Global Caffeine Substitute Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global caffeine substitute market and the whole industry have come a long way where they used to be a very quiet and hidden niche and now they are amongst the places where habits are changing, scientific studies are being performed and cultural changes are occurring simultaneously. The journey of the global caffeine substitute market actually started much earlier than the era of modern branding when different people living in close proximity to each other were trying to use the same methods to get milder energizers from roasted grains, herbal mixtures, and local plants. Those ancient practices already prepared the ground for the food scientists' further exploration in the mid-20th century when people's concerns about overstimulation, sleep disruption, and workplace fatigue forced companies to look for alternatives that would still mask alertness but without caffeine in the form of coffee or tea. North American and European research groups began gradually to publicize the effects of ingredients like roasted chicory, maca, guayusa, and ginseng during the 1980s through agricultural bulletins, thus providing reliable data that allowed manufacturers to create products with dosable functional properties.

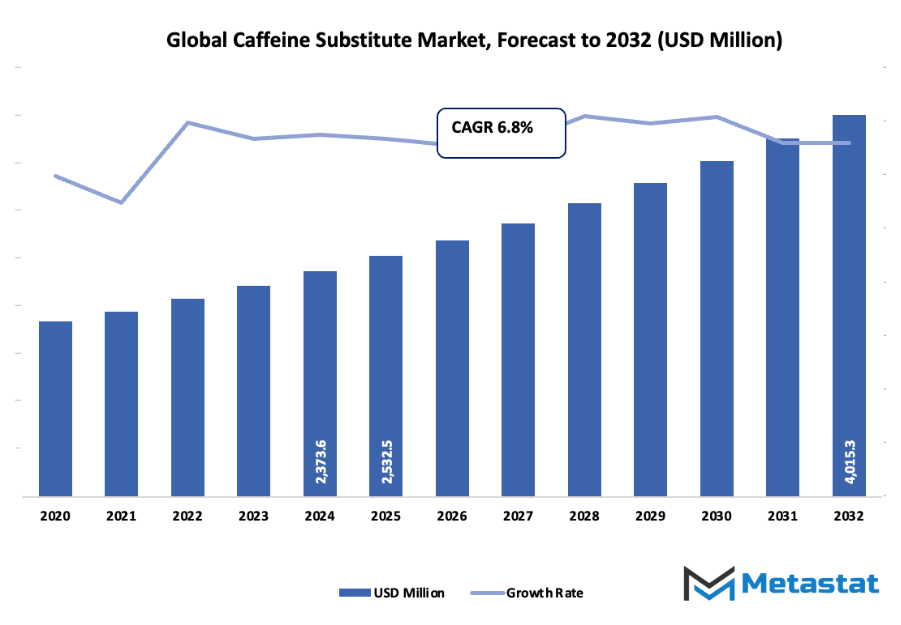

- The global caffeine substitute market is estimated to be valued at around USD 2532.5 million by the year 2025, and it is foreseen that the market will keep expanding at a rate of about 6.8% per year with a possibility of exceeding USD 4015.3 million by the year 2032.

- The segment of herbal alternatives claims nearly 76.4% of the global caffeine substitute market and is responsible for research activities that lead to new developments and various applications of the products.

- The growing awareness of the negative health impacts of excessive caffeine consumption by the consumers together with the rising popularity of naturally sourced energy-boosting ingredients in the functional drinks sector are the primary drivers that are pushing the market upward.

- The influx of innovation in the production of plant-based and adaptogenic caffeine alternatives specifically targeted towards the younger generation is amongst the opportunities.

As the market transitioned into the 2000s, organizations such as the U.S. Department of Agriculture and Health Canada recommended, in their dietary guidelines, caffeine consumption patterns, and the lead to that, in most developed countries, the intake of adult population soared to above 150–200 mg daily. These occurrences, as a result, diverted the attention towards milder-stimulating counterparts. The industry at this time had a breakthrough in extracting methods directly from food technology laboratories which made plant processing more regular to take even less heat exposure. The modern-day extraction methods not only facilitated the concentration of water-soluble compounds that are responsible for concentration but also made it less cumbersome for the manufacturers to come up with mixtures that have more aligned sensory characteristics.

Having said that, the world market for caffeine alternatives is still on the way to cleaner labeled goods, easy to track origins, and gentler energy release products. There has been consistent demand for low-caffeine or caffeine-free functional drinks especially from youngsters who are becoming more conscious about their sleeping habits and stress levels, which consumer survey reports from organizations like the International Food Information Council corroborate. Furthermore, regulatory bodies have also updated the safety standards for ingredients giving manufacturers a more specific area of application for plants. Digital retailing is set to expand further and the transparency of supply chains will be enhanced through government-backed agricultural traceability programs. Thus, producers will adopt newer practices for quality control, and brands will keep on introducing future products after the themes of wellness, sustainable farming, and better scientific validation have been.

