MARKET OVERVIEW

The Global Shredder Blades market, within the industrial sector, embodies a dynamic landscape characterized by the production, distribution, and utilization of specialized cutting components pivotal to various shredding machinery. These blades serve as essential components in a spectrum of applications ranging from recycling facilities to industrial waste management plants, where they are tasked with the efficient breakdown of diverse materials into manageable fragments.

The essence of the Global Shredder Blades market lies in its ability to cater to the diverse needs of industries reliant on shredding technology for material processing. With a focus on durability, precision, and performance, manufacturers within this sector continuously strive to innovate and refine blade designs to optimize shredding efficiency across different materials, be it plastic, metal, wood, or organic matter.

One of the defining features of the Global Shredder Blades market is its adaptability to a wide array of industrial contexts. From heavy-duty shredders utilized in scrap metal recycling facilities to compact units employed in document destruction services, the demand for specialized shredder blades remains robust. This versatility underscores the market's significance as a critical enabler of efficient material handling and resource recovery processes across various industries.

Furthermore, the Global Shredder Blades market operates within a competitive landscape shaped by technological advancements and evolving customer requirements. As industries seek to enhance operational efficiency and minimize downtime, there is a growing emphasis on the development of high-performance shredder blades capable of withstanding rigorous operational demands while delivering consistent results.

In addition to technological innovation, factors such as material composition, blade geometry, and manufacturing processes play a crucial role in shaping the performance and longevity of shredder blades. Manufacturers leverage cutting-edge materials such as high-strength alloys and advanced coatings to enhance blade durability and resistance to wear and tear, thereby extending their operational lifespan.

Moreover, the Global Shredder Blades market is closely intertwined with broader trends in sustainability and environmental stewardship. As industries increasingly prioritize waste reduction and resource conservation, shredding technology emerges as a vital tool for facilitating material recovery and recycling initiatives. Shredder blades, as integral components of shredding equipment, enable the efficient processing of recyclable materials, thereby contributing to the circular economy and reducing the environmental footprint of industrial operations.

The Global Shredder Blades market epitomizes the intersection of innovation, industrial efficiency, and environmental responsibility within the broader industrial landscape. As industries continue to evolve and adapt to changing market dynamics, the demand for high-performance shredder blades is expected to remain robust, driven by the imperative for efficient material processing and resource utilization. By leveraging cutting-edge technologies and engineering expertise, manufacturers within this sector are poised to address the evolving needs of diverse industries while advancing sustainability goals and operational excellence.

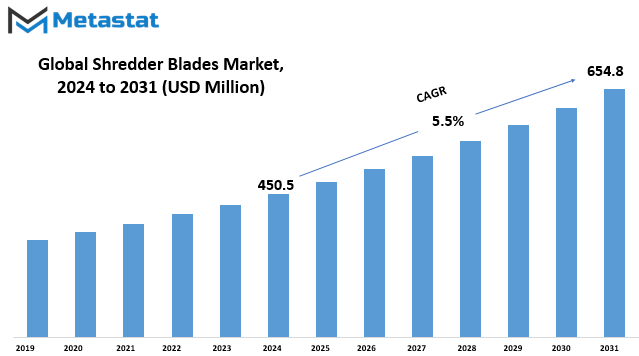

Global Shredder Blades market is estimated to reach $654.8 Million by 2031; growing at a CAGR of 5.5% from 2024 to 2031.

GROWTH FACTORS

The global market for shredder blades is experiencing various driving factors, along with some restraints and opportunities. One significant driver is the increasing emphasis on recycling and waste management worldwide. As societies become more aware of environmental issues, there's a growing push to recycle materials and manage waste more effectively. This trend directly impacts the demand for shredder blades, which are essential components in recycling machinery.

Moreover, the process of industrialization and urbanization across the globe contributes to the expansion of the shredder blades market. With more industries and urban areas emerging, there's a higher demand for machinery equipped with shredder blades to handle waste and recycling tasks efficiently. This increasing demand drives the growth of the market.

However, despite these driving factors, there are some restraints to consider. One such restraint is the high initial investment costs associated with setting up shredding operations. The machinery required for shredding often involves significant upfront expenses, which can deter potential buyers or investors. Additionally, stringent environmental regulations pose challenges to the market. Compliance with these regulations requires additional investments in technology and processes to ensure environmental sustainability, adding to the overall cost of operations.

