MARKET OVERVIEW

The global data center transformer market plays a critical role in providing infrastructure for data-intensive operations across industries. Powers, protects, and optimizes data centers, with electrical systems maintaining voltage stability, energy efficiency, and protection of valuable equipment during power disturbances. This is the function the transformers support in the ecosystem.

With the demand for more efficient power distribution rising, this becomes a key driver for the global data center transformer market. Data centers need transformers with continuous-load capabilities and minimum energy losses. This has triggered innovations in transformer technology to enhance reducing electrical resistance and better thermal management. The greener alternatives are also gaining traction, integrating biodegradable insulation fluids and recyclable materials into the transformers' designs. The environmental sustainability concerns entwined with a demand for an energy-efficient solution feed the above outlook.

The global data center transformer market is also responding to the trend of modular data center development. These prefabricated constructions don't require transformers to be compact or high-power, given needing seamless power distribution. While companies look to reduce their time to deployment and improve scalability, transformer manufacturers are tailoring their solutions to meet these needs. Coupling the efficiency of these transformers with smart grid technology would enhance this. Smart grid technology would enable remote monitoring, predictive maintenance, and real-time data analysis to optimize performance.

Resilience and reliability build the foundation of priority setting in the global data center transformer market. Data centers operate 24 hours, and small disruptions can cause considerable downtimes and monetary losses. Transformer manufacturers are working on advanced insulation materials, cooling mechanisms, and fault tolerance. The digital twin application is gaining acceptance in witnessing transformer modeling performance to forecast possible failures before they arise.

Another discussion emerging in the global data center transformer market is in relation to integrating renewable energy sources. Now, as organizations move toward ever-lower carbon footprints, there is increased interest in transformers that can seamlessly interface with solar and wind power systems. Coupled with a battery energy storage system, this compatibility is yet another forward move toward sustainable power infrastructure.

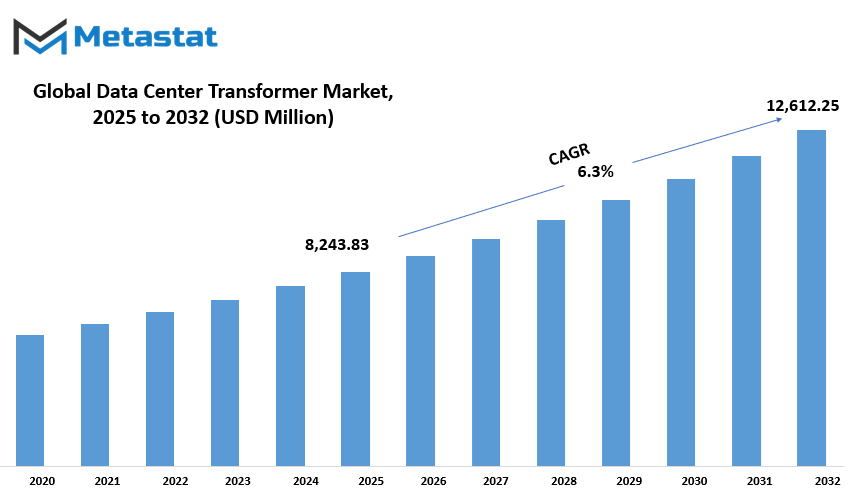

Global data center transformer market is estimated to reach $12,612.25 Million by 2032; growing at a CAGR of 6.3% from 2025 to 2032.

GROWTH FACTORS

The global data center transformer market is seeing robust growth with rising demand for data storage and processing power. This necessitates the supporting infrastructure of efficient and high-performance systems. Data centers require reliable power solutions to maintain uninterrupted operation, with transformers playing a critical role in their electrical systems. Energy efficiency is the foremost consideration, incentivizing operators to seek advanced transformer technologies that reduce energy loss and enhance performance.

Nonetheless, the increasing demand could impede market growth due to the challenges it poses. The initial capital investments related to transformer setup and maintenance are a primary concern. Along with advance equipment procurement, the expenses of infrastructure upgrades amount to a considerable financial burden. To start with, such operations are criticized by a shortage of trained personnel available for specialized installation and servicing in most markets of the world. With expertise in maintenance and troubleshooting of transformers in limited numbers, adverse consequence in reduced transformers acceptance in the market will be experienced across certain regions.

Nevertheless, these are the opportunities that the market can take advantage of, especially due to global moves toward renewable energy sources. The investments are being greatly energized by the increasing emphasis on sustainability, stimulating interest in eco-conscientious transformer solutions. Firms are actively examining designs that meld renewables into their transformers in such a way as to minimize their adverse environmental impact while guaranteeing uncompromising operational efficiency. The implementations, these transformer designs promise, would further contribute to the larger industry goal of realizing energy-efficient data centers without compromise on performance.

