MARKET OVERVIEW

The global home insurance market provides coverage to homeowners against possible risks that may cause them financial loss and is thus classified under the broader umbrella of financial services. The market operates mainly on insurance policies aimed at residential property protection so that impairments caused by unforeseen events will not hang over their heads as long-term financial burdens. As the housing structures are shifting and property values are changing, the demand for wider coverage solutions will further direct the insurers toward the design of products that mitigate future risks created by emerging threats and frameworks set by regulators.

This market works under a contract wherein the premiums paid by a policyholder are an obligation of the insurer to provide indemnification or payment. The global home insurance market would continue to devise policies for various property damage descriptions, inclusive of natural calamities, theft, and accidental destruction. These agreements are much more than just reimbursement since the assessment of the risks by an insurer considers quite a number of factors, such as geographical location, property value, and historical claims. As more data-driven technologies come into play in this new-age industry, insurers will harness onward innovations that add more viability into the risk assessment of any given underwriter.

With various forms of policies created to satisfy divergent homeowner needs, Global Home Insurance encompasses coverage options ranging from basic protection plans to comprehensive policies that include liability coverage and additional living expenses. Policy customization will assume an even larger role, with insurers catering to various property types from single-family homes to multi-unit dwellings. Customization will be driven by advanced analytics and digital platforms, allowing insurers to provide policies based on individual risk profiles.

The global home insurance market will also be molded by statutory influences, which means that the government and financial authorities, through legislation, would ensure the protection of the policyholders as well as the stability of the industry. The respect and compliance with these regulations will remain a binding parameter that will determine how insurers craft their policies and arbitrarily decide upon settlements of claims. In that sense, as the climate changes, more areas would have to adapt their coverage terms to meet the new risk exposure conditions brought by these extreme weather conditions.

The global home insurance market also touches the real estate and mortgage industries in that lenders would generally require homeowners to keep insurance coverage in place under loan agreements. Such interaction reinforces the need for home insurance, which is thus central to property ownership. As long as mortgage providers rely on insurers to mitigate their financial risks regarding property, it is prudent to ensure that properties remain protected throughout the repayment of the loan.

Technological advancements will alter the landscape of the Global Home Insurance industry with artificial intelligence and predictive analytics helping more with pricing of policies and detecting fraud. Smart home devices will also aid in assessing risks, as real-time data will provide insurers with the ability to monitor the conditions of properties and identify potential hazards prior to them becoming costly claims. Such innovations will not only make the management of policies efficient but also arm homeowners with preventive tools for their safety.

The constantly changing property markets and evolving housing trends will open up new challenges and opportunities for the global home insurance market. The urban expansion of neighborhoods along with changing customer expectations and homeownership rates will shape the actions of an insurer. Apart from more conventional policies that will still enjoy their relevance, new models of coverage will emerge, entailing data-based risk assessment and customization with respect to an evolving residential property ownership outlook.

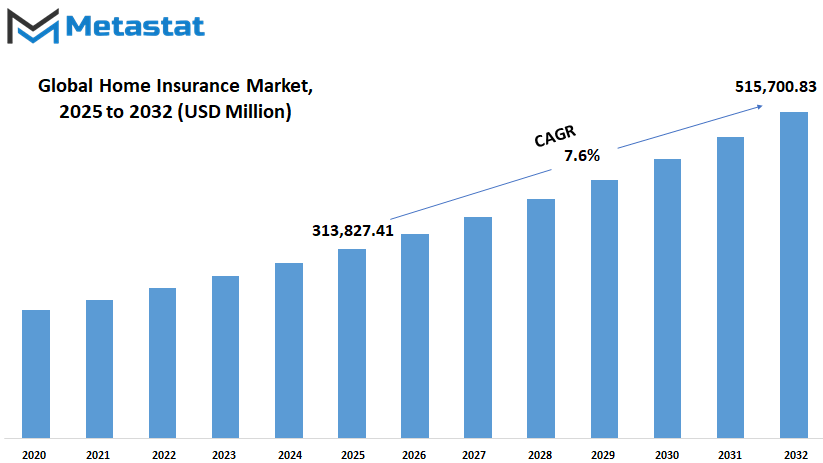

global home insurance market is estimated to reach $515,700.83 Million by 2032; growing at a CAGR of 7.6% from 2025 to 2032.

