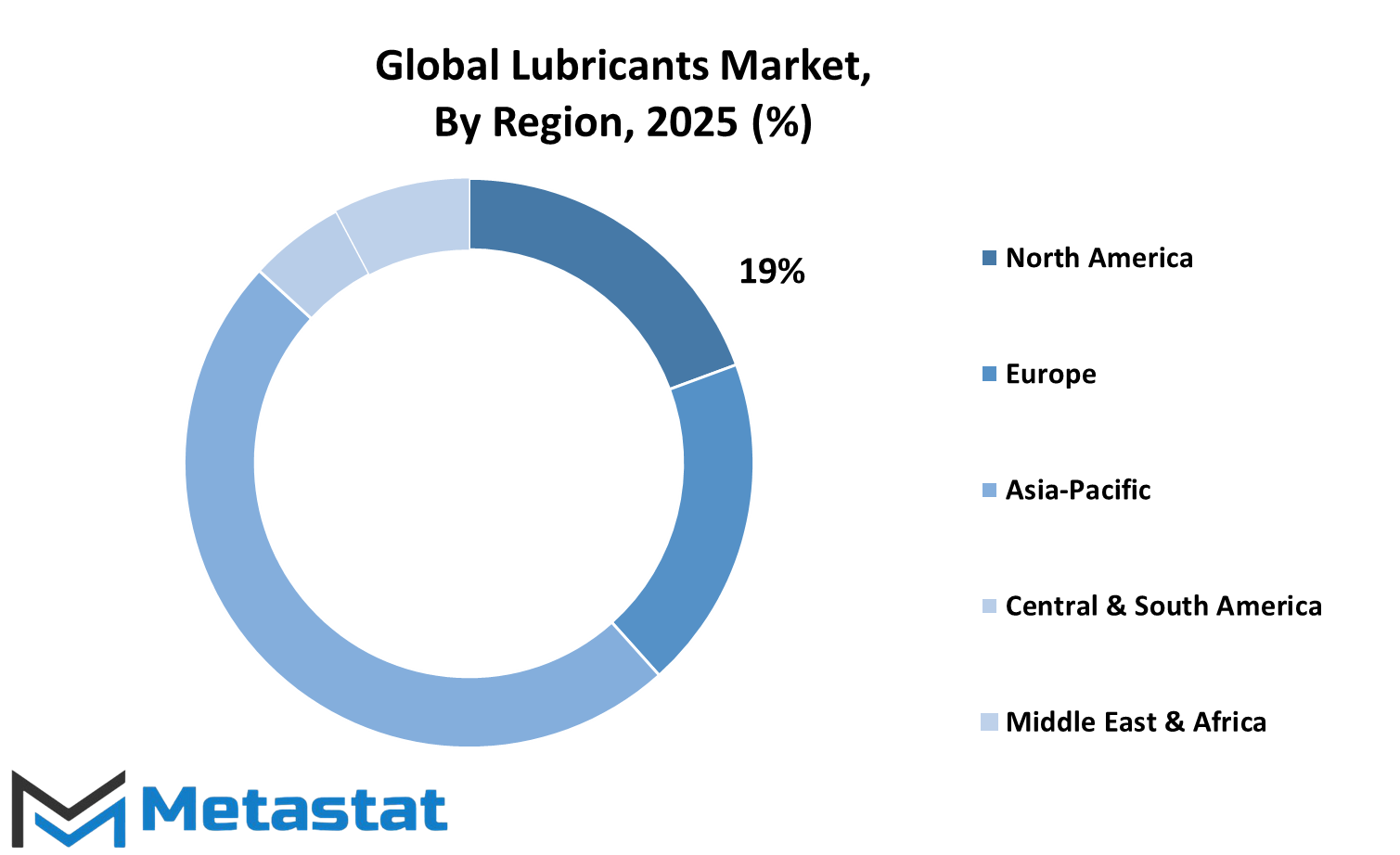

REGIONAL ANALYSIS

The global lubricants market will experience a series of transformations over the next few years. This change will be influenced by emerging technologies, altered customer behavior, more stringent environmental regulations, and differential demand in different regions. Each region of the world will have its unique trajectory, driven by its economy, industrialization, and energy demands. While there will be innovation-led growth in some regions, others will grow steadily with industry growth and enhanced mobility.

