MARKET OVERVIEW

The Global Industrial Communication market is located within the broader industrial automation and control industry. It will act as the key enabler for synchronized operations across other heterogeneous environments for manufacturing and production. This market will enable real-time data exchange between machinery, sensors, control systems, and software platforms integrated into seamless, responsive networks. The more digitized the industrial infrastructure becomes, the more effective communication protocols and standards will be in determining how efficiently machines, systems, and users work together to support unbroken industrial workflows.

At the crux of the Global Industrial Communication market will be data-driven technologies integrated into physical systems. These technologies will allow industrial environments to transmit control signals, operational feedback, and system diagnostics between components without latency. Future industrial communication will largely depend on high-reliability and low-interference protocols designed especially for environments with complex machinery and sensitive timing requirements. Such standards-including Ethernet/IP, Modbus TCP, and PROFINET-will remain essential in maintaining continuity across operations worldwide.

The Global Industrial Communication market includes such varied applications as automotive manufacturing, oil and gas production, food processing, energy management, and smart logistics. In these areas, reliable data transmissions will assist operators in executing fast decisions under conditions of machine safety and production accuracy. As industrial environments become increasingly decentralized, communication networks will be called upon to operate over larger geographic ranges while maintaining consistent performance and the ability to communicate with legacy systems and emerging technologies.

Another defining feature for the Global Industrial Communication market will be its interaction with industrial IoT infrastructure. Machine-to-machine and machine-to-human data transmission will enable remote monitoring, predictive maintenance, and system optimization without any human intervention. Interconnected systems will allow minimal errors, energy efficiency, and achievement of production targets, thanks to easier access to data. For the market to flourish and grow, uniformity in communication architecture with a secured communication channel would be needed, particularly in instances involving risks to either human lives or heavy-duty industrial machinery that may work under different environmental constraints.

Cybersecurity will become more reinforced in the Global Industrial Communication market. As systems evolve to include wireless networks and cloud-based interfaces, securing data and retaining operational integrity will become paramount. Security procedures will be embedded within the communication platform to avoid unauthorized access and compliance with international industrial safety standards.

Vendors in the Global Industrial Communication market will continue to adapt their offerings of configurable, modular solutions to accommodate projects of varying scales, with a view toward ever-more stringent demands for reliable and precise data exchanges. The importance of communications in this context will vary from compact manufacturing sites to continent-spanning utility grids, thereby augmenting the need for speed, transparency, and operational resilience in product solutions.

From the perspective of the future, the Global Industrial Communication market will continue to evolve with technological advancements and regulatory framework changes, which will serve as a bridge connecting physical processes into digital oversight. The new role it will assume will not be limited to one-way signal transmission but will rather contextualize such communication to support areas like predictive intelligence, asset optimization, and strategic decision-making across industrial operations the world over.

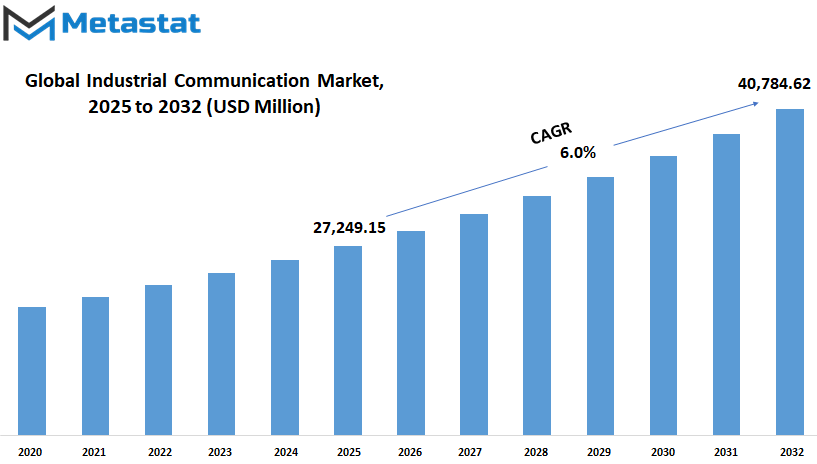

Global Industrial Communication market is estimated to reach $40,784.62 Million by 2032; growing at a CAGR of 6.0% from 2025 to 2032.

GROWTH FACTORS

The Global Industrial Communication market will continue to grow as industries keep changing to become smarter and more efficient. Growth in this regard with Industry 4.0 focuses on advancements in connecting machines, systems, and processes by enabling technologies. With factories and plants becoming more automated, the need for strong and reliable communication networks implies great importance. This will facilitate real-time data exchange for improved decision-making, less downtime, and increased productivity.

