Global Fruit Powder Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global fruit powder market will be determined by a sector that has come a long way from simple, necessity-driven experiments to one that is dynamic and drives its direction through changing diets and continuous improvements in food processing. Its earliest origins can be traced back to the practices of preserving which were done by the communities long before the advent of industrial manufacturing, where drying the fruit in warm air or sunlight helped in avoiding spoilage. What was once a practical method of extending the shelf life of fruits gradually transformed into commercial production during the mid-20th century after the spray drying technology started getting accepted in the food and beverage sector. With companies mastering moisture, temperature, and particle size control, the powder slowly advanced from being the smallest ingredient in the kitchen to being the most reliable solution for manufacturers who wanted to keep their products tasting the same for a longer time and also wanted to store them for an extended period.

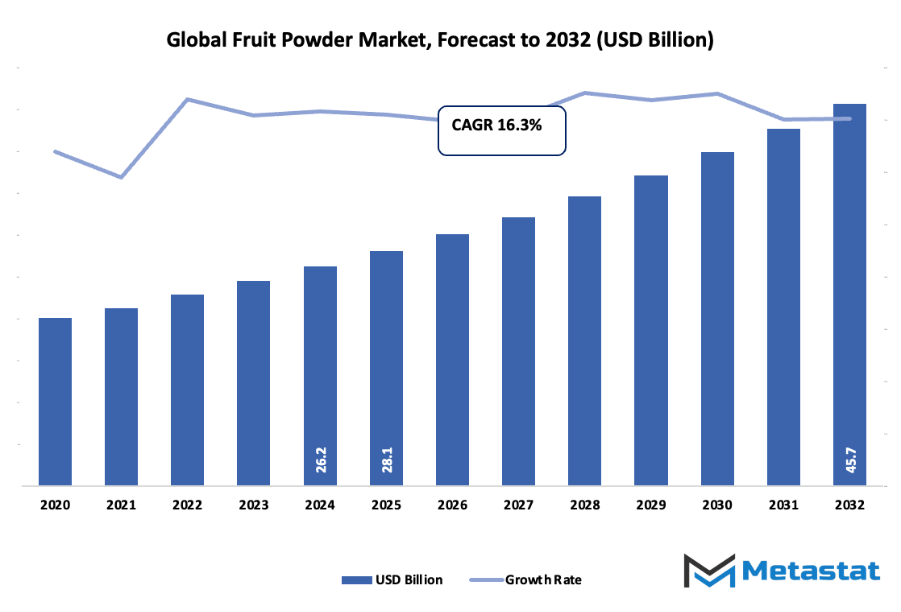

- The global fruit powder market is anticipated to be around USD 28.1 billion in 2025, with a CAGR of about 7.2% till 2032, and has the potential to go beyond USD 45.7 billion.

- Banana alone is responsible for about 16.3% of the market share and, thus, being an important area of research whose results are turning into new uses and applications for it.

- Major trends in the market: The Functional Foods and Beverages Sector continues to grow.

- One of the major opportunities is the expansion of the use of fruit powders in nutraceutical and dietary supplement applications.

- Major takeaway: The market is going to increase in value by leaps and bounds in the next ten years, thus bringing to light the great opportunities for growth.

During the 1970s and 1980s, the boiling demand for instant beverages, ready-to-mix bakery blends, and fortified snacks continued to persuade the producers to refine their processes. The U.S. Department of Agriculture's data revealed that the industrial use of powdered plant-based ingredients gradually increased during this period, especially when food exports expanded. They wouldnufd of the need for long-lasting ingredients that could withstand shipping times. The technological advances, from improved drum drying to microencapsulation, will still be the way to go for aroma retention and nutrient protection as well as solubility, thus supporting wider application.

The new trends in consumer behaviour have also been one of the factors that have influenced the present-day scenario. Regular surveys conducted by industry associations like International Food Information Council show a constant rise in consumer interest in natural flavours, waste reduction and clean-label products. The above-mentioned customer preferences will cause the manufacturers to use fruit powders as the base for their products which are made from whole fruits without any artificial additives. At the same time, the government reports from the European Food Safety Authority and other regulatory bodies are drawing attention to the stricter regulation on the pesticide residues and food additives, which will compel the sellers to be more transparent in their sourcing, implement better tracing, and adopt safer processing methods.