GROWTH FACTORS

The post shows how demanding the home insurance market is going to be future-wise; even more homeowners would be in search of saving themselves from losses incurred as a result of unforeseen events. Most importantly, the rising frequency of natural disasters has contributed to the increase. Homeowners become very much aware of the risk every time their property faces extreme weather event events, something that has largely intensified again with climate change leading to evidence such as hurricanes, wildfires, flood worse storms, making property coverage a must have. Hence, the new initiated direction impacts much on the number of policy purchases that one can witness as the individuals realize the importance of having financial security in the event of any damage.

Increase in ownership and purchases of buildings has contributed another major change in this segment. The more people purchase property, the greater the demand for insurance coverage. In fact, in many cases, lenders require insurance as a condition for mortgage approval. Demand is fueled even more by this factor. Besides, people have widely accepted property investments as a means to build wealth; therefore, many individuals and organizations are buying properties to rent them out. This makes property owners realize the importance of protecting their assets resulting in a steady rise in policy subscriptions.

The growth factors are not in isolation from challenges. One of the most significant headaches is the whole cost of insurance premiums. Many homeowners, particularly lower income, just cannot seem to get together the odds and ends to purchase comprehensive coverage. And like every other need that homes present in some form, the price of premiums becomes an added burden to many, pushing them out of keeping their policy and leaving them wide open to property damage without coverage. Definitely, the often-complicated procedures of claims could leave some policyholders with high stress levels. These homeowners expect prompt and fairly simple settlement processing after property damage; however, they find themselves going through extended approval processes and extensive documentation requirements. There arose a regrettable sense of loss of satisfaction; in some cases, they led to policy cancellations. This also affects the overall global home insurance market growth.

Advances in technology will bring about many changes in the future with regard to the way insurance services will be offered. The application of big data analytics and artificial intelligence is likely to create a better experience for consumers through user-specific policies. Automation in claims will relieve clients of delays and fast-track process claims while creating more satisfaction and better service. With the processing of millions of terabytes, insurers will not only understand risk better but also gain a much higher statistical utility for a fairer pricing model. Such innovations will make policies more accessible and efficient and will probably encourage more and more homeowners to have coverage.

The emerging concerns of affordable coverage and hassle-free claims-rendering mechanism may not bog down an otherwise bright future of the global home insurance market, given the ever-increasing awareness of property risks and the promise of bright technological evolution to solve major challenges. Although the two areas have become points of concern, new developments have great potential to ease them into a much smoother, friendlier insurance experience.

MARKET SEGMENTATION

By Coverage Type

The global home insurance market is about to enter a phase of transformation, the phase that is expected to be marked with decent growth towards the year of 2025. Driven by various indicators such as technological advancement, positive changes in consumer needs, and an increase in the awareness that home protection is quite important, this sector promises a lot to grow considerably before 2025.

The global home insurance market valuation in 2025 by type of coverage: Basic Homeowners Insurance worth USD 145,189.64 million; Comprehensive Homeowners Insurance worth USD 82,064.52 million; Renters Insurance worth around USD 38,281.80 million; Condo Insurance at USD 19,912.59 million; Landlord Insurance at USD 19,447.17 million; and Mobile Home Insurance worth USD 8,931.68 million. All these numbers reflect the different needs that exist among homeowners and tenants, thus underscoring the relevance of ensuring itemized solutions.

With natural disasters becoming more recurrent, insurance companies are forced to rethink their strategies. Some of the firms have been reducing coverage because of the occurrence of those events in specific locations. This has created an opening for all international and domestic players to tap into those markets using specific policies under adjusted prices. Hiscox and Munich Re are example firms that have extended their reach in the areas that experience high catastrophes by providing coverage options that offset increased risks.