Smart manufacturing requires fast and seamless machine-to-machine and system-to-system interactions. Whether a robotic arm on an assembly line or a sensor evaluating performance, the connection must be on. The Global Industrial Communication market will support such interconnectivity. With widespread automated systems, the demand for fast, secure, and reliable communication technologies will continue to grow. This shift is not restricted to large factories; even smaller plants are realizing their ROI in upgrading their operational systems.

However, challenges remain despite the sunny forecast for growth, and these challenges could slow down actual growth. Among the more pressing problems, one is the compatibility of legacy systems with today’s modern communication tools. Many industries are still depending on older equipment that was not designed to connect with technology today. Upgrading these systems is often technically demanding and costly. Advanced communication networks require some form of investment to install and maintain, which can be a deterrent for companies with a tight purse string during uncertain economic times.

Yet, the opportunities for growth in the future seem to be many. Wireless communication technologies are providing further flexibility in the establishment of networks without requiring extensive changes to the existing infrastructure. Industrial Internet of Things (IIoT) is yet another development this growth may want to embrace. It is in IIoT that machines could be more liberal in the exchange of data that could mean better monitoring, maintenance, and control. These advancements will not only be put more to the use of efficiency but also serve on the side of cost reduction in the following time.

Demand for the Global Industrial Communication market is likely to experience buoyancy as these industries seek smarter and more connected solutions. As barriers are pushed aside and automation grows in application, so will the preparedness of enterprises for the future. Speed, reliability, and smarter working methods will pave the way forward, suggesting that the future is bright for this market.

MARKET SEGMENTATION

By Offering

The market for Global Industrial Communication acquires more importance in industries working toward smarter, more connected operations. Automation is changing the way manufacturing and production have been; strong communication systems will be the backbone supporting these changes. An offering breakdown classifies the market broadly into hardware, software, and services. Each segment plays its own role towards the maintenance of industrial environments, smooth and safe, whereas all roll into one to make a system that helps machines, control systems, and workers stay connected.

Hardware will remain strong in industrial communication. It involves devices router, switches, sensors, and connectors to physically link systems together. These tools are the physical link between any machine and its digital systems that guide it. With factories being fully automated, the need for dependable and high-performance equipment will grow. Manufacturers would want equipment that withstands harsh conditions, provides stable connections, and allows real-time data exchange. This market demand will increase as smart factories become more popular.

And the software provides this intelligence layer that would allow effective communication between the systems. The software then helps in the management of data, operation control, and decision-making based on real-time feedback. With the industry's focus shifting toward increased efficiency and reduced downtime, the Global Industrial Communications market is also anticipated to have a growing importance placed on software. The smart systems will enable machines to automatically change their behavior whenever something changes in the production line. Igor software will allow the company to identify possible problems that will become serious beforehand, saving time and money.

Equally important are services. Services ensure the correct performance of both hardware and software-from installation and configuring to training and provision of support. Moreover, advanced technology would call for companies' professional support to maintain their currency and competitiveness. On the other hand, service provision would enable system upgrades and a fast response to new needs. Such flexibility will most likely benefit industries that operate on a 24-hour cycle, where time wastage could cost a fortune.

The Global Industrial Communication market is expected to grow and customize with the beginning of a new path. Likewise, each component-hardware, software, and services-prepares itself for this transition to smarter, faster, and safer industrial spaces. As connected systems grow in their rank, the demand for competent supply instruments for communication will also rise steadily, and thus, this market will stand out as a prime in defining the industry's future.

By Communication Protocol

Whereas industrial industries begin their search for faster, more reliable, and secure ways to communicate between machines and systems, this becomes an opportunity for improving efficiency, reducing mistakes, and remote monitoring and control of operations. This industry is transforming communication between machines in preparation for a connected future. The selection of communication protocols, among many other issues, will become one of the main factors that will bring about that transformation.

Fieldbus has been around for ages and will always remain valid in some cases. It allowed for communication between disparate types of equipment without requiring human intervention to an appreciable degree. While not being the last word in modernity, Fieldbus will continue to be associated over the years with a certain level of stability for many industries running long-established systems. There still may be some time during which Fieldbus is considered a reliable option where costs and basic features are more important than speed or complex options.

Industrial Ethernet is, however, to lead just about all growths on this business side. With the advent of smart factories and digital control systems, Industrial Ethernet embodies the speed and reliability demanded by modern setups. It can hold larger amounts of data which means real-time responses will be vital as the automation of the machines progresses. It helps in the collaboration of machines and systems, even if they are from different vendors. As industries move towards fully digital setups, Industrial Ethernet will play a major role in ensuring smooth functioning of these systems.

