MARKET OVERVIEW

The Global CMOS Image Sensors market is an integral part of the larger electronics and semiconductor industry and plays an indispensable role in imaging and vision-related applications. Complementary Metal-Oxide-Semiconductor (CMOS) image sensors are at the heart of modern digital imaging, enabling high-quality images and video capture across a very wide range of devices and sectors. This market includes CMOS image sensors for design, production, and deployment in different applications, ranging from consumer electronics, automotive, and healthcare industries to industrial automation.

The Global CMOS Image Sensors market can be considered essentially as a sensor production market of converting light into electrical signals and therefore forms the foundation of digital imaging technology. Differing from the traditional CCDs, the CMOS image sensors are high-energy efficiency with better integration capabilities and advanced functionalities. The sensors are strongly adopted across devices ranging from smartphones and cameras to more complex autonomous vehicles and medical imaging equipment. Versatility has been attributed to the balance between performance and cost-effectiveness, leading to adoption across many applications.

It will be shaped by technological advancements as it evolves in this market. Emerging trends are miniaturization, increased resolution, and greater sensitivity to low-lighting. CMOS image sensors are expected to integrate artificial intelligence and machine learning algorithms that will make imaging solutions more intelligent and responsive. These sensors are destined to become integral components in automotive applications of ADAS and self-driving cars that will promote enhanced safety and efficiency. In health, they will provide power for highly advanced imaging technologies used in diagnosis and minimally invasive interventions.

Industrial automation as well as security systems can be implemented globally through CMOS Image Sensors. Factories would use it to monitor and measure their quality control and surveillance system, which in turn uses these image sensors to strengthen facial recognition and motion detection capacities. With this, IoT devices will remain the driving force of the market since their connected devices rely on high-performance imaging solutions in order to decode and respond appropriately to their environment.

