MARKET OVERVIEW

The Global Oil and Gas Biocides market and its industry are at the forefront of answering growing concerns in the oil and gas sector about efficiency, safety, and environmental standards. Demand for biocides will be particularly high due to oil and gas industry mainly because they retard the microbial growth that can cause pipeline or reservoir corrosion, blockage, or contamination of the processing equipment. This is crucial in biocide applications in smooth offshore drilling and production facility operations, taking into account the persistence threat of microorganisms to system integrity.

Biocides are chemical control agents that specifically target harmful microorganisms, including bacteria, fungi, and algae that thrive in water-based systems used for oil and gas extraction. The Global Oil and Gas Biocides market will find greater varieties in terms of product types and applications as companies seek more effective and environmentally friendly solutions. These biocides are to be prepared in different ways to tackle a specific microbial threat and tailored to suit the unique needs of differences in environments, such as offshore platforms, refineries, and gas treatment plants.

The Global Oil and Gas Biocides market shall have fulfillment of regulatory compliance and sustainable practices as one of its dominant themes. Governments, as well as international bodies, shall be throwing up stricter environmental regulations- starting the call for biocides that do not harm surrounding ecosystems. Thus, companies with upstream operations in the oil and gas sector will look for alternatives that may be less harmful, yet biodegradable and more than sufficient for operational requirements and environmental standards. Thus, there is a growing need for innovation for the development of eco-friendly biocides to replace their equivalent chemical-based counterpart.