The global fruit powder market today will still be a place of change, as companies will be developing their freeze-drying techniques to get the nutrients locked in more efficiently and agricultural organizations will be promoting the use of surplus or imperfect fruits to cut down on waste. The market has come a long way from its early preservation-driven origins to the sophisticated production lines now operating in different parts of the world. The industry will not only remain a part of beverages, snacks, supplements, and culinary innovations but will also keep on acting as a driving force by showing how a once-simple preservation practice can still be applied in so many different ways to keep the quality.

Market Segments

The global fruit powder market is mainly classified based on Fruit Type, Nature, Application, Distribution Channel.

By Fruit Type is further segmented into:

- Banana:

Globally, the Banana powder market is powered by the demand for banana-based powder products for the food makers who intend to have a product with mildly sweet and smooth texture. The production process revolves mostly around drying it with utmost care to retain the natural taste and color. The powder of this fruit helps products to be mixed easy in various ways without disrupting the whole taste balance.

- Apples:

The apple-based powder is gentle with its sweetness and aroma thus it very much supports the recipe and used inapplicably. Producers of the powder use slow drying technique to preserve its quality. The powder of apple is very much suitable with dry mixes, and its familiarity and broad acceptance among the consumers across the different food categories make the producers add that taste very easy.

- Mango:

Mango powder is such a product that adds not only a bright flavor but also a very appealing color to dry mixes. The consistent production of the powder around the trace of the natural mango taste can be done in the case of snacks and flavored drinks; that is, the acidity needs to be neutralized and so on. The powder makes it possible for manufacturers to create a tropical taste in a product that requires a long shelf life, thus facilitating the use in both the heating and cooling of the processing steps.

- Grapes:

Rich flavor and light natural color are common qualities identified with grape powder. Producers operate in a way that the drying process is the one that retains natural sugars. The powder can be mixed into the food without the addition of excess liquid thus it can also find use in dry mixes where the texture is required to be stable and the taste is to be still present even in complicated recipes.

- Oranges:

Orange powder offers a sharp citrus note used in drink mixes, candies, and seasoning blends. Producers work to hold natural acidity during drying. This powder allows food makers to add zest without affecting moisture levels, supporting clear flavour release in both hot and cold serving conditions across varied products.

- Berries:

Berry powders, made from fruits such as blueberries and strawberries, bring bright colour and distinct taste. Production focuses on keeping natural compounds that give these fruits strong appeal. These powders help food makers add vibrant flavour to items while maintaining a stable mixture that works well in dry applications.

- Others:

Fruit powders made from less common fruits offer unique flavours that suit niche product lines. Makers focus on steady drying to protect natural traits while giving food producers options beyond widely used fruits. These powders support variety in product development, allowing new tastes without changing existing production methods.

By Nature the market is divided into:

- Conventional:

Conventional fruit powders are widely chosen due to steady supply and suitable cost. Producers follow standard farming and drying practices to meet general product needs. These powders support consistent quality for large-scale food makers that require stable flavour and texture without major changes to current sourcing patterns. - Organic:

Organic fruit powders are produced using farming methods free from synthetic inputs. Makers focus on minimal processing to protect natural character. These powders appeal to buyers seeking cleaner labels and steady flavour from fruits grown with care. Food producers use them to support product lines with clear natural positioning.

By Application the market is further divided into:

- Bakery:

Fruit powders are added to bakery mixes for flavour, gentle sweetness, and colour. Dry form supports even blending without adding moisture that might affect dough structure. Bakers use these powders to help products keep a stable texture while offering fruit notes that hold steady through both mixing and baking steps. - Confectionery:

Confectionery makers rely on fruit powders to give natural flavour without excess liquid that might disrupt set textures. These powders support clear taste release in candies, gummies, and fillings. Makers value their ability to mix evenly with sugars and other dry ingredients while keeping overall texture firm and consistent. - Beverages:

Fruit powders are used in drink mixes to offer easy blending and reliable flavour. Dry form allows instant mixing in water or other liquids. Makers choose these powders for stable shelf life, allowing them to create flavoured drinks that hold taste over time without risking spoilage tied to fresh fruit. - Frozen Desserts:

Frozen dessert makers use fruit powders to add strong flavour without extra moisture, helping maintain smooth texture after freezing. These powders support consistent taste from batch to batch. Makers value their stability during temperature shifts, allowing the fruit note to remain noticeable even after extended time in frozen storage. - Others:

Fruit powders also appear in sauces, seasonings, and nutrition products. Producers value their flexible use across many processes, including dry blending and heat treatment. Food makers choose them for convenience, long shelf life, and steady flavour release. This supports product development across categories that need reliable fruit taste.

By Distribution Channel the global fruit powder market is divided as:

- Supermarkets/Hypermarkets:

Large retail stores offer broad visibility for fruit powders, giving buyers access to multiple brands and pack sizes. Placement in these stores supports steady sales due to high foot traffic. Producers focus on packaging that protects freshness while drawing buyer interest in busy aisles with clear labeling and simple design. - Convenience Stores:

Small retail outlets carry select fruit powder options that meet quick purchase needs. Stock levels are usually limited but steady. Makers use compact packaging for easy shelf fit. These stores support impulse buys for drink mixes and small baking needs, helping maintain regular sales in high-turnover locations. - Specialty Stores:

Specialty outlets focus on targeted products, including gourmet and health-focused fruit powders. Makers provide options with cleaner labels or unique fruit sources. These stores help buyers find specific flavours not always stocked in larger retailers, supporting steady growth for items that appeal to more selective customer groups. - Online Retail:

Online platforms offer wide choice and easy comparison of fruit powders. Makers use this channel to showcase origin details and processing methods. Buyers value doorstep delivery and access to niche products. This channel helps producers reach broader markets without relying on physical shelf space or limited local distribution. - Others:

Additional channels include direct sales, small distributors, and food service suppliers. These outlets help fruit powder makers reach cafes, bakeries, and small producers. Steady supply through these paths supports flexible ordering and tailored product needs, allowing smooth movement of goods outside standard retail networks.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$28.1 Billion |

|

Market Size by 2032 |

$45.7 Billion |

|

Growth Rate from 2025 to 2032 |

7.2% |

|

Base Year |

2024 |

|

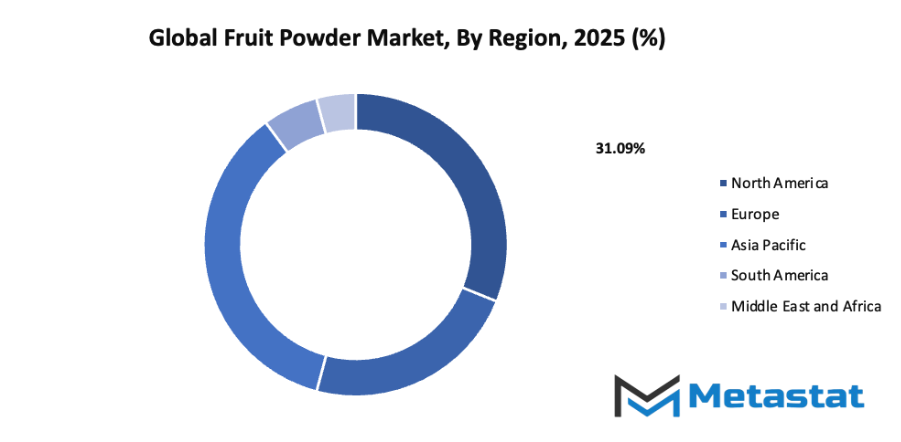

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

- Based on geography, the global fruit powder market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising Demand for Natural and Clean-Label Ingredients:

Growing focus on simple, natural ingredient lists encourages broader use of fruit-based powders across multiple food categories. Strong preference for minimally processed inputs supports wider acceptance within the global fruit powder market, with steady adoption across snacks, beverages, and bakery goods fueled by cleaner formulations and transparent sourcing practices. - Growth of the Functional Foods and Beverages Sector:

Functional product development encourages stronger reliance on concentrated fruit sources for flavour, colour, and nutritional support. Rising attention toward wellness-focused consumption strengthens commercial demand, as manufacturers seek concentrated forms of vitamins and antioxidants, leading to broader use of fruit-derived powders for enhanced formulation benefits and consistent product quality

Challenges and Opportunities

- High Production Costs and Complex Processing Requirements:

Specialized drying equipment, strict quality controls, and careful handling of raw fruit materials raise operational expenses for producers. Maintaining nutritional value during conversion requires advanced technology, contributing to greater financial pressure. These factors influence pricing structures while motivating stronger innovation efforts aimed at reducing waste and improving processing efficiency across production facilities. - Limited Shelf Stability for Certain Fruit Powders:

Some fruit-based powders face sensitivity to moisture, temperature changes, and oxygen exposure, creating obstacles for storage and distribution. Protective packaging, controlled environments, and improved drying techniques become essential for product preservation. Stability concerns encourage research focused on extending freshness, reducing spoilage risk, and supporting consistent performance across diverse application areas.

Opportunities

Expansion in Nutraceutical and Dietary Supplement Applications:

Rising interest in concentrated fruit nutrients opens pathways for broader adoption within supplement capsules, drink mixes, and wellness formulations. Strong demand for plant-focused health products supports the introduction of antioxidant-rich powders, encouraging partnerships between ingredient suppliers and nutraceutical brands to create targeted solutions for energy support, immune health, and overall nutrition.

Competitive Landscape & Strategic Insights

The industry is a mix of global leaders and rising regional groups competing for growth. Strong demand for fruit-based ingredients encourages continuous expansion and adaptation across many markets. Rising health awareness supports wider interest in clean-label and nutrient-rich fruit powder solutions. Growing adoption in snacks, beverages, and supplements encourages steady investment from major producers. Kanegrade Ltd, Döhler Group, Paradise Fruits, and Chaucer Foods Ltd play major roles worldwide. Saipro Biotech Pvt Ltd and Baobab Foods Inc. strengthen regional activity with focused product lines. NutraDry, FutureCeuticals, Van Drunen Farms, and Milne MicroDried support steady supply through advanced drying methods. Aarkay Food Products Ltd. and Creative Enzymes add value through steady development of specialized formulations.

Bluegrass Ingredients and Nutradry Pty Ltd maintain strong engagement with premium food and wellness segments. Iprona SpA continues to shape market attention through concentrated fruit-based offerings for varied applications. Rising preference for natural colours and flavours encourages broader use of fruit powder across manufacturing. Food service operators seek consistent quality, encouraging producers to refine sourcing and processing steps. Sustained interest from sports nutrition brands supports higher demand for stable and nutrient-dense options. Packaging improvements help protect nutritional value, supporting better acceptance across global regions.

Market size is forecast to rise from USD 28.1 billion in 2025 to over USD 45.7 billion by 2032. Fruit Powder will maintain dominance but face growing competition from emerging formats.

Retail channels present steady opportunities as consumers seek convenient forms of fruit-based nutrition. Stricter food standards guide producers toward transparent labeling and reliable production practices. Seasonal variations influence supply planning, leading companies to secure dependable sourcing networks. Marketing efforts highlight natural benefits, supporting stronger visibility for fruit powder in many sectors.

Report Coverage

This research report categorizes the global fruit powder market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fruit powder market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global fruit powder market.

Fruit Powder Market Key Segments:

By Fruit Type

- Banana

- Apples

- Mango

- Grapes

- Oranges

- Berries

- Others

By Nature

- Conventional

- Organic

By Application

- Bakery

- Confectionery

- Beverages

- Frozen Desserts

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Key Global Fruit Powder Industry Players

- Kanegrade Ltd

- Döhler Group

- Paradise Fruits

- Chaucer Foods Ltd

- Saipro Biotech Pvt Ltd

- Baobab Foods Inc.

- NutraDry

- FutureCeuticals

- Van Drunen Farms

- Milne MicroDried

- Aarkay Food Products Ltd.

- Creative Enzymes

- Bluegrass Ingredients

- Nutradry Pty Ltd

- Iprona SpA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252