New technologies are also bringing about changes in the home insurance sector. The combination of home automation and Internet of Things (IoT) technology has enabled insurers to provide personalized policies through real-time data tracking. This measure ensures an accurate assessment of risks and is likely to motivate all policyholders to take measures that lessen risks, thereby receiving lower premiums and increased safety.

The consumer is now evolving, and with it comes the birth of demands for more flexible and comprehensive coverage. An average modern-day policyholder has requirements for schemes that can shift with the tides of life and also provide shelter for assorted risks. This is driving the insurance sector towards innovation as well as diversification of products and services.

Also, it is easy for customers to buy insurance through this channel. Customers nowadays can quote, compare, and have their policy managed online. It makes it easier and more accessible. The whole of that digital shift contributes to the customer experience improvement but also has the potential to stretch the insurers' horizons to reach a wider audience and expand markets.

Continuing beyond 2025, the global home insurance market in all countries will have attractive future prospects. Urbanization, increased levels of ownership, and general knowledge of the importance of insurance would keep this upward trend. Insurers who will innovate, keep satisfying customers, and keep abreast of changes set to take place will not only survive but eventually flourish in the new marketplace.

By Distribution Channel

The global home insurance market is an increasingly dynamic market, with technological advancements, alterations in consumer behaviours and transformations in the regulatory landscape contributing to the change. One such shift is in the channels through which home insurance now reaches customers-direct sales, insurance brokers and agents, bancassurance, and e-aggregation. Each channel provides different combination of advantages and would play a different role in the evolution of home insurance distribution channels.

Typically, direct sales mean that the customer purchases the policy directly from the insurer without any intervening persons. The policyholder now has a direct relationship with the insurer, and all engagement takes place through insurer interfaces. Advantageous is personalization of services in terms of possible reduction of some costs. However, direct sales are usually associated with rising costs when strict conditions are applied during digital direct sales. Direct purchase and management of policies online infers the increasing modernity of this channel, whereby customers can manage policies online easily-from purchase to claims. It is expected that the convenience associated with this channel shall attract an ever-increasing population of tech-savvy consumers who prefer straightforward methods to obtain insurance products.

Historically, insurance brokers and agents have been specific major distributors of home insurance policies. They give expertise advice, help clients in traversing complex insurance products, and customize appropriate coverage to each client's needs. Even though the number of digital channels has increased markedly, the special importance that clients give to personalized service by brokers and agents remains high. Particularly among clients with special needs or complex insurance requirements, these professionals are likely to incorporate such digital tools in their services as the global home insurance market evolves. This will enhance their delivery service to clients, while continuing to provide the human touch that distinguishes their services.

Bancassurance forms yet another main distribution channel, which is the collaboration of banks with insurance companies. By customer and structural banks of those institutions, insurers can reach a much wider audience by utilizing this channel. Then the client has all kinds of facilities under one bank to take care of safely availing themselves of the needs for insurance services from familiar banking institutions. Furthermore, it makes the best use of regions where extensive banking networks are located, few other methods are as convenient as this in trying to pull some financial and insurance services into one package for a client. So, the dual linking between banking and insurance services is likely to tighten, providing unified remedies and solutions for comprehensive financial needs of consumers.

Online aggregators have come as one of the most powerful forces within the global home insurance market. With this platform, consumers can compare policies across the board from different insurers and based on this, make an uplifting decision concerning coverage options, premiums, and even customer reviews. It is expected that such open arrangements and convenience that are offered by online aggregators would be attractive to young individuals who typically shop over the net. As consumers continue to search for value as well as personalization, aggregation channels are set to continue flourishing, potentially forcing carriers to offer tailored products thus increasing competition in this already crowded marketplace.

By End-User

The global home insurance market has gone through and is going steady through different changes. Technological advancements, environmental concerns, and new customer requirements have redefined how different segments ranging from homeowners to renters and landlords view home insurance.

For the homeowner, smart home technologies will become even more prevalent. Smart sensors and security systems are the devices, which are likely to enhance home safety and allow insurers to come up with personalized policies based on real-time data. This approach allows a more accurate evaluation of risk and, potentially, lower premiums for those adopting proactive measures to safeguard their properties. However, as climate change further worsens the frequency of natural disasters, homeowners are becoming keen on receiving comprehensive floating cover that includes these emerging risks in their plans. Insurance companies are responding by developing policies that add climate resilience and property owners should undertake eco-friendly, disaster-resistant designs.