Market Segments

The global caffeine substitute market is mainly classified based on Type, Form, Distribution Channel.

By Type is further segmented into:

- Herbal Alternatives: Herbal alternatives within the global caffeine substitute market gain attention for gentle stimulation sourced from plants. Consumer focus on natural ingredients encourages steady demand, as many routines now include soothing blends. Market expansion comes from rising interest in clean-label beverages, with manufacturers offering wider options to match shifting lifestyle habits.

- Grain-based Alternatives: Grain-based alternatives in the global caffeine substitute market draw interest through mild flavour and smoother energy support. Growing consumption stems from increasing product diversity using barley, chicory, and similar grains. Expanded awareness surrounding digestive comfort and reduced bitterness encourages higher adoption across multiple regions, supporting ongoing development within this category.

By Form the market is divided into:

- Powder: Powder form within the global caffeine substitute market appeals through easy mixing, longer shelf stability, and flexible use across drinks or recipes. Strong demand connects with portable packaging and controlled serving options. Rising participation from fitness-focused consumers and busy workers strengthens market presence as brands introduce convenient, nutrient-enriched blends.

- Liquid: Liquid form in the global caffeine substitute market gains traction from ready-to-drink formats requiring minimal preparation. Smooth texture, quick absorption, and wider flavour choices support increased sales. Improved production methods allow balanced taste with functional benefits, drawing attention from consumers seeking faster consumption during work hours or travel.

- Capsules/Tablets: Capsules and tablets within the global caffeine substitute market deliver measured intake and discreet consumption. Growing interest in supplement-style products encourages stronger visibility on retail shelves. Compact packaging, longer storage stability, and predictable daily use attract wellness-focused buyers searching for dependable energy support without traditional caffeine sources.

By Distribution Channel the market is further divided into:

- Online Retail: Online retail distribution in the global caffeine substitute market expands through easy comparison, rapid delivery, and access to niche brands. Digital promotions encourage repeat purchases, while subscription models support consistent demand. Wider product availability through global platforms strengthens cross-border trade, allowing broader exposure to emerging formulations and specialty blends.

- Supermarkets and Hypermarkets: Supermarkets and hypermarkets within the global caffeine substitute market offer broad product displays that support impulse purchases and brand discovery. Competitive pricing and regular in-store promotions stimulate stronger foot traffic. Clear labeling, organized shelving, and frequent product trials help consumers identify suitable caffeine-free options aligned with personal routines.

- Specialty Stores: Specialty stores in the global caffeine substitute market provide curated selections with knowledgeable staff guiding purchasing decisions. Focused product education and targeted assortments support higher-quality offerings. Shoppers seeking unique blends or premium ingredients often rely on specialty outlets, encouraging strong loyalty toward trusted retailers and artisanal producers.

- Convenience Stores: Convenience stores within the global caffeine substitute market contribute through fast access, compact packaging, and impulse-driven sales. Strategic placement near checkout counters boosts visibility for ready-to-use formats. Extended operating hours support consumers requiring quick energy alternatives, strengthening demand among commuters, students, and workers seeking immediate purchase options.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2532.5 Million |

|

Market Size by 2032 |

$4015.3 Million |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

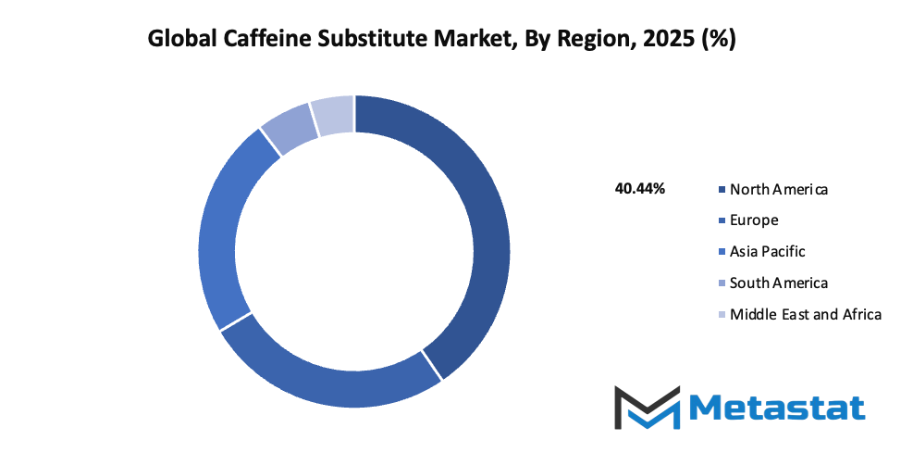

By Region:

- Based on geography, the global caffeine substitute market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising consumer awareness of the negative effects of excessive caffeine consumption: Growing attention to health has encouraged many shoppers to look at habits that may cause restlessness or discomfort. This shift has opened space for milder energy sources within the global caffeine substitute market, as careful buyers look for options that support steady alertness without harsh crashes or unwanted reactions.