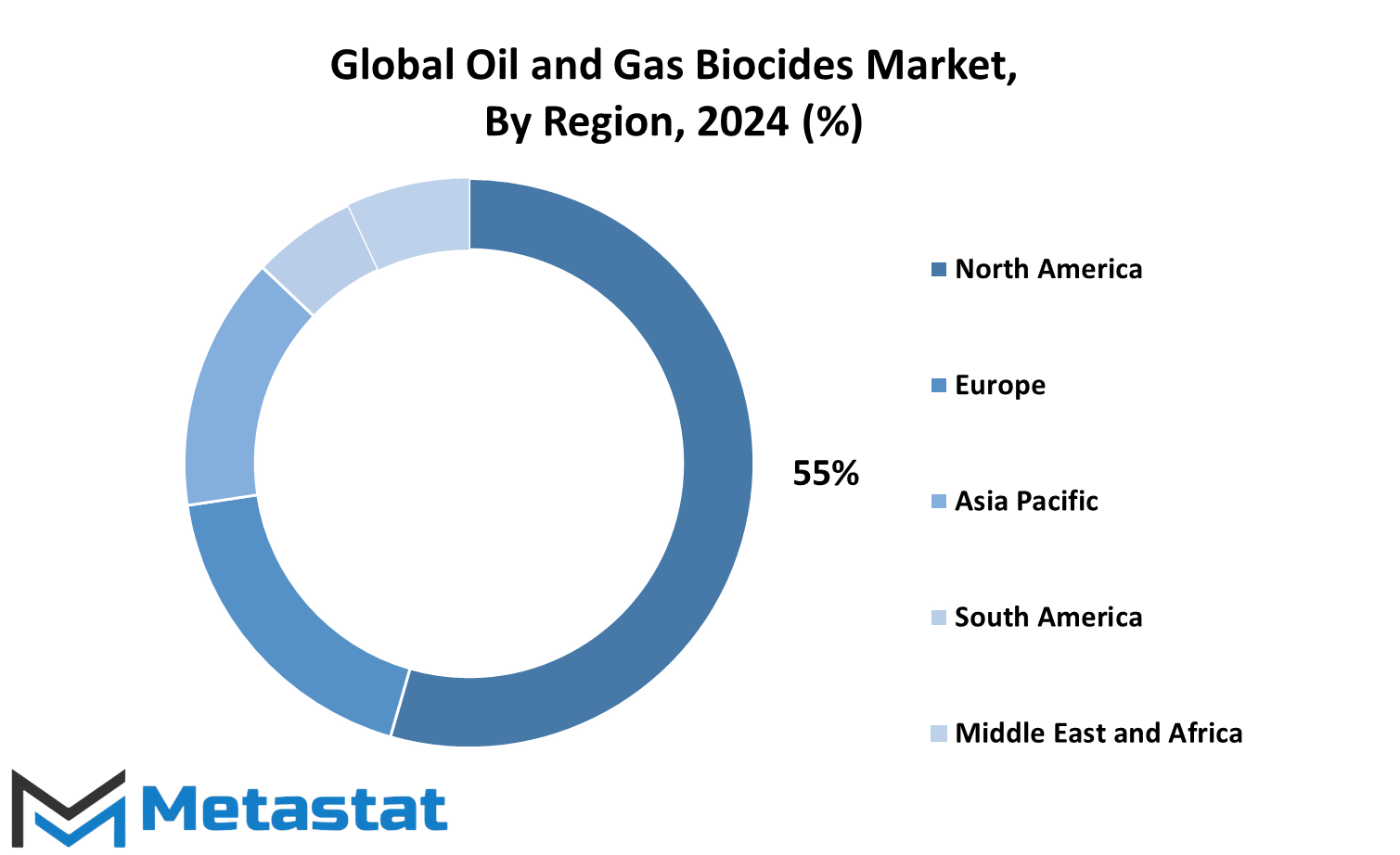

The Global Oil and Gas Biocides market is expected to extend its scope across regions such as North America, Europe, the Middle East, and Asia-Pacific. In North America, major oil reserves and shale gas formations will also determine the demand for more developed solutions of biocides to use against microbial contamination in the course of enhanced oil recovery and fracking processes. Demand would increase in the Middle East and Asia-Pacific regions as a result of increased oil production and exploitation activities, thus developing biocides predominantly for offshore drilling applications where the risk of microbial contamination is more significant. In these regions, products would be biased towards both harsh environmental conditions and extreme temperatures and pressures.

New technologies discovered in this regard are slowly coming into the market, and future treatments in terms of biocides will only indicate better methods in their application in the global market for oil and gas biocides. Such treatment systems, being the slower-releasing type and good application methods in their mechanism, will ensure that biocide application minimizes overall consumption without compromising effectiveness. Monitoring technology trends will also make it possible to spot microbial activities in real time, thus making operators apply biocides with greater accuracy, reducing cost, and maximizing system longevity.

Cost-efficiency, sustainability, and enhanced performance define the future shape of the Global Oil and Gas Biocides market. Manufacturers of biocides will continue to adapt their products in response to operators in the oil and gas industry. Increased demand for safer, cleaner, and more efficient biocidal solutions to protect oil and gas operations from environmental or microbiological damage will change the current market trend towards innovative products that can offer enough protection but at a reduced impact on the environment associated with oil and gas operations.

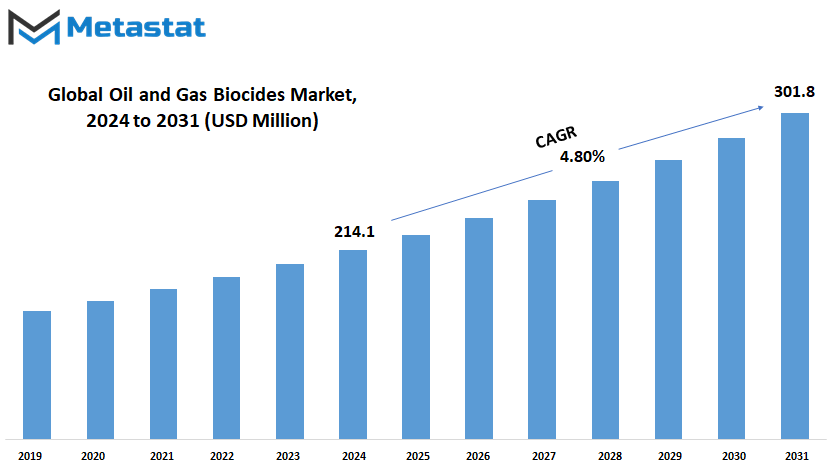

Global Oil and Gas Biocides market is estimated to reach $301.8 Million by 2031; growing at a CAGR of 4.80% from 2024 to 2031.