Renters are a much-underinsured group that has even been ignored with respect to all facets of insurance. Most types of household products are about property owners. This left a gap for tenants to fill in house insurance products. As a response, policy makers are now trying to develop specifications that would be given to the renter between an owner’s coverage on property contents and liability protection. The expansion and education of tenants about the need to protect their belongings against damage or theft would be the effect of this change. In FAOs, such insurance products are expected to be on the rise because they are all correlating with an increasing urbanization trend that has developed and is leading to higher numbers of people renting houses.

This means that landlords have unique problems in protecting their buildings and the associated liabilities. In most cases, the demand for landlord insurance policies covering their rental premises against damage and loss of rental income as well as liability is increasing due to the shift towards rental housing. The policies on offer are designed to provide customized plans that address the specific risks landlord's encounter. Furthermore, with the advent of short-term rentals and shared housing platforms, insurance providers are adapting to offer coverage that aligns with these modern rental arrangements, ensuring landlords are adequately protected in a rapidly changing the global home insurance market.

There is digital transformation across all market segments in the industry towards customer-experiential and efficient operations. Use of artificial intelligence and data analytics would streamline all processes from issuing a policy to processing claims. Its online and mobile applications create contact points between policyholders and insurers, encouraging communication and transparency in the whole process. The openness with which services will be provided as well as the products that are more innovative due to changing lifestyles may address the diverse needs of homeowners, renters, and landlords.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$313,827.41 million |

|

Market Size by 2032 |

$515,700.83 Million |

|

Growth Rate from 2025 to 2032 |

7.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global home insurance market is at the verge of a great metamorphosis, brought about by technological advancement, environmental calamities, and changing consumer expectations. Foresight will place a role in every one of these vectors in determining which path the industry will take.

The home insurance scenario is responding to an increasing frequency of natural catastrophes in North America, more particularly in the United States. Therefore, insurers are empowering themselves through advanced technology to sharpen their businesses toward excellent customer experience. This proactive measure will lay out the industry's response to a growing demand for all-encompassing coverage against environmental uncertainties.

Interventions in the European home insurance market are influenced by strict regulations and greater awareness of the benefits of insurance among homeowners. Smart home technologies and a green approach are among the region's driving forces that are helping to transform the industry, leaning more toward personalized and ecological insurance solutions.

Due to rapid urbanization and a burgeoning middle class, the demand for home insurance has surged around the Asia-Pacific region. Residential construction is burgeoning, whereas digital platforms enhance the reach of insurance among potential customers. Such a transition highlights a lucrative opportunity for insurers to target a heterogeneous and expanding home insurance market.

In contrast, Unawareness and Economic Improvements, South America are becoming more conscious of property insurance. More emphasis is placed on risk management, leading to homeowners increasingly looking for coverage. Therefore, this increasing awareness is an opportunity for insurers to provide tailored products in response to the specific requirements of the global home insurance market.

The insurance uptake receives some enhancement through the regulatory frameworks in the Middle East and Africa. With the continued developments, these regions create opportunities for substantial growth within the insurance's spaces. Furthermore, insurers can entrench themselves through an understanding of and strategy for the unique challenges and opportunities in such markets.

Across the board, an increasing frequency of natural calamities is a challenge facing the sustainability of home insurance. Insurers are exploring new avenues, like public and private sector partnerships and more stringent building codes, to reduce the risks and maintain affordable premiums for homeowners. Through these efforts, the goal is to arrive at a More Resilient Insurance Industry able to work along the variable lines of the environment.

An overview was therefore given of the alignment of technological innovations, aspects of environmentalism, and varying consumer gratification. Thus, embracing these modifications will allow insurers to contribute to developing effective and customized solutions whereby homeowners across the globe will have access to trustworthy and comprehensive coverage on their safeguarding interests in the more-developed advanced industries.