- Growing demand for natural energy-boosting ingredients in functional beverages: More people are choosing drinks made with simple and plant-derived ingredients that offer gentle stimulation. This trend has guided brands to use roots, seeds, and botanical extracts that provide smoother vitality. Such choices support steady expansion across beverage lines that highlight transparency, clean labels, and balanced daily energy.

Challenges and Opportunities

- Limited consumer familiarity and acceptance of alternative stimulants: Many potential buyers still lack exposure to newer plant-based boosters, creating slower adoption. Some shoppers remain uncertain about taste, strength, or long-term comfort. This hesitation encourages careful education and honest communication from manufacturers so that trust can grow and usage can rise at a steady and comfortable pace.

- Higher formulation costs compared to traditional caffeine sources: Developing blends built from botanicals or adaptogenic plants often requires careful sourcing, gentle processing, and quality checks, which raise production expenses. These added steps can make final products costlier than standard options. Thoughtful planning and larger-scale supply chains can gradually reduce costs while supporting consistent quality.

Opportunities

Increasing innovation in plant-based and adaptogenic caffeine alternatives for wellness-focused consumers: Active research and creative product development continue to bring forward gentler boosters made from mushrooms, herbs, and nutrient-rich plants. These ingredients appeal to shoppers who value steady energy and overall balance. Continued imagination in this space supports broader choices and encourages makers to craft blends that match changing lifestyle needs.

Competitive Landscape & Strategic Insights

The industry presents a competitive landscape shaped by both global leaders and rising regional brands. Each player contributes unique approaches to the growing demand for caffeine alternatives, reflecting a wider shift in consumer preferences. Health awareness and interest in natural energy sources have encouraged companies to develop new products that meet these needs while maintaining high quality and taste. This growing market encourages constant innovation as businesses focus on natural ingredients and sustainable production methods to attract health-conscious customers.

Among the important competitors, Rover Chicory Roasters and The Baytown Coffee Company have established strong recognition through consistent product quality and diverse offerings. Artizan Coffee Roasters and Milaf Cola Australia & NZ Pty Ltd continue to strengthen their market presence by introducing blends made from chicory, roasted grains, and plant-based ingredients. Bateel, Brown Living, and Satopradhan Ltd emphasize ethical sourcing and environmentally friendly practices, aligning their products with sustainable values that appeal to modern consumers. Laird Superfood, Inc. and RYZE Superfoods concentrate on functional beverages that support wellness while offering smooth flavour profiles. Maverick & Farmer Coffee and Zevia contribute by exploring plant-based caffeine substitutes that promote clean energy without relying on synthetic additives.

Market size is forecast to rise from USD 2532.5 million in 2025 to over USD 4015.3 million by 2032. Caffeine Substitute will maintain dominance but face growing competition from emerging formats.

The competitive environment encourages continuous research and development to meet changing expectations. Focus on taste, sustainability, and transparency allows these companies to connect with a wide audience that values health and ethical responsibility. The rise of natural caffeine substitutes highlights how innovation and consumer awareness can drive steady market growth. With each competitor working to strengthen brand identity and expand reach, the global caffeine substitute market will continue to develop through creativity, authenticity, and a shared commitment to better lifestyle choices.

Report Coverage

This research report categorizes the global caffeine substitute market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global caffeine substitute market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global caffeine substitute market.

Caffeine Substitute Market Key Segments:

By Type

- Herbal Alternatives

- Grain-based Alternatives

By Form

- Powder

- Liquid

- Capsules/Tablets

By Distribution Channel

- Online Retail

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

Key Global Caffeine Substitute Industry Players

- Rover Chicory Roasters

- The Baytown Coffee Company

- Artizan Coffee Roasters

- Milaf Cola Australia & NZ Pty Ltd

- Bateel

- Brown Living

- Satopradhan Ltd

- Laird Superfood, Inc.

- RYZE Superfoods

- Maverick & Farmer Coffee

- Zevia

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252