GROWTH FACTORS

The growth of the Global Oil and Gas Biocides market is, therefore, due to the increasing demand for effective microbial control in oil pipelines and storage tanks. Growth of microorganisms in these environments causes costly issues, such as corrosion, fouling, and sludge formation, raising concerns over equipment integrity and efficiency. As a result, operators in the oil and gas industry are spending more on biocides to reduce these microbial issues and therefore have trouble-free operations. The urge to safeguard pipelines and storage tanks from the destructive activities of microbes will continue to drive demand for biocides in the future.

Along with this, the rising onshore and offshore oil and gas exploration and production operations are additionally boosting the growth of the market. Offshore drilling operations expose infrastructure to more rigid conditions, including high pressure, extreme temperatures, and the presence of seawater. These factors make microbial contamination even more vulnerable. As the exploration activities increase, mainly in deepwater and offshore regions, the requirement for an effective microbial control becomes highly critical. This will continue fueling the areas to demand biocides.

However, despite these growth factors, there are a number of challenges that can potentially prevent the market's progress. Stricter environmental regulations on the use of chemical biocides are just one example. Such regulations have become stricter due to the potential ecological impacts of these chemicals. However, synthetic types of biocides, in general, have negative impacts on the environment, and the high usage rate has worrisome implications. As a result, there has been increased scrutiny and the need for the oil and gas industry to identify alternatives with proven environmental friendliness.

There is also an issue with a high price for biocides. Indeed, it is clear that if the demand grows for biocides, their prices grow as well. In the case of the unstable market, this can lead to a serious financial crisis for companies. Another problem is resistance among certain microbial species. Indeed, just like the effectiveness of antibiotics decreases with time, so does that of biocides. New and more effective solutions should always be developed.

Even while the future is not rosy, the market has quite a few promising opportunities. There will be much development of eco-friendly biodegradable biocides and advanced formulations meeting regulatory standards. These biocides could go so far in mitigating environmental concerns without the sacrifice of being effective. As the concept of sustainability and its impacts become a central theme in decisions regarding this industry, innovative solutions such as these will have a good deal of integration into the biocides produced. In the next few years, so many progresses are supposed to create more avenues for growth, overcome the barriers that currently exist, and ensure the continued growth of the Global Oil and Gas Biocides market.

MARKET SEGMENTATION

By Type

This market’s importance for the oil and gas industry arises from significant segments—biocides applied for preventing bacterial, fungal, as well as all other microorganism growth, which can damage equipment, pipelines, and even result in the deterioration of extracted resources. The global market for oil and gas biocides is likely to reach its peak in the years to come. These products are likely to face increased demand with the scale of growing industry and the impending microbial contamination issues. The application of biocides will become even more important as the need for the proper maintenance of oil and gas operations increases.

The market is segmented by type and comprises various types of products, namely: Glutaraldehyde, THPS (Tetrakis (hydroxymethyl) phosphonium sulfate), TTPC (Tributyl Tetradecyl Phosphonium Chloride), DBNPA, QAC (Quaternary Ammonium Compounds), Bronopol, etc. These types of biocides have specific application and use in oil and gas systems. Glutaraldehyde is applied widely for its broad spectrum of antimicrobial properties in multiple usages. In controlling bacterial growth within the different phases of oil and gas extraction, it is especially helpful. On the other hand, THPS is gaining popularity due to its efficacy in control over bacterial and fungal growth, especially oilfield water treatment.