COMPETITIVE PLAYERS

The global home insurance market is significantly changing with the advent of technology, consumers changing expectations, and climate change awareness. Well-established insurance companies are making changes to adapt to cope with these changes to improve competition.

State Farm Mutual Automobile Insurance Company is maximizing its vast network and history to continue providing personalized insurance solutions for homes. It uses advanced data analytics to augment its risk assessment and provide personalized policy offerings to customers.

Allstate Insurance is embracing digital innovations for improved service delivery. User-friendly mobile apps and online platforms were launched to ease the management of policies and processing of claims for its clients, defining Allstate's commitment to a customer experience enhanced by technology.

Liberty Mutual Insurance has created possibilities for real-time assessments of property values, allowing for reactive adjustments in coverage options. This approach enables policyholders to obtain coverage that fits present market circumstances, evidencing Liberty Mutual's commitment to providing responsive and adaptive insurance solutions.

Farmers Insurance Group is expanding its products to cover emerging risks from smart home technology. Farmers wants to address these problems-new and old-to be ready for homeowners' ever-changing desires in a world becoming more connected.

Nationwide Mutual Insurance Company has initiatives to champion financial education for homeowners, equips them with resources to make informed decisions regarding their insurance needs, and empowers customers through learning and transparency.

Using predictive analytics, The Travelers Companies Inc. is on a path toward forecasting and cushioning probable losses. Travelers would thus analyze patterns and trends to mitigate risks before they arise, making coverage options more reliable and effective.

Chubb Limited is known as the world's largest publicly traded property and casualty insurance company and operates in 55 countries and territories. The company provides it with an entire range of property and casualty insurance, accidents and health insurance, reinsurance, and life insurance. It has a wide global network and ample insurance coverage products, giving it a major stake in the industry.

USAA Insurance proudly serves specialized home insurance products to military members and their families. By focusing on the unique needs of this community, the company sustains a strong and loyal customer base.

Progressive Casualty Insurance Company is employing telematics and data-driven insights to personalize policies and pricing. It is this personalized approach that enables Progressive to remain competitive while accurately assessing individual risk profiles.

The strategic maneuvering of the Zurich Insurance Group has begun afresh, thanks to the extinguished partnership with the Indian partner, Bajaj Finserv, which had lasted 24 years. This move opens up new vistas for Zurich and new joint ventures in the Indian market, confirming the flexible and adaptive character of its strategy in a disturbed global environment.

AXA S.A. is putting climate resilience into its policies to attract environmentalists. AXA has chosen to focus on sustainability to address climate change's increasing concern and effect on home insurance.

Allianz Insurance plc has been gaining the global home insurance market share through acquisitions such as the one of British Cornhill Insurance plc. Such strategic moves have consolidated Allianz's position in various geographies to be able to sell a greater line of home insurance products.

There are also some considerable mergers and acquisitions going on in the home insurance market. For instance, Aviva's purchase of Direct Line for 3.7 billion will see it become one of the largest motor insurers in the UK. This wave of consolidation is pointing towards a trend of building larger entities capable of providing comprehensive insurance solutions.

The further the evolution of the global home insurance market, the more companies stress on innovation, customer orientation, and strategic partnerships to cope with the shifting terrain and meet the different needs of homeowners around the globe.

Home Insurance Market Key Segments:

By Coverage Type

- Basic Homeowners Insurance

- Comprehensive Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Landlord Insurance

- Mobile Home Insurance

By Distribution Channel

- Direct Sales

- Insurance Brokers & Agents

- Bancassurance

- Online Aggregators

By End-User

- Homeowners

- Renters

- Landlords

Key Global Home Insurance Industry Players

- State Farm Mutual Automobile Insurance Company

- Allstate Insurance Company

- Liberty Mutual Insurance

- Farmers Insurance Group

- Nationwide Mutual Insurance Company

- The Travelers Companies Inc.

- Chubb Limited

- USAA Insurance

- Progressive Casualty Insurance Company

- Zurich Insurance Group

- AXA S.A.

- Allianz Insurance plc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383