Nevertheless, amidst these challenges, there are opportunities for growth, particularly driven by technological advancements in shredder blade materials and design. Innovations in materials science and engineering lead to the development of more durable, efficient, and cost-effective shredder blades. These advancements not only improve the performance of shredding machinery but also reduce maintenance costs and enhance overall productivity. As a result, manufacturers and operators in the shredder blades market can capitalize on these opportunities to stay competitive and meet the evolving needs of their customers.

The global market for shredder blades is influenced by various factors, including increasing emphasis on recycling, industrialization, initial investment costs, environmental regulations, and technological advancements. While challenges exist, opportunities arise from innovations in materials and design, paving the way for sustainable growth in the market.

MARKET SEGMENTATION

By Type

The global market for shredder blades is diverse, divided into several segments based on the type of material they’re designed to shred. These segments include plastic, wood, metal, and others. In 2023, the plastic shredder blades segment was valued at 127.7 million USD, while the wood shredder blades segment was valued at 53.6 million USD.

Each segment caters to specific needs and industries. Plastic shredder blades are crucial for recycling plastic waste efficiently, contributing to environmental sustainability. Wood shredder blades, on the other hand, play a significant role in the forestry and lumber industries, where wood waste needs to be processed and recycled.

Metal shredder blades are essential for recycling metal scraps in industries such as automotive manufacturing and construction. The “others” category encompasses blades designed for shredding materials like rubber, textiles, and electronic waste, catering to various niche markets and specialized recycling processes.

These segmented markets reflect the diverse applications and demands for shredder blades across different industries, highlighting the importance of efficient material processing and recycling in today’s economy.

By Shaft Count

The global market for shredder blades is segmented by shaft count, which includes single shaft, double shaft, four shaft, and other types. These different shaft counts cater to various shredding needs across industries.

Single shaft shredders are commonly used for general-purpose shredding tasks. They are efficient in breaking down materials into smaller pieces, making them suitable for applications such as recycling, waste management, and size reduction.

Double shaft shredders, on the other hand, offer enhanced efficiency and versatility compared to single shaft shredders. With two interlocking shafts equipped with blades, they can handle tougher materials and larger volumes, making them ideal for industrial and heavy-duty shredding operations.

Four shaft shredders are designed for even greater power and precision. With four shafts working in tandem, they provide superior shredding performance, especially for materials that require thorough and consistent reduction, such as plastics, metals, and electronic waste.

The Others category encompasses a range of specialty shredders tailored to specific requirements, such as high-security shredding, tire shredding, and medical waste shredding. These specialized shredders address niche markets and unique shredding challenges beyond the capabilities of single, double, or four shaft shredders.

The market for shredder blades offers a variety of options based on shaft count, each suited to different shredding needs and applications. Whether it’s for general-purpose shredding, heavy-duty industrial operations, or specialized requirements, there’s a shredder blade solution available to meet diverse customer demands.

By Blade Design

The global market for shredder blades can be segmented by blade design, with two main categories: hook and square. In 2023, the hook segment of the market was valued at 287.4 USD Million, while the square segment was valued at 143.9 USD Million.

The hook design features curved edges that hook onto materials to be shredded, providing efficient cutting and tearing action. This design is commonly used in industrial settings where heavy-duty shredding is required, such as recycling facilities and waste management plants. Its high value in the market reflects its effectiveness and widespread use in various industries.

On the other hand, the square design features straight edges that provide precise cutting, making it suitable for shredding materials like paper, cardboard, and plastic. This design is often found in office shredders and smaller-scale shredding equipment. Despite its lower market value compared to the hook design, the square segment remains significant due to the demand for shredding solutions in office and residential settings Both blade designs play essential roles in the shredding industry, catering to different applications and requirements. While the hook design dominates in heavy-duty industrial shredding, the square design serves smaller-scale needs, including document destruction and recycling.

The distinct characteristics of each blade design offer customers options based on their specific shredding needs, ensuring efficiency and effectiveness in material processing. As the demand for shredding solutions continues to grow globally, the market for shredder blades is expected to expand further, driven by technological advancements and increasing environmental awareness.