Wireless, in turn, will also be huge. It offers flexibility in locations where cable installation or maintenance are very difficult. Wireless is especially advantageous in scenarios involving very large plants or remote locations where the movement of equipment and people require constant connection to the control system. As wireless technology continues to improve, it should become a more robust and secure solution. It is reasonable to assume that, in the near term, wireless will become the method of choice where speed and mobility are paramount.

As each of the communication protocols matures or goes through transformation, so will the Global Industrial Communication market. The integration of the old and the new systems will guarantee that industries have the necessary tools to keep moving forward in finding new ways to connect and improve their operations.

By Hardware

Future of connected technologies and intelligent industrial establishments-the Global Industrial Communication market approaches. The demand for communication hardware will tighten as more industries would like to realize a jump in productivity with reduced downtime. They are components in solidifying the backbone for communications, ensuring smooth flow of data transfer between machines, systems, and people without delays. All that rising interest in automation, data tracking, and remote control makes sure that the need for hardware in industry communications will continue to grow steadily through different sectors.

Among the very key elements that make these systems better would be the switches, gateways, routers, and wireless access points. These enable the data transfer across networks, so machines and control systems can be connected with each other. Switches will be a major part in directing traffic within the networks, ensuring smooth data flow even when devices are added. Gateways will be required so that legacy systems will be integrated with modern technology, which allows the industry to go through a transition process and not to have to replace everything at once. Routers and wireless access points will connect machines without wires, offering an advantage to their usage, efficient especially in large or moving setups.

Controllers and connectors will still continue appearing on the scene. Controllers will define how machines will deal with each other, direct their responses to real-time inputs, and ensure processes remain under control. Connectors will, however, form strong connections between parts of the system, minimizing downtime caused by poor connections. As the size and efficiency of equipment are being reduced, so will the designs and performance of these components become improved to make them easier to install and maintain.

Today, these communication interfaces and converters will become pivotal in linking different kinds of machines and software systems. Since not all systems, in their basic form, speak the same digital language, converters will serve up logical understandable value for them. This, moreover, will keep the old machine working even if the newer ones are switched onto the particular setup. Improvements in power supply devices will also be made to bring more reliable energy delivery into continuity among parts of a network.

Going forward, the Global Industrial Communication market will see robust growth as industries turn to smarter, more connected systems. All new hardware technologies will keep stretching the imaginations of factories, plants, and industrial sites concerning what they can do faster, safer, and with better control in every aspect of the process.

By End User

The communication networks and systems used in industrial applications should benefit and impact remaining industries with better performance, less time consumption, and enhanced safety. Eventually, these networks will create stronger links between machines, systems, and people. It is anticipated that communication networks will go beyond mere transfer of information and will be expected to facilitate real-time decision-making and seamless operations.

When it comes to the automotive sector, it is the call for smarter manufacturing processes that will create demand for better communication networks. Fast and reliable links will be required for automated assembly lines, driver-less testing processes, and predictive maintenance aids. The ability to early detect faults and make on-the-spot adjustments during manufacturing relevant to the world in any way is to reduce wastage and improve safety. Production cycles and quality inspection processes in the electrical and electronics industries will also be high-speed communication candidates, such that production becomes reliant on the uninterrupted flow of information throughout the entire process chain, considering the sophistication and ever-lowering dimensions of previous devices.

Aerospace and defence will rely more on secure and reliable networks, especially in view of safety being the topmost priority. Such environments deal with sensitive data and complicated machinery and will thus call for systems that prevent downtime and sniff issues before they can be serious problems. Harsh environments in oil and gas as well as chemicals and fertilizers render robust communication system a must. Supervising pressure, temperature, and safety alerts in real time can avert accidents while easing this handling of often hazardous materials.

Food and beverages will pair alongside pharmaceuticals and medical devices, which practically eliminate the risk of error and delays. Cleanroom environments and strict health regulations will need communication networks capable of syncing various stages of production without failure or latency. Finally, energy and power will continue to grow alongside renewable sources, a modern communication tool that enables efficient resource management. As power grids become smarter and more distributed, communication will play a significant role.