The demand for unwavering power distribution solutions will be ever-increasing as innovations will keep advancing. Players in the sector are emphasizing greater transformer efficiency, longevity, and flexibility to meet the needs of modern data centers. The quest for sustainable energy solutions, and uninterrupted dependable power supply directly affects the direction of many sectors and promotes innovation and growth.

MARKET SEGMENTATION

By Type

Initially more due to increased demand for reliable power and electrical systems into this transformer markets are growing fast globally. Transformers in the data center play the important part of additional assurance of smooth operation at data centers by controlling voltage levels, reducing power fluctuations, and improving energy efficiency. The increasing dependence on cloud computing, artificial intelligence, and big data processing is driving the need for high-capacity transformers. Companies are trying to improve the lifespan and performance of transformers in order to meet the stringent demands of modern data centers.

It offers every type of transformer that qualifies its application under its different operations. The presence of great cooling power has made it ($3,372.96 million) widely used and suited for large data centers. An alternative and low-maintenance transformer would be the dry-type transformer, which installed indoors. Additionally, cast-resin transformers improve safety features, commonly where fire-resistant areas are needed. Auto transformers help in adjusting voltage; while phase-shifting transformers manage power flow in interconnected grids. A rectifier transformer is used often in applications involving direct current conversion. Beyond the ones mentioned here, there remains a range of transformers targeting industrial and commercial applications.

As digital requirements expand, so do data centers. Accordingly, companies are investing in new transformer technologies to promote better efficiency and sustainability. Energy-efficient design, intelligent monitoring systems, and green materials will be the three crucial focus areas. This integration of automation and real-time monitoring helps data centers optimize the benefits of power consumption, thus reducing risks regarding operations. Apart from the newness in government regulations, pressure for sustainability purposes has broadened this shift for transducers to an environment-friendly footprint.

This will be characterized by technological progress seeing more investment into digital infrastructure and a strong focus on energy consumption reduction. With data centers increasingly becoming the core of the digital transformation, the demand for efficient yet reliable transformers will thus be on the rise. Innovation will thus prevail as companies strive to ensure that transformers meet the emerging needs of high-performance computing, cloud services, and artificial intelligence-driven applications.

By Cooling Type

The global data center transformer market as critical infrastructure for data centers to acquire energy efficiency and stability. High-load transformers have been constructed to provide voltage regulation to increase energy efficiency and eliminate power losses. This is due to the fact that, with increasing demands of cloud computing, AI and digital services, it has become important that access to power management solutions be available, as well as the usage of Data Center Transformers for voltage stabilization and fluctuation, as well as downtime minimization and energy efficiency.

Cooling technologies incorporated within this market can also be contributory to the optimal operational capacity of transformers while averting overheating of the latter. The market can be divided as per the type of cooling applied to these transformers, namely, oil-cooled, air-cooled, water-cooled, hybrid cooling, and other advanced cooling methods. Oil-cooled transformers dissipate heat through insulating oil and are expected to provide adequate output level for heavy-duty applications. Unlike this type, air-cooled transformers operate by utilizing either natural or forced air circulation while thereby using a simpler and less maintenance intensive method for heat dissipation. Water-cooled transformers transfer heat to the water through a closed water circuit, thus favoring areas wherein the space and temperature control are critical. Hybrid cooling systems make use of cooling combinations that promote efficiency across various operating conditions.

Data centers consume large amounts of electricity, and thus energy efficiency and sustainability are coming into focus. Manufacturers of transformers are incorporating advanced materials and innovative cooling techniques to cut down energy consumption and environmental concerns. Renewable energy integration into data centers has also affected the transformer market, as manufacturers are coming up with solutions that favor green energy sources, such as solar and wind power. Besides, regulatory guidelines promoting energy efficiency and environmental responsibility have further supported transformers conforming to stringent efficiency criteria.

Emerging technologies have seen tremendous growth in the global data center transformer, thanks to advancements in smart grid technology and automation. Integrating monitoring-and-predictive-maintenance solutions enables operators to foresee potential failures, improving energy monitoring with enhanced reliability of the entire system. As digital infrastructure continues to expand globally, demand for high-performance transformers will persist, ensuring stable and efficient power distribution to data centers.