TTPC is widely used also due to its high biocidal efficiency against microorganisms in cooling water systems and oilfield applications. Generally DBNPA is used as it is very fast acting and is effective in situations requiring immediate control of microorganisms. QACs are biocides that have formulations like benzalkonium chloride in it. These are effective in a wide range of environments, and therefore they are highly used for prevention and treatment. Bronopol is particularly useful in treating water systems since it effectively combats the microbial growth.

The chemical formulations in the Global Oil and Gas Biocides market will only progress forward. Environmental concerns would continue to increase while the establishment of regulations becomes sterner. This oil and gas industry will shift further into friendlier operations toward the environment, and thus, more eco-friendly biocides will thrive in the industry. In addition, innovations in nanotechnology and biotechnology will yield the development of more efficient biocides for a targeted on specific microorganisms in a more cost-effective and environmental-friendly solution.

The Global Oil and Gas Biocides market would continue to grow steadily since the pressure of operational efficiency against the growing stringency in environmental compliance in the industry for oil and gas would further justify the use of biocides. The going demand for biocides would significantly shape the future of this market with improvements in the chemical industry.

By Application

The Global Oil and Gas Biocides market contribute significantly toward the sustainability and efficiency of oil and gas management. Biocides are used at various stages of oil and gas operation to inhibit the growth of microorganisms, which may, in turn cause corrosion, biofouling, among other issues detrimental to production and safety. This is because the further a perfect solution, the more the market has grown in these industries. This sector has been growing, and the development of oil and gas continues marking an increase in demand for biocides with considerable emphasis on specific applications including drilling operations, hydraulic fracturing, produced water treatment, pipeline preservation, storage tanks treatment, refining, and gas processing.

Other important application areas of biocides in operation are drilling where fluids used in drilling are liable for microbial contamination. With the degradation of the fluid by microbes, its performance is reduced, and thus, the efficiency of the drilling process is reduced as well. Biocides ensure the smooth running of the drilling process with the help of the growth control of microbes. Next decade will see more advanced types of biocides being applied with long-lasting protection still remaining eco-friendly.

Another application that highly depends on biocides is hydraulic fracturing, or fracking. In this case, fracturing of rock formations with fluids injected to extract oil and gas most often comes into contact with underground microorganisms; therefore, biocides are added to prevent microbial contamination that could otherwise cause blockages or even damage equipment. With shale gas, however, the consumption of biocides in hydraulic fracturing is likely to rise, and research will be channeled more into looking for effective biocides that can also be environmentally safe and financially sound.

Another significant use of biocides is produced water treatment. Produced water is linked with the oil and gas production process and typically harbors pathogenic microorganisms. Treating the produced water with biocides kills all the pathogenic microorganisms, which otherwise would enter the ground with this water or be disposed of. This implies a great potential for this purpose to experience a steady rise in its demand for biocides as it moves forward with environmental considerations becoming more stringent and new solutions emerge in response.

Biocides in Pipeline Preservation and Storage Tank Treatment: Biocides are used in other vital applications such as the preservation of pipelines and treatment of storage tanks. Since microbes are likely to develop along the lines of these pipelines as well as those of storage tanks, corrosion, blockages, and safety hazards may be expected. Biocides therefore eliminate all these risks, ensuring that pipelines and storage tanks operate uninterruptedly. This is how the market for biocides in pipeline preservation and storage tank treatment will grow hand in hand with the constantly increasing demand for oil and gas across the world.

Biocides also find application in the refinery and gas processing industries. In refineries, biocides are used for the prevention of microbial contamination in the equipment. Such contaminants could otherwise determine the quality of the refined product. In the gas processing sector, biocides prevent microbial fouling of gas pipelines and equipment. Both industries will continue to grow, but that growth translates into increased demand for biocides.