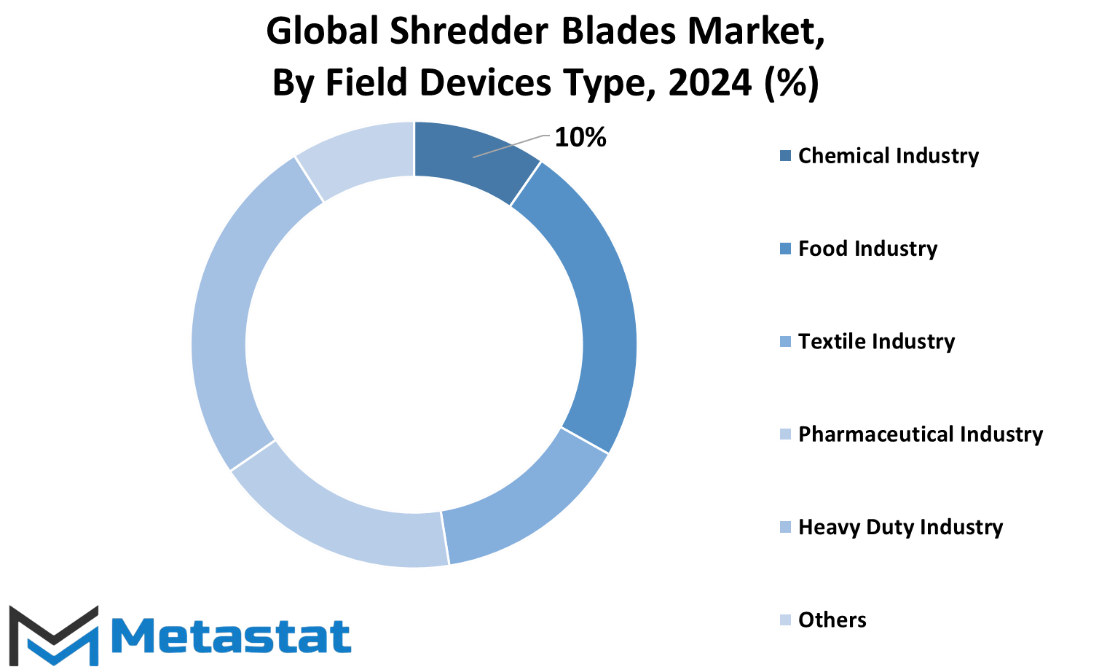

By Application

The global market for shredder blades is segmented based on application into various sectors including the chemical industry, food industry, textile industry, pharmaceutical industry, heavy-duty industry, and others. This segmentation allows for a more targeted understanding of the diverse applications and demands for shredder blades across different industrial sectors.

In the chemical industry, shredder blades play a crucial role in processing and recycling materials, contributing to the efficient management of waste and by-products. Similarly, in the food industry, these blades are essential for breaking down organic matter and facilitating the recycling of packaging materials.

The textile industry relies on shredder blades for the processing of textile waste, including cutting and shredding fabric remnants and old garments for recycling purposes. Meanwhile, in the pharmaceutical industry, these blades are utilized for the destruction of expired medications and the disposal of pharmaceutical waste in compliance with regulatory requirements.

The heavy-duty industry encompasses a wide range of sectors, including automotive, construction, and manufacturing, where shredder blades are used for shredding various materials such as metals, plastics, and rubber. Additionally, other industries such as paper and pulp, electronics, and renewable energy also utilize shredder blades for material processing and recycling purposes.

Overall, the segmentation of the global shredder blades market by application highlights the versatility and widespread use of these essential industrial components across different sectors, contributing to sustainability efforts and resource efficiency in various industries worldwide.

REGIONAL ANALYSIS

The global market for shredder blades is experiencing significant growth, driven by various factors such as increasing industrialization, rising demand for recycling, and technological advancements in shredder blade design. However, to gain a deeper understanding of this market, it's crucial to analyze its regional dynamics.

One key aspect of regional analysis is examining the market trends, growth potential, and challenges specific to different geographical areas. For example, in North America, the shredder blades market is propelled by stringent environmental regulations promoting recycling practices and the presence of a well-established industrial sector. On the other hand, in emerging economies like Asia-Pacific, the market growth is fueled by rapid industrialization, urbanization, and increasing awareness about environmental sustainability.

Moreover, regional analysis helps identify market opportunities and tailor strategies accordingly. For instance, in Europe, where there's a strong emphasis on reducing carbon footprint and promoting circular economy initiatives, there's a growing demand for high-quality, durable shredder blades that can effectively process recyclable materials. In contrast, in regions with lower environmental awareness, such as some parts of Africa and Latin America, the market growth may be slower due to limited adoption of recycling practices and infrastructure constraints.