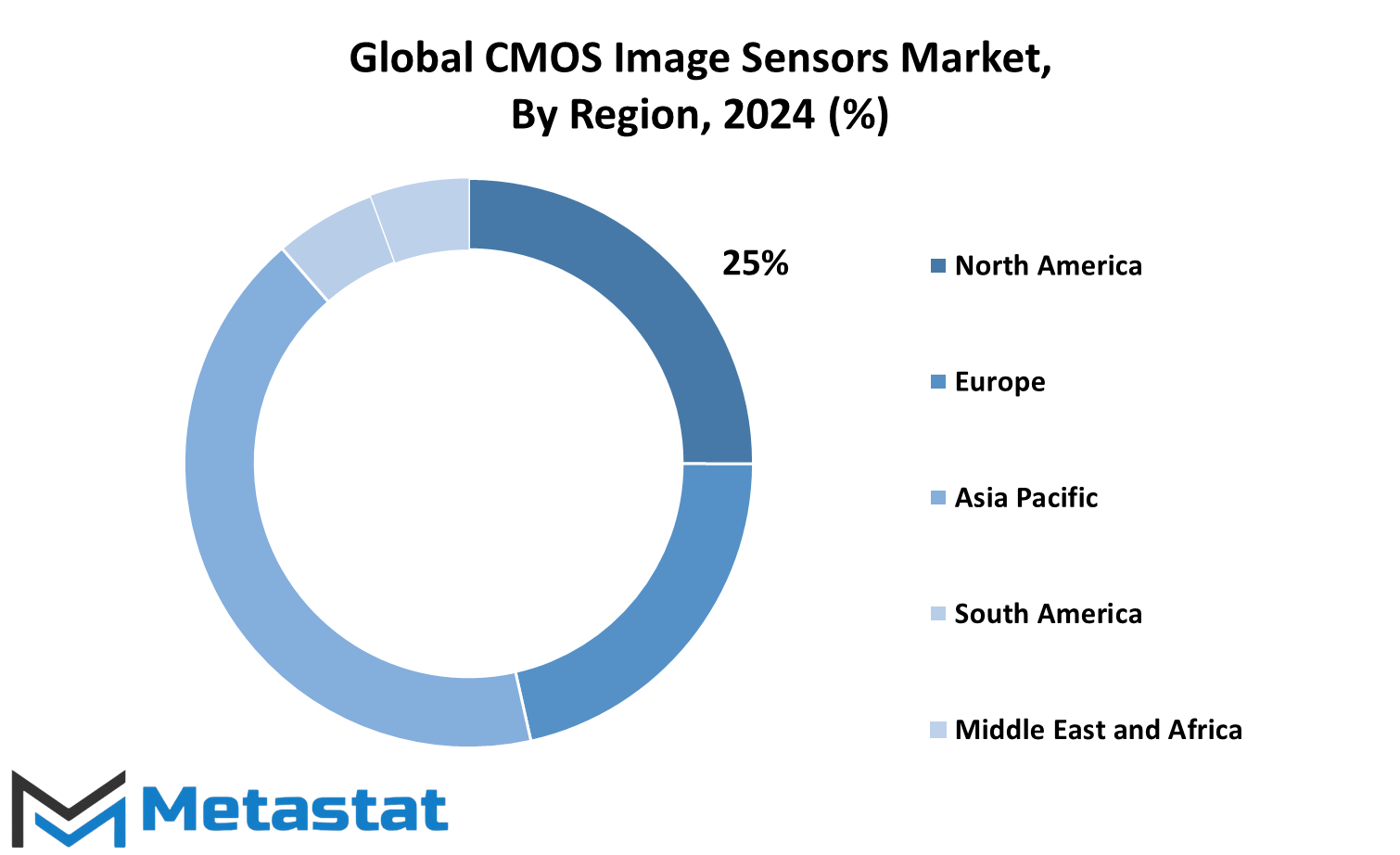

Geographically, this market captures the regions of North America, Europe, Asia-Pacific, and the Middle East and Africa, which each play differently in forming its dynamics. Asia-Pacific is expected to lead in both production and consumption due to its strong base of electronics manufacturing and technological innovation. North America and Europe will, however, be very important areas for research and development and for application-specific innovations.

The Global CMOS Image Sensors market will challenge the industry with issues related to the evolving consumer expectations and adaptation to emerging technologies. The challenges in this field will include concerns of cost-efficiency while achieving high performance levels. Moreover, with increasing concerns over environmentally sustainable technologies, this industry will experience greater pressure toward using eco-friendly manufacturing processes and materials.

The Global CMOS Image Sensors market would remain one of the mainstays within the imaging technology spectrum, fueled further by continued innovation and expanded applications. Actually, such space will become all the more invaluable as sectors’ integration accelerates toward an era of a future replete with image-centric solutions transforming information capture, analysis, and application.

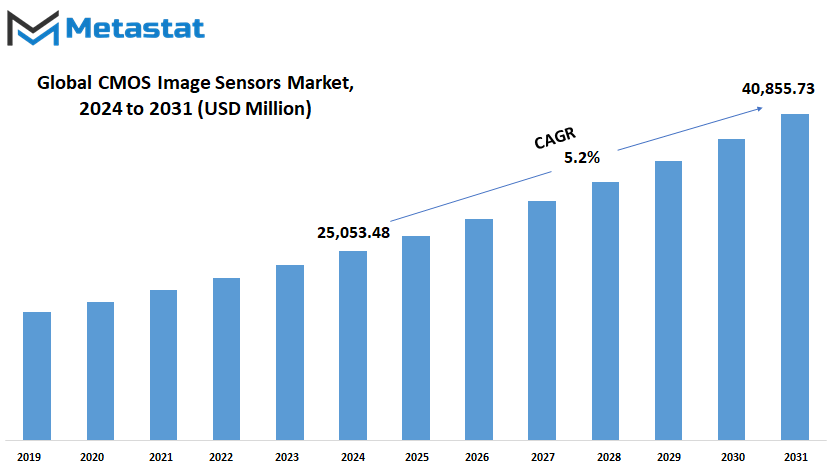

Global CMOS Image Sensors market is estimated to reach $40,855.73 Million by 2031; growing at a CAGR of 7.2% from 2024 to 2031.