By Application

One of the most important players in the global data center transformer market. It makes sure that everything runs smoothly in data centers worldwide and promises no downtime. Digital transformation is rapidly progressing and the demands of businesses and industries for reliable power solutions are now pressing priorities because they solely depend on data centers to store, process, and manage vast amounts of information. These transformers are designed to cater to the contemporary power requirements of data centers, ensuring increased stability of voltage with minimized energy losses for smooth operational conduct. Beyond just the distribution of power, the transformers are responsible for ensuring that entire data infrastructure systems are efficient, safe, and sustainable.

Precision and reliability are very important for power management in any data center. The transformers of this market perform multiple functions, from power distribution and backup power to grid connectivity, voltage regulation, and load balancing. Power distribution is one of the most widely used applications, that is to evenly distribute electricity across different systems in a data center. With the increasing complexity of digital infrastructure, keeping a steady flow of electricity is very important to avert disruptions that would result in either data loss or operational downtime. Backup systems come to the rescue in a power outage. Should there be a failure in electricity supply, transformers containing backup power systems keep operations flowing without a hitch using alternative sources.

On the other hand, grid connectivity is highly important; therefore, data centers must be connected to the main grid but with stability and efficiency. They help to regulate voltage fluctuations and render a uniform supply of power that, for example, protects sensitive devices from possible damage. This regulation is particularly critical for performance because the efficiency and life of data center components can depend on variations in their input voltage. Load balancing evenly distributes electrical loads among the different circuits, avoiding overload for any single system while ensuring a balanced energy flow.

Increasing numbers of data centers that are built and growing in scale will only intensify the demand for advanced transformer technology. Companies are investing in energy-efficient and sustainable transformer technologies to reduce power consumption and minimize their environmental impacts. This includes increasing durability and reliability in alignment with the growing workloads that newer data centers will impose. As continuous progress is made in power management, the global data center transformer market will remain crucial to the future of these infrastructures and digital excellence in terms of efficiency, reliability, and sustainability.

By End-Users

The global data center transformer market forms the bedrock of modern-day digital infrastructure. The demand for data storage, processing, and transfer is ever-increasing, rendering efficient power management paramount. Data centers are the core of this transformation, while transformers serve the important function of a stable-holding power source. These transformers are constructed to tolerate serious electrical loads to guarantee seamless operations while remaining operationally efficient and reliable.

The market is segmented based on end-users; each of the segments has unique needs. Hyperscale data centers developed for processing data on behalf of large corporations and tech firms work with high-capacity transformers which will allow uninterrupted operations. Colocation data centers rely on transformers that assure stable power distribution to prevent downtime for shared hosting environments for different businesses. Enterprise data centers are primarily concerned with energy efficiency and cost-effectiveness but will ensure operational reliability for the private organization in question.

Cloud service providers operate huge networks of data centers and are among the major consumers of transformers for scalability and energy optimization. Security is a priority for government and defense data centers, making the procurement of transformers with upgraded protection schemes to secure critical information a must. These telecommunication data centers that run nteractive and mobile services require uninterrupted power supply to channelize huge communication networks. Other data centers such as those serving scientific research and healthcare are also calling for advanced transformer solutions.

The demand for energy-efficient, high-performance transformers is projected to increase with the acceleration of digital transformation. Organizations are constantly looking for solutions that can reduce power losses and carbon footprints while improving operational stability. We foresee that with advances in smart grid technology and renewable energy integration, this market will attract innovations to suit the changing industry requirements. Ultimately, this transition towards sustainable and intelligent power solutions is likely to transform data center operations in the upcoming years.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8,243.83 million |