Additionally, analyzing regional variations in consumer preferences, purchasing power, and regulatory frameworks is essential for market players to devise targeted marketing campaigns and distribution strategies. For instance, in regions with a high concentration of small and medium-sized enterprises (SMEs), offering cost-effective shredder blade solutions tailored to their specific needs can be a lucrative approach.

Regional analysis plays a crucial role in understanding the nuances of the global shredder blades market. By examining regional trends, growth drivers, and challenges, stakeholders can make informed decisions and capitalize on emerging opportunities in different parts of the world.

COMPETITIVE PLAYERS

The global market for shredder blades is a competitive arena with several key players vying for dominance. Among these players are Accu Grind, Aker Tools & Components, American Cutting Edge, Anhui Yafei Machine Tool Co. Ltd., BKS Knives, Fernite of Sheffield Ltd., and Fordura China. Each of these companies brings its own set of strengths and capabilities to the table, contributing to the dynamic landscape of the industry.

Accu Grind is known for its precision and quality in manufacturing shredder blades. With a focus on innovation and customer satisfaction, Accu Grind has established itself as a trusted name in the market. Aker Tools & Components, on the other hand, emphasizes durability and reliability in its products. Customers value the longevity of Aker Tools & Components' blades, making them a popular choice in various applications.

American Cutting Edge prides itself on its extensive experience and expertise in the field of blade manufacturing. With a long history of serving diverse industries, American Cutting Edge offers a wide range of solutions tailored to meet specific customer needs. Anhui Yafei Machine Tool Co. Ltd. distinguishes itself through its commitment to technological advancement. Constantly seeking to improve its products and processes, Anhui Yafei Machine Tool Co. Ltd. stays at the forefront of innovation in the shredder blade industry.

BKS Knives focuses on customization and flexibility, providing customers with tailored solutions to suit their unique requirements. Whether it's a specialized material or a specific cutting application, BKS Knives delivers precision-engineered blades that deliver optimal performance. Fernite of Sheffield Ltd. is renowned for its craftsmanship and attention to detail. With a dedication to quality craftsmanship, Fernite of Sheffield Ltd. produces blades that meet the highest standards of excellence.

Fordura China brings a global perspective to the market, leveraging its extensive network and resources to deliver value to customers worldwide. With a focus on efficiency and cost effectiveness, Fordura China offers competitive solutions without compromising on quality. Collectively, these key players shape the competitive landscape of the shredder blade market, driving innovation and excellence across the industry.

In addition to these established players, the market also sees the emergence of new entrants and disruptive technologies. These up-and-coming companies bring fresh ideas and perspectives to the table, challenging traditional norms and pushing the boundaries of what's possible. As competition intensifies, companies must stay agile and adaptable to navigate the ever-changing landscape of the shredder blade market.

Overall, the competitive dynamics of the shredder blade market are shaped by a diverse array of players, each bringing its own unique strengths and capabilities to the table. From precision and durability to innovation and customization, these key players drive the industry forward, ensuring that customers have access to high-quality solutions that meet their evolving needs., , , ,

Shredder Blades Market Key Segments:

By Type

- Plastic Shredder Blades

- Wood Shredder Blades

- Metal Shredder Blades

- Others

By Shaft Count

- Single Shaft Shredder

- Double Shaft Shredder

- Four Shaft Shredder

- Others

By Blade Design

- Hook

- Square

By Application

- Chemical Industry

- Food Industry

- Textile Industry

- Pharmaceutical Industry

- Heavy Duty Industry

- Others

Key Global Shredder Blades Industry Players

- Accu Grind

- Aker Tools & Components

- American Cutting Edge

- Anhui Yafei Machine Tool Co. Ltd.

- BKS Knives

- Fernite of Sheffield Ltd.

- Fordura China

- Kamadur Industrial Knives B.V.

- Maanshan Henglong Mechanical Technology Co. Ltd

- Miheu D.O.O.

- Multech Machinery Corp.

- Nanjing Huaxin Machinery Tool Manufacturing Co. Ltd.

- Nanjing Jingfeng Knife Manufacturing Co. Ltd.

- Povelato Srl

- Saturn Machine Knives Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252