That said, it is the Global Industrial Communication market that will become requiring more in these sectors to compete in their field. The future can expect a much higher demand set forth towards communication systems, so these will direct industries toward investing in tools that will be more reliable and smarter enough to alter to change.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$27,249.15 million |

|

Market Size by 2032 |

$40,784.62 Million |

|

Growth Rate from 2025 to 2032 |

6.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

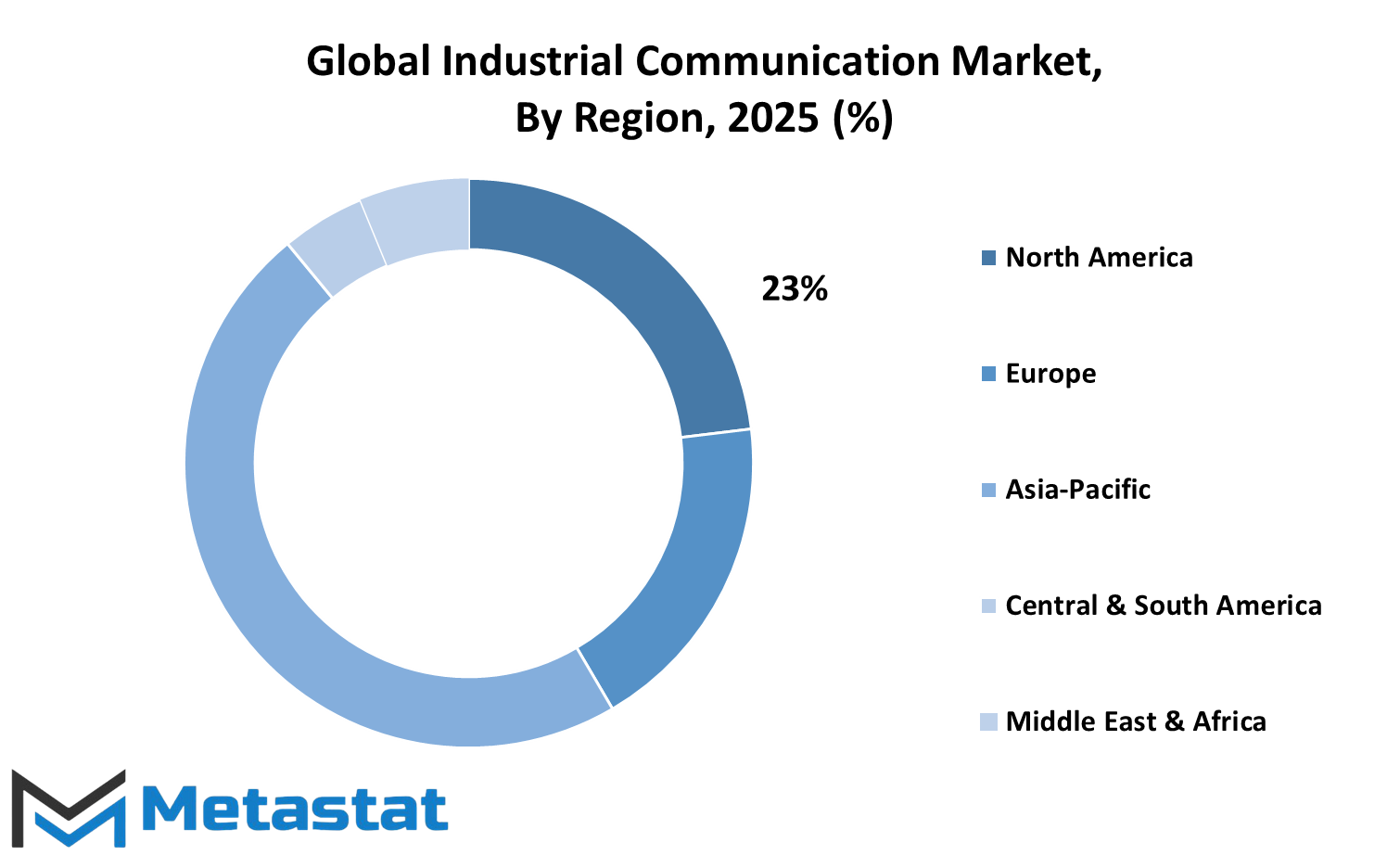

According to past reports and forecasts, a good growth rate for the Global Industrial Communication market is expected in the near future, fueled by rapid technological advancements and an increasing demand for effective communication systems in all industries. As industries worldwide continue to modernize and digitalize their activities, the demand for fast and reliable communication tools will continue to assume even greater importance. The physical boundaries of the market are expanding across various regions, each of which contributes its fair share to the overall development.

North America will see strong demand for industrial communication solutions from the United States, Canada, and Mexico. Foremost, the United States will take the lead with its sizable industrial sector, particularly with the growing demand for automated manufacturing and smart factories. Canada and Mexico also are enhancing their industrial capacities, thus creating demand for communication systems that support more complex operations. North America will continue to play a role in the development of industrial communication systems as industries strive for higher efficiency and connectivity.