|

Market Size by 2032 |

$12,612.25 million |

|

Growth Rate from 2025 to 2032 |

6.3% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

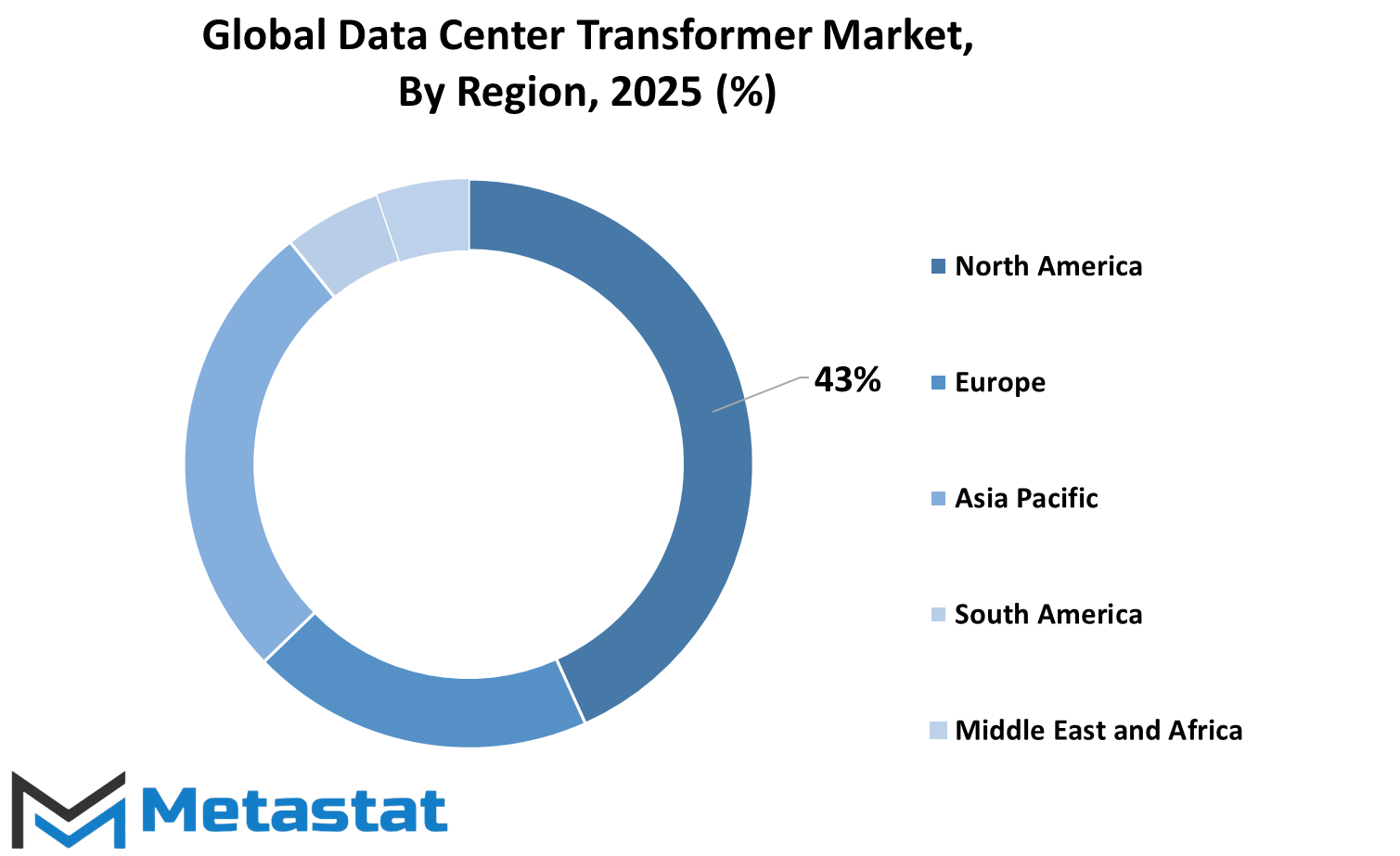

REGIONAL ANALYSIS

The global data center transformer market is seeing an uptick on a worldwide scale due to increasing concerns over the efficiency and reliability of power distribution therein. Such transformers are necessary to ensure stable electricity flow, power fluctuations avoidance, and cited performances regarding data centers' operation. The global demand for data centers has increased because of the greater reliance on digital services such as cloud computing and heavy data processing for enterprises, which ultimately has a direct positive influence on demands for high-quality transformers.

The geographical division of the market into segments includes all these regions with their own levels of development and advancement in technology. North America constitutes a significant share, as there are large data centers and several cloud service providers present in this region. This segment covers the U.S., Canada, and Mexico. The U.S. garners a lion's share due to diversified and extensive network infrastructures as well as investments incorporated in the continuous expansion of the data center. The other two countries are within a phase of development, their growth boosted with the increasing trend of digital transformation initiatives.

The foremost European market may be counted as the UK, Germany, France, Italy, and the Rest of Europe. Amongst those, Germany and UK occupy the top two ranks due to cutting-edge technological advancements and an increasing number of data centers. The other European countries, mainly France and Italy, are on their way to great market development by investing more in data storage and cloud computing infrastructure. Other European countries are on the gradual advancement track of expanding their data centers, thus strengthening the region's position in the overall market.

Asia-Pacific is also a pivotal region comprising segments such as India, China, Japan, South Korea, and the Rest of Asia-Pacific. Mainland China takes command of market leadership due to a booming digital economy and rapid industrialization plus government policy boosts for data center development. India is fast catching up through increased use of cloud services and building IT backbone infrastructure, while Japan and South Korea also have established themselves in the technology sector, contributing much towards supplying demand for state-of-the-art data centers. Digitalization is gradually trickling down into other countries in the region.