Where manufacturing and heavy vehicle usage are predominant, requirements for lubricants will continue to increase. These regions depend upon lubricants to ensure smooth-running machines, lower wear rates, and enhanced performance. More factories implementing equipment upgrades and more vehicles on the roads imply a higher demand for quality lubricants. Meanwhile, the emphasis on solutions that are longer lasting and cleaner will spur the use of synthetic products, particularly in environments where governments are driving people towards lower emissions. Advanced economies can go in a slightly different direction. In these regions, the drive for cleaner energy and stricter environmental regulations will result in new ways of producing lubricants and utilizing them. Organizations in these regions will likely fund research to come up with products that last longer and cause fewer environmental effects. These developments will potentially turn these regions into hubs for innovation, leading the way for the rest of the market.

Concurrently, in the emerging regions of the globe, demand is set to increase as a result of growth in the automotive and construction industry. As more roads, houses, and cars are built by these economies, they are also going to require more lubricants to fuel this expansion. Price sensitivity and availability, though, are going to be even bigger factors in these regions. While performance is crucial, numerous users would go for alternatives that are easier on the pocket and more readily available.

In the future, the global lubricants market will not go one way. Regional trends, economic change, and the rate of innovation will all influence how the market develops. Some regions will emphasize cleaner and more efficient products, whereas others will emphasize affordability and satisfying increasing demand. As firms adapt to these trends, the future of this market will be determined by the extent to which they get and react to regional needs. By having a proper balance of innovation and flexibility, every region will contribute to determining what is to come.

COMPETITIVE PLAYERS

The global lubricants market will further be influenced by innovation, sustainability measures, and evolving needs from different industries. With the world moving towards cleaner energy and improved machinery, the requirement for quality lubricants will continue to be a priority. Lubricants are an essential necessity in minimizing wear and tear, enhancing equipment performance, and prolonging machine life in automotive, industrial, and marine applications. The market will tend to evolve as consumers require more efficient, sustainable, and specialized products that satisfy both performance requirements and environmental standards. Main players have been fine-tuning their strategies to address these changing needs.

Firms like Mobil (ExxonMobil), Shell Philippines, and Chevron Philippines are spending on research to develop sophisticated products that reduce emissions and enhance energy efficiency. This action not only supports international environmental objectives but also serves the requirements of industries that pursue long-term savings and long life. Petron Corporation, Phoenix Petroleum, and Seaoil Philippines, on the other hand, have been building their presence in the country through enhanced distribution systems and customer services. Being close to end-users has allowed them to address individual market demands promptly. Fuchs Lubricants and Liqui Moly are looking at high-performance products aimed at specialized equipment, while Castrol (BP), Valvoline, and Motul are looking at synthetic blends and oils that can withstand harsh environments. These will continue to gain momentum as the transport industry shifts toward electric and hybrid cars, which have specific lubrication requirements.

Gulf Oil Philippines and Idemitsu are responding to global lubricants market trends and adjusting in terms of supply chain management and product development. Not only is the Global Lubricants industry impacted by technology but also by competition. Every business is striving to acquire a solid position through enhancing customer loyalty, product launches, and maintaining consistent quality. With more sectors depending on automation and machinery, demand for reliable lubricants will increase, compelling businesses to remain ahead with innovation and responsiveness. For the future, market leaders will be the ones able to deliver on expectations while remaining rooted in service and quality. This encompasses embracing new fuels, developing longer-lasting formulas, and providing bespoke solutions. The competition will have to remain flexible, earn trust, and keep investing in development to keep pace with evolving business and consumer demands.

Lubricants Market Key Segments:

By Type

- Engine Oil

- Hydraulic Oil

- Gear Oil

- Compressor Oil

- Greases

- Industrial Oils

- Transformer Oils

- Turbine Oils

- Marine Lubricants

By Application

- Automotive (Passenger Cars, Commercial Vehicles)

- Industrial (Manufacturing, Power Generation, Construction))

- Marine

- Aviation

- Agriculture

By End User

- Retail Consumers

- Industrial Users

- Commercial Transport Fleets

- Marine Operators

- Aviation Companies

- Agriculture Sector

Key Global Lubricants Industry Players

- Mobil (ExxonMobil)

- Petron Corporation

- Shell Philippines

- Chevron Philippines

- Total Philippines

- Phoenix Petroleum

- Seaoil Philippines

- Fuchs Lubricants

- Castrol (BP)

- Gulf Oil Philippines

- TotalEnergies

- Idemitsu

- Motul

- Liqui Moly

- Valvoline

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252