GROWTH FACTORS

The Global CMOS Image Sensors market is experiencing rapid expansion and change mainly due to changes in technology. The demand for new applications further fuels this upward trend. Perhaps the most pivotal driver of such growth is increasing smartphone usage: consumers are in need of having better cameras included in their smart phones, requiring high-performance sensors. Modern smartphones rely heavily on CMOS image sensors to deliver features such as high-resolution photography, video recording, and enhanced image processing, making these sensors a vital component of the industry.

The automotive segment has also been a significant driver of the growth of the market. With increasing safety concerns, manufacturers are implementing advanced driver-assistance systems (ADAS) and autonomous driving technologies in the vehicle. All these systems are dependent on the high-quality CMOS image sensors for lane detection, collision avoidance, and 360-degree vision. This further increases the growing integration of image sensors in automotive applications, further emphasizing their significance in enhancing safety and convenience.

Despite these positive trends, the market faces certain challenges. One major issue is the price volatility of raw materials. Fluctuations in material costs can impact production expenses and ultimately influence the pricing of CMOS image sensors. Intense competition among manufacturers has created a highly competitive landscape, where companies must continually innovate to maintain their market position. This dynamic can sometimes hinder smaller players from achieving sustainable growth.

The future looks bright for the Global CMOS Image Sensors market as IoT devices continue to grow in number. As more and more technologies of IoT come into everyday life, the need for compact, energy-efficient, and versatile sensors is expected to increase significantly. These devices require image sensors to be used in smart security systems, wearable devices, and automated industrial machinery. This trend promises a rosy future to manufacturers who would be able to develop innovative solutions tailored to the evolving needs of IoT applications.

This will lead to a significant growth for the Global CMOS Image Sensors. Technological improvements in automobile and smartphone technologies are increasing at a rapid pace. With respect to challenges, fluctuation in material prices and extreme rivalry are a few drawbacks. Conversely, prospects based on increasing IoT development create an optimistic view. Provided that it follows the trends and confronts possible drawbacks of such expansion, this market is well on its way to sustaining significant roles in future technological improvements.

MARKET SEGMENTATION

By Technology

Global CMOS Image Sensors market is under a notable change, with new developments in the imaging technology sector and rising demands in the fields. CMOS image sensors are now part and parcel of every modern device that can capture good quality images without much expense. This technology for the front and back sides will likely hold large market value. Front Side Illuminator will possibly grow up to USD 8,334.75 million while Back Side Illuminator up to USD 16,718.73 million during 2024.

One of the factors that spur the growth is widespread applications in mobile devices, including smartphone cameras, automotive systems, medical equipment, and security cameras. This technology keeps improving to allow higher performance from these sensors with enhanced low light sensitivity, more pixels, or better processing times. These all enable CMOS image sensors as a preferred technology among developers requiring efficient and reliable imaging solutions.

These have grown the applications of CMOS image sensors because of two reasons: the rapid increase in connected devices and artificial intelligence. They are increasingly being used in consumer and industrial products for features like facial recognition, gesture tracking, or augmented reality. For example, the automotive segment is using them to create the next-generation ADAS and self-driving vehicles, where higher precision imaging is crucial for safety navigation.

Front Side Illuminator and Back Side Illuminator are the major innovations in this market. Front Side Illuminator is a cost-efficient technology with satisfactory performance, thus suitable for the devices that prioritize affordability without sacrificing important functionalities. Back Side Illuminator, on the other hand, is famous for its high image quality, particularly in low light, which is essential for professional-grade cameras and high-end smartphones.

The future outlook of the Global CMOS Image Sensors market appears promising with industries in constant pursuit of digital transformation and automation. Innovations in pixel technology, quantum efficiency, and energy efficiency would change the sensor’s horizon of what it can accomplish. Finally, the increased interest in space exploration and remote sensing has the potential to open up new vistas for the role of CMOS image sensors in capturing data from challenging environments.

With these developments, the market is set to grow at a robust rate. As manufacturers and developers continue to invest in research and development, the capabilities of CMOS image sensors will only expand, offering versatile and innovative solutions to meet the demands of an increasingly tech-driven world.