Advances in technology and greater concern for environmental care are likely to propagate in the Global Oil and Gas Biocides market. The future of the market would therefore be characterized by biocides that are more potent and cost-effective, environmentally friendly as well. Consumer demand for oil and gas alongside the increasing demand for sustainable solutions will propel the growth in the market, creating new opportunities across different applications.

By Function

It is only the Global Oil and Gas Biocides market that bears the final face of the oil and gas industry, as it smoothes and makes the operation of the industry very efficient. Global demand for energy continues to rise, and therefore effective biocides to eliminate specific threats from biological agents have been critical in the industry. These are chemicals used as biocides with the intent to prevent or control microorganisms’ growth, which destroys the equipment, pipelines, and infrastructure. This market for biocides is expected to grow over the coming years through improved safety and operational efficiency and environmental sustainability in oil and gas operations.

Corrosion inhibition is one among the most prominent functions of biocides used in the oil and gas sector to prevent corrosion steel. One of the more serious types of damage from oil and gas pipelines is corrosion stemming from water and microbial activity. Companies can avoid metal surface degradation and minimize the risks for pipeline leaks or failures by using corrosion inhibitors. Future innovations in biocide formulations will support formulation of a more efficient, better environment-friendly corrosion inhibitor resulting in longer life for critical infrastructure.

Another significant role of the biocides is controlling sulfate-reducing bacteria (SRB). SRB is bacteria that are believed to produce hydrogen sulfide, an unsafe gas, posing safety hazards but also promoting pipeline and equipment corrosion. The SRB control is very crucial in maintaining oil and gas facilities integrity. It still remains a very important management tool for biocides while controlling such harmful bacteria hence preventing the damage that these bacteria may cause as oil and gas operations reach more hostile conditions.

An equally important aspect of the application of biocides in the oil and gas industry is their impact on algae. Growth of algae can easily cause blockages in any storage tank in the water storage tanks and even in the cooling system, which causes the overall system to operate inefficiently. As such, biocides used against algae will likely seek newer, greener methods to be applied with more effectiveness while being environmentally friendly. This innovation would prove essential as environmental regulations continue to become harder to handle and more demanding on the industry to hold more environmentally friendly practices.

Control of fungi and slime-producing bacteria also will be crucial to the future of the oil and gas industry. Fungi growth in equipment forms biofilm, very difficult to kill and tends to contribute to equipment failure. More or less, slimeforming bacteria cause clogging and nuisance of oil and gas flow. Biocides targeting these microorganisms will continue as a vital tool to help maintain operational efficiency.

Prevention of biofouling will continue to be a prime concern for the oil and gas sector in the future. Biofouling is the settlement of microorganisms on surfaces that, after passage of time, develops into thick organic layers interfering with the flow of pipelines and equipment, which often leads to poor performances. More advanced biocides will play a vital role in the prevention of biofouling to ensure smoother operations in the future. As challenges unfold with oil and gas, the market for biocides specialized for each function continues to grow, as companies seek effective and environment-friendly solutions.

By End-User

Global oil and gas biocides markets are also a vital factor in the efficiency of oil and gas operations worldwide to ensure reliability. With the market having diverse applications, the market for end-users can be broken down into three main categories: upstream, midstream, and downstream. Different sectors have very distinct demands that call for completely distinct biocidal solutions to prevent microbial growth and corrosion with all its problems, problems that can also reach security and efficiency levels in the operations.

In upstream exploration and production operations, biocides are absolutely critical to preventing microbial growth in water injection systems, pipelines, and other equipment:. Microbial corrosion in the industry is, therefore, a major factor since it may result in devastating effects on the infrastructure through reducing the efficiency of production. Since the demand for oil and gas continues to rise, the exploration and production stages of this industry will highly require biocides for efficient running of operations. These biocides are coupled with the better assurance that the products extracted need to be of the right quality; production at high rates will therefore be maintained while costs are kept in check.