Europe retains a strong foothold in the market, with activity in the UK, Germany, France, and Italy. Germany is noted for its advanced manufacturing and industrial automation and is positioned as a nucleus of industrial communication technology. The pressure for communication tools in Europe will continue as industries seek to improve their production processes and reduce their operational costs. Furthermore, demand for industrial communication solutions that can be easily integrated within automated systems will increase with the growing emphasis on Industry 4.0 around Europe.

Asia-Pacific will hold a vital role in enhancing growth within the Global Industrial Communication market. Countries like China, India, Japan, and South Korea are being industrialized rapidly, increasing demand for advanced communication systems. China, being the heavyweight in manufacture, is likely to contribute immensely to such growth. Japan and South Korea, on the other hand, are pushing advanced automation technologies, demanding effective and reliable communication networks in turn. With further expansions of the industrial segments in the respective countries, a push in demand for industrial communication solutions shall be witnessed.

Firm developments in industrial infrastructure are seen in Brazil and Argentina, among other nations of South America. Though the pace of growth for the South American market may be relatively slow, modernization and technology adoption initiatives will augment demand for industrial communication systems. The last stronghold is for the emerging markets in the Middle East and Africa, e.g. UAE, Egypt, and South Africa, which are heavily investing in developing their infrastructure and industrial projects. As the regions evolve, communication solutions will be of essence to ensure smooth operations and enhance productivity.

COMPETITIVE PLAYERS

The Global Industrial Communication market is set to experience dynamic growth in years ahead, primarily propelled by technological advancements and the increasing need for such systems to facilitate communications in industrial operations. Communication networks will play a vital role in connecting machines, devices, and people to facilitate operations as industries adopt more automation and integration. With respect to the innovations brought into the market by the giant players, each will offer unique solutions catering to the increasing demands of industrial communication.

Companies like ABB Ltd., Cisco Systems, Inc., Honeywell International Inc., and Mitsubishi Electric Corporation are the pioneers of this revolution. Companies like these are financing huge investments in new technologies that will enhance the communication of the present and future industrial environments. They would be working towards the development of resilient and scalable solutions meant to facilitate real-time data exchange, remote monitoring, and predictive maintenance. This will help industries in realizing optimized productivity, minimized downtimes, and a very high overall efficiency. Some of these digitalization strategies are targeted towards advanced technology for communication with such systems, making their operations smooth. For example, ABB Ltd.

As such, Rockwell Automation, Inc. and Schneider Electric SE will also promote the value of industrial communication in the progress of automation. The more manufacturing plants shift toward being automated, the more they are likely to develop a need for reliable communications systems to help monitor complex systems and implement the integration of numerous devices and machines. These two companies will also add to their portfolios for industrial communications hardware and software solutions that are compatible with different industrial communication protocols-so that all systems, regardless of their functions, can communicate well with each other.

Major market contributors are Siemens AG, Texas Instruments Incorporated, and General Electric. These organizations are primarily engaged in developing next-generation industrial communication products that can allow for better precision and control in the hands of manufacturers. Their products enable industries to incorporate intelligent manufacturing, which requires faster and more reliable communication networks to support complex automation and real-time decision-making.

With the traction toward new technologies like 5G and the Internet of Things (IoT), industrial communications will require the capacity to handle larger volumes of data at faster speeds. Providing the necessary infrastructure and connectivity solutions to ensure that industries stay connected and operational as they evolve with such advancements is a focal point of organizations such as Huawei Technologies Co., Ltd., Advantech Co., Ltd., and HMS Networks. Thus, these solutions will help industries realize the value of the current technologies that make communication within and between them possible.

Industrial Communication Market Key Segments:

By Offering

- Hardware

- Software

- Services

By Communication Protocol

- Fieldbus

- Industrial Ethernet

- Wireless

By Hardware

- Switches

- Gateways

- Routers & WAP

- Controllers & Connectors

- Communication Interfaces & Converters

- Power Supply Devices

- Others

By End User

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Oil & Gas

- Chemicals & Fertilizers

- Food & Beverages

- Pharmaceuticals & Medical Devices

- Energy & Power

- Others

Key Global Industrial Communication Industry Players

- ABB Ltd

- Cisco Systems, Inc.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Texas Instruments Incorporated

- General Electric

- AAEON Technology Inc.

- Advantech Co., Ltd

- HMS Networks

- Huawei Technologies Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252