By Application

Advancements in technology and the high demands of the advanced imaging solution required in various industries are likely to boost the Global CMOS Image Sensors market in the near future. The demand for better quality image sensors remains strong in smartphones, cameras, and various other devices because consumer electronics continually evolve. CMOS image sensors feature high-resolution and relatively low power consumption and good performance, which makes them an indispensable component of modern devices.

Consumer electronics have adopted the use of CMOS image sensors. Advanced sensors are being used in smartphones, laptops, and tablets to take camera quality to the next level, enabling great photography and videography. It is expected that the demand for 4K image sensors will be growing as more people look for higher definition. Further development in better camera functionalities that enhance the user experience will accelerate growth in this CMOS image sensor market.

The growth of the automobile segment is going to play a very significant role in the overall growth of the Global CMOS Image Sensors market. With increased trends toward autonomous and connected vehicles, image sensors are becoming crucial for various applications, such as ADAS, parking assistance, and vehicle surveillance. These sensors offer real-time, high-definition imagery while enhancing safety and navigation features in new-age vehicles. High-performance usage of electric vehicles and smart car technologies will be driven by an increasing demand for CMOS image sensors.

In the industrial sector, the market will increasingly require these sensors in automation, quality control, and machine vision. CMOS image sensors allow the accurate detection, inspection, and monitoring and therefore are an essential part of industrial processes. It is likely that this trend will continue because several industries require more efficient operation with fewer errors from automation. Advanced CMOS image sensors offer high-resolution imaging systems, such as in the surveillance, reconnaissance, and monitoring applications for which there is huge demand in aerospace and defense fields, where high image resolution offers better clear images even under challenging environmental conditions.

This integration of CMOS image sensors will greatly benefit the applications for healthcare. Medical imaging, such as endoscopy, microscopy, and diagnostic imaging, depends highly on high-quality sensors to have clear images. This means, as healthcare technology evolves, it will depend much on CMOS image sensors, providing better tools for diagnosis and improvement in medical procedures.

All these will only further the uses of Global CMOS Image Sensors, taking these well into different areas of the future into new innovative applications and solutions. Once implemented, the sensors will add not only value to already established technology but will also create room for entirely new products that would have the possibility to revolutionize things in themselves with future change.

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$25,053.48 million |

|

Market Size by 2031 |

$40,855.73 Million |

|

Growth Rate from 2024 to 2031 |

7.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The CMOS image sensors market across the world is growing on an immense scale and is influenced by the increasing demand of various industries for high-quality imaging technology. A geographical break-up of this market can be useful in understanding diverse trends and dynamics that exist within such geographies. These include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

The market in North America is going to grow. United States, Canada, and Mexico are considered leaders. Strong presence of leading players in semiconductor and electronics would continue to grow due to further advancements in the technological arena. Rising image sensors use in consumer electronics, automotive, and surveillance system is also on the growth in this region. The U.S. will remain a significant market demand driver, with the development of imaging technology and further investments in research and development.

Europe, which also includes the UK, Germany, France, Italy, and others, is booming in the CMOS image sensor market. The region has adopted the use of image sensors in automotive, healthcare, and industrial sectors with wide acceptance. The increasing adoption of automation and Internet of Things will create further demand for imaging solutions with greater reliability. Energy-efficient sensors in Europe, emerging from innovations with a commitment to sustainable technologies, carbon emission reduction, and resultant innovations, will further enhance market potential.

The Asia-Pacific region is a key driver in the global CMOS image sensors market. Manufacturing and consumption will be led by countries such as China, India, Japan, and South Korea. The burgeoning electronics industry in Asia-Pacific, especially consumer electronics, will be a lead driver for the market. Rapid growth in security and surveillance demands together with the advancement of artificial intelligence and machine learning will fuel further innovation in imaging technology.

South America, including countries like Brazil and Argentina, is witnessing a gradual rise in demand for CMOS image sensors. Although the market in this region is not as mature as in North America or Europe, growth in industries such as automotive, healthcare, and agriculture is creating new opportunities. As technology adoption increases, the demand for sophisticated imaging solutions will rise in these markets as well.