The midstream region is in charge of the transportation of oil and gases. Pipelines, tanks, and storage facilities located here suffer from microbial contaminants which may result in corrosion and clogging. As the extraction, transmission, and distribution of oil and gas continue to rise all over the world, the use of biocides in this particular industry is also likely to increase. These chemicals need to be used to prevent biofilm formation, which can fill up the pipelines and thus decrease the general flow of crude oil, natural gas, and refined products. As more focus is laid on the continuous aspect of transporting lines, biocides will continue to remain an integral part of uninterrupted and safe deliveries.

It is expected that treated water systems should continue the refining processes efficiently in regions where the downstream sector contains refining and subsequent treatment and processing, including biocide treatment. Refining is a very complex process that requires effective water treatment to prevent microbe contamination of cooling and boiler systems. As refining continues to expand to meet energy demands globally, it is likely that more significance will be achieved in product purity and fewer days lost to operational delay because of microbial contamination through biocides.

Going forward, the Global Oil and Gas Biocides market will grow exponentially. This is because increased availability and access of the oil and gas sectors into more isolated and tougher challenges are expected to promote needs for specific biocides. Technology changes and new production methods will introduce more types of biocides capable of responding more effectively to the increasing challenges of modern oil and gas extraction and transportation. Biocides will thus prove to be one of the unavoidable tools used in keeping the oil and gas operation efficient, safe, and cost-effective at all stages.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$214.1 Million |

|

Market Size by 2031 |

$301.8 Million |

|

Growth Rate from 2024 to 2031 |

4.80% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

Consistently growing demands for effective solutions in the oil and gas industry lead to this global growth in the Oil and Gas Biocides market. Biocides are necessary chemicals to regulate the growth of harmful microorganisms in water systems, and their application is quite vital for smooth oil and gas operations. Geographically, the market is segmented into many regions, each of which has its characteristics and potential for growth.

The economy of North America includes the U.S., Canada, and Mexico, and it is dominated by the oil and gas industry. With its solid infrastructure, high demands for biocides exist mainly because of the safe and efficient treatment of water in oilfields. The use of biocides is expected to grow, primarily because of a shift towards more environmentally friendly practice, especially in developed technologies like hydraulic fracturing. The market share is dominated by the U.S., followed closely by Canada and Mexico. However, the dynamics of the market have some differences from one location to another depending on the regulations and production rates.

The Europe market would include oil and gas biocides in countries like the UK, Germany, France, Italy, and so on. This region is slowly shifting towards renewable energy, but it is still having a sizeable percentage of oil and gas in its energy mix. In Europe, with the increased enforcing of environmental protection regulations, the demand for biocides is much more crucial, meaning the industry has no option but to embrace safer and more eco-friendly chemicals. The country that leads and is showing increased focus on more ‘green’ alternatives than others is clearly such big markets as the UK and Germany.

Asia-Pacific, comprising China, India, Japan, South Korea, and others, is rapidly industrializing, and the demand for oil and gas biocides in this region is growing at an impressive rate. China and India are the largest markets for it, mainly driven by expansive energy requirements and booming oil and gas production. The varied climatic conditions and the extensive industrial processes in the region require massive consumption of biocides for controlling microbial contamination and efficiency of oil extraction processes.

Brazil and Argentina are some of the other countries included in South America, which has increased demand within the market. More importantly, Brazil has a wide number of offshore oil fields. Country-wise, the oil and gas industry in this country is booming. Here, the biocides play significant roles in the maintenance of production levels and safety. Although Argentina and other areas in South America are under increasing demand, this market remains relatively small compared to North America and Asia-Pacific.

More challenging environmental conditions than ever before will require the significance of biocides to be very essential in Middle East & Africa, including GCC countries, Egypt, South Africa, and other parts of the region for oil and gas operations. Even though the Middle East still remains a main player in the global market with its deep-seated oil resources, more than ever it will need efficient biocides as the region opens up its infrastructure to modernization and expands production. Africa’s output is due to increase but the growth of its market hinges on the resolution of factors like a lack of infrastructure and political instability.