Brazil, Argentina, and the Rest of South America constitute South America moving steadily. Brazil remains at the forefront in terms of market development owing to the heightened investment in cloud services and solutions for data storage. Argentina thus naturally follows with slow, consistent technology advancements. At such pace, other countries in the region would eventually catch up through steady albeit gradual adoption of digital solutions.

Middle East & Africa: GCC Countries, Egypt, South Africa, and the rest of the Middle East & Africa. The heavy expenditure in data center infrastructure by the GCC Countries, primarily the UAE and Saudi Arabia, is to support these nations' growing digital economies. In addition, Egypt and South Africa are developing their markets more so now due to the growing demand for cloud computing and the increased connectivity they enjoy.

COMPETITIVE PLAYERS

The global data center transformer market is a necessary stage for the emerging requirement of data-processing and storage solutions. Increasing the number of data centers will naturally rely more heavily on transformers, which need to be reliable and efficient to guarantee consistent, high-performance action as well as protection against electrical failure occurring within it. These kinds of transformers are designed to work under heavy loads with stable power supply all the time while reducing power wastage. Industry continues to transform in accordance with advancement technology that further improves the efficiency, reduction in equipment downtimes, and sustainability in operations.

By Far Lead the list of Top Players to Contribute in This Sector in Development and Innovation: Eaton Corporation plc, Virginia Transformer Corp, MGM Transformers, Sunbelt Solomon, PTI Transformers, Maddox Industrial, ABB Ltd., Siemens AG, General Electric (GE), Hitachi Energy, Vertiv Group Corp., Fuji Electric Co., Ltd., Hammond Power Solutions Inc., Schneider Electric SE, Rex Power Magnetics, JST Power Equipment, TMC Transformers S.p.A., Trafo Power Solutions, WEG Industries (WEG S.A.), HD Hyundai Electric & Energy Systems Co., Ltd. All of them define the market by advanced solutions for transformers which are tuned to the dynamic requirements of data centers across the globe. The product will fulfill various energy requirements and integrate with current infrastructures along with energy efficiency standards.

The demand for data center transformers will also be dictated by the increase in cloud, artificial intelligence, and massive data analytics in business operations. In addition, with the growing dependency of organizations on service delivery through the internet, such data centers are expected to function effectively and efficiently. Infrastructure would be backed up by transformers which play a role in stabilizing power supplies while shielding it from voltage mismatches and installing cleaner resources. Innovations in transformer technology include advancements toward energy efficiency improvement via reduced waste, upgraded cooling approaches, and smart-grid compatibility.

Sustainability is an increasing concern in this industry. Similar to the previous developments, the manufacturers are making eco-friendly transformers designed with biodegradable insulating fluids and materials with lesser damage potential to the environment. With the energy-efficient transformers, carbon emissions tend to decrease, for this is part of the worldwide effort to harvest green data center operations. Given that energy consumption and emission regulations continue to tighten, industry players continue to invest in research and development toward producing solutions that meet their expected standards and promote sustainability.

The global data center transformer market will see further demands from automation and digital monitoring and predictive maintenance. This provides better optimization of performance while reducing the costs incurred on operation and improves reliability in general of the overall power infrastructure for the data centers.

Data Center Transformer Market Key Segments:

By Type

- Liquid-Immersed Transformers

- Dry-Type Transformers

- Cast-Resin Transformers

- Auto Transformers

- Phase-Shifting Transformers

- Rectifier Transformers

- Others

By Cooling Type

- Oil-Cooled

- Air-Cooled

- Water-Cooled

- Hybrid Cooling

- Others

By Application

- Power Distribution

- Backup Power

- Grid Connectivity

- Voltage Regulation

- Load Balancing

- Others

By End-Users

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Cloud Service Providers

- Government & Defense Data Centers

- Telecommunications Data Centers

- Others

Key Global Data Center Transformer Industry Players

- Eaton Corporation plc

- Virginia Transformer Corp

- MGM Transformers

- Sunbelt Solomon

- PTI Transformers

- Maddox Industrial

- ABB Ltd.

- Siemens AG

- General Electric (GE)

- Hitachi Energy

- Vertiv Group Corp.

- Fuji Electric Co., Ltd.

- Hammond Power Solutions Inc.

- Schneider Electric SE

- Rex Power Magnetics

- JST Power Equipment

- TMC Transformers S.p.A.

- Trafo Power Solutions

- WEG Industries (WEG S.A.)

- HD Hyundai Electric & Energy Systems Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383