The Middle East & Africa region, including countries like Egypt, South Africa, and the GCC nations, is growing steadily. As infrastructure development continues, there will be an increasing need for surveillance, security systems, and automation, further pushing demand for CMOS image sensors. With ongoing urbanization and technological advancements, the region is likely to witness an upsurge in demand for these sensors in the coming years.

Looking forward, the global market for CMOS image sensors would continue to extend across all geographical regions, each to develop its respective demand and application patterns. Increased connected devices, smart technologies, and automation will doubtless shape future prospects for the image sensor space, making this technology integral in many industries throughout the world.

COMPETITIVE PLAYERS

The Global CMOS Image Sensors market is currently one of the most dynamic and promising sectors in the world of technology, showing no signs of slowing down. With demand for high-quality imaging solutions growing by the day, a number of key players have emerged to steer the industry in new and innovative directions. Most investment of these companies are being placed for research and development purposes with which new products, and sometimes totally new technology in line with lots of different types of application-from smartphones, the automotive systems right down to a medical device as well as in surveillance equipment could be accommodated.

Industry heavyweights are seen to include two imaging space big hitters, namely, Sony Corporation as well as Samsung Electronics. The companies are continuously evolving their CMOS sensor technologies by improving aspects like resolution, light sensitivity, and overall performance. Sony is considered one of the world leaders in image sensor technology. Its sensors can be found in a wide variety of consumer electronics as well as professional equipment. Samsung has managed to create a good market share for its sensors in the mobile industry where its sensors have been installed in hundreds and thousands of handsets.

Applied Materials is another company that is doing great work. It is the company that has been providing leading-edge materials engineering solutions. The Applied Materials company has been focusing on developing cutting-edge technologies that can enhance the performance and manufacturing efficiency of CMOS sensors. The demand for image sensors that are smaller, faster, and more efficient is increasing rapidly. ON Semiconductor is also gaining some notable ground in the sector with sensor solutions in consumer and industrial applications.

Other prominent organizations in the space are Canon Inc., SK Hynix Inc., and Panasonic Corporation, leveraging their centuries of innovation heritage toward the further revolutionization of the image sensor. Through its heritage with optical imaging and expertise, Canon works to continue improvements in CMOS sensor quality while SK Hynix and Panasonic work to bring improvements in terms of sensor speed and energy efficiency.

This also means that as the market is expanding, there are newer entrants in the fray like Teledyne Technologies, PixelPlus, and Himax Technologies. These players focus on niche areas such as medical imaging, automotive sensors, and advanced surveillance systems. Teledyne Technologies has been looking to integrate CMOS sensors into scientific and industrial applications and is expected to provide some fresh revenue streams.

The Global CMOS Image Sensors market is expected to remain extremely competitive as firms such as Sharp Corporation, AMS AG, and Tower Semiconductor are developing innovative and diversifying products. Advancements in artificial intelligence, 5G technology, and growing demands for quality imaging across all sectors indicate an optimistic future for the CMOS image sensor market. Such developments in technology will make competition move to new dimensions because companies will increasingly be expected to meet the needs of a high-tech and image-driven world.

CMOS Image Sensors Market Key Segments:

By Technology

- Front Side Illuminator

- Back Side Illuminator

By Application

- Consumer Electronics

- Automobiles

- Industrial

- Aerospace & Defense

- Healthcare

- Other

Key Global CMOS Image Sensors Industry Players

- Sony Corporation

- Samsung Electronics Co., Ltd.

- Applied Materials, Inc.

- ON Semiconductor

- Canon Inc.

- SK Hynix Inc.

- Panasonic Corporation

- STMicroelectronics

- Teledyne Technologies Incorporated

- GalaxyCore Inc.

- PixelPlus Co., Ltd.

- Sharp Corporation

- AMS AG

- Himax Technologies, Inc.

- Hamamatsu Photonics K.K.

- Tower Semiconductor Ltd.

- Pixart Imaging Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383