Regional influence drives the global Oil and Gas Biocides market, where every region would be subjected to a set of different needs and growth prospects. The primary change in the industry's growth and sustainability and environmental responsibility based on which the demand for advanced biocide solutions would see changes is still going to continue and prove to be a challenge that will begin to steadily grow in the coming years across this market.

COMPETITIVE PLAYERS

The Global Oil and Gas Biocides market may undergo significant change in the next two to three years. Increased demand for energy, along with continuous efforts toward finding new oil and gas supplies, increasingly makes effective biocide solutions critical to maintain safety and operational efficiency. Biocides are chemical agents that prevent the unwanted development of pathogenic microorganisms such as bacteria, fungi, and algae and negatively impact oil and gas operations through the damage of equipment and production and eventual damage to the environment. Indeed, with such complexity in the industry and technical advancement in energy, biocides have emerged as crucial agents in the management of smooth operations in conformity with environmental regulations.

The Global Oil and Gas Biocides market is highly competitive, with some of the largest players in the market that are working to develop innovative solutions. A few of the companies identified include DowDuPont Inc, Solvay, BASF SE, and Lonza. They have an excellent market position and are associated with advanced technology and extensive portfolios of products. Examples include DowDuPont’s offering of a large portfolio of specialty chemicals for oilfield applications and Solvay, which boasts sustainability solutions that reduce the environmental footprint of biocides. BASF SE and Lonza have been the driving force behind developing high-performance formulations that meet the challenges of operation under extreme conditions of temperature and pressure.

Kemira OYJ, VINK CHEMICALS GmbH & Co. KG, and Evonik Industries AG among others are some of the leading companies in this market. They are engaged in producing biocide products that help improve operational efficiency while at the same time meeting stringent environmental requirements. Their innovations are going to fuel future growth in this market because the regulatory environment of the use of chemicals in the oil and gas industry becomes increasingly strict.

The variety of products is still diversified, and companies like BWA Water Additives, Pilot Chemical Corp, and Stepan Company are no less proof for that. These companies are extremely concentrated on strategic partnerships with companies to extend their reach across the globe. It would also be wise to note that Nouryon, Baker Hughes, and ChemTreat, Inc are not too behind either, with the development of biocides for specific applications in both offshore and onshore oil production.

A look into the future will see Clariant AG, Ecolab Inc., and Halliburton driving the biocide oil and gas future. The commitment to sustainable development with a high level of technological advancement will make it possible for more efficient, safer, and environmentally friendly biocides to hit the global market as demand increases. Such players are not only improving the performance of biocides but also are contributing to the overall development and sustainability in the oil and gas industry.

Oil and Gas Biocides Market Key Segments:

By Type

- Glutaraldehyde

- THPS [Tetrakis (hydroxymethyl) phosphonium sulfate]

- TTPC [Tributyl Tetradecyl Phosphonium Chloride]

- DBNPA

- QAC (Quaternary Ammonium Compounds)

- Bronopol

- Others

By Application

- Drilling Operations

- Hydraulic Fracturing

- Produced Water Treatment

- Pipeline Preservation

- Storage Tanks Treatment

- Refining Gas Processing

By Function

- Corrosion Inhibition

- Sulfate-Reducing Bacteria (SRB) Control

- Algae Control

- Fungal Control

- Slime Control

- Biofouling Prevention

By End-User

- Upstream (Exploration & Production)

- Midstream (Transport)

- Downstream (Refining)

Key Global Oil and Gas Biocides Industry Players

- DowDuPont Inc

- Solvay

- BASF SE

- Lonza

- Kemira OYJ

- VINK CHEMICALS GmbH & Co. KG

- Evonik Industries AG

- BWA Water Additives

- Pilot Chemical Corp

- Stepan Company

- Nouryon

- Baker Hughes

- ChemTreat, Inc.

- Clariant AG

- Ecolab Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383